Key Insights

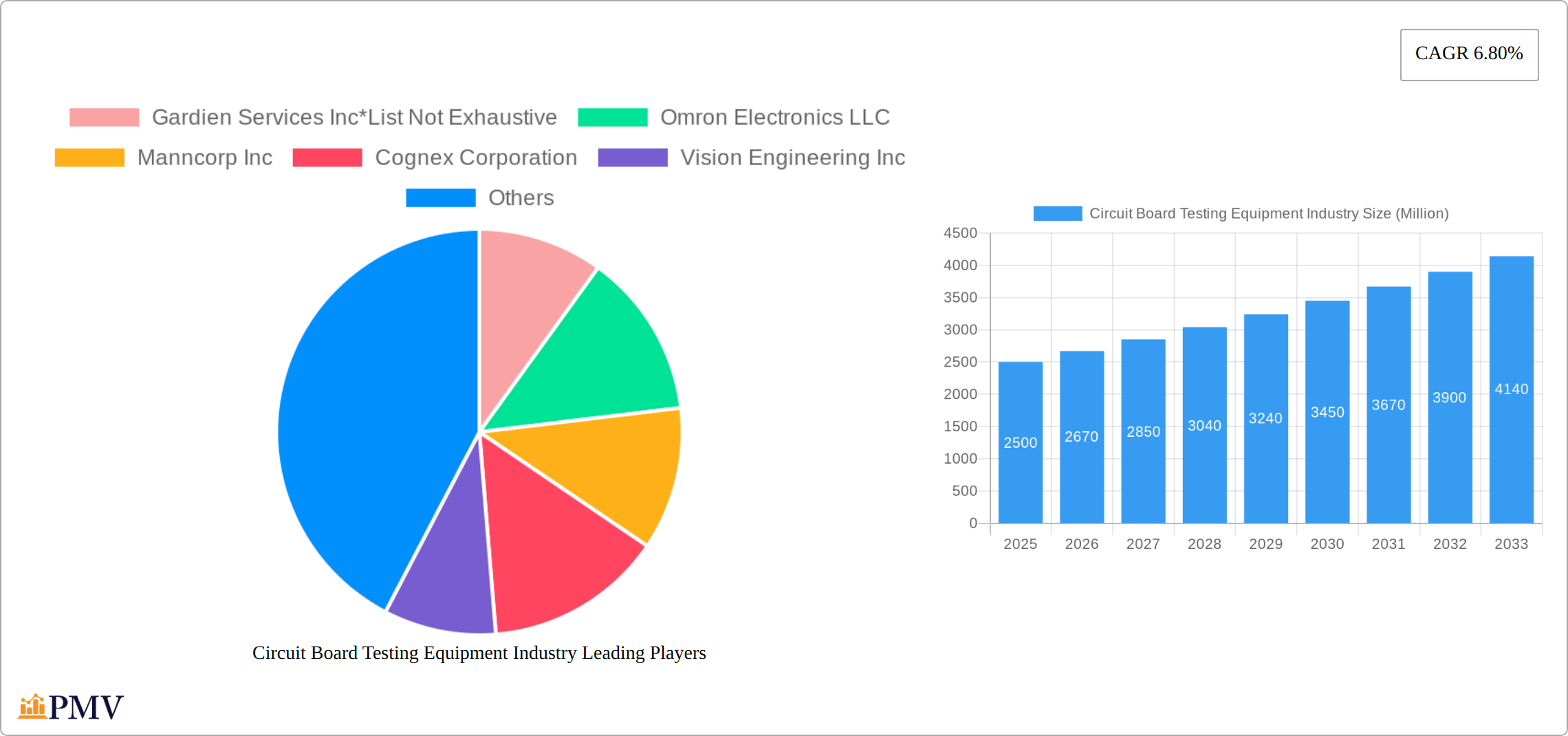

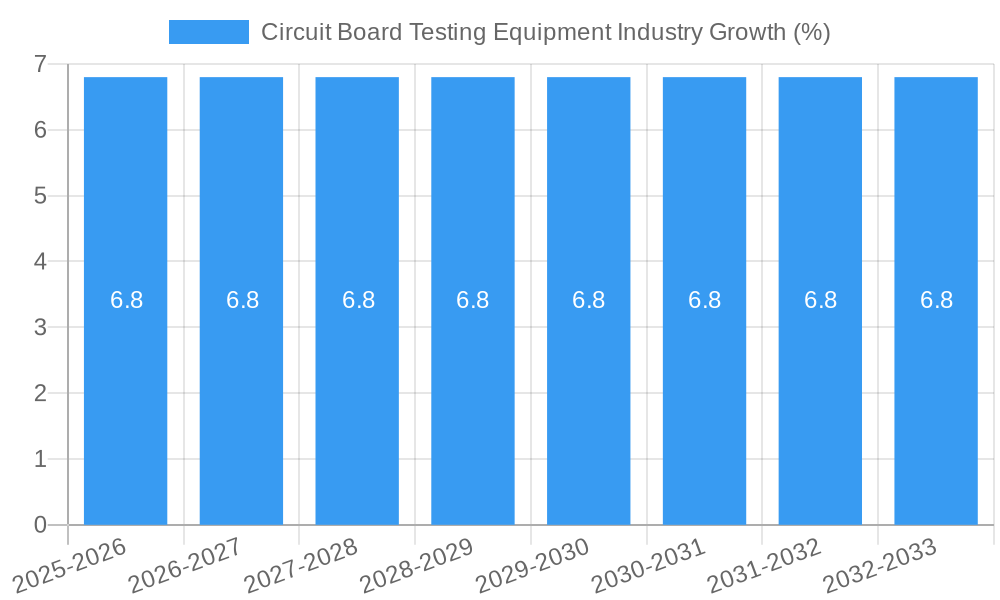

The global Circuit Board Testing Equipment Industry is poised for significant growth, with a projected market size of $2.5 billion by 2025 and a compound annual growth rate (CAGR) of 6.80% from 2025 to 2033. This growth is driven by the increasing complexity of electronic devices and the demand for high-quality, reliable circuit boards. Automatic Optical Inspection (AOI) and X-Ray Inspection are the primary segments within the market, with AOI expected to hold a larger share due to its non-destructive nature and ability to quickly detect surface-level defects. Key drivers include the rapid expansion of the electronics industry, particularly in sectors like consumer electronics, automotive, and aerospace, which require stringent quality control measures. Leading companies such as Gardien Services Inc, Omron Electronics LLC, and Cognex Corporation are at the forefront, continuously innovating to meet evolving industry standards.

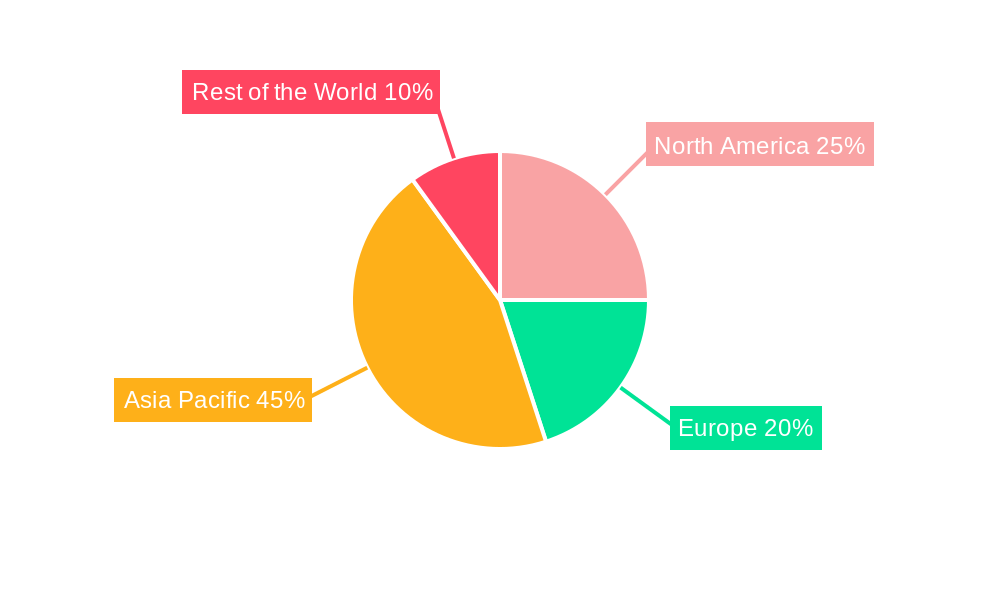

Market trends indicate a shift towards more advanced inspection technologies and automation, enhancing efficiency and accuracy in circuit board testing. However, the industry faces restraints such as high initial costs and the need for skilled technicians to operate sophisticated equipment. Regionally, Asia Pacific is anticipated to dominate the market due to its robust electronics manufacturing base, followed by North America and Europe, where technological advancements and stringent regulations drive demand. The forecast period from 2025 to 2033 will likely see increased investments in R&D to further refine inspection methods and integrate AI and machine learning for predictive maintenance and fault detection, thereby sustaining the industry's growth trajectory.

Circuit Board Testing Equipment Industry Market Structure & Competitive Dynamics

The Circuit Board Testing Equipment Industry is characterized by a mix of established players and innovative startups, with a market concentration that favors companies like Gardien Services Inc, Omron Electronics LLC, and Manncorp Inc. The innovation ecosystem is vibrant, driven by continuous advancements in technology such as AI and machine learning, which are being integrated into testing solutions to enhance accuracy and efficiency. Regulatory frameworks in major markets such as the United States and Europe are increasingly stringent, pushing companies to adhere to high standards of quality and safety. The presence of product substitutes like manual testing methods remains, although their use is diminishing due to the superior efficiency and accuracy of automated systems.

- Market Share: Omron Electronics LLC holds approximately 15% of the market, followed by Gardien Services Inc with around 10%.

- Mergers and Acquisitions: Over the past five years, there have been M&A deals worth over $500 Million, with a focus on acquiring technology and expanding market reach.

- End-User Trends: There is a growing demand for high-precision testing equipment in sectors such as automotive and aerospace, driven by the need for reliable and efficient circuit boards.

- Innovation: The industry is witnessing a surge in patents related to automated optical inspection (AOI) and X-ray technologies, indicating a strong push towards innovation.

Circuit Board Testing Equipment Industry Industry Trends & Insights

The Circuit Board Testing Equipment Industry is experiencing robust growth, driven by the increasing complexity of electronic devices and the demand for higher quality and reliability in circuit boards. The compound annual growth rate (CAGR) for the industry is projected to be around 6.5% from 2025 to 2033. Technological disruptions, particularly in AI and machine learning, are reshaping the landscape by enabling more sophisticated inspection methods that can detect defects with greater accuracy. Consumer preferences are shifting towards smaller, more powerful devices, which necessitates advanced testing equipment capable of inspecting high-density circuit boards.

The competitive dynamics within the industry are intense, with companies like Cognex Corporation and Vision Engineering Inc investing heavily in R&D to stay ahead. Market penetration in emerging economies is increasing, driven by the growth of the electronics manufacturing sector. Economic factors such as rising disposable incomes and the proliferation of consumer electronics are further fueling demand. However, the industry faces challenges from rapid technological obsolescence and the need for continuous innovation to meet evolving market demands.

Dominant Markets & Segments in Circuit Board Testing Equipment Industry

The Asia-Pacific region is the leading market for Circuit Board Testing Equipment, driven by the strong presence of electronics manufacturing in countries like China and South Korea. Within the segments, Automatic Optical Inspection (AOI) is the dominant method due to its non-destructive nature and high throughput.

- Economic Policies: Favorable government initiatives and subsidies in Asia-Pacific are boosting the adoption of advanced testing equipment.

- Infrastructure: The region's robust manufacturing infrastructure supports the growth of the Circuit Board Testing Equipment Industry.

- Technological Advancements: Continuous innovation in AOI technology is making it the preferred choice for many manufacturers.

The dominance of AOI is further solidified by its versatility in handling various types of circuit boards, from simple to complex. On the other hand, X-Ray Inspection, while less dominant, is crucial for detecting internal defects that AOI cannot identify. The demand for X-Ray Inspection is growing, particularly in high-reliability applications such as aerospace and medical devices, where the cost of failure is high.

Circuit Board Testing Equipment Industry Product Innovations

Recent product innovations in the Circuit Board Testing Equipment Industry are centered around enhancing inspection speed and precision. The integration of AI and machine learning into systems like the 3Di series by Saki Corporation and the VT-S10 Series by Omron Corporation exemplifies the industry's focus on automation and accuracy. These advancements are not only improving the efficiency of testing processes but also broadening the market fit by catering to the needs of industries requiring high-precision inspection.

Report Segmentation & Scope

The Circuit Board Testing Equipment Industry is segmented by inspection method into Automatic Optical Inspection (AOI) and X-Ray Inspection.

Automatic Optical Inspection (AOI): This segment is expected to grow at a CAGR of 7% from 2025 to 2033, driven by its widespread adoption across various industries. The market size for AOI is projected to reach $2.5 Billion by 2033, with competitive dynamics favoring companies that offer integrated solutions.

X-Ray Inspection: The X-Ray Inspection segment is anticipated to grow at a CAGR of 5.5% over the same period. Its market size is expected to be around $1.2 Billion by 2033, with a focus on niche applications where internal inspection is critical.

Key Drivers of Circuit Board Testing Equipment Industry Growth

The growth of the Circuit Board Testing Equipment Industry is propelled by several key factors. Technological advancements in AI and machine learning are enhancing the capabilities of testing equipment, making them more efficient and accurate. Economically, the rise in consumer electronics demand, particularly in emerging markets, is driving the need for reliable testing solutions. Regulatory pressures are also playing a role, with stricter quality standards pushing manufacturers to invest in advanced testing equipment to ensure compliance.

Challenges in the Circuit Board Testing Equipment Industry Sector

The Circuit Board Testing Equipment Industry faces several challenges that could impede growth. Regulatory hurdles, especially in regions with stringent quality control standards, can increase the cost and complexity of compliance. Supply chain issues, exacerbated by global disruptions, can lead to delays and increased costs. Competitive pressures are intense, with companies needing to continuously innovate to maintain market share. These challenges are estimated to impact the industry's growth by up to 2% annually.

Leading Players in the Circuit Board Testing Equipment Industry Market

- Gardien Services Inc*List Not Exhaustive

- Omron Electronics LLC

- Manncorp Inc

- Cognex Corporation

- Vision Engineering Inc

- ViTrox Corp Bhd

- Nordson YESTECH Inc

Key Developments in Circuit Board Testing Equipment Industry Sector

- May 2022: Saki Corporation developed the new 3Di series of high-speed, high-precision, next-generation in-line 3D automated optical inspection systems. The system is ideal for the complex inspection of high-density printed circuit boards and boards with a combination of very small and tall components, significantly impacting market dynamics by setting new standards for inspection capabilities.

- August 2021: Omron Corporation announced the global launch of the PCB inspection system "VT-S10 Series," which features an industry-first imaging technique and AI to automate the high-precision inspection process for electronic substrates, thus eliminating the need for specialist skills. This development has broadened the market by making advanced inspection technology more accessible.

Strategic Circuit Board Testing Equipment Industry Market Outlook

The future outlook for the Circuit Board Testing Equipment Industry is promising, with significant growth potential driven by the increasing demand for high-quality electronics. Strategic opportunities lie in expanding into emerging markets, where the electronics manufacturing sector is growing rapidly. Additionally, the integration of advanced technologies like AI and IoT into testing equipment presents new avenues for innovation and market differentiation. Companies that can leverage these trends and adapt to the evolving needs of the industry are poised to capture significant market share in the coming years.

Circuit Board Testing Equipment Industry Segmentation

-

1. Inspection Method

- 1.1. Automatic Optical Inspection (AOI)

- 1.2. X-Ray Inspection

Circuit Board Testing Equipment Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Circuit Board Testing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Diversity and Density of PCB is Fuelling the Market Demand

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity Due to Miniaturisation of Components is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. X-Ray Inspection to Gain Majority Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Inspection Method

- 5.1.1. Automatic Optical Inspection (AOI)

- 5.1.2. X-Ray Inspection

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Inspection Method

- 6. North America Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Inspection Method

- 6.1.1. Automatic Optical Inspection (AOI)

- 6.1.2. X-Ray Inspection

- 6.1. Market Analysis, Insights and Forecast - by Inspection Method

- 7. Europe Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Inspection Method

- 7.1.1. Automatic Optical Inspection (AOI)

- 7.1.2. X-Ray Inspection

- 7.1. Market Analysis, Insights and Forecast - by Inspection Method

- 8. Asia Pacific Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Inspection Method

- 8.1.1. Automatic Optical Inspection (AOI)

- 8.1.2. X-Ray Inspection

- 8.1. Market Analysis, Insights and Forecast - by Inspection Method

- 9. Rest of the World Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Inspection Method

- 9.1.1. Automatic Optical Inspection (AOI)

- 9.1.2. X-Ray Inspection

- 9.1. Market Analysis, Insights and Forecast - by Inspection Method

- 10. North America Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Circuit Board Testing Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Gardien Services Inc*List Not Exhaustive

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Omron Electronics LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Manncorp Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Cognex Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Vision Engineering Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 ViTrox Corp Bhd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Nordson YESTECH Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.1 Gardien Services Inc*List Not Exhaustive

List of Figures

- Figure 1: Global Circuit Board Testing Equipment Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 11: North America Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 12: North America Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 15: Europe Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 16: Europe Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 19: Asia Pacific Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 20: Asia Pacific Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Pacific Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Rest of the World Circuit Board Testing Equipment Industry Revenue (Million), by Inspection Method 2024 & 2032

- Figure 23: Rest of the World Circuit Board Testing Equipment Industry Revenue Share (%), by Inspection Method 2024 & 2032

- Figure 24: Rest of the World Circuit Board Testing Equipment Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Rest of the World Circuit Board Testing Equipment Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 3: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Circuit Board Testing Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 13: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 15: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 17: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Inspection Method 2019 & 2032

- Table 19: Global Circuit Board Testing Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Circuit Board Testing Equipment Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Circuit Board Testing Equipment Industry?

Key companies in the market include Gardien Services Inc*List Not Exhaustive, Omron Electronics LLC, Manncorp Inc, Cognex Corporation, Vision Engineering Inc, ViTrox Corp Bhd, Nordson YESTECH Inc.

3. What are the main segments of the Circuit Board Testing Equipment Industry?

The market segments include Inspection Method.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Diversity and Density of PCB is Fuelling the Market Demand.

6. What are the notable trends driving market growth?

X-Ray Inspection to Gain Majority Share.

7. Are there any restraints impacting market growth?

Increasing Complexity Due to Miniaturisation of Components is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

May 2022 - Saki Corporation developed the new 3Di series of high-speed, high-precision, next-generation in-line 3D automated optical inspection systems. The system is ideal for the complex inspection of high-density printed circuit boards and boards with a combination of very small and tall components.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Circuit Board Testing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Circuit Board Testing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Circuit Board Testing Equipment Industry?

To stay informed about further developments, trends, and reports in the Circuit Board Testing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence