Key Insights

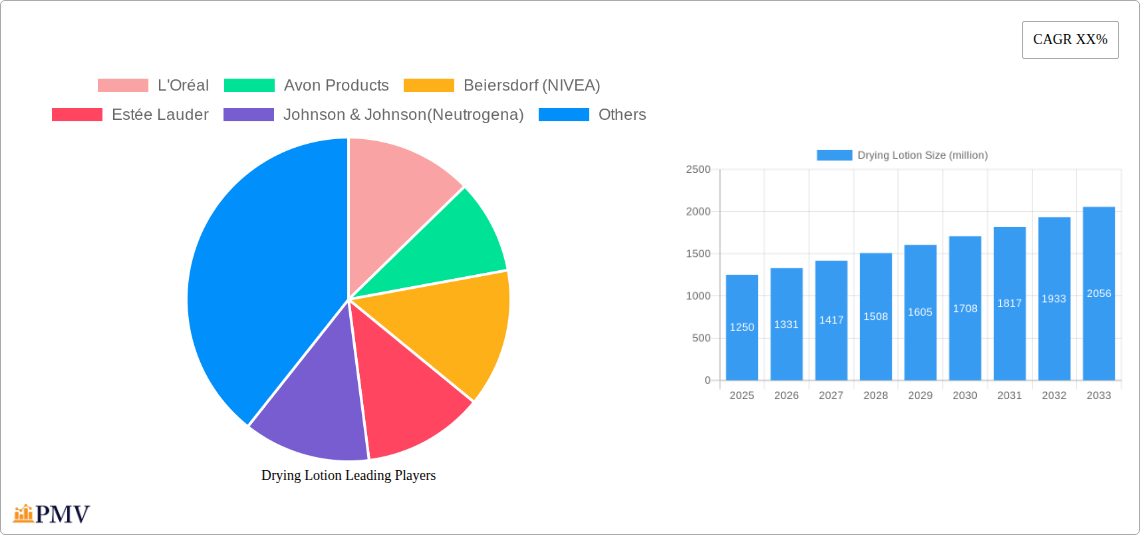

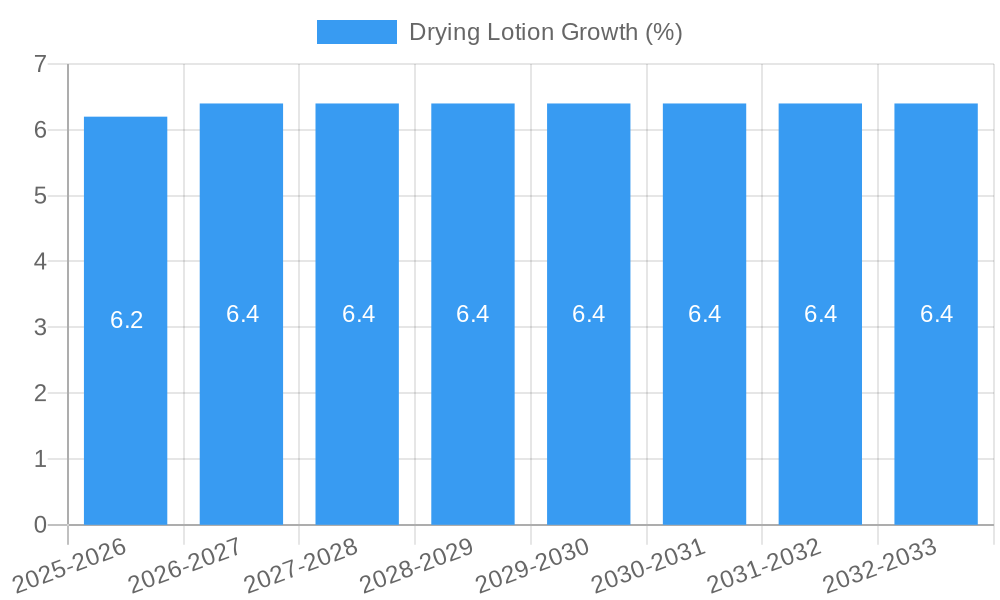

The global Drying Lotion market is poised for substantial growth, projected to reach approximately $1,250 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.2% during the forecast period of 2025-2033. This expansion is fueled by a growing awareness of skincare routines, particularly among younger demographics, and an increasing demand for targeted solutions for common skin concerns like acne and blemishes. The market is further propelled by advancements in product formulations, with brands focusing on natural ingredients and scientifically proven efficacy. Key drivers include rising disposable incomes, a greater emphasis on personal grooming and appearance, and the pervasive influence of social media and beauty influencers who actively promote effective skincare products. The segmentation by application reveals a robust demand across all demographics, with the Male and Female segments leading, driven by an increasing convergence in skincare concerns and product adoption. The Children segment, while smaller, is also showing promising growth as parents become more invested in early skincare education and preventative measures.

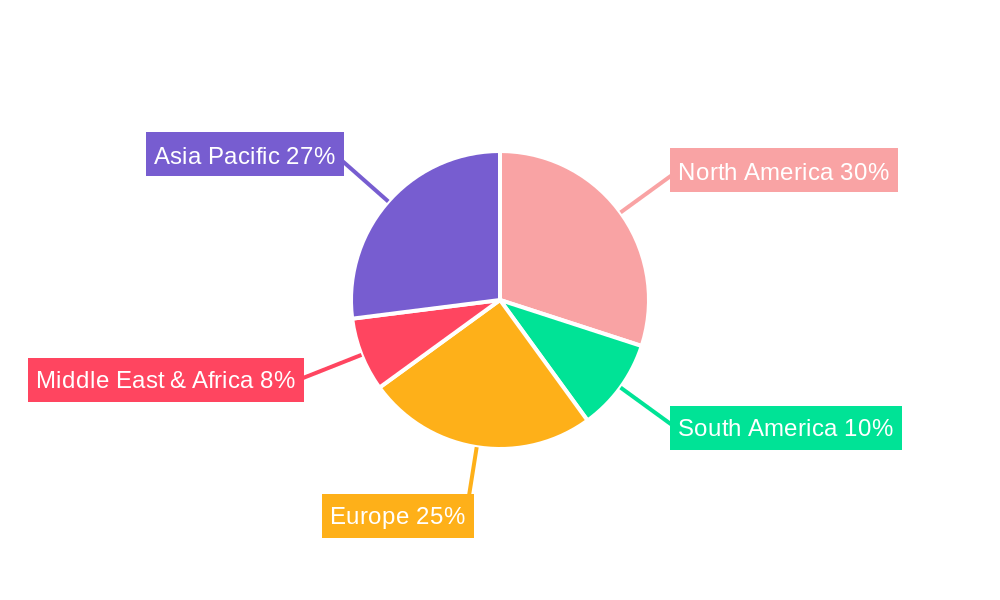

The market's trajectory is characterized by a dynamic interplay of opportunities and challenges. While the demand for specialized drying lotions for various skin types – Dry Skin, Oil Skin, and Normal Skin – continues to grow, the market also faces restraints such as intense competition from established players and the potential for product commoditization. However, innovative product development, focusing on addressing specific skin issues beyond general blemishes, such as hyperpigmentation or redness, will likely offer significant growth avenues. Geographically, Asia Pacific is anticipated to emerge as a high-growth region, driven by its large population, increasing urbanization, and a burgeoning middle class with a growing interest in premium beauty products. North America and Europe remain mature yet significant markets, with a continuous demand for high-quality, effective skincare solutions. Companies like L'Oréal, Beiersdorf (NIVEA), and Estée Lauder are expected to maintain strong market positions through continuous product innovation and strategic marketing efforts, capitalizing on emerging trends and evolving consumer preferences.

Drying Lotion Market: Comprehensive Analysis and Future Outlook (2019-2033)

This detailed report delves into the global Drying Lotion market, offering a comprehensive analysis of its structure, trends, innovations, and future prospects. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report is an invaluable resource for industry stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes. Our analysis encompasses key segments, dominant markets, and influential players, providing actionable insights for strategic decision-making.

Drying Lotion Market Structure & Competitive Dynamics

The global Drying Lotion market is characterized by a moderately concentrated structure, with several multinational corporations and a growing number of niche players vying for market share. The estimated market share of top 5 players is projected to be over 60 million in 2025. Innovation ecosystems are thriving, driven by a demand for targeted skincare solutions and advancements in dermatological research. Regulatory frameworks, while generally supportive of product safety and efficacy, can vary across regions, impacting market entry and product approvals. The presence of numerous product substitutes, including spot treatments, astringents, and natural remedies, necessitates continuous product differentiation and effective marketing strategies. End-user trends highlight a growing preference for natural ingredients, sustainable packaging, and personalized skincare routines. Merger and acquisition (M&A) activities have been strategic, with a cumulative deal value estimated to exceed 50 million in recent years, aimed at expanding product portfolios, market reach, and technological capabilities.

- Market Concentration: Moderate, with key players holding significant influence.

- Innovation Ecosystems: Active, fueled by R&D in dermatology and ingredient technology.

- Regulatory Landscape: Varied across regions, with a focus on safety and efficacy.

- Product Substitutes: Abundant, requiring strong brand differentiation.

- End-User Preferences: Increasing demand for natural, sustainable, and personalized solutions.

- M&A Activities: Strategic consolidations to enhance market position and product offerings.

Drying Lotion Industry Trends & Insights

The Drying Lotion market is poised for robust growth, driven by several key factors. A significant market growth driver is the escalating global prevalence of acne and blemishes, particularly among adolescents and young adults, leading to an increased demand for effective topical treatments. The market penetration of specialized skincare products has steadily increased, with consumers becoming more aware of targeted solutions for specific skin concerns. The estimated Compound Annual Growth Rate (CAGR) for the Drying Lotion market is projected to be around 7.5% during the forecast period of 2025–2033. Technological disruptions are revolutionizing product formulations, with advancements in ingredient delivery systems, such as microencapsulation and liposomal technologies, enhancing product efficacy and reducing side effects. Consumer preferences are shifting towards clean beauty, with a growing demand for products formulated with natural, organic, and sustainably sourced ingredients, free from harsh chemicals like parabens and sulfates. The competitive dynamics are intensifying, with established brands focusing on product innovation and marketing campaigns, while new entrants are leveraging online channels and influencer marketing to gain traction. The rising disposable incomes in emerging economies are also contributing to market expansion, as consumers have greater purchasing power for premium skincare products. Furthermore, the influence of social media and beauty bloggers in promoting effective skincare solutions continues to shape consumer purchasing decisions, driving the demand for products that offer visible results. The increasing awareness about skin health and the desire for blemish-free complexions are fundamental to the sustained growth of this market.

Dominant Markets & Segments in Drying Lotion

The Female segment is anticipated to dominate the Drying Lotion market, driven by a higher propensity among women to invest in specialized skincare and address concerns like acne and blemishes. Within the Application segmentation, the Female demographic is expected to contribute a substantial market share, estimated at over 300 million in 2025. The Used for Oil Skin type is projected to be the most dominant segment, accounting for an estimated 400 million market share in 2025. This is attributed to the widespread occurrence of oily skin and acne among diverse age groups, making drying lotions a staple in their skincare routines. Geographically, North America and Europe currently hold the largest market shares due to high consumer awareness, advanced healthcare infrastructure, and a strong presence of leading cosmetic and pharmaceutical companies. However, the Asia Pacific region is projected to witness the fastest growth owing to increasing disposable incomes, growing awareness about skincare, and a burgeoning youth population actively seeking solutions for acne.

- Dominant Application Segment: Female, due to higher investment in specialized skincare.

- Dominant Type Segment: Used for Oily Skin, reflecting the widespread need for oil control and blemish treatment.

- Leading Geographic Regions: North America and Europe, with Asia Pacific showing significant growth potential.

- Key Drivers for Dominance in Asia Pacific: Rising disposable incomes, increasing consumer awareness, and a large youth demographic.

- Economic Policies Impact: Favorable trade policies and increasing healthcare expenditure contribute to market growth in key regions.

- Infrastructure: Well-developed retail and online distribution networks facilitate market access.

Drying Lotion Product Innovations

Product innovations in the Drying Lotion market are primarily focused on enhancing efficacy, improving user experience, and catering to growing consumer demand for natural and gentle formulations. Key developments include the incorporation of advanced active ingredients like salicylic acid, benzoyl peroxide, and sulfur, often in combination with soothing agents to minimize irritation. There's a noticeable trend towards lightweight, fast-absorbing formulations that are non-comedogenic and suitable for sensitive skin. Packaging innovations are also crucial, with the introduction of precision applicators and travel-friendly sizes. Competitive advantages are being built on unique ingredient blends, scientifically backed claims, and aesthetically pleasing branding.

Report Segmentation & Scope

This report meticulously segments the Drying Lotion market to provide a granular understanding of its dynamics. The Application segmentation includes Male, Female, and Children. The Type segmentation encompasses products designed for Dry Skin, Oily Skin, and Normal skin. Market sizes and growth projections are detailed for each sub-segment, offering insights into their relative contributions and future potential. Competitive dynamics within each segment are also analyzed, highlighting key players and their strategies.

- Application Segments:

- Male: Growth is projected at a steady pace, driven by increasing male grooming awareness.

- Female: Expected to remain the largest segment with sustained demand for targeted acne solutions.

- Children: A niche but growing segment, focusing on gentle formulations for adolescent acne.

- Type Segments:

- Used for Dry Skin: Focused on formulations that manage breakouts without exacerbating dryness.

- Used for Oily Skin: The largest segment, offering effective oil control and blemish reduction.

- Used for Normal Skin: Catering to occasional breakouts and maintaining skin clarity.

Key Drivers of Drying Lotion Growth

The Drying Lotion market is propelled by a confluence of technological, economic, and regulatory factors. The rising global incidence of acne and blemishes, particularly among younger demographics, is a primary driver. Advancements in dermatological research and ingredient technology have led to the development of more effective and targeted formulations, enhancing product appeal. Increasing consumer awareness regarding skincare and the availability of specialized treatments contribute significantly to market expansion. Furthermore, the growing disposable incomes in emerging economies allow a larger consumer base to access and afford premium skincare products, including drying lotions.

- Technological Advancements: Development of potent and gentle active ingredients.

- Economic Factors: Increasing disposable incomes and consumer spending on beauty and personal care.

- Consumer Awareness: Growing understanding of skin health and the need for targeted treatments.

- Prevalence of Acne: High and increasing rates of acne globally.

Challenges in the Drying Lotion Sector

Despite the positive growth trajectory, the Drying Lotion sector faces several challenges. Stringent regulatory hurdles in certain regions regarding ingredient approvals and product claims can impact market entry and product development timelines. Intense competition from a multitude of brands, both established and emerging, necessitates significant marketing investments to maintain brand visibility and market share. Supply chain disruptions, as experienced in recent years, can affect raw material availability and product distribution, leading to increased costs and potential stockouts. Furthermore, consumer skepticism towards certain chemical ingredients and a growing preference for natural alternatives can pose a challenge for traditional formulations.

- Regulatory Hurdles: Varied and sometimes complex approval processes.

- Intense Competition: Crowded market with numerous product offerings.

- Supply Chain Vulnerabilities: Risks of disruption in raw material sourcing and logistics.

- Consumer Preference Shifts: Growing demand for natural and clean beauty products.

Leading Players in the Drying Lotion Market

- L'Oréal

- Avon Products

- Beiersdorf (NIVEA)

- Estée Lauder

- Johnson & Johnson (Neutrogena)

- Physicians Formula

Key Developments in Drying Lotion Sector

- 2023 Q4: Launch of several new drying lotions with enhanced natural ingredient profiles by L'Oréal, responding to clean beauty trends.

- 2024 Q1: Estée Lauder announces strategic acquisition of a niche clean beauty brand specializing in blemish treatments, aiming to expand its portfolio.

- 2024 Q2: Neutrogena (Johnson & Johnson) introduces a dermatologist-developed drying lotion featuring a novel combination of salicylic acid and niacinamide for improved efficacy.

- 2024 Q3: Beiersdorf (NIVEA) invests in advanced R&D for sustainable packaging solutions for its skincare range, including drying lotions.

- 2024 Q4: Avon Products expands its online direct-to-consumer channels, increasing accessibility for its drying lotion products in emerging markets.

Strategic Drying Lotion Market Outlook

The strategic outlook for the Drying Lotion market is highly optimistic, fueled by ongoing innovations and evolving consumer demands. Growth accelerators include the continued rise in demand for effective, science-backed acne solutions, particularly from younger demographics. The expanding middle class in developing economies presents a significant opportunity for market penetration. Strategic investments in product development, focusing on natural ingredients, personalized formulations, and sustainable practices, will be crucial for sustained success. Furthermore, leveraging digital marketing channels and influencer collaborations will be key to reaching and engaging target audiences effectively. The market is ripe for further consolidation and strategic partnerships to enhance market reach and technological capabilities.

Drying Lotion Segmentation

-

1. Application

- 1.1. Male

- 1.2. Female

- 1.3. Children

-

2. Types

- 2.1. Used for Dry Skin

- 2.2. Used for Oil Skin

- 2.3. Used for Normal skin

Drying Lotion Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Drying Lotion REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drying Lotion Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Male

- 5.1.2. Female

- 5.1.3. Children

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Used for Dry Skin

- 5.2.2. Used for Oil Skin

- 5.2.3. Used for Normal skin

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Drying Lotion Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Male

- 6.1.2. Female

- 6.1.3. Children

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Used for Dry Skin

- 6.2.2. Used for Oil Skin

- 6.2.3. Used for Normal skin

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Drying Lotion Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Male

- 7.1.2. Female

- 7.1.3. Children

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Used for Dry Skin

- 7.2.2. Used for Oil Skin

- 7.2.3. Used for Normal skin

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Drying Lotion Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Male

- 8.1.2. Female

- 8.1.3. Children

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Used for Dry Skin

- 8.2.2. Used for Oil Skin

- 8.2.3. Used for Normal skin

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Drying Lotion Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Male

- 9.1.2. Female

- 9.1.3. Children

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Used for Dry Skin

- 9.2.2. Used for Oil Skin

- 9.2.3. Used for Normal skin

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Drying Lotion Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Male

- 10.1.2. Female

- 10.1.3. Children

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Used for Dry Skin

- 10.2.2. Used for Oil Skin

- 10.2.3. Used for Normal skin

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 L'Oréal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Avon Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Beiersdorf (NIVEA)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Estée Lauder

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson & Johnson(Neutrogena)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Physicians Formula

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 L'Oréal

List of Figures

- Figure 1: Global Drying Lotion Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Drying Lotion Revenue (million), by Application 2024 & 2032

- Figure 3: North America Drying Lotion Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Drying Lotion Revenue (million), by Types 2024 & 2032

- Figure 5: North America Drying Lotion Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Drying Lotion Revenue (million), by Country 2024 & 2032

- Figure 7: North America Drying Lotion Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Drying Lotion Revenue (million), by Application 2024 & 2032

- Figure 9: South America Drying Lotion Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Drying Lotion Revenue (million), by Types 2024 & 2032

- Figure 11: South America Drying Lotion Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Drying Lotion Revenue (million), by Country 2024 & 2032

- Figure 13: South America Drying Lotion Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Drying Lotion Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Drying Lotion Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Drying Lotion Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Drying Lotion Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Drying Lotion Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Drying Lotion Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Drying Lotion Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Drying Lotion Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Drying Lotion Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Drying Lotion Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Drying Lotion Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Drying Lotion Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Drying Lotion Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Drying Lotion Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Drying Lotion Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Drying Lotion Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Drying Lotion Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Drying Lotion Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Drying Lotion Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Drying Lotion Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Drying Lotion Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Drying Lotion Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Drying Lotion Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Drying Lotion Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Drying Lotion Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Drying Lotion Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Drying Lotion Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Drying Lotion Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Drying Lotion Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Drying Lotion Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Drying Lotion Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Drying Lotion Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Drying Lotion Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Drying Lotion Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Drying Lotion Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Drying Lotion Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Drying Lotion Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Drying Lotion Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drying Lotion?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Drying Lotion?

Key companies in the market include L'Oréal, Avon Products, Beiersdorf (NIVEA), Estée Lauder, Johnson & Johnson(Neutrogena), Physicians Formula.

3. What are the main segments of the Drying Lotion?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drying Lotion," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drying Lotion report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drying Lotion?

To stay informed about further developments, trends, and reports in the Drying Lotion, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence