Key Insights

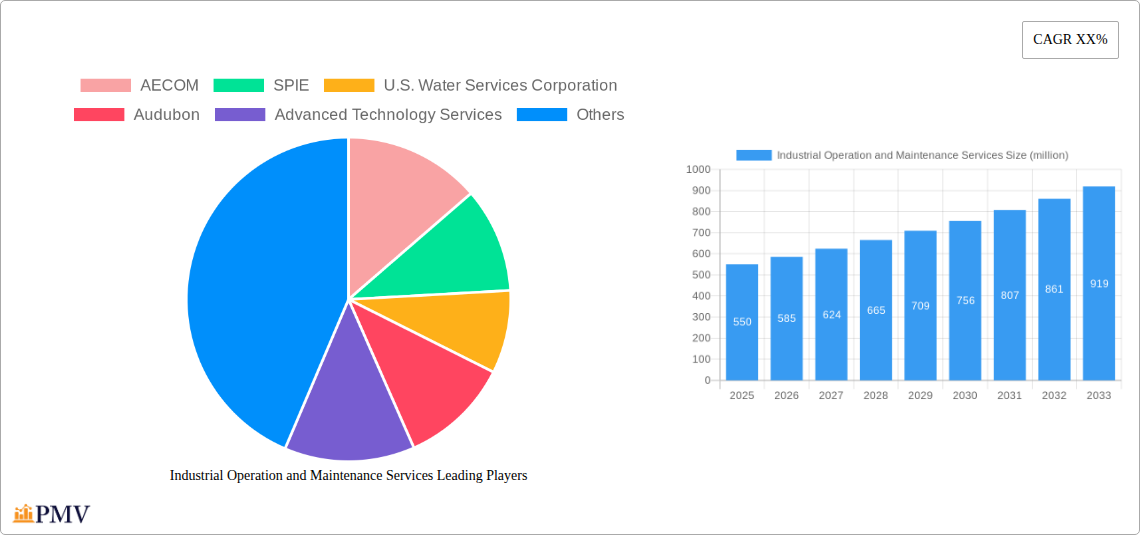

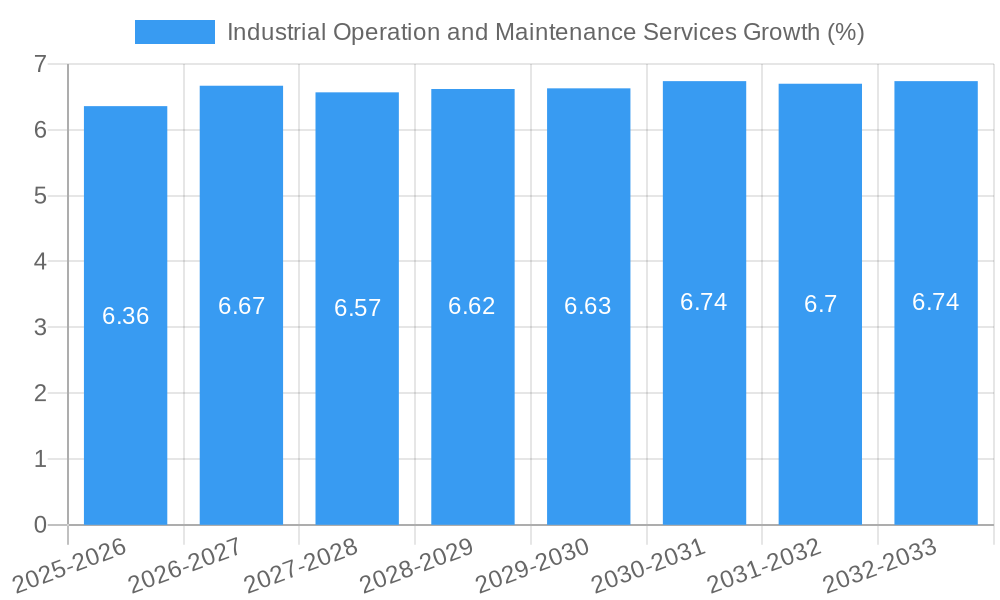

The global Industrial Operation and Maintenance (O&M) Services market is poised for significant expansion, projected to reach an estimated $550 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This upward trajectory is primarily propelled by an increasing demand for enhanced asset reliability and operational efficiency across a diverse range of industries, including chemicals, energy, and metals. As industries grapple with the need to optimize production processes, minimize downtime, and ensure regulatory compliance, the adoption of sophisticated O&M strategies and services is becoming paramount. Key drivers include the growing complexity of industrial machinery, the aging infrastructure in many established economies, and the continuous drive for cost reduction and performance improvement. Furthermore, the escalating integration of digital technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and predictive analytics, is revolutionizing O&M practices, enabling proactive maintenance and remote monitoring, thereby further fueling market growth.

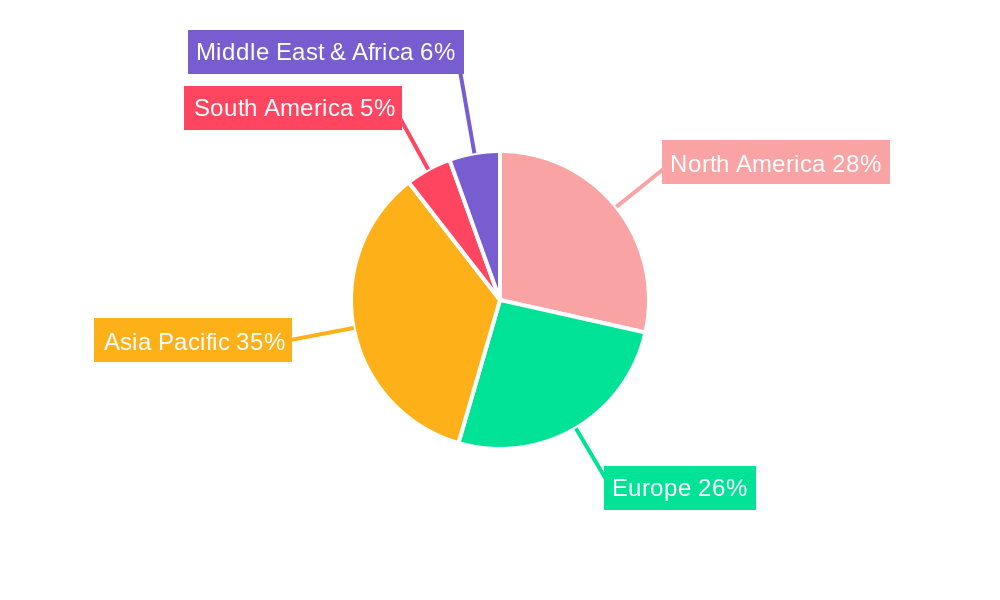

The market is characterized by a dynamic landscape of service providers, with a strong emphasis on specialized operational services and maintenance solutions. Companies are increasingly investing in advanced technological capabilities and expanding their service portfolios to cater to evolving industry needs. The Asia Pacific region is expected to emerge as a significant growth engine, driven by rapid industrialization and substantial investments in infrastructure development. Conversely, North America and Europe, with their mature industrial bases and a strong focus on technological adoption, will continue to represent substantial market shares. However, the market faces certain restraints, including the high initial investment costs associated with advanced O&M technologies and the availability of skilled labor. Despite these challenges, the overall outlook for the Industrial Operation and Maintenance Services market remains exceptionally positive, underpinned by the fundamental need for industries to maintain peak operational performance and longevity of their assets.

Comprehensive Report: Industrial Operation and Maintenance Services Market Analysis (2019-2033)

This in-depth market research report provides a detailed analysis of the Industrial Operation and Maintenance (O&M) Services market, covering the historical period of 2019–2024, the base year of 2025, and a forecast period extending to 2033. Our comprehensive coverage delves into market structure, competitive dynamics, key industry trends, dominant segments, product innovations, critical growth drivers, significant challenges, leading players, vital developments, and a strategic market outlook. We quantify market opportunities, project growth with a Compound Annual Growth Rate (CAGR), and analyze the impact of technological advancements and evolving end-user demands across various industrial sectors. With an estimated market size of over five million in the base year of 2025, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on the burgeoning industrial O&M services sector.

Industrial Operation and Maintenance Services Market Structure & Competitive Dynamics

The Industrial Operation and Maintenance Services market exhibits a moderate to high level of concentration, with several key players establishing significant market share. Major companies like AECOM, SPIE, U.S. Water Services Corporation, Audubon, Advanced Technology Services, Worley, Fives, Savage, PRIDE Industries, Black & Veatch, Monadelphous, H+M Industrial, and Focused Photonics are actively shaping the competitive landscape through innovation, strategic partnerships, and mergers and acquisitions. The innovation ecosystem is driven by the increasing adoption of digital technologies, predictive maintenance, AI-powered diagnostics, and IoT solutions aimed at enhancing efficiency, reducing downtime, and optimizing operational costs. Regulatory frameworks, particularly concerning safety, environmental compliance, and data security, play a crucial role in dictating service offerings and operational standards. Product substitutes, such as in-house O&M teams, are gradually being overshadowed by the specialized expertise and cost-effectiveness offered by dedicated O&M service providers. End-user trends are heavily influenced by the demand for improved asset longevity, operational resilience, and cost optimization across industries. Mergers and acquisition (M&A) activities, with reported deal values in the hundreds of millions, are a significant factor in market consolidation and expansion, enabling companies to acquire new capabilities and increase their geographical reach.

- Market Concentration: Moderate to High, driven by strategic consolidation.

- Innovation Ecosystem: Fueled by digital transformation, AI, IoT, and predictive analytics.

- Regulatory Frameworks: Influencing safety, environmental, and data security standards.

- Product Substitutes: In-house maintenance teams are a diminishing alternative.

- End-User Trends: Focus on asset longevity, resilience, and cost efficiency.

- M&A Activities: Significant consolidation and capability expansion through deals valued in the millions.

Industrial Operation and Maintenance Services Industry Trends & Insights

The Industrial Operation and Maintenance Services market is experiencing robust growth, projected to expand at a significant CAGR. This expansion is primarily driven by the increasing complexity of industrial machinery and processes, necessitating specialized expertise for efficient operation and proactive maintenance. The escalating adoption of Industry 4.0 technologies, including the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and advanced robotics, is revolutionizing O&M strategies. Predictive maintenance, powered by sensor data and sophisticated analytics, is becoming a cornerstone of modern industrial operations, enabling companies to anticipate equipment failures and schedule maintenance proactively, thereby minimizing costly unplanned downtime and maximizing asset utilization. Furthermore, the growing emphasis on sustainability and energy efficiency across all industrial sectors is compelling businesses to invest in optimized O&M practices that reduce waste, conserve resources, and lower their environmental footprint. The aging infrastructure in many established industrial economies also presents a substantial opportunity for O&M service providers, as companies seek to extend the lifespan and improve the performance of their existing assets. Consumer preferences are shifting towards integrated O&M solutions that offer end-to-end management, from routine servicing to complex repairs and upgrades. The competitive landscape is characterized by intense competition among established global players and emerging niche providers, all vying to offer value-added services and differentiate themselves through technological innovation and service quality. Market penetration is deepening across all major industrial segments as businesses recognize the critical role of effective O&M in maintaining operational continuity and achieving their strategic objectives. The ongoing digital transformation and the pursuit of operational excellence are key determinants of market growth, with companies that embrace these trends poised for significant success. The market size is projected to reach several hundred million by the end of the forecast period.

Dominant Markets & Segments in Industrial Operation and Maintenance Services

The Industrial Operation and Maintenance Services market demonstrates significant dominance in the Energy and Chemicals application segments, driven by the continuous need for reliable and safe operations in these critical sectors. The Energy sector, encompassing oil and gas, power generation, and renewables, requires highly specialized O&M services to ensure the integrity and performance of complex infrastructure, from offshore drilling platforms to power grids. Market growth in this segment is propelled by increasing energy demand, the transition to renewable energy sources, and stringent safety regulations, contributing an estimated XX million in market value. Similarly, the Chemicals industry relies heavily on precise operational control and meticulous maintenance to prevent accidents, ensure product quality, and comply with environmental standards, representing another substantial market share of approximately XX million.

In terms of Types of services, Maintenance Services currently hold a dominant position, encompassing both planned and unplanned maintenance activities designed to preserve asset functionality and prevent failures. This segment benefits from the inherent need to maintain aging industrial assets and the proactive shift towards predictive and preventive maintenance strategies, contributing an estimated XX million. Operational Services, which focus on the day-to-day management and optimization of industrial processes, are also experiencing significant growth, driven by the demand for enhanced efficiency, automation, and performance monitoring, projecting a market value of XX million.

Geographically, North America and Europe represent dominant markets due to their well-established industrial bases, advanced technological adoption, and robust regulatory environments that mandate high O&M standards. However, the Asia-Pacific region is exhibiting the fastest growth, fueled by rapid industrialization, expanding manufacturing sectors, and increasing investments in infrastructure development, with a projected market value of over XX million.

- Dominant Application Segments:

- Energy: High demand for operational reliability and safety in oil & gas, power generation, and renewables.

- Chemicals: Critical need for precise process control, safety compliance, and environmental management.

- Dominant Service Types:

- Maintenance Services: Driven by asset upkeep, predictive maintenance adoption, and extended asset life.

- Operational Services: Fueled by efficiency improvements, automation, and performance monitoring.

- Dominant Regions:

- North America & Europe: Mature markets with strong regulatory frameworks.

- Asia-Pacific: Fastest-growing region due to industrialization and infrastructure investment.

Industrial Operation and Maintenance Services Product Innovations

Product innovations in the Industrial Operation and Maintenance Services sector are largely centered around the integration of advanced digital technologies. The development of AI-powered predictive analytics platforms, IoT-enabled remote monitoring systems, and sophisticated diagnostic tools are transforming how O&M is performed. These innovations offer significant competitive advantages by enabling real-time performance tracking, early detection of potential equipment failures, and optimized maintenance scheduling, leading to reduced downtime and operational costs. Companies are also focusing on developing modular and adaptable O&M solutions that can be customized to meet the specific needs of diverse industrial applications. The market fit for these innovations is exceptionally strong as industries increasingly prioritize efficiency, reliability, and cost-effectiveness in their operations.

Report Segmentation & Scope

This report meticulously segments the Industrial Operation and Maintenance Services market across various critical dimensions, providing granular insights into each segment's growth trajectory, market size, and competitive dynamics.

Application Segments:

- Chemicals: Expected market size of XX million with a projected CAGR of XX%. Competitive landscape characterized by specialized chemical process O&M providers.

- Energy: Forecasted market size of XX million with a CAGR of XX%. Driven by infrastructure needs in oil & gas and renewables.

- Metals: Estimated market size of XX million, with a CAGR of XX%. Influenced by mining and manufacturing output.

- Building Materials: Projected market size of XX million, CAGR XX%. Supported by construction sector activity.

- Automobiles: Market size of XX million, CAGR XX%. Tied to automotive manufacturing efficiency.

- Food: Estimated market size of XX million, CAGR XX%. Focus on hygiene and continuous production.

- Medical: Projected market size of XX million, CAGR XX%. Driven by stringent regulatory compliance and specialized equipment.

- Others: Encompassing diverse industrial applications, with an estimated market size of XX million and a CAGR of XX%.

Types of Services:

- Operational Services: Forecasted market size of XX million, CAGR XX%. Focus on process optimization and efficiency.

- Maintenance Services: Estimated market size of XX million, CAGR XX%. Dominant segment driven by asset upkeep and predictive strategies.

Key Drivers of Industrial Operation and Maintenance Services Growth

The growth of the Industrial Operation and Maintenance Services market is propelled by several interconnected factors. The relentless drive for operational efficiency and cost reduction across industries compels businesses to seek external expertise for their O&M needs, recognizing the benefits of specialized knowledge and economies of scale. Technological advancements, particularly the widespread adoption of Industry 4.0 technologies like IoT, AI, and data analytics, are enabling more sophisticated and predictive maintenance strategies, leading to fewer breakdowns and optimized asset performance. Furthermore, the increasing complexity and value of industrial assets necessitate professional maintenance to ensure longevity and prevent catastrophic failures. Stringent safety and environmental regulations across various sectors also mandate robust O&M practices, further fueling market demand. Economic policies that encourage industrial investment and infrastructure development also play a significant role in expanding the market for O&M services.

Challenges in the Industrial Operation and Maintenance Services Sector

Despite the positive growth outlook, the Industrial Operation and Maintenance Services sector faces several challenges. Regulatory hurdles, particularly in highly regulated industries such as pharmaceuticals and nuclear energy, can increase the complexity and cost of service delivery. Supply chain disruptions, exacerbated by global events, can impact the availability of critical spare parts and specialized equipment, leading to project delays. Intense competitive pressure from both established players and new entrants can affect pricing and profit margins. Moreover, a shortage of skilled labor with expertise in advanced O&M technologies, such as AI and robotics, poses a significant constraint on service providers' ability to scale their operations and meet increasing demand. The capital investment required for adopting new technologies can also be a barrier for smaller O&M firms.

Leading Players in the Industrial Operation and Maintenance Services Market

- AECOM

- SPIE

- U.S. Water Services Corporation

- Audubon

- Advanced Technology Services

- Worley

- Fives

- Savage

- PRIDE Industries

- Black & Veatch

- Monadelphous

- H+M Industrial

- Focused Photonics

Key Developments in Industrial Operation and Maintenance Services Sector

- 2024 February: AECOM announced a strategic partnership with a major energy conglomerate to provide integrated O&M services for renewable energy assets, focusing on predictive maintenance.

- 2023 November: SPIE expanded its digital O&M capabilities by acquiring a leading AI-driven asset management firm, enhancing its predictive analytics offerings.

- 2023 July: U.S. Water Services Corporation launched a new suite of smart water management solutions for industrial clients, leveraging IoT for optimized water treatment and O&M.

- 2023 March: Worley secured a multi-year contract for the operation and maintenance of a significant petrochemical complex, highlighting its expertise in the chemicals sector.

- 2022 September: Advanced Technology Services introduced a new robotics-based inspection service for critical infrastructure in the manufacturing sector.

Strategic Industrial Operation and Maintenance Services Market Outlook

The strategic outlook for the Industrial Operation and Maintenance Services market remains exceptionally bright, driven by the ongoing digital transformation and the increasing imperative for operational resilience and cost optimization. Growth accelerators include the continued adoption of AI and IoT for predictive maintenance, the expansion into emerging markets with developing industrial bases, and the growing demand for integrated, end-to-end O&M solutions. Strategic opportunities lie in developing specialized service offerings for niche industries, investing in workforce training to address the skills gap, and forming strategic alliances to enhance technological capabilities and market reach. Companies that can effectively leverage data analytics, automation, and a customer-centric approach are best positioned to capitalize on the expanding opportunities and achieve sustainable growth in this dynamic market.

Industrial Operation and Maintenance Services Segmentation

-

1. Application

- 1.1. Chemicals

- 1.2. Energy

- 1.3. Metals

- 1.4. Building materials

- 1.5. Automobiles

- 1.6. Food

- 1.7. Medical

- 1.8. Others

-

2. Types

- 2.1. Operational Services

- 2.2. Maintenance Services

Industrial Operation and Maintenance Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Industrial Operation and Maintenance Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Operation and Maintenance Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Chemicals

- 5.1.2. Energy

- 5.1.3. Metals

- 5.1.4. Building materials

- 5.1.5. Automobiles

- 5.1.6. Food

- 5.1.7. Medical

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Operational Services

- 5.2.2. Maintenance Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Industrial Operation and Maintenance Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Chemicals

- 6.1.2. Energy

- 6.1.3. Metals

- 6.1.4. Building materials

- 6.1.5. Automobiles

- 6.1.6. Food

- 6.1.7. Medical

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Operational Services

- 6.2.2. Maintenance Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Industrial Operation and Maintenance Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Chemicals

- 7.1.2. Energy

- 7.1.3. Metals

- 7.1.4. Building materials

- 7.1.5. Automobiles

- 7.1.6. Food

- 7.1.7. Medical

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Operational Services

- 7.2.2. Maintenance Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Industrial Operation and Maintenance Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Chemicals

- 8.1.2. Energy

- 8.1.3. Metals

- 8.1.4. Building materials

- 8.1.5. Automobiles

- 8.1.6. Food

- 8.1.7. Medical

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Operational Services

- 8.2.2. Maintenance Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Industrial Operation and Maintenance Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Chemicals

- 9.1.2. Energy

- 9.1.3. Metals

- 9.1.4. Building materials

- 9.1.5. Automobiles

- 9.1.6. Food

- 9.1.7. Medical

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Operational Services

- 9.2.2. Maintenance Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Industrial Operation and Maintenance Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Chemicals

- 10.1.2. Energy

- 10.1.3. Metals

- 10.1.4. Building materials

- 10.1.5. Automobiles

- 10.1.6. Food

- 10.1.7. Medical

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Operational Services

- 10.2.2. Maintenance Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AECOM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 SPIE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 U.S. Water Services Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Audubon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advanced Technology Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Worley

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fives

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Savage

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PRIDE Industries

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Black & Veatch

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Monadelphous

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 H+M Industrial

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Focused Photonics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 AECOM

List of Figures

- Figure 1: Global Industrial Operation and Maintenance Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Operation and Maintenance Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Industrial Operation and Maintenance Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Industrial Operation and Maintenance Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Industrial Operation and Maintenance Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Industrial Operation and Maintenance Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Industrial Operation and Maintenance Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Industrial Operation and Maintenance Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Industrial Operation and Maintenance Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Industrial Operation and Maintenance Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Industrial Operation and Maintenance Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Industrial Operation and Maintenance Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Industrial Operation and Maintenance Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Industrial Operation and Maintenance Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Industrial Operation and Maintenance Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Industrial Operation and Maintenance Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Industrial Operation and Maintenance Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Industrial Operation and Maintenance Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Industrial Operation and Maintenance Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Industrial Operation and Maintenance Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Industrial Operation and Maintenance Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Industrial Operation and Maintenance Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Industrial Operation and Maintenance Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Industrial Operation and Maintenance Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Industrial Operation and Maintenance Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Industrial Operation and Maintenance Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Industrial Operation and Maintenance Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Industrial Operation and Maintenance Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Industrial Operation and Maintenance Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Industrial Operation and Maintenance Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Industrial Operation and Maintenance Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Industrial Operation and Maintenance Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Industrial Operation and Maintenance Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Operation and Maintenance Services?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Industrial Operation and Maintenance Services?

Key companies in the market include AECOM, SPIE, U.S. Water Services Corporation, Audubon, Advanced Technology Services, Worley, Fives, Savage, PRIDE Industries, Black & Veatch, Monadelphous, H+M Industrial, Focused Photonics.

3. What are the main segments of the Industrial Operation and Maintenance Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Operation and Maintenance Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Operation and Maintenance Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Operation and Maintenance Services?

To stay informed about further developments, trends, and reports in the Industrial Operation and Maintenance Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence