Key Insights

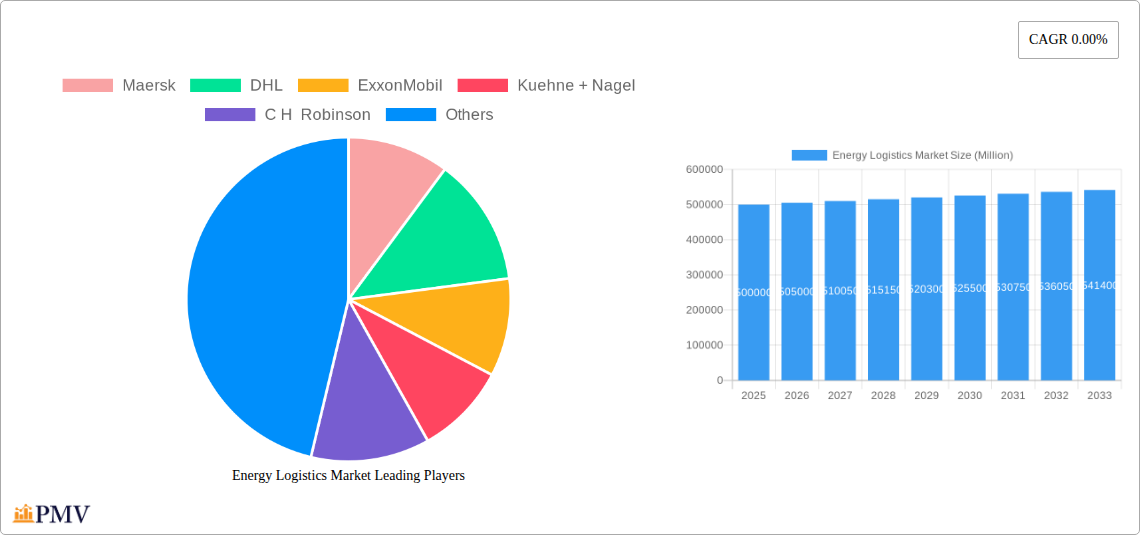

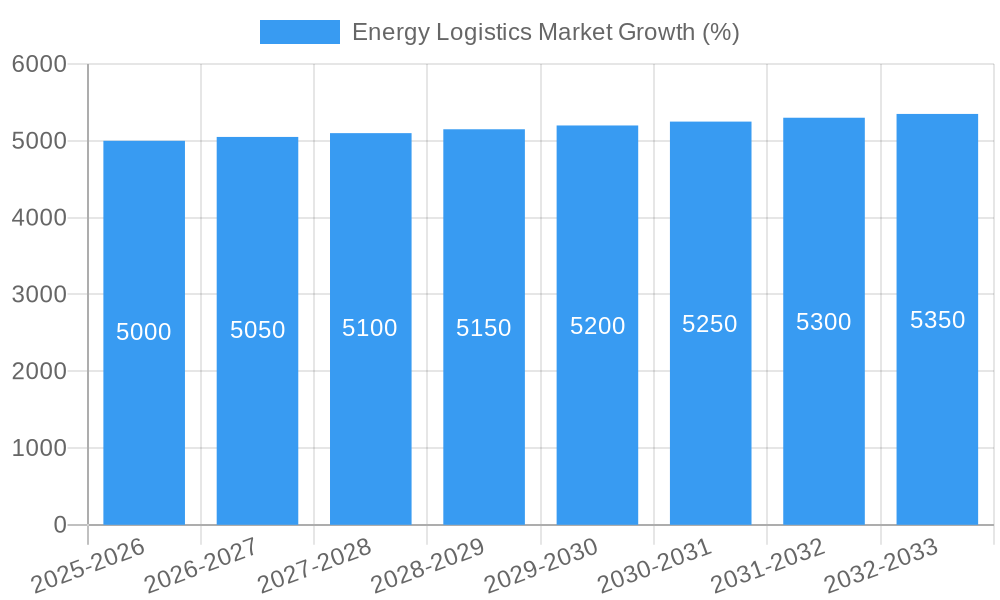

The energy logistics market, encompassing the transportation and storage of energy resources, is a dynamic sector experiencing moderate growth. While a precise market size for 2025 is unavailable, a reasonable estimation, considering the involvement of major players like Maersk, DHL, and ExxonMobil, and the significant global energy demand, would place the market value in the hundreds of billions of dollars. The near-zero CAGR suggests a period of stabilization rather than explosive growth, likely driven by existing infrastructure capacity and mature operational processes. However, several factors influence market trends. The increasing demand for renewable energy sources like solar and wind, necessitates specialized logistical solutions, driving segment growth in renewable energy transportation. Similarly, the expansion of power generation and energy mining projects in developing economies, particularly within Asia-Pacific, presents significant opportunities. Conversely, fluctuating energy prices and geopolitical uncertainties represent major constraints, impacting investment decisions and potentially slowing market expansion. The market is segmented by application (oil & gas, renewable energy, power generation, energy mining), end-user (government and private sectors), and mode of transport (railways, airways, roadways, waterways), offering diverse avenues for growth depending on specific market conditions and technological advancements. The dominance of established players like Maersk and DHL underscores the importance of established supply chains and infrastructure in this sector, and also hints at a potential barrier to entry for new businesses.

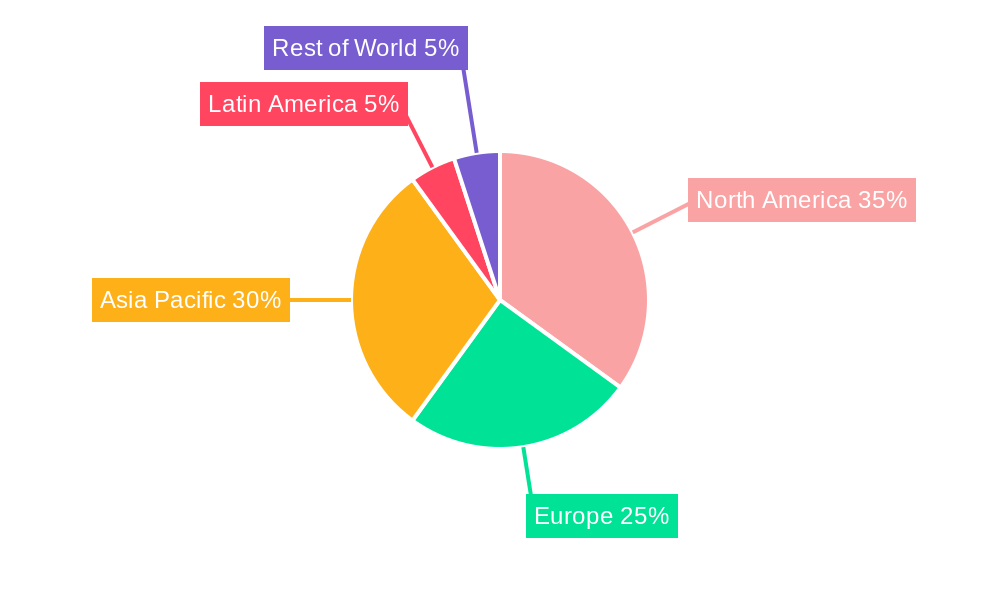

The forecast period (2025-2033) will likely see steady growth fueled by the ongoing energy transition, though this might not translate into a dramatic CAGR increase. Technological advancements, such as the adoption of more efficient transport methods and improved logistics technologies, will be pivotal in optimizing operational efficiencies and reducing costs. Furthermore, the growing awareness of environmental concerns will likely influence the selection of transportation modes, with a potential increase in the demand for sustainable transport options. Regional variations will persist, with North America and Asia-Pacific potentially leading in terms of market size, driven by energy production and consumption patterns. Effective risk management strategies regarding geopolitical instability and fuel price volatility will be critical for companies operating within this sector to ensure long-term sustainability and profitability.

Energy Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Energy Logistics Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on the 2025-2033 forecast, this report delivers a detailed overview of market structure, competitive dynamics, key trends, and growth opportunities. The study utilizes data from the historical period (2019-2024) and a base year of 2025 to project future market trends. The report segments the market by application (Oil & Gas, Renewable Energy, Power Generation, Energy Mining), end-user (Government Sector, Private Sector), and mode of transport (Railways, Airways, Roadways, Waterways), providing granular analysis for informed decision-making.

Energy Logistics Market Market Structure & Competitive Dynamics

The Energy Logistics Market exhibits a moderately concentrated structure, with several major players holding significant market share. Key players like Maersk, DHL, ExxonMobil, Kuehne + Nagel, C.H. Robinson, COSCO Shipping Lines, Chevron, Mediterranean Shipping Company (MSC), BP, and TransCanada, alongside 73 other companies, compete intensely. Market concentration is further analyzed through the Herfindahl-Hirschman Index (HHI), revealing a value of xx, indicating a (competitive/oligopolistic/monopolistic) market structure. Innovation in logistics technologies, such as blockchain for supply chain transparency and AI for route optimization, is driving competition. Stringent regulatory frameworks concerning environmental compliance and safety standards significantly influence operational costs and strategies. The market experiences moderate substitution with alternative transportation methods and energy sources impacting market share. End-user preferences are shifting towards sustainable and efficient logistics solutions. M&A activities in the sector reached a value of xx Million in 2024, with a projected xx Million in 2025, primarily driven by companies seeking to expand their geographic reach and service portfolio. Market share data for key players is presented below:

- Maersk: xx%

- DHL: xx%

- ExxonMobil: xx%

- Kuehne + Nagel: xx%

- C.H. Robinson: xx%

- COSCO Shipping Lines: xx%

- Chevron: xx%

- MSC: xx%

- BP: xx%

- TransCanada: xx%

Energy Logistics Market Industry Trends & Insights

The Energy Logistics Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is driven by increasing global energy demand, particularly in emerging economies, and the expansion of renewable energy sources. Technological advancements, such as autonomous vehicles and drone delivery, are transforming logistics operations, enhancing efficiency and reducing costs. However, geopolitical instability, fluctuating fuel prices, and environmental regulations pose challenges. Consumer preference for sustainable and transparent supply chains is also impacting market dynamics. The market penetration of advanced logistics technologies is estimated at xx% in 2025, expected to reach xx% by 2033. Competitive dynamics are characterized by strategic alliances, technological innovation, and a focus on offering customized solutions to meet diverse end-user needs. The shift towards digitalization is significantly influencing the industry, enhancing visibility, and optimizing supply chain management. This trend is further accelerated by increasing adoption of IoT and Big Data Analytics. The focus on reducing carbon footprint and promoting environmental sustainability is another notable trend, driving demand for eco-friendly transportation and logistics solutions.

Dominant Markets & Segments in Energy Logistics Market

The Oil & Gas segment currently dominates the Energy Logistics Market by application, accounting for xx% of the total market value in 2025. This dominance is attributed to the substantial volume of oil and gas transported globally. However, the Renewable Energy segment exhibits the highest growth potential, with a projected CAGR of xx% during the forecast period. The Private Sector holds the largest market share by end-user, driven by the significant logistics needs of energy companies. Roadways remain the dominant mode of transport due to widespread infrastructure and accessibility, but the Waterways segment is expected to show considerable growth, driven by cost efficiency for long-distance transportation.

- Key Drivers for Oil & Gas Dominance: High energy demand, established infrastructure, and extensive global trade networks.

- Key Drivers for Renewable Energy Growth: Government incentives, increasing environmental awareness, and technological advancements.

- Key Drivers for Private Sector Dominance: Extensive operations of energy companies and third-party logistics providers.

- Key Drivers for Roadways Dominance: Extensive road networks, flexibility, and accessibility.

- Key Drivers for Waterways Growth: Cost efficiency for bulk transportation, environmental considerations, and infrastructural developments.

North America currently holds the largest market share by region, owing to its robust energy sector and developed logistics infrastructure. However, Asia-Pacific is projected to witness the fastest growth due to rapid industrialization and rising energy consumption.

Energy Logistics Market Product Innovations

Recent product innovations focus on enhancing efficiency, sustainability, and security within energy logistics. This includes the adoption of real-time tracking systems, advanced analytics for route optimization, and the integration of blockchain technology for enhanced supply chain transparency. Autonomous vehicles and drones are emerging as key technological trends, promising to revolutionize the sector. These innovations are enhancing market fit by reducing transportation costs, improving delivery times, and lowering the environmental impact. The development of specialized containers and handling equipment for the safe and efficient transport of various energy products are also contributing to market growth.

Report Segmentation & Scope

This report comprehensively segments the Energy Logistics Market by Application (Oil & Gas, Renewable Energy, Power Generation, Energy Mining), End-User (Government Sector, Private Sector), and Mode of Transport (Railways, Airways, Roadways, Waterways). Each segment's growth projections, market size estimations, and competitive dynamics are thoroughly analyzed. For instance, the Oil & Gas segment is anticipated to maintain a significant market share throughout the forecast period, driven by continuous demand. Conversely, the Renewable Energy segment is expected to demonstrate rapid growth, owing to government support and increasing environmental concerns. The Private sector dominates the end-user segment. Roadways presently leads in transportation modes, while Waterways are expected to grow significantly.

Key Drivers of Energy Logistics Market Growth

Several factors propel the Energy Logistics Market's growth. The increasing global energy demand, particularly from developing economies, necessitates efficient logistics solutions. Technological advancements, such as automation and digitalization, enhance operational efficiency and reduce costs. Favorable government policies and regulations supporting sustainable energy transportation further stimulate market expansion. The growing adoption of renewable energy sources necessitates specialized logistics solutions, driving market growth in this segment.

Challenges in the Energy Logistics Market Sector

The Energy Logistics Market faces significant challenges, including fluctuating fuel prices, which impact transportation costs. Stringent environmental regulations increase operational complexities and compliance costs. Supply chain disruptions caused by geopolitical instability and natural disasters can severely impact logistics operations. Intense competition from established players and emerging entrants also presents a challenge. These factors collectively constrain market growth to a certain extent.

Leading Players in the Energy Logistics Market Market

- Maersk

- DHL

- ExxonMobil

- Kuehne + Nagel

- C.H. Robinson

- COSCO Shipping Lines

- Chevron

- Mediterranean Shipping Company (MSC)

- BP

- TransCanada

- 73 Other Companies

Key Developments in Energy Logistics Market Sector

- January 2023: Maersk launches a new fleet of LNG-powered vessels, reducing carbon emissions.

- July 2022: DHL invests in a new automated warehouse facility for improved efficiency.

- October 2021: A major merger between two smaller energy logistics companies increases market consolidation.

Strategic Energy Logistics Market Market Outlook

The Energy Logistics Market presents substantial growth potential, fueled by rising energy demand and the transition to cleaner energy sources. Strategic opportunities exist in developing innovative technologies, expanding into emerging markets, and forging strategic partnerships. Companies focusing on sustainable solutions and digitalization are expected to gain a competitive advantage. The market's future hinges on adapting to technological advancements, regulatory changes, and evolving consumer preferences. The sector will see continued consolidation and diversification, presenting both challenges and opportunities for businesses of all sizes.

Energy Logistics Market Segmentation

-

1. Application

- 1.1. Oil & Gas

- 1.2. Renewable Energy

- 1.3. Power Generation

- 1.4. Energy Mining

-

2. End-User

- 2.1. Government Sector

- 2.2. Private Sector

-

3. Mode of Transport

- 3.1. Railways

- 3.2. Airways

- 3.3. Roadways

- 3.4. Waterways

Energy Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Energy Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. The Oil & Gas Segment is booming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil & Gas

- 5.1.2. Renewable Energy

- 5.1.3. Power Generation

- 5.1.4. Energy Mining

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Government Sector

- 5.2.2. Private Sector

- 5.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 5.3.1. Railways

- 5.3.2. Airways

- 5.3.3. Roadways

- 5.3.4. Waterways

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil & Gas

- 6.1.2. Renewable Energy

- 6.1.3. Power Generation

- 6.1.4. Energy Mining

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Government Sector

- 6.2.2. Private Sector

- 6.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 6.3.1. Railways

- 6.3.2. Airways

- 6.3.3. Roadways

- 6.3.4. Waterways

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil & Gas

- 7.1.2. Renewable Energy

- 7.1.3. Power Generation

- 7.1.4. Energy Mining

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Government Sector

- 7.2.2. Private Sector

- 7.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 7.3.1. Railways

- 7.3.2. Airways

- 7.3.3. Roadways

- 7.3.4. Waterways

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil & Gas

- 8.1.2. Renewable Energy

- 8.1.3. Power Generation

- 8.1.4. Energy Mining

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Government Sector

- 8.2.2. Private Sector

- 8.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 8.3.1. Railways

- 8.3.2. Airways

- 8.3.3. Roadways

- 8.3.4. Waterways

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil & Gas

- 9.1.2. Renewable Energy

- 9.1.3. Power Generation

- 9.1.4. Energy Mining

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Government Sector

- 9.2.2. Private Sector

- 9.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 9.3.1. Railways

- 9.3.2. Airways

- 9.3.3. Roadways

- 9.3.4. Waterways

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil & Gas

- 10.1.2. Renewable Energy

- 10.1.3. Power Generation

- 10.1.4. Energy Mining

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Government Sector

- 10.2.2. Private Sector

- 10.3. Market Analysis, Insights and Forecast - by Mode of Transport

- 10.3.1. Railways

- 10.3.2. Airways

- 10.3.3. Roadways

- 10.3.4. Waterways

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of Latin America

- 15. Rest of the World Energy Logistics Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Maersk

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 DHL

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ExxonMobil

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Kuehne + Nagel

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 C H Robinson

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 COSCO Shipping Lines

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Chevron

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mediterranean Shipping Company (MSC)

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 BP

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 TransCanada**List Not Exhaustive 7 3 Other Companie

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Maersk

List of Figures

- Figure 1: Global Energy Logistics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Rest of the World Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Rest of the World Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Energy Logistics Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Energy Logistics Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Energy Logistics Market Revenue (Million), by End-User 2024 & 2032

- Figure 15: North America Energy Logistics Market Revenue Share (%), by End-User 2024 & 2032

- Figure 16: North America Energy Logistics Market Revenue (Million), by Mode of Transport 2024 & 2032

- Figure 17: North America Energy Logistics Market Revenue Share (%), by Mode of Transport 2024 & 2032

- Figure 18: North America Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Energy Logistics Market Revenue (Million), by Application 2024 & 2032

- Figure 21: South America Energy Logistics Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Energy Logistics Market Revenue (Million), by End-User 2024 & 2032

- Figure 23: South America Energy Logistics Market Revenue Share (%), by End-User 2024 & 2032

- Figure 24: South America Energy Logistics Market Revenue (Million), by Mode of Transport 2024 & 2032

- Figure 25: South America Energy Logistics Market Revenue Share (%), by Mode of Transport 2024 & 2032

- Figure 26: South America Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 27: South America Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Europe Energy Logistics Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Europe Energy Logistics Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Energy Logistics Market Revenue (Million), by End-User 2024 & 2032

- Figure 31: Europe Energy Logistics Market Revenue Share (%), by End-User 2024 & 2032

- Figure 32: Europe Energy Logistics Market Revenue (Million), by Mode of Transport 2024 & 2032

- Figure 33: Europe Energy Logistics Market Revenue Share (%), by Mode of Transport 2024 & 2032

- Figure 34: Europe Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East & Africa Energy Logistics Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East & Africa Energy Logistics Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East & Africa Energy Logistics Market Revenue (Million), by End-User 2024 & 2032

- Figure 39: Middle East & Africa Energy Logistics Market Revenue Share (%), by End-User 2024 & 2032

- Figure 40: Middle East & Africa Energy Logistics Market Revenue (Million), by Mode of Transport 2024 & 2032

- Figure 41: Middle East & Africa Energy Logistics Market Revenue Share (%), by Mode of Transport 2024 & 2032

- Figure 42: Middle East & Africa Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East & Africa Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Asia Pacific Energy Logistics Market Revenue (Million), by Application 2024 & 2032

- Figure 45: Asia Pacific Energy Logistics Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Asia Pacific Energy Logistics Market Revenue (Million), by End-User 2024 & 2032

- Figure 47: Asia Pacific Energy Logistics Market Revenue Share (%), by End-User 2024 & 2032

- Figure 48: Asia Pacific Energy Logistics Market Revenue (Million), by Mode of Transport 2024 & 2032

- Figure 49: Asia Pacific Energy Logistics Market Revenue Share (%), by Mode of Transport 2024 & 2032

- Figure 50: Asia Pacific Energy Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Asia Pacific Energy Logistics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Energy Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Energy Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Energy Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Global Energy Logistics Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 5: Global Energy Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United Kingdom Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Energy Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Energy Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 29: Global Energy Logistics Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 30: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Mexico Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Energy Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Energy Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Global Energy Logistics Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 37: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Brazil Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Argentina Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Energy Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Energy Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 43: Global Energy Logistics Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 44: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: United Kingdom Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: France Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Spain Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Russia Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Benelux Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Nordics Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Global Energy Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Energy Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 56: Global Energy Logistics Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 57: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Turkey Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Israel Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: GCC Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: North Africa Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: South Africa Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Middle East & Africa Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Energy Logistics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 65: Global Energy Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 66: Global Energy Logistics Market Revenue Million Forecast, by Mode of Transport 2019 & 2032

- Table 67: Global Energy Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 68: China Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: India Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Japan Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: South Korea Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: ASEAN Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Oceania Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Asia Pacific Energy Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Energy Logistics Market?

The projected CAGR is approximately 0.00%.

2. Which companies are prominent players in the Energy Logistics Market?

Key companies in the market include Maersk, DHL, ExxonMobil, Kuehne + Nagel, C H Robinson, COSCO Shipping Lines, Chevron, Mediterranean Shipping Company (MSC), BP, TransCanada**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Energy Logistics Market?

The market segments include Application, End-User, Mode of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

The Oil & Gas Segment is booming.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Energy Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Energy Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Energy Logistics Market?

To stay informed about further developments, trends, and reports in the Energy Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence