Key Insights

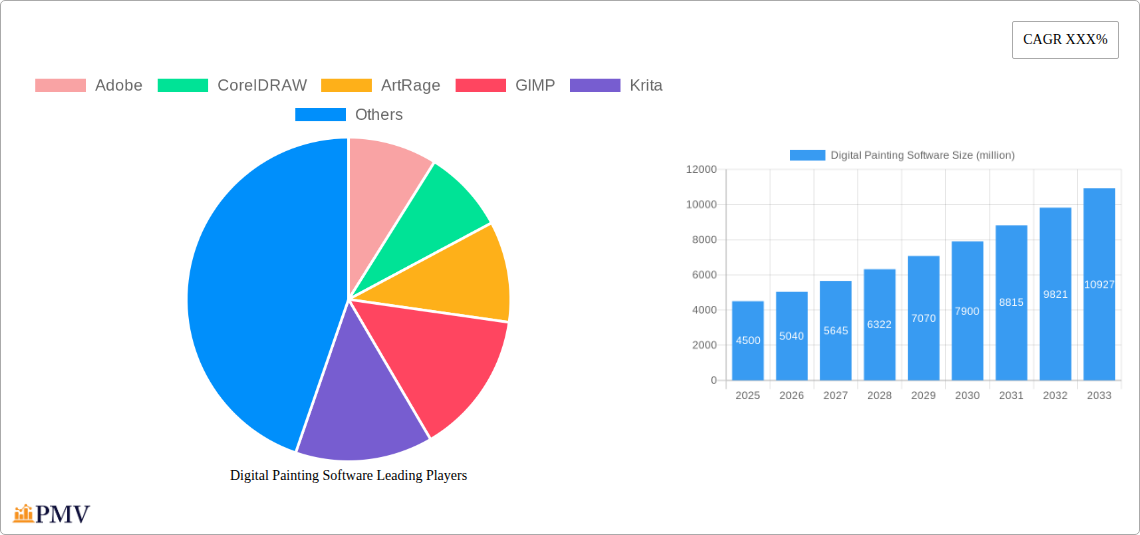

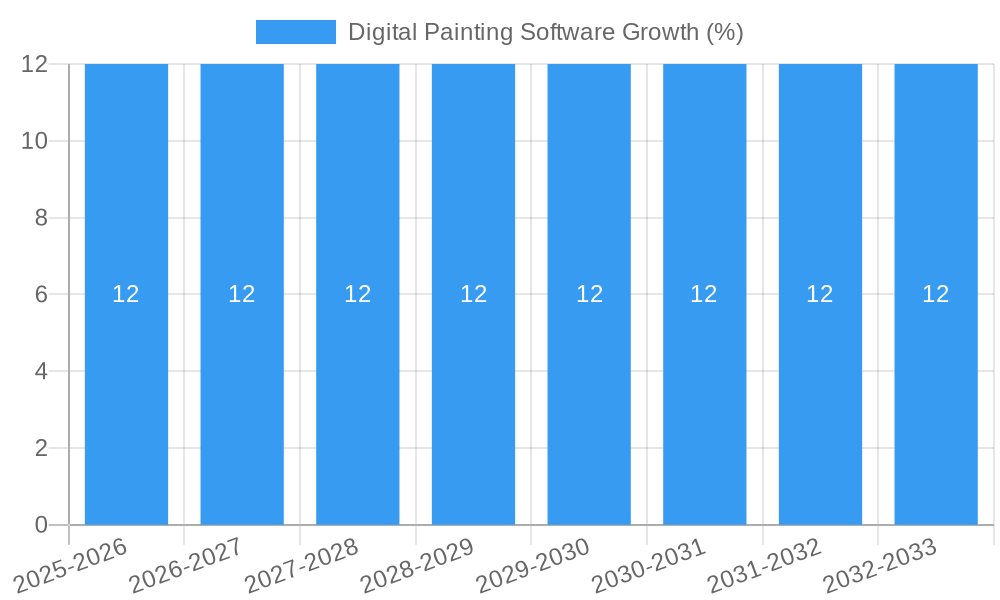

The global Digital Painting Software market is poised for significant expansion, estimated to reach a substantial market size of approximately $4.5 billion in 2025. This growth trajectory is fueled by an impressive Compound Annual Growth Rate (CAGR) of around 12%, projecting the market value to reach over $8 billion by 2033. This robust expansion is primarily driven by the increasing adoption of digital art tools across diverse applications, from large enterprises leveraging sophisticated design solutions for marketing and product development to Small and Medium Enterprises (SMEs) seeking cost-effective yet powerful creative platforms. The burgeoning creator economy, coupled with advancements in hardware like high-resolution displays and pressure-sensitive styluses, further democratizes digital art, attracting a wider user base. Key trends shaping the market include the rise of cloud-based software offering enhanced collaboration and accessibility, the integration of AI-powered features for efficiency, and the growing demand for intuitive interfaces that cater to both professional artists and hobbyists.

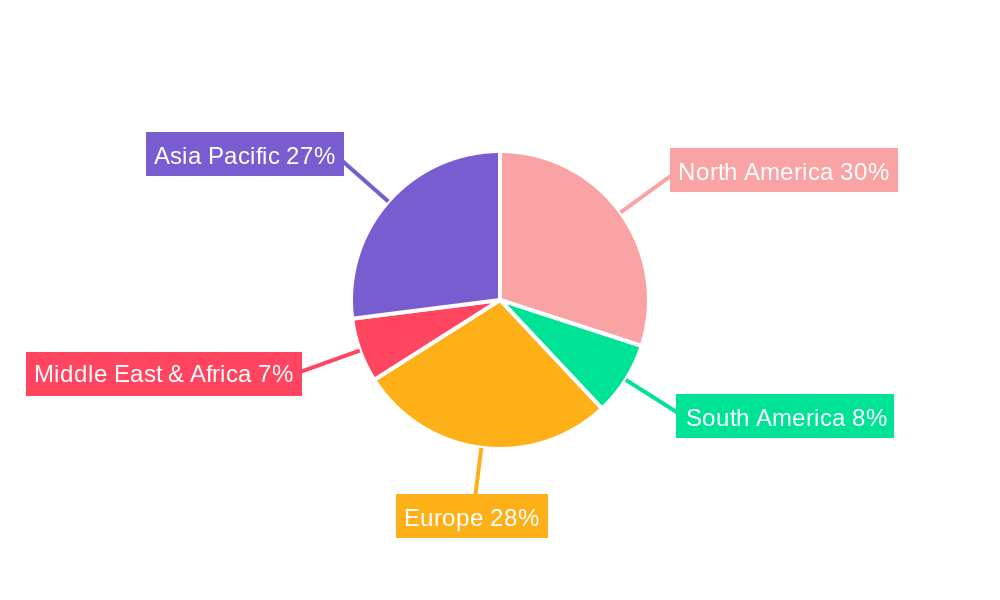

Despite this positive outlook, certain factors may present challenges to sustained growth. High initial investment costs for some premium software packages and powerful hardware can act as a restraint, particularly for individual artists or smaller organizations. The competitive landscape is also intensifying, with established players like Adobe and CorelDRAW facing competition from emerging and open-source alternatives such as Krita and GIMP, which offer compelling features at lower or no cost. The market is segmented by application into large enterprises and SMEs, and by type into software for computers and pads. Geographically, North America and Europe currently dominate the market, driven by a strong presence of creative industries and early adoption of digital technologies. However, the Asia Pacific region, particularly China and India, is expected to exhibit the fastest growth due to a rapidly expanding digital art community and increasing disposable incomes.

This in-depth market research report provides a detailed analysis of the global digital painting software market, offering critical insights for stakeholders, investors, and industry professionals. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report leverages historical data from 2019–2024 to deliver robust predictions and actionable strategies. The report delves into market structure, competitive dynamics, emerging trends, regional dominance, product innovations, growth drivers, challenges, leading players, and key developments shaping the digital art software landscape.

Digital Painting Software Market Structure & Competitive Dynamics

The global digital painting software market exhibits a moderately concentrated structure, with a few dominant players alongside a burgeoning ecosystem of innovative independent developers. Key companies such as Adobe, CorelDRAW, ArtRage, GIMP, Krita, and openCanvas command significant market share through their established brand recognition and comprehensive feature sets. The innovation ecosystem is vibrant, driven by continuous advancements in hardware capabilities, rendering engines, and user interface design. Regulatory frameworks are generally permissive, focusing on intellectual property and data privacy, with minimal direct industry-specific regulation. Product substitutes, while present in the form of traditional art mediums, are increasingly being integrated or augmented by digital tools. End-user trends reveal a growing demand for accessible, versatile, and feature-rich software catering to both professional artists and hobbyists. Mergers and acquisitions (M&A) activities, while not pervasive, can significantly impact market concentration, with deal values often in the tens of millions or even hundreds of millions of dollars for prominent acquisitions. The market share of top players is estimated to be in the range of 20-35% for leading brands.

Digital Painting Software Industry Trends & Insights

The digital painting software market is poised for substantial growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 8-12% over the forecast period. This expansion is fueled by several key industry trends and insights. Market growth drivers include the escalating adoption of digital art in professional industries like animation, gaming, concept art, and illustration, alongside the burgeoning popularity of digital art as a hobby and a form of personal expression. Technological disruptions are at the forefront, with advancements in AI-powered brushes, intelligent color palettes, natural media emulation, and cloud-based collaboration tools significantly enhancing the creative workflow and user experience. The increasing accessibility and affordability of powerful hardware, such as high-resolution displays and pressure-sensitive styluses, further democratize digital art creation. Consumer preferences are shifting towards intuitive user interfaces, customizable workflows, and seamless integration with other creative applications and platforms. Competitive dynamics are characterized by intense innovation, with companies vying to offer unique brush engines, advanced layering systems, and robust community support. Market penetration is expected to rise as more individuals and businesses recognize the efficiency and creative potential of digital painting tools. The integration of VR/AR technologies into digital painting environments represents a significant emerging trend, promising immersive and interactive artistic experiences. Furthermore, the rise of subscription-based models and freemium offerings is expanding market reach and fostering user engagement. The increasing demand for cross-platform compatibility and cloud synchronization ensures artists can create and share their work seamlessly across devices.

Dominant Markets & Segments in Digital Painting Software

The digital painting software market is experiencing dominance from several key regions and segments, driven by a confluence of economic policies, technological infrastructure, and evolving consumer behaviors.

Application: Large Enterprise

Large enterprises, particularly those in the animation, gaming, film production, and advertising sectors, represent a significant and dominant segment. The market penetration within this segment is high, with adoption rates often exceeding 70%.

- Key Drivers:

- Economic Policies: Government incentives and investments in creative industries, such as tax breaks for animation studios or funding for game development, directly boost demand for professional-grade digital painting software.

- Infrastructure: Robust IT infrastructure, including high-performance workstations and reliable network connectivity, is essential for handling complex digital art projects, making these regions attractive markets.

- Industry Concentration: The presence of major studios and production houses creates a concentrated demand for standardized and powerful digital art tools.

- Demand for High-Quality Visuals: The constant need for visually stunning content in entertainment and marketing drives the adoption of advanced digital painting solutions that offer superior realism and efficiency.

- Collaboration Tools: Large enterprises heavily rely on software with robust collaboration features to facilitate teamwork among geographically dispersed artists.

Application: SME

Small and Medium-sized Enterprises (SMEs) are emerging as a rapidly growing segment. While their individual purchase volumes are smaller, the sheer number of SMEs worldwide translates into substantial market potential. Market penetration here is estimated to be around 40-55% and is projected to grow.

- Key Drivers:

- Affordability and Accessibility: The availability of cost-effective software options and subscription models makes digital painting tools accessible to smaller businesses with limited budgets.

- Increased Demand for Digital Content: SMEs across various sectors, including e-commerce, marketing, and web design, require digital art for their online presence and promotional materials, driving adoption.

- Freelance and Gig Economy Growth: The rise of freelance artists and small creative agencies fuels demand for versatile and user-friendly digital painting software.

- Cloud-Based Solutions: SMEs benefit from the scalability and reduced IT overhead associated with cloud-based software solutions.

Type: For Computer

Desktop or computer-based digital painting software continues to be the dominant type, accounting for an estimated 60-70% of the total market revenue. This dominance is attributed to the powerful processing capabilities and larger screen real estate offered by traditional computers, which are ideal for intricate digital art creation.

- Key Drivers:

- Processing Power: High-end desktops and workstations provide the computational power required for complex brushes, large canvas sizes, and intricate layering without performance lag.

- Ergonomics and Workflow: Larger monitors and specialized input devices (graphics tablets) connected to computers offer a more ergonomic and efficient workflow for professional artists.

- Software Feature Set: Historically, the most advanced features and comprehensive toolsets have been developed for desktop platforms.

- Legacy Users: A significant base of established artists and studios are accustomed to desktop workflows.

Type: For Pad

Tablet-based digital painting software is experiencing rapid growth, projected to capture an increasing share of the market, potentially reaching 30-40% by the end of the forecast period. The portability, intuitiveness, and integrated touch/pen input of tablets are driving this trend.

- Key Drivers:

- Portability and Convenience: Tablets allow artists to create on the go, in studios, or in client meetings, offering unparalleled flexibility.

- Intuitive Touch and Pen Input: The direct manipulation and pressure sensitivity offered by stylus input on tablets provide a natural and intuitive drawing and painting experience.

- Advancements in Tablet Technology: Modern tablets, particularly those with high-resolution displays and powerful processors, are capable of running sophisticated digital painting applications.

- Emergence of Pro-Level Tablets: Devices like the iPad Pro and Microsoft Surface Pro are blurring the lines between traditional computers and tablets, making them viable for professional work.

- Mobile-First Content Creation: The growing trend of creating content directly on mobile devices fuels demand for powerful tablet-based art tools.

Digital Painting Software Product Innovations

Recent product innovations in the digital painting software market are significantly enhancing the creative process and expanding artistic possibilities. Advancements include the development of highly sophisticated AI-powered brush engines that can emulate a vast array of traditional media with uncanny realism, intelligent color prediction systems, and real-time texture generation. Cloud integration is enabling seamless collaboration and file synchronization across devices, while augmented reality (AR) features are beginning to offer artists new ways to visualize and interact with their creations in 3D space. Competitive advantages are being forged through intuitive user interfaces, customizable workspaces, and robust asset management systems, catering to both novice users and seasoned professionals.

Report Segmentation & Scope

This report segments the digital painting software market across key dimensions to provide granular insights. The Application segmentation includes Large Enterprise and SME, each analyzed for their unique adoption patterns, market size, and growth trajectories. The Type segmentation focuses on software optimized For Computer and For Pad, evaluating their respective market shares, technological advancements, and future potential. Each segment is analyzed with specific growth projections and competitive dynamics derived from the comprehensive market data.

- Large Enterprise: This segment is characterized by high spending, demand for advanced features, and integrated workflows. Expected market size in the base year is in the range of $1.5 - $2.0 billion, with a CAGR of 7-10%.

- SME: This segment shows rapid adoption due to affordability and accessibility, with an expected market size of $800 million - $1.2 billion in the base year and a higher CAGR of 10-14%.

- For Computer: This segment maintains a dominant market share, estimated at $1.8 - $2.5 billion in the base year, with a steady CAGR of 6-9%.

- For Pad: This segment is experiencing explosive growth, with a projected market size of $500 million - $800 million in the base year and a robust CAGR of 12-16%.

Key Drivers of Digital Painting Software Growth

Several key drivers are propelling the digital painting software market forward. Technologically, the relentless advancement in AI and machine learning is leading to more intelligent brushes, automated colorization, and predictive tools that streamline the artistic process. The proliferation of high-performance graphics processing units (GPUs) and affordable, powerful digital art hardware, such as pressure-sensitive tablets and stylus pens, lowers the barrier to entry. Economically, the booming digital content creation industry, encompassing gaming, animation, VFX, and digital marketing, fuels a sustained demand for sophisticated digital painting solutions. Government initiatives supporting creative industries and digital transformation further bolster market growth. Regulatory frameworks that protect intellectual property encourage innovation and investment in the sector.

Challenges in the Digital Painting Software Sector

Despite the robust growth, the digital painting software sector faces several challenges. High software development costs and the continuous need for research and development to keep pace with technological advancements pose significant financial hurdles for smaller developers. The intense competition from both established players and emerging startups can lead to price wars and reduced profit margins. Piracy remains a persistent issue, impacting revenue streams, particularly for premium software. Supply chain disruptions, though less direct for software, can indirectly affect hardware availability, which is crucial for the end-user experience. Furthermore, the steep learning curve associated with some advanced software packages can be a deterrent for new users, necessitating ongoing investment in user education and support. The evolving landscape of digital art trends and user expectations requires constant adaptation, which can be a strain on resources.

Leading Players in the Digital Painting Software Market

- Adobe

- CorelDRAW

- ArtRage

- GIMP

- Krita

- openCanvas

Key Developments in Digital Painting Software Sector

- 2023/09: Release of Adobe Photoshop 2024 with enhanced AI features and cloud integration.

- 2023/07: Krita introduces new brush stabilization and performance improvements.

- 2023/05: ArtRage 7 focuses on more realistic paint simulation and intuitive UI.

- 2023/03: CorelDRAW Graphics Suite 2023 offers expanded vector and raster capabilities.

- 2023/01: openCanvas announces a new version with improved performance and toolsets for digital illustration.

- 2022/11: Major advancements in AI-powered generative art tools by several independent developers.

- 2022/08: Increased integration of subscription models and cloud-based services across the industry.

Strategic Digital Painting Software Market Outlook

The strategic outlook for the digital painting software market is exceptionally positive, driven by continued technological innovation and expanding application areas. Growth accelerators include the increasing demand for personalized digital content, the metaverse’s burgeoning need for 3D art assets, and the ongoing democratization of digital art creation through accessible platforms. Strategic opportunities lie in developing AI-driven creative assistants, VR/AR-integrated painting environments, and cross-platform solutions that offer seamless workflows for hybrid artists. The market is ripe for collaborations between software providers and hardware manufacturers to optimize the user experience and for strategic partnerships to penetrate emerging markets and niche creative sectors.

Digital Painting Software Segmentation

-

1. Application

- 1.1. Large Enterprise

- 1.2. SME

-

2. Type

- 2.1. For Computer

- 2.2. For Pad

Digital Painting Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Digital Painting Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Painting Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Large Enterprise

- 5.1.2. SME

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. For Computer

- 5.2.2. For Pad

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Digital Painting Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Large Enterprise

- 6.1.2. SME

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. For Computer

- 6.2.2. For Pad

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Digital Painting Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Large Enterprise

- 7.1.2. SME

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. For Computer

- 7.2.2. For Pad

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Digital Painting Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Large Enterprise

- 8.1.2. SME

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. For Computer

- 8.2.2. For Pad

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Digital Painting Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Large Enterprise

- 9.1.2. SME

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. For Computer

- 9.2.2. For Pad

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Digital Painting Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Large Enterprise

- 10.1.2. SME

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. For Computer

- 10.2.2. For Pad

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Adobe

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CorelDRAW

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ArtRage

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GIMP

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Krita

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 openCanvas

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Adobe

List of Figures

- Figure 1: Global Digital Painting Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Digital Painting Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Digital Painting Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Digital Painting Software Revenue (million), by Type 2024 & 2032

- Figure 5: North America Digital Painting Software Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Digital Painting Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Digital Painting Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Digital Painting Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Digital Painting Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Digital Painting Software Revenue (million), by Type 2024 & 2032

- Figure 11: South America Digital Painting Software Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Digital Painting Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Digital Painting Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Digital Painting Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Digital Painting Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Digital Painting Software Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Digital Painting Software Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Digital Painting Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Digital Painting Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Digital Painting Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Digital Painting Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Digital Painting Software Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Digital Painting Software Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Digital Painting Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Digital Painting Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Digital Painting Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Digital Painting Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Digital Painting Software Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Digital Painting Software Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Digital Painting Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Digital Painting Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Digital Painting Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Digital Painting Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Digital Painting Software Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Digital Painting Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Digital Painting Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Digital Painting Software Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Digital Painting Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Digital Painting Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Digital Painting Software Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Digital Painting Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Digital Painting Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Digital Painting Software Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Digital Painting Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Digital Painting Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Digital Painting Software Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Digital Painting Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Digital Painting Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Digital Painting Software Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Digital Painting Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Digital Painting Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Painting Software?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Digital Painting Software?

Key companies in the market include Adobe, CorelDRAW, ArtRage, GIMP, Krita, openCanvas.

3. What are the main segments of the Digital Painting Software?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Painting Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Painting Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Painting Software?

To stay informed about further developments, trends, and reports in the Digital Painting Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence