Key Insights

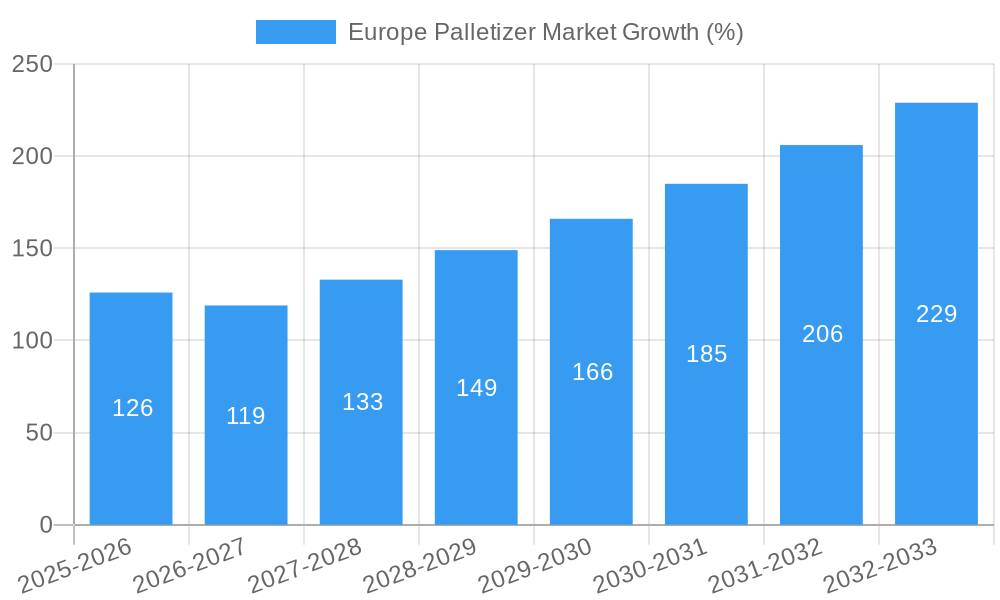

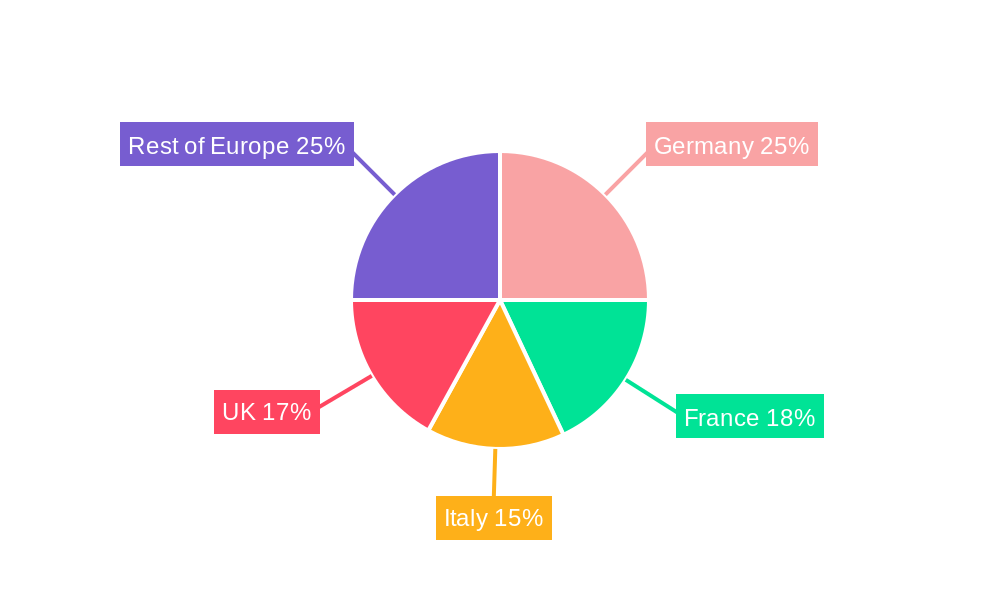

The European palletizer market, currently experiencing robust growth, is projected to expand significantly over the forecast period (2025-2033). Driven by the increasing automation needs across diverse sectors like food & beverages, pharmaceuticals, and personal care, the market is witnessing a strong shift towards robotic palletizers. This transition is fueled by the advantages of increased efficiency, reduced labor costs, and improved product handling compared to conventional palletizers. The adoption of Industry 4.0 technologies, including advanced robotics and AI-powered systems, further enhances the capabilities and appeal of robotic palletizers. While the initial investment for robotic systems might be higher, the long-term returns in terms of productivity and reduced operational expenses make them a compelling proposition for businesses of all sizes. Germany, Italy, France, and the United Kingdom are key markets within Europe, contributing significantly to the overall market value. However, other European nations are also demonstrating promising growth potential, fueled by increased investment in manufacturing and logistics infrastructure. Competition within the market is intense, with major players like BEUMER Group, KUKA, and ABB vying for market share through innovation, strategic partnerships, and expansion of their product portfolios.

Growth restraints include the high initial investment costs associated with robotic palletizers, particularly for smaller companies. Additionally, the integration of palletizing systems into existing infrastructure can be complex and require specialized expertise. However, these challenges are being addressed by providers who offer financing solutions and comprehensive integration services. The market is segmented by type (conventional and robotic), end-user vertical (food & beverages, pharmaceuticals, personal care & cosmetics, chemicals), and geography (Germany, Italy, France, United Kingdom, and other European countries). The robotic segment is expected to dominate the market due to its superior efficiency and flexibility. The food and beverage sector is a major driver due to its high volume production and demand for efficient handling of packaged goods. The continued growth in e-commerce and the increasing demand for faster delivery times further fuels the demand for advanced palletizing solutions across all sectors. Looking forward, the European palletizer market is poised for continued expansion, driven by technological advancements, increasing automation adoption, and robust growth in key end-user industries.

Europe Palletizer Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Palletizer Market, offering valuable insights into market dynamics, competitive landscape, and future growth prospects. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The study meticulously examines various market segments, including conventional and robotic palletizers across key end-user verticals like Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Chemicals, within major European countries such as Germany, Italy, France, the United Kingdom, and others. Expect detailed analysis of market size (in Millions), CAGR, and key industry developments.

Europe Palletizer Market Structure & Competitive Dynamics

The Europe palletizer market exhibits a moderately concentrated structure, with several major players holding significant market share. Key players leverage technological innovation and strategic partnerships to maintain a competitive edge. The market's innovative ecosystem is fueled by ongoing R&D efforts in robotics and automation, leading to advancements in palletizer technology. Regulatory frameworks, particularly those related to safety and environmental standards, significantly impact market dynamics. Product substitutes, such as manual palletizing methods, pose a challenge, but automation trends drive market growth. End-user preferences are shifting towards efficient, flexible, and adaptable palletizing solutions. M&A activity remains moderate, with deal values varying based on the size and technology involved. Examples include (but are not limited to):

- Market Share: Top 5 players collectively hold approximately xx% of the market share (2024 estimate).

- M&A Activity: The average deal value for M&A activities in the sector was approximately xx Million in 2024. Deals primarily involve companies acquiring smaller specialized firms to enhance their technological capabilities.

Europe Palletizer Market Industry Trends & Insights

The European palletizer market is experiencing robust growth, driven by the increasing adoption of automation across various industries. The CAGR for the forecast period (2025-2033) is projected to be xx%. This growth is fueled by several factors, including the rising demand for efficient and cost-effective packaging solutions, growing e-commerce activities, and a continuous shift towards Industry 4.0 technologies. Technological disruptions, such as the incorporation of AI and machine learning in palletizer systems, enhance efficiency and optimize operations. Consumer preferences are shifting towards sustainable and eco-friendly palletizing solutions. The competitive dynamics are characterized by innovation, strategic partnerships, and acquisitions, all driving market consolidation. Market penetration of robotic palletizers is increasing, currently at xx% (2024), reflecting the industry's preference for automated solutions.

Dominant Markets & Segments in Europe Palletizer Market

Germany currently holds the largest market share in the Europe palletizer market, driven by its strong manufacturing base and high adoption of automation technologies.

- Key Drivers for Germany: Strong automotive and industrial sectors, well-established infrastructure, supportive government policies promoting automation.

Italy follows as the second-largest market, driven by the robust food and beverage sector and expanding e-commerce activities. The UK and France also constitute substantial markets, although their growth rates may be slightly lower than Germany and Italy due to economic and regulatory factors.

- Segment Dominance: Robotic palletizers are experiencing the highest growth rate, outpacing conventional palletizers due to increased efficiency and flexibility.

- End-User Vertical: The food and beverage industry is the dominant end-user vertical, owing to its high production volumes and the need for efficient packaging. However, pharmaceuticals and personal care are witnessing significant growth, driven by stringent quality and hygiene requirements.

Europe Palletizer Market Product Innovations

Recent innovations focus on enhancing speed, precision, and flexibility. The introduction of cartesian palletizers by companies like Concetti provides a more customizable and adaptable solution. The integration of AI and machine learning algorithms is improving palletizer efficiency and reducing downtime. Smart bin-picking systems, such as KUKA’s SmartBinPicking, are automating complex tasks, contributing to higher productivity and reduced labor costs. These innovations are improving market fit by offering tailored solutions for specific industry needs and improving overall efficiency.

Report Segmentation & Scope

This report segments the Europe palletizer market by type (conventional and robotic), end-user vertical (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Chemicals), and country (Germany, Italy, France, United Kingdom, and Others). Each segment's growth projections, market size, and competitive dynamics are extensively analyzed.

Type: The robotic palletizer segment is projected to exhibit a higher CAGR than the conventional segment due to its advanced features and higher efficiency.

End-user Vertical: The Food & Beverages segment holds the largest market share, while the Pharmaceuticals and Personal Care segments are demonstrating faster growth.

Country: Germany commands the largest market share, followed by Italy and the UK.

Key Drivers of Europe Palletizer Market Growth

Several factors drive the market's growth: the increasing demand for automation in various industries to enhance efficiency and reduce labor costs, the growing adoption of Industry 4.0 technologies, stringent quality control measures, especially in the pharmaceutical and personal care sectors, and supportive government policies encouraging automation. The rise of e-commerce is also significantly driving the demand for efficient palletizing systems.

Challenges in the Europe Palletizer Market Sector

The market faces challenges such as high initial investment costs for advanced robotic systems, the complexity of integration with existing production lines, and potential supply chain disruptions affecting component availability. Furthermore, stringent safety and environmental regulations necessitate compliance, and intense competition from established players can impact profit margins.

Leading Players in the Europe Palletizer Market Market

Key Developments in Europe Palletizer Market Sector

- September 2022: BEUMER Group wins a major contract from Otto Group for a new dispatch center automation project.

- June 2022: Concetti introduces a new range of cartesian palletizers.

- October 2022: KUKA launches its first intelligent bin-picking system, KUKA.SmartBinPicking.

Strategic Europe Palletizer Market Outlook

The Europe palletizer market is poised for sustained growth, driven by technological advancements and the increasing demand for automation across diverse industries. Strategic opportunities lie in developing innovative, sustainable, and cost-effective palletizing solutions tailored to specific industry needs. The focus on integrating AI, machine learning, and IoT technologies will shape the future of the market. Companies should prioritize strategic partnerships, R&D investments, and exploring new market segments to capitalize on future growth prospects.

Europe Palletizer Market Segmentation

-

1. Type

- 1.1. Conventional

- 1.2. Robotic

-

2. End-user Vertical

- 2.1. Food & Beverages

- 2.2. Pharmaceuticals

- 2.3. Personal Care & Cosmetics

- 2.4. Chemicals

Europe Palletizer Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Palletizer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand from food and beverages Sector; Rising demand for high-quality consumer goods and adoption of robotic palletizers

- 3.3. Market Restrains

- 3.3.1. Rising Privacy and Security Concerns

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry to Hold a Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Conventional

- 5.1.2. Robotic

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food & Beverages

- 5.2.2. Pharmaceuticals

- 5.2.3. Personal Care & Cosmetics

- 5.2.4. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Palletizer Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BEUMER Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Mitsubishi Electric

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 ABB

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 FANUC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Stäubli Robotics

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Schneider Electric

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KUKA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 BEUMER Group

List of Figures

- Figure 1: Europe Palletizer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Palletizer Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Palletizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Palletizer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Palletizer Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Europe Palletizer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Palletizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Palletizer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Palletizer Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 15: Europe Palletizer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Palletizer Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Palletizer Market?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the Europe Palletizer Market?

Key companies in the market include BEUMER Group, Mitsubishi Electric , ABB, FANUC , Stäubli Robotics, Schneider Electric , KUKA .

3. What are the main segments of the Europe Palletizer Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand from food and beverages Sector; Rising demand for high-quality consumer goods and adoption of robotic palletizers.

6. What are the notable trends driving market growth?

Food and Beverage Industry to Hold a Major Share.

7. Are there any restraints impacting market growth?

Rising Privacy and Security Concerns.

8. Can you provide examples of recent developments in the market?

October 2022 - KUKA brings the first intelligent bin-picking system to market. KUKA.SmartBinPicking software and associated components equip KUKA robots to bin-pick specific parts. For the first time, this automation solution is available as a vision toolkit package, which makes it easier to integrate into the production

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Palletizer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Palletizer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Palletizer Market?

To stay informed about further developments, trends, and reports in the Europe Palletizer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence