Key Insights

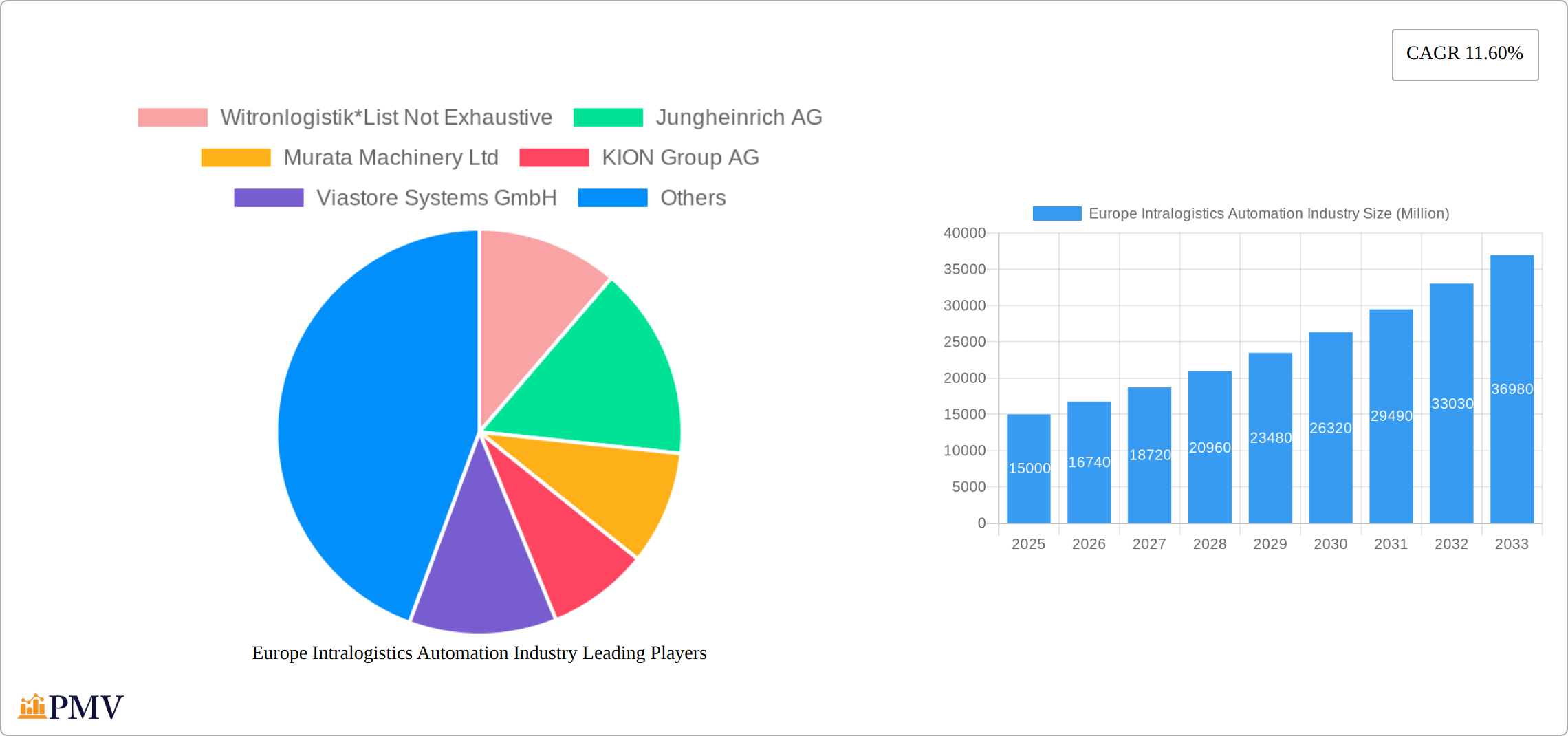

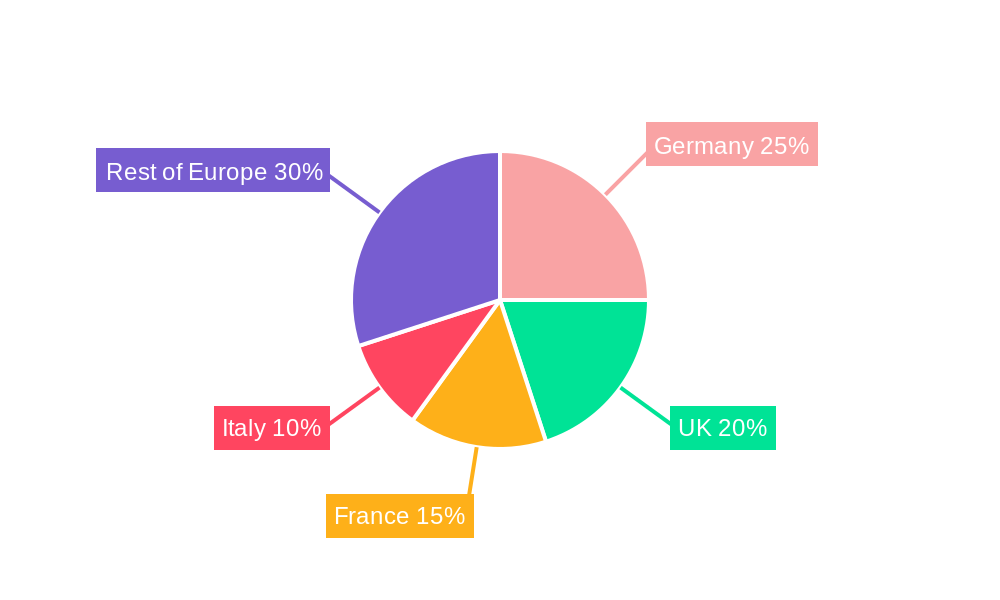

The European intralogistics automation market is experiencing robust growth, driven by the increasing need for efficiency and optimization within warehousing and distribution centers across various sectors. The market, valued at approximately €XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 11.60% and a 2019 base value – this value requires an actual 2019 figure to be accurately calculated), is projected to witness significant expansion throughout the forecast period (2025-2033). Key drivers include the burgeoning e-commerce sector demanding faster delivery times and improved supply chain management, coupled with a growing labor shortage across Europe pushing businesses towards automation solutions. Further fueling this growth are advancements in robotics, AI, and sophisticated software solutions offering enhanced warehouse management and order picking capabilities. The integration of these technologies allows for greater accuracy, speed, and overall productivity, making intralogistics automation a compelling investment for businesses of all sizes. Significant growth is expected across segments, including hardware (AGVs, AS/RS), software (WMS, WCS), and across end-user industries such as e-commerce fulfillment, manufacturing, and food & beverage. Germany, the UK, France, and Italy represent the largest national markets, though other European countries are expected to exhibit strong growth as automation adoption increases.

Market restraints include high initial investment costs for implementing automation systems, the need for skilled labor to manage and maintain these systems, and concerns surrounding the integration of new technologies into existing infrastructure. However, these challenges are being addressed through innovative financing options, improved training programs, and the development of more user-friendly, scalable automation solutions. The competitive landscape is characterized by a mix of established global players and innovative startups, driving innovation and offering businesses a diverse range of options to suit their specific needs. The continued expansion of e-commerce, coupled with the aforementioned industry drivers, strongly suggests that the European intralogistics automation market will maintain its upward trajectory throughout the forecast period. The market’s sustained growth will likely depend on the pace of technological innovation, continued investment in infrastructure, and successful adaptation to ongoing economic conditions.

This comprehensive report provides a detailed analysis of the Europe Intralogistics Automation industry, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is essential for businesses, investors, and stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Intralogistics Automation Industry Market Structure & Competitive Dynamics

The European intralogistics automation market is characterized by a moderately concentrated structure, with several major players holding significant market share. Key players include Witronlogistik, Jungheinrich AG, Murata Machinery Ltd, KION Group AG, Viastore Systems GmbH, Interroll Holding AG, Beumer Group GmbH & Co KG, Toyota Industries Corporation, SSI Schaefer AG, Visionnav Robotics, System Logistics Spa, Kardex Group, JBT Corporation, Honeywell Intelligrated Inc, Daifuku Co Ltd, Vanderlande Industries BV, and Kuka AG. However, the market also features numerous smaller, specialized firms contributing to innovation and competition.

The competitive landscape is dynamic, shaped by ongoing mergers and acquisitions (M&A) activity. For instance, M&A deal values in the sector totalled approximately xx Million in 2024. Market share is constantly shifting as companies strive to innovate and expand their product offerings. Regulatory frameworks, such as those related to data privacy and safety standards, significantly impact market operations. The industry is also witnessing increasing substitution of traditional methods with automated solutions. End-user trends, driven by e-commerce growth and the need for increased efficiency, are significant growth drivers.

Europe Intralogistics Automation Industry Industry Trends & Insights

The European intralogistics automation market is experiencing robust growth, driven by a confluence of factors. The explosive expansion of e-commerce continues to fuel demand for highly efficient warehousing and distribution solutions, significantly accelerating the adoption of automation technologies. Simultaneously, groundbreaking advancements in Artificial Intelligence (AI), robotics, and the Internet of Things (IoT) are revolutionizing the sector, resulting in unprecedented productivity gains and streamlined logistics processes. The increasing consumer expectation for faster delivery times and enhanced transparency further compels businesses to invest heavily in automation infrastructure. Furthermore, the industry is actively addressing persistent labor shortages, making automation a crucial solution for maintaining operational efficiency and competitiveness. Market analysts project a substantial increase in automated solution penetration, with estimates suggesting a market share of xx% by 2033, clearly indicating significant future growth potential.

Dominant Markets & Segments in Europe Intralogistics Automation Industry

Within the European intralogistics automation landscape, the Warehousing & Distribution segment currently holds a dominant position, primarily propelled by the booming e-commerce sector and the critical need for seamless order fulfillment. Germany leads the pack as the largest national market, followed closely by the United Kingdom and France. Each nation presents unique drivers:

- Key Drivers for Germany: A robust and technologically advanced manufacturing sector, coupled with a well-established technological infrastructure and supportive government policies promoting automation initiatives.

- Key Drivers for the United Kingdom: A dynamic and highly competitive e-commerce market, a strong emphasis on supply chain optimization, and strategic investments in modernizing logistics infrastructure.

- Key Drivers for France: A growing trend towards industrial automation adoption, proactive government policies encouraging technological advancements, and substantial investments in the development of cutting-edge logistics infrastructure.

Analyzing the technology segments, Hardware currently dominates the market share, followed by sophisticated Order Picking Systems and intelligent Software solutions. The Automotive and Food & Beverage sectors represent significant end-user industries, demonstrating considerable investment in automated solutions to achieve enhanced efficiency and productivity.

Europe Intralogistics Automation Industry Product Innovations

Recent product innovations in the European intralogistics automation market focus on AI-powered robotics, advanced warehouse management systems (WMS), and automated guided vehicles (AGVs). These developments offer enhanced precision, efficiency, and flexibility. The market is seeing a trend towards modular and scalable solutions that can adapt to changing business needs. Companies are prioritizing user-friendly interfaces and seamless integration with existing systems. Such innovative solutions are gaining considerable market traction, driven by the need for agility and cost optimization.

Report Segmentation & Scope

This comprehensive report provides a granular segmentation of the European intralogistics automation market across several key dimensions:

By Type: Hardware (encompassing AGVs, conveyor systems, and robotic arms), Order Picking Systems (including automated storage and retrieval systems (AS/RS) and automated guided carts (AGCs)), and Software (such as warehouse management systems (WMS) and transportation management systems (TMS)). Hardware is projected to maintain the largest market share, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% throughout the forecast period.

By End-user Industry: A detailed breakdown encompassing Airport, Post & Parcel, General Manufacturing, Automotive, Food and Beverage, Retail, Warehousing & Distribution, and Other End-user Industries. The Warehousing & Distribution segment is anticipated to experience the most significant growth rate.

By Country: A thorough analysis covering the United Kingdom, Germany, France, Italy, and the Rest of Europe. Germany is projected to maintain its leading market position, driven by its strong manufacturing base and continuous investments in automation technologies.

Key Drivers of Europe Intralogistics Automation Industry Growth

The remarkable growth trajectory of the European intralogistics automation market is fueled by a combination of compelling factors:

- Rapid Technological Advancements: AI, robotics, and IoT are fundamentally transforming warehouse operations, leading to significant improvements in efficiency and substantial reductions in operational costs.

- Unprecedented E-commerce Boom: The explosive growth of online retail is creating an unprecedented surge in demand for highly efficient order fulfillment solutions.

- Persistent Labor Shortages: Automation is increasingly recognized as a vital solution for addressing persistent workforce challenges and ensuring sustained operational capacity.

- Supportive Government Initiatives: Proactive government policies promoting automation and digitalization across various industries are fostering a favorable environment for market expansion and growth.

Challenges in the Europe Intralogistics Automation Industry Sector

Despite significant growth, several challenges hinder the European intralogistics automation market:

- High Initial Investment Costs: The substantial upfront investment required for automation can be a barrier for smaller businesses.

- Integration Complexity: Integrating new automation systems into existing infrastructure can be complex and time-consuming.

- Cybersecurity Concerns: The increasing reliance on technology increases vulnerability to cyber threats, requiring robust cybersecurity measures.

- Skills Gap: A shortage of skilled labor to operate and maintain advanced automation systems poses a challenge.

Leading Players in the Europe Intralogistics Automation Industry Market

- Witronlogistik

- Jungheinrich AG

- Murata Machinery Ltd

- KION Group AG

- Viastore Systems GmbH

- Interroll Holding AG

- Beumer Group GmbH & Co KG

- Toyota Industries Corporation

- SSI Schaefer AG

- Visionnav Robotics

- System Logistics Spa

- Kardex Group

- JBT Corporation

- Honeywell Intelligrated Inc

- Daifuku Co Ltd

- Vanderlande Industries BV

- Kuka AG

Key Developments in Europe Intralogistics Automation Industry Sector

February 2021: Duravant LLC acquired Votech GS B.V., expanding its capabilities in bag filling, palletizing, and pallet transport systems. This acquisition strengthened Duravant's position in the food processing and material handling sectors.

May 2021: Siemens Logistics partnered with Deutsche Post to implement advanced parcel sorting technology at its Niederaula facility. This collaboration demonstrated the increasing adoption of high-performance sorting systems in the postal and logistics industry.

Strategic Europe Intralogistics Automation Industry Market Outlook

The European intralogistics automation market presents significant growth opportunities over the next decade. Continued advancements in AI, robotics, and related technologies will drive further automation adoption. The ongoing expansion of e-commerce and the need for supply chain optimization will fuel demand for automated solutions. Strategic partnerships, technological innovation, and expansion into new market segments will be key for companies to capitalize on the considerable potential of this dynamic market. Companies that focus on flexible, scalable solutions and address the challenges related to integration and cybersecurity will be well-positioned for success.

Europe Intralogistics Automation Industry Segmentation

-

1. Type

-

1.1. Hardware

- 1.1.1. Mobile Robots (AGV, AMR)

- 1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 1.1.3. Automated Sorting Systems

- 1.1.4. De-palletizing/Palletizing Systems

- 1.1.5. Conveyor Systems

- 1.1.6. Automati

- 1.1.7. Order Picking Systems

- 1.2. Software

-

1.1. Hardware

-

2. End-user Industry

- 2.1. Airport

- 2.2. Post & Parcel

- 2.3. General Manufacturing

- 2.4. Automotive

- 2.5. Food and Beverage

- 2.6. Retail, Warehousing & Distribution

- 2.7. Other End-user Industries

Europe Intralogistics Automation Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Intralogistics Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Automation in the Food Processing Sector and Other Process and Discrete Industries Owing to Emerging 5G Applications

- 3.3. Market Restrains

- 3.3.1. ; High Cost and Time Consuming Implementation

- 3.4. Market Trends

- 3.4.1. Mobile Robots are Gaining Popularity Throughout Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Mobile Robots (AGV, AMR)

- 5.1.1.2. Automated Storage and Retrieval Systems (AS/RS)

- 5.1.1.3. Automated Sorting Systems

- 5.1.1.4. De-palletizing/Palletizing Systems

- 5.1.1.5. Conveyor Systems

- 5.1.1.6. Automati

- 5.1.1.7. Order Picking Systems

- 5.1.2. Software

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Airport

- 5.2.2. Post & Parcel

- 5.2.3. General Manufacturing

- 5.2.4. Automotive

- 5.2.5. Food and Beverage

- 5.2.6. Retail, Warehousing & Distribution

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Intralogistics Automation Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Witronlogistik*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Jungheinrich AG

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Murata Machinery Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 KION Group AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Viastore Systems GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Interroll Holding AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Beumer Group GmbH & Co KG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toyota Industries Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SSI Schaefer AG

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Visionnav Robotics

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 System Logistics Spa

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Kardex Group

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 JBT Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Honeywell Intelligrated Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Daifuku Co Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Vanderlande Industries BV

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Kuka AG

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.1 Witronlogistik*List Not Exhaustive

List of Figures

- Figure 1: Europe Intralogistics Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Intralogistics Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Intralogistics Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Intralogistics Automation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Intralogistics Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Europe Intralogistics Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Intralogistics Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Intralogistics Automation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Intralogistics Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Europe Intralogistics Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Intralogistics Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Intralogistics Automation Industry?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Europe Intralogistics Automation Industry?

Key companies in the market include Witronlogistik*List Not Exhaustive, Jungheinrich AG, Murata Machinery Ltd, KION Group AG, Viastore Systems GmbH, Interroll Holding AG, Beumer Group GmbH & Co KG, Toyota Industries Corporation, SSI Schaefer AG, Visionnav Robotics, System Logistics Spa, Kardex Group, JBT Corporation, Honeywell Intelligrated Inc, Daifuku Co Ltd, Vanderlande Industries BV, Kuka AG.

3. What are the main segments of the Europe Intralogistics Automation Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Automation in the Food Processing Sector and Other Process and Discrete Industries Owing to Emerging 5G Applications.

6. What are the notable trends driving market growth?

Mobile Robots are Gaining Popularity Throughout Europe.

7. Are there any restraints impacting market growth?

; High Cost and Time Consuming Implementation.

8. Can you provide examples of recent developments in the market?

February 2021 - Duravant LLC, a global provider of engineered equipment and automation solutions to the food processing, material handling, and packaging industries, acquired Votech GS B.V., a leading Dutch manufacturer of bag filling machines, palletizer machines, stretch hood machines, and pallet transport systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Intralogistics Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Intralogistics Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Intralogistics Automation Industry?

To stay informed about further developments, trends, and reports in the Europe Intralogistics Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence