Key Insights

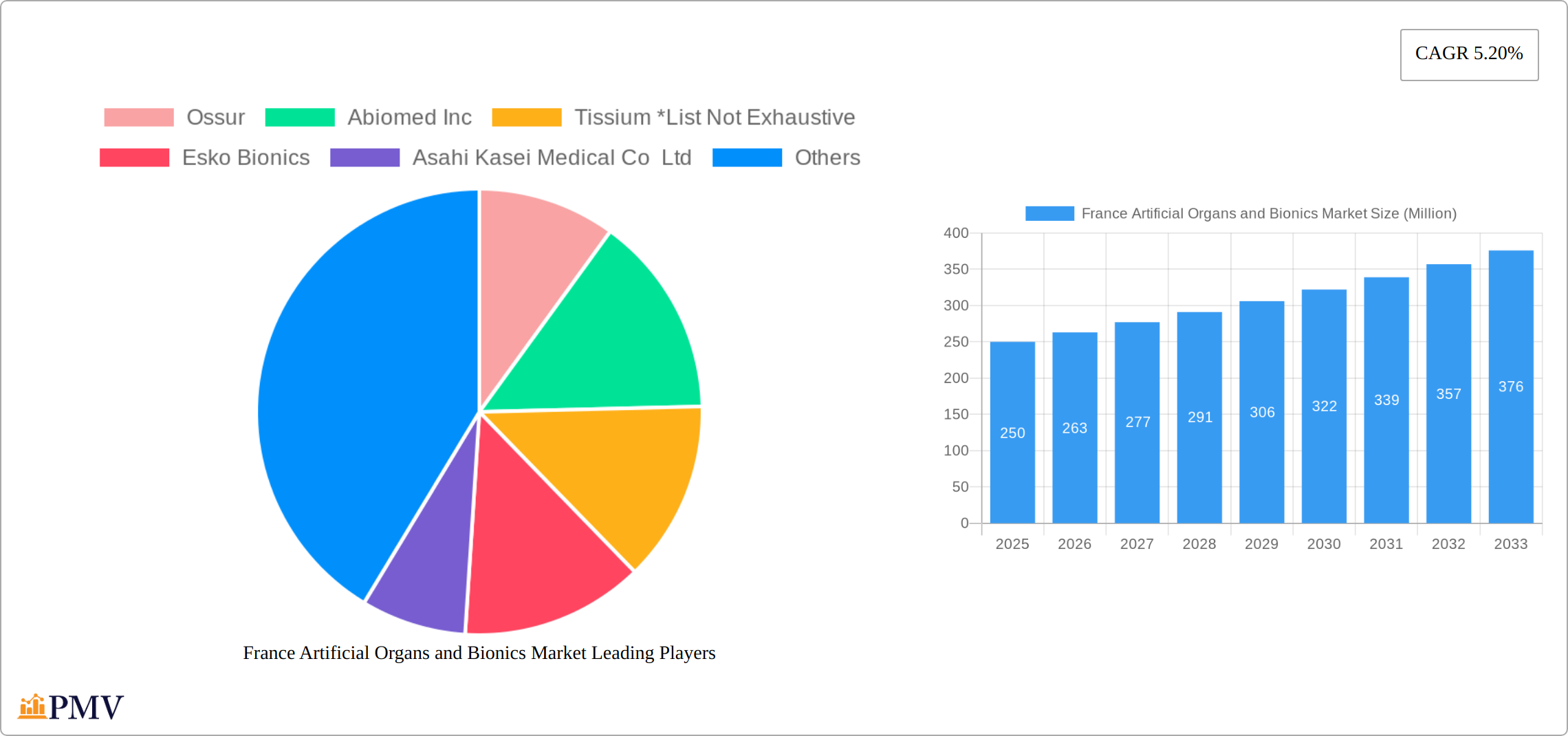

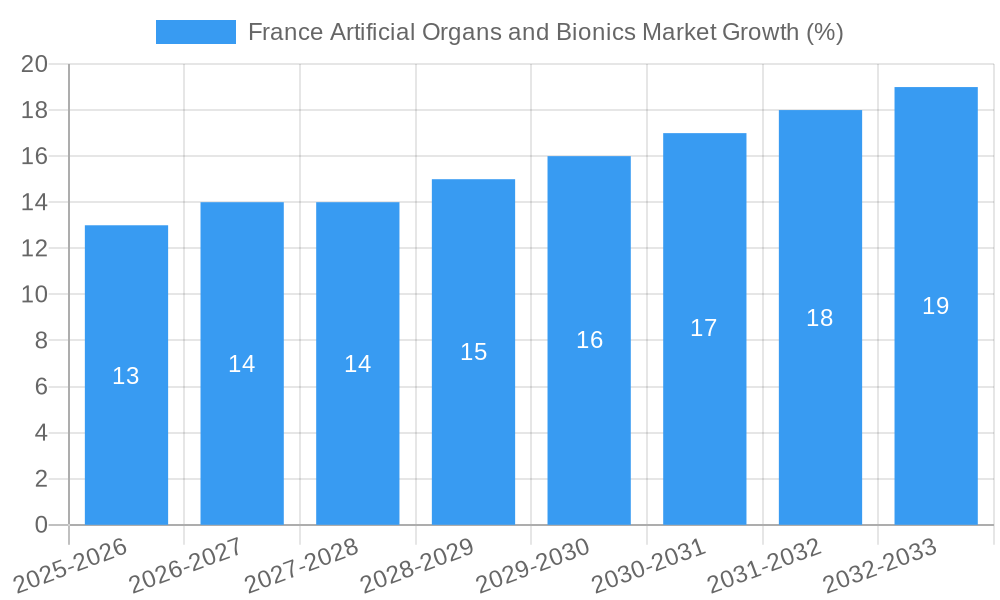

The French artificial organs and bionics market is poised for significant growth, driven by an aging population, increasing prevalence of chronic diseases, and advancements in medical technology. The market, valued at approximately €[Estimate based on market size XX and currency conversion; if XX is in USD, use current exchange rate] million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This growth is fueled by several key factors. Technological advancements leading to improved functionality, durability, and biocompatibility of artificial organs and bionic devices are paramount. Furthermore, rising government initiatives to support healthcare infrastructure and increasing healthcare expenditure within France are contributing to market expansion. The increasing acceptance of minimally invasive surgical procedures and a growing preference for advanced prosthetic solutions are also bolstering market growth. Within the artificial organs segment, artificial hearts, kidneys, and lungs are expected to dominate, driven by a high incidence of heart failure, kidney disease, and respiratory illnesses. The bionics segment, encompassing exoskeletons, bionic limbs, and vision bionics, is witnessing rapid growth, fueled by technological breakthroughs and increasing demand for improved quality of life for patients with disabilities. While challenges remain, such as high costs associated with these advanced medical technologies and potential regulatory hurdles, the overall market outlook for artificial organs and bionics in France remains strongly positive over the forecast period.

The competitive landscape in France's artificial organs and bionics market is marked by the presence of both established multinational corporations and innovative smaller companies. Key players like Ossur, Abiomed, Medtronic, and Boston Scientific are leveraging their extensive research and development capabilities to introduce cutting-edge products. The market is also characterized by strategic partnerships and collaborations aimed at accelerating innovation and market penetration. Companies are focusing on developing personalized and customized solutions to address individual patient needs. The increasing emphasis on data-driven healthcare and remote patient monitoring is also transforming the market, improving patient outcomes and creating new avenues for growth. This competitive and innovative environment contributes significantly to the overall market’s positive outlook.

France Artificial Organs and Bionics Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the burgeoning France artificial organs and bionics market, offering invaluable insights for stakeholders, investors, and industry professionals. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges, projecting the market's trajectory from 2025 to 2033.

France Artificial Organs and Bionics Market Market Structure & Competitive Dynamics

The French artificial organs and bionics market exhibits a moderately concentrated structure, with several multinational corporations and specialized companies vying for market share. Key players include Ossur, Abiomed Inc, Tissium, Esko Bionics, Asahi Kasei Medical Co Ltd, CARMAT, Medtronic PLC, LivaNova PLC, Getinge AB, and Boston Scientific Corporation. However, the market also accommodates smaller, specialized firms focusing on niche applications.

Market concentration is influenced by factors such as regulatory approvals, intellectual property rights, and technological advancements. The innovation ecosystem involves collaborations between research institutions, medical device manufacturers, and healthcare providers. The regulatory landscape, governed by the Agence nationale de sécurité du médicament et des produits de santé (ANSM), plays a crucial role in product approvals and market access. The market faces competitive pressures from substitute therapies and treatments, including traditional surgical procedures and pharmaceutical interventions. End-user trends, driven by an aging population and increasing prevalence of chronic diseases, favor the adoption of advanced artificial organs and bionics. M&A activities within the sector remain relatively frequent, with deal values averaging xx Million in recent years. For instance, in March 2021, Carmat SA completed a capital increase of USD 66.4 Million. Further analysis reveals that market share is distributed as follows: Medtronic holds approximately xx%, while Ossur and Abiomed share xx% collectively. Other players account for the remaining xx%.

France Artificial Organs and Bionics Market Industry Trends & Insights

The France artificial organs and bionics market is poised for substantial growth, driven by several key factors. Technological advancements, such as the development of biocompatible materials and miniaturized devices, are enhancing product functionality and safety. The increasing prevalence of chronic diseases, including cardiovascular ailments, renal failure, and neurological disorders, fuels the demand for artificial organs and bionics. The aging population in France further exacerbates this need. Consumer preferences are shifting towards minimally invasive procedures and improved quality of life, favoring the adoption of advanced technologies. Government initiatives aimed at promoting medical innovation and improving healthcare access also contribute to market growth.

Competitive dynamics are characterized by ongoing product innovation, strategic partnerships, and investments in research and development. The market displays a positive Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), exceeding the global average of xx%. Market penetration rates are projected to increase significantly, driven by enhanced device affordability and improved reimbursement policies. The market continues to mature, with technological disruptions leading to increased competition and innovation. The segment exhibiting the highest growth is expected to be cardiac bionics, fueled by increased prevalence of heart failure and growing investments in R&D of advanced cardiac assistance devices.

Dominant Markets & Segments in France Artificial Organs and Bionics Market

Within the France artificial organs and bionics market, several segments demonstrate significant dominance.

Artificial Organs: The artificial heart segment leads in terms of value and growth, driven by a rising incidence of heart failure. Key drivers include technological advancements in artificial heart design and increasing healthcare expenditure.

Bionics: The exoskeleton segment is experiencing rapid growth, particularly propelled by expanding applications in rehabilitation and assistive technologies. Government initiatives and increased investments are further driving market dominance.

Regional Dominance: The Île-de-France region, encompassing Paris, holds the largest market share due to a high concentration of specialized healthcare facilities, research institutions, and medical device manufacturers. The region benefits from robust healthcare infrastructure and favorable government policies.

France Artificial Organs and Bionics Market Product Innovations

Recent product innovations encompass the development of biocompatible materials, improved sensor technology, and enhanced control systems. These improvements result in more effective, durable, and user-friendly devices. For instance, advancements in artificial heart design focus on minimizing thrombogenicity and enhancing longevity. In bionics, the integration of advanced sensors and AI-driven control algorithms improves functional capabilities. These innovations are driving market expansion and improved patient outcomes.

Report Segmentation & Scope

This report segments the France artificial organs and bionics market across various categories:

Artificial Organs: Artificial Heart (projected market size xx Million in 2033, with xx% CAGR), Artificial Kidney (xx Million, xx% CAGR), Artificial Liver (xx Million, xx% CAGR), Artificial Pancreas (xx Million, xx% CAGR), Artificial Lungs (xx Million, xx% CAGR), and Others (xx Million, xx% CAGR). Each segment’s competitive dynamics vary, with some characterized by high concentration and others by more fragmented competition.

Bionics: Ear Bionics (xx Million, xx% CAGR), Vision Bionics (xx Million, xx% CAGR), Exoskeletons (xx Million, xx% CAGR), Bionic Limbs (xx Million, xx% CAGR), Brain Bionics (xx Million, xx% CAGR), Cardiac Bionics (xx Million, xx% CAGR), and Others (xx Million, xx% CAGR). Growth is primarily fueled by technological advancements and increasing adoption rates in various therapeutic applications.

Key Drivers of France Artificial Organs and Bionics Market Growth

Several factors contribute to the market's growth: a rising geriatric population requiring advanced medical interventions, increasing prevalence of chronic diseases, technological advancements leading to safer and more effective devices, substantial investments in research and development, supportive regulatory frameworks promoting innovation, and favorable reimbursement policies. These elements collectively accelerate market expansion.

Challenges in the France Artificial Organs and Bionics Market Sector

The French artificial organs and bionics market faces significant challenges, including stringent regulatory requirements that can delay product launches, high production costs limiting device affordability, potential supply chain disruptions impacting availability, and intense competition from both established players and emerging companies. These factors could constrain overall market growth to a degree.

Leading Players in the France Artificial Organs and Bionics Market Market

- Ossur

- Abiomed Inc

- Tissium

- Esko Bionics

- Asahi Kasei Medical Co Ltd

- CARMAT

- Medtronic PLC

- LivaNova PLC

- Getinge AB

- Boston Scientific Corporation

Key Developments in France Artificial Organs and Bionics Market Sector

- March 2021: Carmat SA completed a capital increase of USD 66.4 Million to boost the development of its total artificial heart in Europe. This significantly impacted the market by accelerating the development of a key product.

- May 2022: A successful kidney re-transplantation at AP-HP Saint-Louis and Lariboisière Hospitals showcased advancements in transplantation techniques, boosting confidence in the field and indirectly influencing market sentiment.

Strategic France Artificial Organs and Bionics Market Market Outlook

The France artificial organs and bionics market presents substantial future growth potential. Continued technological advancements, coupled with an aging population and rising prevalence of chronic illnesses, will drive demand. Strategic opportunities lie in developing innovative products, fostering collaborations, and navigating regulatory complexities. Focusing on cost-effectiveness and improved patient outcomes will be crucial for market leadership.

France Artificial Organs and Bionics Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Vision Bionics

- 1.2.2. Ear Bionics

- 1.2.3. Orthopedic Bionics

- 1.2.4. Cardiac Bionics

-

1.1. Artificial Organ

France Artificial Organs and Bionics Market Segmentation By Geography

- 1. France

France Artificial Organs and Bionics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Incidence of Road Accidents; Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures

- 3.4. Market Trends

- 3.4.1. Artificial Kidney Segment is Expected to Show Better Growth in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Artificial Organs and Bionics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Vision Bionics

- 5.1.2.2. Ear Bionics

- 5.1.2.3. Orthopedic Bionics

- 5.1.2.4. Cardiac Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ossur

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abiomed Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tissium *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esko Bionics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asahi Kasei Medical Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CARMAT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LivaNova PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Getinge AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Boston Scientific Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ossur

List of Figures

- Figure 1: France Artificial Organs and Bionics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Artificial Organs and Bionics Market Share (%) by Company 2024

List of Tables

- Table 1: France Artificial Organs and Bionics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Artificial Organs and Bionics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: France Artificial Organs and Bionics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: France Artificial Organs and Bionics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: France Artificial Organs and Bionics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: France Artificial Organs and Bionics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Artificial Organs and Bionics Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the France Artificial Organs and Bionics Market?

Key companies in the market include Ossur, Abiomed Inc, Tissium *List Not Exhaustive, Esko Bionics, Asahi Kasei Medical Co Ltd, CARMAT, Medtronic PLC, LivaNova PLC, Getinge AB, Boston Scientific Corporation.

3. What are the main segments of the France Artificial Organs and Bionics Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Incidence of Road Accidents; Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics.

6. What are the notable trends driving market growth?

Artificial Kidney Segment is Expected to Show Better Growth in the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Procedures.

8. Can you provide examples of recent developments in the market?

May 2022: For the first time in history, the teams of the removal/transplantation departments of the AP-HP Saint-Louis and Lariboisière Hospitals in France carried out a delicate operation in which a re-transplant of a kidney graft that was transplanted 10 years earlier was done.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Artificial Organs and Bionics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Artificial Organs and Bionics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Artificial Organs and Bionics Market?

To stay informed about further developments, trends, and reports in the France Artificial Organs and Bionics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence