Key Insights

The food grade tank trucking market, valued at $5.41 billion in 2025, is projected to experience robust growth, driven by increasing demand for processed food and beverages globally. A Compound Annual Growth Rate (CAGR) of 5.88% from 2025 to 2033 indicates a significant expansion in market size over the forecast period. This growth is fueled by several key factors, including the rising preference for convenience foods, expansion of the food processing industry, and stringent regulations requiring specialized transportation for food-grade materials. The need for maintaining the integrity and safety of food products throughout the supply chain necessitates the use of temperature-controlled and sanitized tank trucks, further driving market demand. Key players like Hegelmann Group, C.H. Robinson, DHL, and others are capitalizing on these trends, investing in advanced logistics solutions and expanding their fleets to meet the growing demand. Competition is expected to remain intense, with companies focusing on efficiency improvements, technological integration, and strategic partnerships to maintain a competitive edge. While the market faces some restraints such as fluctuating fuel prices and driver shortages, the overall positive trajectory is anticipated to continue throughout the forecast period.

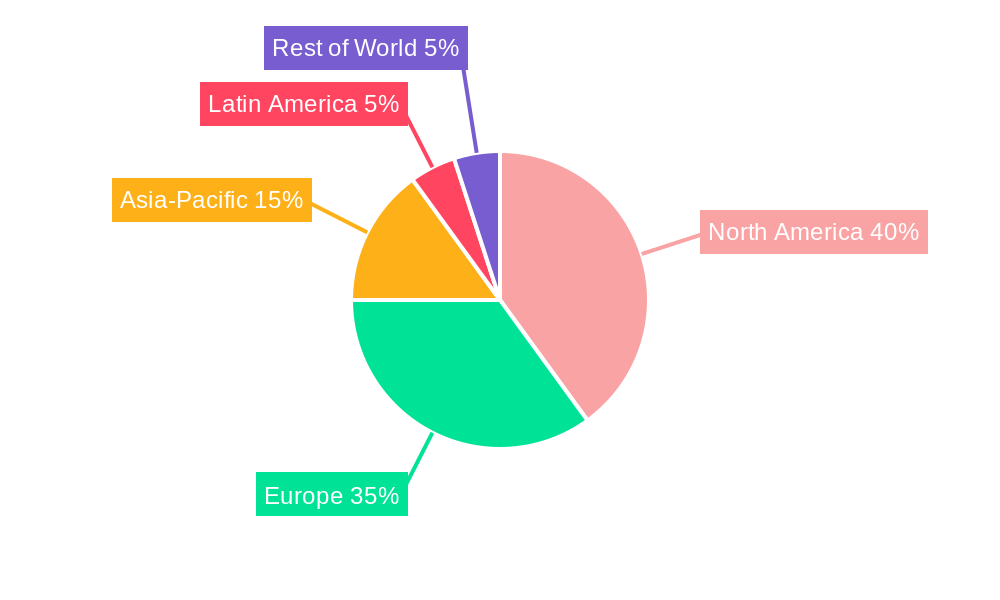

The geographical distribution of the market is likely skewed towards regions with significant food processing and consumption, such as North America and Europe. However, emerging economies in Asia-Pacific and Latin America are projected to experience faster growth rates due to rising disposable incomes and increasing urbanization. Segmentation within the market likely exists based on vehicle type (refrigerated vs. non-refrigerated), transported goods (dairy, beverages, oils, etc.), and transportation distance. Further analysis of individual segments could reveal specific growth drivers and opportunities for businesses within the food grade tank trucking industry. The continued expansion of e-commerce and the demand for home delivery of fresh and processed foods will contribute to the long-term sustainability and growth of the food grade tank trucking market.

Food Grade Tank Trucking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Food Grade Tank Trucking Market, covering market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The report utilizes data from the historical period (2019-2024), with 2025 serving as the base and estimated year, and forecasts extending to 2033. The analysis incorporates insights into market segmentation, leading players, and significant industry developments, providing actionable intelligence for businesses operating within this dynamic sector. The total market size is projected to reach xx Million by 2033.

Food Grade Tank Trucking Market Market Structure & Competitive Dynamics

The Food Grade Tank Trucking market exhibits a moderately concentrated structure, with several large players holding significant market share. However, a considerable number of smaller, regional operators also contribute significantly to the overall market volume. Key players like Hegelmann Group, C H Robinson, DHL, Odyssey Logistics, SHAL (Sea Hawk Lines), Kenan Advantage Group Inc, Bulk Connection, Trimac Transportation Services, Heniff Transportation Systems LLC, and Quality Carriers, along with 73 other companies, compete intensely, primarily based on pricing, service quality, and geographic reach. The market is characterized by a dynamic innovation ecosystem, with ongoing investments in technologies aimed at improving efficiency, safety, and tracking capabilities. Stringent regulatory frameworks governing food safety and transportation standards influence market operations, impacting operational costs and competitive dynamics. Product substitutes, while limited, include alternative transportation modes such as rail and pipelines for specific product types and distances. End-user trends, particularly towards increased demand for specialized transportation solutions for sensitive food products, drive market growth.

Mergers and acquisitions (M&A) activity is a significant factor shaping the market structure. Recent deals, such as TFI International's acquisition of Entreposage Marco and Trimac Transportation's acquisition of AIP Logistics (detailed further in the report), significantly alter the competitive landscape. These transactions highlight the strategic importance of consolidation and expansion within the food-grade tank trucking sector. The average M&A deal value in the past five years has been approximately xx Million, indicating a significant investment in market consolidation and expansion. Market share distribution among the top 10 players is estimated at approximately xx%, with the remaining share distributed across numerous smaller companies.

Food Grade Tank Trucking Market Industry Trends & Insights

The Food Grade Tank Trucking market is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected to be xx%. This growth is fueled by rising demand for processed and packaged food products globally, leading to increased transportation needs for food ingredients and finished products. Technological advancements, such as the adoption of telematics and advanced tracking systems, are improving operational efficiency and enhancing safety standards, further boosting market expansion. Consumer preferences for higher-quality, sustainably produced food are influencing transportation choices, leading to increased demand for specialized food-grade transportation services that adhere to strict hygiene standards. Competitive dynamics remain intense, with companies focusing on differentiating their services through technological innovation, efficient logistics networks, and superior customer service to gain market share. Market penetration of temperature-controlled transportation solutions is increasing at a CAGR of xx%, indicating a growing preference for specialized food-grade transport services.

Dominant Markets & Segments in Food Grade Tank Trucking Market

The North American region currently dominates the food-grade tank trucking market, primarily driven by the large food processing industry and well-established transportation infrastructure. Within North America, the United States holds the largest market share.

- Key Drivers in North America:

- Robust food processing industry

- Extensive highway network

- Favorable regulatory environment (although subject to change)

- High disposable incomes driving consumption

The dominance of North America is attributed to a combination of factors: the highly developed food processing sector, extensive highway networks facilitating efficient transportation, and a relatively favorable regulatory environment. However, other regions such as Europe and Asia-Pacific are exhibiting strong growth potential due to increasing food consumption and infrastructure development. The market is segmented by transportation mode (e.g., over-the-road, intermodal), cargo type (e.g., edible oils, liquid sugars), and geographic region. Each segment displays unique growth trajectories and competitive dynamics, influenced by factors specific to each area.

Food Grade Tank Trucking Market Product Innovations

Recent product innovations in the food-grade tank trucking market are primarily focused on enhancing efficiency, safety, and hygiene. This includes the adoption of telematics for real-time tracking and monitoring, advanced cleaning and sanitation technologies to prevent cross-contamination, and specialized tank designs for transporting specific food products under optimal conditions. These advancements improve operational efficiency, reduce the risk of product spoilage, and enhance compliance with stringent food safety regulations, providing significant competitive advantages for companies that implement them. Furthermore, the integration of data analytics and predictive maintenance strategies is gaining traction, optimizing fleet management and minimizing downtime.

Report Segmentation & Scope

This report segments the Food Grade Tank Trucking market based on several key parameters:

By Transportation Mode: Over-the-road, Intermodal, Rail, other. Each mode presents unique growth opportunities and challenges based on factors such as cost, speed, and capacity limitations.

By Cargo Type: Edible oils, liquid sugars, dairy products, other food ingredients. The varying characteristics of food products dictate specific transportation requirements and influence market segmentation.

By Region: North America, Europe, Asia-Pacific, etc. The report analyzes regional growth patterns, focusing on key market drivers and constraints within each region.

Each segment's market size, growth projections, and competitive dynamics are analyzed in detail, providing insights into the current and future market landscape.

Key Drivers of Food Grade Tank Trucking Market Growth

Several factors are driving the growth of the food-grade tank trucking market. Increased global demand for processed foods directly translates to higher transportation needs. Technological advancements, such as GPS tracking and advanced tank cleaning systems, enhance efficiency and safety, optimizing operations. Furthermore, government regulations enforcing stricter food safety standards necessitate the use of specialized, food-grade transportation solutions, further stimulating market growth. The expanding e-commerce sector and the shift towards home delivery of food products are also contributing to increased demand for efficient and reliable transportation services.

Challenges in the Food Grade Tank Trucking Market Sector

The food-grade tank trucking market faces various challenges. Fluctuating fuel prices significantly impact operational costs, squeezing profit margins. Stringent regulatory compliance requirements for food safety and driver hours necessitate substantial investments in training and technology. Driver shortages, a persistent issue in the trucking industry, limit operational capacity and increase transportation costs. Finally, intense competition among numerous players necessitates continuous innovation and operational efficiency improvements to maintain profitability. These factors collectively represent significant headwinds for companies operating in this sector; for example, the driver shortage is estimated to increase transportation costs by approximately xx Million annually.

Leading Players in the Food Grade Tank Trucking Market Market

- Hegelmann Group

- C H Robinson

- DHL

- Odyssey Logistics

- SHAL (Sea Hawk Lines)

- Kenan Advantage Group Inc

- Bulk Connection

- Trimac Transportation Services

- Heniff Transportation Systems LLC

- Quality Carriers

- 73 Other Companies

Key Developments in Food Grade Tank Trucking Market Sector

June 2024: TFI International's acquisition of Entreposage Marco expands its reach in the Canadian food-grade tank hauling market.

April 2023: Trimac Transportation's acquisition of AIP Logistics strengthens its position in bulk transportation and warehousing, including food-grade storage.

These acquisitions highlight a trend towards consolidation within the industry, driven by the need to increase scale and enhance service offerings.

Strategic Food Grade Tank Trucking Market Market Outlook

The Food Grade Tank Trucking market presents significant growth potential driven by increasing global food consumption and the rising demand for specialized transportation services. Strategic opportunities lie in investing in technological advancements, enhancing operational efficiency, and expanding into high-growth markets. Companies focusing on sustainable practices and meeting stricter regulatory requirements will be well-positioned to capitalize on future market expansion. The focus on developing robust logistics networks, ensuring driver retention, and implementing innovative technologies will be critical for success in the years to come.

Food Grade Tank Trucking Market Segmentation

-

1. Food Item

- 1.1. Oil

- 1.2. Dairy

- 1.3. Juice and Beverage

- 1.4. Other Food Items

Food Grade Tank Trucking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. France

- 2.2. Italy

- 2.3. Spain

- 2.4. Netherlands

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Russia

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Food Grade Tank Trucking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Food Safety and Quality; Expansion of the Food and Beverage Industry

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Food Safety and Quality; Expansion of the Food and Beverage Industry

- 3.4. Market Trends

- 3.4.1. Global Cow Milk Consumption and Production Propel Food Grade Tank Trucking Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Grade Tank Trucking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Food Item

- 5.1.1. Oil

- 5.1.2. Dairy

- 5.1.3. Juice and Beverage

- 5.1.4. Other Food Items

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Food Item

- 6. North America Food Grade Tank Trucking Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Food Item

- 6.1.1. Oil

- 6.1.2. Dairy

- 6.1.3. Juice and Beverage

- 6.1.4. Other Food Items

- 6.1. Market Analysis, Insights and Forecast - by Food Item

- 7. Europe Food Grade Tank Trucking Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Food Item

- 7.1.1. Oil

- 7.1.2. Dairy

- 7.1.3. Juice and Beverage

- 7.1.4. Other Food Items

- 7.1. Market Analysis, Insights and Forecast - by Food Item

- 8. Asia Pacific Food Grade Tank Trucking Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Food Item

- 8.1.1. Oil

- 8.1.2. Dairy

- 8.1.3. Juice and Beverage

- 8.1.4. Other Food Items

- 8.1. Market Analysis, Insights and Forecast - by Food Item

- 9. Middle East and Africa Food Grade Tank Trucking Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Food Item

- 9.1.1. Oil

- 9.1.2. Dairy

- 9.1.3. Juice and Beverage

- 9.1.4. Other Food Items

- 9.1. Market Analysis, Insights and Forecast - by Food Item

- 10. South America Food Grade Tank Trucking Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Food Item

- 10.1.1. Oil

- 10.1.2. Dairy

- 10.1.3. Juice and Beverage

- 10.1.4. Other Food Items

- 10.1. Market Analysis, Insights and Forecast - by Food Item

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hegelmann Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 C H Robinson

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Odyssey Logistics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHAL (Sea Hawk Lines)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kenan Advantage Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bulk Connection

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Trimac Transportation Services

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Heniff Transportation Systems LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Quality Carriers**List Not Exhaustive 7 3 Other Companie

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hegelmann Group

List of Figures

- Figure 1: Global Food Grade Tank Trucking Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Food Grade Tank Trucking Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Food Grade Tank Trucking Market Revenue (Million), by Food Item 2024 & 2032

- Figure 4: North America Food Grade Tank Trucking Market Volume (Billion), by Food Item 2024 & 2032

- Figure 5: North America Food Grade Tank Trucking Market Revenue Share (%), by Food Item 2024 & 2032

- Figure 6: North America Food Grade Tank Trucking Market Volume Share (%), by Food Item 2024 & 2032

- Figure 7: North America Food Grade Tank Trucking Market Revenue (Million), by Country 2024 & 2032

- Figure 8: North America Food Grade Tank Trucking Market Volume (Billion), by Country 2024 & 2032

- Figure 9: North America Food Grade Tank Trucking Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Food Grade Tank Trucking Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Food Grade Tank Trucking Market Revenue (Million), by Food Item 2024 & 2032

- Figure 12: Europe Food Grade Tank Trucking Market Volume (Billion), by Food Item 2024 & 2032

- Figure 13: Europe Food Grade Tank Trucking Market Revenue Share (%), by Food Item 2024 & 2032

- Figure 14: Europe Food Grade Tank Trucking Market Volume Share (%), by Food Item 2024 & 2032

- Figure 15: Europe Food Grade Tank Trucking Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Europe Food Grade Tank Trucking Market Volume (Billion), by Country 2024 & 2032

- Figure 17: Europe Food Grade Tank Trucking Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Food Grade Tank Trucking Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Asia Pacific Food Grade Tank Trucking Market Revenue (Million), by Food Item 2024 & 2032

- Figure 20: Asia Pacific Food Grade Tank Trucking Market Volume (Billion), by Food Item 2024 & 2032

- Figure 21: Asia Pacific Food Grade Tank Trucking Market Revenue Share (%), by Food Item 2024 & 2032

- Figure 22: Asia Pacific Food Grade Tank Trucking Market Volume Share (%), by Food Item 2024 & 2032

- Figure 23: Asia Pacific Food Grade Tank Trucking Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Asia Pacific Food Grade Tank Trucking Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Asia Pacific Food Grade Tank Trucking Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Food Grade Tank Trucking Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Middle East and Africa Food Grade Tank Trucking Market Revenue (Million), by Food Item 2024 & 2032

- Figure 28: Middle East and Africa Food Grade Tank Trucking Market Volume (Billion), by Food Item 2024 & 2032

- Figure 29: Middle East and Africa Food Grade Tank Trucking Market Revenue Share (%), by Food Item 2024 & 2032

- Figure 30: Middle East and Africa Food Grade Tank Trucking Market Volume Share (%), by Food Item 2024 & 2032

- Figure 31: Middle East and Africa Food Grade Tank Trucking Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Middle East and Africa Food Grade Tank Trucking Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Middle East and Africa Food Grade Tank Trucking Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Food Grade Tank Trucking Market Volume Share (%), by Country 2024 & 2032

- Figure 35: South America Food Grade Tank Trucking Market Revenue (Million), by Food Item 2024 & 2032

- Figure 36: South America Food Grade Tank Trucking Market Volume (Billion), by Food Item 2024 & 2032

- Figure 37: South America Food Grade Tank Trucking Market Revenue Share (%), by Food Item 2024 & 2032

- Figure 38: South America Food Grade Tank Trucking Market Volume Share (%), by Food Item 2024 & 2032

- Figure 39: South America Food Grade Tank Trucking Market Revenue (Million), by Country 2024 & 2032

- Figure 40: South America Food Grade Tank Trucking Market Volume (Billion), by Country 2024 & 2032

- Figure 41: South America Food Grade Tank Trucking Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: South America Food Grade Tank Trucking Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Food Item 2019 & 2032

- Table 4: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Food Item 2019 & 2032

- Table 5: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Food Item 2019 & 2032

- Table 8: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Food Item 2019 & 2032

- Table 9: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: United States Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Canada Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: Mexico Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Food Item 2019 & 2032

- Table 18: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Food Item 2019 & 2032

- Table 19: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: France Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Italy Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Spain Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Netherlands Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Food Item 2019 & 2032

- Table 32: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Food Item 2019 & 2032

- Table 33: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: China Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: China Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Japan Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 39: India Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: India Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 41: Russia Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Russia Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Asia Pacific Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 45: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Food Item 2019 & 2032

- Table 46: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Food Item 2019 & 2032

- Table 47: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Country 2019 & 2032

- Table 49: GCC Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: GCC Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 51: South Africa Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Africa Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 53: Rest of Middle East and Africa Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Middle East and Africa Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 55: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Food Item 2019 & 2032

- Table 56: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Food Item 2019 & 2032

- Table 57: Global Food Grade Tank Trucking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Food Grade Tank Trucking Market Volume Billion Forecast, by Country 2019 & 2032

- Table 59: Brazil Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Brazil Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 61: Argentina Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Argentina Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 63: Rest of South America Food Grade Tank Trucking Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of South America Food Grade Tank Trucking Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Grade Tank Trucking Market?

The projected CAGR is approximately 5.88%.

2. Which companies are prominent players in the Food Grade Tank Trucking Market?

Key companies in the market include Hegelmann Group, C H Robinson, DHL, Odyssey Logistics, SHAL (Sea Hawk Lines), Kenan Advantage Group Inc, Bulk Connection, Trimac Transportation Services, Heniff Transportation Systems LLC, Quality Carriers**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Food Grade Tank Trucking Market?

The market segments include Food Item.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Food Safety and Quality; Expansion of the Food and Beverage Industry.

6. What are the notable trends driving market growth?

Global Cow Milk Consumption and Production Propel Food Grade Tank Trucking Demand.

7. Are there any restraints impacting market growth?

Increasing Demand for Food Safety and Quality; Expansion of the Food and Beverage Industry.

8. Can you provide examples of recent developments in the market?

June 2024: TFI International has acquired Entreposage Marco, a Quebec, Canada-based food-grade tank hauler. Specializing in the transportation of edible products such as oils, liquid yeast, sweeteners, and fruit juices, Entreposage Marco operates a fleet of 15 power units, as reported by the Federal Motor Carrier Safety Administration. This acquisition is significant and aims to increase the market reach of TFI International.April 2023: Trimac Transportation acquired American Industrial Partners (AIP) Logistics, a Central Ohio-based company specializing in bulk terminal services, transportation, and warehousing for industries such as plastics, liquid chemicals, food-grade storage, and metal production. AIP's fleet includes 13 tractors, 119 trailers, and various yard vehicles. Located on a 52-acre property in Wapakoneta, Ohio, the facility offers cold, dry, and food-grade warehousing, bulk transloading, and storage, with direct access to CSX Transportation’s rail line and capacity for up to 70 railcars. This acquisition strengthens Trimac's five-year strategy to enhance its position in bulk transportation, wash, and maintenance services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Grade Tank Trucking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Grade Tank Trucking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Grade Tank Trucking Market?

To stay informed about further developments, trends, and reports in the Food Grade Tank Trucking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence