Key Insights

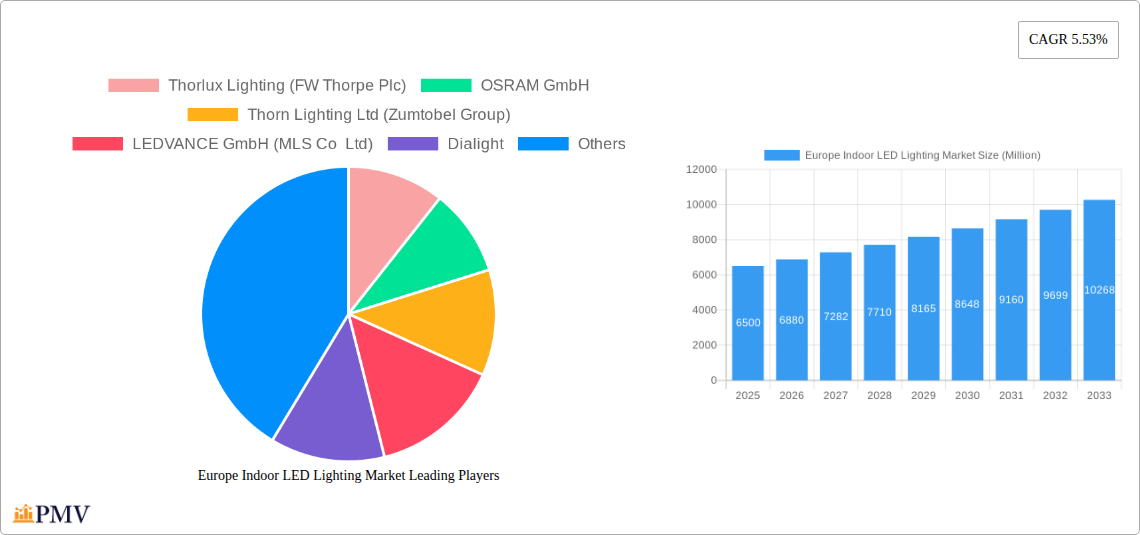

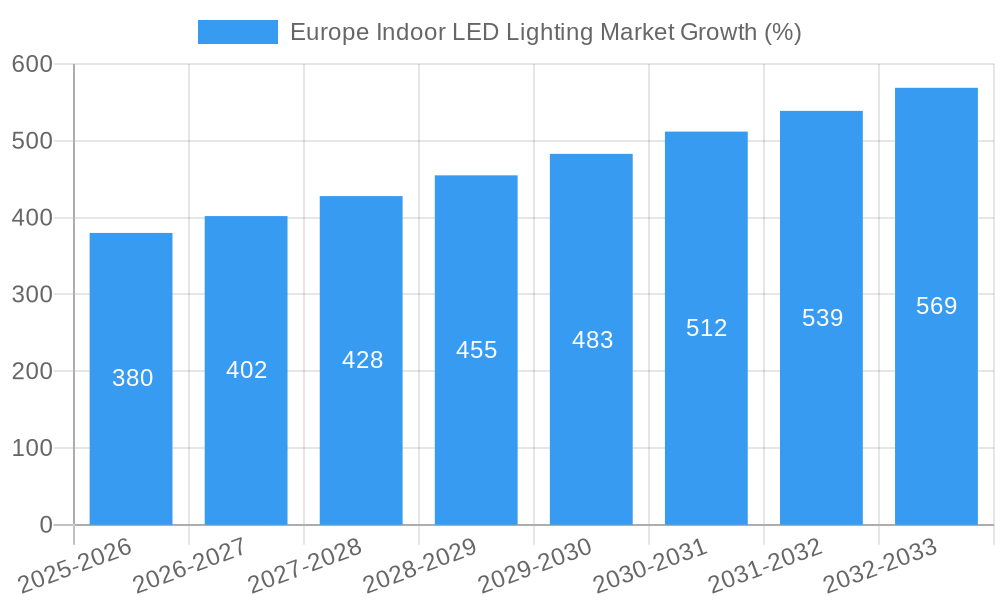

The European indoor LED lighting market is experiencing robust growth, driven by increasing energy efficiency regulations, rising consumer awareness of environmental benefits, and the sustained replacement of traditional lighting technologies with energy-saving LEDs. The market size, estimated at €[Insert Estimated 2025 Market Size in Millions based on CAGR and other information. A reasonable estimate might be in the range of €5-8 Billion, depending on the missing "XX" value] million in 2025, is projected to expand at a compound annual growth rate (CAGR) of 5.53% from 2025 to 2033. This growth is fueled by several key trends, including the smart home revolution, increasing adoption of LED lighting in commercial spaces (driven by reduced operational costs), and the burgeoning agricultural sector's demand for advanced lighting solutions to optimize crop yields. Key segments within the market show varying growth trajectories. For example, agricultural lighting is anticipated to experience faster growth due to technological advancements enabling precise light spectrum control for enhanced plant growth. The residential segment, while substantial, may see comparatively slower growth due to longer replacement cycles of existing lighting fixtures. Germany, France, and the United Kingdom represent the largest national markets within Europe, but other countries in the region are also showing significant potential for growth, contributing to the overall market expansion.

Market restraints include the relatively higher initial investment cost of LED lighting compared to traditional options, although this is rapidly offset by long-term energy savings. Furthermore, concerns around potential health effects from blue light emission from certain LED types, and the need for ongoing technological advancements to address issues like light decay and color consistency, present challenges to be addressed by manufacturers. The competitive landscape is characterized by a mix of global giants like Signify (Philips) and OSRAM, and regional players focusing on specific niches. This creates a dynamic market where both innovation and cost-effectiveness play crucial roles in determining market share and future growth. The forecast period to 2033 indicates continued market expansion, underpinned by consistent technological improvement and growing regulatory pressure to adopt energy-efficient solutions.

This in-depth report provides a comprehensive analysis of the Europe Indoor LED Lighting market, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. Key market segments, leading players, and recent industry developments are meticulously examined to provide a clear picture of the current state and future trajectory of the market. Expected market value for 2025 is estimated at xx Million.

Europe Indoor LED Lighting Market Market Structure & Competitive Dynamics

The Europe Indoor LED Lighting market exhibits a moderately consolidated structure with several key players commanding significant market share. Thorlux Lighting (FW Thorpe Plc), OSRAM GmbH, Thorn Lighting Ltd (Zumtobel Group), LEDVANCE GmbH (MLS Co Ltd), Dialight, NVC International Holdings Limited, TRILUX GmbH & Co K, EGLO Leuchten GmbH, Signify (Philips), and Panasonic Holdings Corporation are among the dominant players. Market concentration is influenced by factors including technological innovation, brand recognition, and economies of scale.

The market's innovation ecosystem is highly dynamic, characterized by continuous advancements in LED technology, including improvements in energy efficiency, lifespan, and color rendering. Regulatory frameworks, such as those focused on energy efficiency and environmental sustainability, play a significant role in shaping market trends. The presence of substitute lighting technologies, such as OLEDs, creates competitive pressure. End-user trends, particularly the growing preference for energy-efficient and smart lighting solutions, are driving market growth. M&A activity within the sector is relatively frequent, with deal values varying depending on the size and strategic importance of the acquired companies. For instance, in the period 2019-2024, there were approximately xx M&A deals totaling approximately xx Million, with an average deal size of xx Million. The highest valued deal in this period was xx Million.

- Market Concentration: Moderately Consolidated

- Innovation Ecosystem: Highly Dynamic

- Regulatory Framework: Increasingly Stringent

- Product Substitutes: OLEDs

- End-User Trends: Growing Demand for Energy Efficiency and Smart Lighting

- M&A Activity: Frequent, with deal values ranging from xx Million to xx Million

Europe Indoor LED Lighting Market Industry Trends & Insights

The Europe Indoor LED Lighting market is experiencing robust growth, driven by several key factors. The increasing adoption of energy-efficient lighting solutions is a major driver, fueled by government regulations and rising energy costs. Technological advancements, such as the development of high-efficacy LEDs and smart lighting technologies, are further propelling market expansion. Consumer preferences are shifting towards aesthetically pleasing and customizable lighting solutions, which is influencing product design and innovation. The market also benefits from increasing investments in infrastructure projects, particularly in commercial and industrial sectors. However, economic fluctuations and geopolitical events could impact market growth. The CAGR for the Europe Indoor LED lighting market during the forecast period (2025-2033) is projected to be xx%, with market penetration expected to reach xx% by 2033.

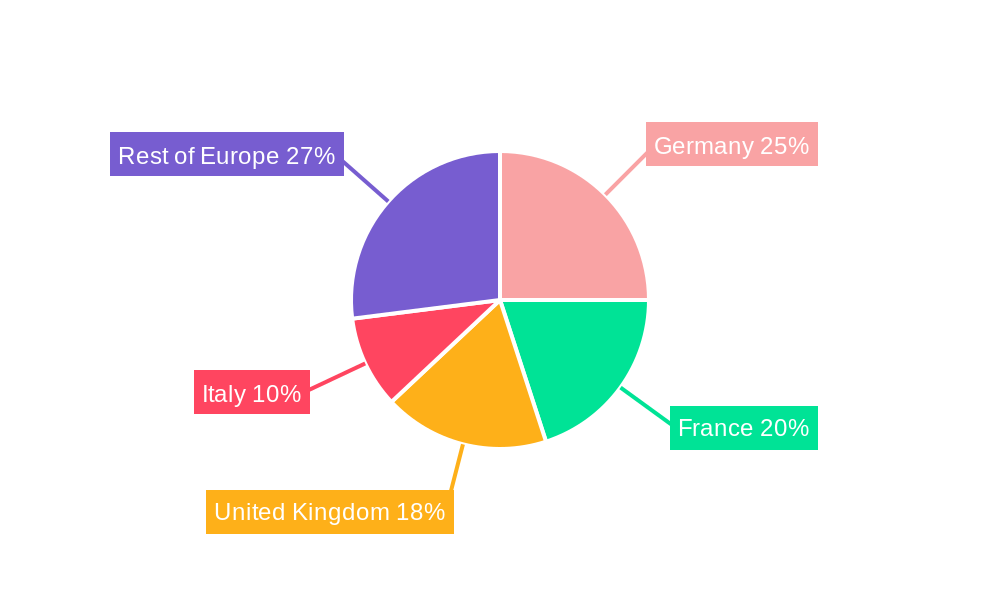

Dominant Markets & Segments in Europe Indoor LED Lighting Market

The Europe Indoor LED Lighting market is geographically diverse, with significant variations in market size and growth rates across different regions and countries. Germany, the United Kingdom, and France represent the largest markets within Europe.

- Germany: Strong industrial base, stringent energy efficiency regulations, and high adoption of smart technologies drive market growth.

- United Kingdom: Growing emphasis on sustainable building practices and government initiatives promoting energy savings.

- France: Significant investments in infrastructure and increasing awareness of energy efficiency contribute to market expansion.

- Rest of Europe: A mix of growth rates driven by varying economic conditions, adoption of new technologies, and government policies.

The commercial segment currently dominates the Indoor Lighting market, followed by industrial and warehouse lighting. Residential segment is showing gradual growth, driven by the increasing affordability and availability of LED lighting products. The agricultural lighting sector is expected to witness significant growth due to increasing adoption of LED grow lights in controlled environment agriculture.

- Key Drivers (Germany): Stringent energy efficiency regulations, high technological adoption, robust industrial base.

- Key Drivers (UK): Government initiatives, emphasis on sustainable building practices.

- Key Drivers (France): Infrastructure investments, growing energy efficiency awareness.

- Key Drivers (Agricultural Lighting): Controlled environment agriculture, increased yield, improved plant growth.

Europe Indoor LED Lighting Market Product Innovations

Recent product innovations in the Europe Indoor LED Lighting market focus on enhancing energy efficiency, improving light quality (CRI), and integrating smart features. Companies are launching new LED chips with higher lumen output and longer lifespans. The introduction of tunable white LED solutions allows customization of light color and intensity, catering to diverse user preferences. The integration of IoT capabilities enables remote control and monitoring of lighting systems, increasing convenience and energy savings. These innovations are enhancing the market competitiveness and addressing the evolving needs of consumers.

Report Segmentation & Scope

This report segments the Europe Indoor LED Lighting market based on lighting type (Indoor Lighting: Agricultural, Commercial, Industrial & Warehouse, Residential) and geography (France, Germany, UK, Rest of Europe). The report provides detailed analysis of each segment, including historical data (2019-2024), current market size (2025), and future projections (2025-2033). Growth projections vary across segments, reflecting diverse market dynamics. The competitive landscape is analyzed for each segment, identifying key players and their respective market strategies.

Key Drivers of Europe Indoor LED Lighting Market Growth

Several key factors fuel the growth of the Europe Indoor LED Lighting market: stringent government regulations promoting energy efficiency (e.g., EU's Ecodesign Directive), decreasing LED prices, increasing consumer awareness of energy savings and environmental sustainability, and technological advancements leading to improved LED performance (higher efficacy, better color rendering, longer lifespan). Furthermore, the growing adoption of smart lighting systems and IoT integration contributes to market expansion.

Challenges in the Europe Indoor LED Lighting Market Sector

The Europe Indoor LED Lighting market faces several challenges. Supply chain disruptions can impact the availability and cost of LED components. Intense competition among established players and new entrants puts downward pressure on prices. Stringent environmental regulations necessitate compliance costs, affecting profitability. Moreover, consumer resistance to change and a lack of awareness about the benefits of LED lighting in certain segments (e.g., residential) can hinder market growth.

Leading Players in the Europe Indoor LED Lighting Market Market

- Thorlux Lighting (FW Thorpe Plc)

- OSRAM GmbH

- Thorn Lighting Ltd (Zumtobel Group)

- LEDVANCE GmbH (MLS Co Ltd)

- Dialight

- NVC International Holdings Limited

- TRILUX GmbH & Co K

- EGLO Leuchten GmbH

- Signify (Philips)

- Panasonic Holdings Corporation

Key Developments in Europe Indoor LED Lighting Market Sector

- July 2023: OSRAM introduced Osconiq E 2835 CRI 90 (QD), a new mid-power LED with high efficiency (over 200 lm/W) and excellent color rendering. This expands OSRAM's portfolio and strengthens its position in the high-quality LED market.

- May 2023: Osram announced the OSLON Optimum family of LEDs, designed for horticulture lighting, offering high efficiency, reliable performance, and cost-effectiveness. This strengthens Osram's presence in the growing agricultural lighting segment.

- April 2023: Launch of Novaline Style, a stylish circular luminaire providing diffuse and subtle backlight, expanding product options in the commercial segment and targeting design-conscious consumers.

Strategic Europe Indoor LED Lighting Market Market Outlook

The Europe Indoor LED Lighting market presents significant growth opportunities, driven by continued technological advancements, increasing demand for energy-efficient solutions, and supportive government policies. Strategic players should focus on developing innovative and energy-efficient products, expanding their product portfolio to cater to diverse market segments (e.g., smart lighting, horticultural lighting), and investing in research and development to maintain a competitive edge. The market's potential lies in capitalizing on emerging trends such as smart lighting integration, IoT connectivity, and the expanding agricultural lighting sector.

Europe Indoor LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

Europe Indoor LED Lighting Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Indoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Deployments Bolster the Market Growth; High Regional Demand for Broadband

- 3.3. Market Restrains

- 3.3.1. Lack of awareness about serious games among end-users

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. Germany Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Thorlux Lighting (FW Thorpe Plc)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 OSRAM GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Thorn Lighting Ltd (Zumtobel Group)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LEDVANCE GmbH (MLS Co Ltd)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Dialight

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 NVC International Holdings Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 TRILUX GmbH & Co K

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 EGLO Leuchten GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Signify (Philips)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Thorlux Lighting (FW Thorpe Plc)

List of Figures

- Figure 1: Europe Indoor LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Indoor LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 3: Europe Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 13: Europe Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Indoor LED Lighting Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Europe Indoor LED Lighting Market?

Key companies in the market include Thorlux Lighting (FW Thorpe Plc), OSRAM GmbH, Thorn Lighting Ltd (Zumtobel Group), LEDVANCE GmbH (MLS Co Ltd), Dialight, NVC International Holdings Limited, TRILUX GmbH & Co K, EGLO Leuchten GmbH, Signify (Philips), Panasonic Holdings Corporation.

3. What are the main segments of the Europe Indoor LED Lighting Market?

The market segments include Indoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5G Deployments Bolster the Market Growth; High Regional Demand for Broadband.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of awareness about serious games among end-users.

8. Can you provide examples of recent developments in the market?

July 2023: OSRAM introduced Osconiq E 2835 CRI 90 (QD) that expands ams OSRAM's portfolio of lighting solutions that provide prominent quality in a new mid-power LED. Its In-house Quantum Dot technology ensures outstanding efficiency values of over 200 lm/W, even at high color rendering indices (CRI).May 2023: Osram announced the release of the OSLON Optimum family of LEDs in May 2022. These LEDs are based on the most recent ams Osram 1mm2 chip and are designed for horticulture lighting. They offer an exceptional combination of high efficiency, dependable performance, and great value.April 2023: The company launched Novaline Style - elegant and slim circular luminaire that provides diffuse light from the front and a subtle 10% backlight.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Indoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Indoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Indoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the Europe Indoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence