Key Insights

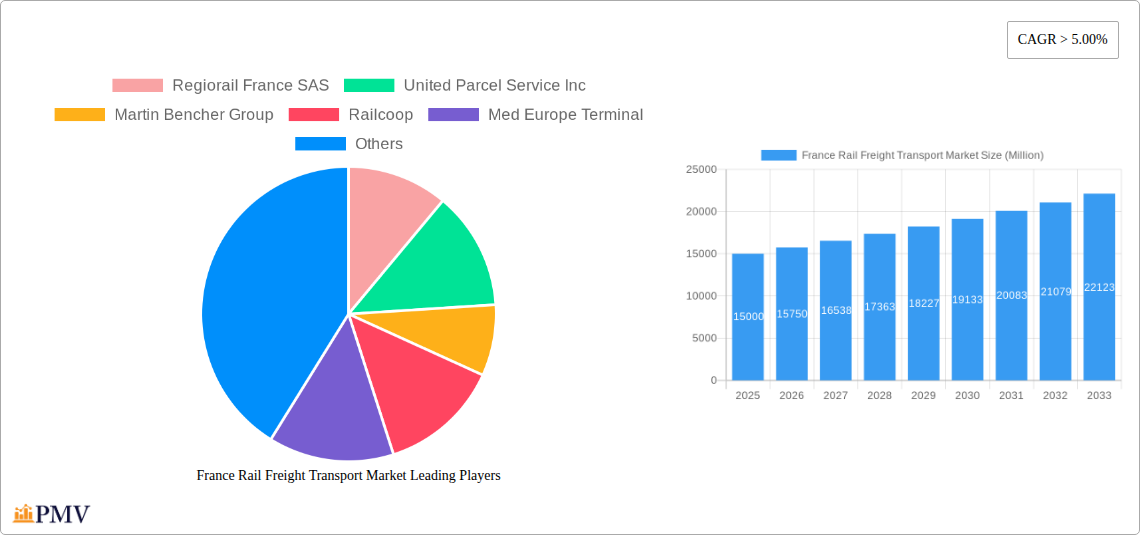

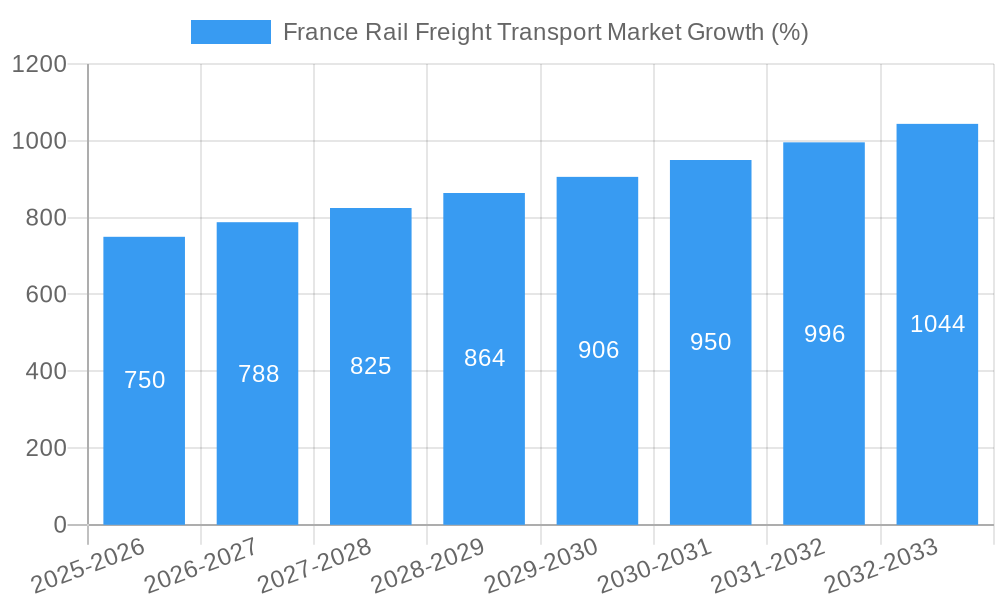

The France rail freight transport market, valued at approximately €15 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting sustainable transportation and reducing reliance on road freight are significantly boosting rail's appeal. Secondly, the ongoing expansion of the French railway network and improvements in infrastructure are enhancing efficiency and capacity. This improved infrastructure, coupled with technological advancements in rail technology, is leading to faster transit times and reduced operational costs. Furthermore, the rise of e-commerce and the need for efficient last-mile delivery solutions are driving demand for reliable and cost-effective rail freight services. The market is segmented by cargo type (containerized, non-containerized, liquid bulk) and service type (transportation, allied transportation services), with containerized intermodal transport representing the largest segment due to its efficiency and scalability. Key players such as SNCF Logistics, Deutsche Bahn AG, and regional operators like Regiorail France are actively shaping market dynamics through strategic investments and service expansion.

However, the market faces challenges. Fluctuations in fuel prices and increasing labor costs exert pressure on operational margins. Competition from other modes of transportation, particularly road freight, remains significant. Regulatory hurdles and potential infrastructure bottlenecks could also hinder growth. Despite these restraints, the long-term outlook for the French rail freight transport market remains positive, driven by the aforementioned growth drivers and increasing awareness of environmental sustainability within the logistics sector. The continued investment in infrastructure modernization and technological advancements, along with supportive government policies, will be crucial in realizing the market's full potential.

France Rail Freight Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France Rail Freight Transport Market, offering valuable insights for stakeholders across the industry. The study period covers 2019-2033, with 2025 as the base and estimated year. The report meticulously examines market dynamics, competitive landscapes, and future growth projections, empowering businesses to make informed strategic decisions. Key segments analyzed include By Cargo Type (Containerized (Intermodal), Non-containerized, Liquid Bulk) and Service Type (Transportation, Services Allied to Transportation). Leading players like SNCF Logistics, Deutsche Bahn AG (DB Group), and Regiorail France SAS are profiled, alongside emerging players such as Railcoop.

France Rail Freight Transport Market Market Structure & Competitive Dynamics

The French rail freight transport market exhibits a moderately concentrated structure, with a few major players holding significant market share. SNCF Logistics, a subsidiary of SNCF, maintains a dominant position, followed by other national and international operators like Deutsche Bahn AG (DB Group) and Regiorail France SAS. The market is influenced by robust regulatory frameworks established by the French government, aimed at promoting sustainable transportation and intermodal connectivity. Innovation within the sector is driven by the increasing adoption of digital technologies, including advanced logistics management systems and predictive analytics.

The market witnesses ongoing M&A activities, though deal values vary considerably depending on the size and strategic importance of the target company. Recent years have seen smaller players being acquired by larger firms to enhance operational efficiency and expand market reach. For example, (xx Million) worth of M&A deals were recorded in 2024. Several factors influence market concentration, including government policies favoring consolidation and the high capital investment required for infrastructure development. Product substitutes, primarily road transport, present stiff competition, particularly for shorter distances. End-user trends favor sustainable and efficient solutions, driving the demand for eco-friendly rail freight services.

- Market Concentration: Moderately concentrated, with SNCF Logistics holding a leading share.

- Innovation Ecosystem: Growing adoption of digital technologies and focus on sustainable solutions.

- Regulatory Framework: Robust regulations promoting intermodal transport and sustainability.

- Product Substitutes: Road transport poses significant competition, especially for shorter hauls.

- End-User Trends: Preference for eco-friendly and efficient rail freight services.

- M&A Activities: Ongoing consolidation with varying deal values (xx Million in 2024).

France Rail Freight Transport Market Industry Trends & Insights

The France Rail Freight Transport Market exhibits a positive growth trajectory, driven by several factors. The CAGR is projected at xx% during the forecast period (2025-2033), with market penetration steadily increasing. Growth is fueled by the government’s focus on decarbonization initiatives, promoting rail as a cleaner alternative to road transport. Technological disruptions, particularly the implementation of smart logistics and automation, improve efficiency and reduce operational costs. The increasing demand for e-commerce and the need for efficient supply chain solutions are also boosting market growth. Consumer preferences are shifting towards sustainability and reliability, further favoring rail freight. However, competition from road transport and infrastructure limitations remain challenges. The market is projected to reach xx Million by 2033.

Dominant Markets & Segments in France Rail Freight Transport Market

- Leading Region: Île-de-France (Paris region) due to high population density and industrial activity.

- Dominant Cargo Type: Containerized (Intermodal) freight dominates due to efficiency and standardization.

- Leading Service Type: Transportation services represent the largest segment, driven by high demand for freight movement.

Key Drivers for Dominant Segments:

- Containerized (Intermodal): Standardization, efficiency gains, and cost reductions compared to other cargo types.

- Île-de-France Region: High concentration of industries, consumption centers, and efficient rail infrastructure.

- Transportation Services: Core function of the rail freight industry, accommodating the bulk of freight demand.

Dominance Analysis:

The dominance of the Île-de-France region reflects its pivotal role as a major consumption and distribution hub within France. The high volume of goods requiring transport in and out of Paris and surrounding areas drives significant demand for rail freight services. The robust rail infrastructure in this region enhances the efficiency of operations. Containerized freight dominates owing to its scalability, standardization, and interoperability with other transport modes, facilitating efficient and cost-effective logistics. Transportation services form the bedrock of the industry.

France Rail Freight Transport Market Product Innovations

Recent innovations focus on improving efficiency, sustainability, and safety in rail freight operations. This includes the implementation of advanced digital technologies, such as IoT sensors for real-time tracking and predictive maintenance, as well as the adoption of hydrogen-powered locomotives for greener transportation. These innovations enhance operational efficiency, reduce environmental impact, and improve the overall competitiveness of rail freight compared to road transport. Market fit is high for such innovations, given the growing demand for sustainable and efficient logistics solutions.

Report Segmentation & Scope

By Cargo Type:

Containerized (Intermodal): This segment is projected to experience significant growth due to its efficiency and cost-effectiveness, with a market size of xx Million in 2025 and xx Million by 2033. Competitive dynamics are shaped by the need for efficient handling and intermodal transfers.

Non-containerized: This segment comprises bulk goods and other non-standardized cargo. Growth is expected to be moderate, reaching xx Million in 2025 and xx Million in 2033. Competition is fragmented.

Liquid Bulk: This segment involves transportation of liquid goods like chemicals and petroleum products. Growth is expected to be relatively stable, reaching xx Million in 2025 and xx Million in 2033. Safety and regulatory compliance are critical aspects of this segment.

By Service Type:

Transportation: This segment dominates the market, representing the core freight transportation activity. Market size is projected to be xx Million in 2025 and xx Million in 2033, with strong competition between major players.

Services Allied to Transportation: This includes warehousing, logistics management, and other related services. Growth is expected to be in line with overall market expansion, with market size reaching xx Million in 2025 and xx Million in 2033. This segment shows potential for specialization and niche service offerings.

Key Drivers of France Rail Freight Transport Market Growth

Several factors drive the growth of the French rail freight transport market. Government initiatives promoting sustainable transportation and reducing carbon emissions significantly influence market expansion. The increasing demand for efficient and reliable supply chain solutions, especially in the e-commerce sector, provides a significant boost. Furthermore, continuous technological advancements, such as the development of autonomous vehicles and improved tracking systems, improve efficiency and operational capabilities. Improved infrastructure development also contributes positively to market growth.

Challenges in the France Rail Freight Transport Market Sector

The rail freight transport market in France faces several challenges. High infrastructure investment costs and maintenance requirements represent significant hurdles. Competition from road transport, particularly for shorter distances, also impacts market growth. Stringent environmental regulations, while promoting sustainability, necessitate costly upgrades and technology investments. Moreover, potential labor shortages and skills gaps could hamper operational efficiency. These factors collectively impact the profitability and growth potential of companies within this sector.

Leading Players in the France Rail Freight Transport Market Market

- Regiorail France SAS

- United Parcel Service Inc

- Martin Bencher Group

- Railcoop

- Med Europe Terminal

- Deutsche Bahn AG (DB Group)

- Ace-Trans Transportation and Logistics

- NVO Consolidation SAS

- Touax Rail Ltd

- Europorte France

- SNCF Logistics

- Atir Rail

Key Developments in France Rail Freight Transport Market Sector

- November 2022: VIIA launched a new rail freight service connecting Sete to Valenton, boosting French and Spanish traffic and DFDS Ro-Ro cargo from Turkey.

- November 2022: Nestlé announced hydrogen-powered rail transport for Vittel water from 2025, showcasing green technology adoption.

Strategic France Rail Freight Transport Market Market Outlook

The France Rail Freight Transport Market presents substantial long-term growth potential. Government support for sustainable transportation, coupled with technological advancements, will drive market expansion. Strategic opportunities lie in investing in green technologies, optimizing logistics operations, and focusing on niche segments. Companies that embrace innovation and adapt to evolving customer needs will be well-positioned to capitalize on the market’s future growth.

France Rail Freight Transport Market Segmentation

-

1. Cargo Type

- 1.1. Containerized (Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Service Type

- 2.1. Transportation

- 2.2. Services Allied to Transportation

France Rail Freight Transport Market Segmentation By Geography

- 1. France

France Rail Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.2.1.1 technology innovation in temperature controlled packaging4.; Cross Border collaborations and initiative to enhance healthcare infrastructure

- 3.3. Market Restrains

- 3.3.1. 4.; Supply chain distruption and transportation bottlenecks can hinder timely vaccine distribution

- 3.4. Market Trends

- 3.4.1. High fuel prices pushing transporters shift towards rail freight driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Rail Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 5.1.1. Containerized (Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Transportation

- 5.2.2. Services Allied to Transportation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Regiorail France SAS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Martin Bencher Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Railcoop

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Med Europe Terminal

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Deutsche Bahn AG (DB Group)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ace-Trans Transportation and Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NVO Consolidation SAS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Touax Rail Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Europorte France

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SNCF Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Atir Rail

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Regiorail France SAS

List of Figures

- Figure 1: France Rail Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Rail Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: France Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 3: France Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: France Rail Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: France Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: France Rail Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 7: France Rail Freight Transport Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 8: France Rail Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Rail Freight Transport Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the France Rail Freight Transport Market?

Key companies in the market include Regiorail France SAS, United Parcel Service Inc, Martin Bencher Group, Railcoop, Med Europe Terminal, Deutsche Bahn AG (DB Group), Ace-Trans Transportation and Logistics, NVO Consolidation SAS, Touax Rail Ltd, Europorte France, SNCF Logistics, Atir Rail.

3. What are the main segments of the France Rail Freight Transport Market?

The market segments include Cargo Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.2.1.1 technology innovation in temperature controlled packaging4.; Cross Border collaborations and initiative to enhance healthcare infrastructure.

6. What are the notable trends driving market growth?

High fuel prices pushing transporters shift towards rail freight driving the market.

7. Are there any restraints impacting market growth?

4.; Supply chain distruption and transportation bottlenecks can hinder timely vaccine distribution.

8. Can you provide examples of recent developments in the market?

November 2022: VIIA, the French transportation corporation, launched a new rail freight service connecting the southern French port of Sete with the Valenton terminal, which is 15 kilometres from Paris. The commerce of DFDS Ro-Ro cargo leaving the Yalova terminal in northwest Turkey by sea is anticipated to increase as a result of this new connection. Given that Paris is a significant consumption hub, the new connection will boost both the regional French and Spanish traffic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Rail Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Rail Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Rail Freight Transport Market?

To stay informed about further developments, trends, and reports in the France Rail Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence