Key Insights

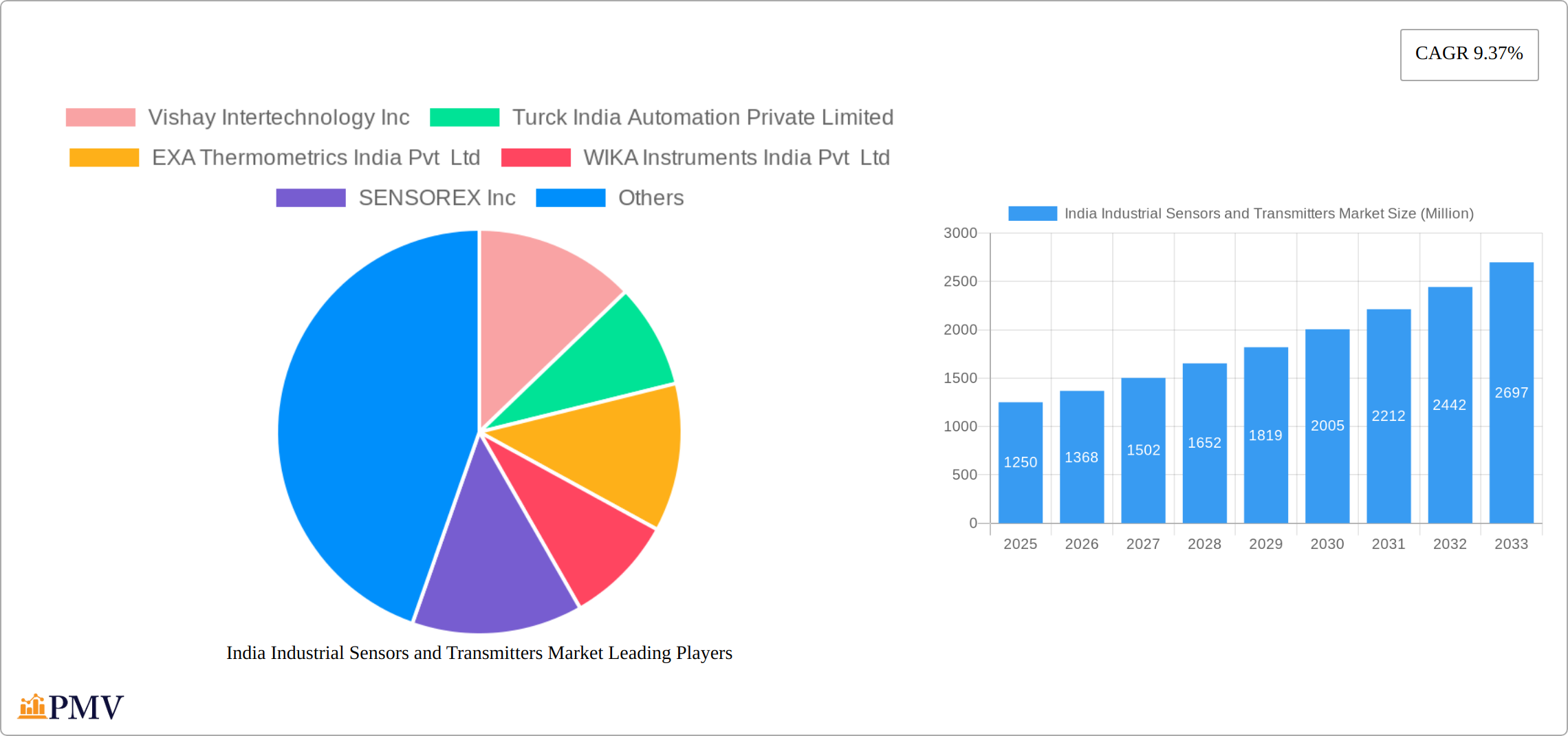

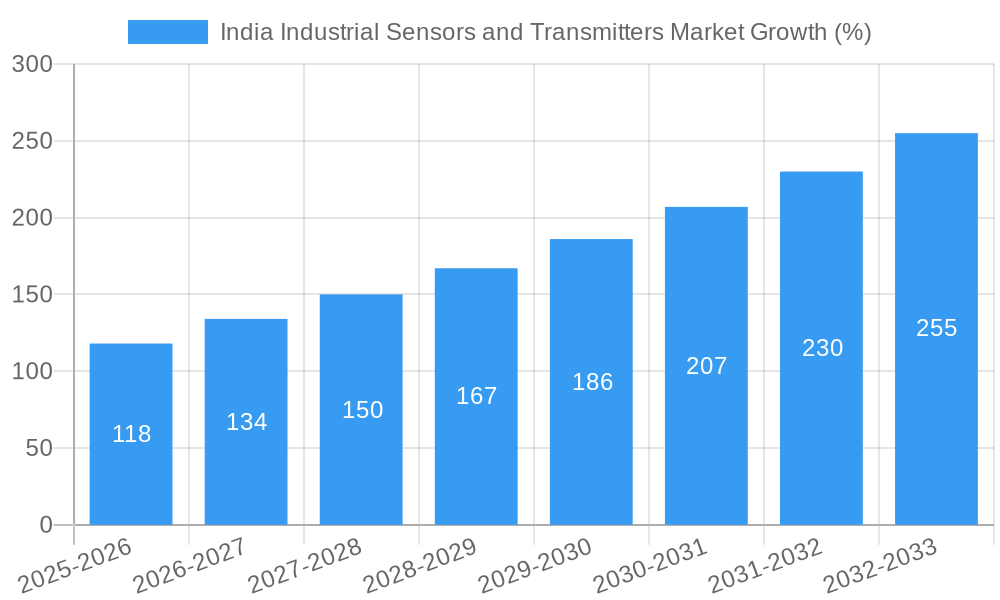

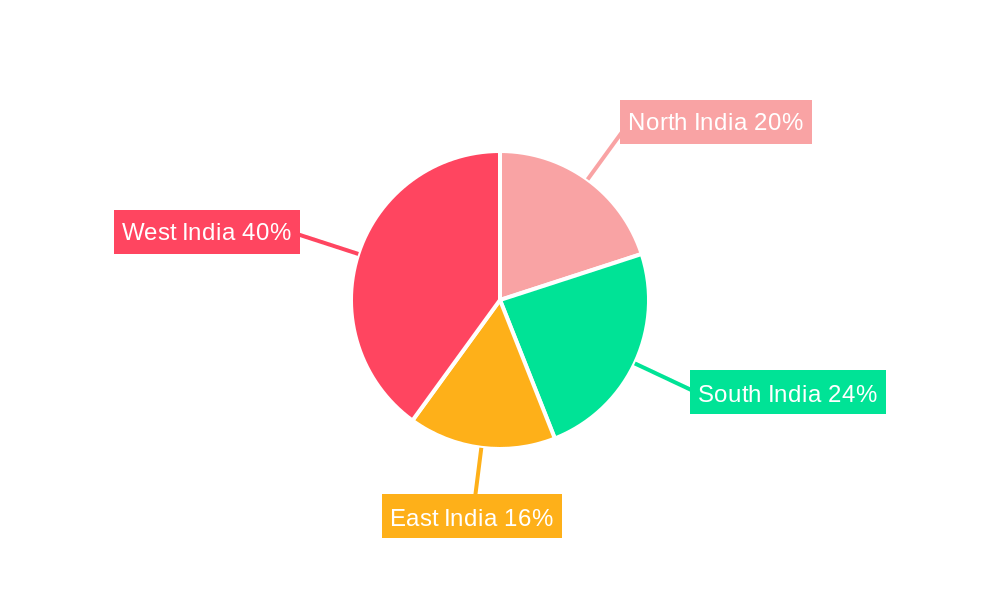

The India Industrial Sensors and Transmitters Market is experiencing robust growth, projected to reach \$1.25 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.37% from 2025 to 2033. This expansion is driven by several key factors. The accelerating adoption of automation and Industry 4.0 initiatives across various industrial sectors, including power generation, petrochemicals, chemicals and fertilizers, food and beverage, and water and wastewater treatment, is significantly boosting demand. Furthermore, stringent environmental regulations and the need for enhanced process efficiency are prompting industries to invest in advanced sensor technologies for precise monitoring and control. Growth is also fueled by the rising demand for sophisticated sensors capable of collecting real-time data for predictive maintenance, improving operational safety, and reducing downtime. The market is segmented by sensor type (flow, temperature, pressure, level, transmitters, and others) and end-user industry, with significant growth anticipated across all segments, particularly in those industries undergoing rapid modernization and digital transformation. The competitive landscape is characterized by a mix of global and domestic players, each vying to capture market share through product innovation, strategic partnerships, and expansion into new regions within India. The four major regions – North, South, East, and West India – all contribute significantly to the overall market growth, with potential for regional variations in growth rates depending on the concentration of industries and infrastructure development.

The substantial growth in the Indian industrial sector fuels this market's expansion. Government initiatives promoting "Make in India" and infrastructure development are further stimulating demand for locally produced sensors and transmitters. However, challenges remain. High initial investment costs for advanced sensor technologies can act as a restraint, particularly for smaller companies. Furthermore, the reliability and accuracy of sensors in harsh industrial environments are critical concerns. Addressing these challenges through technological advancements, cost-effective solutions, and robust quality control measures will be crucial for continued market growth. The market is expected to witness further consolidation as larger players strategically acquire smaller companies with specialized sensor technologies. The focus on developing smart factories and interconnected systems is poised to drive future demand for sophisticated sensor networks and data analytics capabilities, further solidifying the market's long-term growth trajectory.

India Industrial Sensors and Transmitters Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Industrial Sensors and Transmitters Market, offering invaluable insights for businesses operating within this dynamic sector. Covering the period from 2019 to 2033, with 2025 as the base and estimated year, this report meticulously examines market trends, competitive landscapes, and future growth prospects. The report is crucial for strategic decision-making, investment planning, and understanding the evolving dynamics of this critical industry segment. The total market size in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period (2025-2033).

India Industrial Sensors and Transmitters Market Market Structure & Competitive Dynamics

The Indian industrial sensors and transmitters market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized companies fosters a dynamic competitive landscape. Innovation plays a crucial role, with companies constantly developing advanced sensor technologies to meet the growing demands of various end-user industries. The regulatory framework, while evolving, generally supports the growth of the sector. Product substitution is a factor, with new technologies continuously emerging, driving competition and innovation.

End-user trends are significantly impacting market growth, with increasing automation and digitization in sectors like manufacturing, energy, and infrastructure driving demand for sophisticated sensors and transmitters. Mergers and acquisitions (M&A) activity has been moderate, with larger companies strategically acquiring smaller firms to expand their product portfolios and market reach. While precise M&A deal values are not publicly available for all transactions in this sector, the aggregate value of reported deals between 2019 and 2024 is estimated to be approximately xx Million. Major players hold approximately xx% market share collectively, while the remaining share is distributed across numerous smaller players.

India Industrial Sensors and Transmitters Market Industry Trends & Insights

The Indian industrial sensors and transmitters market is experiencing robust growth, fueled by several key factors. The increasing adoption of automation and Industry 4.0 technologies across various industrial sectors is a primary driver. Government initiatives promoting industrial development and infrastructure projects further stimulate demand. Technological advancements, particularly in areas like IoT (Internet of Things) and IIoT (Industrial Internet of Things), are creating new opportunities for sensor applications. The market's growth is also influenced by rising consumer demand for enhanced product quality, safety, and efficiency.

Furthermore, the increasing preference for sophisticated, real-time monitoring solutions in industrial processes is contributing to market growth. Competitive dynamics are characterized by both cooperation and competition, with leading players collaborating on technology development and standardization efforts while simultaneously vying for market share through product innovation and cost optimization. The market's current penetration rate is estimated at xx%, with the penetration expected to reach xx% by 2033 driven primarily by industrial automation initiatives and the growth of IIoT applications.

Dominant Markets & Segments in India Industrial Sensors and Transmitters Market

Within the Indian industrial sensors and transmitters market, several segments demonstrate strong dominance.

Leading End-User: The power sector constitutes the largest end-user segment, driven by the need for efficient power generation and distribution, grid modernization, and renewable energy integration. Key drivers include government investments in renewable energy sources, the expansion of the power grid, and stringent regulatory compliance requirements.

Leading Sensor Type: Temperature sensors hold a significant market share due to their widespread applications in various industrial processes and machine monitoring. The demand is driven by the need for accurate temperature control and process optimization across numerous industries. Pressure sensors are also dominant owing to their use in numerous industrial applications, followed by flow sensors.

Regional Dominance: The western and southern regions of India exhibit stronger market growth due to the concentration of industrial hubs and manufacturing facilities. The presence of substantial investments in infrastructure development and industrialization further contribute to the dominance of these regions.

Detailed analysis reveals that the market is characterized by a high degree of specialization, with different sensor types catering to specific end-user needs. Economic policies supporting industrial growth, improvements in infrastructure, and increasing investments in automation and technological advancements are key factors contributing to the dominance of these segments.

India Industrial Sensors and Transmitters Market Product Innovations

Recent product innovations in the Indian industrial sensors and transmitters market include the development of smart sensors with integrated data processing capabilities and wireless communication technologies. This allows for real-time data monitoring and improved operational efficiency. The market is seeing a significant shift towards miniaturization and increased accuracy of sensors. Furthermore, there is a growing focus on developing sensors with enhanced durability and reliability to withstand harsh industrial environments. This focus on advanced functionalities, combined with cost-effectiveness, is shaping the competitive landscape.

Report Segmentation & Scope

This report segments the India Industrial Sensors and Transmitters Market based on end-user industries (Power, Petrochemicals, Chemicals and Fertilizers, Food and Beverage, Water and Wastewater, Life Sciences, Oil and Gas, Other End-Users) and sensor types (Flow, Temperature, Pressure, Level, Transmitters, and Other Sensors). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. For instance, the Power segment is projected to experience significant growth due to increasing investments in renewable energy and grid modernization. Similarly, the temperature sensor segment is anticipated to maintain its dominance due to its wide applicability across various industries. The report offers detailed insights into the market size and competitive landscape for each segment.

Key Drivers of India Industrial Sensors and Transmitters Market Growth

Several factors propel the growth of the India Industrial Sensors and Transmitters Market. Technological advancements, such as the rise of IoT and IIoT, are driving the adoption of advanced sensor technologies for real-time monitoring and predictive maintenance. Government initiatives promoting industrial automation and digitalization are also fueling market expansion. Furthermore, the growing emphasis on industrial safety and efficiency is increasing the demand for sophisticated sensors and transmitters. Strong economic growth and increasing industrial activity within India contribute to a positive outlook for the market.

Challenges in the India Industrial Sensors and Transmitters Market Sector

Despite the positive outlook, several challenges hinder the growth of the Indian industrial sensors and transmitters market. High initial investment costs for implementing sensor technologies can deter some businesses, especially small and medium-sized enterprises (SMEs). The complexity of integrating sensors into existing systems can also pose a barrier. Supply chain disruptions can lead to production delays and increased costs. Furthermore, intense competition from both domestic and international players can impact profit margins for some companies. The impact of these challenges varies depending on segment and specific company size and strategy.

Leading Players in the India Industrial Sensors and Transmitters Market Market

- Vishay Intertechnology Inc

- Turck India Automation Private Limited

- EXA Thermometrics India Pvt Ltd

- WIKA Instruments India Pvt Ltd

- SENSOREX Inc

- Arcotherm Pvt Ltd

- SRI Electronics

Key Developments in India Industrial Sensors and Transmitters Market Sector

May 2022: Turck India launched its first combination air humidity/temperature sensor with IO-Link interface, enabling cost-effective condition monitoring for IIoT applications. This development significantly impacts the market by providing a cost-effective solution for condition monitoring across various industries.

October 2021: Vishay Intertechnology introduced the VEML6031X00, a highly sensitive ambient light sensor for automotive and consumer applications. This product launch expands the market by providing a solution for demanding applications requiring high sensitivity in detecting light.

Strategic India Industrial Sensors and Transmitters Market Market Outlook

The future of the Indian industrial sensors and transmitters market appears promising. Continued technological advancements, coupled with government support for industrial development, will drive substantial growth. The increasing adoption of smart manufacturing practices and the expansion of the IIoT ecosystem are expected to create significant opportunities for sensor manufacturers. Strategic partnerships and collaborations will play a vital role in shaping the market's future trajectory. Companies focusing on innovation, cost-effectiveness, and reliable solutions are poised to capitalize on the market's growth potential.

India Industrial Sensors and Transmitters Market Segmentation

-

1. Type of Sensor

- 1.1. Flow

- 1.2. Temperature

- 1.3. Pressure

- 1.4. Level

- 1.5. Transmitters and Other Sensors

-

2. End-User

- 2.1. Power

- 2.2. Petrochemicals, Chemicals and Fertilizers

- 2.3. Food and Beverage

- 2.4. Water and Wastewater

- 2.5. Life Sciences

- 2.6. Oil and Gas

- 2.7. Other End-Users

India Industrial Sensors and Transmitters Market Segmentation By Geography

- 1. India

India Industrial Sensors and Transmitters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities; Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention

- 3.3. Market Restrains

- 3.3.1. Cost and Operational Concerns

- 3.4. Market Trends

- 3.4.1. Flow Sensors are Expected to be Higher in Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Sensor

- 5.1.1. Flow

- 5.1.2. Temperature

- 5.1.3. Pressure

- 5.1.4. Level

- 5.1.5. Transmitters and Other Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Power

- 5.2.2. Petrochemicals, Chemicals and Fertilizers

- 5.2.3. Food and Beverage

- 5.2.4. Water and Wastewater

- 5.2.5. Life Sciences

- 5.2.6. Oil and Gas

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type of Sensor

- 6. North India India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Industrial Sensors and Transmitters Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vishay Intertechnology Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Turck India Automation Private Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 EXA Thermometrics India Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 WIKA Instruments India Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SENSOREX Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Arcotherm Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SRI Electronics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Vishay Intertechnology Inc

List of Figures

- Figure 1: India Industrial Sensors and Transmitters Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Industrial Sensors and Transmitters Market Share (%) by Company 2024

List of Tables

- Table 1: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Type of Sensor 2019 & 2032

- Table 4: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Type of Sensor 2019 & 2032

- Table 5: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 7: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: North India India Industrial Sensors and Transmitters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North India India Industrial Sensors and Transmitters Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: South India India Industrial Sensors and Transmitters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South India India Industrial Sensors and Transmitters Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: East India India Industrial Sensors and Transmitters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: East India India Industrial Sensors and Transmitters Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: West India India Industrial Sensors and Transmitters Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: West India India Industrial Sensors and Transmitters Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Type of Sensor 2019 & 2032

- Table 20: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Type of Sensor 2019 & 2032

- Table 21: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 23: India Industrial Sensors and Transmitters Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Industrial Sensors and Transmitters Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Industrial Sensors and Transmitters Market?

The projected CAGR is approximately 9.37%.

2. Which companies are prominent players in the India Industrial Sensors and Transmitters Market?

Key companies in the market include Vishay Intertechnology Inc, Turck India Automation Private Limited, EXA Thermometrics India Pvt Ltd, WIKA Instruments India Pvt Ltd, SENSOREX Inc, Arcotherm Pvt Ltd, SRI Electronics.

3. What are the main segments of the India Industrial Sensors and Transmitters Market?

The market segments include Type of Sensor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities; Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention.

6. What are the notable trends driving market growth?

Flow Sensors are Expected to be Higher in Demand.

7. Are there any restraints impacting market growth?

Cost and Operational Concerns.

8. Can you provide examples of recent developments in the market?

May 2022 - Turck India's first combination air humidity/temperature sensor, which is very easy to incorporate thanks to the IO-Link interface, provides cost-effective condition monitoring in the field and IIoT applications. The CMTH's combination of the two measured variables, air humidity, and temperature, in a single device, makes it ideal for use in machine and plant condition monitoring systems or for monitoring climatic conditions in production halls and warehouses in a wide range of industries, from the automobile industry to the semiconductor and food industries, all the way through to agriculture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Industrial Sensors and Transmitters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Industrial Sensors and Transmitters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Industrial Sensors and Transmitters Market?

To stay informed about further developments, trends, and reports in the India Industrial Sensors and Transmitters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence