Key Insights

The Indonesia Enterprise Network Infrastructure Market is poised for significant growth, with a projected market size of $0.52 million in 2025 and a Compound Annual Growth Rate (CAGR) of 9.12% from 2025 to 2033. This growth is driven by the increasing demand for robust network solutions that support digital transformation initiatives across various industries. Key drivers include the adoption of cloud services, the need for enhanced data security, and the expansion of IoT applications. Major players such as Cisco Systems Inc, HPE Aruba Networking, and VMware LLC are at the forefront, offering innovative solutions that cater to the evolving needs of Indonesian enterprises. The market's growth is further fueled by trends such as the integration of AI and machine learning in network management, which enhances operational efficiency and predictive maintenance capabilities.

Despite the positive outlook, the market faces certain restraints, including the high cost of initial deployment and the complexity of integrating new technologies with existing infrastructure. However, these challenges are being addressed through strategic partnerships and the development of cost-effective solutions. The market is segmented into various components, with companies like Dell Inc, Huawei Technologies Co Ltd, and Nokia playing crucial roles in different segments. The competitive landscape is dynamic, with companies like A10 Networks, Telefonaktiebolaget LM Ericsson, and ZTE Corporation continually innovating to capture a larger market share. As enterprises in Indonesia continue to prioritize digital transformation, the enterprise network infrastructure market is set to play a pivotal role in supporting their growth and operational efficiency.

Indonesia Enterprise Network Infrastructure Market Market Structure & Competitive Dynamics

The Indonesia Enterprise Network Infrastructure Market is characterized by a mix of global giants and local players, creating a dynamic and competitive environment. Market concentration is moderate, with leading companies such as Cisco Systems Inc, HPE Aruba Networking, and Huawei Technologies Co Ltd holding significant shares. Market share statistics indicate that Cisco holds approximately 25% of the market, while HPE Aruba and Huawei each possess around 15%. Innovation ecosystems thrive in this sector, driven by collaborations with local universities and tech hubs, fostering advanced solutions tailored to Indonesia's unique needs.

Regulatory frameworks in Indonesia are stringent, aiming to protect consumer data and ensure robust infrastructure. The government's push for digital transformation under the Indonesia Digital Vision 2045 has spurred growth in network infrastructure, though it also introduces challenges related to compliance. Product substitutes, such as cloud-based networking solutions, are gaining traction, impacting traditional hardware sales. End-user trends show a shift towards integrated solutions that offer scalability and flexibility, particularly in sectors like finance and healthcare.

Mergers and acquisitions (M&A) play a crucial role in shaping market dynamics. In the last five years, M&A activities totaled over $500 Million, with key deals like the acquisition of a local network solutions provider by Dell Inc for $100 Million. These activities are aimed at expanding market reach and enhancing technological capabilities.

- Market Concentration: Moderate, with top players holding significant shares.

- Innovation Ecosystems: Driven by collaborations with local universities and tech hubs.

- Regulatory Frameworks: Stringent, focusing on data protection and digital transformation.

- Product Substitutes: Increasing adoption of cloud-based networking solutions.

- End-User Trends: Demand for integrated, scalable solutions.

- M&A Activities: Over $500 Million in deals, with key acquisitions enhancing market presence.

Indonesia Enterprise Network Infrastructure Market Industry Trends & Insights

The Indonesia Enterprise Network Infrastructure Market is experiencing robust growth, driven by several key factors. The market's Compound Annual Growth Rate (CAGR) is projected to be 8.5% from 2025 to 2033, reflecting strong demand for advanced networking solutions. Technological disruptions, such as the adoption of 5G technology and the Internet of Things (IoT), are reshaping the landscape, enabling faster and more reliable connectivity. These advancements are particularly crucial in industries like manufacturing and telecommunications, where real-time data processing is essential.

Consumer preferences are shifting towards solutions that offer high security and efficiency. The rise in cyber threats has led enterprises to invest heavily in secure network infrastructures, with cybersecurity solutions becoming an integral part of network offerings. Competitive dynamics are intense, with companies like VMware LLC and Extreme Networks focusing on niche markets to differentiate their products. Market penetration is increasing, with network infrastructure solutions reaching 70% of large enterprises and 50% of SMEs by 2025.

The government's initiatives, such as the development of smart cities and the relocation of the capital to Nusantara, are further propelling market growth. These projects require extensive network infrastructure, creating opportunities for companies to expand their footprint. Additionally, the push for digitalization across various sectors is driving demand for robust and scalable network solutions.

Overall, the Indonesia Enterprise Network Infrastructure Market is poised for significant expansion, fueled by technological advancements, government initiatives, and evolving consumer needs. Companies that can adapt to these trends and offer innovative solutions will likely gain a competitive edge in this rapidly evolving market.

Dominant Markets & Segments in Indonesia Enterprise Network Infrastructure Market

The Indonesia Enterprise Network Infrastructure Market is dominated by the telecommunications and IT services sector, which accounts for the largest share due to the country's rapid digitalization efforts. Key drivers for this dominance include the government's focus on digital infrastructure development and the increasing demand for high-speed internet and data services.

- Economic Policies: Government initiatives like the Indonesia Digital Vision 2045 are boosting investments in network infrastructure.

- Infrastructure Development: The construction of smart cities and the relocation of the capital to Nusantara are driving demand for advanced networking solutions.

- Technological Advancements: The rollout of 5G and IoT technologies is enhancing the capabilities of network infrastructure.

- Market Demand: Growing need for high-speed internet and robust data networks in both urban and rural areas.

The telecommunications sector's dominance is further solidified by its critical role in supporting other industries, such as finance, healthcare, and education. The sector's growth is closely tied to the expansion of mobile and broadband services, with companies like Nokia and Telefonaktiebolaget LM Ericsson leading the charge in providing cutting-edge solutions.

In terms of regional dominance, Java remains the leading region due to its high population density and concentration of businesses. However, other regions like Sumatra and Sulawesi are catching up, driven by government initiatives to bridge the digital divide. The market's segmentation into hardware, software, and services also plays a crucial role, with hardware solutions currently holding the largest market share due to the need for physical infrastructure upgrades.

The dominance of the telecommunications and IT services sector is expected to continue, supported by ongoing government initiatives and the increasing demand for digital solutions. Companies that can capitalize on these trends and offer tailored solutions for different regions and industries will be well-positioned to succeed in this market.

Indonesia Enterprise Network Infrastructure Market Product Innovations

Product innovations in the Indonesia Enterprise Network Infrastructure Market are driven by the need for more efficient, secure, and scalable solutions. Recent developments include the introduction of software-defined networking (SDN) and network function virtualization (NFV), which offer greater flexibility and cost-effectiveness. Companies like Cisco and HPE Aruba are at the forefront, providing advanced solutions that integrate AI and machine learning for predictive maintenance and optimized performance. These innovations align well with market needs, particularly in sectors requiring high-speed and reliable connectivity.

Report Segmentation & Scope

The Indonesia Enterprise Network Infrastructure Market is segmented into hardware, software, and services. The hardware segment, encompassing routers, switches, and other physical components, is expected to grow at a CAGR of 7.5% from 2025 to 2033, reaching a market size of $2.5 Billion by 2033. The software segment, including network management and security solutions, is projected to grow at a CAGR of 9.5%, with a market size of $1.8 Billion by 2033. Services, such as installation, maintenance, and consulting, are anticipated to grow at a CAGR of 8.0%, reaching $1.2 Billion by 2033. Each segment faces competitive dynamics, with companies vying for market share through innovation and strategic partnerships.

Key Drivers of Indonesia Enterprise Network Infrastructure Market Growth

The growth of the Indonesia Enterprise Network Infrastructure Market is driven by several key factors. Technologically, the adoption of 5G and IoT is fueling demand for advanced network solutions. Economically, the government's focus on digital transformation and smart city projects is increasing investments in infrastructure. Regulatory initiatives, such as the Indonesia Digital Vision 2045, are encouraging enterprises to upgrade their networks to meet compliance standards. These drivers are creating a favorable environment for market expansion.

Challenges in the Indonesia Enterprise Network Infrastructure Market Sector

The Indonesia Enterprise Network Infrastructure Market faces several challenges. Regulatory hurdles, such as stringent data protection laws, can delay project timelines and increase costs. Supply chain disruptions, particularly those related to global chip shortages, impact the availability of hardware components. Competitive pressures are intense, with companies needing to innovate continuously to maintain market share. These challenges can lead to a 5-10% reduction in projected growth rates if not addressed effectively.

Leading Players in the Indonesia Enterprise Network Infrastructure Market Market

- Cisco Systems Inc

- HPE Aruba Networking

- VMware LLC

- Extreme Networks

- Dell Inc

- Huawei Technologies Co Ltd

- A10 Networks

- Nokia

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

Key Developments in Indonesia Enterprise Network Infrastructure Market Sector

- October 2023: ZTE Corporation partnered with PT iForte Solusi Infotek to drive telecom energy innovation and bolster Indonesia's network infrastructure for sustainable development. This partnership is expected to enhance the market's focus on eco-friendly solutions.

- January 2024: Indonesia's Nusantara Capital Authority (OIKN) announced that Nusantara's telecommunications infrastructure is set to go live by August 2024, aligning with the capital's relocation from Jakarta. This development will significantly impact the demand for network infrastructure in the new capital region.

Strategic Indonesia Enterprise Network Infrastructure Market Market Outlook

The future outlook for the Indonesia Enterprise Network Infrastructure Market is promising, with significant growth potential driven by technological advancements and government initiatives. The market is expected to see increased adoption of 5G and IoT solutions, further boosting demand for advanced network infrastructure. Strategic opportunities lie in expanding into emerging regions like Sumatra and Sulawesi, where digitalization efforts are gaining momentum. Companies that can leverage these trends and offer innovative, tailored solutions will be well-positioned to capitalize on the market's growth trajectory.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Indonesia Enterprise Network Infrastructure Market Segmentation

-

1. Equipment

- 1.1. Routers and Switches (Ethernet Switch, MPLS)

- 1.2. WLAN

- 1.3. Network Security

- 1.4. Other Equipment

-

2. End-user Industry

- 2.1. Service Providers

-

2.2. Enterprises

- 2.2.1. SMEs

- 2.2.2. Large Enterprises

Indonesia Enterprise Network Infrastructure Market Segmentation By Geography

- 1. Indonesia

Indonesia Enterprise Network Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for High-speed Network and Data Transfer; Growing Industrial Automation

- 3.3. Market Restrains

- 3.3.1. Rising Demand for High-speed Network and Data Transfer; Growing Industrial Automation

- 3.4. Market Trends

- 3.4.1. Routers and Switches to Exhibit a Significant Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Enterprise Network Infrastructure Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 5.1.1. Routers and Switches (Ethernet Switch, MPLS)

- 5.1.2. WLAN

- 5.1.3. Network Security

- 5.1.4. Other Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Service Providers

- 5.2.2. Enterprises

- 5.2.2.1. SMEs

- 5.2.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HPE Aruba Networking

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 VMware LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Extreme Networks

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dell Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Huawei Technologies Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 A10 Networks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nokia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Telefonaktiebolaget LM Ericsson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZTE Corporatio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

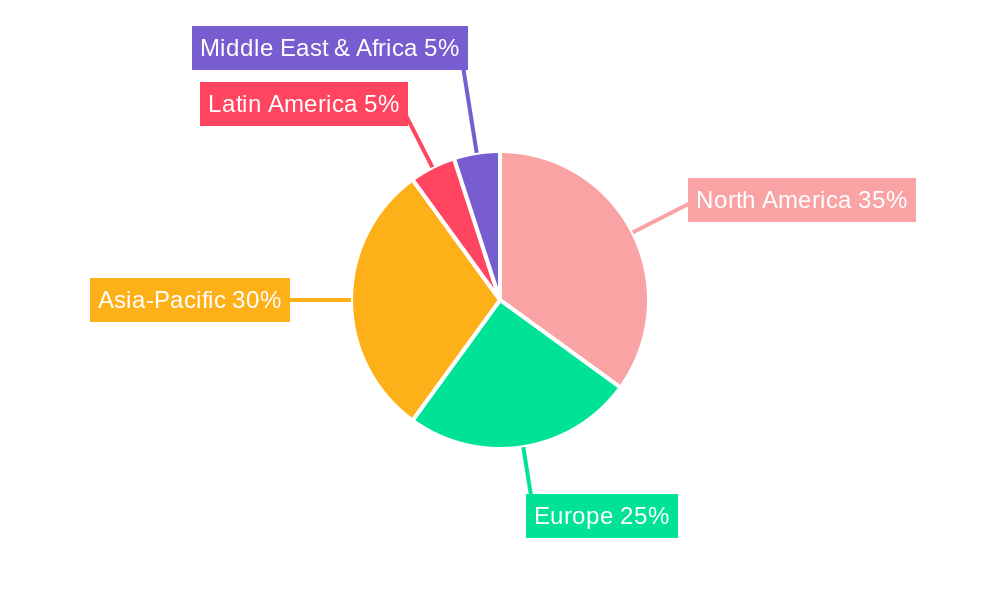

- Figure 1: Indonesia Enterprise Network Infrastructure Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Enterprise Network Infrastructure Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 4: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by Equipment 2019 & 2032

- Table 5: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by Equipment 2019 & 2032

- Table 10: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by Equipment 2019 & 2032

- Table 11: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Indonesia Enterprise Network Infrastructure Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Enterprise Network Infrastructure Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Enterprise Network Infrastructure Market?

The projected CAGR is approximately 9.12%.

2. Which companies are prominent players in the Indonesia Enterprise Network Infrastructure Market?

Key companies in the market include Cisco Systems Inc, HPE Aruba Networking, VMware LLC, Extreme Networks, Dell Inc, Huawei Technologies Co Ltd, A10 Networks, Nokia, Telefonaktiebolaget LM Ericsson, ZTE Corporatio.

3. What are the main segments of the Indonesia Enterprise Network Infrastructure Market?

The market segments include Equipment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for High-speed Network and Data Transfer; Growing Industrial Automation.

6. What are the notable trends driving market growth?

Routers and Switches to Exhibit a Significant Growth Rate.

7. Are there any restraints impacting market growth?

Rising Demand for High-speed Network and Data Transfer; Growing Industrial Automation.

8. Can you provide examples of recent developments in the market?

October 2023 - ZTE Corporation, a provider of information and communication technology solutions, partnered with PT iForte Solusi Infotek, an Indonesian telecommunications infrastructure and internet services provider. Together, they aim to drive telecom energy innovation and bolster Indonesia's network infrastructure for sustainable development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Enterprise Network Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Enterprise Network Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Enterprise Network Infrastructure Market?

To stay informed about further developments, trends, and reports in the Indonesia Enterprise Network Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence