Key Insights

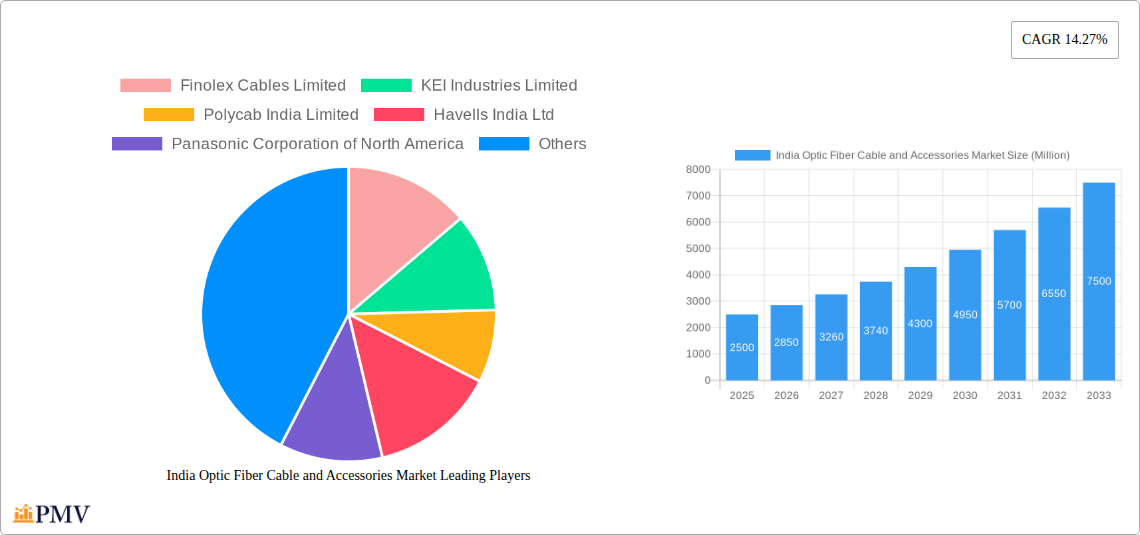

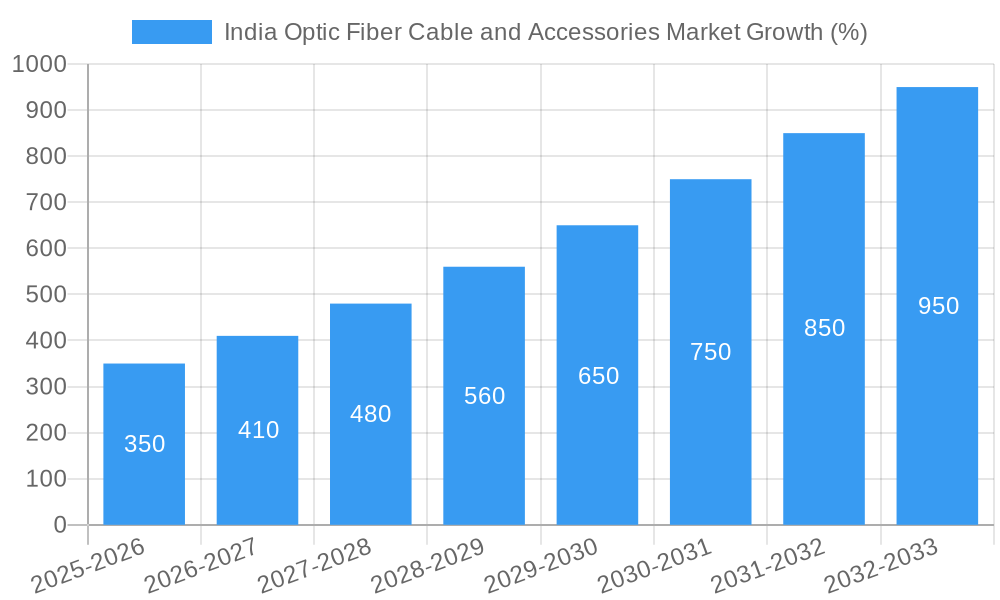

The India Optic Fiber Cable and Accessories Market is experiencing robust growth, fueled by increasing demand for high-speed internet and digital infrastructure development across the country. The market, valued at approximately ₹X Billion (estimated based on provided CAGR and assuming a reasonable 2025 market size given the scale of India's infrastructure projects) in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 14.27% from 2025 to 2033. This expansion is primarily driven by government initiatives promoting digital India, the expansion of 5G networks, and the rising adoption of fiber-to-the-home (FTTH) technology. Furthermore, the burgeoning telecommunications sector and the increasing demand for data centers are significantly contributing to market growth. Key players like Finolex Cables, KEI Industries, Polycab India, and Havells are strategically investing in advanced technologies and expanding their product portfolios to capitalize on these opportunities. The market is segmented by product type (fiber optic cables, connectors, splices, etc.), application (telecommunications, broadband, etc.), and region.

However, challenges remain. The high initial investment costs associated with fiber optic infrastructure deployment can be a significant restraint for smaller players and in less developed regions. Furthermore, competition amongst established players is intense, necessitating continuous innovation and efficient cost management to maintain market share. Nevertheless, the long-term outlook for the India Optic Fiber Cable and Accessories Market remains exceptionally positive, with significant growth potential driven by ongoing digitalization and the government's commitment to expanding broadband connectivity across the nation. This market is likely to witness increased mergers and acquisitions as companies strive for greater market penetration and technological advancement.

India Optic Fiber Cable and Accessories Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Optic Fiber Cable and Accessories Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The analysis delves into market size, segmentation, competitive landscape, technological advancements, and key growth drivers, offering a 360-degree view of this dynamic market. The report is meticulously crafted using extensive primary and secondary research, ensuring data accuracy and reliability.

India Optic Fiber Cable and Accessories Market Structure & Competitive Dynamics

The Indian optic fiber cable and accessories market exhibits a moderately concentrated structure, with several large players holding significant market share. However, the presence of numerous smaller players contributes to a dynamic and competitive environment. The market is characterized by intense competition based on price, quality, innovation, and after-sales service. Innovation ecosystems are emerging, driven by both established players and startups focusing on advanced fiber optic technologies. Regulatory frameworks, such as those governing telecom infrastructure deployment, significantly impact market growth. Product substitutes, such as wireless technologies, pose a competitive challenge, though the demand for higher bandwidth and reliability continues to favor fiber optics. End-user trends are characterized by increasing demand from telecom operators, internet service providers (ISPs), and government initiatives like BharatNet. M&A activities have been moderate, with deal values ranging from xx Million to xx Million USD in recent years, primarily focused on enhancing market reach and technological capabilities.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation: Growing ecosystem with focus on high-density cables, advanced fiber types, and improved installation techniques.

- Regulatory Framework: Government initiatives supporting digital infrastructure development drive market growth.

- Product Substitutes: Wireless technologies offer competition but fiber optics remain favored for high bandwidth needs.

- End-User Trends: Strong demand from telecom operators, ISPs, and government projects.

- M&A Activity: Moderate activity observed, with deals primarily focused on expansion and technological upgrades.

India Optic Fiber Cable and Accessories Market Industry Trends & Insights

The Indian optic fiber cable and accessories market is experiencing robust growth, driven by the expanding telecom sector, increasing internet penetration, and government initiatives promoting digital infrastructure development. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Technological disruptions, such as the adoption of 5G and the rise of FTTH (Fiber to the Home) deployments, are accelerating market expansion. Consumer preferences are shifting towards higher bandwidth speeds and reliable connectivity, fueling the demand for advanced fiber optic solutions. Competitive dynamics are shaped by pricing strategies, product differentiation, and strategic partnerships. Market penetration of fiber optic technology is steadily increasing, particularly in urban areas and expanding rapidly into rural regions thanks to government initiatives. The shift towards cloud computing and data centers further supports market expansion.

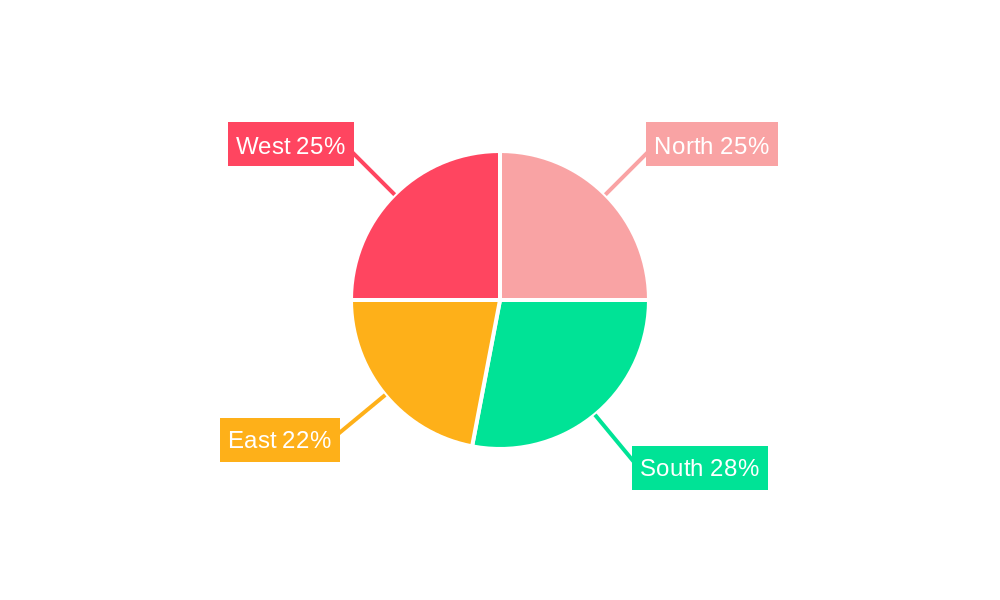

Dominant Markets & Segments in India Optic Fiber Cable and Accessories Market

The dominant market segment is currently the metropolitan areas of major cities like Mumbai, Delhi, Bengaluru, and Chennai due to higher demand and established infrastructure. However, significant growth is anticipated in Tier 2 and Tier 3 cities, fueled by government initiatives to expand digital connectivity nationwide.

- Key Drivers for Metropolitan Area Dominance:

- High population density and increased demand for high-speed internet.

- Well-established telecom infrastructure.

- High concentration of businesses and data centers.

- Key Drivers for Growth in Tier 2 & 3 Cities:

- Government initiatives like BharatNet promoting digital connectivity in rural areas.

- Increasing smartphone penetration and internet adoption.

- Growing awareness of the benefits of high-speed internet.

The detailed dominance analysis reveals that metropolitan areas currently command a larger market share due to higher internet penetration and existing infrastructure, however, government initiatives targeting rural areas show a promising upward trend in the coming years. This balanced growth indicates a strong overall market expansion throughout the country.

India Optic Fiber Cable and Accessories Market Product Innovations

Recent product innovations focus on high-density fiber cables, improving installation efficiency and space optimization. Bend-insensitive fibers offer improved performance in complex installation environments. The market is also witnessing advancements in fiber optic accessories, enhancing the overall reliability and cost-effectiveness of fiber optic networks. These innovations align with the industry's ongoing trend towards delivering faster speeds and greater network capacity at a reduced cost.

Report Segmentation & Scope

The report segments the market based on product type (optical fiber cables, accessories), application (telecommunications, broadband, enterprise), and geography (urban, rural). Each segment's growth projection and market size are meticulously analyzed, with a comprehensive evaluation of competitive dynamics within each segment. For example, the telecommunications segment is expected to witness significant growth due to the increasing demand for 5G networks and expanded broadband services, while the accessories segment will benefit from ongoing infrastructure development and network upgrades. The geographical segmentation reveals that urban areas will maintain strong growth, yet rural penetration is expected to increase significantly in coming years, opening new opportunities for growth.

Key Drivers of India Optic Fiber Cable and Accessories Market Growth

The market's growth is propelled by several key factors: the increasing demand for high-speed internet driven by rising smartphone usage and digitalization, government initiatives like BharatNet aiming to connect rural areas, the expanding telecommunications industry and 5G rollout, and the burgeoning data center and cloud computing market. The supportive regulatory environment further encourages infrastructure development and investment.

Challenges in the India Optic Fiber Cable and Accessories Market Sector

Challenges include the high initial investment required for fiber optic infrastructure deployment, especially in rural areas, the complexities involved in obtaining necessary permits and approvals, and the potential for supply chain disruptions affecting the availability of raw materials. Competition from other connectivity technologies and the need for skilled labor to install and maintain fiber optic networks pose further challenges to industry growth. These factors, while present, do not diminish the overall positive growth outlook.

Leading Players in the India Optic Fiber Cable and Accessories Market Market

- Finolex Cables Limited

- KEI Industries Limited

- Polycab India Limited

- Havells India Ltd

- Panasonic Corporation of North America

- Sterlite Technologies Limited (STL Tech)

- Birla Cable Limited

- Vindhya Telelinks Ltd

- HFCL Limited

- Aksh Optifibre Limited

Key Developments in India Optic Fiber Cable and Accessories Market Sector

- May 2024: Runaya plans to double its capacity and achieve INR 500 crore (~USD 60 million) in revenue within 3-4 years, driven by 5G rollout, tower fiberization, home broadband growth, and the BharatNet project. This significant investment demonstrates confidence in the market's long-term potential.

- July 2024: STL launches its 864F Micro Cables, offering high fiber density and improved network efficiency. This reflects ongoing innovation and competition to deliver superior connectivity solutions.

Strategic India Optic Fiber Cable and Accessories Market Outlook

The Indian optic fiber cable and accessories market is poised for sustained growth, driven by continued government investment in digital infrastructure, the expansion of 5G networks, and the rising demand for high-speed internet access across both urban and rural regions. Strategic opportunities exist for companies focused on innovation, efficient supply chains, and providing cost-effective solutions that cater to the specific needs of both telecom operators and individual consumers. The market's robust growth trajectory presents significant opportunities for players who can adapt to the evolving technological landscape and the demands of a rapidly expanding digital economy.

India Optic Fiber Cable and Accessories Market Segmentation

-

1. Offering

- 1.1. Optical Fiber Cables

- 1.2. Optical Fiber Connectors

- 1.3. Optical Fiber Accessories

-

2. End-user Vertical

- 2.1. Industrial

- 2.2. Telecommunication

- 2.3. Energy and Utilities

- 2.4. Other End-user Verticals

India Optic Fiber Cable and Accessories Market Segmentation By Geography

- 1. India

India Optic Fiber Cable and Accessories Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.27% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.3. Market Restrains

- 3.3.1. Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and 5G Deployment to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Optic Fiber Cable and Accessories Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Optical Fiber Cables

- 5.1.2. Optical Fiber Connectors

- 5.1.3. Optical Fiber Accessories

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Industrial

- 5.2.2. Telecommunication

- 5.2.3. Energy and Utilities

- 5.2.4. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Finolex Cables Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KEI Industries Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Polycab India Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Havells India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation of North America

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sterlite Technologies Limited (STL Tech)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Birla Cable Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vindhya Telelinks Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HFCL Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aksh Optifibre Limite

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Finolex Cables Limited

List of Figures

- Figure 1: India Optic Fiber Cable and Accessories Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Optic Fiber Cable and Accessories Market Share (%) by Company 2024

List of Tables

- Table 1: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 6: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 7: India Optic Fiber Cable and Accessories Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Optic Fiber Cable and Accessories Market?

The projected CAGR is approximately 14.27%.

2. Which companies are prominent players in the India Optic Fiber Cable and Accessories Market?

Key companies in the market include Finolex Cables Limited, KEI Industries Limited, Polycab India Limited, Havells India Ltd, Panasonic Corporation of North America, Sterlite Technologies Limited (STL Tech), Birla Cable Limited, Vindhya Telelinks Ltd, HFCL Limited, Aksh Optifibre Limite.

3. What are the main segments of the India Optic Fiber Cable and Accessories Market?

The market segments include Offering , End-user Vertical .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

6. What are the notable trends driving market growth?

Rising Internet Penetration and 5G Deployment to Drive the Market.

7. Are there any restraints impacting market growth?

Robust Logistics and Supply Chain Infrastructure; Rising Internet Penetration and 5G Deployment; Growing Adoption of Smart Cities and IoT.

8. Can you provide examples of recent developments in the market?

May 2024 - Runaya, a manufacturer of optical fiber cable components, aimed to double its capacity and scale its revenues to INR 500 crore (~USD 60 million) within the next 3-4 years. This ambition is driven by the accelerated rollout of 5G, the fiberization of towers, the push for home broadband connectivity, and the government's Bharatnet Project. Since 2019, the company has channeled a capital expenditure of INR 60 crore (~USD 7 million) into manufacturing FRP (fiber-reinforced polymer) rods, essential for optical fibers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Optic Fiber Cable and Accessories Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Optic Fiber Cable and Accessories Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Optic Fiber Cable and Accessories Market?

To stay informed about further developments, trends, and reports in the India Optic Fiber Cable and Accessories Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence