Key Insights

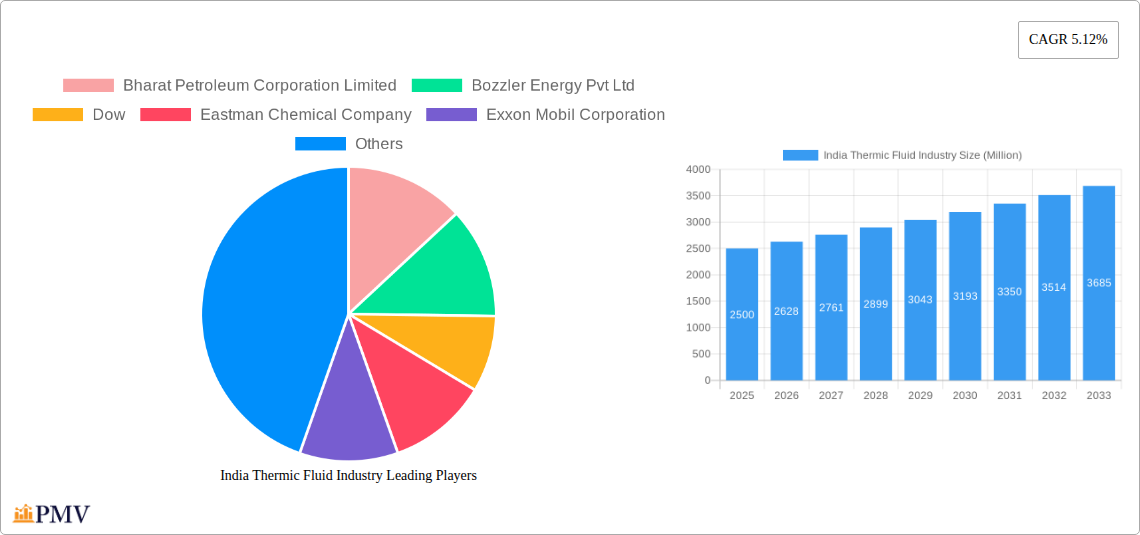

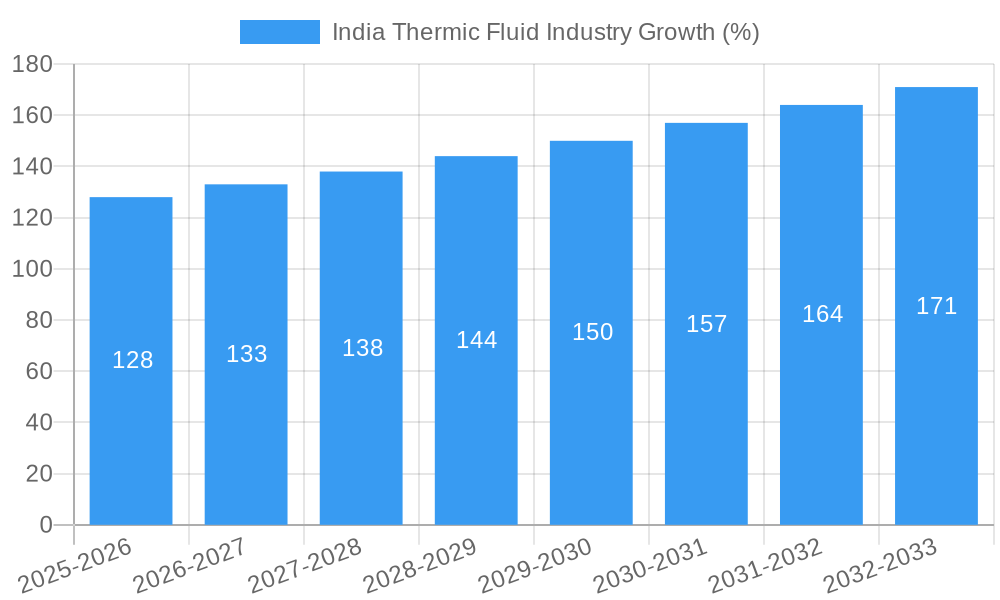

The India thermic fluid market, exhibiting a Compound Annual Growth Rate (CAGR) of 5.12% from 2019 to 2024, is poised for continued expansion. Driven by increasing industrialization, particularly within sectors like petrochemicals, power generation, and manufacturing, the demand for efficient heat transfer fluids is rising steadily. Growth is further fueled by the adoption of advanced technologies and stringent environmental regulations promoting the use of eco-friendly thermic fluids. Key players like Bharat Petroleum Corporation Limited, Indian Oil Corporation Ltd, and Shell plc are strategically investing in expanding their product portfolios and distribution networks to cater to this growing demand. The market segmentation is likely diverse, encompassing various fluid types based on their chemical composition and application-specific properties. A significant portion of the market might be concentrated in key industrial hubs across India. While challenges such as price volatility of raw materials and potential supply chain disruptions could influence market growth, the overall outlook remains positive.

The forecast period (2025-2033) anticipates sustained growth, mirroring the trajectory of India's industrial expansion and infrastructural development. The market size in 2025 is estimated to be substantial, given the historical growth rate and current market dynamics. Continued government initiatives focused on sustainable industrial practices and energy efficiency will play a crucial role in driving adoption of high-performance thermic fluids. Companies are likely to focus on innovation, developing specialized fluids to meet the specific needs of different industries. The competitive landscape is expected to remain dynamic, with both established players and new entrants vying for market share through product differentiation, technological advancements, and strategic partnerships.

This comprehensive report provides an in-depth analysis of the India Thermic Fluid Industry, offering valuable insights for businesses, investors, and stakeholders seeking to understand this dynamic market. Covering the period 2019-2033, with a focus on 2025, this report leverages extensive market research and data analysis to deliver actionable intelligence. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and future projections (2025-2033), to create a holistic view of market trends and opportunities. The study period covers significant industry developments, allowing for a complete understanding of past performance and future potential.

India Thermic Fluid Industry Market Structure & Competitive Dynamics

The Indian thermic fluid market exhibits a moderately concentrated structure, with key players holding significant market shares. The market is characterized by a blend of multinational corporations and domestic players, creating a competitive landscape marked by both established brands and emerging innovators. The market share of the top five players is estimated at xx%, indicating a moderate level of concentration. Innovation is driven by a combination of internal R&D efforts and strategic collaborations. The regulatory framework, while largely supportive of industrial growth, presents certain compliance challenges. Product substitutes, primarily alternative heat transfer fluids, pose a moderate competitive threat. End-user trends increasingly favor environmentally friendly and energy-efficient solutions. M&A activity has been relatively low in recent years, with deal values averaging approximately xx Million annually.

- Market Concentration: Moderate, with top 5 players holding xx% market share.

- Innovation Ecosystem: Blend of internal R&D and strategic partnerships.

- Regulatory Framework: Supportive but with specific compliance requirements.

- Product Substitutes: Alternative heat transfer fluids pose a moderate threat.

- End-User Trends: Growing preference for eco-friendly and energy-efficient solutions.

- M&A Activity: Low, with average annual deal values around xx Million.

India Thermic Fluid Industry Industry Trends & Insights

The Indian thermic fluid market is experiencing robust growth, driven by increasing industrialization, expanding manufacturing capacity, and rising demand across diverse sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, such as advancements in heat transfer fluid formulations and improved process technologies, are reshaping market dynamics. Consumer preferences are increasingly focused on sustainability and improved performance. Competitive dynamics are intense, with companies focusing on innovation, cost optimization, and strategic partnerships to gain a competitive edge. Market penetration of high-performance thermic fluids is increasing at a rate of xx% annually.

Dominant Markets & Segments in India Thermic Fluid Industry

The dominant market segment within the Indian thermic fluid industry is the [Specify dominant segment, e.g., industrial sector] segment, which accounts for approximately xx% of the total market value. This dominance is primarily attributed to the robust growth of the manufacturing and process industries in India.

- Key Drivers for Dominance:

- Rapid industrialization and manufacturing growth.

- Favorable government policies and infrastructure development.

- Increasing demand from various sectors like textiles, chemicals, and pharmaceuticals.

- High concentration of manufacturing hubs in specific regions (mention specific regions).

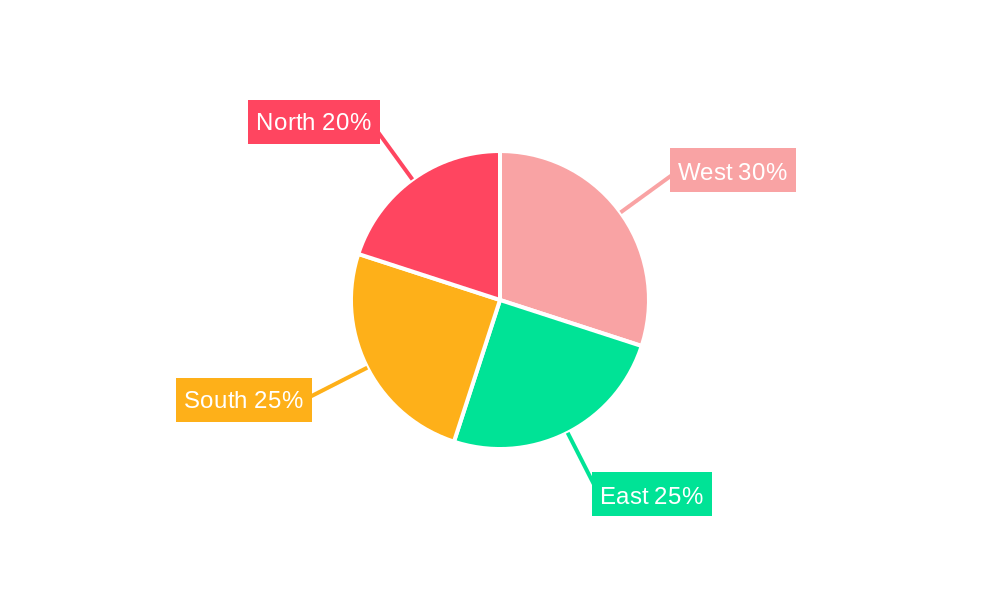

The detailed dominance analysis reveals that the [Specify dominant region, e.g., Western India] region holds the largest market share due to its concentrated industrial base and significant investments in infrastructure.

India Thermic Fluid Industry Product Innovations

Recent product innovations in the Indian thermic fluid market include the development of eco-friendly, high-performance fluids with improved thermal stability and operational efficiency. These innovations address the growing demand for sustainable and cost-effective solutions. Companies are also focusing on developing specialized fluids for niche applications, such as those in the renewable energy sector. These advancements are enhancing the competitiveness of Indian manufacturers and catering to evolving market requirements.

Report Segmentation & Scope

This report segments the Indian thermic fluid market based on type (e.g., synthetic, mineral-based), application (e.g., industrial heating, power generation), and region. Each segment’s growth projections, market size, and competitive dynamics are analyzed in detail. The synthetic segment is projected to witness higher growth than the mineral-based segment due to its superior performance characteristics. The industrial heating application segment is expected to dominate, driven by expansion in manufacturing. The market is further segmented geographically, with key regions and their respective growth trajectories analyzed separately.

Key Drivers of India Thermic Fluid Industry Growth

The growth of the Indian thermic fluid industry is primarily driven by several factors including:

- Technological advancements: Development of higher-efficiency and eco-friendly thermic fluids.

- Economic growth: Expansion of manufacturing and industrial sectors.

- Favorable government policies: Initiatives promoting industrial development and infrastructure enhancement.

- Rising energy demands: Increasing need for efficient heat transfer solutions.

Challenges in the India Thermic Fluid Industry Sector

The Indian thermic fluid industry faces several challenges, including:

- Regulatory hurdles: Compliance with environmental regulations and import/export restrictions.

- Supply chain disruptions: Dependence on raw material imports and potential logistics challenges.

- Intense competition: Presence of both domestic and international players.

- Price volatility: Fluctuations in raw material prices impacting profitability.

Leading Players in the India Thermic Fluid Industry Market

- Bharat Petroleum Corporation Limited

- Bozzler Energy Pvt Ltd

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- GS Caltex India

- Hitech Solution (Generation Four Engitech Ltd)

- HP Lubricants

- Indian Oil Corporation Ltd

- Paras Lubricants Ltd

- Shell plc

- Savita Oil Technologies Limited

- Tide Water Oil Co (India) Ltd

- List Not Exhaustive

Key Developments in India Thermic Fluid Industry Sector

- August 2022: Shell lubricants announced the launch of Electric Vehicle battery coolants (heat transfer fluids) in India, initially through imports, with plans for local manufacturing. This signifies a significant shift towards sustainable mobility solutions and strengthens the EV ecosystem.

- September 2022: Bozzler Energy Pvt Ltd showcased new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition, highlighting a focus on environmentally friendly and sustainable technologies. This emphasizes the growing importance of eco-conscious practices within the industry.

Strategic India Thermic Fluid Industry Market Outlook

The future of the Indian thermic fluid industry appears bright, driven by sustained economic growth, industrial expansion, and the increasing adoption of energy-efficient technologies. Strategic opportunities abound for companies focusing on innovation, sustainability, and catering to the growing demands of diverse industrial sectors. The market is expected to continue its robust growth trajectory, presenting significant potential for both domestic and international players. Companies that effectively adapt to changing market dynamics and embrace sustainable practices are poised to capture significant market share.

India Thermic Fluid Industry Segmentation

-

1. Type

- 1.1. Mineral Oil

- 1.2. Silicon And Aromatics

- 1.3. Glycols

- 1.4. Other Types

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Chemicals

- 2.3. Pharmaceuticals

- 2.4. Oil and Gas

- 2.5. Concentrated Solar Power

- 2.6. Other End-user Industries

India Thermic Fluid Industry Segmentation By Geography

- 1. India

India Thermic Fluid Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.3. Market Restrains

- 3.3.1. Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power

- 3.4. Market Trends

- 3.4.1. Rising Demand for Mineral Oil Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Thermic Fluid Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mineral Oil

- 5.1.2. Silicon And Aromatics

- 5.1.3. Glycols

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Chemicals

- 5.2.3. Pharmaceuticals

- 5.2.4. Oil and Gas

- 5.2.5. Concentrated Solar Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bharat Petroleum Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bozzler Energy Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eastman Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Exxon Mobil Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GS Caltex India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitech Solution (Generation Four Engitech Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HP Lubricants

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indian Oil Corporation Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Paras Lubricants Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shell plc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Savita Oil Technologies Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tide Water Oil Co (India) Ltd *List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Bharat Petroleum Corporation Limited

List of Figures

- Figure 1: India Thermic Fluid Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Thermic Fluid Industry Share (%) by Company 2024

List of Tables

- Table 1: India Thermic Fluid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Thermic Fluid Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Thermic Fluid Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: India Thermic Fluid Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Thermic Fluid Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: India Thermic Fluid Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: India Thermic Fluid Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Thermic Fluid Industry?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the India Thermic Fluid Industry?

Key companies in the market include Bharat Petroleum Corporation Limited, Bozzler Energy Pvt Ltd, Dow, Eastman Chemical Company, Exxon Mobil Corporation, GS Caltex India, Hitech Solution (Generation Four Engitech Ltd), HP Lubricants, Indian Oil Corporation Ltd, Paras Lubricants Ltd, Shell plc, Savita Oil Technologies Limited, Tide Water Oil Co (India) Ltd *List Not Exhaustive.

3. What are the main segments of the India Thermic Fluid Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

6. What are the notable trends driving market growth?

Rising Demand for Mineral Oil Segment.

7. Are there any restraints impacting market growth?

Extensive Demand from the Oil and Gas Sector; Increasing Use in Concentrated Solar Power.

8. Can you provide examples of recent developments in the market?

September 2022: Bozzler Energy Pvt Ltd announced that the company would be showcasing its new designs of Thermic Fluid Heaters at the Boiler India 2022 exhibition organized by Orangebeak Technologies, which was to be held at CIDCO Exhibition Centre, Navi Mumbai. The new designs are expected to be highly suitable for environmental health and eco-friendly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Thermic Fluid Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Thermic Fluid Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Thermic Fluid Industry?

To stay informed about further developments, trends, and reports in the India Thermic Fluid Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence