Key Insights

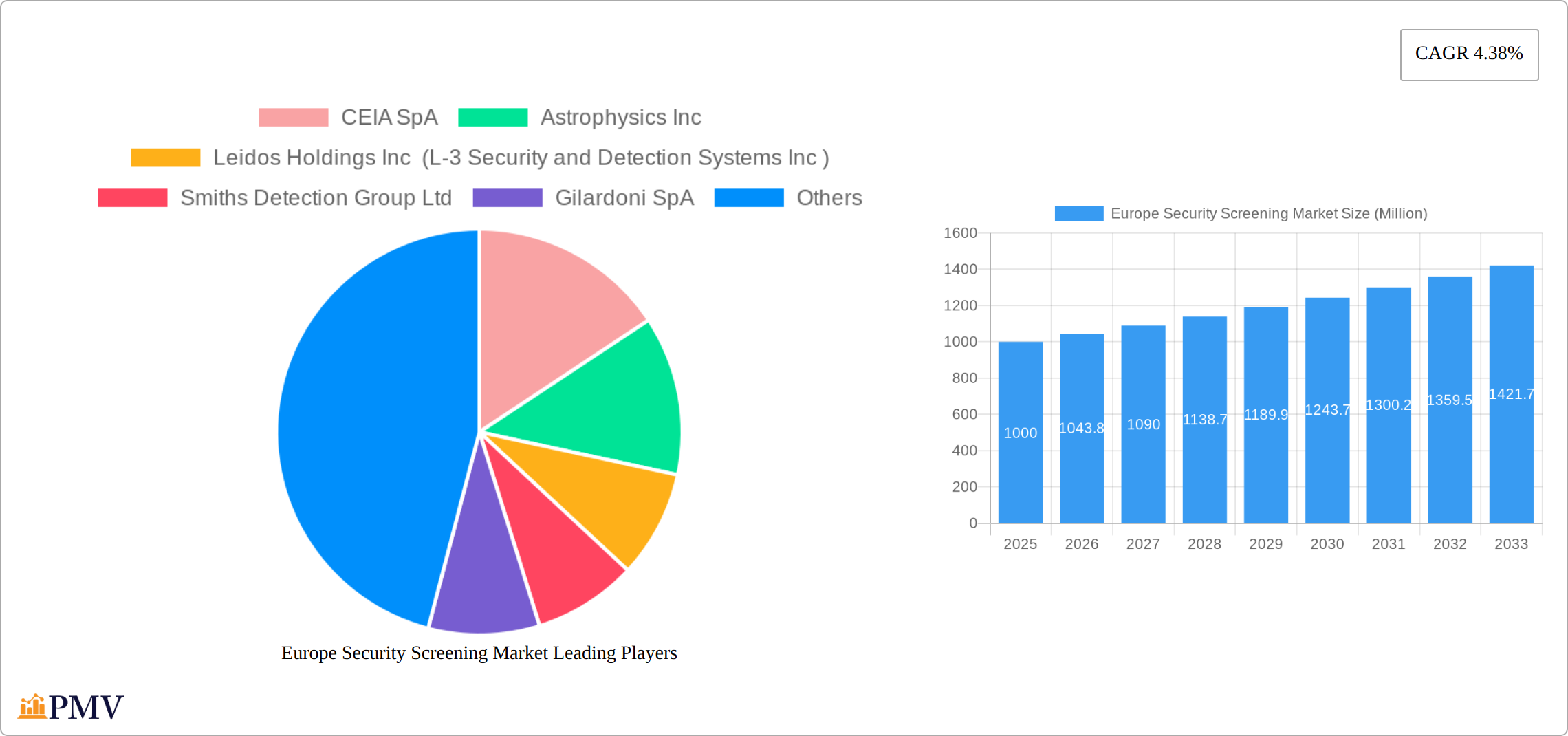

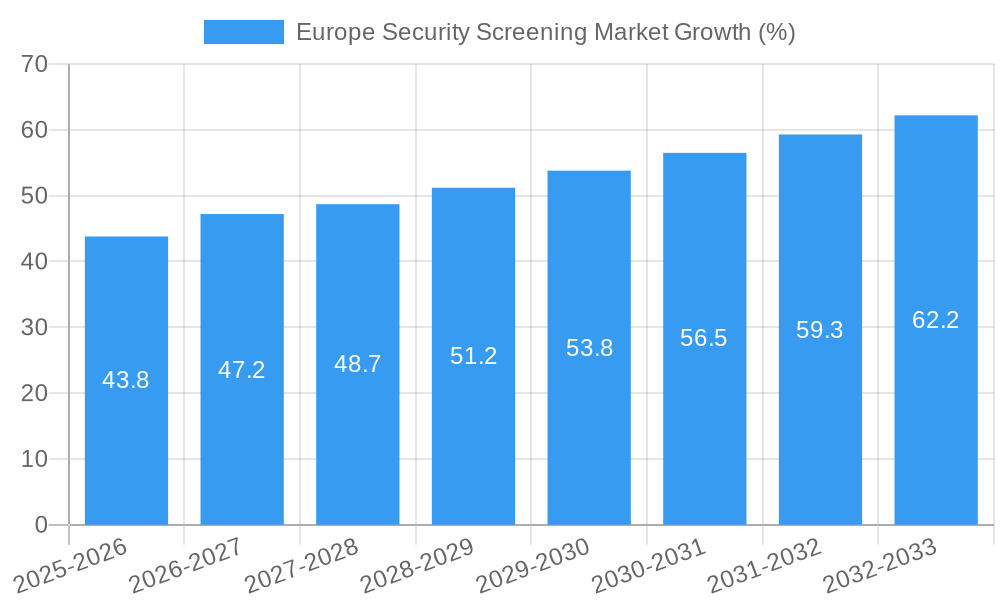

The European security screening market is experiencing robust growth, driven by increasing concerns over terrorism, organized crime, and the need to protect critical infrastructure. The market, valued at approximately €[Estimate based on market size XX and Value Unit Million. For example, if XX = 1000, then the value is €1000 million in 2025], is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.38% from 2025 to 2033. This growth is fueled by rising adoption of advanced security technologies, such as millimeter-wave scanners, X-ray systems, and explosive detection systems, across airports, ports, borders, and other critical infrastructure. Furthermore, stringent government regulations mandating enhanced security measures in public spaces are significantly contributing to market expansion. The increasing demand for efficient and reliable security solutions, coupled with technological advancements leading to improved accuracy and speed of screening, are key drivers. Segment-wise, the application segment focusing on people screening holds a significant share, followed by product screening. Within end-users, airports, ports and borders dominate the market due to the high volume of passenger and cargo traffic requiring stringent security checks.

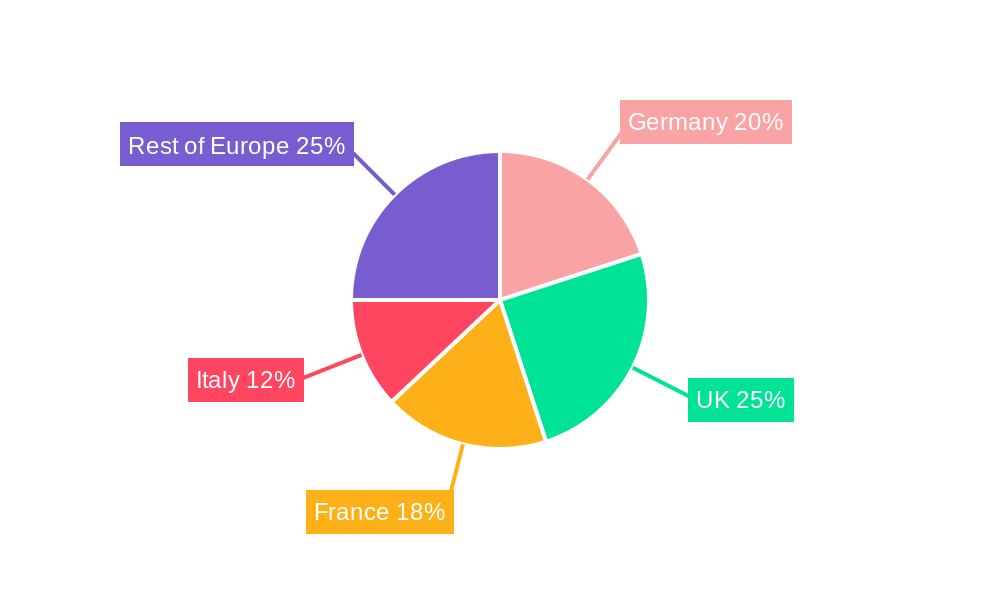

The growth trajectory of the European security screening market is influenced by several factors. The United Kingdom, Germany, France, and Italy represent the largest national markets within Europe, driven by substantial investments in security infrastructure and higher passenger traffic at major transportation hubs. However, potential restraints include the high initial investment costs associated with advanced security technologies, and the need for ongoing maintenance and training. Nevertheless, the escalating demand for enhanced security in the face of evolving threats, and the continuous innovation in security screening technology, are expected to outweigh these restraints, leading to sustained market growth throughout the forecast period. Key players such as CEIA SpA, Smiths Detection, and OSI Systems are actively contributing to this growth through product innovation and strategic partnerships.

Europe Security Screening Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe Security Screening Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by application (people, product), end-user (airports, ports and borders, defense, critical infrastructure, other end-users), and country (United Kingdom, Germany, France, Italy, Rest of Europe). The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Key players analyzed include CEIA SpA, Astrophysics Inc, Leidos Holdings Inc (L-3 Security and Detection Systems Inc), Smiths Detection Group Ltd, Gilardoni SpA, OSI Systems Inc, 3DX-RAY Ltd, Teledyne ICM SA, and Nuctech Company Limited.

Europe Security Screening Market Structure & Competitive Dynamics

The Europe security screening market exhibits a moderately consolidated structure, with a few dominant players holding significant market share. The market concentration is further influenced by the presence of both established multinational corporations and specialized regional players. Innovation ecosystems are robust, driven by ongoing advancements in technologies such as AI, machine learning, and advanced imaging. Stringent regulatory frameworks, particularly concerning data privacy and security protocols, shape market dynamics. Product substitutes, such as enhanced physical security measures, exist but are often less efficient and less technologically advanced. End-user trends increasingly favor integrated solutions providing seamless security screening across various applications. M&A activity has been relatively moderate in recent years, with deal values averaging approximately xx Million per transaction. Several key players have employed strategic acquisitions to expand their product portfolios and geographic reach. For instance, in 2022, Smiths Detection acquired a smaller company specializing in explosives detection, expanding its product range.

- Market Share: Top 3 players hold approximately xx% of the market share.

- M&A Activity: Average deal value: xx Million; Number of deals: xx (2019-2024).

- Regulatory Landscape: Compliance with GDPR and other data protection regulations significantly influences market dynamics.

Europe Security Screening Market Industry Trends & Insights

The Europe security screening market is experiencing significant growth fueled by several key trends. Heightened security concerns following terrorist attacks and geopolitical instability are driving demand for advanced screening technologies. The increasing adoption of biometric technologies and AI-powered analytics is revolutionizing security practices. Consumer preferences are shifting towards faster, more efficient, and less intrusive screening methods. Technological disruptions, such as the introduction of millimeter-wave scanners and advanced X-ray systems, are transforming the market landscape. Competitive dynamics are characterized by ongoing innovation and strategic partnerships to provide comprehensive security solutions. The market has witnessed a steady increase in the adoption of advanced screening technologies, reflecting a growing awareness of security threats and the demand for enhanced security measures across diverse settings. The market's expansion is largely driven by escalating security concerns, evolving technological advancements, and the increasing demand for streamlined and efficient security solutions across various end-user sectors. The market is anticipated to record a significant CAGR of xx% during the forecast period (2025-2033).

Dominant Markets & Segments in Europe Security Screening Market

The airports segment dominates the Europe security screening market, driven by stringent security protocols and high passenger traffic. The United Kingdom holds a leading position within Europe, owing to its robust aviation industry and advanced security infrastructure.

- By Application: The "people" segment dominates due to the widespread need for passenger and personnel screening.

- By End-User: Airports are the leading segment, followed by ports and borders, due to strict security regulations and high traffic volumes.

- By Country: The United Kingdom holds the largest market share due to extensive airport infrastructure and high security standards. Germany and France follow closely.

Key Drivers for Dominant Segments:

- Airports: Stringent security regulations, increasing passenger traffic, and continuous technological upgrades.

- United Kingdom: Significant investment in airport infrastructure, robust security protocols, and a large aviation industry.

Europe Security Screening Market Product Innovations

Recent innovations focus on enhancing speed, accuracy, and passenger experience. Millimeter-wave scanners, advanced X-ray systems with improved image processing, and AI-powered threat detection systems are gaining traction. These technologies aim to reduce false alarms, improve detection rates, and streamline screening processes. The market is also witnessing the integration of biometric technologies for enhanced security and identification.

Report Segmentation & Scope

This report segments the Europe security screening market by application (people screening, product screening), end-user (airports, ports and borders, defense, critical infrastructure, other end-users), and country (United Kingdom, Germany, France, Italy, Rest of Europe). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The report provides comprehensive insights into the current market scenario, growth drivers, challenges, and future outlook.

Key Drivers of Europe Security Screening Market Growth

The market's growth is fueled by increasing security concerns, stringent regulatory frameworks mandating advanced security measures (e.g., EU aviation regulations), and technological advancements enhancing detection capabilities and efficiency. Economic growth in several European countries also contributes to increased investment in security infrastructure.

Challenges in the Europe Security Screening Market Sector

Challenges include the high initial investment costs associated with advanced technologies, the need for skilled personnel to operate and maintain these systems, and the potential for supply chain disruptions affecting the availability of components and materials. The need for continuous adaptation to evolving security threats and regulatory changes also presents a significant challenge.

Leading Players in the Europe Security Screening Market

- CEIA SpA

- Astrophysics Inc

- Leidos Holdings Inc (L-3 Security and Detection Systems Inc)

- Smiths Detection Group Ltd

- Gilardoni SpA

- OSI Systems Inc

- 3DX-RAY Ltd

- Teledyne ICM SA

- Nuctech Company Limited

Key Developments in Europe Security Screening Market Sector

- 2023 (June): Smiths Detection launched a new explosives trace detection system.

- 2022 (October): Leidos Holdings Inc secured a significant contract for airport security upgrades.

- 2021 (December): CEIA SpA introduced a new generation of metal detectors.

Strategic Europe Security Screening Market Outlook

The Europe security screening market presents significant growth potential. Continued technological advancements, stringent security regulations, and increasing passenger traffic at airports and seaports will drive demand for sophisticated security screening solutions. Strategic partnerships, acquisitions, and investments in R&D will further enhance market growth and innovation in this crucial sector. The market is poised for robust expansion over the next decade.

Europe Security Screening Market Segmentation

-

1. Application

- 1.1. People

-

1.2. Product

- 1.2.1. Mail and Parcel

- 1.2.2. Baggage

- 1.2.3. Cargo and Vehicle Inspection

- 1.2.4. Trace Detection

- 1.2.5. Other Applications

-

2. End User

- 2.1. Airports

- 2.2. Ports and Borders

- 2.3. Defense

- 2.4. Critical Infrastructure

- 2.5. Other End Users

Europe Security Screening Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Security Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.38% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Terror Activities Happening Across the Region; Automation of Screening Processes

- 3.3. Market Restrains

- 3.3.1. ; Multiple apprehensions regarding X-ray radiation on health limiting the growth

- 3.4. Market Trends

- 3.4.1. Airports are Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. People

- 5.1.2. Product

- 5.1.2.1. Mail and Parcel

- 5.1.2.2. Baggage

- 5.1.2.3. Cargo and Vehicle Inspection

- 5.1.2.4. Trace Detection

- 5.1.2.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Airports

- 5.2.2. Ports and Borders

- 5.2.3. Defense

- 5.2.4. Critical Infrastructure

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Germany Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Security Screening Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 CEIA SpA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Astrophysics Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Leidos Holdings Inc (L-3 Security and Detection Systems Inc )

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Smiths Detection Group Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Gilardoni SpA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 OSI Systems Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 3DX-RAY Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Teledyne ICM SA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nuctech Company Limited

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 CEIA SpA

List of Figures

- Figure 1: Europe Security Screening Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Security Screening Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Security Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Security Screening Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Security Screening Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Security Screening Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Security Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Security Screening Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Europe Security Screening Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Security Screening Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Security Screening Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Security Screening Market?

The projected CAGR is approximately 4.38%.

2. Which companies are prominent players in the Europe Security Screening Market?

Key companies in the market include CEIA SpA, Astrophysics Inc, Leidos Holdings Inc (L-3 Security and Detection Systems Inc ), Smiths Detection Group Ltd, Gilardoni SpA, OSI Systems Inc, 3DX-RAY Ltd, Teledyne ICM SA, Nuctech Company Limited.

3. What are the main segments of the Europe Security Screening Market?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Terror Activities Happening Across the Region; Automation of Screening Processes.

6. What are the notable trends driving market growth?

Airports are Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

; Multiple apprehensions regarding X-ray radiation on health limiting the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Security Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Security Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Security Screening Market?

To stay informed about further developments, trends, and reports in the Europe Security Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence