Key Insights

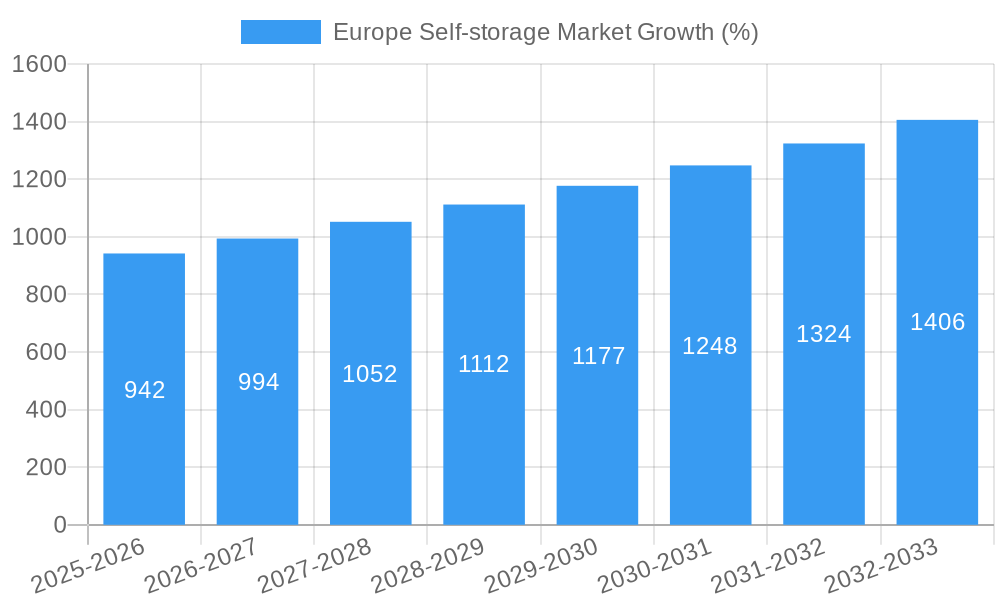

The European self-storage market is experiencing robust growth, driven by several key factors. Urbanization and population density in major European cities are leading to space constraints, particularly for individuals and businesses. The rise of e-commerce fuels the need for additional warehousing space for online retailers and inventory management. Furthermore, increased mobility and shorter-term leases are creating a demand for flexible storage solutions. The market is segmented by user type (personal and business) and geographically across key European nations, with Germany, the United Kingdom, and France representing significant market shares. While the provided CAGR of 5.95% indicates a healthy growth trajectory, it's reasonable to assume that specific national markets within Europe may exhibit variations in growth rates, influenced by factors such as economic conditions, building regulations, and competitive landscape. For example, Germany, with its strong economy and large population, might experience a slightly higher growth rate than some smaller European nations. The competitive landscape includes a mix of established multinational players and regional operators, suggesting a dynamic market with opportunities for both expansion and consolidation. Challenges for the industry include maintaining high occupancy rates amidst economic fluctuations and managing operational costs, including rent, insurance, and security.

The forecast period of 2025-2033 presents several promising opportunities for growth within the European self-storage market. Technological advancements, such as online booking systems and smart storage solutions, are improving customer experience and operational efficiency. A growing awareness of the benefits of self-storage among both personal and business users is expanding the market base. However, potential restraints include increased construction costs and land scarcity in prime urban locations, influencing the expansion capacity of existing providers. The market's future growth will depend on the ability of operators to adapt to evolving consumer demands, embrace innovation, and navigate regulatory frameworks related to property development and environmental sustainability. Strategic mergers and acquisitions could further reshape the competitive landscape.

Europe Self-Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe self-storage market, offering invaluable insights for investors, industry professionals, and strategic planners. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The report utilizes a robust methodology to provide accurate market sizing (in Millions) and forecasts, enabling informed decision-making.

Europe Self-storage Market Market Structure & Competitive Dynamics

The European self-storage market exhibits a moderately concentrated structure, with a mix of large multinational players and smaller regional operators. Key players like Lok'nStore Limited, 24Storage, Lagerboks, Shurgard Self Storage SA, Safestore Holdings PLC, Pelican Self Storage, Casaforte (SMC Self-Storage Management), Big Yellow Group PLC, Nettolager, W Wiedmer AG, Self Storage Group ASA, Access Self Storage, SureStore Ltd, and W P Carey Inc. compete for market share. The market is characterized by ongoing innovation, particularly in technology-driven solutions like online booking and automated access systems. Regulatory frameworks vary across European countries, influencing operational costs and expansion strategies. Product substitution is limited, with the primary alternatives being traditional storage solutions like basements or rented spaces. End-user trends point towards increasing demand for flexible, short-term storage options, particularly among younger demographics and businesses. M&A activity has been significant, with deal values reaching xx Million in recent years, driven by consolidation and expansion efforts. Market share dynamics are influenced by factors such as location strategy, pricing, and service quality.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller operators.

- Innovation Ecosystems: Active development of technology-driven solutions for enhanced customer experience and operational efficiency.

- Regulatory Frameworks: Vary significantly across countries, impacting operating costs and expansion strategies.

- Product Substitutes: Limited substitutes, primarily traditional storage solutions, making the market relatively insulated.

- End-User Trends: Growing preference for flexible, short-term rental options.

- M&A Activity: Significant activity, indicating market consolidation and expansion efforts. Deal values are estimated at xx Million annually.

Europe Self-storage Market Industry Trends & Insights

The European self-storage market is experiencing robust growth, driven by several key factors. Urbanization, population growth, and increased e-commerce activity contribute to rising storage needs. Changing lifestyles and increased mobility have fueled demand for flexible storage solutions. The market's CAGR from 2025 to 2033 is projected at xx%, with market penetration expected to reach xx% by 2033. Technological advancements, including online booking platforms and smart storage solutions, are transforming customer experience and operational efficiency. Consumer preferences increasingly favor secure, clean, and easily accessible facilities with flexible rental terms. Intense competition among established players and new entrants drives innovation and cost optimization. The market also faces challenges such as land scarcity in urban areas and fluctuations in property prices.

Dominant Markets & Segments in Europe Self-storage Market

The United Kingdom currently holds the largest market share within Europe's self-storage sector, followed by Germany and France. This dominance is attributed to several factors:

United Kingdom:

- High population density and urbanization.

- Well-developed infrastructure supporting logistics and distribution.

- Strong economy and high disposable incomes.

- Established regulatory framework for the self-storage industry.

Germany:

- Large and growing population.

- Increasing urbanization and e-commerce growth.

- Relatively stable economic conditions.

France:

- Significant population and urbanization trends.

- Robust tourism industry contributing to demand.

The personal segment currently dominates the market, driven by residential mobility and home renovation projects. However, the business segment is experiencing rapid growth, driven by e-commerce expansion and the need for flexible warehouse space for small and medium-sized enterprises.

Europe Self-storage Market Product Innovations

Recent innovations focus on enhancing security, accessibility, and customer experience. Smart locks, online booking systems, and climate-controlled units are becoming increasingly common. Modular designs and sustainable building materials are also gaining traction. These innovations improve market fit by catering to specific customer needs and enhancing operational efficiency.

Report Segmentation & Scope

This report segments the European self-storage market by user type (personal and business) and by country (Germany, United Kingdom, France, Netherlands, Italy, Spain, Norway, Denmark, Sweden, and Rest of Europe). Each segment is analyzed based on market size, growth projections, and competitive dynamics. Market size is provided for each segment and country, with detailed projections for the forecast period (2025-2033). Competitive analysis includes key players, market share, and strategies for each segment.

Key Drivers of Europe Self-storage Market Growth

Several factors are driving market growth, including:

- Urbanization and Population Growth: Increased population density leads to limited residential space and higher demand for off-site storage.

- E-commerce Boom: The growth of online retail requires more storage for inventory and distribution.

- Increased Mobility: Frequent moves, due to job changes or lifestyle shifts, necessitate temporary storage solutions.

- Technological Advancements: Improved facilities and convenient online booking systems enhance user experience.

Challenges in the Europe Self-storage Market Sector

The market faces several challenges:

- Land Scarcity in Urban Areas: High land costs and limited availability restrict expansion in prime locations.

- Competition: Intense competition among existing players and new entrants leads to price pressure and the need for differentiation.

- Regulatory Hurdles: Varying regulations across countries create operational complexities and limit expansion.

Leading Players in the Europe Self-storage Market Market

- Lok'nStore Limited

- 24Storage

- Lagerboks

- Shurgard Self Storage SA

- Safestore Holdings PLC

- Pelican Self Storage

- Casaforte (SMC Self-Storage Management)

- Big Yellow Group PLC

- Nettolager

- W Wiedmer AG

- Self Storage Group ASA

- Access Self Storage

- SureStore Ltd

- W P Carey Inc

Key Developments in Europe Self-storage Market Sector

- October 2022: Big Yellow Group PLC opens two new stores in Harrow and Kingston North, adding over 1,000 storage units. This expansion demonstrates market confidence and addresses growing local demand.

- October 2022: Padlock Partners UK Fund III and Cinch Self Storage acquire a facility near Watford, planning to open in summer 2023 with over 65,000 square meters of space. This significant investment highlights the market's attractiveness to investors.

Strategic Europe Self-storage Market Market Outlook

The European self-storage market is poised for continued growth, driven by sustained urbanization, population growth, and the ongoing expansion of e-commerce. Strategic opportunities exist for companies focusing on technological innovation, sustainable practices, and expansion into underserved markets. Companies that successfully adapt to evolving consumer preferences and effectively manage operational costs are best positioned for long-term success.

Europe Self-storage Market Segmentation

-

1. User Type

- 1.1. Personal

- 1.2. Business

Europe Self-storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Self-storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.95% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Increasing Network Complexity

- 3.4. Market Trends

- 3.4.1. Business Storage Expected to Gain Market Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 5.1.1. Personal

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by User Type

- 6. Germany Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Self-storage Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Lok'nStore Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 24Storage

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Lagerboks

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Shurgard Self Storage SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Safestore Holdings PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pelican Self Storage

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Casaforte (SMC Self-Storage Management)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Big Yellow Group PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nettolager

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 W Wiedmer AG*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Self Storage Group ASA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Access Self Storage

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 SureStore Ltd

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 W P Carey Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Lok'nStore Limited

List of Figures

- Figure 1: Europe Self-storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Self-storage Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Self-storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Self-storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 3: Europe Self-storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Self-storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Self-storage Market Revenue Million Forecast, by User Type 2019 & 2032

- Table 13: Europe Self-storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Self-storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Self-storage Market?

The projected CAGR is approximately 5.95%.

2. Which companies are prominent players in the Europe Self-storage Market?

Key companies in the market include Lok'nStore Limited, 24Storage, Lagerboks, Shurgard Self Storage SA, Safestore Holdings PLC, Pelican Self Storage, Casaforte (SMC Self-Storage Management), Big Yellow Group PLC, Nettolager, W Wiedmer AG*List Not Exhaustive, Self Storage Group ASA, Access Self Storage, SureStore Ltd, W P Carey Inc.

3. What are the main segments of the Europe Self-storage Market?

The market segments include User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Greater Urbanization Coupled with Smaller Living Spaces; Changing Business Practices and COVID-19 Consumer Behavior.

6. What are the notable trends driving market growth?

Business Storage Expected to Gain Market Popularity.

7. Are there any restraints impacting market growth?

Increasing Network Complexity.

8. Can you provide examples of recent developments in the market?

October 2022: Big Yellow Group PLC has announced the opening of two new stores in Harrow and Kingston North. The two recent locations offer over 1,000 safe and secure storage rooms ranging from 9 sq ft to 500 sq ft - introducing more space into those living and working in Harrow, Kingston North, and the immediate surrounding areas. From short-term storage when renovating or moving home to flourishing businesses needing more space to store merchandise, we welcome the use of our rooms for both personal and business purposes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Self-storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Self-storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Self-storage Market?

To stay informed about further developments, trends, and reports in the Europe Self-storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence