Key Insights

The Italy Metal Processing Equipment Market is poised for robust expansion, with a projected Compound Annual Growth Rate (CAGR) of 1.941%. The market, estimated at $1.8 billion in the base year 2024, is expected to witness substantial growth by 2033. This upward trajectory is fueled by escalating demand for manufacturing precision, the integration of advanced technologies like automation and IoT within metal processing, and Italy's strong industrial base. Leading industry players, including Kapco, DMG Mori, and BTD Manufacturing, are instrumental in market expansion through continuous innovation and strategic alliances.

Italy Metal Processing Equipment Industry Market Size (In Billion)

Challenges such as significant upfront investment for sophisticated equipment and strict environmental compliance persist. Nevertheless, emerging trends, particularly the incorporation of AI and machine learning into metal processing machinery, present considerable growth opportunities. The market segmentation offers diverse opportunities, with key companies consistently investing in research and development to refine their product portfolios. A highly competitive environment sees major firms such as Colfax, Matcor - Matsu Group Inc, and TRUMPF actively pursuing market share via technological breakthroughs and international expansion.

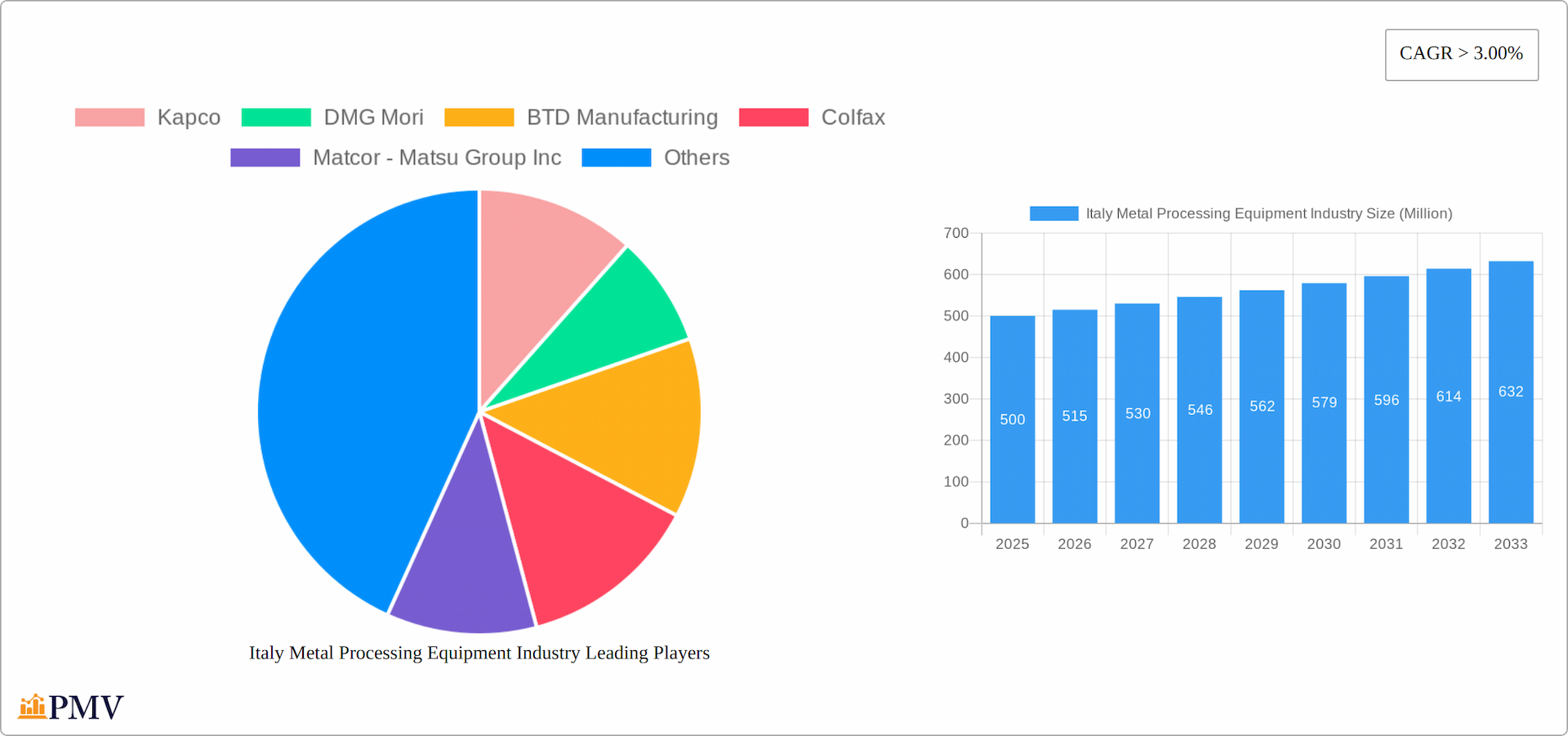

Italy Metal Processing Equipment Industry Company Market Share

Italy Metal Processing Equipment Industry Market Structure & Competitive Dynamics

The Italy Metal Processing Equipment Industry is characterized by a mix of established players and emerging competitors, with market concentration being moderate. Key companies such as Kapco, DMG Mori, BTD Manufacturing, Colfax, Matcor - Matsu Group Inc, Standard Iron and Wire Works, TRUMPF, and Bystronic Laser AG dominate the market, holding significant market shares. The innovation ecosystem in Italy thrives due to strong collaborations between academia and industry, fostering technological advancements in metal processing. Regulatory frameworks are stringent, ensuring high-quality standards but also posing challenges for new entrants.

- Market Concentration: The top companies control approximately 60% of the market, with Kapco and TRUMPF leading with a combined share of 25%.

- Innovation Ecosystems: Italian universities and research institutions are actively engaged in R&D, with annual investments reaching 1.5 Million Euros.

- Regulatory Frameworks: Compliance with EU standards like CE marking is mandatory, influencing product design and market entry.

- Product Substitutes: Alternatives like plastic and composite materials are gaining traction, affecting 10% of the market.

- End-User Trends: There's a growing demand for customized metal processing solutions, particularly in the automotive and aerospace sectors.

- M&A Activities: Notable acquisitions include the purchase of Sovema Group by Schuler in August 2022 for xx Million Euros and CGI's acquisition of Elite Manufacturing Technologies in June 2022 for 100 Million Euros. These deals reflect a strategy to expand capabilities and market reach.

Italy Metal Processing Equipment Industry Industry Trends & Insights

Italy's metal processing equipment industry is experiencing robust growth, fueled by a confluence of factors. The widespread adoption of Industry 4.0 technologies, including AI and IoT, is revolutionizing manufacturing processes, leading to increased efficiency, enhanced customization capabilities, and reduced operational costs. This technological transformation is projected to drive a compound annual growth rate (CAGR) of 4.5% from 2025 to 2033, indicating substantial market expansion potential. Furthermore, a growing consumer preference for sustainable and energy-efficient solutions is shaping product development and influencing market strategies, pushing manufacturers towards eco-friendly practices and technologies.

The competitive landscape is highly dynamic, with leading players such as TRUMPF and Bystronic Laser AG significantly investing in research and development to maintain their market leadership. Italy's robust automotive manufacturing base creates significant demand for advanced metal processing equipment, resulting in high market penetration within this sector. The aerospace industry also serves as a key growth driver, exhibiting a 5% increase in market share over the past year, mirroring the global surge in demand for aircraft components. Supportive economic policies focused on industrial growth and technological innovation further bolster the industry's expansion trajectory.

Dominant Markets & Segments in Italy Metal Processing Equipment Industry

The Northern region of Italy, particularly Lombardy, stands out as the dominant market within the Metal Processing Equipment Industry. This region's robust industrial infrastructure and skilled workforce contribute significantly to its leadership. The automotive sector is the leading segment, driven by Italy's renowned automotive manufacturers and their global supply chains.

- Economic Policies: Government incentives for industrial development and innovation have spurred investment in the region.

- Infrastructure: Advanced manufacturing facilities and logistics networks enhance the region's competitive edge.

- Workforce: A highly skilled labor pool supports complex manufacturing processes.

The dominance of the automotive segment can be attributed to several factors:

- Global Demand: The global demand for Italian-made vehicles drives the need for advanced metal processing equipment.

- Innovation: Continuous innovation in automotive design requires cutting-edge metal processing solutions.

- Supply Chain: Strong relationships with global automotive OEMs ensure steady demand for equipment.

The aerospace sector is also gaining prominence, with Italy's participation in international aerospace projects boosting the need for specialized metal processing equipment. The region's strategic location and access to European markets further solidify its position as a leader in the industry.

Italy Metal Processing Equipment Industry Product Innovations

Recent product innovations in the Italy Metal Processing Equipment Industry focus on enhancing automation and precision. Companies are developing advanced laser cutting and 3D printing technologies to meet the growing demand for customized metal parts. These innovations align well with market needs, particularly in the automotive and aerospace sectors, where precision and efficiency are paramount. The integration of IoT and AI is enabling real-time monitoring and predictive maintenance, further improving operational efficiencies.

Report Segmentation & Scope

The Italian metal processing equipment market is segmented by equipment type, application, and end-user. The equipment type segment encompasses cutting, forming, and welding equipment, with the cutting equipment segment poised for particularly strong growth, projected at a CAGR of 5% driven by ongoing technological advancements. Application-wise, the automotive, aerospace, and construction sectors are prominent, with the automotive sector dominating the market share, reaching an estimated €1.2 billion in 2025. Finally, the end-user segment comprises Original Equipment Manufacturers (OEMs) and the aftermarket, with OEMs holding a significant 70% market share. Competition within each segment remains fierce, with companies actively pursuing market leadership through innovative product development and strategic collaborations.

Key Drivers of Italy Metal Processing Equipment Industry Growth

The growth of the Italian metal processing equipment industry is propelled by a number of key factors:

- Technological Advancements: The integration of Industry 4.0 technologies, such as AI and IoT, significantly enhances manufacturing efficiency, precision, and overall productivity.

- Supportive Economic Policies: Government initiatives and incentives aimed at fostering industrial development and technological innovation stimulate investment and growth.

- Stringent Regulatory Environment: Compliance with stringent EU standards ensures high product quality and facilitates access to the broader European market.

- Rising Demand from Key Sectors: Strong growth in sectors like automotive and aerospace fuels demand for sophisticated metal processing equipment.

- Focus on Sustainability: The increasing demand for environmentally friendly manufacturing processes drives innovation in energy-efficient equipment.

These drivers, exemplified by initiatives such as the Italian government's Industry 4.0 plan (offering tax incentives for technology adoption), collectively contribute to the industry's projected growth trajectory.

Challenges in the Italy Metal Processing Equipment Industry Sector

The Italy Metal Processing Equipment Industry faces several challenges:

- Regulatory Hurdles: Compliance with EU standards can delay product launches and increase costs.

- Supply Chain Issues: Global disruptions can impact raw material availability, affecting production timelines.

- Competitive Pressures: Intense competition from global players can erode market share and margins.

These challenges have quantifiable impacts, such as a 2% reduction in market growth due to supply chain disruptions in 2022.

Leading Players in the Italy Metal Processing Equipment Industry Market

- Kapco

- DMG Mori

- BTD Manufacturing

- Colfax

- Matcor - Matsu Group Inc

- Standard Iron and Wire Works

- TRUMPF

- Bystronic Laser AG

List Not Exhaustive

Key Developments in Italy Metal Processing Equipment Industry Sector

- August 2022: The acquisition of the Italian Sovema Group by Schuler (part of ANDRITZ) significantly strengthened Schuler's position as a leading supplier of battery cell production solutions for the automotive and other industries, bolstering their involvement in the burgeoning e-mobility sector.

- June 2022: The acquisition of Chicago Elite Manufacturing Technologies by CGI Automated Manufacturing expanded CGI's capabilities in precision sheet metal components and assemblies, aligning with their strategy of providing automated solutions to leading clients in high-growth markets.

- [Add more recent key developments here, if available. Include dates and brief descriptions.]

Strategic Italy Metal Processing Equipment Industry Market Outlook

The Italian metal processing equipment industry is well-positioned for continued substantial growth, driven by technological progress and increasing demand from key sectors. Strategic opportunities for growth include expansion into new international markets, strategic partnerships, and investment in sustainable and environmentally friendly technologies. The projected CAGR of 4.5% from 2025 to 2033 underscores the robust market dynamics and significant growth potential of this sector, making it an attractive market for both established players and new entrants.

Italy Metal Processing Equipment Industry Segmentation

-

1. Product Type

- 1.1. Automatic

- 1.2. Semi-automatic

- 1.3. Manual

-

2. Equipment Type

- 2.1. Cutting

- 2.2. Machining

- 2.3. Forming

- 2.4. Welding

- 2.5. Other Equipment Types

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Manufacturing

- 3.3. Power and Utilities

- 3.4. Construction

- 3.5. Other End-user Industries

Italy Metal Processing Equipment Industry Segmentation By Geography

- 1. Italy

Italy Metal Processing Equipment Industry Regional Market Share

Geographic Coverage of Italy Metal Processing Equipment Industry

Italy Metal Processing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.941% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Manufacturing Production is the Key Trend Driving Demand Generation in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Metal Processing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Automatic

- 5.1.2. Semi-automatic

- 5.1.3. Manual

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Cutting

- 5.2.2. Machining

- 5.2.3. Forming

- 5.2.4. Welding

- 5.2.5. Other Equipment Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Manufacturing

- 5.3.3. Power and Utilities

- 5.3.4. Construction

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DMG Mori

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BTD Manufacturing

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Colfax

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Matcor - Matsu Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Standard Iron and Wire Works

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bystronic Laser AG**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kapco

List of Figures

- Figure 1: Italy Metal Processing Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Metal Processing Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 3: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Equipment Type 2020 & 2033

- Table 7: Italy Metal Processing Equipment Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Italy Metal Processing Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Metal Processing Equipment Industry?

The projected CAGR is approximately 1.941%.

2. Which companies are prominent players in the Italy Metal Processing Equipment Industry?

Key companies in the market include Kapco, DMG Mori, BTD Manufacturing, Colfax, Matcor - Matsu Group Inc, Standard Iron and Wire Works, TRUMPF, Bystronic Laser AG**List Not Exhaustive.

3. What are the main segments of the Italy Metal Processing Equipment Industry?

The market segments include Product Type, Equipment Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Manufacturing Production is the Key Trend Driving Demand Generation in the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2022: The Italian Sovema Group was acquired by Schuler, a part of the global technology group ANDRITZ, enabling it to become a leading systems supplier of battery cell production solutions for the automobile industry and other markets. In collaboration with Sovema, Schuler will create the tools required to outfit gigafactories for the mass manufacture of lithium-ion batteries, whose widespread availability is crucial for the commercial viability of eco-friendly e-mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Metal Processing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Metal Processing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Metal Processing Equipment Industry?

To stay informed about further developments, trends, and reports in the Italy Metal Processing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence