Key Insights

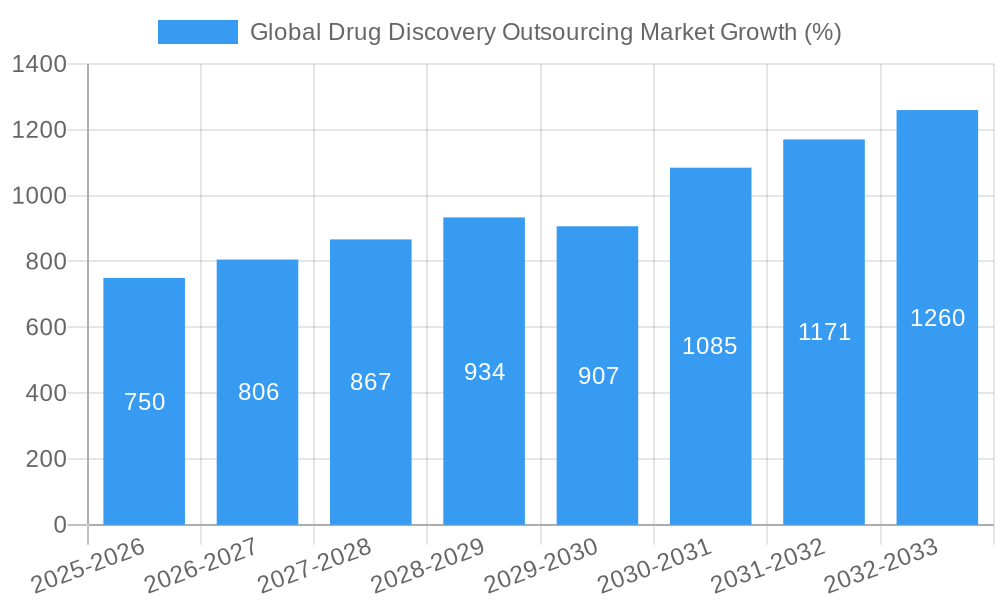

The global drug discovery outsourcing market is experiencing robust growth, driven by escalating research and development (R&D) costs within the pharmaceutical industry, coupled with the increasing complexity of drug development. The market's Compound Annual Growth Rate (CAGR) of 7.50% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. This growth is fueled by several key factors. Firstly, pharmaceutical companies are increasingly outsourcing non-core activities like preclinical testing, clinical trials, and manufacturing to specialized contract research organizations (CROs). This allows them to focus on core competencies, reduce operational costs, and accelerate drug development timelines. Secondly, the rise of innovative therapeutic areas like oncology and immunology, with their complex biological mechanisms, necessitate specialized expertise and advanced technologies often provided by CROs. Finally, the increasing demand for personalized medicine further fuels the outsourcing trend as CROs possess the technological capabilities and infrastructure to manage the complexities of this evolving field.

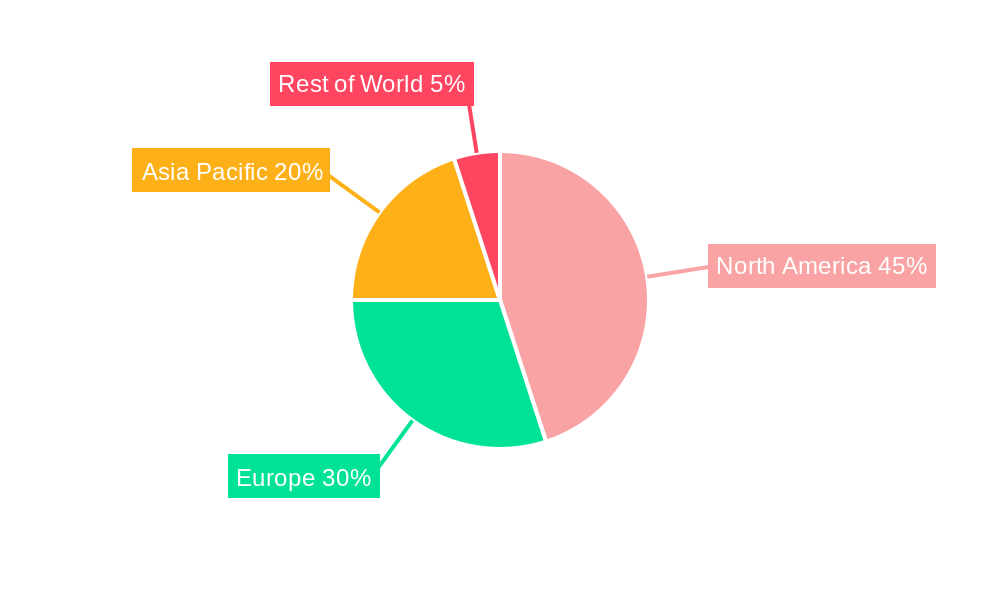

The market segmentation reveals significant opportunities across various service types and therapeutic areas. The large molecule (biopharmaceutical) segment is expected to show strong growth owing to the expanding pipeline of biologics and advanced therapies. Within therapeutic areas, oncology continues to dominate due to high investment and a large unmet medical need. Geographically, North America currently holds a substantial market share, driven by a mature pharmaceutical industry and high R&D spending. However, the Asia-Pacific region is anticipated to witness faster growth in the coming years, fueled by increasing healthcare expenditure and the rise of domestic pharmaceutical companies. While regulatory hurdles and data privacy concerns pose certain restraints, the overall market outlook remains positive, indicating considerable expansion and lucrative opportunities for CROs and pharmaceutical companies alike. Competition is fierce among established players like Thermo Fisher Scientific, Eurofins Scientific, and Charles River Laboratories, leading to continuous innovation and a focus on providing comprehensive, integrated services to clients.

Global Drug Discovery Outsourcing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Global Drug Discovery Outsourcing Market, offering actionable insights for stakeholders across the pharmaceutical and biotechnology industries. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. Key market segments, including drug type, therapeutic area, and service type, are thoroughly examined, alongside a competitive landscape analysis of leading players.

Global Drug Discovery Outsourcing Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the global drug discovery outsourcing market. The market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share. Thermo Fisher Scientific (PPD Inc.), Eurofins Scientific, Laboratory Corporation of America Holdings, and Charles River Laboratories International Inc. are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. The market is characterized by a dynamic innovation ecosystem, with continuous advancements in technologies such as artificial intelligence (AI) and machine learning (ML) driving innovation and shaping competitive strategies.

Regulatory frameworks, particularly those governing Good Manufacturing Practices (GMP) and data privacy, significantly impact market operations. Product substitutes are limited due to the specialized nature of drug discovery services, though increasing competition drives innovation and efficiency improvements. End-user trends favor outsourcing to reduce internal costs and leverage specialized expertise. The market has seen considerable M&A activity in recent years, with deal values totaling an estimated USD xx Million in 2024. Key M&A activities include strategic acquisitions to expand service offerings and geographic reach. For example, the recent acquisition of Company X by Company Y significantly altered market share dynamics in the [specific segment] sector.

Global Drug Discovery Outsourcing Market Industry Trends & Insights

The global drug discovery outsourcing market is experiencing robust growth, driven by several key factors. The increasing complexity of drug development, coupled with rising R&D costs, is pushing pharmaceutical and biotechnology companies to outsource non-core activities. Technological advancements, particularly in AI/ML, genomics, and high-throughput screening, are significantly accelerating drug discovery processes and enhancing efficiency. The market is witnessing a shift towards integrated service providers that offer a comprehensive suite of services, from target identification to clinical trial support. Consumer preferences are leaning towards outsourcing partners with strong track records, robust regulatory compliance, and technological expertise.

The market's Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033), exceeding the global pharmaceutical market's CAGR of xx%. Market penetration is highest in North America and Europe, reflecting the established pharmaceutical industries in these regions. However, significant growth opportunities exist in emerging markets such as Asia-Pacific and Latin America, driven by rising healthcare spending and increasing pharmaceutical production. The competitive landscape is intense, with continuous innovation and strategic partnerships shaping the industry's trajectory.

Dominant Markets & Segments in Global Drug Discovery Outsourcing Market

The North American market currently holds the largest share of the global drug discovery outsourcing market, driven by the presence of major pharmaceutical companies, well-established research institutions, and a robust regulatory framework.

Key Drivers of Dominance:

- Strong presence of pharmaceutical and biotech companies

- Advanced research infrastructure

- High levels of funding for R&D

- Favorable regulatory environment

Segment Dominance Analysis:

- Drug Type: Small molecule drugs currently dominate the market, driven by their established production methods and cost-effectiveness. However, large molecule (biopharmaceutical) outsourcing is witnessing rapid growth, fueled by the increasing prevalence of biologics in new drug development.

- Therapeutic Area: Oncology leads in outsourcing due to the high demand for novel cancer therapies and the complexity of cancer drug development. Infectious disease and respiratory disease also represent significant segments, particularly driven by current global health challenges.

- Service Type: Medical chemistry services currently dominate, though biology services are showing strong growth, reflecting the growing importance of biological assays and target validation in drug discovery.

Global Drug Discovery Outsourcing Market Product Innovations

Recent years have witnessed significant innovation in drug discovery outsourcing, driven by technological advancements. The adoption of AI and machine learning for drug target identification, lead optimization, and clinical trial design is revolutionizing the industry. High-throughput screening technologies allow for rapid and efficient testing of thousands of compounds, while advanced analytical techniques enable deeper understanding of drug mechanisms. These innovations are leading to improved efficacy, reduced development times, and lower costs, enhancing market competitiveness and attracting new clients.

Report Segmentation & Scope

The report segments the market based on drug type (small molecule, large molecules), therapeutic area (oncology, infectious disease, respiratory disease, cardiovascular, gastrointestinal, others), and service type (medical chemistry service, biology service). Each segment's growth projection, market size, and competitive dynamics are analyzed. The small molecule segment is projected to hold the largest market share in 2025, followed by large molecule drugs, which are expected to experience faster growth during the forecast period. The oncology therapeutic area dominates due to high R&D investments, while the medical chemistry services segment leads in the service type category. Competitive intensity varies across segments, with some characterized by a concentrated market structure and others exhibiting more fragmented competition.

Key Drivers of Global Drug Discovery Outsourcing Market Growth

Several key factors drive the growth of the global drug discovery outsourcing market. Technological advancements, such as AI and high-throughput screening, are significantly accelerating drug discovery. The rising cost of in-house drug development pushes pharmaceutical companies to outsource non-core functions. Favorable regulatory environments in many countries encourage outsourcing and foster competition. The increasing prevalence of chronic diseases and the growing demand for novel therapies fuel the need for efficient drug development solutions.

Challenges in the Global Drug Discovery Outsourcing Market Sector

The market faces challenges, including stringent regulatory compliance requirements that increase operational complexity and cost. Supply chain disruptions can impact the availability of essential materials and services, leading to project delays and cost overruns. Intense competition among outsourcing providers necessitates continuous innovation and efficiency improvements to maintain market share. Intellectual property protection concerns also require careful contract management and robust security measures. The global nature of the market necessitates effective risk management and contingency planning for global economic and political uncertainties. These challenges affect the profitability and timelines of outsourced drug discovery projects.

Leading Players in the Global Drug Discovery Outsourcing Market Market

- Thermo Fisher Scientific (PPD Inc)

- Eurofins Scientific

- Laboratory Corporation of America Holdings

- Charles River Laboratories International Inc

- GenScript Biotech Corporation

- Oncodesign

- WuXi AppTec

- Evotec SE

- Dalton Pharma Services

- Curia Inc

- Jubilant Life Sciences Limited

Key Developments in Global Drug Discovery Outsourcing Market Sector

- November 2022: Sanofi and Insilico Medicine inked a USD 1200 Million drug development deal, leveraging AI for advancing drug development in up to six new targets. This highlights the increasing adoption of AI in drug discovery and the significant investment in outsourced services.

- October 2022: Amphista Therapeutics collaborated with Domainex, demonstrating the growing trend of partnerships for integrated drug discovery services and leveraging specialized expertise to accelerate research programs.

Strategic Global Drug Discovery Outsourcing Market Market Outlook

The global drug discovery outsourcing market is poised for continued strong growth, driven by technological innovation, increasing R&D expenditure, and the growing need for efficient drug development solutions. Strategic opportunities exist for companies that can leverage AI and other advanced technologies, offer integrated services, and expand their geographic reach to tap into emerging markets. Focusing on specialized therapeutic areas and building strong partnerships with pharmaceutical and biotech companies will be crucial for success. The increasing demand for biologics and personalized medicine presents further avenues for growth and innovation within the outsourcing sector.

Global Drug Discovery Outsourcing Market Segmentation

-

1. Type

- 1.1. Medical Chemistry Service

- 1.2. Biology Service

-

2. Drug Type

- 2.1. Small Molecule

- 2.2. Large Molecules (Biopharmaceuticals)

-

3. Therapeutic Area

- 3.1. Oncology

- 3.2. Infectious Disease

- 3.3. Respiratory Disease

- 3.4. Cardiovascular

- 3.5. Gastrointestinal

- 3.6. Others

Global Drug Discovery Outsourcing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Drug Discovery Outsourcing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing R&D In Biopharmaceutical Industry; Increasing demand for outsourcing Services in Drug Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Drug Development and Stringent Regulations for Drug Manufacturing

- 3.4. Market Trends

- 3.4.1. Oncology Segment is Expected to Hold a Significant Market Share Over The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Medical Chemistry Service

- 5.1.2. Biology Service

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Small Molecule

- 5.2.2. Large Molecules (Biopharmaceuticals)

- 5.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 5.3.1. Oncology

- 5.3.2. Infectious Disease

- 5.3.3. Respiratory Disease

- 5.3.4. Cardiovascular

- 5.3.5. Gastrointestinal

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Medical Chemistry Service

- 6.1.2. Biology Service

- 6.2. Market Analysis, Insights and Forecast - by Drug Type

- 6.2.1. Small Molecule

- 6.2.2. Large Molecules (Biopharmaceuticals)

- 6.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 6.3.1. Oncology

- 6.3.2. Infectious Disease

- 6.3.3. Respiratory Disease

- 6.3.4. Cardiovascular

- 6.3.5. Gastrointestinal

- 6.3.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Medical Chemistry Service

- 7.1.2. Biology Service

- 7.2. Market Analysis, Insights and Forecast - by Drug Type

- 7.2.1. Small Molecule

- 7.2.2. Large Molecules (Biopharmaceuticals)

- 7.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 7.3.1. Oncology

- 7.3.2. Infectious Disease

- 7.3.3. Respiratory Disease

- 7.3.4. Cardiovascular

- 7.3.5. Gastrointestinal

- 7.3.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Medical Chemistry Service

- 8.1.2. Biology Service

- 8.2. Market Analysis, Insights and Forecast - by Drug Type

- 8.2.1. Small Molecule

- 8.2.2. Large Molecules (Biopharmaceuticals)

- 8.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 8.3.1. Oncology

- 8.3.2. Infectious Disease

- 8.3.3. Respiratory Disease

- 8.3.4. Cardiovascular

- 8.3.5. Gastrointestinal

- 8.3.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Medical Chemistry Service

- 9.1.2. Biology Service

- 9.2. Market Analysis, Insights and Forecast - by Drug Type

- 9.2.1. Small Molecule

- 9.2.2. Large Molecules (Biopharmaceuticals)

- 9.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 9.3.1. Oncology

- 9.3.2. Infectious Disease

- 9.3.3. Respiratory Disease

- 9.3.4. Cardiovascular

- 9.3.5. Gastrointestinal

- 9.3.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Medical Chemistry Service

- 10.1.2. Biology Service

- 10.2. Market Analysis, Insights and Forecast - by Drug Type

- 10.2.1. Small Molecule

- 10.2.2. Large Molecules (Biopharmaceuticals)

- 10.3. Market Analysis, Insights and Forecast - by Therapeutic Area

- 10.3.1. Oncology

- 10.3.2. Infectious Disease

- 10.3.3. Respiratory Disease

- 10.3.4. Cardiovascular

- 10.3.5. Gastrointestinal

- 10.3.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Global Drug Discovery Outsourcing Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Thermo Fisher Scientific (PPD Inc )

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Eurofins Scientific

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Laboratory Corporation of America Holdings

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Charles River Laboratories International Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 GenScript Biotech Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Oncodesign

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 WuXi AppTec

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Evotec SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Dalton Pharma Services

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Curia Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Jubilant Life Sciences Limited

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Thermo Fisher Scientific (PPD Inc )

List of Figures

- Figure 1: Global Global Drug Discovery Outsourcing Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Global Drug Discovery Outsourcing Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Global Drug Discovery Outsourcing Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 15: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 16: North America Global Drug Discovery Outsourcing Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 17: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 18: North America Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Global Drug Discovery Outsourcing Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Global Drug Discovery Outsourcing Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 23: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 24: Europe Global Drug Discovery Outsourcing Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 25: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 26: Europe Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 31: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 32: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 33: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 34: Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 39: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 40: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 41: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 42: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: South America Global Drug Discovery Outsourcing Market Revenue (Million), by Type 2024 & 2032

- Figure 45: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Type 2024 & 2032

- Figure 46: South America Global Drug Discovery Outsourcing Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 47: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 48: South America Global Drug Discovery Outsourcing Market Revenue (Million), by Therapeutic Area 2024 & 2032

- Figure 49: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Therapeutic Area 2024 & 2032

- Figure 50: South America Global Drug Discovery Outsourcing Market Revenue (Million), by Country 2024 & 2032

- Figure 51: South America Global Drug Discovery Outsourcing Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 5: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: GCC Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Africa Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Brazil Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 34: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 35: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Canada Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 41: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 42: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 51: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 52: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia Pacific Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 61: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 62: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 63: GCC Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: South Africa Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Middle East and Africa Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Type 2019 & 2032

- Table 67: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 68: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Therapeutic Area 2019 & 2032

- Table 69: Global Drug Discovery Outsourcing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: Brazil Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Argentina Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of South America Global Drug Discovery Outsourcing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Drug Discovery Outsourcing Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Global Drug Discovery Outsourcing Market?

Key companies in the market include Thermo Fisher Scientific (PPD Inc ), Eurofins Scientific, Laboratory Corporation of America Holdings, Charles River Laboratories International Inc, GenScript Biotech Corporation, Oncodesign, WuXi AppTec, Evotec SE, Dalton Pharma Services, Curia Inc, Jubilant Life Sciences Limited.

3. What are the main segments of the Global Drug Discovery Outsourcing Market?

The market segments include Type, Drug Type, Therapeutic Area.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing R&D In Biopharmaceutical Industry; Increasing demand for outsourcing Services in Drug Development.

6. What are the notable trends driving market growth?

Oncology Segment is Expected to Hold a Significant Market Share Over The Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Drug Development and Stringent Regulations for Drug Manufacturing.

8. Can you provide examples of recent developments in the market?

November 2022: Sanofi and Insilico Medicine, a clinical-stage biotechnology company, inked USD 1200 million Drug Development Deal. The agreement will see Sanofi use Insilico's AI platform, Pharma.AI, to advance drug development in up to six new targets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Drug Discovery Outsourcing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Drug Discovery Outsourcing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Drug Discovery Outsourcing Market?

To stay informed about further developments, trends, and reports in the Global Drug Discovery Outsourcing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence