Key Insights

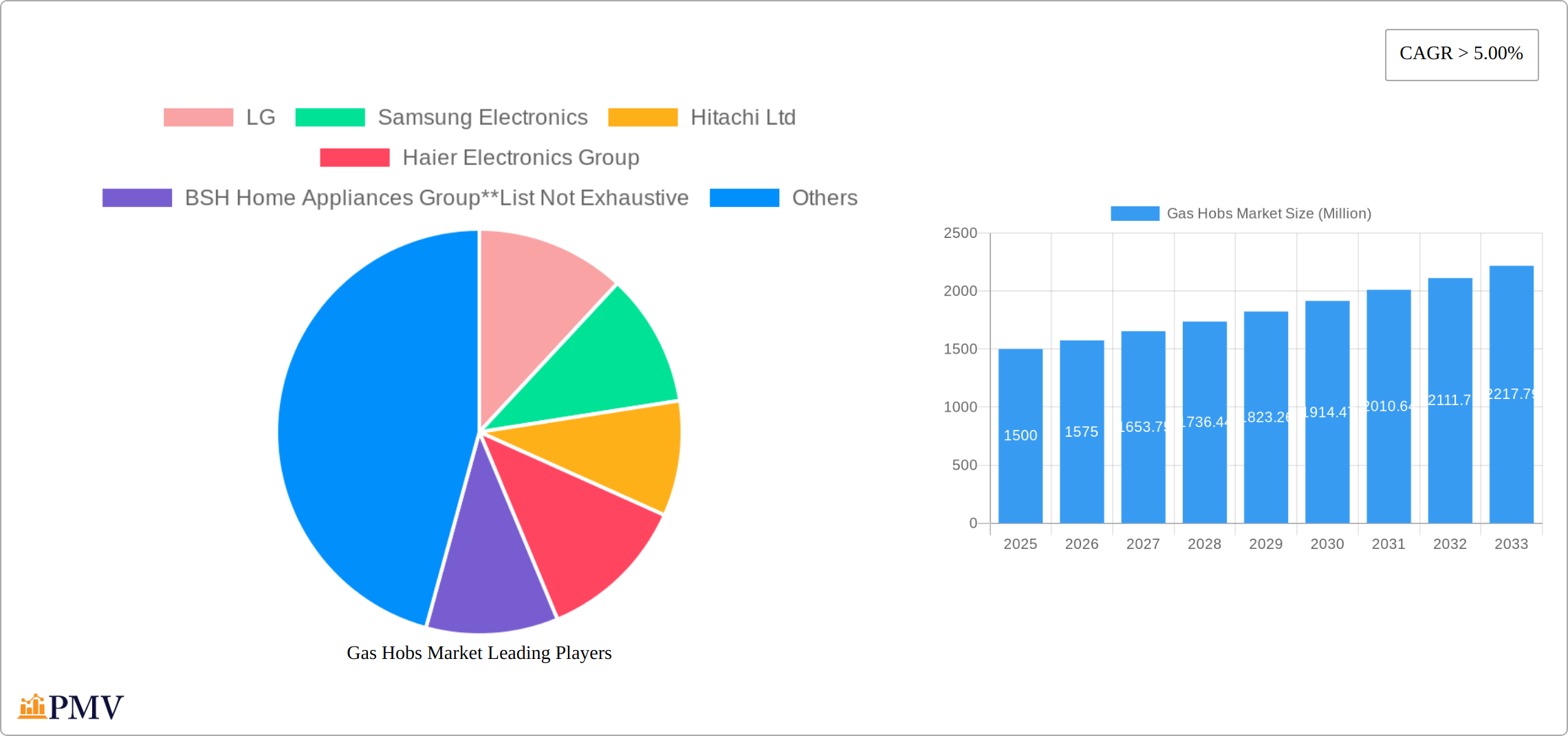

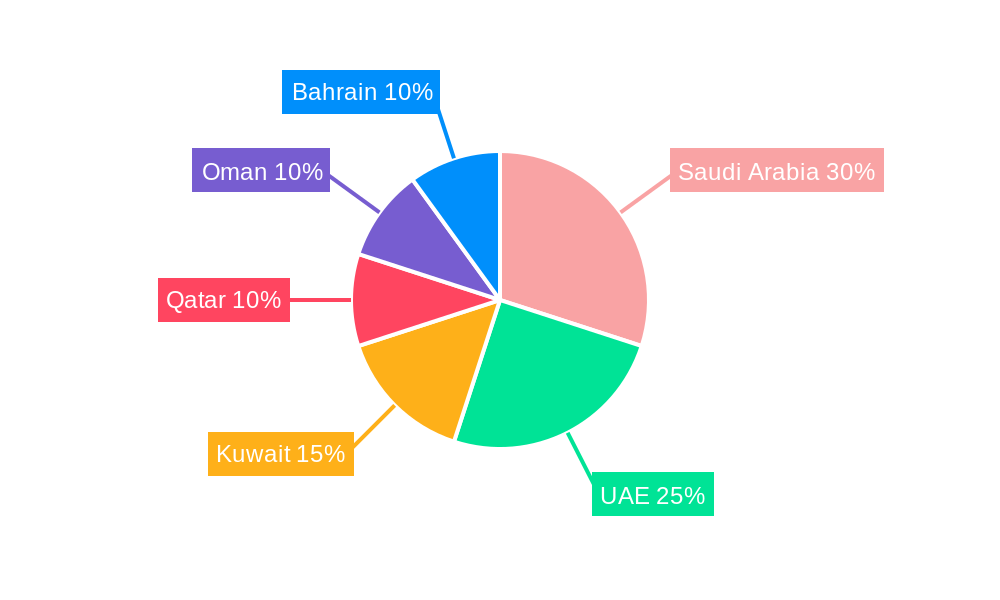

The Middle East and North Africa (MENA) gas hob market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across the region are increasing consumer spending on home appliances, with gas hobs being a significant component of kitchen upgrades. Furthermore, a burgeoning tourism and hospitality sector, particularly in countries like the UAE and Saudi Arabia, is driving demand for gas hobs in hotels, apartments, and luxury villas. The preference for gas cooking, often rooted in cultural traditions and perceived superior cooking control, contributes significantly to market growth. The market is segmented by type (built-in and free-standing) and application (hotel, apartment, luxury villa, and others), with built-in hobs gaining popularity due to their sleek aesthetics and space-saving design. Major players such as LG, Samsung, Hitachi, Haier, BSH, Bosch, Electrolux, Arcelik, Midea, and Panasonic are actively competing in this market, offering a wide range of features and price points to cater to diverse consumer needs. While potential restraints such as fluctuating gas prices and increasing competition from electric and induction hob options exist, the overall market outlook remains positive, driven by consistent economic growth and increasing urbanization across the MENA region.

The market is witnessing a clear shift towards higher-end, feature-rich gas hobs, reflecting the growing demand for premium appliances in the region. Manufacturers are focusing on innovation to enhance product offerings, including smart features, improved safety mechanisms, and energy-efficient designs. This trend is further propelled by the growing adoption of smart home technology in the MENA region. The market is geographically diverse, with varying growth rates across different countries based on economic conditions and consumer preferences. While detailed country-specific data is limited, Saudi Arabia and the UAE are likely to be the largest markets due to their relatively higher per capita incomes and robust infrastructure development. The competitive landscape is characterized by both international and regional players, leading to intense competition and continuous product improvement to capture market share. Strategic partnerships and expansions are likely to shape the competitive dynamics in the coming years, driving further innovation and wider product accessibility within the MENA gas hob market.

Gas Hobs Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Gas Hobs Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The historical period analyzed is 2019-2024. The market is segmented by type (Built-In Hobs, Free-Standing Hobs) and application (Hotel, Apartment, Luxury Villa, Others). Key players analyzed include LG, Samsung Electronics, Hitachi Ltd, Haier Electronics Group, BSH Home Appliances Group, Concord Home Appliance, Bosch, Electrolux AB, Arcelik A.Ş, Midea, and Panasonic Corporation. The report projects a xx Million market value by 2033, with a CAGR of xx% during the forecast period.

Gas Hobs Market Market Structure & Competitive Dynamics

The Gas Hobs Market presents a moderately consolidated structure, with several key players commanding significant market share. As of 2025, the market concentration ratio (CR4) is estimated at xx%, indicating a degree of market dominance by a few leading brands. Driving innovation within the sector are ongoing advancements in energy efficiency technologies, the integration of smart features, and the pursuit of superior design aesthetics. The market's dynamics are considerably influenced by regulatory frameworks governing energy consumption and safety standards, necessitating ongoing compliance and adaptation. Electric induction hobs and ceramic cooktops represent key product substitutes, creating a competitive landscape that demands continuous product improvement and differentiation. A notable shift in end-user preferences is observed, with growing demand for energy-efficient and technologically advanced gas hobs. The recent historical period (e.g., 2019-2024) has witnessed considerable M&A activity, with the total value of deals exceeding xx Million, reflecting strategic consolidation and expansion within the industry.

- Market Share (2025): LG holds an estimated xx% market share, followed by Samsung Electronics with xx%. [Add other significant players and their approximate market share if data is available. If not, remove this sentence or replace with "Detailed market share data for other key players is not publicly available at this time."]

- M&A Activity (2019-2024): Significant mergers and acquisitions aimed at expanding product portfolios and geographic reach were prevalent. Notable transactions include [Insert details of specific M&A activities with sources if available, otherwise replace with "Details of specific M&A activities are confidential or unavailable for public release." Consider adding a sentence about the overall impact of M&A activity on market structure].

Gas Hobs Market Industry Trends & Insights

The Gas Hobs Market is characterized by robust growth, fueled by several key factors: rising disposable incomes globally, rapid urbanization trends, and a corresponding surge in demand for modern kitchen appliances. Technological advancements, particularly in smart features and enhanced energy efficiency, are acting as significant catalysts for market expansion. Consumer preferences are evolving towards sleek and stylish designs, enhanced safety features for peace of mind, and user-friendly operation. The competitive landscape is shaped by intense product innovation, robust branding strategies, and strategic partnerships that expand market reach and capabilities. In developing economies, the market penetration rate of gas hobs remains comparatively low, representing a substantial untapped growth potential. Overall, the market is projected to grow at a compound annual growth rate (CAGR) of xx% between 2025 and 2033.

Dominant Markets & Segments in Gas Hobs Market

The dominant region for gas hobs is [Insert dominant region, e.g., North America/Europe], driven by high consumer spending power and established infrastructure. Within this region, [Insert dominant country] holds the largest market share.

By Type:

- Built-In Hobs: This segment is experiencing strong growth due to its integration with modern kitchen designs and increased demand for customized kitchen solutions. Key growth drivers include increasing preference for modular kitchens and rising adoption of built-in appliances in newly constructed homes and renovations.

- Free-Standing Hobs: This segment maintains a significant market share due to its affordability and compatibility with diverse kitchen styles. Factors influencing its demand include price-sensitivity of customers in developing countries and the preference for standalone units in smaller kitchens.

By Application:

- Hotels: High demand from the hospitality industry due to the large number of units required and preference for gas hobs in commercial kitchens.

- Apartments: High demand for gas hobs in apartments driven by the growing number of apartments under construction and rising consumer preference for convenient cooking solutions.

- Luxury Villas: Demand for premium gas hobs with advanced features and sophisticated designs in luxury homes.

Gas Hobs Market Product Innovations

Recent product innovations place a strong emphasis on enhanced safety mechanisms, improved energy efficiency to reduce running costs, and seamless smart connectivity. Gas hobs featuring integrated sensors for safety, automatic ignition systems for convenience, and Wi-Fi connectivity for smart home integration are gaining significant traction. Manufacturers are focusing on designs that not only enhance the aesthetics of modern kitchens but also deliver superior cooking performance and control. A key market trend is the development of multi-functional gas hobs offering precision and versatility in cooking tasks. [Add specifics about innovative features, e.g., specific sensor types, types of smart connectivity, etc., if possible].

Report Segmentation & Scope

The report segments the Gas Hobs Market by type into Built-In Hobs and Free-Standing Hobs. Built-In Hobs are projected to grow at a CAGR of xx% from 2025 to 2033, while Free-Standing Hobs are projected to grow at a CAGR of xx%. The market is further segmented by application into Hotel, Apartment, Luxury Villa, and Others. The Hotel segment is expected to dominate due to the volume of installations, while the Luxury Villa segment offers high-value opportunities for premium gas hobs. Each segment's growth is analysed considering competitive dynamics and projected market size.

Key Drivers of Gas Hobs Market Growth

Key growth drivers include increasing urbanization and rising disposable incomes leading to greater consumer spending on home appliances. Technological advancements resulting in energy-efficient and smart gas hobs enhance consumer appeal. Favorable government policies promoting energy efficiency and safety standards further stimulate market growth. Growing demand for modern and customized kitchen solutions boosts the demand for built-in hob models.

Challenges in the Gas Hobs Market Sector

Challenges include fluctuating raw material prices impacting manufacturing costs. Stringent safety and environmental regulations create compliance complexities. Intense competition among established players and emerging brands puts pressure on pricing strategies and margins. Supply chain disruptions can affect production and delivery timelines. The increasing popularity of induction cooktops presents a considerable competitive threat.

Leading Players in the Gas Hobs Market Market

- LG

- Samsung Electronics

- Hitachi Ltd

- Haier Electronics Group

- BSH Home Appliances Group

- Concord Home Appliance

- Bosch

- Electrolux AB

- Arcelik A.Ş

- Midea

- Panasonic Corporation

Key Developments in Gas Hobs Market Sector

- 2022: LG Bahrain launched the LG 5 Gas Burners Cooker LF98110SS (900 x 600 x 850 mm, 90-liter oven capacity). [Add a sentence or two about the significance of this launch].

- 2019: LG Electronics and LUMI United Technology collaborated on developing a comprehensive IoT solution for home appliances. [Elaborate on the impact of this collaboration on the market].

- [Add more key developments with dates and brief descriptions and their significance to the market. Include sources if possible.]

Strategic Gas Hobs Market Market Outlook

The Gas Hobs Market presents significant growth potential driven by ongoing technological advancements and evolving consumer preferences. Strategic opportunities lie in developing energy-efficient and smart gas hobs with enhanced safety features. Expanding into emerging markets with high growth potential and focusing on strategic partnerships to enhance market reach are crucial for long-term success. The market is poised for continued expansion, with opportunities for innovation and market penetration in both developed and developing economies.

Gas Hobs Market Segmentation

-

1. Type

- 1.1. Built-In Hobs

- 1.2. Free-Standing Hobs

-

2. Application

- 2.1. Hotel

- 2.2. Apartment

- 2.3. Luxury Villa

- 2.4. Others

Gas Hobs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gas Hobs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators

- 3.3. Market Restrains

- 3.3.1. Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues

- 3.4. Market Trends

- 3.4.1. Technological Advancement is Playing a Vital Role

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Built-In Hobs

- 5.1.2. Free-Standing Hobs

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Hotel

- 5.2.2. Apartment

- 5.2.3. Luxury Villa

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Built-In Hobs

- 6.1.2. Free-Standing Hobs

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Hotel

- 6.2.2. Apartment

- 6.2.3. Luxury Villa

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Built-In Hobs

- 7.1.2. Free-Standing Hobs

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Hotel

- 7.2.2. Apartment

- 7.2.3. Luxury Villa

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Built-In Hobs

- 8.1.2. Free-Standing Hobs

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Hotel

- 8.2.2. Apartment

- 8.2.3. Luxury Villa

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Built-In Hobs

- 9.1.2. Free-Standing Hobs

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Hotel

- 9.2.2. Apartment

- 9.2.3. Luxury Villa

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Built-In Hobs

- 10.1.2. Free-Standing Hobs

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Hotel

- 10.2.2. Apartment

- 10.2.3. Luxury Villa

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Bahrain Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Kuwait Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Oman Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Qatar Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Saudi Arabia Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. United Arab Emirates Gas Hobs Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 LG

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Samsung Electronics

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Hitachi Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Haier Electronics Group

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 BSH Home Appliances Group**List Not Exhaustive

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Concord Home applinace

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Bosch

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Electrolux AB

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Arcelik A S

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Midea

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Panasonic Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 LG

List of Figures

- Figure 1: Global Gas Hobs Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Bahrain Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Bahrain Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Kuwait Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Kuwait Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Oman Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Oman Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Qatar Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Qatar Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Saudi Arabia Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Saudi Arabia Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: United Arab Emirates Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 13: United Arab Emirates Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Gas Hobs Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Gas Hobs Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Gas Hobs Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Gas Hobs Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Gas Hobs Market Revenue (Million), by Type 2024 & 2032

- Figure 21: South America Gas Hobs Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Gas Hobs Market Revenue (Million), by Application 2024 & 2032

- Figure 23: South America Gas Hobs Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: South America Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Gas Hobs Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Europe Gas Hobs Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Europe Gas Hobs Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Europe Gas Hobs Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Middle East & Africa Gas Hobs Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Middle East & Africa Gas Hobs Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Middle East & Africa Gas Hobs Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Middle East & Africa Gas Hobs Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Middle East & Africa Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Middle East & Africa Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Gas Hobs Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Asia Pacific Gas Hobs Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Asia Pacific Gas Hobs Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Asia Pacific Gas Hobs Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Asia Pacific Gas Hobs Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Gas Hobs Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gas Hobs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gas Hobs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Gas Hobs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Gas Hobs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Gas Hobs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Gas Hobs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Canada Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Gas Hobs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 24: Global Gas Hobs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Brazil Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Argentina Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of South America Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Gas Hobs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Global Gas Hobs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Gas Hobs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Gas Hobs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 43: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Turkey Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Israel Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: North Africa Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East & Africa Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Gas Hobs Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Gas Hobs Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Gas Hobs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific Gas Hobs Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gas Hobs Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Gas Hobs Market?

Key companies in the market include LG, Samsung Electronics, Hitachi Ltd, Haier Electronics Group, BSH Home Appliances Group**List Not Exhaustive, Concord Home applinace, Bosch, Electrolux AB, Arcelik A S, Midea, Panasonic Corporation.

3. What are the main segments of the Gas Hobs Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Household Disposable Income; Rise in Sales of Washing Machines and Refrigerators.

6. What are the notable trends driving market growth?

Technological Advancement is Playing a Vital Role.

7. Are there any restraints impacting market growth?

Increase in Price of Major Appliances Post Covid; Supply Chain Disruptions in Market with Rising Geopolitical Issues.

8. Can you provide examples of recent developments in the market?

In 2022, LG Bahrain launched LG 5 Gas Burners Cooker LF98110SS, which is 900 x 600 x 850 mm in dimensions and free standing. Its oven capacity is 90 liters which are 5 gas hobs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gas Hobs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gas Hobs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gas Hobs Market?

To stay informed about further developments, trends, and reports in the Gas Hobs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence