Key Insights

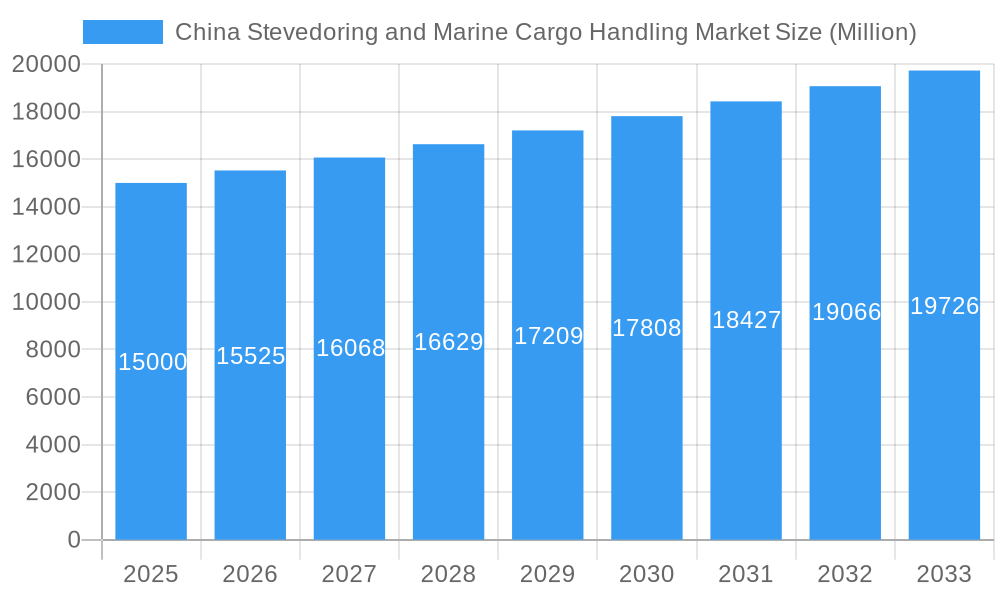

The China stevedoring and marine cargo handling market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. This expansion is fueled by several key drivers. China's booming e-commerce sector and increasing reliance on global trade are significantly boosting cargo volumes. Government initiatives aimed at modernizing port infrastructure and enhancing logistics efficiency further contribute to market growth. The increasing adoption of automation and technology within port operations, such as advanced container handling systems and intelligent logistics platforms, also plays a crucial role. Furthermore, the expansion of China's strategic Belt and Road Initiative is generating significant demand for efficient and reliable stevedoring and cargo handling services. The market is segmented by type (stevedoring, cargo and handling transportation, others) and cargo type (bulk cargo, containerized cargo, other cargo), with containerized cargo currently dominating due to its prominence in global trade. While challenges exist, such as potential fluctuations in global trade and the need for ongoing investment in port infrastructure, the overall outlook for the China stevedoring and marine cargo handling market remains positive.

China Stevedoring and Marine Cargo Handling Market Market Size (In Billion)

The market’s competitive landscape is characterized by a mix of large state-owned enterprises (SOEs) and privately-owned companies. Major players like China Ocean Shipping Company and China Shipbuilding Trading Co Ltd are leveraging their established networks and infrastructure to maintain their market share. However, smaller, specialized companies are also emerging, offering niche services and innovative solutions. Competition is expected to intensify as companies strive to improve efficiency, reduce costs, and offer enhanced value-added services to meet the growing demands of shippers. The market's future growth will depend on several factors, including sustained economic growth in China, effective government policies to support port development, and continued technological advancements within the industry. Successful companies will be those that can adapt to these evolving market dynamics and effectively leverage technological innovations to optimize their operations.

China Stevedoring and Marine Cargo Handling Market Company Market Share

This comprehensive report provides an in-depth analysis of the China stevedoring and marine cargo handling market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period (2019-2024) and incorporates detailed segmentation by cargo type (Bulk Cargo, Containerized Cargo, Other Cargo) and service type (Stevedoring, Cargo and handling transportation, Others). The market size is valued in Millions.

China Stevedoring and Marine Cargo Handling Market Market Structure & Competitive Dynamics

The China stevedoring and marine cargo handling market is characterized by a dynamic and evolving structure, balancing consolidation with specialized service offerings. A moderately concentrated landscape prevails, where established major players, often with deep roots in specific port regions or cargo types, hold significant sway. Their dominance is underpinned by critical factors such as unparalleled operational efficiency, superior access to and investment in state-of-the-art port infrastructure, and robust, long-standing client relationships built on trust and reliability.

Innovation is a dual-edged sword. Established giants are aggressively investing in automation, robotics, and advanced digital technologies to streamline operations, reduce turnaround times, and enhance safety. Simultaneously, agile emerging companies are carving out niches by offering highly specialized services, catering to unique cargo requirements or leveraging novel logistical approaches. This competitive tension drives continuous improvement across the sector.

The regulatory framework, while generally supportive of trade facilitation and economic growth, is a key consideration. Periodic adjustments to regulations concerning environmental standards, labor practices, and port operations can influence operational costs and necessitate ongoing compliance efforts. Companies that proactively adapt to these changes and invest in sustainable practices are better positioned for long-term success.

Product substitutes, particularly in the form of enhanced inland transportation networks and multimodal logistics solutions, present a competitive threat. As these inland networks become more efficient and cost-effective, they can reduce reliance on ports for shorter-haul cargo movements, forcing stevedoring and handling providers to focus on value-added services and efficiency improvements to retain business.

End-user trends are profoundly shaping demand. The global shift towards just-in-time inventory management and sophisticated supply chain optimization strategies necessitates faster, more predictable, and transparent cargo handling. This is pushing service providers to adopt more integrated and technology-driven solutions.

Mergers and acquisitions (M&A) activity has been a significant, albeit moderate, force in shaping the market. Deals, with reported values ranging from approximately [Insert estimated minimum deal value in USD or RMB, e.g., tens of millions USD] to [Insert estimated maximum deal value in USD or RMB, e.g., hundreds of millions USD], are often strategic. These transactions are primarily aimed at consolidating regional player dominance, expanding service portfolios to offer end-to-end logistics solutions, and gaining access to new technologies or markets. Key M&A activities include [Insert specific examples of M&A activity with deal values if available, e.g., "Port Authority X's acquisition of Regional Stevedore Y for an estimated $XX Million," otherwise state "Specific recent M&A data is not publicly disclosed but indicates a trend towards consolidation"]. The market concentration ratio (CRx) for the top x players is estimated at xx%, underscoring a moderately competitive yet increasingly sophisticated landscape.

China Stevedoring and Marine Cargo Handling Market Industry Trends & Insights

The China stevedoring and marine cargo handling market is experiencing robust growth, driven by the nation's expanding economy, increasing international trade, and substantial investments in port infrastructure modernization. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. Technological advancements, such as automation in container handling and improved logistics software, are enhancing efficiency and reducing operational costs. Consumer preferences for faster and more reliable delivery solutions are driving the adoption of advanced technologies. Increased demand for efficient and sustainable cargo handling is pushing industry players toward innovative solutions, such as the adoption of LNG-powered vessels as demonstrated by COSCO SHIPPING Energy's maiden voyage of the YUAN RUI YANG in May 2022. However, competitive pressures, fluctuating fuel prices, and potential disruptions from geopolitical events could impact market growth. Market penetration of automated systems is currently at xx% and is expected to reach xx% by 2033.

Dominant Markets & Segments in China Stevedoring and Marine Cargo Handling Market

The economic heartland of China's stevedoring and marine cargo handling operations beats strongest along its extensive coastal regions, particularly the eastern seaboard. This geographical dominance is not accidental but a direct consequence of a confluence of powerful factors, making these areas the undisputed hubs for cargo throughput.

Key Drivers of Dominance:

- Unrivaled Economic Activity: The eastern coastal provinces are the engine room of China's industrial output and export-oriented manufacturing. This translates directly into colossal volumes of goods needing to be moved to and from international markets, creating a consistently high demand for stevedoring and cargo handling services.

- World-Class Port Infrastructure: Decades of strategic investment have resulted in a dense network of highly developed, modern, and efficient ports along the coast. These facilities are equipped with advanced handling machinery, deep-water berths, and sophisticated logistics support, capable of accommodating the largest vessels and handling diverse cargo types at high speeds.

- Proactive Government Support & Policy Environment: The Chinese government has consistently prioritized the development of its maritime infrastructure and trade facilitation. Favorable policies, tax incentives, and ongoing investment in port expansion, dredging, and connectivity projects create an environment that actively encourages and supports the growth of the stevedoring and marine cargo handling market.

Segment Analysis:

- Containerized Cargo: This segment reigns supreme, driven by the unparalleled efficiency and global standardization of container shipping. The exponential growth of international trade, facilitated by containerization, ensures this segment consistently represents the largest share of market activity and revenue.

- Bulk Cargo: While containerized cargo leads, bulk cargo remains a critically important segment. This includes essential raw materials like iron ore, coal, grains, and petrochemicals. Demand in this segment is inherently cyclical, heavily influenced by global commodity prices, industrial production levels, and international trade policies.

- Stevedoring Services: This foundational segment, encompassing the physical loading and unloading of all types of cargo, is characterized by fierce competition. Success here hinges on achieving peak operational efficiency, minimizing vessel turnaround times, ensuring cargo safety, and increasingly, on the adoption of advanced technologies and automation to reduce costs and improve service quality.

The eastern coastal regions offer a rich ecosystem where these segments converge, creating intense competition among a multitude of domestic and international players. Companies vie for market share by optimizing their pricing strategies, expanding their service offerings to provide more integrated logistics solutions, and extending their geographical reach within these vital trade corridors.

China Stevedoring and Marine Cargo Handling Market Product Innovations

Recent product innovations focus on automation, digitalization, and environmentally friendly solutions. Automated guided vehicles (AGVs), remote-controlled cranes, and advanced port management systems are increasing efficiency and reducing labor costs. The integration of blockchain technology enhances transparency and security in supply chains. Furthermore, the growing adoption of LNG-powered vessels, as exemplified by the successful maiden voyage of the YUAN RUI YANG, reflects a shift toward greener and more sustainable practices within the industry. These innovations are improving operational efficiency, reducing environmental impact, and enhancing overall competitiveness.

Report Segmentation & Scope

This report offers a comprehensive breakdown of the China Stevedoring and Marine Cargo Handling Market, segmented to provide granular insights into its various facets. The scope is designed to capture the nuances of the industry, from the core services to specialized offerings and diverse cargo types.

By Type of Service:

- Stevedoring: This primary segment encompasses all operations related to the physical loading and unloading of cargo onto and from vessels at ports and terminals. Growth in this segment is directly correlated with overall port activity and is increasingly influenced by the adoption of advanced automation and specialized handling equipment to boost efficiency and safety.

- Cargo and Handling Transportation: This broad category includes the crucial inland logistics activities that move goods to and from the ports. This encompasses trucking, rail, and barge services, and its growth is significantly fueled by ongoing improvements in China's national transportation infrastructure and the ever-present demand for seamless, end-to-end logistics solutions.

- Others: This "catch-all" category includes a range of ancillary and value-added services that complement core stevedoring and handling operations. This may encompass warehousing, inventory management, customs brokerage, freight forwarding, and other essential logistics-related activities that contribute to the comprehensive supply chain.

By Cargo Type:

- Bulk Cargo: This segment deals with unpackaged goods, such as minerals, grains, coal, and liquid chemicals. Its growth trajectory is intrinsically linked to global commodity markets, industrial production cycles, and the demand for raw materials.

- Containerized Cargo: As the most dominant segment, this category is driven by the efficiency and globalization of container shipping. The rise of e-commerce and the interconnectedness of global supply chains continue to fuel substantial growth in this area.

- Other Cargo: This segment addresses specialized cargo that requires unique handling and transportation methods. This includes project cargo, oversized equipment, vehicles, and other non-standardized freight that demands specific expertise and equipment.

Each of these segments presents distinct growth prospects, competitive dynamics, and operational challenges. The full report provides detailed market sizing, historical data, and future growth projections for each identified segment, offering a clear roadmap for understanding the market's trajectory.

Key Drivers of China Stevedoring and Marine Cargo Handling Market Growth

The China stevedoring and marine cargo handling market’s growth is primarily driven by: (1) China's expanding economy and its role in global trade; (2) significant investments in port infrastructure development and modernization across the country; (3) technological advancements, such as automation and digitalization, leading to increased efficiency and reduced operational costs; (4) supportive government policies aimed at improving logistics and supply chain efficiency; and (5) increasing demand for efficient and sustainable cargo handling practices.

Challenges in the China Stevedoring and Marine Cargo Handling Market Sector

The China stevedoring and marine cargo handling market, while robust, navigates a complex terrain fraught with several significant challenges that can impact profitability and market expansion:

- Intense Competition and Price Pressures: The market is characterized by a large number of service providers, leading to a highly competitive environment. This often translates into significant price pressures, forcing companies to operate on thinner margins. Differentiation through service quality and efficiency is crucial to counter this.

- Supply Chain Disruptions: The global nature of trade makes the sector susceptible to unforeseen disruptions. Geopolitical events, trade disputes, natural disasters, pandemics, and logistical bottlenecks can severely impact cargo flow, leading to operational inefficiencies and financial losses.

- High Capital Expenditure for Modernization: Maintaining competitiveness requires continuous investment in port infrastructure, advanced handling equipment, and digital technologies. These upgrades represent substantial capital expenditures, posing a financial hurdle, particularly for smaller players.

- Evolving Environmental Regulations: Increasing global and national focus on environmental sustainability is leading to stricter regulations concerning emissions, waste management, and the use of greener technologies. Compliance with these evolving standards can necessitate costly operational adjustments and investments in new equipment.

- Technological Adaptation and Skill Gaps: The rapid pace of technological advancement, from automation and AI to IoT, demands constant adaptation. Companies face the challenge of integrating new technologies and ensuring their workforce possesses the necessary skills to operate and maintain them effectively. A persistent skill gap can hinder the adoption of efficiency-boosting innovations.

- Demand Volatility and Economic Sensitivity: The stevedoring and cargo handling market is intrinsically linked to the health of the global and domestic economy. Fluctuations in trade volumes, commodity prices, and manufacturing output directly influence demand, creating periods of both high activity and potential slowdowns.

Successfully navigating these challenges requires strategic foresight, robust operational planning, significant investment in technology and human capital, and a keen understanding of the evolving regulatory and economic landscape.

Leading Players in the China Stevedoring and Marine Cargo Handling Market Market

- ASEAN Seas Line Co Limited

- Guangzhou Shipyard International (GSI)

- China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- China Shipbuilding Trading Co Ltd (CSTC)

- CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- Qingdao Port International Limited

- Taizhou Sanfu Ship Engineering Co Ltd

- China Merchants Jinling Shipyard (Weihai) Co Ltd

- Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- China Ocean Shipping Company

Key Developments in China Stevedoring and Marine Cargo Handling Market Sector

- July 2022: Commissioning of China's first indigenously developed offshore oil and gas extraction facility ("Xmas Tree" system) in Hainan Province, significantly boosting domestic energy production and potentially impacting related maritime cargo handling.

- May 2022: Successful maiden voyage of the world's first LNG dual-fuel ultra-large crude oil tanker, "YUAN RUI YANG," highlighting China's commitment to sustainable maritime energy transportation and potentially influencing future fuel choices and associated infrastructure needs.

Strategic China Stevedoring and Marine Cargo Handling Market Market Outlook

The strategic outlook for the China stevedoring and marine cargo handling market remains decidedly positive, buoyed by robust underlying economic drivers and a commitment to modernization. The continued expansion of China's economy, coupled with ongoing, substantial investments in port infrastructure and the relentless pursuit of technological innovation, paints a promising picture for future growth.

Key strategic opportunities lie in embracing digitalization and automation. Companies that proactively invest in and implement advanced technologies such as AI-powered logistics management, automated guided vehicles (AGVs), robotic loading/unloading systems, and comprehensive IoT-enabled tracking solutions are poised to achieve significant gains in efficiency, reduce operational costs, and enhance cargo visibility. These advancements are not merely about cost savings but are becoming essential for meeting the demands of sophisticated global supply chains.

Sustainability is another critical strategic imperative. As environmental regulations tighten and corporate social responsibility gains prominence, companies that adopt greener operational practices, invest in eco-friendly equipment, and develop sustainable logistics solutions will not only ensure compliance but also gain a competitive advantage. This includes optimizing energy consumption, reducing emissions, and implementing effective waste management strategies.

Companies with strong technological capabilities, agile and efficient operational models, and a forward-thinking approach to sustainability are exceptionally well-positioned to capture an increasing share of the market. Building integrated service offerings that extend beyond traditional stevedoring to encompass end-to-end logistics solutions will also be a key differentiator.

The long-term outlook for the China stevedoring and marine cargo handling market is one of sustained growth and increasing sophistication. While subject to the broader fluctuations of the global economic climate and evolving geopolitical dynamics, the fundamental drivers of trade, infrastructure development, and technological advancement provide a strong foundation for continued expansion and strategic development within the sector.

China Stevedoring and Marine Cargo Handling Market Segmentation

-

1. Type

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Bulk Cargo

- 2.2. Containerized Cargo

- 2.3. Other Cargo

China Stevedoring and Marine Cargo Handling Market Segmentation By Geography

- 1. China

China Stevedoring and Marine Cargo Handling Market Regional Market Share

Geographic Coverage of China Stevedoring and Marine Cargo Handling Market

China Stevedoring and Marine Cargo Handling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. China’s increasing investments in the ocean freight shipping industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Stevedoring and Marine Cargo Handling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Bulk Cargo

- 5.2.2. Containerized Cargo

- 5.2.3. Other Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ASEAN Seas Line Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guangzhou Shipyard International (GSI)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China (Shenzhen) International Logistics and Supply Chain Fair (CILF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Shipbuilding Trading Co Ltd (CSTC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qingdao Port International Limited**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Taizhou Sanfu Ship Engineering Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 China Merchants Jinling Shipyard (Weihai) Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shenzhen Yihaitong Global Supply Chain Management Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Ocean Shipping Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ASEAN Seas Line Co Limited

List of Figures

- Figure 1: China Stevedoring and Marine Cargo Handling Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Stevedoring and Marine Cargo Handling Market Share (%) by Company 2025

List of Tables

- Table 1: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 3: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Cargo Type 2020 & 2033

- Table 6: China Stevedoring and Marine Cargo Handling Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Stevedoring and Marine Cargo Handling Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the China Stevedoring and Marine Cargo Handling Market?

Key companies in the market include ASEAN Seas Line Co Limited, Guangzhou Shipyard International (GSI), China (Shenzhen) International Logistics and Supply Chain Fair (CILF), China Shipbuilding Trading Co Ltd (CSTC), CSSC Huangpu Wenchong Shipbuilding Co Ltd (HPWS), Qingdao Port International Limited**List Not Exhaustive, Taizhou Sanfu Ship Engineering Co Ltd, China Merchants Jinling Shipyard (Weihai) Co Ltd, Shenzhen Yihaitong Global Supply Chain Management Co Ltd, China Ocean Shipping Company.

3. What are the main segments of the China Stevedoring and Marine Cargo Handling Market?

The market segments include Type, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

China’s increasing investments in the ocean freight shipping industry.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

July 2022: China's first indigenously developed offshore oil and gas extraction facility, subsea 'Xmas Tree' system, was put into operation in the Yingge Sea, south China's Hainan Province. The system is able to produce about 200 million cubic meters of natural gas per year, according to China National Offshore Oil Corporation (CNOOC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Stevedoring and Marine Cargo Handling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Stevedoring and Marine Cargo Handling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Stevedoring and Marine Cargo Handling Market?

To stay informed about further developments, trends, and reports in the China Stevedoring and Marine Cargo Handling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence