Key Insights

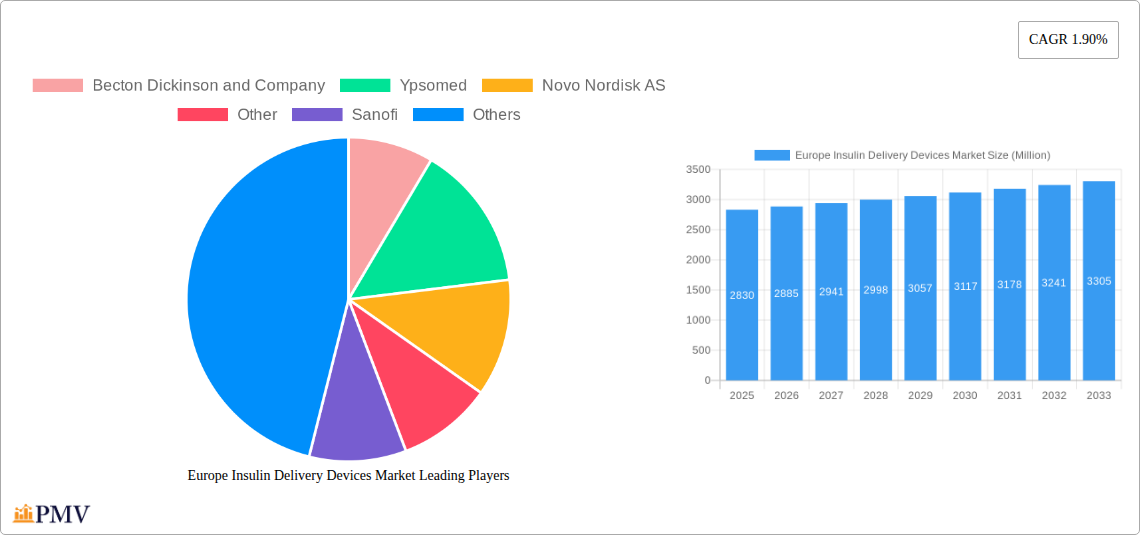

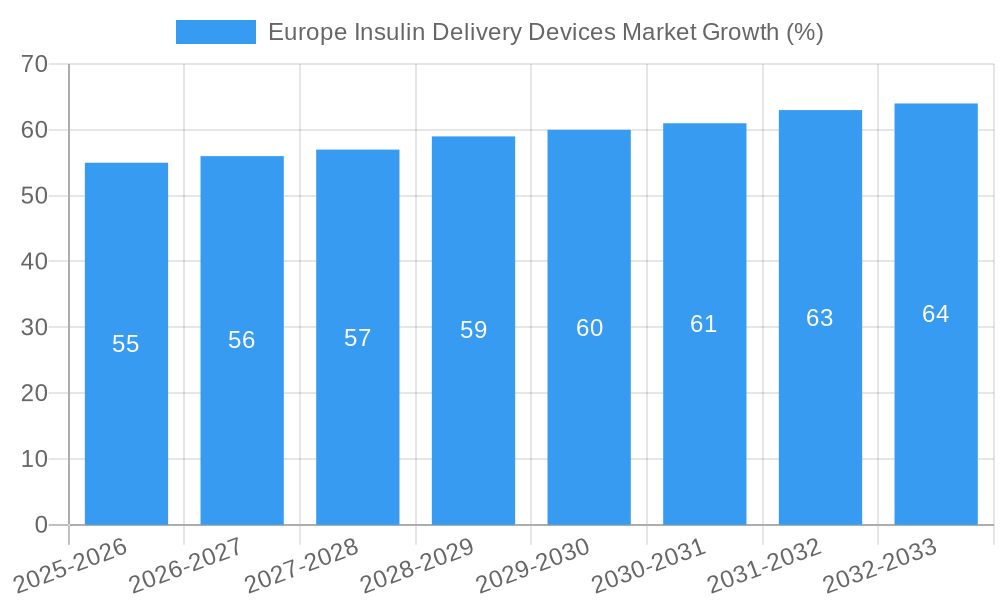

The European insulin delivery devices market, valued at €2.83 billion in 2025, is projected to experience steady growth, driven by several key factors. The rising prevalence of diabetes, particularly type 1 and type 2 diabetes, across Europe is a primary driver. Aging populations in many European countries contribute to this increased prevalence, necessitating a higher demand for effective insulin delivery solutions. Technological advancements in insulin pump technology, such as the introduction of tubeless insulin pumps offering greater convenience and improved patient outcomes, are further fueling market expansion. Furthermore, growing awareness of the benefits of continuous glucose monitoring (CGM) systems and their integration with insulin pumps is enhancing patient adherence to therapy and improving glycemic control, which in turn boosts market demand. Increased healthcare expenditure within the region and the growing availability of advanced insulin delivery systems through improved healthcare infrastructure also contribute to the market's positive trajectory.

However, market growth is tempered by factors such as high costs associated with insulin delivery devices and associated therapies, potentially limiting accessibility for some patients. Regulatory hurdles and stringent approval processes for new devices can also impact market entry and expansion. Nevertheless, the overall market outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 1.90% between 2025 and 2033. This growth is expected to be driven by ongoing technological innovation, increasing patient awareness, and continued investment in diabetes management within the European healthcare sector. Market segmentation reveals a strong demand for insulin pumps, followed by related components such as reservoirs, infusion sets, and disposable pens. Leading market players like Becton Dickinson, Ypsomed, Novo Nordisk, Sanofi, Eli Lilly, Insulet Corporation, and Medtronic are likely to further shape the landscape through their research and development initiatives and market strategies within this growing sector.

Europe Insulin Delivery Devices Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe Insulin Delivery Devices Market, covering the period 2019-2033. It offers invaluable insights into market dynamics, competitive landscapes, and future growth potential, making it an essential resource for industry stakeholders, investors, and researchers. The report utilizes rigorous data analysis and expert insights to present a clear picture of this crucial sector within the healthcare industry. The base year for this report is 2025, with the estimated year also being 2025, and the forecast period spanning 2025-2033. The historical period examined is 2019-2024.

Europe Insulin Delivery Devices Market Market Structure & Competitive Dynamics

The European insulin delivery devices market is characterized by a moderately concentrated structure, with key players such as Becton Dickinson and Company, Ypsomed, Novo Nordisk AS, Sanofi, Eli Lilly and Company, Insulet Corporation, and Medtronic PLC holding significant market share. However, the presence of "Other" players indicates a competitive landscape with smaller, specialized companies offering niche products or services. Market share data for 2025 is estimated as follows (xx denotes unavailable data): BD - 15%, Ypsomed - 12%, Novo Nordisk - 18%, Sanofi - 10%, Eli Lilly - 8%, Insulet - 5%, Medtronic - 20%, Other - 22%.

Innovation within the sector focuses heavily on technological advancements, such as the development of tubeless insulin pumps and integrated automated insulin delivery (AID) systems. Regulatory frameworks, primarily those set by the European Medicines Agency (EMA), significantly influence product approvals and market access. Product substitutes, including traditional insulin injection methods, continue to exist, but their market share is expected to decline due to advancements in device technology and improved patient outcomes. End-user trends indicate a growing preference for user-friendly, connected devices offering personalized data tracking and management capabilities. M&A activity in the sector has been moderate, with deal values totaling approximately xx Million in the past five years. Notable examples include the CamDiab and Ypsomed partnership detailed below.

Europe Insulin Delivery Devices Market Industry Trends & Insights

The European insulin delivery devices market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: the increasing prevalence of diabetes, particularly Type 1 and Type 2 diabetes, across Europe; a rising preference for more convenient and effective insulin delivery methods; and ongoing technological advancements resulting in the development of sophisticated, automated insulin delivery systems. The market penetration rate of insulin pumps is projected to increase from xx% in 2025 to xx% by 2033, driven by increased awareness and improved reimbursement policies. Consumer preferences are increasingly focused on ease of use, accuracy, connectivity, and data integration, contributing to the rapid adoption of advanced technologies such as tubeless pumps and smart insulin pens. Competitive dynamics are shaping the market through continuous product innovation, strategic partnerships, and price competition.

Dominant Markets & Segments in Europe Insulin Delivery Devices Market

By Device: Insulin pumps are the dominant segment, representing xx% of the market in 2025, followed by insulin pens at xx%. The high market share of insulin pumps is attributed to their superior efficacy in managing blood glucose levels.

By Technology: Tubeless insulin pumps are experiencing significant growth, projected to achieve a market share of xx% by 2033, outpacing tethered insulin pumps due to their increased convenience and reduced risk of infection.

By Component: The insulin pump device is the most significant component segment, followed by infusion sets and reservoirs.

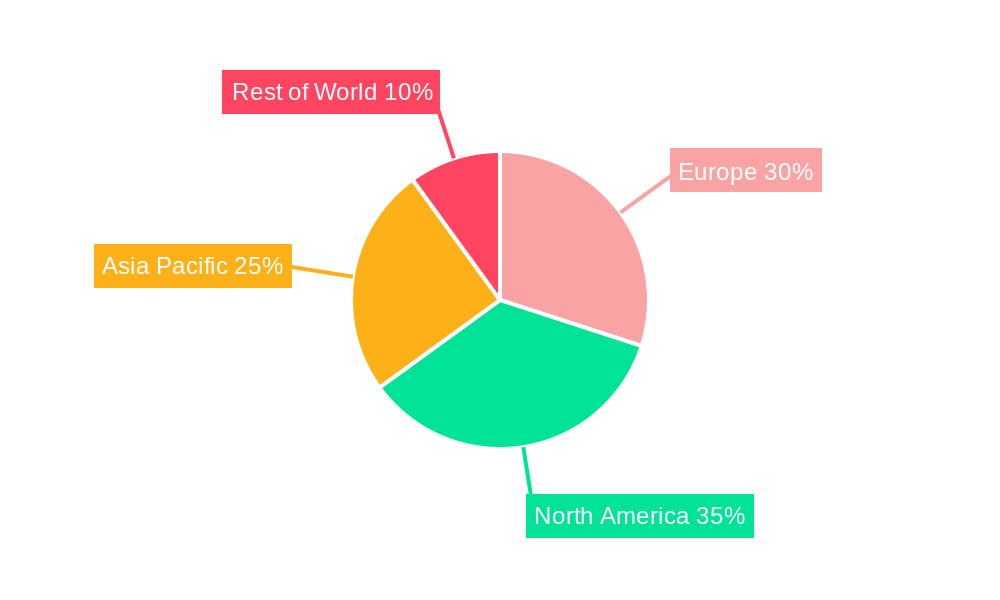

Leading Region/Country: Germany is anticipated to be the largest market, followed by the United Kingdom and France. This dominance is primarily driven by high diabetes prevalence rates, robust healthcare infrastructure, and higher healthcare expenditure. Key drivers for the market dominance in these countries include:

- Well-established healthcare systems: Access to sophisticated medical infrastructure, enabling advanced treatments and technology adoption.

- Favorable regulatory environments: streamlined approval processes allowing easier access to innovative devices.

- High awareness and education about diabetes: resulting in increased self-management and early adoption of advanced therapies.

Europe Insulin Delivery Devices Market Product Innovations

Recent years have witnessed significant advancements in insulin delivery devices, focusing on improved accuracy, usability, and connectivity. Tubeless insulin pump systems have gained traction due to their improved convenience and reduced infection risks. Integrated automated insulin delivery (AID) systems, combining continuous glucose monitoring (CGM) with insulin pumps, represent the cutting edge, promising greater efficiency and reduced burdens for patients. These innovations are gaining market acceptance due to their superior clinical outcomes and patient satisfaction rates, driving market expansion and competitive dynamics.

Report Segmentation & Scope

This report segments the Europe Insulin Delivery Devices market comprehensively across several parameters:

By Device: Insulin Pumps, Insulin Pens, Insulin Syringes, Disposable Pens, Jet Injectors. Growth projections for each segment vary based on technological advancements, market acceptance, and cost-effectiveness. Competitive dynamics vary depending on the technological sophistication of each segment.

By Technology: Tethered Insulin Pump, Tubless Insulin Pump. The tubeless insulin pump segment shows higher growth potential due to improved patient experience and reduced complications.

By Component: Insulin Pump Device, Reservoir, Infusion Sets. Each component segment has its own market size and growth potential, with the insulin pump device representing the largest share.

Key Drivers of Europe Insulin Delivery Devices Market Growth

Several key factors drive the growth of the Europe Insulin Delivery Devices Market. The rising prevalence of diabetes is a primary driver, fuelled by lifestyle changes and an aging population. Technological advancements leading to safer and more user-friendly devices also contribute significantly. Favorable regulatory landscapes in several European countries are aiding market expansion, while improved reimbursement policies are increasing patient access to these life-enhancing technologies. Furthermore, increasing awareness campaigns and patient education about diabetes management are also contributing to this market growth.

Challenges in the Europe Insulin Delivery Devices Market Sector

Despite considerable growth opportunities, the market faces certain challenges. High costs associated with insulin delivery devices pose a significant barrier to broader access, particularly for patients in lower socioeconomic groups. Supply chain disruptions and fluctuating raw material prices can affect production and pricing. Furthermore, stringent regulatory hurdles and obtaining approvals for new products can increase the time-to-market, thus limiting growth potential. Finally, intense competition among established and emerging players necessitates continuous innovation and product differentiation to secure a strong market position.

Leading Players in the Europe Insulin Delivery Devices Market Market

- Becton Dickinson and Company

- Ypsomed

- Novo Nordisk AS

- Other

- Sanofi

- Eli Lilly and Company

- Insulet Corporation

- Medtronic PLC

Key Developments in Europe Insulin Delivery Devices Market Sector

October 2022: Medtronic launched the My Insights program for MiniMed 770G users, providing personalized diabetes management tips via data analysis. This reflects a growing trend towards personalized medicine and the leveraging of data-driven insights for improved patient care.

April 2022: CamDiab and Ypsomed partnered to develop an integrated automated insulin delivery (AID) system. This highlights the increasing collaboration among companies to create innovative and seamless solutions for diabetes management. The focus on automated insulin delivery further emphasizes the move towards improved convenience and precision in therapy.

Strategic Europe Insulin Delivery Devices Market Market Outlook

The future of the European insulin delivery devices market is promising. Continued technological innovations, focusing on AI-powered automated insulin delivery, improved sensor accuracy, and enhanced connectivity, will significantly expand market opportunities. Growing awareness and supportive regulatory environments will drive market penetration and adoption rates. Strategic partnerships and collaborations will play a crucial role in shaping the market landscape, driving further innovation and market growth. The market is poised for significant expansion in the coming years, offering considerable growth potential for both established players and new entrants.

Europe Insulin Delivery Devices Market Segmentation

-

1. Device

- 1.1. Insulin Pumps

- 1.2. Insulin Syringes

- 1.3. Insulin Pens

- 1.4. Jet Injectors

-

2. Technology

- 2.1. Continuous Glucose Monitoring

- 2.2. Automated Insulin Delivery

- 2.3. Sensor-Augmented Insulin Pumps

-

3. Components

- 3.1. Insulin Pump Device

- 3.2. Reservoir

- 3.3. Infusion Sets

Europe Insulin Delivery Devices Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Russia

- 5. Spain

- 6. United Kingdom

- 7. Rest of Europe

Europe Insulin Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Insulin Pump segment is expected to witness highest growth during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Insulin Pumps

- 5.1.2. Insulin Syringes

- 5.1.3. Insulin Pens

- 5.1.4. Jet Injectors

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Continuous Glucose Monitoring

- 5.2.2. Automated Insulin Delivery

- 5.2.3. Sensor-Augmented Insulin Pumps

- 5.3. Market Analysis, Insights and Forecast - by Components

- 5.3.1. Insulin Pump Device

- 5.3.2. Reservoir

- 5.3.3. Infusion Sets

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.4.2. Germany

- 5.4.3. Italy

- 5.4.4. Russia

- 5.4.5. Spain

- 5.4.6. United Kingdom

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. France Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Insulin Pumps

- 6.1.2. Insulin Syringes

- 6.1.3. Insulin Pens

- 6.1.4. Jet Injectors

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Continuous Glucose Monitoring

- 6.2.2. Automated Insulin Delivery

- 6.2.3. Sensor-Augmented Insulin Pumps

- 6.3. Market Analysis, Insights and Forecast - by Components

- 6.3.1. Insulin Pump Device

- 6.3.2. Reservoir

- 6.3.3. Infusion Sets

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Germany Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Insulin Pumps

- 7.1.2. Insulin Syringes

- 7.1.3. Insulin Pens

- 7.1.4. Jet Injectors

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Continuous Glucose Monitoring

- 7.2.2. Automated Insulin Delivery

- 7.2.3. Sensor-Augmented Insulin Pumps

- 7.3. Market Analysis, Insights and Forecast - by Components

- 7.3.1. Insulin Pump Device

- 7.3.2. Reservoir

- 7.3.3. Infusion Sets

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Italy Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Insulin Pumps

- 8.1.2. Insulin Syringes

- 8.1.3. Insulin Pens

- 8.1.4. Jet Injectors

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Continuous Glucose Monitoring

- 8.2.2. Automated Insulin Delivery

- 8.2.3. Sensor-Augmented Insulin Pumps

- 8.3. Market Analysis, Insights and Forecast - by Components

- 8.3.1. Insulin Pump Device

- 8.3.2. Reservoir

- 8.3.3. Infusion Sets

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Russia Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Insulin Pumps

- 9.1.2. Insulin Syringes

- 9.1.3. Insulin Pens

- 9.1.4. Jet Injectors

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Continuous Glucose Monitoring

- 9.2.2. Automated Insulin Delivery

- 9.2.3. Sensor-Augmented Insulin Pumps

- 9.3. Market Analysis, Insights and Forecast - by Components

- 9.3.1. Insulin Pump Device

- 9.3.2. Reservoir

- 9.3.3. Infusion Sets

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Spain Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device

- 10.1.1. Insulin Pumps

- 10.1.2. Insulin Syringes

- 10.1.3. Insulin Pens

- 10.1.4. Jet Injectors

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Continuous Glucose Monitoring

- 10.2.2. Automated Insulin Delivery

- 10.2.3. Sensor-Augmented Insulin Pumps

- 10.3. Market Analysis, Insights and Forecast - by Components

- 10.3.1. Insulin Pump Device

- 10.3.2. Reservoir

- 10.3.3. Infusion Sets

- 10.1. Market Analysis, Insights and Forecast - by Device

- 11. United Kingdom Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Device

- 11.1.1. Insulin Pumps

- 11.1.2. Insulin Syringes

- 11.1.3. Insulin Pens

- 11.1.4. Jet Injectors

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Continuous Glucose Monitoring

- 11.2.2. Automated Insulin Delivery

- 11.2.3. Sensor-Augmented Insulin Pumps

- 11.3. Market Analysis, Insights and Forecast - by Components

- 11.3.1. Insulin Pump Device

- 11.3.2. Reservoir

- 11.3.3. Infusion Sets

- 11.1. Market Analysis, Insights and Forecast - by Device

- 12. Rest of Europe Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Device

- 12.1.1. Insulin Pumps

- 12.1.2. Insulin Syringes

- 12.1.3. Insulin Pens

- 12.1.4. Jet Injectors

- 12.2. Market Analysis, Insights and Forecast - by Technology

- 12.2.1. Continuous Glucose Monitoring

- 12.2.2. Automated Insulin Delivery

- 12.2.3. Sensor-Augmented Insulin Pumps

- 12.3. Market Analysis, Insights and Forecast - by Components

- 12.3.1. Insulin Pump Device

- 12.3.2. Reservoir

- 12.3.3. Infusion Sets

- 12.1. Market Analysis, Insights and Forecast - by Device

- 13. Germany Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Insulin Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Becton Dickinson and Company

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Ypsomed

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Novo Nordisk AS

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Other

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Sanofi

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Eli Lilly and Company

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Insulet Corporation

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Medtronic PLC

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Europe Insulin Delivery Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Insulin Delivery Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 4: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 5: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 7: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 8: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 9: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Germany Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Germany Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: France Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Netherlands Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Sweden Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Europe Insulin Delivery Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Europe Insulin Delivery Devices Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 28: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 29: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 30: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 31: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 32: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 33: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 36: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 37: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 38: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 39: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 40: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 41: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 44: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 45: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 46: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 47: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 48: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 49: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 52: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 53: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 54: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 55: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 56: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 57: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 59: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 60: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 61: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 62: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 63: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 64: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 65: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 68: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 69: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 70: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 71: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 72: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 73: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 75: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Device 2019 & 2032

- Table 76: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Device 2019 & 2032

- Table 77: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 78: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Technology 2019 & 2032

- Table 79: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Components 2019 & 2032

- Table 80: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Components 2019 & 2032

- Table 81: Europe Insulin Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Europe Insulin Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insulin Delivery Devices Market?

The projected CAGR is approximately 1.90%.

2. Which companies are prominent players in the Europe Insulin Delivery Devices Market?

Key companies in the market include Becton Dickinson and Company, Ypsomed, Novo Nordisk AS, Other, Sanofi, Eli Lilly and Company, Insulet Corporation, Medtronic PLC.

3. What are the main segments of the Europe Insulin Delivery Devices Market?

The market segments include Device, Technology, Components.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.83 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Insulin Pump segment is expected to witness highest growth during the forecast period.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

October 2022: Medtronic introduced a new program called My Insights, which is exclusively made for individuals using the MiniMed 770G system. Using an individual's data, My Insights relies on the power of data science to provide personalized tips, trends, and reminders that customers can use to help with their diabetes management goals. My Insights personalized recommendations are shared via a monthly email with educational content that is most relevant to what an individual may currently be experiencing. This is the first program in diabetes management that goes beyond generalized tips and instead shares personalized suggestions using data from an integrated pump system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insulin Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insulin Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insulin Delivery Devices Market?

To stay informed about further developments, trends, and reports in the Europe Insulin Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence