Key Insights

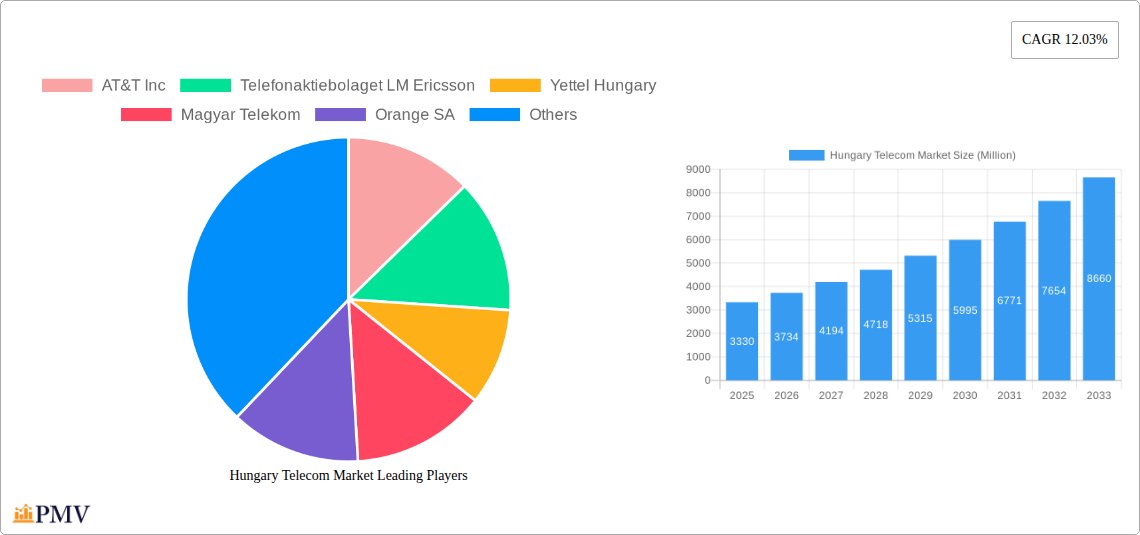

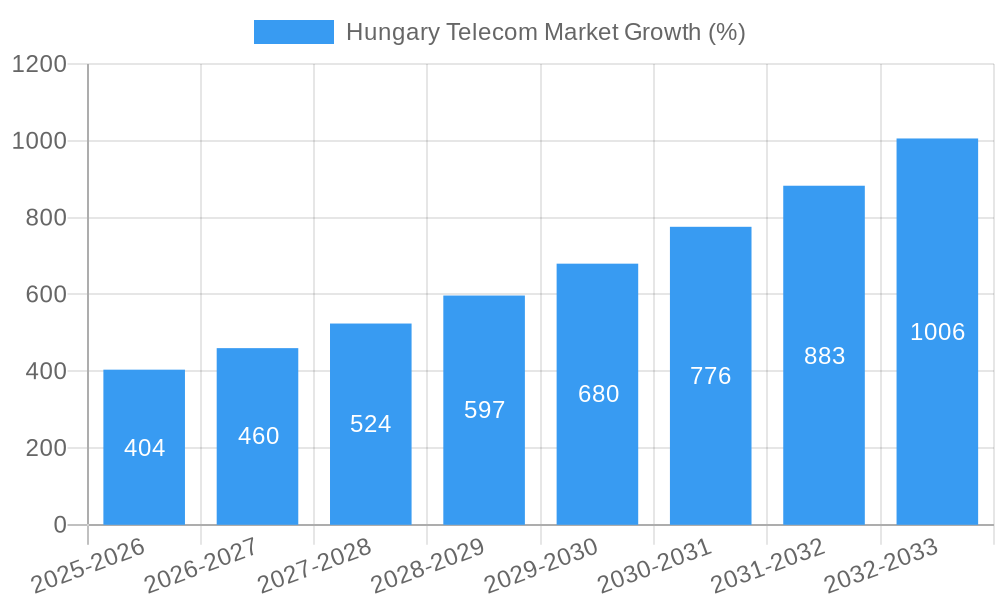

The Hungarian telecom market, valued at €3.33 billion in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising data consumption fueled by streaming services and online gaming, and the expanding adoption of 5G technology. Key players like AT&T, Ericsson, Magyar Telekom, and others are investing heavily in network infrastructure upgrades to meet this surging demand. The market's growth is further propelled by government initiatives promoting digitalization and the expansion of broadband access across rural areas. However, challenges remain, including intense competition among established players and the potential for regulatory hurdles impacting investment and market entry. The market segmentation likely includes fixed-line services, mobile communication, broadband internet, and specialized services like enterprise solutions. Competition is fierce, with both established international players and smaller, agile domestic companies vying for market share. The forecast period of 2025-2033 anticipates a Compound Annual Growth Rate (CAGR) of 12.03%, indicating a significant expansion of the market's overall value. This growth trajectory suggests continued investment opportunities, especially in areas focused on technological advancement and improved network infrastructure. The market's future success hinges on the ability of telecom companies to adapt to changing consumer needs, invest in innovative services, and navigate the regulatory landscape effectively.

The consistent 12.03% CAGR suggests a strong and sustained growth pattern for the Hungarian telecom market throughout the forecast period. This growth is likely to be unevenly distributed across segments, with mobile data and broadband internet experiencing particularly rapid expansion due to increasing user demand and the expanding reach of high-speed networks. While the presence of established players ensures market stability, the competitive environment necessitates continuous innovation and strategic planning. The forecast necessitates a careful consideration of potential economic fluctuations and shifts in consumer behavior that could impact overall growth projections. The success of the market will also depend on the successful implementation of 5G networks and the continued investment in infrastructure improvements needed to support the growing data demands of the population.

Hungary Telecom Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Hungary telecom market, encompassing market structure, competitive dynamics, industry trends, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, building upon the historical period of 2019-2024. This report is invaluable for telecom operators, investors, and industry stakeholders seeking actionable insights into this dynamic market.

Hungary Telecom Market Market Structure & Competitive Dynamics

The Hungarian telecom market exhibits a moderately concentrated structure, with Magyar Telekom holding a significant market share, followed by Yettel Hungary and other smaller players. The market is characterized by intense competition, driven by price wars, service innovation, and strategic partnerships. The regulatory framework, overseen by the Hungarian Media Authority (NMHH), plays a crucial role in shaping market dynamics, influencing licensing, spectrum allocation, and consumer protection. Recent M&A activities, while not as frequent as in some other European markets, have involved smaller players consolidating to improve competitiveness and expand their service offerings. The total value of M&A deals in the period 2019-2024 is estimated to be around USD xx Million. Innovation ecosystems are emerging, focusing on 5G deployment, IoT solutions, and digital transformation initiatives. Product substitutes, such as over-the-top (OTT) services, are increasingly challenging traditional telecom offerings, prompting operators to explore new revenue streams and diversify their service portfolios. End-user trends reveal a growing demand for high-speed internet, mobile data, and bundled services, along with increasing adoption of smart devices and connected technologies.

- Market Concentration: High (Magyar Telekom dominates)

- Innovation: Focus on 5G, IoT, Digital Transformation

- Regulatory Framework: NMHH's influence on licensing and spectrum.

- M&A Activity: USD xx Million (2019-2024), consolidation among smaller players.

- End-user trends: High demand for high-speed internet and bundled services.

Hungary Telecom Market Industry Trends & Insights

The Hungarian telecom market is poised for sustained growth, driven by increasing smartphone penetration, rising broadband adoption, and the government's push for 5G deployment. The compound annual growth rate (CAGR) for revenue is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the widespread adoption of 5G, are revolutionizing the market, creating opportunities for new services and business models. Consumer preferences are shifting towards data-centric plans, bundled offerings, and personalized experiences, compelling operators to adapt their strategies. Competitive dynamics remain intense, with operators constantly striving to enhance their network infrastructure, improve customer service, and innovate new services to gain a competitive edge. Market penetration for mobile broadband is currently estimated at xx%, with significant potential for further growth in rural areas. Fixed broadband penetration is at xx%.

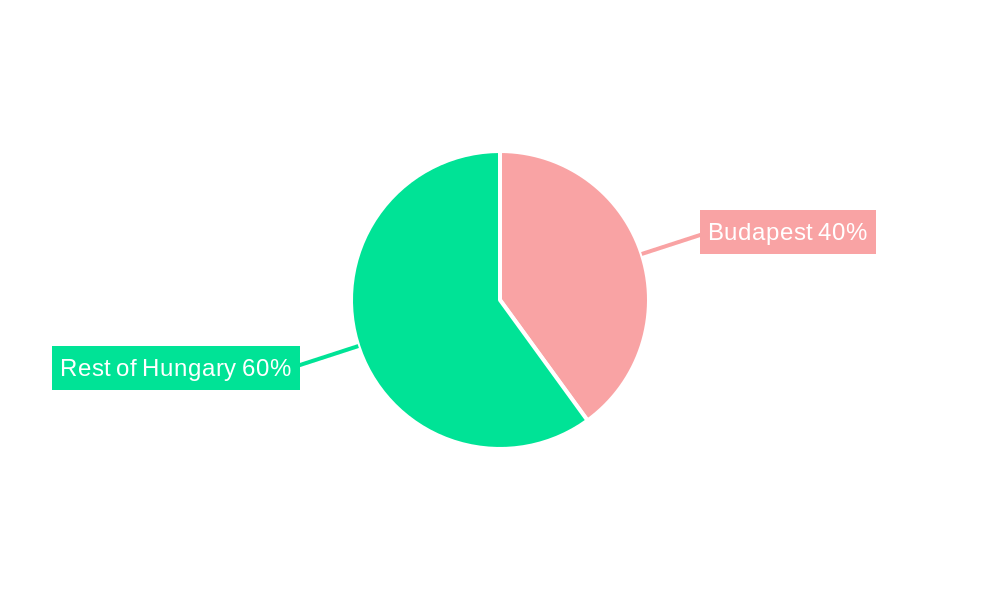

Dominant Markets & Segments in Hungary Telecom Market

The urban areas of Hungary represent the dominant segment in the telecom market, exhibiting higher smartphone penetration, broadband adoption, and demand for advanced services compared to rural regions. Key drivers of this dominance include higher disposable incomes, advanced infrastructure, and greater access to technological advancements. Government policies focused on digitalization and infrastructure development further contribute to the robust growth in urban areas.

- Key Drivers (Urban Areas):

- Higher disposable incomes

- Advanced infrastructure

- Government initiatives for digitalization

- Higher concentration of businesses and technology users

Hungary Telecom Market Product Innovations

Recent product innovations focus on enhancing data speeds, improving network reliability, and integrating advanced features into mobile and fixed-line offerings. 5G deployment is a significant driver of innovation, enabling operators to offer higher bandwidth and lower latency services. Bundled packages incorporating entertainment and OTT services have become increasingly popular, adding value for customers. The focus on personalized services and targeted offerings reflects the competitive landscape and changing consumer demands.

Report Segmentation & Scope

This report segments the Hungarian telecom market by technology (2G, 3G, 4G, 5G), service type (mobile, fixed-line, broadband, IPTV), and geographical region (urban vs. rural). Growth projections, market sizes, and competitive dynamics are provided for each segment, offering a granular view of market opportunities and challenges. The revenue projections for each segment are estimated to be as follows: Mobile - USD xx Million; Fixed Line - USD xx Million; Broadband - USD xx Million; and IPTV - USD xx Million (by 2033).

Key Drivers of Hungary Telecom Market Growth

Several key factors are driving the growth of the Hungary telecom market. The increasing adoption of smartphones and mobile devices is a major contributor, fueling demand for mobile data and related services. The government's initiatives to expand broadband infrastructure and promote digitalization are further stimulating growth. The rollout of 5G networks is expanding connectivity and creating opportunities for new services and applications. The growth of the digital economy and the increasing reliance on internet-based services are also driving demand for robust telecom infrastructure.

Challenges in the Hungary Telecom Market Sector

Despite significant opportunities, the Hungarian telecom market faces several challenges. Maintaining a competitive pricing strategy while investing heavily in network upgrades is a key challenge for telecom operators. The increasing competition from OTT providers and the need to constantly innovate to keep pace with technological advancements also pose significant hurdles. Regulatory changes and the potential impact of geopolitical events can also influence market dynamics.

Leading Players in the Hungary Telecom Market Market

- AT&T Inc

- Telefonaktiebolaget LM Ericsson

- Yettel Hungary

- Magyar Telekom

- Orange SA

- Invitech Ltd

- 4iG PLC

- PR Telecom

- Vidanet

- Antenna Hungária Zrt

Key Developments in Hungary Telecom Market Sector

- April 2024: Yettel Magyarország and Cetin Hungary partnered with the Hungarian government, committing USD 200 Million to network enhancements, aiming for 99% 5G residential coverage by 2028. This move eliminates the windfall profit tax for telcos starting in 2025.

- March 2024: Magyar Telekom partnered with Netflix to enhance entertainment experiences, offering bundled packages and streamlined setups on their TV interfaces.

Strategic Hungary Telecom Market Market Outlook

The Hungary telecom market presents considerable growth potential over the forecast period, driven by ongoing 5G rollout, increasing demand for data services, and supportive government policies. Operators who strategically invest in network infrastructure, develop innovative service offerings, and cultivate strong customer relationships are poised to capture significant market share. The market’s future hinges on effective strategies for 5G deployment, addressing rural connectivity challenges, and adapting to evolving consumer preferences.

Hungary Telecom Market Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and

- 1.3. OTT and PayTV Services

-

1.1. Voice Services

Hungary Telecom Market Segmentation By Geography

- 1. Hungary

Hungary Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Internet Penetration; Growth of IoT Usage in Telecom

- 3.3. Market Restrains

- 3.3.1. Growing Internet Penetration; Growth of IoT Usage in Telecom

- 3.4. Market Trends

- 3.4.1. Growing Internet Penetration in Hungary

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Hungary Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and

- 5.1.3. OTT and PayTV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Hungary

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AT&T Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telefonaktiebolaget LM Ericsson

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yettel Hungary

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Magyar Telekom

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Orange SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Invitech Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 4iG PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PR Telecom

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vidanet

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Antenna Hungária Zrt *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AT&T Inc

List of Figures

- Figure 1: Hungary Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Hungary Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Hungary Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Hungary Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Hungary Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 4: Hungary Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 5: Hungary Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Hungary Telecom Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Hungary Telecom Market Revenue Million Forecast, by Services 2019 & 2032

- Table 8: Hungary Telecom Market Volume Billion Forecast, by Services 2019 & 2032

- Table 9: Hungary Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Hungary Telecom Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hungary Telecom Market?

The projected CAGR is approximately 12.03%.

2. Which companies are prominent players in the Hungary Telecom Market?

Key companies in the market include AT&T Inc, Telefonaktiebolaget LM Ericsson, Yettel Hungary, Magyar Telekom, Orange SA, Invitech Ltd, 4iG PLC, PR Telecom, Vidanet, Antenna Hungária Zrt *List Not Exhaustive.

3. What are the main segments of the Hungary Telecom Market?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Internet Penetration; Growth of IoT Usage in Telecom.

6. What are the notable trends driving market growth?

Growing Internet Penetration in Hungary.

7. Are there any restraints impacting market growth?

Growing Internet Penetration; Growth of IoT Usage in Telecom.

8. Can you provide examples of recent developments in the market?

April 2024: Yettel Magyarország, a telecommunications company, and Cetin Hungary, an infrastructure firm, entered a cooperation agreement with the Hungarian government. Yettel Magyarorszag and Cetin Hungary have committed to investing a minimum of HUF 72 billion (equivalent to USD 200 million) in network enhancements by 2028. By the agreement's conclusion, they aim to elevate 5G coverage to 99% of residential areas. Notably, the deal solidifies the government's plan to eliminate the windfall profit tax for telcos starting in 2025.March 2024: Deutsche Telekom and Netflix unveiled a strategic partnership to enhance the entertainment experience for Deutsche Telekom's clientele across numerous European nations. Deutsche Telekom's subsidiaries, beginning with Hrvatski Telekom in Croatia and Magyar Telekom in Hungary, would provide new avenues for Netflix integration. This includes options like bundling and streamlined set-up features directly on their TV interfaces. Such initiatives empower customers, offering them greater flexibility in accessing their preferred content.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hungary Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hungary Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hungary Telecom Market?

To stay informed about further developments, trends, and reports in the Hungary Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence