Key Insights

The High Temperature Resistant PET Film market is poised for substantial expansion, projected to reach a significant valuation by 2033. This growth is fueled by robust CAGR driven by escalating demand across a spectrum of high-growth industries. The Food & Beverage sector, a primary consumer, leverages these films for advanced packaging solutions, ensuring product integrity and extended shelf life under varying thermal conditions. Similarly, the Automobile industry's increasing adoption of lightweight, durable components and the burgeoning electric vehicle market, which relies on high-performance insulation, are key accelerators. Furthermore, the Electronic sector's miniaturization trends and the need for reliable insulating materials in devices operating at higher temperatures contribute significantly to market traction. The Pharmaceutical industry's stringent requirements for sterile packaging and the Furniture sector's demand for aesthetically pleasing yet resilient surfaces also play a crucial role in this market's upward trajectory.

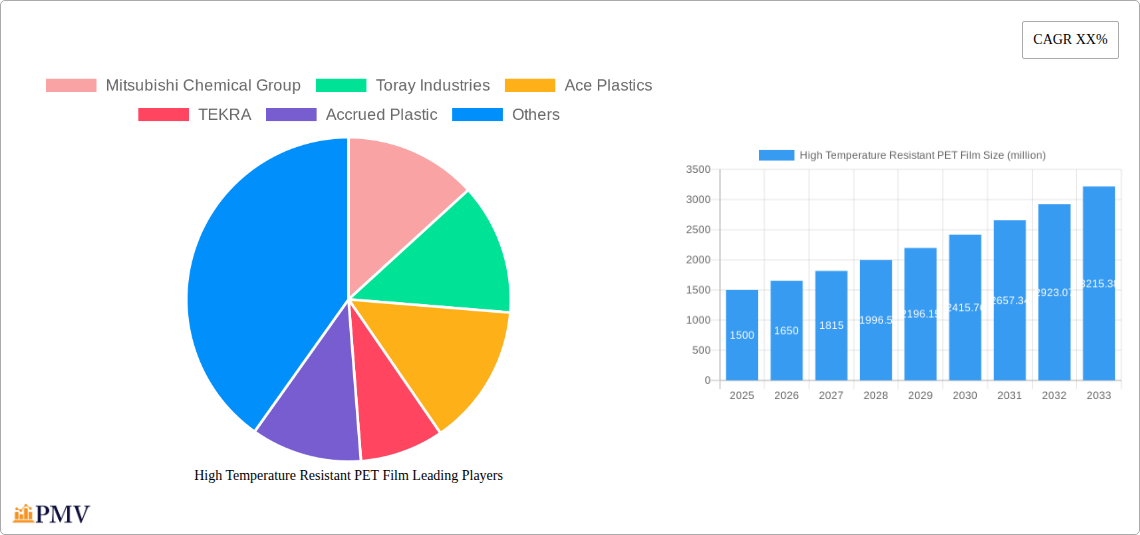

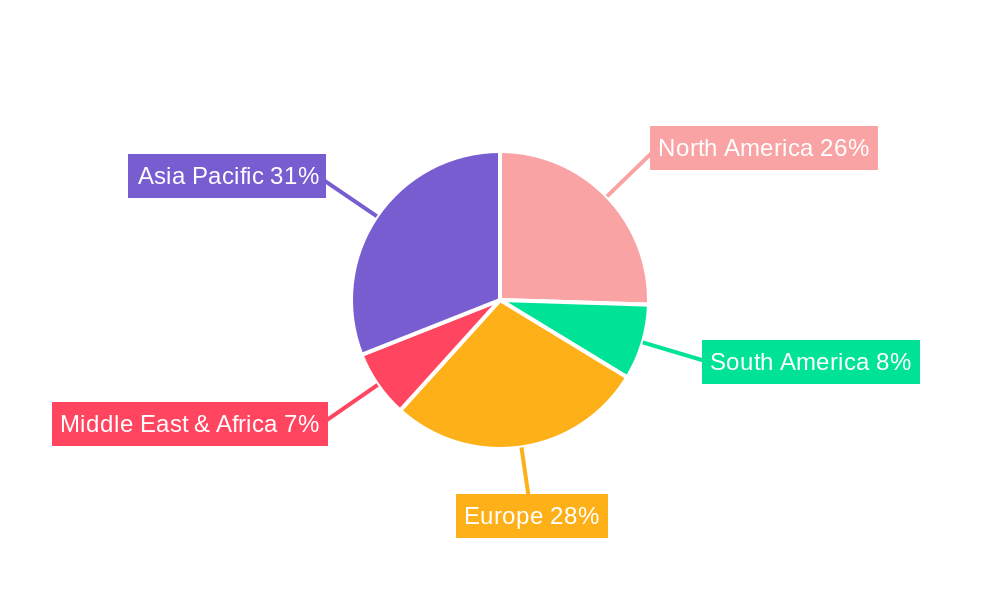

Emerging trends and strategic initiatives by key players are shaping the competitive landscape of the High Temperature Resistant PET Film market. Innovations in film technology, focusing on enhanced thermal stability, superior mechanical strength, and advanced barrier properties, are paramount. The development of specialized films like Electrical Insulating Film and Capacitor Film is catering to niche but high-value applications. While market growth is promising, certain restraints exist, including the fluctuating raw material costs and the inherent price sensitivity of some end-use segments. However, the expanding geographical reach, particularly in the Asia Pacific region, driven by rapid industrialization and increased manufacturing capabilities, coupled with growing adoption in North America and Europe, are expected to offset these challenges. Leading companies are actively engaged in research and development, strategic partnerships, and capacity expansions to capture market share and meet evolving industry demands, solidifying the market's dynamic nature.

This in-depth market research report provides a detailed analysis of the global High Temperature Resistant PET Film market, covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033. The report delves into market structure, competitive dynamics, industry trends, dominant segments, product innovations, key drivers, challenges, and a strategic outlook for this rapidly evolving sector.

High Temperature Resistant PET Film Market Structure & Competitive Dynamics

The global High Temperature Resistant PET Film market exhibits a moderate to high degree of concentration, with several multinational corporations and specialized manufacturers vying for market share. Innovation ecosystems are robust, driven by continuous research and development in material science and processing technologies. Key players are investing heavily in enhancing thermal stability, mechanical strength, and dielectric properties of PET films to meet stringent application requirements. Regulatory frameworks are evolving to ensure product safety, environmental compliance, and performance standards, particularly in sensitive sectors like electronics and pharmaceuticals.

- Market Concentration: Characterized by a mix of large, integrated players and niche specialists.

- Innovation Ecosystems: Driven by R&D in material science, advanced extrusion, and surface treatments.

- Regulatory Frameworks: Focus on safety, environmental impact, and performance certification.

- Product Substitutes: While PET films offer unique advantages, alternatives like PEEK and high-performance polyimides may compete in extremely high-temperature applications.

- End-User Trends: Increasing demand for thinner, stronger, and more durable films with superior thermal resistance.

- M&A Activities: Strategic acquisitions are common to expand product portfolios, gain market access, and consolidate market positions. M&A deal values are estimated to be in the range of tens to hundreds of million dollars annually, reflecting the strategic importance of this market.

High Temperature Resistant PET Film Industry Trends & Insights

The High Temperature Resistant PET Film industry is poised for substantial growth, propelled by escalating demand from a multitude of high-growth sectors. The intrinsic properties of PET, such as excellent dielectric strength, chemical resistance, and mechanical robustness, coupled with enhanced thermal stability achieved through specialized manufacturing processes and additives, make it an indispensable material. Market penetration is steadily increasing across various applications.

One of the primary market growth drivers is the burgeoning electronics industry, where high temperature resistant PET films are critical for components such as flexible printed circuit boards (FPCBs), insulating layers, and display technologies. The increasing miniaturization and performance demands in consumer electronics, automotive electronics, and industrial automation necessitate materials that can withstand elevated operating temperatures without degradation. The automotive sector is another significant contributor, with high temperature resistant PET films finding applications in electric vehicle (EV) battery insulation, under-the-hood components, and sensor encapsulation. As the automotive industry continues its transition towards electrification and advanced driver-assistance systems (ADAS), the demand for specialized films with superior thermal management capabilities is expected to surge.

Technological disruptions are playing a pivotal role. Advancements in polymer synthesis, compounding, and film extrusion techniques are enabling the production of PET films with significantly improved thermal stability, often exceeding 200°C continuous use temperatures. Nanotechnology integration, for instance, is being explored to enhance thermal conductivity and mechanical properties. Furthermore, the development of specialized coatings and surface treatments is expanding the application scope of these films, offering enhanced chemical resistance, scratch resistance, and electrical insulation.

Consumer preferences are indirectly influencing the market by driving innovation in end-products. The demand for more durable, energy-efficient, and compact electronic devices, as well as safer and higher-performing automotive components, directly translates into a need for advanced material solutions like high temperature resistant PET films. The packaging segment is also witnessing a growing adoption of these films, especially for retort packaging and specialized food applications requiring high-temperature sterilization or processing. The pharmaceutical industry relies on these films for specialized packaging solutions that maintain product integrity under varying temperature conditions.

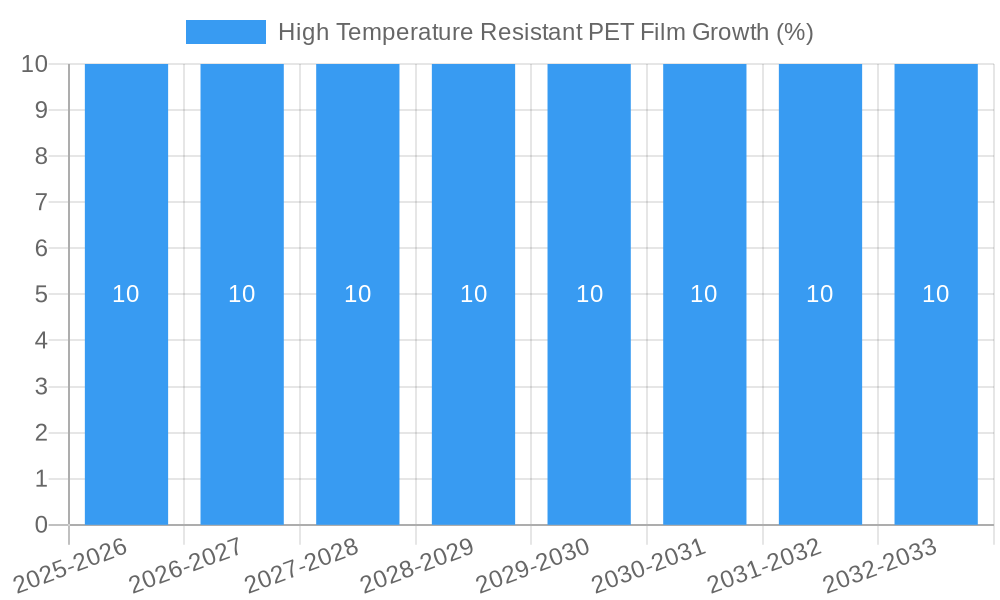

Competitive dynamics are characterized by intense rivalry, with companies differentiating themselves through product quality, customization capabilities, technological innovation, and global supply chain efficiency. Strategic partnerships and collaborations are becoming increasingly common to leverage complementary expertise and expand market reach. The market is also influenced by global economic policies, trade agreements, and environmental regulations, which can impact raw material costs, production, and market access. The projected Compound Annual Growth Rate (CAGR) for this market is estimated to be in the range of 6.5% to 8.0% over the forecast period, reflecting its strong growth trajectory.

Dominant Markets & Segments in High Temperature Resistant PET Film

The High Temperature Resistant PET Film market is segmented based on Application and Type, with significant regional variations and dominance patterns.

Dominant Region: Asia-Pacific currently holds a dominant position in the global High Temperature Resistant PET Film market. This dominance is attributed to several key factors:

- Manufacturing Hub: The region serves as a global manufacturing hub for electronics, automotive components, and packaging, driving substantial demand for PET films. Countries like China, South Korea, Japan, and Taiwan are at the forefront of this demand.

- Growing End-User Industries: Rapid industrialization and economic growth in countries like India and Southeast Asian nations further bolster demand.

- Technological Advancement: Significant investments in R&D and advanced manufacturing capabilities within the region contribute to its leadership.

- Government Support: Favorable government policies promoting domestic manufacturing and technological innovation play a crucial role.

Dominant Applications:

- Electronic: This is a primary driver of demand. High temperature resistant PET films are indispensable in the production of flexible printed circuit boards (FPCBs), insulation layers for transformers and motors, display components, and advanced semiconductor packaging. The relentless pace of innovation in consumer electronics, telecommunications, and automotive electronics fuels this segment's growth. Economic policies that encourage electronics manufacturing and R&D investments directly benefit this segment.

- Automobile: The automotive sector, particularly with the rise of electric vehicles (EVs) and sophisticated automotive electronics, is a rapidly expanding application. High temperature resistant PET films are used in battery pack insulation, wire and cable insulation, sensors, and other under-the-hood components requiring thermal stability and electrical insulation. Infrastructure development for EV charging and the increasing adoption of autonomous driving technologies are key drivers.

- Packaging: Specialized high temperature resistant PET films are crucial for demanding packaging applications like retort pouches for food and beverages, as well as pharmaceutical packaging that requires sterilization or protection against extreme temperatures. Growth in this segment is linked to changing consumer lifestyles and the demand for convenient, long-shelf-life food products. Strict food safety regulations also necessitate the use of high-performance packaging materials.

Dominant Types:

- Universal Film: This broad category encompasses standard high temperature resistant PET films used across various general-purpose applications where thermal stability is a key requirement but without highly specialized performance metrics. Its widespread applicability in industries like furniture, industrial components, and general packaging contributes to its significant market share.

- Electrical Insulating Film: Driven by the electronics and automotive sectors, electrical insulating films represent a critical and high-growth segment. These films are engineered to provide superior dielectric strength and thermal endurance, essential for preventing electrical shorts and ensuring the safe operation of electrical components in high-temperature environments. Infrastructure investments in power grids and renewable energy further boost demand.

- Capacitor Film: Essential for the production of high-performance capacitors used in power electronics, automotive systems, and industrial equipment. The increasing use of power electronics in various applications, from energy storage to power conversion, drives the demand for these specialized films. Stringent performance requirements for energy efficiency and reliability are key market drivers.

- Laminating Film: Used in various industrial and decorative applications, including laminating printed circuit boards, graphic overlays, and decorative surfaces that are exposed to elevated temperatures. Growth is linked to advancements in manufacturing processes and the demand for durable, high-quality finishes in diverse industrial applications.

High Temperature Resistant PET Film Product Innovations

Recent product developments in High Temperature Resistant PET Film focus on enhancing thermal stability beyond traditional limits, often exceeding 200°C, and improving mechanical properties like tensile strength and elongation. Innovations include the development of advanced composite films incorporating nanoparticles or specialized polymers to boost thermal conductivity and fire retardancy. New formulations are also emerging with enhanced chemical resistance, crucial for applications in harsh industrial environments or with specialized solvents. These advancements enable new applications in cutting-edge electronics, high-performance automotive components, and demanding industrial sectors, offering competitive advantages through superior performance and extended product lifecycles.

Report Segmentation & Scope

This report segments the High Temperature Resistant PET Film market by Application and Type.

Application Segments:

- Food & Beverage: Focused on retort packaging, high-temperature sterilization, and specialized food processing applications. Projections indicate steady growth driven by demand for safe and convenient food packaging solutions.

- Automobile: Encompasses EV battery insulation, under-the-hood components, sensors, and automotive electronics. Significant growth anticipated due to the electrification and advancement of vehicle technologies.

- Electronic: Critical for FPCBs, insulation, displays, and semiconductor packaging. Expected to exhibit robust expansion driven by technological innovation and miniaturization.

- Pharmaceutical: Used in specialized packaging requiring thermal stability and product integrity. Moderate but consistent growth anticipated due to increasing healthcare demands.

- Packaging: Broad applications beyond food, including industrial and protective packaging requiring thermal resistance. Stable growth projected.

- Furniture: Applications in decorative laminates and protective coatings for furniture exposed to heat. Steady but niche growth expected.

Type Segments:

- Universal Film: Covers general-purpose films with enhanced thermal properties. Significant market share due to broad applicability.

- Electrical Insulating Film: High-growth segment crucial for electrical components. Driven by electronics and automotive demand.

- Capacitor Film: Essential for high-performance capacitors. Steady growth linked to power electronics expansion.

- Laminating Film: Used in industrial and decorative lamination. Moderate growth anticipated with advancements in manufacturing.

Key Drivers of High Temperature Resistant PET Film Growth

The growth of the High Temperature Resistant PET Film market is primarily fueled by technological advancements that enhance thermal performance and durability, making these films suitable for increasingly demanding applications. The burgeoning electronics sector, driven by miniaturization, increased processing power, and the proliferation of smart devices, necessitates materials that can withstand higher operating temperatures. Similarly, the rapid evolution of the automotive industry, particularly the surge in electric vehicles (EVs) and advanced driver-assistance systems (ADAS), demands films with superior thermal management and electrical insulation properties for batteries, power electronics, and sensors. Growing investments in renewable energy infrastructure and industrial automation further contribute to this demand by requiring reliable, high-temperature resistant components. Economic growth and government initiatives supporting manufacturing and technological innovation in key regions like Asia-Pacific also act as significant catalysts.

Challenges in the High Temperature Resistant PET Film Sector

Despite its strong growth potential, the High Temperature Resistant PET Film sector faces several challenges. Fluctuations in raw material prices, particularly crude oil derivatives used in PET production, can impact profit margins and pricing strategies. Stringent environmental regulations regarding plastic production and disposal may necessitate investments in sustainable manufacturing practices and recycling technologies. Furthermore, the market is characterized by intense competition, with established players and emerging manufacturers vying for market share, leading to price pressures. The development and adoption of substitute materials, such as high-performance polyimides or advanced composite materials, in niche applications could also pose a competitive threat. Supply chain disruptions, exacerbated by geopolitical events or natural disasters, can affect production timelines and material availability, impacting order fulfillment and market stability. The estimated impact of these challenges on market growth can range from a reduction of 0.5% to 1.5% in the projected CAGR if not effectively mitigated.

Leading Players in the High Temperature Resistant PET Film Market

- Mitsubishi Chemical Group

- Toray Industries

- Ace Plastics

- TEKRA

- Accrued Plastic

- JTAPE

- FATRA

- Lumirror

- TOYOBO

- DuPont Teijin Films

- Mainyang Prochema

- Teraoka Seisakusho

- Shanghai Huzheng Industrial

- Guangdong NB Technology

- Shandong Top Leader Plastic Packing

- Naikos(Xiamen) Adhesive Tape

- Xiamen Guangboshi Optronics

Key Developments in High Temperature Resistant PET Film Sector

- 2023 October: Development of novel PET films with enhanced flame retardant properties for electronic applications.

- 2023 September: Launch of advanced PET films for EV battery insulation with improved thermal conductivity.

- 2023 July: Strategic partnership announced to expand R&D in nanotechnology-enhanced PET films.

- 2023 May: Major investment in new extrusion lines to increase production capacity for high-temperature resistant films.

- 2022 December: Acquisition of a specialized PET film manufacturer to broaden product portfolio and market reach.

- 2022 August: Introduction of eco-friendly high-temperature resistant PET films with a focus on recyclability.

Strategic High Temperature Resistant PET Film Market Outlook

- 2023 October: Development of novel PET films with enhanced flame retardant properties for electronic applications.

- 2023 September: Launch of advanced PET films for EV battery insulation with improved thermal conductivity.

- 2023 July: Strategic partnership announced to expand R&D in nanotechnology-enhanced PET films.

- 2023 May: Major investment in new extrusion lines to increase production capacity for high-temperature resistant films.

- 2022 December: Acquisition of a specialized PET film manufacturer to broaden product portfolio and market reach.

- 2022 August: Introduction of eco-friendly high-temperature resistant PET films with a focus on recyclability.

Strategic High Temperature Resistant PET Film Market Outlook

The strategic outlook for the High Temperature Resistant PET Film market is exceptionally promising, driven by sustained innovation and the indispensable role these films play in rapidly expanding industries. The ongoing transition towards electrification in the automotive sector, coupled with the relentless advancement of electronic devices, will continue to be primary growth accelerators. Opportunities lie in developing customized solutions for specific high-temperature applications, exploring new frontiers in material science through nanocomposites and advanced surface treatments, and establishing robust global supply chains to ensure consistent availability. Furthermore, a focus on sustainability and the development of recyclable or bio-based high-temperature resistant PET films will be crucial for long-term market leadership and catering to evolving environmental consciousness. Strategic collaborations and R&D investments will be paramount for companies aiming to capitalize on the significant future market potential.

High Temperature Resistant PET Film Segmentation

-

1. Application

- 1.1. Food & Beverage

- 1.2. Automobile

- 1.3. Electronic

- 1.4. Pharmaceutical

- 1.5. Packaging

- 1.6. Furniture

-

2. Types

- 2.1. Universal Film

- 2.2. Electrical Insulating Film

- 2.3. Capacitor Film

- 2.4. Laminating Film

High Temperature Resistant PET Film Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Temperature Resistant PET Film REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Temperature Resistant PET Film Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food & Beverage

- 5.1.2. Automobile

- 5.1.3. Electronic

- 5.1.4. Pharmaceutical

- 5.1.5. Packaging

- 5.1.6. Furniture

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Universal Film

- 5.2.2. Electrical Insulating Film

- 5.2.3. Capacitor Film

- 5.2.4. Laminating Film

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Temperature Resistant PET Film Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food & Beverage

- 6.1.2. Automobile

- 6.1.3. Electronic

- 6.1.4. Pharmaceutical

- 6.1.5. Packaging

- 6.1.6. Furniture

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Universal Film

- 6.2.2. Electrical Insulating Film

- 6.2.3. Capacitor Film

- 6.2.4. Laminating Film

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High Temperature Resistant PET Film Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food & Beverage

- 7.1.2. Automobile

- 7.1.3. Electronic

- 7.1.4. Pharmaceutical

- 7.1.5. Packaging

- 7.1.6. Furniture

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Universal Film

- 7.2.2. Electrical Insulating Film

- 7.2.3. Capacitor Film

- 7.2.4. Laminating Film

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High Temperature Resistant PET Film Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food & Beverage

- 8.1.2. Automobile

- 8.1.3. Electronic

- 8.1.4. Pharmaceutical

- 8.1.5. Packaging

- 8.1.6. Furniture

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Universal Film

- 8.2.2. Electrical Insulating Film

- 8.2.3. Capacitor Film

- 8.2.4. Laminating Film

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High Temperature Resistant PET Film Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food & Beverage

- 9.1.2. Automobile

- 9.1.3. Electronic

- 9.1.4. Pharmaceutical

- 9.1.5. Packaging

- 9.1.6. Furniture

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Universal Film

- 9.2.2. Electrical Insulating Film

- 9.2.3. Capacitor Film

- 9.2.4. Laminating Film

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High Temperature Resistant PET Film Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food & Beverage

- 10.1.2. Automobile

- 10.1.3. Electronic

- 10.1.4. Pharmaceutical

- 10.1.5. Packaging

- 10.1.6. Furniture

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Universal Film

- 10.2.2. Electrical Insulating Film

- 10.2.3. Capacitor Film

- 10.2.4. Laminating Film

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mitsubishi Chemical Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toray Industries

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ace Plastics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TEKRA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Accrued Plastic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JTAPE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FATRA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lumirror

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TOYOBO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DuPont Teijin Films

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mainyang Prochema

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Teraoka Seisakusho

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Shanghai Huzheng Industrial

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mainyang Prochema

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Teraoka Seisakusho

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Guangdong NB Technology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Shandong Top Leader Plastic Packing

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Naikos(Xiamen) Adhesive Tape

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Xiamen Guangboshi Optronics

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Mitsubishi Chemical Group

List of Figures

- Figure 1: Global High Temperature Resistant PET Film Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High Temperature Resistant PET Film Revenue (million), by Application 2024 & 2032

- Figure 3: North America High Temperature Resistant PET Film Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High Temperature Resistant PET Film Revenue (million), by Types 2024 & 2032

- Figure 5: North America High Temperature Resistant PET Film Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High Temperature Resistant PET Film Revenue (million), by Country 2024 & 2032

- Figure 7: North America High Temperature Resistant PET Film Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High Temperature Resistant PET Film Revenue (million), by Application 2024 & 2032

- Figure 9: South America High Temperature Resistant PET Film Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High Temperature Resistant PET Film Revenue (million), by Types 2024 & 2032

- Figure 11: South America High Temperature Resistant PET Film Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High Temperature Resistant PET Film Revenue (million), by Country 2024 & 2032

- Figure 13: South America High Temperature Resistant PET Film Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High Temperature Resistant PET Film Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High Temperature Resistant PET Film Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High Temperature Resistant PET Film Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High Temperature Resistant PET Film Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High Temperature Resistant PET Film Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High Temperature Resistant PET Film Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High Temperature Resistant PET Film Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High Temperature Resistant PET Film Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High Temperature Resistant PET Film Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High Temperature Resistant PET Film Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High Temperature Resistant PET Film Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High Temperature Resistant PET Film Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High Temperature Resistant PET Film Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High Temperature Resistant PET Film Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High Temperature Resistant PET Film Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High Temperature Resistant PET Film Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High Temperature Resistant PET Film Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High Temperature Resistant PET Film Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High Temperature Resistant PET Film Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High Temperature Resistant PET Film Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High Temperature Resistant PET Film Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High Temperature Resistant PET Film Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High Temperature Resistant PET Film Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High Temperature Resistant PET Film Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High Temperature Resistant PET Film Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High Temperature Resistant PET Film Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High Temperature Resistant PET Film Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High Temperature Resistant PET Film Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High Temperature Resistant PET Film Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High Temperature Resistant PET Film Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High Temperature Resistant PET Film Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High Temperature Resistant PET Film Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High Temperature Resistant PET Film Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High Temperature Resistant PET Film Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High Temperature Resistant PET Film Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High Temperature Resistant PET Film Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High Temperature Resistant PET Film Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High Temperature Resistant PET Film Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Temperature Resistant PET Film?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High Temperature Resistant PET Film?

Key companies in the market include Mitsubishi Chemical Group, Toray Industries, Ace Plastics, TEKRA, Accrued Plastic, JTAPE, FATRA, Lumirror, TOYOBO, DuPont Teijin Films, Mainyang Prochema, Teraoka Seisakusho, Shanghai Huzheng Industrial, Mainyang Prochema, Teraoka Seisakusho, Guangdong NB Technology, Shandong Top Leader Plastic Packing, Naikos(Xiamen) Adhesive Tape, Xiamen Guangboshi Optronics.

3. What are the main segments of the High Temperature Resistant PET Film?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Temperature Resistant PET Film," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Temperature Resistant PET Film report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Temperature Resistant PET Film?

To stay informed about further developments, trends, and reports in the High Temperature Resistant PET Film, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence