Key Insights

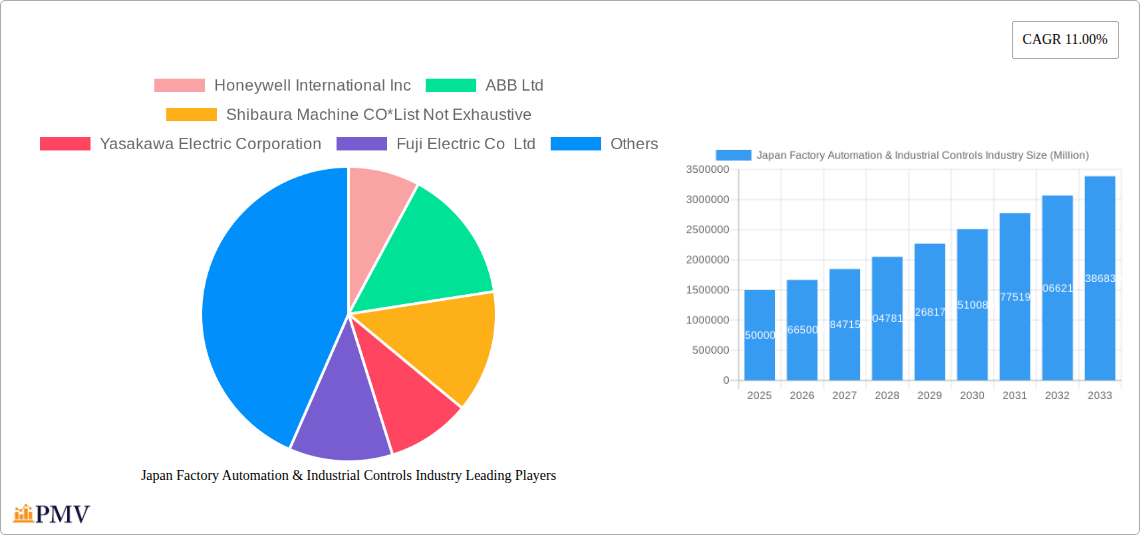

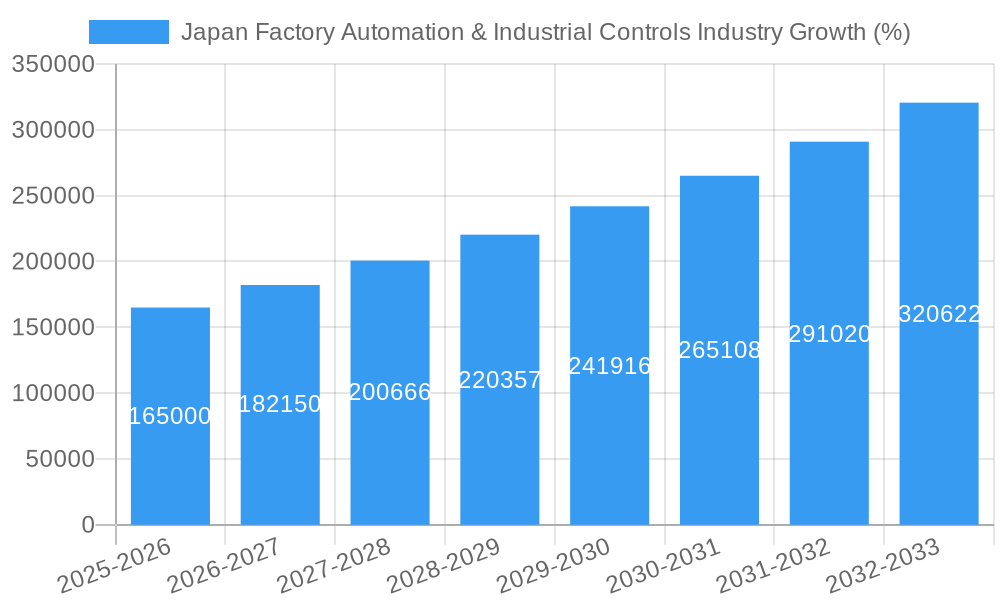

The Japan Factory Automation & Industrial Controls market, valued at approximately ¥1.5 trillion (assuming a reasonable market size based on global trends and the provided CAGR) in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 11% through 2033. This expansion is driven by several key factors. Firstly, the increasing adoption of Industry 4.0 technologies, including advanced robotics, AI-powered systems, and IoT-enabled devices, is significantly boosting automation across various sectors. Secondly, the Japanese government's ongoing initiatives to modernize its manufacturing base and enhance productivity are fueling further investment in factory automation solutions. The automotive, food and beverage, and chemical industries are leading the adoption, primarily driven by the need for increased efficiency, improved product quality, and reduced labor costs. However, the market faces challenges, including the high initial investment costs associated with implementing new automation technologies and a potential skills gap in operating and maintaining these sophisticated systems.

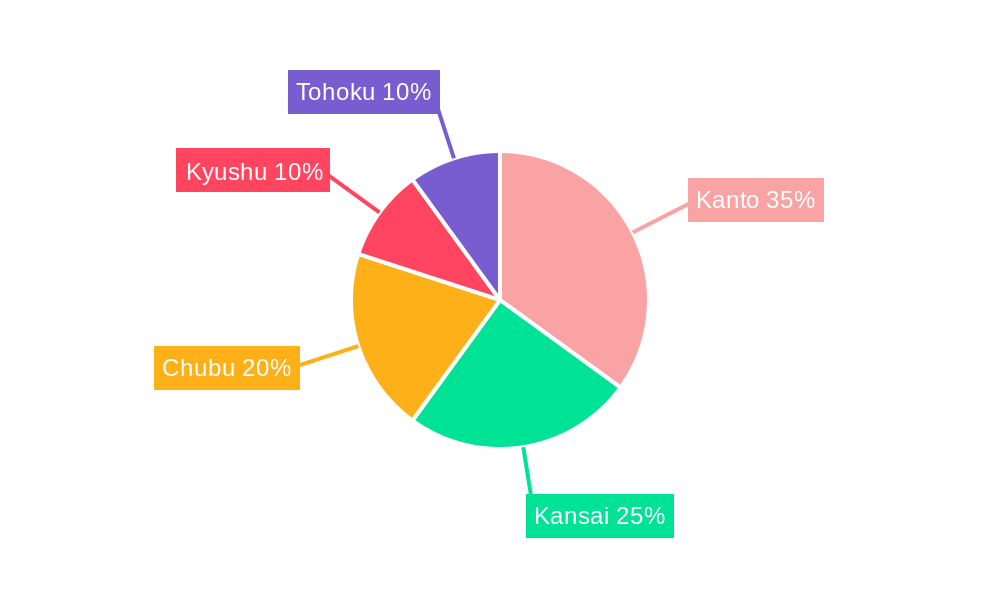

Despite these restraints, the long-term outlook remains positive. The segmentation within the market reveals strong performance across various types of industrial control systems, including field devices, and across numerous end-user industries. Regional analysis shows significant market activity across Japan's key industrial hubs like Kanto, Kansai, and Chubu. Leading players such as Honeywell, ABB, Fanuc, and Mitsubishi Electric are strategically positioning themselves to capitalize on the market's growth potential, fostering competition and driving innovation within the sector. Further growth is anticipated through strategic partnerships, technological advancements, and the continued government support for industrial automation within the country. The continued focus on improving efficiency and productivity amidst labor shortages will solidify the sustained growth of this market throughout the forecast period.

This comprehensive report provides a detailed analysis of the Japan Factory Automation & Industrial Controls industry, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025-2033, building upon historical data from 2019-2024. Key market segments, leading players, and recent developments are thoroughly examined, enabling informed decision-making and strategic planning. The market size is projected to reach xx Million by 2033.

Japan Factory Automation & Industrial Controls Industry Market Structure & Competitive Dynamics

The Japanese factory automation and industrial controls market is characterized by a moderately concentrated structure, with several multinational corporations and established domestic players holding significant market share. Market concentration is driven by economies of scale, technological advancements, and strong brand recognition. The market is highly innovative, fostering a dynamic ecosystem involving research institutions, technology providers, and system integrators. Regulatory frameworks, including safety standards and environmental regulations, significantly influence industry practices. Product substitution is a factor, with continuous advancements leading to the replacement of older technologies with newer, more efficient solutions. End-user trends, particularly the increasing adoption of Industry 4.0 principles and smart manufacturing technologies, are reshaping market demand. Mergers and acquisitions (M&A) activity is relatively frequent, reflecting efforts to expand market reach, gain access to new technologies, and consolidate market positions.

- Market Share: Fanuc Corporation, Omron Corporation, and Mitsubishi Electric Corporation collectively hold a significant portion (estimated at xx%) of the market share in 2025. Other major players like Honeywell International Inc, ABB Ltd, and Siemens AG contribute substantially.

- M&A Activity: The total value of M&A deals in the Japanese factory automation sector from 2019 to 2024 reached approximately xx Million, with an average deal size of approximately xx Million. This activity is expected to continue, driven by industry consolidation and expansion into new technological areas.

Japan Factory Automation & Industrial Controls Industry Industry Trends & Insights

The Japan Factory Automation & Industrial Controls market exhibits robust growth, driven primarily by increasing automation demands across various sectors, technological advancements in robotics and AI, and government initiatives promoting Industry 4.0 adoption. The market is experiencing significant technological disruption, with the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) significantly impacting production efficiency and operational improvements. Consumer preferences are shifting towards more flexible, adaptable, and data-driven automation solutions that enhance productivity and reduce costs. Competitive dynamics are intense, with companies focusing on innovation, product differentiation, and strategic partnerships to maintain their market positions. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated to be xx%, indicating substantial market expansion. Market penetration of advanced automation technologies remains relatively high in key sectors like automotive, with a penetration rate of approximately xx% in 2025.

Dominant Markets & Segments in Japan Factory Automation & Industrial Controls Industry

The automotive and transportation sector dominates the Japanese factory automation and industrial controls market, driven by strong domestic production and the presence of major global automotive manufacturers. The chemical and petrochemical industry also represents a significant market segment due to its high level of automation and process control requirements.

Key Drivers:

- Automotive and Transportation: High level of automation in vehicle manufacturing, stringent quality control requirements, and ongoing investments in new technologies.

- Chemical and Petrochemical: Complex process control requirements, safety regulations, and ongoing need for process optimization.

- Power and Utilities: Investments in smart grids, renewable energy technologies, and automation solutions to enhance operational efficiency.

Dominance Analysis: The dominance of these sectors stems from their large-scale operations, high levels of capital expenditure, and emphasis on efficiency and productivity improvements. Government incentives and supportive economic policies also contribute to market growth in these sectors.

Japan Factory Automation & Industrial Controls Industry Product Innovations

Recent product developments focus on integrating AI and machine learning capabilities into industrial robots and control systems, enabling greater adaptability, self-learning, and predictive maintenance. This allows for more efficient operations and reduced downtime, creating competitive advantages. The market fit is strong, meeting the growing demand for advanced automation solutions in diverse industries. New applications include collaborative robots (cobots) designed for human-robot interaction and autonomous mobile robots (AMRs) for material handling, enhancing flexibility and safety.

Report Segmentation & Scope

The report segments the market by type and end-user industry.

By Type:

- Industrial Control Systems: This segment encompasses Programmable Logic Controllers (PLCs), Supervisory Control and Data Acquisition (SCADA) systems, and Distributed Control Systems (DCS). Growth is projected at xx% CAGR during the forecast period, driven by increasing demand for advanced control solutions. Competitive dynamics are shaped by technological innovation and integration capabilities.

- Other Industrial Control Systems: Field Devices: This includes sensors, actuators, and other field instruments. Market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. Competition is intense, with a focus on providing high-accuracy, reliable, and cost-effective solutions.

By End-user Industry:

- Oil and Gas: This segment is characterized by high levels of automation and process control, with a focus on safety and efficiency.

- Chemical and Petrochemical: Similar to the Oil and Gas segment, a high degree of automation and process control is present.

- Power and Utilities: This segment is experiencing growth due to smart grid initiatives and the integration of renewable energy sources.

- Food and Beverage: This sector demands hygienic and reliable automation solutions to maintain high standards of food safety.

- Automotive and Transportation: This is the largest segment, driven by high automation levels in vehicle manufacturing.

- Other End-user Industries: This comprises sectors like pharmaceuticals, textiles, and manufacturing.

Key Drivers of Japan Factory Automation & Industrial Controls Industry Growth

Several factors drive the growth of the Japanese factory automation and industrial controls industry. These include:

- Technological advancements: The continuous development of advanced robotics, AI, and IoT technologies, enabling increased efficiency, productivity, and flexibility in manufacturing.

- Government support: Government initiatives promoting Industry 4.0 adoption and smart manufacturing strategies are boosting investment and adoption.

- Rising labor costs: Automation solutions help mitigate the impact of rising labor costs, making them increasingly attractive to businesses.

- Increased demand for higher quality and efficiency: Factory automation delivers better quality control, and enhanced productivity and reduces human error.

Challenges in the Japan Factory Automation & Industrial Controls Industry Sector

The industry faces some challenges:

- High initial investment costs: The implementation of factory automation systems can involve substantial upfront investment.

- Skill gap: A shortage of skilled labor to design, implement, and maintain advanced automation systems poses a significant challenge.

- Cybersecurity concerns: The increasing connectivity of industrial control systems raises concerns about cybersecurity vulnerabilities.

- Supply chain disruptions: Global supply chain issues can impact the availability of components and equipment.

Leading Players in the Japan Factory Automation & Industrial Controls Industry Market

- Honeywell International Inc

- ABB Ltd

- Shibaura Machine CO

- Yasakawa Electric Corporation

- Fuji Electric Co Ltd

- Nidec Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Fanuc Corporation

- Omron Corporation

- Seiko Epson Corporation

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Emerson Electric Company

Key Developments in Japan Factory Automation & Industrial Controls Industry Sector

- May 2022: Kawasaki Heavy Industries unveiled a humanoid robot, "HINOTORI," designed for medical aid and surgical support, showcasing advancements in robotics for both factory and non-factory environments. This aligns with their Group Vision 2030 focusing on robotics for safety and security in remote areas and future mobility.

- April 2022: Yaskawa Electric Corporation introduced an AI-powered industrial robot capable of identifying object color and shape for precise positioning, demonstrating advancements in AI-driven automation for various industries, including the automotive sector.

Strategic Japan Factory Automation & Industrial Controls Industry Market Outlook

The Japanese factory automation and industrial controls market is poised for sustained growth, driven by ongoing technological advancements, government support for Industry 4.0 adoption, and rising demand for efficient and flexible manufacturing solutions. Strategic opportunities exist for companies focusing on developing and deploying AI-powered automation solutions, collaborative robots, and advanced process control systems. Expansion into niche markets and strategic partnerships will be key to capturing market share and achieving long-term success. The growing demand for sustainability and environmentally friendly technologies presents a significant opportunity for environmentally conscious automation solutions.

Japan Factory Automation & Industrial Controls Industry Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Manufacturing Execution System (MES)

- 1.1.6. Human Machine Interface (HMI)

- 1.1.7. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Industrial Robotics

- 1.2.3. Sensors and Transmitters

- 1.2.4. Motors and Drives

- 1.2.5. Safety Systems

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverage

- 2.5. Automotive and Transportation

- 2.6. Other End-user Industries

Japan Factory Automation & Industrial Controls Industry Segmentation By Geography

- 1. Japan

Japan Factory Automation & Industrial Controls Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?

- 3.3. Market Restrains

- 3.3.1. ; Trade Tensions and Implementation Challenges

- 3.4. Market Trends

- 3.4.1. Distributed Control Systems are Expected to Witness a Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Manufacturing Execution System (MES)

- 5.1.1.6. Human Machine Interface (HMI)

- 5.1.1.7. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Industrial Robotics

- 5.1.2.3. Sensors and Transmitters

- 5.1.2.4. Motors and Drives

- 5.1.2.5. Safety Systems

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverage

- 5.2.5. Automotive and Transportation

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Factory Automation & Industrial Controls Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shibaura Machine CO*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yasakawa Electric Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fuji Electric Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nidec Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mitsubishi Electric Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schneider Electric SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fanuc Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Seiko Epson Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rockwell Automation Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yokogawa Electric Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Emerson Electric Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Japan Factory Automation & Industrial Controls Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Factory Automation & Industrial Controls Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Factory Automation & Industrial Controls Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: Japan Factory Automation & Industrial Controls Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Factory Automation & Industrial Controls Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Japan Factory Automation & Industrial Controls Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Shibaura Machine CO*List Not Exhaustive, Yasakawa Electric Corporation, Fuji Electric Co Ltd, Nidec Corporation, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Fanuc Corporation, Omron Corporation, Seiko Epson Corporation, Rockwell Automation Inc, Yokogawa Electric Corporation, Emerson Electric Company.

3. What are the main segments of the Japan Factory Automation & Industrial Controls Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of Stringent Energy Conservation Standards and Drive for Local Manufacturing?.

6. What are the notable trends driving market growth?

Distributed Control Systems are Expected to Witness a Significant Market Growth.

7. Are there any restraints impacting market growth?

; Trade Tensions and Implementation Challenges.

8. Can you provide examples of recent developments in the market?

May 2022 - Kawasaki Heavy Industries developed a humanoid robot that works like humans outside factories and exhibited it in Tokyo. The company sports a Group Vision 2030, appealing for robotics technology in two areas: safety and security in remote societies and mobility in the future. In the area of the safety and security of remote society, the company exhibited the "HINOTORI," a Medic-aid or a surgical support robot.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Factory Automation & Industrial Controls Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Factory Automation & Industrial Controls Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Factory Automation & Industrial Controls Industry?

To stay informed about further developments, trends, and reports in the Japan Factory Automation & Industrial Controls Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence