Key Insights

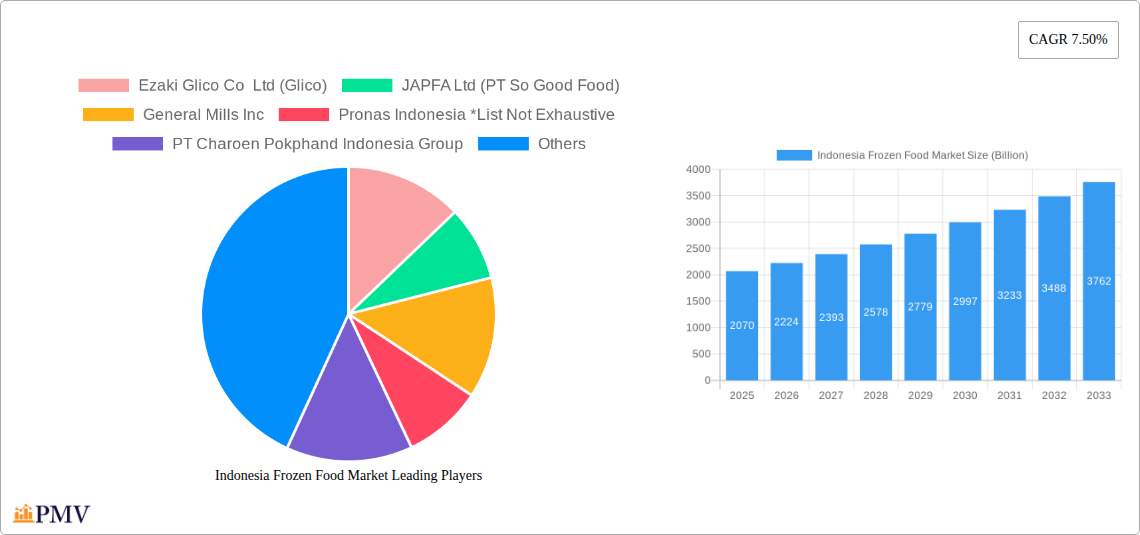

The Indonesian frozen food market, valued at $2.07 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.50% from 2025 to 2033. This surge is driven by several key factors. Rising disposable incomes and a burgeoning middle class are fueling increased consumer spending on convenient and readily available food options. The increasing urbanization in Indonesia is leading to busier lifestyles, boosting demand for time-saving frozen meals. Furthermore, the growing popularity of Western-style diets and international cuisines is contributing to the market's expansion. The convenience and extended shelf life of frozen food are particularly attractive to busy professionals and young families. Key segments within the market include frozen ready meals, witnessing significant growth due to their ease of preparation, and frozen fruits and vegetables, driven by health-conscious consumers seeking convenient access to nutritious options. Hypermarkets and supermarkets remain the dominant distribution channels, although online retail is showing promising growth, driven by increased internet penetration and e-commerce adoption. Major players such as Ezaki Glico, JAPFA, and Unilever are leveraging their strong brand presence and distribution networks to capture significant market share. However, challenges such as maintaining cold chain integrity and addressing consumer concerns about food quality and safety remain critical for sustained market growth.

The competitive landscape is marked by both established multinational corporations and local players. The presence of established international brands provides consumers with a wide range of choices, while local companies leverage their understanding of local tastes and preferences. This dynamic interplay fuels innovation and ensures the market remains diverse and responsive to consumer demands. Future growth will be influenced by factors such as government regulations related to food safety, the evolution of consumer preferences, and the expansion of e-commerce platforms. Continued investment in cold chain infrastructure will be crucial to support market expansion, while addressing consumer concerns regarding nutritional value and potential health impacts of processed frozen foods will play a significant role in shaping the market's trajectory. The ongoing development of innovative frozen food products tailored to specific dietary needs and preferences will be a critical driver of future market growth.

Indonesia Frozen Food Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesia frozen food market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects the market's trajectory through 2033, providing a robust forecast based on historical data (2019-2024). The market is valued at Billion USD in 2025 and is projected to reach Billion USD by 2033. The report covers key market segments, competitive dynamics, and emerging trends, highlighting growth opportunities and challenges within this rapidly evolving sector.

Indonesia Frozen Food Market Structure & Competitive Dynamics

The Indonesian frozen food market exhibits a moderately concentrated structure, with a mix of multinational corporations and local players vying for market share. Key players include Ezaki Glico Co Ltd (Glico), JAPFA Ltd (PT So Good Food), General Mills Inc, Pronas Indonesia, PT Charoen Pokphand Indonesia Group, Aice Group Holdings, Gunung Sewu Group (Belfoods Indonesia), Unilever PLC, PT Sekar Bumi Tbk, and Mccain Foods Ltd. However, this list is not exhaustive and several smaller, regional players also contribute to market activity.

Market concentration is influenced by factors including brand recognition, distribution networks, and product innovation. Larger players often command significant market share through extensive distribution channels and established brand loyalty. However, smaller players are successfully carving out niches through specialized products and regional focus.

The Indonesian frozen food market is characterized by a dynamic innovation ecosystem, with both established and emerging players continuously introducing new products and technologies to cater to evolving consumer preferences. Regulatory frameworks play a significant role, impacting product safety, labeling requirements, and import/export regulations. Importantly, the market experiences competition from fresh and chilled food alternatives, acting as significant substitutes.

M&A activity has been moderate in recent years, with deal values varying depending on the size and scope of the acquisition. While precise M&A deal values are not publicly available for every transaction in this sector, estimated deal values are xx Billion USD annually, influencing market consolidation and competitiveness. Several industry participants have adopted strategies involving both organic growth and strategic partnerships to strengthen their market positions. End-user trends indicate a growing preference for convenient, ready-to-eat meals, influencing product development and marketing strategies.

Indonesia Frozen Food Market Industry Trends & Insights

The Indonesian frozen food market is experiencing robust growth, driven by several key factors. Rising disposable incomes, increasing urbanization, and changing lifestyles are fueling demand for convenient and time-saving food options. The burgeoning middle class, particularly in urban areas, is driving consumption of frozen ready meals, snacks, and desserts. Technological advancements in food preservation and processing are contributing to higher-quality and longer-lasting frozen products. Furthermore, expanding retail infrastructure, including the rise of online grocery platforms, is facilitating wider market access.

The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and it's projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration is steadily increasing, especially in regions with growing urbanization and improved cold chain infrastructure. However, challenges remain, such as maintaining consistent product quality across distribution channels and addressing concerns related to food safety and preservation. Competitive dynamics are intensifying, with both domestic and international players vying for market share through innovation, branding, and aggressive marketing campaigns.

Dominant Markets & Segments in Indonesia Frozen Food Market

Leading Segments:

By Type: The Frozen Ready Meals segment is currently the dominant type, followed closely by Frozen Processed Meat Products. Growth in this segment is largely fueled by increasing consumer demand for convenient and quick meal options. Frozen Fruits and Vegetables are also experiencing a steady rise, driven by increased health consciousness and the desire for convenient access to nutritious foods.

By Distribution Channel: Hypermarkets/Supermarkets remain the leading distribution channel, accounting for the largest share of sales. However, the Online Retail Stores segment is experiencing the most rapid growth, driven by the increasing adoption of e-commerce and online grocery shopping. The expansion of logistics infrastructure and improved cold chain management are supporting this growth.

Key Drivers for Segment Dominance:

Economic Factors: Rising disposable incomes and increased purchasing power among Indonesian consumers are driving overall growth across all segments.

Infrastructure Development: Improved cold chain infrastructure, including better transportation and storage facilities, is crucial in supporting the growth of the frozen food market, especially in more remote areas.

Government Policies: Supportive government policies aimed at promoting food security and infrastructure development are also contributing to the expansion of the frozen food sector.

Indonesia Frozen Food Market Product Innovations

Recent product innovations in the Indonesian frozen food market focus on improving convenience, enhancing taste and nutritional value, and addressing sustainability concerns. Manufacturers are developing a wider range of ready-to-eat and ready-to-cook meals, catering to busy lifestyles and diverse culinary preferences. There's a clear emphasis on incorporating natural ingredients and reducing preservatives. The incorporation of new technologies such as improved freezing methods and sustainable packaging solutions is gaining traction. This allows for longer shelf life and reduces the environmental impact of the products.

Report Segmentation & Scope

This report segments the Indonesian frozen food market by Type: Frozen Fruits and Vegetables, Frozen Ready Meals, Frozen Processed Meat Products, Frozen Processed Seafood, Frozen Bakery Products, and Other Types. Each segment’s growth projection and market size are detailed within the complete report. The competitive dynamics within each segment, along with potential disruptions and opportunities are also discussed.

The market is also segmented by Distribution Channel: Hypermarkets/Supermarkets, Grocery Stores/Convenience Stores, and Online Retail Stores. Each channel's unique growth trajectory, market size, and competitive landscape are thoroughly analyzed. The growth projections reflect the anticipated expansion of each channel based on current market trends and future projections.

Key Drivers of Indonesia Frozen Food Market Growth

Several factors are driving the growth of the Indonesian frozen food market. The rising disposable incomes of the growing middle class fuels demand for convenient food options. Urbanization leads to a time-constrained lifestyle, increasing the demand for quick-meal solutions. Advances in freezing technologies are improving product quality and extending shelf life. Government initiatives promoting infrastructure development have aided the growth of the cold chain infrastructure required for this market to thrive. The expansion of e-commerce platforms is opening up new distribution channels.

Challenges in the Indonesia Frozen Food Market Sector

The Indonesian frozen food market faces several challenges. Maintaining a consistent cold chain throughout the supply chain is crucial for product quality. Regulatory compliance relating to food safety and labeling requirements represents a continuous hurdle for manufacturers. Intense competition from both domestic and international players puts pressure on profit margins. Fluctuations in raw material prices can impact profitability and the affordability of products for consumers. Limited awareness regarding the nutritional value of frozen food in certain segments of the population still requires addressing.

Leading Players in the Indonesia Frozen Food Market Market

- Ezaki Glico Co Ltd (Glico)

- JAPFA Ltd (PT So Good Food)

- General Mills Inc

- Pronas Indonesia

- PT Charoen Pokphand Indonesia Group

- Aice Group Holdings

- Gunung Sewu Group (Belfoods Indonesia)

- Unilever PLC

- PT Sekar Bumi Tbk

- Mccain Foods Ltd

Key Developments in Indonesia Frozen Food Market Sector

February 2023: Haagen-Dazs and EIT Food launched the Start-Up Innovation Challenge, focusing on sustainable ice cream production. This highlights a growing industry focus on sustainability.

March 2022: Traveloka launched its e-grocery platform "Mart," expanding online access to frozen food products and increasing competition in the online retail space.

January 2022: Yili Group expanded its operations in Indonesia, indicating increased foreign investment and competition within the market. This contributed to wider distribution and increased product variety.

Strategic Indonesia Frozen Food Market Outlook

The Indonesian frozen food market holds significant future potential, driven by continued economic growth, urbanization, and evolving consumer preferences. Strategic opportunities exist in developing innovative products catering to health-conscious consumers and expanding distribution networks in underserved regions. Investment in advanced technologies and sustainable practices will be key for success. Companies that can effectively manage their supply chains, comply with regulations, and adapt to changing consumer preferences will be best positioned to capitalize on the growth opportunities within this dynamic market.

Indonesia Frozen Food Market Segmentation

-

1. Type

- 1.1. Frozen Fruits and Vegetables

- 1.2. Frozen Ready Meals

- 1.3. Frozen Processed Meat Products

- 1.4. Frozen Processed SeaFood

- 1.5. Frozen Bakery Products

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Hypermarkets/Supermarkets

- 2.2. Grocery Stores/ Convenience Stores

- 2.3. Online Retail Stores

Indonesia Frozen Food Market Segmentation By Geography

- 1. Indonesia

Indonesia Frozen Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of Convenient Food Products; Expansion of Cold Chain Logistics

- 3.3. Market Restrains

- 3.3.1. Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Convenience Food Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Frozen Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Frozen Fruits and Vegetables

- 5.1.2. Frozen Ready Meals

- 5.1.3. Frozen Processed Meat Products

- 5.1.4. Frozen Processed SeaFood

- 5.1.5. Frozen Bakery Products

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/Supermarkets

- 5.2.2. Grocery Stores/ Convenience Stores

- 5.2.3. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ezaki Glico Co Ltd (Glico)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAPFA Ltd (PT So Good Food)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pronas Indonesia *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Charoen Pokphand Indonesia Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aice Group Holdings

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gunung Sewu Group (Belfoods Indonesia)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Unilever PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Sekar Bumi Tbk

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mccain Foods Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ezaki Glico Co Ltd (Glico)

List of Figures

- Figure 1: Indonesia Frozen Food Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Indonesia Frozen Food Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Frozen Food Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Indonesia Frozen Food Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 3: Indonesia Frozen Food Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 4: Indonesia Frozen Food Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Indonesia Frozen Food Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Indonesia Frozen Food Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 7: Indonesia Frozen Food Market Revenue Billion Forecast, by Distribution Channel 2019 & 2032

- Table 8: Indonesia Frozen Food Market Revenue Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Frozen Food Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Indonesia Frozen Food Market?

Key companies in the market include Ezaki Glico Co Ltd (Glico), JAPFA Ltd (PT So Good Food), General Mills Inc, Pronas Indonesia *List Not Exhaustive, PT Charoen Pokphand Indonesia Group, Aice Group Holdings, Gunung Sewu Group (Belfoods Indonesia), Unilever PLC, PT Sekar Bumi Tbk, Mccain Foods Ltd.

3. What are the main segments of the Indonesia Frozen Food Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.07 Billion as of 2022.

5. What are some drivers contributing to market growth?

Popularity of Convenient Food Products; Expansion of Cold Chain Logistics.

6. What are the notable trends driving market growth?

Increasing Demand for Convenience Food Products.

7. Are there any restraints impacting market growth?

Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

February 2023: Haagen-Dazs and EIT Food (European Institute of Innovation and Technology) launched the Start-Up Innovation Challenge. The company announced it to be a global project that aims to explore the potential for innovation in technology and ingredients, focusing on opportunities to increase the sustainability potential of the ice cream brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Frozen Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Frozen Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Frozen Food Market?

To stay informed about further developments, trends, and reports in the Indonesia Frozen Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence