Key Insights

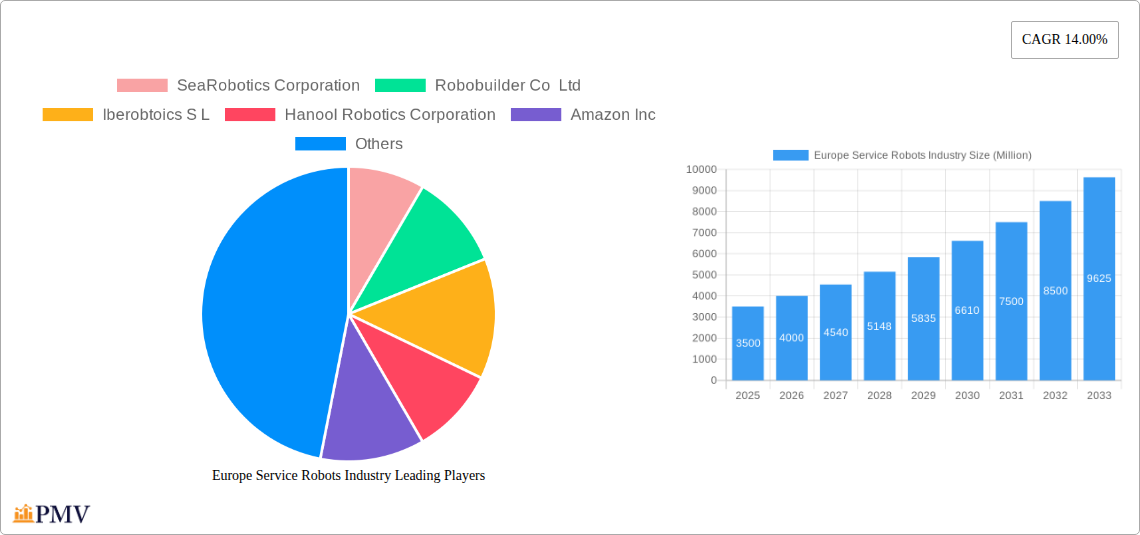

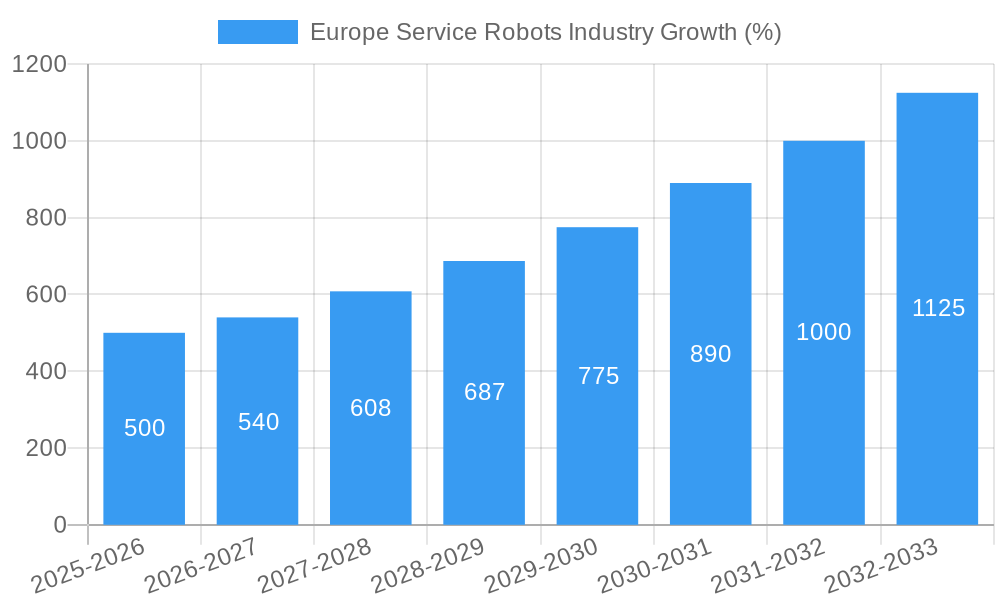

The European service robot market is experiencing robust growth, driven by increasing automation across various sectors and advancements in robotics technology. The market, currently valued in the billions (a precise figure cannot be provided without the missing "XX" market size value), is projected to maintain a Compound Annual Growth Rate (CAGR) of 14% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising adoption of service robots in industries like healthcare (for elderly care and surgical assistance), logistics (for warehouse automation and delivery), and agriculture (for precision farming) is a significant contributor. Secondly, technological advancements, particularly in artificial intelligence (AI), machine learning (ML), and sensor technology, are enhancing the capabilities and functionalities of service robots, making them more efficient and versatile. Finally, supportive government policies and initiatives aimed at promoting technological innovation and automation across various sectors are further bolstering market growth.

However, certain challenges persist. High initial investment costs associated with robot acquisition and integration, coupled with concerns regarding job displacement and data security, pose potential restraints to market growth. Nevertheless, the overall outlook for the European service robot market remains positive, with considerable potential for expansion across various segments, including personal robots for household chores, professional robots for industrial applications, and specialized robots for underwater, aerial, and land-based operations. The key players mentioned — including established robotics companies and technology giants — are actively investing in research and development, further driving innovation and market penetration within specific niches like military applications and construction. Germany, France, and the United Kingdom are expected to remain leading markets within Europe, benefiting from a robust technological infrastructure and strong demand across several industry verticals.

Europe Service Robots Industry: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the European service robots industry, covering market size, segmentation, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and strategists. The report leverages rigorous market research methodologies to provide accurate and reliable data, including detailed analysis of market segments, key players, and emerging trends. The estimated market value in 2025 is expected to reach xx Million.

Europe Service Robots Industry Market Structure & Competitive Dynamics

The European service robots market exhibits a moderately consolidated structure, with a handful of large multinational corporations alongside a significant number of smaller, specialized firms. Market share is distributed across various players, with leading companies like KUKA AG, iRobot Corporation, and Amazon Inc. holding significant positions. However, the market is characterized by intense competition, driven by ongoing technological innovation and a rapidly evolving regulatory landscape. Innovation ecosystems are flourishing across Europe, particularly in countries like Germany and the UK, supported by governmental initiatives and substantial R&D investments. Regulatory frameworks are evolving to address safety, privacy, and ethical concerns surrounding service robots, creating both challenges and opportunities for market participants. Product substitutes, particularly in specific niche applications, are emerging, posing a competitive threat. End-user trends indicate a growing demand for automation across diverse sectors, from healthcare and logistics to agriculture and defense. M&A activities are frequent, with deal values varying depending on the size and strategic importance of the target companies. Recent deals have focused on consolidating market share and acquiring specialized technologies. Examples include (xx Million valued deals in 2024). Analysis shows that market concentration is expected to increase slightly by 2033 due to continued consolidation.

Europe Service Robots Industry Industry Trends & Insights

The European service robots market is experiencing robust growth, driven by several key factors. Technological advancements, such as advancements in AI, computer vision, and sensor technologies, are significantly enhancing the capabilities and functionality of service robots. This is leading to increased adoption across diverse end-user industries. Consumer preferences are shifting towards automation and convenience, further fueling market demand. Specifically, the market is witnessing a surge in demand for autonomous mobile robots (AMRs) in logistics and warehousing, as well as increased interest in robotic surgery systems in the healthcare sector. The market exhibits considerable dynamism with intense competitive rivalry among established and emerging players. The compound annual growth rate (CAGR) for the period 2025-2033 is projected to be xx%, indicating substantial market expansion. Market penetration is expected to increase significantly across various segments, particularly in sectors with a high demand for automation and efficiency gains. Disruptive technologies such as collaborative robots (cobots) are gaining traction, while changing consumer preferences favor human-robot collaboration and user-friendliness. The emergence of Software as a Service (SaaS) business models is changing the industry's dynamics. These trends contribute to the overall growth and evolution of the European service robots market.

Dominant Markets & Segments in Europe Service Robots Industry

By Type: Professional service robots represent a significantly larger market segment compared to personal robots due to higher demand in industries like logistics, healthcare, and manufacturing.

By Area: The Land segment currently dominates, driven by widespread applications in logistics, agriculture, and security. However, the Aerial and Underwater segments show significant growth potential driven by technological advancements and increased investment.

By Components: Sensors and Actuators are currently the largest components market segments, followed by control systems. Software is experiencing rapid growth due to the increasing complexity and intelligence of service robots.

By End-User Industries: The Logistics and Healthcare segments hold prominent positions, largely due to the high demand for automation and efficiency improvements. The Military and Defence sector is also a substantial segment, with continuous demand for unmanned aerial and underwater vehicles. The Agriculture segment is a promising area of growth due to labor shortages and increasing demand for precision farming.

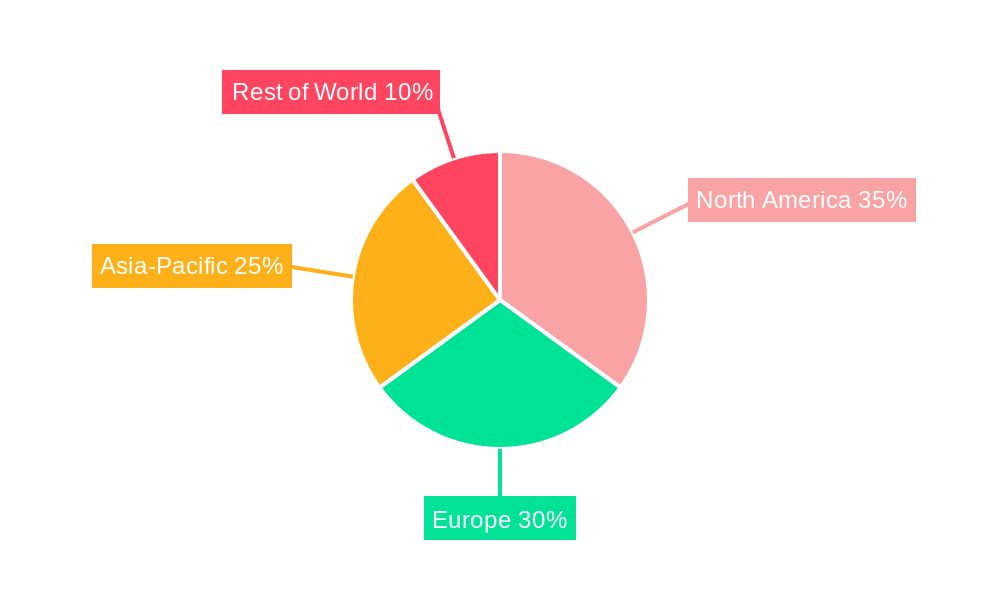

By Countries: Germany and the United Kingdom currently represent the leading national markets, driven by strong industrial bases, technological expertise, and supportive government policies. France also holds a significant market share. However, the market is expected to see further expansion across other European nations. Key drivers for this dominance include well-developed industrial infrastructure, presence of leading robot manufacturers, and favorable regulatory environments. However, factors such as variations in economic conditions and technological infrastructure across different countries need to be considered.

Europe Service Robots Industry Product Innovations

Recent years have witnessed a wave of product innovations in the European service robots market. The focus is on developing more sophisticated and versatile robots with enhanced capabilities. This includes improvements in areas such as navigation, perception, manipulation, and human-robot interaction. The integration of artificial intelligence (AI) and machine learning (ML) is driving advancements in robot autonomy and decision-making. The use of advanced materials, including lighter and stronger materials, is another notable trend. Moreover, several companies are developing cloud-based platforms to enable remote monitoring and control of service robots, enhancing operational efficiency and scalability. These technological advancements are enhancing the adaptability and effectiveness of service robots across diverse applications.

Report Segmentation & Scope

This report provides a detailed segmentation of the European service robots market based on various factors including type (personal and professional robots), area of operation (aerial, land, and underwater), components (sensors, actuators, control systems, software, and others), end-user industries (military and defense, agriculture, construction and mining, transportation & logistics, healthcare, government, and others), and countries (United Kingdom, Germany, France, and others). Each segment's growth projection, market size, and competitive dynamics are analyzed to provide a holistic understanding of the market. The market size and growth projections for each segment are detailed within the full report. Competitive landscapes are analyzed at the segment level, indicating key competitors and their respective market share.

Key Drivers of Europe Service Robots Industry Growth

Several factors contribute to the growth of the European service robots industry. Technological advancements, particularly in artificial intelligence and sensor technologies, are significantly enhancing the capabilities of service robots. Government initiatives and funding programs are promoting the development and adoption of robotics technologies across various sectors. The increasing demand for automation and efficiency improvements across industries like logistics, healthcare, and agriculture is driving market growth. Furthermore, favorable regulatory environments in several European countries are encouraging innovation and investment in the sector. Finally, growing awareness of the benefits of service robots across various fields are positively influencing demand.

Challenges in the Europe Service Robots Industry Sector

Despite its growth potential, the European service robots industry faces several challenges. High initial investment costs for robots and related infrastructure can act as a barrier to entry for smaller companies. Concerns about data privacy and security associated with the use of robots are leading to regulatory hurdles. Supply chain disruptions can impact the availability of essential components, hindering production and delivery. Intense competition among established and emerging players can put downward pressure on prices. Addressing these challenges is crucial for ensuring sustainable growth in the sector. Estimates suggest that these challenges represent an estimated xx% impact on overall market growth.

Leading Players in the Europe Service Robots Industry Market

- SeaRobotics Corporation

- Robobuilder Co Ltd

- Iberobtoics S L

- Hanool Robotics Corporation

- Amazon Inc

- RedZone Robotics

- KUKA AG

- Gecko Systems Corporation

- iRobot Corporation

- Honda Motors Co Ltd

- Northrop Grumman Corporation

Key Developments in Europe Service Robots Industry Sector

July 2021: Amazon announced the launch of a new center in Helsinki, Finland, to support research and development for its autonomous delivery service. This signifies increased investment in the European market and a focus on autonomous delivery solutions.

October 2021: The European Commission launched Robotics4EU, aiming to boost responsible robotics adoption within the European economy. This initiative is expected to accelerate market growth by fostering innovation and addressing ethical concerns.

Strategic Europe Service Robots Industry Market Outlook

The European service robots market presents significant growth opportunities in the coming years. Continued technological advancements, increasing automation demands across industries, and supportive government policies are key growth accelerators. Strategic opportunities lie in developing specialized robots for niche applications, focusing on human-robot collaboration, and leveraging AI and machine learning to enhance robot capabilities. Investing in research and development, building strong partnerships, and addressing regulatory concerns will be crucial for success in this dynamic market. The long-term outlook is positive, projecting substantial market expansion driven by factors mentioned above.

Europe Service Robots Industry Segmentation

-

1. Type

- 1.1. Personal Robots

- 1.2. Professional Robots

-

2. Areas

- 2.1. Aerial

- 2.2. Land

- 2.3. Underwater

-

3. Components

- 3.1. Sensors

- 3.2. Actuators

- 3.3. Control Systems

- 3.4. Software

- 3.5. Others

-

4. End-User industries

- 4.1. Military and Defense

- 4.2. Agriculture, Construction and Mining

- 4.3. Transportation & Logistics

- 4.4. Healthcare

- 4.5. Government

- 4.6. Others

Europe Service Robots Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Service Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for these robots in defense sector; Focus towards research and development is leading to robots with more user-friendly features

- 3.3. Market Restrains

- 3.3.1. Interaction with robot is hindrance for some users; Initial high costs associated with development

- 3.4. Market Trends

- 3.4.1. Increasing demand of service robots due to labor shortage in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Personal Robots

- 5.1.2. Professional Robots

- 5.2. Market Analysis, Insights and Forecast - by Areas

- 5.2.1. Aerial

- 5.2.2. Land

- 5.2.3. Underwater

- 5.3. Market Analysis, Insights and Forecast - by Components

- 5.3.1. Sensors

- 5.3.2. Actuators

- 5.3.3. Control Systems

- 5.3.4. Software

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by End-User industries

- 5.4.1. Military and Defense

- 5.4.2. Agriculture, Construction and Mining

- 5.4.3. Transportation & Logistics

- 5.4.4. Healthcare

- 5.4.5. Government

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Service Robots Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SeaRobotics Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Robobuilder Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Iberobtoics S L

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hanool Robotics Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Amazon Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 RedZone Robotics

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KUKA AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gecko Systems Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 iRobot Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Honda Motors Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Northrop Grumman Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 SeaRobotics Corporation

List of Figures

- Figure 1: Europe Service Robots Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Service Robots Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Service Robots Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Service Robots Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Service Robots Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Service Robots Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Europe Service Robots Industry Revenue Million Forecast, by Areas 2019 & 2032

- Table 6: Europe Service Robots Industry Volume K Unit Forecast, by Areas 2019 & 2032

- Table 7: Europe Service Robots Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 8: Europe Service Robots Industry Volume K Unit Forecast, by Components 2019 & 2032

- Table 9: Europe Service Robots Industry Revenue Million Forecast, by End-User industries 2019 & 2032

- Table 10: Europe Service Robots Industry Volume K Unit Forecast, by End-User industries 2019 & 2032

- Table 11: Europe Service Robots Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Europe Service Robots Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Europe Service Robots Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Service Robots Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Germany Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: France Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: United Kingdom Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Kingdom Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Netherlands Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Sweden Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Europe Service Robots Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Europe Service Robots Industry Volume K Unit Forecast, by Type 2019 & 2032

- Table 31: Europe Service Robots Industry Revenue Million Forecast, by Areas 2019 & 2032

- Table 32: Europe Service Robots Industry Volume K Unit Forecast, by Areas 2019 & 2032

- Table 33: Europe Service Robots Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 34: Europe Service Robots Industry Volume K Unit Forecast, by Components 2019 & 2032

- Table 35: Europe Service Robots Industry Revenue Million Forecast, by End-User industries 2019 & 2032

- Table 36: Europe Service Robots Industry Volume K Unit Forecast, by End-User industries 2019 & 2032

- Table 37: Europe Service Robots Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Europe Service Robots Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Germany Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Germany Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: France Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Italy Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Spain Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Spain Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Netherlands Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Netherlands Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Belgium Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Belgium Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Sweden Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Sweden Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Norway Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Norway Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Poland Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Poland Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Denmark Europe Service Robots Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Denmark Europe Service Robots Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Service Robots Industry?

The projected CAGR is approximately 14.00%.

2. Which companies are prominent players in the Europe Service Robots Industry?

Key companies in the market include SeaRobotics Corporation, Robobuilder Co Ltd, Iberobtoics S L, Hanool Robotics Corporation, Amazon Inc, RedZone Robotics, KUKA AG, Gecko Systems Corporation, iRobot Corporation, Honda Motors Co Ltd, Northrop Grumman Corporation.

3. What are the main segments of the Europe Service Robots Industry?

The market segments include Type, Areas, Components, End-User industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for these robots in defense sector; Focus towards research and development is leading to robots with more user-friendly features.

6. What are the notable trends driving market growth?

Increasing demand of service robots due to labor shortage in Europe.

7. Are there any restraints impacting market growth?

Interaction with robot is hindrance for some users; Initial high costs associated with development.

8. Can you provide examples of recent developments in the market?

July 2021: Amazon announced the launch of a new center in Helsinki, Finland, to support research and development for its autonomous delivery service that currently operates in four US locations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Service Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Service Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Service Robots Industry?

To stay informed about further developments, trends, and reports in the Europe Service Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence