Key Insights

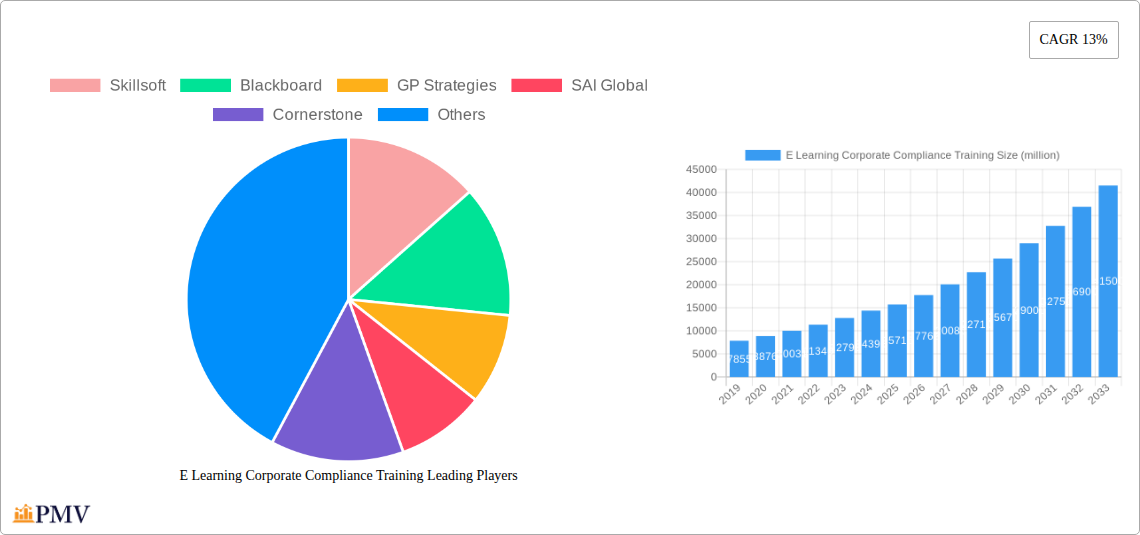

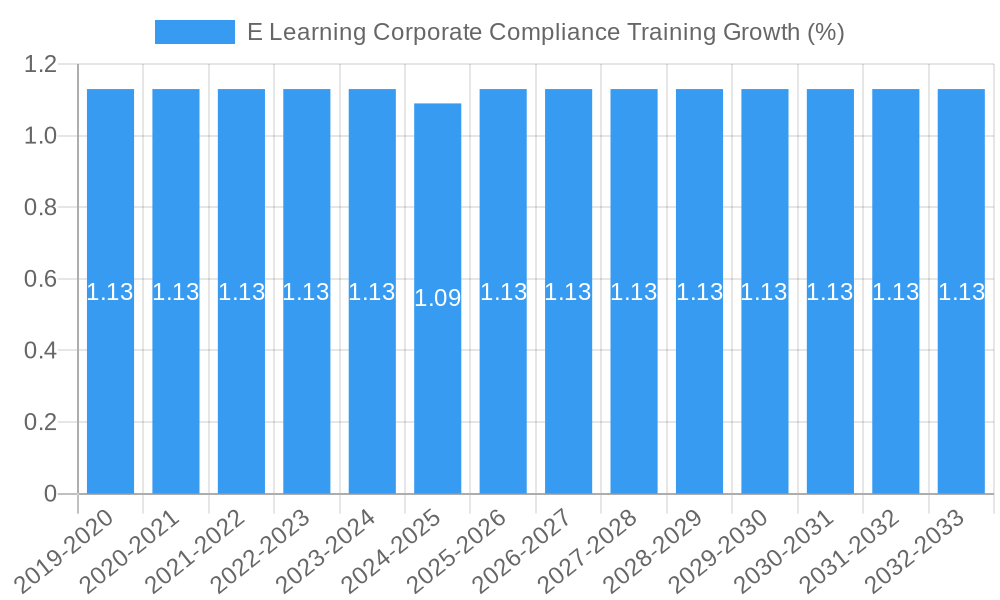

The global E-learning Corporate Compliance Training market is poised for significant expansion, projected to reach a substantial market size of USD 15,710 million by 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 13% throughout the forecast period. The increasing complexity of regulatory landscapes across industries, coupled with a heightened awareness of the detrimental effects of non-compliance, are primary drivers of this upward trajectory. Organizations are increasingly investing in robust compliance training programs to mitigate legal risks, safeguard their reputation, and foster ethical work environments. The shift towards digital learning solutions offers scalable, cost-effective, and accessible training options, making it an attractive choice for businesses of all sizes. This trend is further amplified by the growing demand for specialized training in areas such as cybersecurity, data privacy (GDPR, CCPA), and diversity and inclusion, reflecting evolving societal expectations and regulatory mandates.

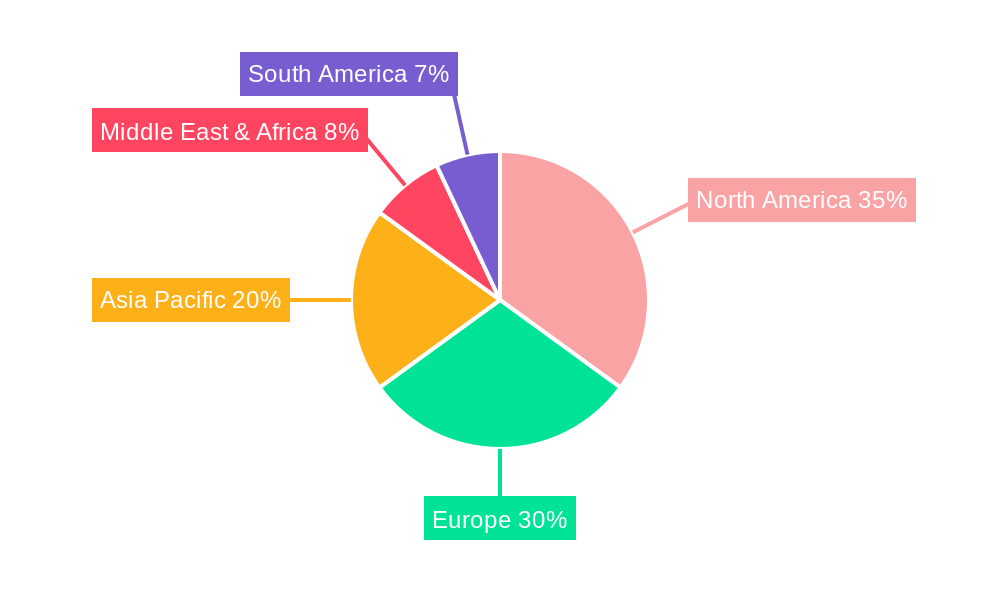

The market segmentation highlights the diverse needs within corporate compliance training. Application segments like Information Security Training, Regulatory Compliance Training, and Cyber Security Training are expected to witness substantial demand as data breaches and cyber threats become more prevalent. Similarly, Sexual Harassment Training and Diversity Training are gaining prominence as companies prioritize creating inclusive and safe workplaces. The "Blended" and "Online" training types are dominating the landscape, offering flexibility and personalized learning experiences that cater to a globally dispersed workforce. Key players such as Skillsoft, Blackboard, and GP Strategies are at the forefront of innovation, offering comprehensive e-learning platforms and content. Geographically, North America and Europe are expected to lead the market, driven by stringent regulatory frameworks and high adoption rates of e-learning technologies. However, the Asia Pacific region presents a significant growth opportunity due to its expanding economies and increasing focus on corporate governance.

E Learning Corporate Compliance Training Market Report Description

This comprehensive E Learning Corporate Compliance Training market research report delves into the evolving landscape of online compliance education for businesses. Covering the historical period of 2019–2024, the base year of 2025, and an extensive forecast period spanning 2025–2033, this report offers unparalleled insights into market structure, competitive dynamics, key trends, dominant segments, product innovations, growth drivers, challenges, and strategic outlooks. With a focus on actionable data and high-ranking keywords, this report is an essential resource for stakeholders seeking to understand and capitalize on the booming corporate e-learning compliance sector.

E Learning Corporate Compliance Training Market Structure & Competitive Dynamics

The E Learning Corporate Compliance Training market exhibits a moderately concentrated structure, with a blend of large, established players and a growing number of specialized niche providers. The innovation ecosystem is robust, fueled by advancements in learning management systems (LMS), artificial intelligence (AI) for personalized learning paths, and immersive technologies like virtual reality (VR) for practical scenario-based training. Regulatory frameworks globally are increasingly stringent, driving consistent demand for compliance education, thereby influencing market expansion. Product substitutes, such as in-person workshops and internal training programs, exist but often fall short in scalability, cost-effectiveness, and tracking capabilities compared to e-learning solutions. End-user trends highlight a growing preference for flexible, on-demand learning accessible across devices, pushing providers to develop mobile-first solutions. Mergers and acquisitions (M&A) activities are significant, with deal values often reaching into the hundreds of millions as larger entities seek to consolidate market share and acquire innovative technologies or specialized content. For instance, recent M&A activity has seen deal values ranging from $50 million to $300 million, indicating a trend towards consolidation and strategic acquisition of complementary services. Market share distribution is dynamic, with leading companies holding substantial portions, but emerging players are gaining traction through niche specialization.

E Learning Corporate Compliance Training Industry Trends & Insights

The E Learning Corporate Compliance Training industry is experiencing robust growth, driven by several interconnected trends and insights. A primary growth driver is the escalating complexity of global regulatory landscapes and the increased enforcement actions by governmental bodies across various sectors. Companies are prioritizing compliance to avoid substantial fines, reputational damage, and legal repercussions, making robust and continuous training a necessity. The Compound Annual Growth Rate (CAGR) for this market is projected to be approximately 15-18% over the forecast period. Technological disruptions are profoundly shaping the industry. Artificial intelligence (AI) is being leveraged for personalized learning experiences, adaptive assessments, and intelligent content curation, ensuring that employees receive training relevant to their specific roles and risk profiles. The integration of gamification techniques is enhancing learner engagement and knowledge retention, transforming compliance training from a chore into a more interactive and rewarding experience. Furthermore, the rise of remote and hybrid work models has accelerated the adoption of online learning platforms, as they offer the flexibility and scalability required to train a distributed workforce effectively. Consumer preferences are shifting towards microlearning modules, bite-sized content that can be consumed quickly and easily, aligning with the busy schedules of modern professionals. This has led to a demand for modular content that can be accessed on demand and on any device. Competitive dynamics are characterized by intense innovation, with providers differentiating themselves through specialized content libraries, advanced analytics on learner progress and compliance gaps, and superior user experience. Market penetration of e-learning solutions for compliance is estimated to reach over 70% of large enterprises by 2028. The focus is shifting from mere completion of training to demonstrable understanding and application of compliance principles, pushing for more sophisticated assessment methodologies and real-time feedback mechanisms. Data analytics plays a crucial role, enabling organizations to track training effectiveness, identify high-risk areas, and demonstrate due diligence to regulatory bodies. The increasing awareness of ethical business practices and corporate social responsibility also contributes significantly to the demand for specialized training modules in areas like anti-bribery and anti-corruption. The demand for scalable and cost-effective training solutions, particularly for multi-national corporations with diverse workforces, further solidifies the dominance of e-learning platforms.

Dominant Markets & Segments in E Learning Corporate Compliance Training

The E Learning Corporate Compliance Training market is dominated by specific regions and segments due to a confluence of economic policies, robust infrastructure, and evolving regulatory demands. North America currently holds the largest market share, driven by a mature regulatory environment, a high concentration of multinational corporations, and a proactive approach to compliance and data security. The United States, in particular, leads with stringent regulations in sectors like finance, healthcare, and technology, necessitating comprehensive compliance training programs. Europe follows closely, with strong demand stemming from the GDPR, ongoing advancements in data privacy laws, and a growing emphasis on ethical conduct and diversity.

Within the Application segment, Regulatory Compliance Training and Information Security Training are the leading categories. Regulatory Compliance Training is paramount due to the ever-increasing complexity of global laws and industry-specific mandates. This includes financial regulations, healthcare compliance (HIPAA), and environmental regulations. Information Security Training, encompassing Cyber Security Training, is experiencing exponential growth due to the escalating threat landscape of data breaches, ransomware attacks, and phishing schemes. Companies are investing heavily to protect sensitive data and maintain customer trust. Sexual Harassment Training and CoC and Ethics Training are also significant, driven by corporate culture initiatives and the need to foster safe and inclusive workplaces.

In terms of Type, the Online segment is the most dominant. Its inherent scalability, cost-effectiveness, and accessibility make it the preferred choice for organizations of all sizes. Companies can easily deploy and manage training programs across geographically dispersed workforces, ensuring consistent delivery and tracking. The Blended learning approach is gaining traction, combining the flexibility of online modules with the interactivity of live virtual sessions or in-person workshops for specific high-risk or sensitive topics. This approach offers the best of both worlds, catering to diverse learning preferences and ensuring deeper engagement.

Key drivers for the dominance of these segments include:

- Economic Policies: Government incentives for digital transformation and corporate responsibility initiatives encourage investment in e-learning solutions.

- Infrastructure: Widespread internet penetration and accessibility to digital devices facilitate the widespread adoption of online compliance training.

- Regulatory Frameworks: The strict enforcement of data privacy laws, anti-corruption legislation, and workplace conduct standards directly fuels demand for specialized training.

- Technological Advancements: The continuous evolution of learning management systems (LMS), AI-powered personalization, and immersive technologies enhance the effectiveness and engagement of e-learning compliance programs.

E Learning Corporate Compliance Training Product Innovations

Product innovations in E Learning Corporate Compliance Training are rapidly transforming the delivery and effectiveness of these crucial programs. Key advancements include AI-driven personalized learning paths that adapt content difficulty and focus based on individual learner performance and role-specific risks. Gamification and interactive simulations are being integrated to enhance engagement and retention, making complex compliance concepts more accessible and memorable. The development of comprehensive analytics dashboards provides organizations with deep insights into training completion rates, knowledge retention, and compliance gaps, enabling proactive risk management. Microlearning modules, designed for on-demand consumption, cater to the busy schedules of modern professionals, improving knowledge transfer and application. Competitive advantages are being carved out through specialized content libraries addressing niche regulatory requirements, seamless integration with existing HR and LMS platforms, and a focus on demonstrable behavioral change rather than just course completion.

Report Segmentation & Scope

This report meticulously segments the E Learning Corporate Compliance Training market to provide granular insights. The Application segment includes: Information Security Training, Regulatory Compliance Training, Sexual Harassment Training, CoC and Ethics Training, Cyber Security Training, Diversity Training, and Others. Each application is analyzed for its market size, growth projections, and specific competitive dynamics. For instance, Information Security Training is projected to grow at a CAGR of 17%, driven by increasing data breaches. Regulatory Compliance Training, valued at an estimated $7,000 million, remains a cornerstone. The Type segment encompasses Blended and Online learning. The Online segment is expected to dominate, projected at $12,000 million in market value by 2033, due to its scalability. The Blended segment, valued at $4,500 million, offers a more interactive approach for complex topics.

Key Drivers of E Learning Corporate Compliance Training Growth

The growth of the E Learning Corporate Compliance Training sector is propelled by several critical factors. Regulatory Escalation stands as a primary driver, with governments worldwide continuously introducing and enforcing more stringent compliance standards, necessitating ongoing training. Technological Advancements, including AI, VR, and mobile learning, enhance engagement and effectiveness, making e-learning a superior alternative to traditional methods. Increasing Global Workforce Mobility and the rise of remote work have created an undeniable need for scalable and accessible online training solutions. Furthermore, growing corporate awareness of Ethical Conduct and Corporate Social Responsibility (CSR) mandates comprehensive training in areas like diversity, inclusion, and anti-harassment. The escalating threat landscape in Information Security also compels organizations to invest heavily in cybersecurity training.

Challenges in the E Learning Corporate Compliance Training Sector

Despite robust growth, the E Learning Corporate Compliance Training sector faces several challenges. Learner Engagement and Retention remain a persistent hurdle, as dry or overly technical content can lead to disinterest and reduced knowledge retention. Keeping Content Updated with rapidly evolving regulations and industry standards requires significant ongoing investment and expertise. Integration with Existing Systems can be complex for some organizations, leading to implementation delays and increased costs. Measuring ROI and Demonstrating Effectiveness beyond completion rates can be challenging, requiring sophisticated analytics and assessment tools. Cost Considerations for highly specialized or customized training content can be a barrier for smaller enterprises. Finally, Global Localization and Cultural Nuances require careful consideration to ensure training is relevant and effective across diverse workforces, often adding significant complexity and cost to content development, with an estimated 20-30% increase in development costs for comprehensive global rollouts.

Leading Players in the E Learning Corporate Compliance Training Market

- Skillsoft

- Blackboard

- GP Strategies

- SAI Global

- Cornerstone

- Saba

- NAVEX Global

- City&Guilds Kineo

- CrossKnowledge

- LRN

- 360training

- Interactive Services

Key Developments in E Learning Corporate Compliance Training Sector

- 2023/08: Skillsoft launches AI-powered personalized learning pathways for compliance training, enhancing learner experience.

- 2023/10: NAVEX Global acquires a leading provider of ethics and compliance hotline solutions, expanding its integrated offerings.

- 2024/01: Blackboard introduces advanced analytics for compliance training, enabling better tracking of learner progress and risk identification.

- 2024/03: Cornerstone OnDemand enhances its compliance course library with new modules on ESG (Environmental, Social, and Governance) reporting.

- 2024/05: LRN partners with a major cybersecurity firm to offer specialized cyber risk management training modules.

- 2024/07: 360training expands its content for healthcare compliance, addressing new federal regulations.

- 2024/09: GP Strategies invests heavily in VR-based compliance training simulations for hazardous industries.

- 2024/11: SAI Global announces a strategic partnership to integrate its compliance software with leading HR platforms.

Strategic E Learning Corporate Compliance Training Market Outlook

The strategic outlook for the E Learning Corporate Compliance Training market remains exceptionally positive. Growth accelerators include the increasing emphasis on proactive risk management, the imperative for continuous learning in dynamic regulatory environments, and the ongoing digital transformation within organizations. The market is poised for sustained expansion, driven by the integration of cutting-edge technologies like AI and VR to create more engaging and effective learning experiences. Strategic opportunities lie in developing specialized content for emerging compliance areas (e.g., AI ethics, data privacy in new technologies), offering comprehensive analytics to demonstrate ROI, and providing flexible, scalable solutions that cater to the diverse needs of a global workforce. The market will continue to see consolidation through M&A, with providers focusing on end-to-end compliance solutions that encompass training, risk management, and policy enforcement, with an estimated market expansion of over 50% in the next five years.

E Learning Corporate Compliance Training Segmentation

-

1. Application

- 1.1. Information Security Training

- 1.2. Regulatory Compliance Training

- 1.3. Sexual Harassment Training

- 1.4. CoC and Ethics Training

- 1.5. Cyber Security Training

- 1.6. Diversity Training

- 1.7. Others

-

2. Type

- 2.1. Blended

- 2.2. Online

E Learning Corporate Compliance Training Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E Learning Corporate Compliance Training REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E Learning Corporate Compliance Training Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Information Security Training

- 5.1.2. Regulatory Compliance Training

- 5.1.3. Sexual Harassment Training

- 5.1.4. CoC and Ethics Training

- 5.1.5. Cyber Security Training

- 5.1.6. Diversity Training

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Blended

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America E Learning Corporate Compliance Training Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Information Security Training

- 6.1.2. Regulatory Compliance Training

- 6.1.3. Sexual Harassment Training

- 6.1.4. CoC and Ethics Training

- 6.1.5. Cyber Security Training

- 6.1.6. Diversity Training

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Blended

- 6.2.2. Online

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America E Learning Corporate Compliance Training Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Information Security Training

- 7.1.2. Regulatory Compliance Training

- 7.1.3. Sexual Harassment Training

- 7.1.4. CoC and Ethics Training

- 7.1.5. Cyber Security Training

- 7.1.6. Diversity Training

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Blended

- 7.2.2. Online

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe E Learning Corporate Compliance Training Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Information Security Training

- 8.1.2. Regulatory Compliance Training

- 8.1.3. Sexual Harassment Training

- 8.1.4. CoC and Ethics Training

- 8.1.5. Cyber Security Training

- 8.1.6. Diversity Training

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Blended

- 8.2.2. Online

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa E Learning Corporate Compliance Training Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Information Security Training

- 9.1.2. Regulatory Compliance Training

- 9.1.3. Sexual Harassment Training

- 9.1.4. CoC and Ethics Training

- 9.1.5. Cyber Security Training

- 9.1.6. Diversity Training

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Blended

- 9.2.2. Online

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific E Learning Corporate Compliance Training Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Information Security Training

- 10.1.2. Regulatory Compliance Training

- 10.1.3. Sexual Harassment Training

- 10.1.4. CoC and Ethics Training

- 10.1.5. Cyber Security Training

- 10.1.6. Diversity Training

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Blended

- 10.2.2. Online

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Skillsoft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blackboard

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GP Strategies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SAI Global

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cornerstone

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Saba

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NAVEX Global

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 City&Guilds Kineo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CrossKnowledge

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LRN

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 360training

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Interactive Services

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Skillsoft

List of Figures

- Figure 1: Global E Learning Corporate Compliance Training Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America E Learning Corporate Compliance Training Revenue (million), by Application 2024 & 2032

- Figure 3: North America E Learning Corporate Compliance Training Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America E Learning Corporate Compliance Training Revenue (million), by Type 2024 & 2032

- Figure 5: North America E Learning Corporate Compliance Training Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America E Learning Corporate Compliance Training Revenue (million), by Country 2024 & 2032

- Figure 7: North America E Learning Corporate Compliance Training Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America E Learning Corporate Compliance Training Revenue (million), by Application 2024 & 2032

- Figure 9: South America E Learning Corporate Compliance Training Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America E Learning Corporate Compliance Training Revenue (million), by Type 2024 & 2032

- Figure 11: South America E Learning Corporate Compliance Training Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America E Learning Corporate Compliance Training Revenue (million), by Country 2024 & 2032

- Figure 13: South America E Learning Corporate Compliance Training Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe E Learning Corporate Compliance Training Revenue (million), by Application 2024 & 2032

- Figure 15: Europe E Learning Corporate Compliance Training Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe E Learning Corporate Compliance Training Revenue (million), by Type 2024 & 2032

- Figure 17: Europe E Learning Corporate Compliance Training Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe E Learning Corporate Compliance Training Revenue (million), by Country 2024 & 2032

- Figure 19: Europe E Learning Corporate Compliance Training Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa E Learning Corporate Compliance Training Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa E Learning Corporate Compliance Training Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa E Learning Corporate Compliance Training Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa E Learning Corporate Compliance Training Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa E Learning Corporate Compliance Training Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa E Learning Corporate Compliance Training Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific E Learning Corporate Compliance Training Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific E Learning Corporate Compliance Training Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific E Learning Corporate Compliance Training Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific E Learning Corporate Compliance Training Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific E Learning Corporate Compliance Training Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific E Learning Corporate Compliance Training Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global E Learning Corporate Compliance Training Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global E Learning Corporate Compliance Training Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global E Learning Corporate Compliance Training Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global E Learning Corporate Compliance Training Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global E Learning Corporate Compliance Training Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global E Learning Corporate Compliance Training Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global E Learning Corporate Compliance Training Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global E Learning Corporate Compliance Training Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global E Learning Corporate Compliance Training Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global E Learning Corporate Compliance Training Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global E Learning Corporate Compliance Training Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global E Learning Corporate Compliance Training Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global E Learning Corporate Compliance Training Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global E Learning Corporate Compliance Training Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global E Learning Corporate Compliance Training Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global E Learning Corporate Compliance Training Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global E Learning Corporate Compliance Training Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global E Learning Corporate Compliance Training Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global E Learning Corporate Compliance Training Revenue million Forecast, by Country 2019 & 2032

- Table 41: China E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific E Learning Corporate Compliance Training Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E Learning Corporate Compliance Training?

The projected CAGR is approximately 13%.

2. Which companies are prominent players in the E Learning Corporate Compliance Training?

Key companies in the market include Skillsoft, Blackboard, GP Strategies, SAI Global, Cornerstone, Saba, NAVEX Global, City&Guilds Kineo, CrossKnowledge, LRN, 360training, Interactive Services.

3. What are the main segments of the E Learning Corporate Compliance Training?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15710 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E Learning Corporate Compliance Training," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E Learning Corporate Compliance Training report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E Learning Corporate Compliance Training?

To stay informed about further developments, trends, and reports in the E Learning Corporate Compliance Training, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence