Key Insights

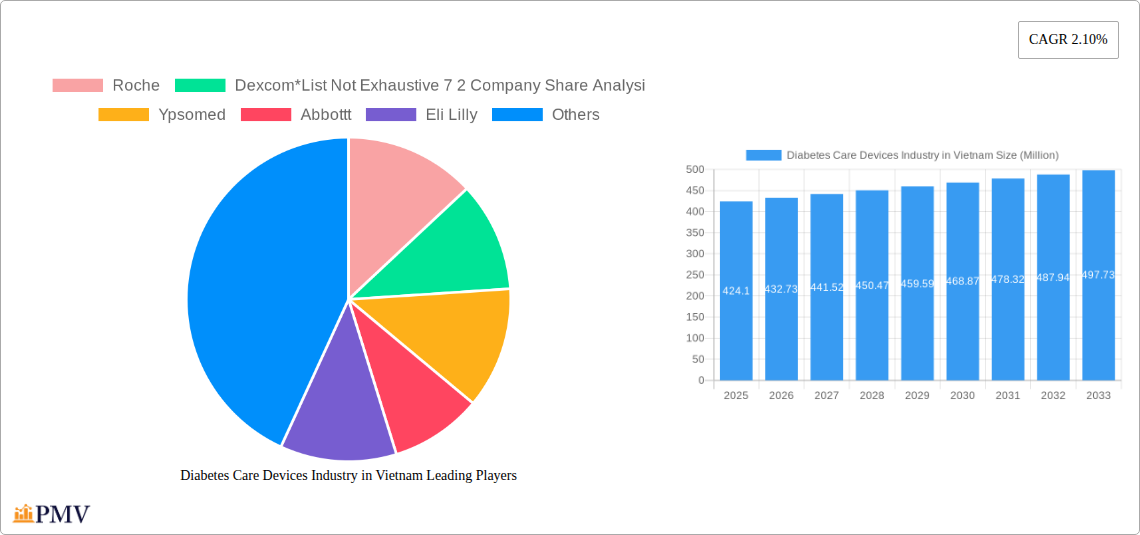

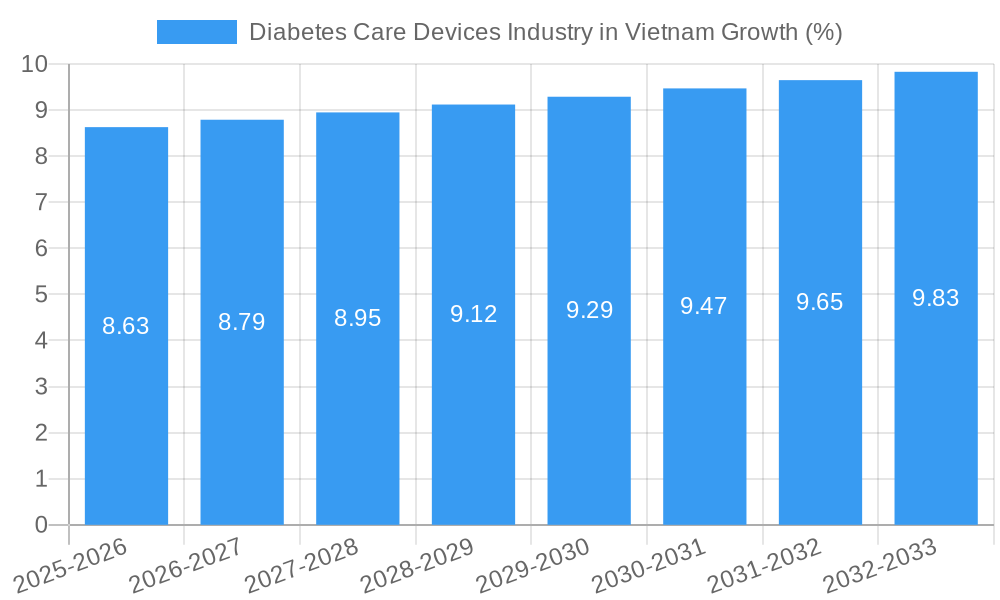

The Vietnamese diabetes care devices market, valued at $424.10 million in 2025, is projected to experience steady growth, driven by rising diabetes prevalence, increasing healthcare expenditure, and growing awareness of effective diabetes management. A compound annual growth rate (CAGR) of 2.10% from 2025 to 2033 suggests a market size exceeding $500 million by the end of the forecast period. This growth is fueled by several factors. Firstly, the expanding geriatric population in Vietnam contributes significantly to the rise in diabetes cases, creating a larger target market for these devices. Secondly, improving healthcare infrastructure and increased access to advanced medical technologies are enhancing diagnosis and treatment capabilities. Finally, government initiatives promoting diabetes awareness and preventive healthcare are boosting demand for self-monitoring and management devices. The market segmentation reveals significant demand across various device categories, including self-monitoring blood glucose devices (SMBG), continuous glucose monitoring (CGM) systems, insulin pumps, infusion sets (syringes, cartridges, pens), and lancets. Key players like Roche, Abbott, Medtronic, and Novo Nordisk are actively competing in this market, offering diverse product portfolios and leveraging strategic partnerships to expand their reach. While the market shows promising potential, challenges like high device costs, limited healthcare access in rural areas, and a lack of comprehensive diabetes education programs might impede growth to some degree.

The competitive landscape is marked by both established multinational corporations and emerging local players. The dominance of multinational companies reflects their advanced technologies, strong brand recognition, and established distribution networks. However, local companies are increasingly gaining market share by offering more affordable and accessible solutions tailored to the specific needs of the Vietnamese population. Further market penetration will depend on effective marketing strategies targeting diverse demographics, affordability improvements, and initiatives to improve diabetes awareness and patient education nationwide. The ongoing trend towards technological advancements, particularly in CGM and insulin pump technologies, will likely shape future market dynamics, offering enhanced convenience and improved disease management. The Vietnamese government's emphasis on improving healthcare outcomes will further incentivize investment and innovation within this sector.

Diabetes Care Devices Industry in Vietnam: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Diabetes Care Devices industry in Vietnam, covering the period 2019-2033. It offers in-depth insights into market size, growth drivers, competitive dynamics, and future outlook, equipping stakeholders with actionable intelligence for strategic decision-making. The report utilizes data from the historical period (2019-2024), the base year (2025), and provides estimations for 2025 and forecasts until 2033. The total market value is expected to reach xx Million by 2033.

Diabetes Care Devices Industry in Vietnam Market Structure & Competitive Dynamics

The Vietnamese diabetes care devices market is characterized by a moderately concentrated structure, with several multinational corporations holding significant market share. Key players like Roche, Abbott, Novo Nordisk, and Medtronic dominate the landscape, exhibiting a combined market share of approximately 72 Million. This concentration is further analyzed in the report's detailed 7-2 company share analysis. The market exhibits a dynamic innovation ecosystem, with ongoing research and development efforts focused on enhancing the accuracy, convenience, and affordability of diabetes care devices.

The regulatory framework in Vietnam plays a crucial role in shaping market access and product approvals. Stringent quality control measures and licensing requirements ensure safety and efficacy, fostering a relatively stable market environment. While a few substitute products exist, the overall dependence on specialized diabetes care devices is high. The end-user trends show a growing preference for advanced technologies such as continuous glucose monitoring (CGM) systems. Recent M&A activities remain limited in scale, with reported deal values averaging around xx Million in the last five years. However, future consolidation and strategic partnerships are expected, driven by the need for expanding market reach and product portfolios.

Diabetes Care Devices Industry in Vietnam Industry Trends & Insights

The Vietnamese diabetes care devices market is projected to experience robust growth, driven by several key factors. The rising prevalence of diabetes, fueled by changing lifestyles and an aging population, constitutes the primary growth driver. The compounded annual growth rate (CAGR) is estimated at xx% during the forecast period (2025-2033), pushing market penetration levels to approximately xx% by 2033. The increasing awareness regarding the benefits of early diagnosis and improved disease management is significantly impacting consumer preferences, leading to a higher adoption rate of advanced monitoring and management devices. This positive trend is further accelerated by government initiatives aimed at improving healthcare access and promoting preventative healthcare. Technological advancements in CGM and insulin pump technologies are further shaping the market landscape, improving treatment outcomes and patient adherence. The competitive dynamics are characterized by ongoing product innovation, aggressive marketing strategies, and efforts to establish robust distribution networks.

Dominant Markets & Segments in Diabetes Care Devices Industry in Vietnam

While data specifying a single dominant region is unavailable, the market is broadly distributed across urban and semi-urban areas, reflecting the distribution of the diabetic population.

Monitoring Devices:

- Self-Monitoring Blood Glucose Devices (SMBG): This segment holds the largest market share, driven by its affordability and widespread accessibility. Key growth drivers include increasing awareness of self-management and government initiatives promoting early disease detection.

- Continuous Blood Glucose Monitoring (CGM): This segment is experiencing rapid growth, fuelled by the demand for real-time glucose monitoring and improved treatment outcomes. However, higher costs remain a barrier to wider adoption.

Management Devices:

- Insulin Pumps: Adoption is increasing, albeit slower than SMBG, due to its higher cost and complexity. However, its benefits in improving glycemic control are driving gradual market expansion.

- Infusion Sets, Insulin Syringes, Insulin Cartridges, Disposable Pens: These segments exhibit steady growth, driven by the increasing number of insulin-dependent diabetics. The market dynamics are largely influenced by pricing and convenience factors.

Diabetes Care Devices Industry in Vietnam Product Innovations

Recent years have witnessed significant product innovations in the Vietnamese market, reflecting global trends. CGM systems with improved accuracy and longer wear times have gained prominence. Furthermore, smart insulin pumps with advanced features like remote monitoring and personalized insulin delivery are gaining traction. The innovations are focused on enhancing user experience, improving data analytics, and enabling remote patient management, aligning closely with the needs of the market.

Report Segmentation & Scope

The report segments the market based on device type (Monitoring and Management Devices), further categorized into sub-segments (SMBG, CGM, Insulin Pumps, Infusion Sets, Insulin Syringes, Insulin Cartridges, and Disposable Pens). Each segment's growth projections, market size estimations (in Millions), and competitive dynamics are thoroughly analyzed. The report includes detailed information on pricing trends, market share distribution, and future growth potential.

Key Drivers of Diabetes Care Devices Industry in Vietnam Growth

The growth of the Vietnamese diabetes care devices market is propelled by factors such as a rising prevalence of diabetes, expanding healthcare infrastructure, increasing awareness campaigns promoting early diagnosis and disease management, and government initiatives focused on improving healthcare access and affordability. Technological advancements like CGM and smart insulin pumps further contribute to market expansion.

Challenges in the Diabetes Care Devices Industry in Vietnam Sector

The Vietnamese diabetes care devices market faces challenges including high healthcare costs, limited access to quality care in rural areas, and a shortage of skilled healthcare professionals. Supply chain disruptions occasionally affect device availability, while strong competition amongst various manufacturers exerts price pressure. Regulatory hurdles for new product launches may also lead to market entry delays. The overall impact of these factors, expressed in terms of market growth suppression, is estimated at approximately xx% annually.

Leading Players in the Diabetes Care Devices Industry in Vietnam Market

- Roche

- Dexcom

- Ypsomed

- Abbott

- Eli Lilly

- Sanofi

- Medtronic

- Tandem

- Insulet

- Lifescan (Johnson & Johnson)

- Becton and Dickenson

- Novo Nordisk

Key Developments in Diabetes Care Devices Industry in Vietnam Sector

- May 2023: Partnership between VPA and Roche Diabetes Care Vietnam to improve healthcare access for children with Type 1 diabetes.

- January 2022: 'Gestational Diabetes in Vietnam' project launched with a grant from the Danish Ministry of Foreign Affairs.

- March 2021: Abbott Vietnam introduces the FreeStyle Libre system.

Strategic Diabetes Care Devices Industry in Vietnam Market Outlook

The Vietnamese diabetes care devices market presents significant opportunities for growth, driven by the rising prevalence of diabetes and the increasing adoption of advanced technologies. Strategic partnerships with local distributors and healthcare providers are crucial for expanding market access. Investing in affordable and user-friendly devices will be key to capturing a greater market share. The overall outlook remains highly positive, with significant potential for sustained growth and expansion in the coming decade.

Diabetes Care Devices Industry in Vietnam Segmentation

-

1. Monitoring Devices

-

1.1. Self-monitoring Blood Glucose Devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Blood Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose Devices

-

2. Management Devices

-

2.1. Insulin Pump

- 2.1.1. Insulin Pump Device

- 2.1.2. Insulin Pump Reservoir

- 2.1.3. Infusion Set

- 2.2. Insulin Syringes

- 2.3. Insulin Cartridges

- 2.4. Disposable Pens

-

2.1. Insulin Pump

Diabetes Care Devices Industry in Vietnam Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Diabetes Care Devices Industry in Vietnam REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Management Devices Hold Highest Market Share in Vietnam Diabetes Care Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Blood Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Pump

- 5.2.1.1. Insulin Pump Device

- 5.2.1.2. Insulin Pump Reservoir

- 5.2.1.3. Infusion Set

- 5.2.2. Insulin Syringes

- 5.2.3. Insulin Cartridges

- 5.2.4. Disposable Pens

- 5.2.1. Insulin Pump

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. North America Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.1.1.1. Glucometer Devices

- 6.1.1.2. Test Strips

- 6.1.1.3. Lancets

- 6.1.2. Continuous Blood Glucose Monitoring

- 6.1.2.1. Sensors

- 6.1.2.2. Durables

- 6.1.1. Self-monitoring Blood Glucose Devices

- 6.2. Market Analysis, Insights and Forecast - by Management Devices

- 6.2.1. Insulin Pump

- 6.2.1.1. Insulin Pump Device

- 6.2.1.2. Insulin Pump Reservoir

- 6.2.1.3. Infusion Set

- 6.2.2. Insulin Syringes

- 6.2.3. Insulin Cartridges

- 6.2.4. Disposable Pens

- 6.2.1. Insulin Pump

- 6.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 7. South America Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.1.1.1. Glucometer Devices

- 7.1.1.2. Test Strips

- 7.1.1.3. Lancets

- 7.1.2. Continuous Blood Glucose Monitoring

- 7.1.2.1. Sensors

- 7.1.2.2. Durables

- 7.1.1. Self-monitoring Blood Glucose Devices

- 7.2. Market Analysis, Insights and Forecast - by Management Devices

- 7.2.1. Insulin Pump

- 7.2.1.1. Insulin Pump Device

- 7.2.1.2. Insulin Pump Reservoir

- 7.2.1.3. Infusion Set

- 7.2.2. Insulin Syringes

- 7.2.3. Insulin Cartridges

- 7.2.4. Disposable Pens

- 7.2.1. Insulin Pump

- 7.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 8. Europe Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.1.1.1. Glucometer Devices

- 8.1.1.2. Test Strips

- 8.1.1.3. Lancets

- 8.1.2. Continuous Blood Glucose Monitoring

- 8.1.2.1. Sensors

- 8.1.2.2. Durables

- 8.1.1. Self-monitoring Blood Glucose Devices

- 8.2. Market Analysis, Insights and Forecast - by Management Devices

- 8.2.1. Insulin Pump

- 8.2.1.1. Insulin Pump Device

- 8.2.1.2. Insulin Pump Reservoir

- 8.2.1.3. Infusion Set

- 8.2.2. Insulin Syringes

- 8.2.3. Insulin Cartridges

- 8.2.4. Disposable Pens

- 8.2.1. Insulin Pump

- 8.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 9. Middle East & Africa Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 9.1.1. Self-monitoring Blood Glucose Devices

- 9.1.1.1. Glucometer Devices

- 9.1.1.2. Test Strips

- 9.1.1.3. Lancets

- 9.1.2. Continuous Blood Glucose Monitoring

- 9.1.2.1. Sensors

- 9.1.2.2. Durables

- 9.1.1. Self-monitoring Blood Glucose Devices

- 9.2. Market Analysis, Insights and Forecast - by Management Devices

- 9.2.1. Insulin Pump

- 9.2.1.1. Insulin Pump Device

- 9.2.1.2. Insulin Pump Reservoir

- 9.2.1.3. Infusion Set

- 9.2.2. Insulin Syringes

- 9.2.3. Insulin Cartridges

- 9.2.4. Disposable Pens

- 9.2.1. Insulin Pump

- 9.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 10. Asia Pacific Diabetes Care Devices Industry in Vietnam Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 10.1.1. Self-monitoring Blood Glucose Devices

- 10.1.1.1. Glucometer Devices

- 10.1.1.2. Test Strips

- 10.1.1.3. Lancets

- 10.1.2. Continuous Blood Glucose Monitoring

- 10.1.2.1. Sensors

- 10.1.2.2. Durables

- 10.1.1. Self-monitoring Blood Glucose Devices

- 10.2. Market Analysis, Insights and Forecast - by Management Devices

- 10.2.1. Insulin Pump

- 10.2.1.1. Insulin Pump Device

- 10.2.1.2. Insulin Pump Reservoir

- 10.2.1.3. Infusion Set

- 10.2.2. Insulin Syringes

- 10.2.3. Insulin Cartridges

- 10.2.4. Disposable Pens

- 10.2.1. Insulin Pump

- 10.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Roche

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dexcom*List Not Exhaustive 7 2 Company Share Analysi

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ypsomed

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbottt

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eli Lilly

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sanofi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Medtronic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tandem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Insulet

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lifescan (Johnson &Johnson)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Becton and Dickenson

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Novo Nordisk

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Roche

List of Figures

- Figure 1: Global Diabetes Care Devices Industry in Vietnam Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Vietnam Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 3: Vietnam Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 5: North America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 6: North America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2024 & 2032

- Figure 7: North America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2024 & 2032

- Figure 8: North America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 11: South America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 12: South America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2024 & 2032

- Figure 13: South America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2024 & 2032

- Figure 14: South America Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 17: Europe Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 18: Europe Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2024 & 2032

- Figure 19: Europe Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2024 & 2032

- Figure 20: Europe Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 23: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 24: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2024 & 2032

- Figure 25: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2024 & 2032

- Figure 26: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million), by Monitoring Devices 2024 & 2032

- Figure 29: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Monitoring Devices 2024 & 2032

- Figure 30: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million), by Management Devices 2024 & 2032

- Figure 31: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Management Devices 2024 & 2032

- Figure 32: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 3: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 4: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 7: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 8: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 13: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 14: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 19: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 20: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 31: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 32: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Monitoring Devices 2019 & 2032

- Table 40: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Management Devices 2019 & 2032

- Table 41: Global Diabetes Care Devices Industry in Vietnam Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Diabetes Care Devices Industry in Vietnam Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diabetes Care Devices Industry in Vietnam?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Diabetes Care Devices Industry in Vietnam?

Key companies in the market include Roche, Dexcom*List Not Exhaustive 7 2 Company Share Analysi, Ypsomed, Abbottt, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson &Johnson), Becton and Dickenson, Novo Nordisk.

3. What are the main segments of the Diabetes Care Devices Industry in Vietnam?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 424.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Management Devices Hold Highest Market Share in Vietnam Diabetes Care Devices Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

May 2023: The VPA and Roche Diabetes Care Vietnam, represented by Roche Vietnam Company Limited, have partnered to improve healthcare access for disadvantaged children with Type 1 diabetes in Vietnam as part of the global initiative CDiC. Led by Novo Nordisk and Roche Diabetes Care, this program aims to expand healthcare access and provide insulin and supplies to children and young individuals with Type 1 diabetes up to age 25 in countries with limited resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diabetes Care Devices Industry in Vietnam," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diabetes Care Devices Industry in Vietnam report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diabetes Care Devices Industry in Vietnam?

To stay informed about further developments, trends, and reports in the Diabetes Care Devices Industry in Vietnam, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence