Key Insights

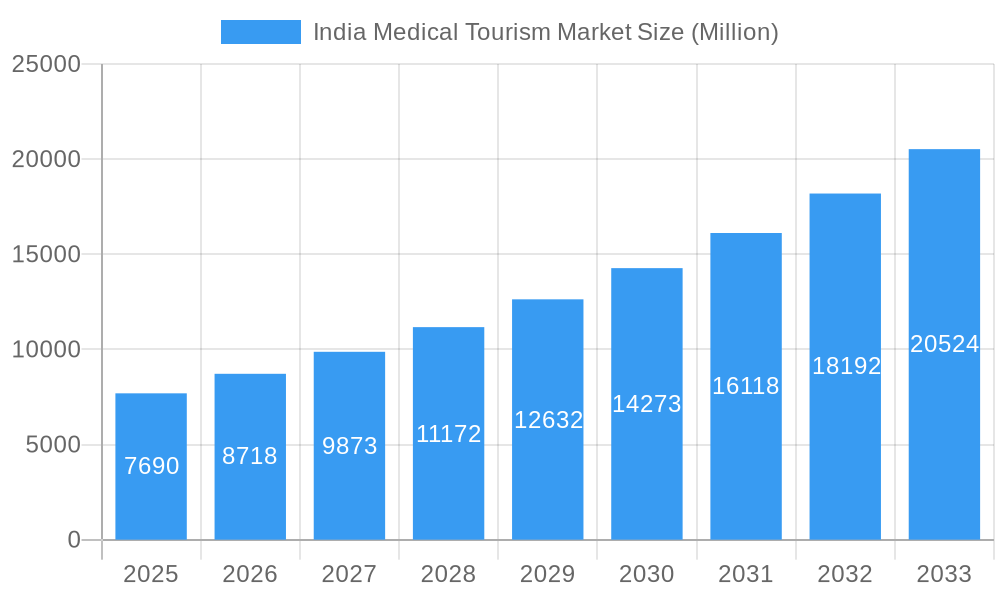

The India medical tourism market is experiencing robust growth, projected to reach a market size of $7.69 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.23% from 2025 to 2033. This significant expansion is driven by several key factors. Firstly, India offers high-quality medical care at significantly lower costs compared to Western nations, making it an attractive destination for patients seeking affordable treatment options. Secondly, the country boasts a large pool of highly skilled medical professionals and advanced medical infrastructure, particularly in specialized areas like cardiovascular surgery, orthopedic procedures, and oncology. The increasing prevalence of chronic diseases globally further fuels demand, with patients seeking cost-effective solutions for complex treatments. Furthermore, improvements in medical infrastructure, streamlined visa processes, and targeted marketing campaigns aimed at international patients are contributing to market growth. The market is segmented by treatment type (dental, cosmetic, cardiovascular, orthopedic, neurological, cancer, fertility, and others) and service provider (public and private), showcasing diverse opportunities within the sector. Regional variations exist, with potential for further expansion in all regions of India (North, South, East, and West) due to varying levels of medical infrastructure development and accessibility. While regulatory hurdles and infrastructural limitations in certain regions could pose challenges, the overall trajectory indicates a positive and expansive outlook for the Indian medical tourism industry.

India Medical Tourism Market Market Size (In Billion)

The competitive landscape is dynamic, with both established players like Apollo Hospitals and emerging organizations such as Tour2India4Health actively competing to capture market share. The success of these companies hinges on their ability to provide high-quality services, efficient patient management, and robust international outreach. Future growth will depend on continuous improvement of medical infrastructure, enhancement of patient experience, and the adoption of innovative technologies to maintain a competitive edge in the global medical tourism arena. Strategies to address challenges such as language barriers, cultural differences, and ensuring ethical practices will be crucial for sustained success. Government initiatives promoting medical tourism and fostering collaborations between public and private healthcare providers will further propel the market’s upward trajectory.

India Medical Tourism Market Company Market Share

India Medical Tourism Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Medical Tourism Market, offering invaluable insights for stakeholders across the healthcare and tourism sectors. The study covers the period 2019-2033, with a focus on 2025 as the base and estimated year. The report projects a market size of xx Million USD by 2033, and includes a detailed segmentation, competitive landscape analysis, and future growth projections.

India Medical Tourism Market Market Structure & Competitive Dynamics

The India medical tourism market exhibits a moderately concentrated structure, with a few large players like Apollo Hospital commanding significant market share alongside numerous smaller, specialized providers. The market displays a dynamic competitive landscape driven by continuous innovation in medical technologies, evolving regulatory frameworks, and increasing M&A activity. Market share analysis reveals that the top 5 players collectively hold approximately xx% of the market, while the remaining share is distributed amongst numerous smaller players. Innovation ecosystems are largely driven by collaborations between hospitals, technology providers, and medical tourism facilitators. The regulatory environment, while supportive of medical tourism, remains subject to periodic revisions, impacting operational procedures and market dynamics. Product substitutes, such as telehealth and remote patient monitoring, are emerging, yet the demand for in-person, specialized medical services remains a key driver of market growth. End-user trends indicate a preference for high-quality, affordable care combined with a positive patient experience. M&A activities have been relatively frequent in recent years, with deal values ranging from USD 1 Million to over USD 10 Million, particularly amongst larger players aiming for expansion and consolidation.

- Market Concentration: Moderately concentrated, with a few dominant players.

- M&A Activity: Frequent, with deal values ranging from USD 1 Million to over USD 10 Million.

- Innovation Ecosystems: Driven by collaborations between hospitals, technology providers, and facilitators.

- Regulatory Framework: Supportive but subject to periodic revisions.

- End-User Trends: Preference for high-quality, affordable care and a positive patient experience.

India Medical Tourism Market Industry Trends & Insights

The India medical tourism market is experiencing robust growth, driven by factors such as increasing affordability of medical services, advancements in medical technology, and rising medical tourism awareness. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the adoption of AI-powered solutions for patient care and management, are transforming market operations and improving efficiency. Consumer preferences are shifting towards personalized and holistic healthcare packages that go beyond just medical treatment, including travel, accommodation, and cultural experiences. Competitive dynamics are shaped by pricing strategies, service offerings, and branding initiatives. Market penetration remains relatively high in urban areas, with rural penetration projected to increase gradually with improved infrastructure and accessibility.

Dominant Markets & Segments in India Medical Tourism Market

- Leading Region/State: Mumbai and other major metropolitan areas dominate due to their well-established medical infrastructure and accessibility.

- Leading Treatment Type: Cardiovascular treatment, orthopedic treatment, and dental treatment comprise the largest segments due to significant demand and competitive pricing.

- Leading Service Provider: Private hospitals dominate the market, driven by their advanced technology and higher service standards.

Key Drivers for Dominant Segments:

- Cardiovascular Treatment: High prevalence of cardiovascular diseases, advanced treatment options, and competitive pricing.

- Orthopedic Treatment: Rising incidence of joint disorders and the availability of advanced surgical techniques.

- Dental Treatment: Affordable cosmetic and restorative dental procedures attracting international patients.

- Private Service Providers: Superior infrastructure, advanced technology, and higher service standards.

The dominance of these segments stems from a confluence of factors, including economic policies that incentivize medical tourism, advanced medical infrastructure concentrated in major cities, and a skilled medical workforce. The growth of these segments is expected to continue at a rapid pace during the forecast period.

India Medical Tourism Market Product Innovations

The Indian medical tourism sector is experiencing a dynamic phase of innovation, marked by the integration of cutting-edge medical technologies and patient-centric approaches. Recent advancements include the widespread adoption of sophisticated surgical techniques, emphasizing minimally invasive procedures that reduce recovery times and patient discomfort. Furthermore, the incorporation of AI-powered diagnostic tools is revolutionizing early detection and treatment planning, enhancing diagnostic accuracy. The focus has shifted towards a holistic enhancement of the patient experience, with personalized care plans, seamless online platforms for appointment booking and virtual consultations, and comprehensive healthcare packages designed to encompass all aspects of a medical journey. This strategic evolution is perfectly aligned with the global demand for high-quality, affordable, and technologically advanced healthcare solutions.

Report Segmentation & Scope

By Treatment Type: This report meticulously segments the India medical tourism market by various treatment categories, offering in-depth analysis for dental procedures, cosmetic surgery, cardiovascular interventions, orthopedic treatments, neurological care, oncology services, fertility treatments, and other specialized medical services. Each segment provides detailed insights into market size, projected growth trajectories, and the prevailing competitive landscape. For instance, the dental treatment segment is anticipated to experience a robust CAGR of approximately XX%, fueled by an escalating demand for both restorative and cosmetic dentistry, coupled with increasing affordability.

By Service Provider: The market is further bifurcated into public and private healthcare service providers. While private providers currently command a significant market share, attributed to their advanced infrastructure, specialized medical expertise, and superior patient amenities, the public sector continues to serve a substantial portion of the domestic population and also caters to specific medical tourism segments. The projections indicate a sustained dominance of the private sector, with the public sector expected to witness gradual enhancements in its infrastructure and service delivery capabilities, potentially attracting a growing segment of medical tourists seeking cost-effective options.

Key Drivers of India Medical Tourism Market Growth

The burgeoning growth of the India medical tourism market is underpinned by a confluence of powerful driving forces. Paramount among these is the significant cost advantage offered by medical treatments in India when compared to developed nations, making it an attractive destination for international patients seeking quality care without exorbitant expenses. Complementing this is the rapid advancement and integration of state-of-the-art medical technologies and world-class hospital infrastructure across India's leading healthcare institutions, establishing a strong competitive edge. Moreover, the proactive and supportive initiatives undertaken by the Indian government, including the streamlining of visa processes for medical travelers, the establishment of dedicated medical travel facilitators, and continuous investments in healthcare infrastructure development, are playing a pivotal role in bolstering the sector's expansion and global appeal.

Challenges in the India Medical Tourism Market Sector

Despite the market’s potential, several challenges hinder its growth. Regulatory hurdles and inconsistent service standards across different facilities pose obstacles to uniform quality assurance. Furthermore, supply chain issues regarding medical equipment and pharmaceuticals can impact service delivery. Finally, intense competition amongst private providers necessitates a constant focus on operational excellence and maintaining competitive pricing strategies. These factors, if not adequately addressed, could affect the market's long-term growth trajectory.

Leading Players in the India Medical Tourism Market Market

- Tour2India4Health

- MediConnect India

- Global Treatment Services

- Health Opinion

- Vaidam

- ANAVARA

- Apollo Hospitals

- Clinicspots

- Mediniq

- Forerunners Healthcare

- Max Healthcare

- Fortis Healthcare

- Manipal Hospitals

Key Developments in India Medical Tourism Market Sector

- August 2022: Apollo Hospitals Enterprise strategically expanded its operational footprint by acquiring a significant hospital asset in Gurugram for USD 6.075 Million. This acquisition underscores a notable trend of consolidation within the industry and strengthens Apollo's market position and service offerings.

- January 2023: Alpine Health Systems demonstrated its commitment to technological advancement by launching an innovative AI-powered solution designed to optimize and streamline the hospital discharge process. This development has the potential to significantly enhance operational efficiency, improve patient outcomes, and contribute to a more seamless healthcare experience across the sector.

- March 2023: Fortis Healthcare announced a strategic partnership with a leading international health insurance provider, aiming to offer enhanced medical tourism packages and simplified claims processing for overseas patients, thereby expanding its global reach.

- April 2023: The Indian Ministry of Health and Family Welfare unveiled new guidelines for accredited medical tourism facilitators, emphasizing enhanced patient safety protocols and ethical practices to further build trust and credibility in the global market.

Strategic India Medical Tourism Market Market Outlook

The future of the India medical tourism market appears bright, underpinned by continued advancements in medical technology, expanding healthcare infrastructure, and supportive government policies. Strategic opportunities exist in focusing on niche treatment areas, developing specialized packages catering to specific patient demographics, and leveraging technology to enhance service delivery and patient experience. The market is poised for robust growth, particularly in segments like cosmetic surgery and dental treatments. Further investments in infrastructure and skilled personnel will be vital for maximizing market potential.

India Medical Tourism Market Segmentation

-

1. Treatment Type

- 1.1. Dental Treatment

- 1.2. Cosmetic Treatment

- 1.3. Cardiovascular Treatment

- 1.4. Orthopedic Treatment

- 1.5. Neurological Treatment

- 1.6. Cancer Treatment

- 1.7. Fertility Treatment

- 1.8. Others

-

2. Service Provider

- 2.1. Public

- 2.2. Private

India Medical Tourism Market Segmentation By Geography

- 1. India

India Medical Tourism Market Regional Market Share

Geographic Coverage of India Medical Tourism Market

India Medical Tourism Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements

- 3.2.2 the online booking industry is undergoing significant transformation

- 3.3. Market Restrains

- 3.3.1. Booking Cancellation

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Medical Tourists in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Medical Tourism Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Dental Treatment

- 5.1.2. Cosmetic Treatment

- 5.1.3. Cardiovascular Treatment

- 5.1.4. Orthopedic Treatment

- 5.1.5. Neurological Treatment

- 5.1.6. Cancer Treatment

- 5.1.7. Fertility Treatment

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Public

- 5.2.2. Private

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tour2India4Health

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MediConnect India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Global Treatment Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Health Opinion

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vaidam

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ANAVARA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Apollo Hospital**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clinicspots

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mediniq

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Forerunners Healthcare

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tour2India4Health

List of Figures

- Figure 1: India Medical Tourism Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Medical Tourism Market Share (%) by Company 2025

List of Tables

- Table 1: India Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: India Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 3: India Medical Tourism Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Medical Tourism Market Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 5: India Medical Tourism Market Revenue Million Forecast, by Service Provider 2020 & 2033

- Table 6: India Medical Tourism Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Medical Tourism Market?

The projected CAGR is approximately 13.23%.

2. Which companies are prominent players in the India Medical Tourism Market?

Key companies in the market include Tour2India4Health, MediConnect India, Global Treatment Services, Health Opinion, Vaidam, ANAVARA, Apollo Hospital**List Not Exhaustive, Clinicspots, Mediniq, Forerunners Healthcare.

3. What are the main segments of the India Medical Tourism Market?

The market segments include Treatment Type, Service Provider.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the online travel agencies in Russia; Due to factors including digital trends and technical improvements. the online booking industry is undergoing significant transformation.

6. What are the notable trends driving market growth?

Increase in the Number of Medical Tourists in India is Driving the Market.

7. Are there any restraints impacting market growth?

Booking Cancellation.

8. Can you provide examples of recent developments in the market?

January 2023: Alpine Health Systems launched a new AI-powered solution to streamline complex hospital discharge with OSF HealthCare and High Alpha Innovation support. The platform allows case managers to quickly identify at-risk patients and safely transition to an appropriate care site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Medical Tourism Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Medical Tourism Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Medical Tourism Market?

To stay informed about further developments, trends, and reports in the India Medical Tourism Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence