Key Insights

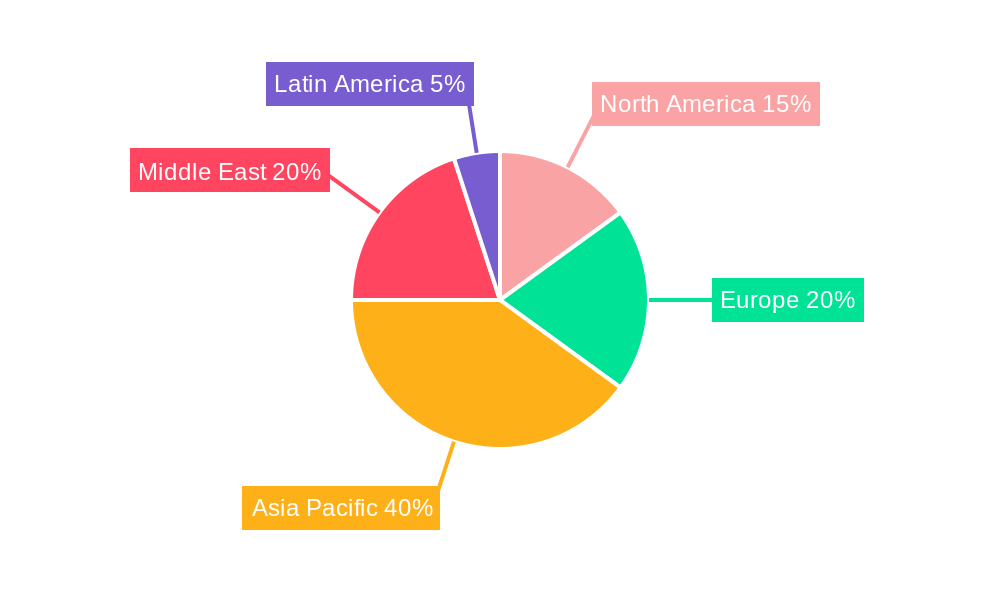

The Halal logistics market, projected to be worth [Estimate based on market size XX and CAGR 7% for 2025. For example, if XX was 100 million in 2019, a reasonable estimate for 2025 could be calculated using the CAGR formula] million in 2025, is experiencing robust growth driven by the burgeoning global demand for Halal products. This expansion is fueled by increasing Muslim populations worldwide and rising consumer awareness regarding Halal certification. Key growth drivers include the expansion of e-commerce platforms specializing in Halal products, stringent regulatory requirements for Halal certification and traceability across the supply chain, and the increasing adoption of advanced technologies such as blockchain for enhancing transparency and efficiency. The market is segmented by type (Storage and Inventory Management, Transportation—Air and Land, Others such as Monitoring Components, Software, and Services) and end-user industry (Food and Beverages, Chemicals, Cosmetics/Personal Care, Pharmaceuticals, and Others). Geographical growth varies; regions with significant Muslim populations like Asia Pacific and the Middle East are expected to dominate market share, although growth in other regions will be supported by increasing Halal product imports and the diversification of consumer preferences.

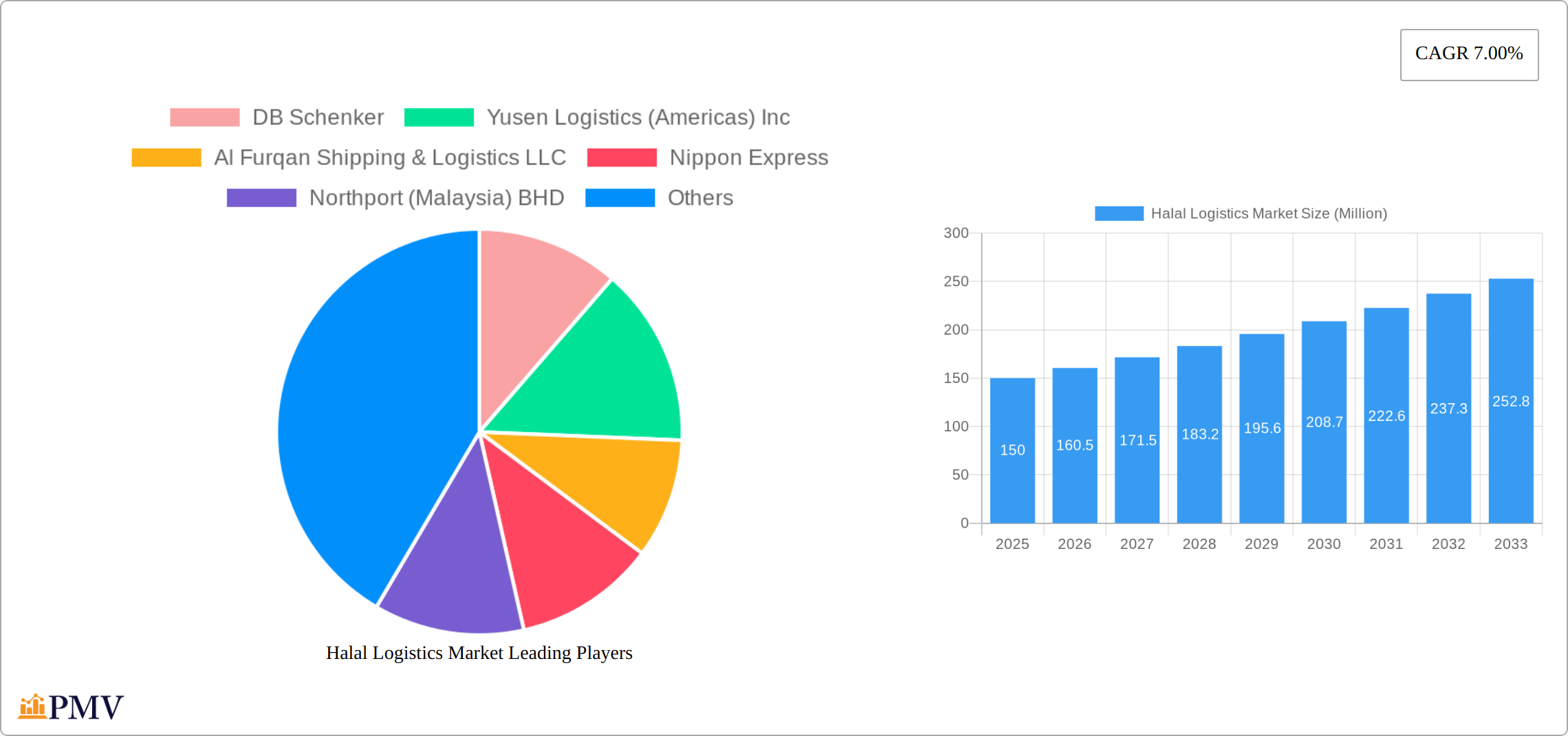

The competitive landscape is characterized by a mix of large multinational logistics providers like DB Schenker and Nippon Express, regional players, and specialized Halal logistics companies. Companies are strategically investing in infrastructure development, technology integration, and compliance certifications to meet the growing demands of the Halal supply chain. However, challenges remain, including the complexity of Halal certification processes across different countries, high transportation costs, particularly for air freight, and the need for standardized global Halal certification guidelines. Addressing these challenges will be critical for ensuring the sustainable growth of this dynamic and increasingly important market sector. Further opportunities for growth lie in the development of specialized Halal cold-chain logistics solutions for temperature-sensitive products and the increasing utilization of digital technologies for enhanced traceability and risk management within the Halal supply chain.

Halal Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Halal Logistics Market, encompassing market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The study period covers 2019–2033, with 2025 as the base and estimated year. The forecast period spans 2025–2033, and the historical period covers 2019–2024. This report is crucial for businesses, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly expanding market. The total market value is projected to reach xx Million by 2033, exhibiting a significant CAGR of xx%.

Halal Logistics Market Structure & Competitive Dynamics

This section analyzes the Halal Logistics market's competitive intensity, innovation dynamics, regulatory landscape, and market trends. The market exhibits a moderately concentrated structure with key players holding significant market share. However, the emergence of smaller, specialized firms is increasing competition. Innovation is driven by technological advancements in tracking, temperature control, and supply chain management software catering specifically to Halal certification requirements.

The regulatory landscape varies across regions, with some countries having more stringent Halal certification processes than others. This creates both challenges and opportunities, with companies adapting their operations to comply with different standards. Product substitutes are minimal, as the core need for Halal-compliant logistics is distinct. End-user trends are shaped by growing consumer demand for Halal products and increasing awareness of ethical and religious considerations.

M&A activity is expected to be moderate in the coming years as larger logistics providers seek to expand their Halal capabilities and acquire specialized businesses. While precise deal values are not publicly available for all transactions, a few major acquisitions within the Halal logistics sector have totaled around xx Million in the past five years. Market share distribution among the top five players is estimated at approximately 60%, with the remaining 40% distributed across a large number of smaller companies.

Halal Logistics Market Industry Trends & Insights

The Halal logistics market is experiencing robust growth, driven by a confluence of factors. The burgeoning global Muslim population, coupled with rising disposable incomes, fuels escalating demand for Halal-certified products across diverse sectors, including food and beverages, pharmaceuticals, cosmetics, and personal care items. This surge is further amplified by the increasing consumer preference for authenticity, ethical sourcing, and transparency throughout the supply chain. Technological advancements, such as blockchain for enhanced traceability, IoT devices for real-time monitoring, and AI-powered predictive analytics for optimized route planning and inventory management, are significantly enhancing efficiency and streamlining operations.

Sustainability is emerging as a key driver, with companies increasingly adopting eco-friendly transportation methods, utilizing sustainable packaging materials, and minimizing their carbon footprint. The competitive landscape is dynamic, characterized by intense competition and significant investments in cutting-edge technologies and infrastructure to gain a competitive edge. Market penetration of advanced technologies is currently estimated at approximately 30%, projected to reach approximately 55% by 2033. This technological integration is expected to drive significant improvements in efficiency, traceability, and overall supply chain resilience. The global Halal logistics market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period, propelled by these positive trends and the increasing global demand for Halal products.

Dominant Markets & Segments in Halal Logistics Market

The Halal logistics market exhibits significant geographic diversity, with robust growth observed across various regions. However, Southeast Asia and the Middle East currently hold dominant positions, owing to their substantial Muslim populations and well-established Halal certification infrastructures. Other regions, particularly those with growing Muslim communities and increasing disposable incomes, are also experiencing rapid expansion.

- Key Drivers in Southeast Asia: Rapid economic growth, an expanding middle class, supportive government regulations fostering Halal industry growth, and a well-developed logistics network facilitating efficient transportation and distribution.

- Key Drivers in the Middle East: High per capita income, strong religious adherence driving demand for Halal products, and a strategically advantageous location facilitating global trade and seamless connectivity.

The Food and Beverages segment commands the largest market share within the Halal logistics sector, fueled by the globally high demand for Halal food products. The Transportation segment is also experiencing rapid expansion due to the increasing need for efficient and reliable transportation, particularly for temperature-sensitive Halal products. Within the Transportation segment, air freight is witnessing particularly robust growth, driven by its speed and ability to transport perishable goods across vast distances, ensuring product freshness and quality preservation.

Detailed dominance analysis indicates that the Food and Beverages segment is poised to maintain its leading position throughout the forecast period, given the sustained growth in demand for Halal food and beverages. However, other segments are demonstrating substantial growth potential. The expansion of the pharmaceuticals and cosmetics sectors is driving growth in the storage and inventory management segment, with increased investments in specialized, temperature-controlled storage facilities and advanced inventory management technologies.

Halal Logistics Market Product Innovations

Recent innovations in Halal logistics focus on improving traceability, temperature control, and overall supply chain efficiency. Blockchain technology is being increasingly adopted to ensure product authenticity and prevent fraud. Smart sensors and IoT devices enable real-time tracking and monitoring of goods, enhancing transparency and minimizing risks associated with temperature-sensitive products. These innovations are addressing market needs for improved efficiency, security, and compliance with Halal standards, enhancing consumer trust and driving market growth.

Report Segmentation & Scope

The Halal Logistics Market is segmented by Type (Storage and Inventory Management, Transportation, Air Freight, Others) and by End-User Industry (Food and Beverages, Chemicals, Cosmetic/Personal Care, Pharmaceuticals, Others).

By Type: The Transportation segment remains the largest, reflecting the critical need for efficient and reliable delivery of Halal products. The Storage and Inventory Management segment is projected to experience significant growth driven by the demand for specialized storage facilities that adhere strictly to Halal regulations and ensure product integrity and safety. The Air Freight segment continues to experience substantial growth, fulfilling the crucial need for rapid and dependable transport of perishable Halal products while maintaining stringent quality and safety standards. The Others segment, encompassing specialized monitoring technologies, sophisticated software solutions, and comprehensive logistical services, is expanding in line with the increasing adoption of technology within the Halal logistics sector.

By End-User Industry: The Food and Beverages segment continues to dominate the market, driven by persistent high demand for Halal-certified food and beverages. Simultaneously, the Pharmaceuticals and Cosmetic/Personal Care segments demonstrate promising growth trajectories, fueled by an expanding consumer base and increasing awareness of Halal certification in these product categories. A detailed analysis of each segment’s growth projections and competitive dynamics is provided in the full report.

Key Drivers of Halal Logistics Market Growth

Several factors are driving the growth of the Halal Logistics Market:

- Rising Muslim Population: The globally increasing Muslim population fuels the demand for Halal-certified products, necessitating specialized logistics solutions.

- Increased Disposable Incomes: Rising disposable incomes in many regions, especially in developing economies with significant Muslim populations, are bolstering consumer spending on Halal products.

- Stringent Halal Certification: The increasing strictness of Halal certification regulations drives the demand for logistics providers who can ensure compliance and traceability throughout the supply chain.

- Technological Advancements: Innovations in tracking, temperature control, and supply chain management are enhancing efficiency and transparency in Halal logistics.

Challenges in the Halal Logistics Market Sector

Despite significant growth potential, the Halal logistics market faces several challenges:

- Regulatory Complexity: Varying Halal certification standards across different regions pose logistical complexities and increase operational costs.

- Supply Chain Disruptions: Global events, such as pandemics and geopolitical instability, can disrupt supply chains and impact the availability of Halal products.

- Competition: The increasing number of players in the market intensifies competition, putting pressure on profit margins. This is estimated to reduce the average profit margin by approximately 5% in the next 5 years.

Leading Players in the Halal Logistics Market Market

- DB Schenker

- Yusen Logistics (Americas) Inc

- Al Furqan Shipping & Logistics LLC

- Nippon Express

- Northport (Malaysia) BHD

- Kontena Nasional BHD (KNB)

- Freight Management Holdings Berhad

- Sejung Corporation

- HAVI

- TASCO Berhad

- TIBA Group

- MASkargo

Key Developments in Halal Logistics Market Sector

- June 2022: The Halal Food Company launched five new ready-made meals in Sainsbury's, United Kingdom, expanding the availability of Halal-certified convenience food and highlighting the growing demand within the market.

- February 2022: The launch of Gethalal Group, a Berlin-based halal food delivery service, demonstrates the growing demand for convenient access to Halal food and the potential for specialized services within the market.

Strategic Halal Logistics Market Outlook

The Halal Logistics Market is poised for continued growth, driven by increasing demand for Halal-certified products, technological advancements, and expanding consumer bases. Strategic opportunities exist for companies that can leverage technology to enhance efficiency, transparency, and traceability within the supply chain, meeting the rising demand for sustainable and ethically sourced products. Focus on regional expansion, particularly in high-growth markets, will be crucial for capturing a larger market share. Collaboration across the industry to develop standardized Halal certification processes will contribute to market growth.

Halal Logistics Market Segmentation

-

1. Type

- 1.1. Storage and Inventory Management

-

1.2. Transportation

- 1.2.1. Road

- 1.2.2. Rail

- 1.2.3. Sea

- 1.2.4. Air

- 1.3. Others (

-

2. End-User Industry

- 2.1. Food and Beverages

- 2.2. Chemicals

- 2.3. Cosmetic / Personal Care

- 2.4. Pharmaceuticals

- 2.5. Others

Halal Logistics Market Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Europe

- 4. Asia Pacific

- 5. Middle East

Halal Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased focus on quality and product sensitivity in the pharma industry; Automation at warehouses to increase efficiency and accuracy

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support

- 3.4. Market Trends

- 3.4.1. The Global Need for Halal Logistics is Rising as Halal Product Demand Rises

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Storage and Inventory Management

- 5.1.2. Transportation

- 5.1.2.1. Road

- 5.1.2.2. Rail

- 5.1.2.3. Sea

- 5.1.2.4. Air

- 5.1.3. Others (

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food and Beverages

- 5.2.2. Chemicals

- 5.2.3. Cosmetic / Personal Care

- 5.2.4. Pharmaceuticals

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Europe

- 5.3.4. Asia Pacific

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Storage and Inventory Management

- 6.1.2. Transportation

- 6.1.2.1. Road

- 6.1.2.2. Rail

- 6.1.2.3. Sea

- 6.1.2.4. Air

- 6.1.3. Others (

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Food and Beverages

- 6.2.2. Chemicals

- 6.2.3. Cosmetic / Personal Care

- 6.2.4. Pharmaceuticals

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Latin America Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Storage and Inventory Management

- 7.1.2. Transportation

- 7.1.2.1. Road

- 7.1.2.2. Rail

- 7.1.2.3. Sea

- 7.1.2.4. Air

- 7.1.3. Others (

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Food and Beverages

- 7.2.2. Chemicals

- 7.2.3. Cosmetic / Personal Care

- 7.2.4. Pharmaceuticals

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Storage and Inventory Management

- 8.1.2. Transportation

- 8.1.2.1. Road

- 8.1.2.2. Rail

- 8.1.2.3. Sea

- 8.1.2.4. Air

- 8.1.3. Others (

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Food and Beverages

- 8.2.2. Chemicals

- 8.2.3. Cosmetic / Personal Care

- 8.2.4. Pharmaceuticals

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Asia Pacific Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Storage and Inventory Management

- 9.1.2. Transportation

- 9.1.2.1. Road

- 9.1.2.2. Rail

- 9.1.2.3. Sea

- 9.1.2.4. Air

- 9.1.3. Others (

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Food and Beverages

- 9.2.2. Chemicals

- 9.2.3. Cosmetic / Personal Care

- 9.2.4. Pharmaceuticals

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Storage and Inventory Management

- 10.1.2. Transportation

- 10.1.2.1. Road

- 10.1.2.2. Rail

- 10.1.2.3. Sea

- 10.1.2.4. Air

- 10.1.3. Others (

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Food and Beverages

- 10.2.2. Chemicals

- 10.2.3. Cosmetic / Personal Care

- 10.2.4. Pharmaceuticals

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Latin America Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Halal Logistics Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 DB Schenker

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Yusen Logistics (Americas) Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Al Furqan Shipping & Logistics LLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nippon Express

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Northport (Malaysia) BHD

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Kontena Nasional BHD (KNB)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Freight Management Holdings Berhad

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sejung Corporation

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 HAVI

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TASCO Berhad

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 TIBA Group**List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 MASkargo

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 DB Schenker

List of Figures

- Figure 1: Global Halal Logistics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Latin America Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Latin America Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Halal Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Halal Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Halal Logistics Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 15: North America Halal Logistics Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 16: North America Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Latin America Halal Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Latin America Halal Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Latin America Halal Logistics Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 21: Latin America Halal Logistics Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: Latin America Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Latin America Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Halal Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Halal Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Halal Logistics Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 27: Europe Halal Logistics Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 28: Europe Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Halal Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Asia Pacific Halal Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Asia Pacific Halal Logistics Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 33: Asia Pacific Halal Logistics Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 34: Asia Pacific Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Halal Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East Halal Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East Halal Logistics Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 39: Middle East Halal Logistics Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 40: Middle East Halal Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Halal Logistics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Halal Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Halal Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Halal Logistics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Halal Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Halal Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Halal Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Halal Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Halal Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Halal Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Halal Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Halal Logistics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Halal Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Halal Logistics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 20: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Halal Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Halal Logistics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 23: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Halal Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Halal Logistics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 26: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Halal Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Halal Logistics Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 29: Global Halal Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Halal Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Halal Logistics Market?

Key companies in the market include DB Schenker, Yusen Logistics (Americas) Inc, Al Furqan Shipping & Logistics LLC, Nippon Express, Northport (Malaysia) BHD, Kontena Nasional BHD (KNB), Freight Management Holdings Berhad, Sejung Corporation, HAVI, TASCO Berhad, TIBA Group**List Not Exhaustive, MASkargo.

3. What are the main segments of the Halal Logistics Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased focus on quality and product sensitivity in the pharma industry; Automation at warehouses to increase efficiency and accuracy.

6. What are the notable trends driving market growth?

The Global Need for Halal Logistics is Rising as Halal Product Demand Rises.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support.

8. Can you provide examples of recent developments in the market?

June 2022: The Halal Food Company launched five new ready-made meals in Sainsbury's, United Kingdom. The company offers a snack pot of chicken curry and basmati rice, peri-peri stir fry with grilled chicken, beef lasagna, shepherd's pie, and macaroni pasta with slow-cooked meatballs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Halal Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Halal Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Halal Logistics Market?

To stay informed about further developments, trends, and reports in the Halal Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence