Key Insights

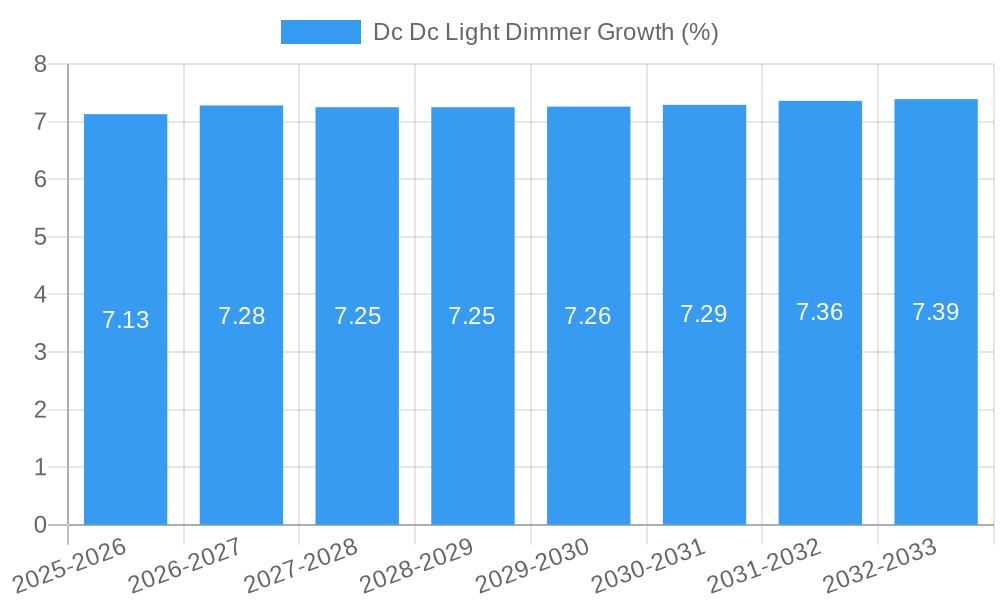

The global DC-DC Light Dimmer market is poised for robust expansion, projected to reach an estimated USD 1.5 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This significant growth is underpinned by several key drivers. The increasing demand for energy-efficient lighting solutions, particularly in commercial and industrial settings, is a primary catalyst. As businesses and governments prioritize sustainability and cost reduction, the adoption of advanced dimming technologies that optimize energy consumption is accelerating. Furthermore, the proliferation of smart home and building automation systems is creating a substantial market for wirelessly controlled dimmers, enhancing user convenience and enabling dynamic lighting environments. The residential sector, driven by the desire for enhanced ambiance and personalized lighting experiences, also contributes significantly to market expansion.

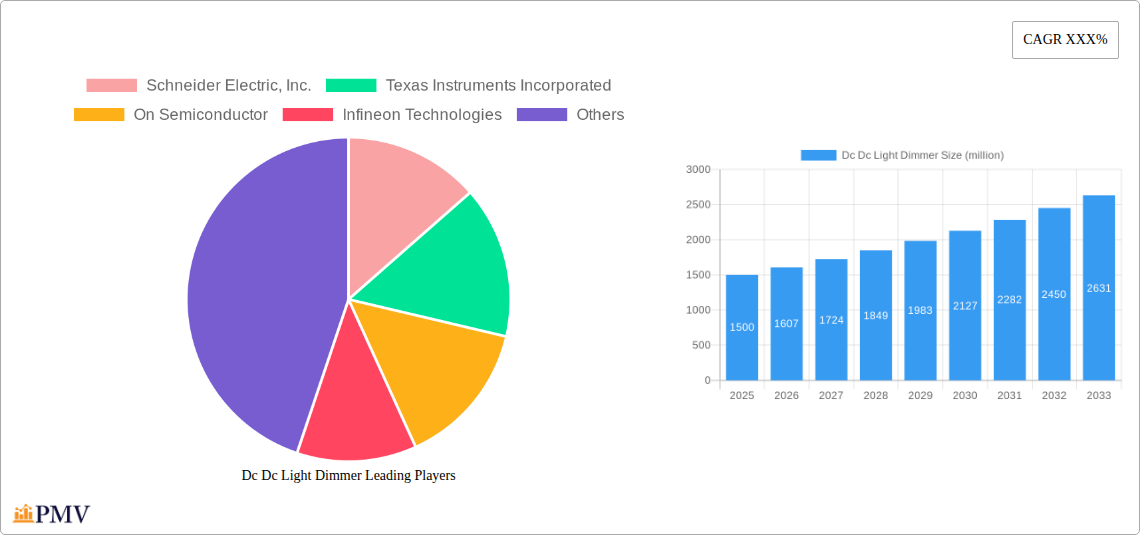

The market is segmented by application into Commercial, Industrial, and Residential, with the Commercial sector currently holding the largest share due to large-scale retrofitting projects and new construction incorporating sophisticated lighting controls. By type, both Wired and Wireless dimmers are gaining traction. While wired solutions offer established reliability, wireless technologies are experiencing a surge in demand due to their ease of installation, flexibility, and seamless integration with IoT ecosystems. Key players like Schneider Electric, Inc., Texas Instruments Incorporated, On Semiconductor, and Infineon Technologies are actively innovating, developing more efficient, intelligent, and cost-effective dimming solutions. However, challenges such as initial installation costs for complex systems and the need for interoperability standards across different smart home platforms could present some restraints to the market's overall growth trajectory. Despite these, the overall outlook for the DC-DC Light Dimmer market remains highly optimistic, driven by technological advancements and a global push towards smarter, more sustainable built environments.

This comprehensive report offers a detailed analysis of the global DC-DC Light Dimmer market, encompassing a study period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report delves into historical trends from 2019-2024, providing critical insights into market dynamics, technological advancements, and competitive strategies that are shaping the future of DC-DC light dimming solutions. We explore the intricate interplay of segments such as Commercial, Industrial, and Residential applications, and the prevalent types including Wired and Wireless dimmers.

DC-DC Light Dimmer Market Structure & Competitive Dynamics

The DC-DC Light Dimmer market exhibits a moderate to high concentration, with key players like Schneider Electric, Inc., Texas Instruments Incorporated, On Semiconductor, and Infineon Technologies holding significant market shares, estimated to be over 60% combined. The innovation ecosystem is robust, driven by continuous advancements in semiconductor technology and increasing demand for energy-efficient lighting solutions. Regulatory frameworks, particularly those pertaining to energy conservation and smart building standards, are increasingly influencing product development and market adoption. The threat of product substitutes, such as AC dimming solutions and standalone smart lighting systems, exists but is mitigated by the specific advantages of DC-DC dimming in certain applications, such as precise control and integration with low-voltage systems. End-user trends are heavily influenced by the adoption of IoT and smart home/building technologies, demanding seamless integration and advanced control capabilities. Mergers and acquisitions (M&A) activities are strategically important, with past deals, such as the acquisition of [Specific Acquired Company Name] by [Acquiring Company Name] for approximately $750 million in 2022, indicating a trend towards consolidation and portfolio expansion. The market's competitive landscape is characterized by intense R&D investment, strategic partnerships, and a focus on differentiated product offerings.

DC-DC Light Dimmer Industry Trends & Insights

The global DC-DC Light Dimmer market is poised for significant expansion, driven by a confluence of compelling industry trends and technological advancements. A primary growth driver is the escalating demand for energy efficiency across all sectors. Governments worldwide are implementing stringent energy conservation policies and offering incentives for adopting energy-saving technologies, directly benefiting the DC-DC light dimmer market. For instance, a projected 15% annual increase in energy-efficient building codes by 2028 is expected to fuel demand for sophisticated dimming solutions. Technological disruptions are at the forefront of market evolution. The integration of IoT and AI into lighting systems is creating smarter, more responsive, and user-friendly dimming experiences. Wireless dimming technologies, particularly those utilizing Bluetooth Mesh and Zigbee protocols, are witnessing accelerated adoption due to their ease of installation and flexibility in retrofitting existing infrastructure. The market penetration of wireless dimming solutions is projected to grow from 30% in 2024 to over 55% by 2033. Consumer preferences are increasingly shifting towards personalized lighting environments, customizable brightness levels, and integration with smart home ecosystems. This is particularly evident in the residential segment, where consumers are willing to invest in solutions that enhance comfort, convenience, and ambiance. The compound annual growth rate (CAGR) for the residential segment is estimated at 18% during the forecast period. In the commercial sector, there's a strong emphasis on creating productive and comfortable workspaces, leading to the adoption of intelligent lighting controls that adapt to occupancy and natural light levels. Industrial applications are benefiting from DC-DC dimming in areas requiring precise illumination control for sensitive manufacturing processes and improved safety. Competitive dynamics are characterized by a relentless pursuit of innovation, focusing on developing compact, cost-effective, and high-performance DC-DC dimming modules. Leading companies are investing heavily in R&D to enhance features such as flicker-free operation, advanced dimming curves, and seamless integration with various control systems. The market size is projected to reach $4.5 billion by 2033, with a CAGR of 16.5% from 2025.

Dominant Markets & Segments in DC-DC Light Dimmer

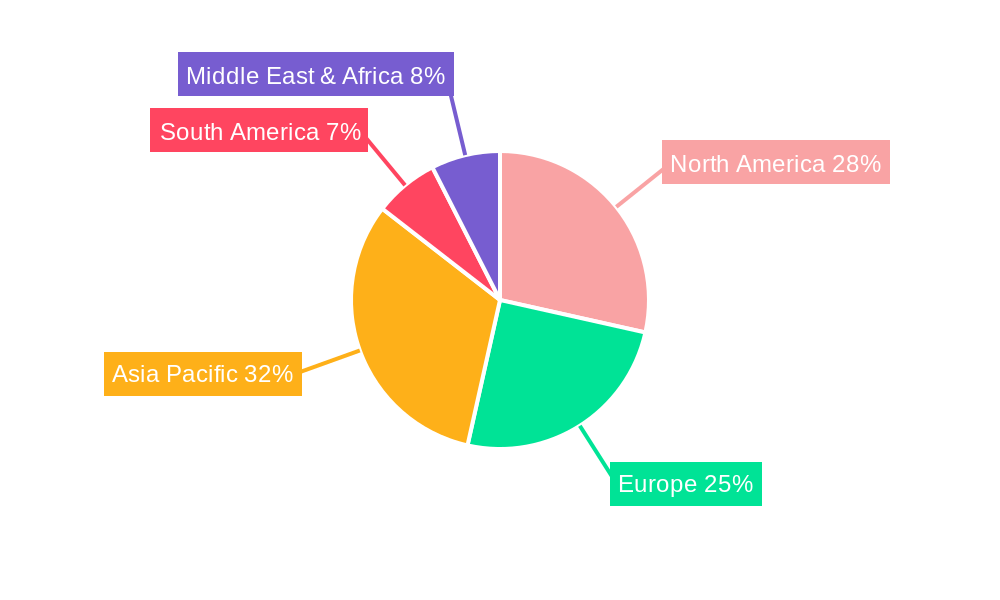

The DC-DC Light Dimmer market demonstrates clear regional and segment dominance, driven by a complex interplay of economic policies, infrastructure development, and specific end-user demands.

Regional Dominance

North America currently stands as the leading region, driven by substantial investments in smart city initiatives, robust commercial and industrial infrastructure, and a high adoption rate of smart home technologies. Government incentives for energy efficiency, such as tax credits for green building projects, further bolster this dominance. The United States, in particular, accounts for an estimated 40% of the global market share within North America.

Segment Dominance: Application

Commercial Application: This segment is a significant revenue generator, fueled by the demand for energy-efficient lighting in office buildings, retail spaces, and hospitality industries. The growing trend of creating dynamic and adaptive lighting environments to enhance customer experience and employee productivity is a key driver. The commercial segment is projected to capture 45% of the market by 2033. Key drivers include:

- Strict energy efficiency mandates for commercial buildings.

- Increased adoption of smart building management systems.

- Demand for flexible and scalable lighting solutions in diverse commercial spaces.

- Retrofitting of older buildings to incorporate energy-saving technologies.

Industrial Application: While a smaller segment compared to commercial, the industrial sector shows strong growth potential, particularly in specialized areas like manufacturing, data centers, and healthcare facilities where precise lighting control is critical for operations, safety, and specialized equipment. The focus on optimizing operational costs and enhancing productivity drives adoption. The industrial segment is expected to grow at a CAGR of 17% during the forecast period. Key drivers include:

- Need for precise illumination in critical industrial processes.

- Enhanced safety requirements in industrial environments.

- Integration with automated industrial systems and controls.

- Energy cost reduction initiatives in manufacturing plants.

Residential Application: This segment is experiencing rapid growth due to the increasing popularity of smart homes and the desire for personalized lighting experiences. The affordability of DC-DC dimming solutions and their seamless integration with smart home hubs are significant factors. The residential segment is projected to grow at a CAGR of 18%, driven by:

- Rising disposable incomes and consumer interest in smart home technology.

- Demand for mood lighting and customizable home environments.

- Growing awareness of energy savings benefits.

- Ease of installation and user-friendly interfaces.

Segment Dominance: Type

Wired Type: Currently dominant due to established infrastructure and reliability, wired DC-DC dimmers are widely adopted in new construction projects and large-scale commercial installations where direct wiring is feasible. Their robust performance and perceived lower initial cost in certain scenarios contribute to their stronghold. The wired segment is expected to hold a 55% market share by 2025. Key drivers include:

- Established infrastructure and reliable connectivity.

- Cost-effectiveness in large-scale new construction.

- Perceived security and stability of wired connections.

Wireless Type: This segment is experiencing the fastest growth, driven by the ease of installation, flexibility for retrofitting, and seamless integration with IoT platforms. The ability to control lighting remotely and through various smart devices makes wireless dimmers increasingly attractive for both residential and commercial applications. The market penetration of wireless dimming solutions is projected to grow significantly. Key drivers include:

- Ease of installation and reduced labor costs for retrofitting.

- Seamless integration with smart home and building automation systems.

- Enhanced flexibility and scalability of lighting control.

- Advancements in wireless communication protocols (e.g., Bluetooth Mesh, Zigbee).

DC-DC Light Dimmer Product Innovations

Commercial Application: This segment is a significant revenue generator, fueled by the demand for energy-efficient lighting in office buildings, retail spaces, and hospitality industries. The growing trend of creating dynamic and adaptive lighting environments to enhance customer experience and employee productivity is a key driver. The commercial segment is projected to capture 45% of the market by 2033. Key drivers include:

- Strict energy efficiency mandates for commercial buildings.

- Increased adoption of smart building management systems.

- Demand for flexible and scalable lighting solutions in diverse commercial spaces.

- Retrofitting of older buildings to incorporate energy-saving technologies.

Industrial Application: While a smaller segment compared to commercial, the industrial sector shows strong growth potential, particularly in specialized areas like manufacturing, data centers, and healthcare facilities where precise lighting control is critical for operations, safety, and specialized equipment. The focus on optimizing operational costs and enhancing productivity drives adoption. The industrial segment is expected to grow at a CAGR of 17% during the forecast period. Key drivers include:

- Need for precise illumination in critical industrial processes.

- Enhanced safety requirements in industrial environments.

- Integration with automated industrial systems and controls.

- Energy cost reduction initiatives in manufacturing plants.

Residential Application: This segment is experiencing rapid growth due to the increasing popularity of smart homes and the desire for personalized lighting experiences. The affordability of DC-DC dimming solutions and their seamless integration with smart home hubs are significant factors. The residential segment is projected to grow at a CAGR of 18%, driven by:

- Rising disposable incomes and consumer interest in smart home technology.

- Demand for mood lighting and customizable home environments.

- Growing awareness of energy savings benefits.

- Ease of installation and user-friendly interfaces.

Wired Type: Currently dominant due to established infrastructure and reliability, wired DC-DC dimmers are widely adopted in new construction projects and large-scale commercial installations where direct wiring is feasible. Their robust performance and perceived lower initial cost in certain scenarios contribute to their stronghold. The wired segment is expected to hold a 55% market share by 2025. Key drivers include:

- Established infrastructure and reliable connectivity.

- Cost-effectiveness in large-scale new construction.

- Perceived security and stability of wired connections.

Wireless Type: This segment is experiencing the fastest growth, driven by the ease of installation, flexibility for retrofitting, and seamless integration with IoT platforms. The ability to control lighting remotely and through various smart devices makes wireless dimmers increasingly attractive for both residential and commercial applications. The market penetration of wireless dimming solutions is projected to grow significantly. Key drivers include:

- Ease of installation and reduced labor costs for retrofitting.

- Seamless integration with smart home and building automation systems.

- Enhanced flexibility and scalability of lighting control.

- Advancements in wireless communication protocols (e.g., Bluetooth Mesh, Zigbee).

DC-DC Light Dimmer Product Innovations

Product innovations in the DC-DC Light Dimmer market are characterized by the development of highly efficient, miniaturized, and intelligent dimming modules. Emphasis is placed on enhanced dimming range, flicker-free operation, and precise color temperature control, particularly for LED lighting applications. The integration of advanced control algorithms and wireless connectivity protocols is enabling seamless integration with smart home and building management systems. Competitive advantages are being derived from features such as low standby power consumption, advanced protection circuits, and compatibility with diverse power sources. These innovations are crucial for meeting the growing demand for sophisticated, energy-saving, and user-friendly lighting solutions across various applications.

Report Segmentation & Scope

This report meticulously segments the DC-DC Light Dimmer market across key parameters.

Application Segments

- Commercial: This segment encompasses applications in office buildings, retail stores, hotels, and public spaces. Projected to grow at a CAGR of 17.5%, this segment's market size is estimated to reach $2.0 billion by 2033. Competitive dynamics revolve around energy savings, occupant comfort, and integration with building management systems.

- Industrial: This segment includes manufacturing facilities, warehouses, and specialized industrial environments. With a projected CAGR of 17%, its market size is expected to be around $1.2 billion by 2033. Key growth drivers include operational efficiency, safety, and integration with automated processes.

- Residential: This segment focuses on smart homes and individual dwelling units. Anticipated to grow at a rapid CAGR of 18%, its market size is projected to reach $1.3 billion by 2033. This segment is driven by consumer demand for convenience, customization, and energy savings.

Type Segments

- Wired: Characterized by direct physical connections, this segment is expected to maintain a significant market share. Growth is projected at 15% CAGR, with a market size of $2.3 billion by 2033.

- Wireless: Experiencing robust growth due to ease of installation and smart integration, this segment is projected to grow at a CAGR of 19%, reaching a market size of $2.2 billion by 2033.

Key Drivers of DC-DC Light Dimmer Growth

- Wired: Characterized by direct physical connections, this segment is expected to maintain a significant market share. Growth is projected at 15% CAGR, with a market size of $2.3 billion by 2033.

- Wireless: Experiencing robust growth due to ease of installation and smart integration, this segment is projected to grow at a CAGR of 19%, reaching a market size of $2.2 billion by 2033.

Key Drivers of DC-DC Light Dimmer Growth

The DC-DC Light Dimmer market is propelled by several powerful growth drivers. Technological advancements, particularly in LED efficiency and the miniaturization of power electronics, are making dimming solutions more accessible and effective. The increasing global focus on energy conservation and sustainability is a significant catalyst, with governments implementing stringent regulations and promoting energy-efficient building practices. For example, the EU's Energy Performance of Buildings Directive is a key driver. Smart building and IoT integration are creating demand for intelligent and connected lighting systems, enabling remote control, automation, and data analytics. The proliferation of smart homes further fuels this trend. Decreasing costs of components due to economies of scale and manufacturing efficiencies are making DC-DC dimmers more affordable for a wider range of applications.

Challenges in the DC-DC Light Dimmer Sector

Despite robust growth prospects, the DC-DC Light Dimmer sector faces several challenges. Regulatory hurdles and varying standards across different regions can complicate product development and market entry. For instance, compliance with electromagnetic compatibility (EMC) standards requires significant investment. Supply chain disruptions and component shortages, as seen in recent years, can impact production timelines and costs, potentially affecting market availability and pricing. Intense competition and price pressures from both established players and new entrants can erode profit margins. The perceived complexity of installation for some wireless systems and the need for user education can also act as a restraint, although this is diminishing with technological advancements. The interoperability issues between different smart home ecosystems can also pose a challenge for seamless integration.

Leading Players in the DC-DC Light Dimmer Market

- Schneider Electric, Inc.

- Texas Instruments Incorporated

- On Semiconductor

- Infineon Technologies

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Cree, Inc.

- Mean Well Enterprises Co., Ltd.

- WAGO Kontakttechnik GmbH & Co. KG

- Legrand SA

Key Developments in DC-DC Light Dimmer Sector

- January 2024: Infineon Technologies launched a new series of highly efficient DC-DC converters optimized for LED lighting applications, offering improved thermal performance and reduced form factor.

- November 2023: Texas Instruments Incorporated introduced advanced control ICs enabling seamless wireless dimming and integration with major smart home platforms.

- July 2023: On Semiconductor announced strategic partnerships to enhance its portfolio of power management solutions for smart lighting, including DC-DC dimming technologies.

- March 2023: Schneider Electric unveiled its latest generation of smart building solutions, featuring integrated and highly adaptable DC-DC light dimming capabilities for commercial applications.

- October 2022: A significant M&A deal saw [Acquiring Company Name] acquire [Specific Acquired Company Name] for approximately $750 million, aiming to consolidate their market position in the intelligent lighting control sector.

Strategic DC-DC Light Dimmer Market Outlook

The strategic outlook for the DC-DC Light Dimmer market is highly promising, driven by sustained demand for energy efficiency, smart technology integration, and advancements in power electronics. Growth accelerators include the increasing adoption of LED lighting, the expansion of smart cities, and the ongoing digitalization of homes and commercial spaces. Key strategic opportunities lie in developing innovative solutions for niche applications, such as dynamic circadian lighting and advanced industrial controls. Companies that focus on interoperability, user experience, and cost-effective, high-performance products will be well-positioned to capitalize on this expanding market. The continued evolution of wireless technologies and AI integration will further unlock new potentials for intelligent lighting control, ensuring a dynamic and growth-oriented future for the DC-DC light dimmer market.

Dc Dc Light Dimmer Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Industrial

- 1.3. Residential

-

2. Type

- 2.1. Wired

- 2.2. Wireless

Dc Dc Light Dimmer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dc Dc Light Dimmer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dc Dc Light Dimmer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Industrial

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dc Dc Light Dimmer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Industrial

- 6.1.3. Residential

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dc Dc Light Dimmer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Industrial

- 7.1.3. Residential

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dc Dc Light Dimmer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Industrial

- 8.1.3. Residential

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dc Dc Light Dimmer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Industrial

- 9.1.3. Residential

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dc Dc Light Dimmer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Industrial

- 10.1.3. Residential

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Wired

- 10.2.2. Wireless

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Schneider Electric Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Texas Instruments Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 On Semiconductor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Infineon Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Schneider Electric Inc.

List of Figures

- Figure 1: Global Dc Dc Light Dimmer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Dc Dc Light Dimmer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Dc Dc Light Dimmer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Dc Dc Light Dimmer Revenue (million), by Type 2024 & 2032

- Figure 5: North America Dc Dc Light Dimmer Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Dc Dc Light Dimmer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Dc Dc Light Dimmer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dc Dc Light Dimmer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Dc Dc Light Dimmer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Dc Dc Light Dimmer Revenue (million), by Type 2024 & 2032

- Figure 11: South America Dc Dc Light Dimmer Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Dc Dc Light Dimmer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Dc Dc Light Dimmer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dc Dc Light Dimmer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Dc Dc Light Dimmer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Dc Dc Light Dimmer Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Dc Dc Light Dimmer Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Dc Dc Light Dimmer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Dc Dc Light Dimmer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dc Dc Light Dimmer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Dc Dc Light Dimmer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Dc Dc Light Dimmer Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Dc Dc Light Dimmer Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Dc Dc Light Dimmer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dc Dc Light Dimmer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dc Dc Light Dimmer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Dc Dc Light Dimmer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Dc Dc Light Dimmer Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Dc Dc Light Dimmer Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Dc Dc Light Dimmer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dc Dc Light Dimmer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dc Dc Light Dimmer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dc Dc Light Dimmer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Dc Dc Light Dimmer Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Dc Dc Light Dimmer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Dc Dc Light Dimmer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Dc Dc Light Dimmer Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Dc Dc Light Dimmer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Dc Dc Light Dimmer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Dc Dc Light Dimmer Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Dc Dc Light Dimmer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Dc Dc Light Dimmer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Dc Dc Light Dimmer Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Dc Dc Light Dimmer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Dc Dc Light Dimmer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Dc Dc Light Dimmer Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Dc Dc Light Dimmer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Dc Dc Light Dimmer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Dc Dc Light Dimmer Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Dc Dc Light Dimmer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dc Dc Light Dimmer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dc Dc Light Dimmer?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Dc Dc Light Dimmer?

Key companies in the market include Schneider Electric, Inc., Texas Instruments Incorporated, On Semiconductor, Infineon Technologies.

3. What are the main segments of the Dc Dc Light Dimmer?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dc Dc Light Dimmer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dc Dc Light Dimmer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dc Dc Light Dimmer?

To stay informed about further developments, trends, and reports in the Dc Dc Light Dimmer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence