Key Insights

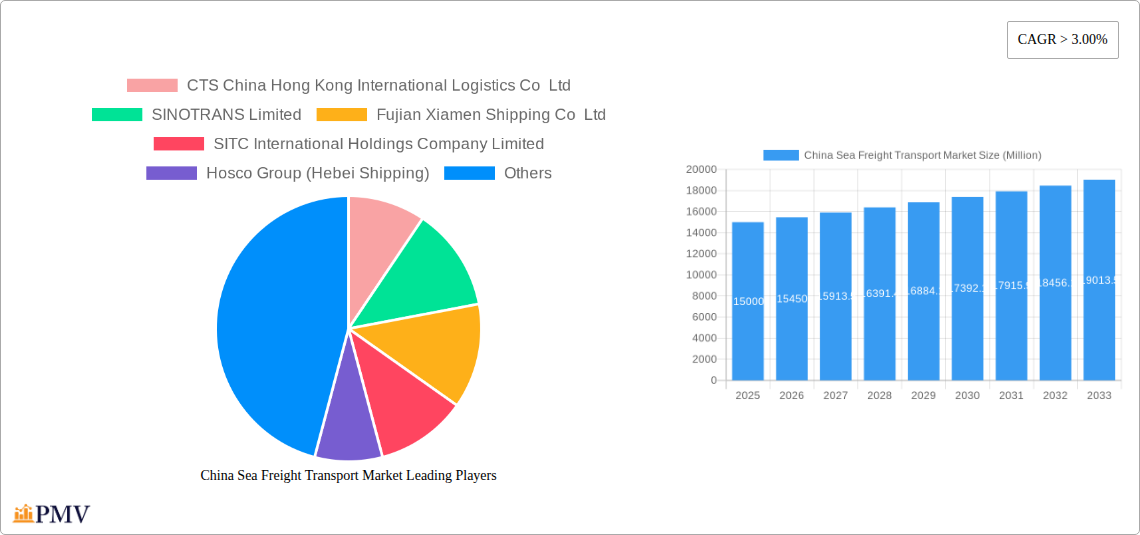

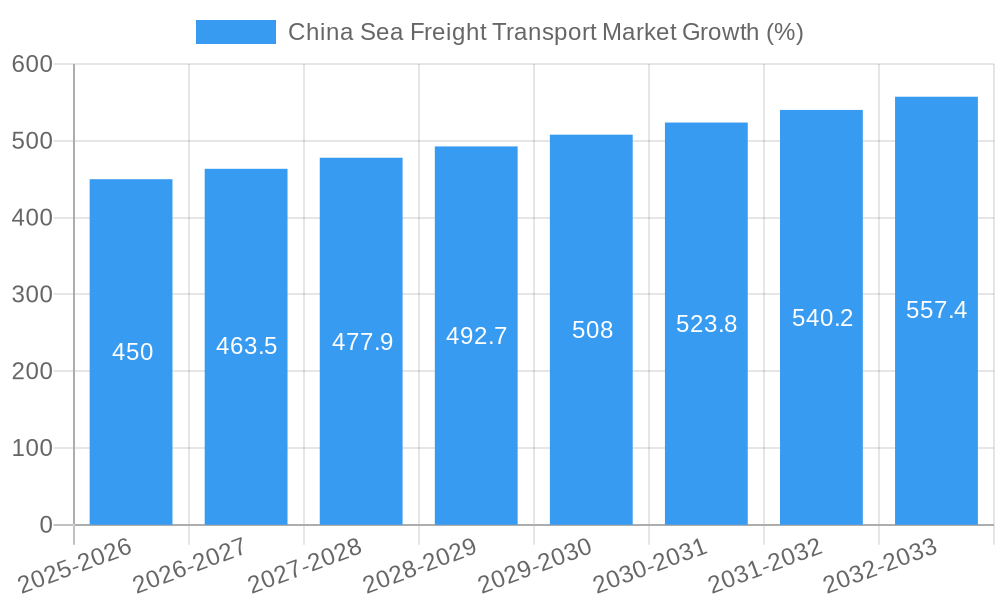

The China sea freight transport market, a significant component of global maritime trade, exhibits robust growth potential. Driven by China's expanding manufacturing sector, burgeoning e-commerce, and increasing global demand for goods, the market is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. Key segments fueling this expansion include containerized cargo, driven by the rise of containerized shipping and efficient logistics networks. Bulk cargo and liquid cargo segments also contribute significantly, reflecting the transportation needs of raw materials and refined products. The market is further segmented by vessel type (container ships, bulk carriers, tankers), catering to diverse cargo needs. The end-use industries driving demand include manufacturing (export-oriented production), retail (import and distribution), and agriculture (import of raw materials and export of finished products). Major players like COSCO Shipping Lines, China Merchants Group, and others dominate the landscape, leveraging their established networks and infrastructure. While challenges exist, such as fluctuating fuel prices and geopolitical uncertainties, the long-term outlook remains positive, supported by China's continued economic growth and its role as a global manufacturing and trading hub.

The competitive landscape is characterized by a mix of large state-owned enterprises and private companies. These companies constantly strive for efficiency improvements through technological advancements, strategic alliances, and expansion of their fleet and port facilities. Growth within specific segments, such as containerized cargo, will outpace others, reflecting global supply chain trends favoring efficient container shipping. Furthermore, government initiatives focused on infrastructure development and port modernization will continue to support the market's expansion. Regional variations in growth rates are anticipated, with coastal regions benefiting most from increased port activity and proximity to manufacturing hubs. The market’s sustained growth trajectory necessitates strategic investments in sustainable practices and adherence to international maritime regulations to ensure environmentally responsible operations and maintain a positive public image.

China Sea Freight Transport Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the China Sea Freight Transport Market, offering invaluable insights for businesses operating within this dynamic sector. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report leverages rigorous research methodologies to provide accurate market sizing and growth projections, enabling informed strategic decision-making.

China Sea Freight Transport Market Market Structure & Competitive Dynamics

This section delves into the competitive landscape of the China Sea Freight Transport Market, analyzing market concentration, innovation, regulatory frameworks, and M&A activities. The market is characterized by a mix of large, established players and smaller, specialized firms. COSCO Shipping Lines and China Merchants Group hold significant market share, estimated at xx% and xx% respectively in 2025. However, smaller companies like Fujian Xiamen Shipping Co Ltd and SITC International Holdings Company Limited are carving out niches through specialized services and regional focus. The market exhibits moderate concentration, with the top five players accounting for approximately xx% of the total market revenue in 2025.

Innovation within the sector centers on improving logistics efficiency through technological advancements such as digitalization and automation. Regulatory frameworks, primarily overseen by the Ministry of Transport, are crucial in shaping market dynamics. Stringent environmental regulations drive the adoption of cleaner technologies and fuel-efficient vessels. The market witnesses regular M&A activity, with deal values totaling an estimated xx Million in 2024. These activities are largely driven by companies seeking to expand their market reach, enhance service offerings, and gain access to new technologies. End-user trends are shifting towards greater demand for speed, reliability, and transparency in shipping services.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Innovation: Focus on digitalization, automation, and environmentally friendly technologies.

- Regulatory Landscape: Stringent regulations impacting fuel efficiency and environmental compliance.

- M&A Activity: Significant activity, with total deal values of approximately xx Million in 2024.

China Sea Freight Transport Market Industry Trends & Insights

The China Sea Freight Transport Market is experiencing robust growth, driven by a surge in global trade, particularly within the Asia-Pacific region. The market's Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). This growth is fueled by the expansion of e-commerce, increasing consumer demand for imported goods, and the ongoing development of China's infrastructure. Technological disruptions, such as the adoption of blockchain technology for enhanced transparency and security in supply chains, are further shaping the industry landscape. Consumer preferences are shifting towards faster delivery times and greater visibility into shipment tracking. Competitive dynamics are characterized by intense rivalry amongst major players, with companies constantly seeking to differentiate their services and improve operational efficiency. Market penetration of digital freight forwarding solutions is steadily increasing, expected to reach xx% by 2033.

Dominant Markets & Segments in China Sea Freight Transport Market

The coastal regions of China, particularly those supporting major manufacturing hubs, represent the dominant market for sea freight transport. Within the segment breakdown:

By Cargo Type: Containerized cargo dominates, representing approximately xx% of the market in 2025. This is driven by the high volume of manufactured goods exported from China. Bulk cargo and liquid cargo segments also show substantial growth, driven by increased raw material imports and energy demands.

By Vessel Type: Container ships account for the largest share of the market due to the dominance of containerized cargo. The bulk carrier and tanker segments also exhibit significant growth, reflecting the expansion of raw material and energy trade.

By End-Use Industry: The manufacturing sector is the leading end-user, followed by retail and agriculture. The manufacturing sector's dominance is primarily attributable to the significant volume of exported manufactured goods. The retail sector's growth is fueled by increased e-commerce activity, while agricultural products contribute a steadily growing volume of sea freight.

Key Drivers:

- Robust economic growth in China and Asia-Pacific.

- Expansion of manufacturing and industrial activities.

- Increased consumer demand for imported goods.

- Government investments in port infrastructure.

- Technological advancements in logistics and shipping.

China Sea Freight Transport Market Product Innovations

Recent innovations include the introduction of larger, more fuel-efficient container ships, the adoption of smart containers with real-time tracking capabilities, and the use of AI-powered route optimization software. These innovations aim to improve efficiency, reduce costs, and enhance supply chain visibility. The market is seeing a significant push towards automation and digitalization across various aspects of the shipping process, enhancing speed, reliability, and overall effectiveness. The focus on eco-friendly technologies and sustainable shipping practices is also driving innovation.

Report Segmentation & Scope

This report provides a detailed segmentation of the China Sea Freight Transport Market across various key parameters:

By Cargo Type: Containerized cargo, bulk cargo, liquid cargo. Growth projections and market sizes are provided for each segment, along with analysis of competitive dynamics.

By Vessel Type: Container ships, bulk carriers, tankers. Market shares and growth forecasts are detailed for each vessel type, along with competitive landscape analysis.

By End-Use Industry: Manufacturing, retail, agriculture. Growth projections, market sizes, and competitive landscapes are provided for each end-use industry.

Key Drivers of China Sea Freight Transport Market Growth

Several factors fuel the growth of the China Sea Freight Transport Market. These include: the sustained growth of China's economy, expansion of its manufacturing sector, rising e-commerce activity, and increased international trade. Government initiatives aimed at improving port infrastructure and logistics efficiency further contribute to market expansion. Technological advancements such as automation, digitalization, and the use of AI are also key drivers.

Challenges in the China Sea Freight Transport Market Sector

The sector faces several challenges, including: increasing fuel costs, stringent environmental regulations, geopolitical uncertainties, and potential supply chain disruptions. Port congestion, labor shortages, and fluctuating exchange rates also pose significant hurdles. These factors can impact operational efficiency and profitability, necessitating proactive strategies for mitigation.

Leading Players in the China Sea Freight Transport Market Market

- COSCO Shipping Lines

- China Merchants Group

- CTS China Hong Kong International Logistics Co Ltd

- SINOTRANS Limited

- Fujian Xiamen Shipping Co Ltd

- SITC International Holdings Company Limited

- Hosco Group (Hebei Shipping)

- Jincheng International Shipping Agency

- C&K Ocean Shipping Company

- Nanjing Ocean Shipping Co Ltd

Key Developments in China Sea Freight Transport Market Sector

- Jan 2023: COSCO Shipping Lines launches a new fleet of LNG-powered container ships.

- Jun 2022: China Merchants Group invests in a new port automation project.

- Oct 2021: SITC International Holdings Company Limited expands its presence in Southeast Asia. (Further developments to be added based on available data)

Strategic China Sea Freight Transport Market Market Outlook

The China Sea Freight Transport Market holds significant future potential, driven by continued economic growth, technological advancements, and expanding global trade. Strategic opportunities exist for companies that can adapt to evolving market trends, leverage technological innovations, and enhance operational efficiency. Focusing on sustainability, improving supply chain resilience, and expanding into new markets will be crucial for success in the coming years. The market is poised for continued expansion, presenting lucrative prospects for investors and businesses alike.

China Sea Freight Transport Market Segmentation

- 1. Water Transport Services

- 2. Vessel Leasing and Rental Services

- 3. Cargo Ha

- 4. Supporti

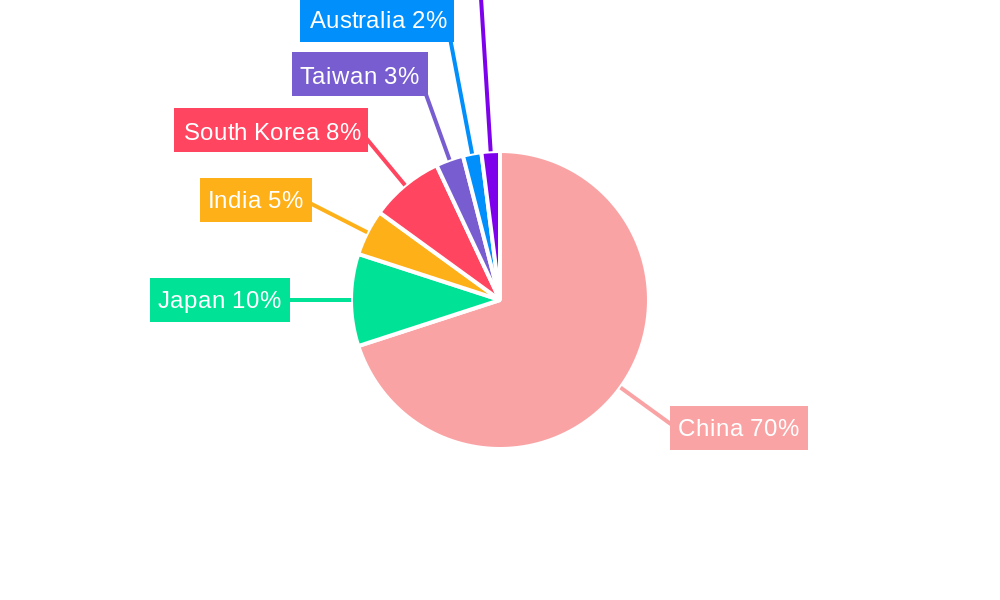

China Sea Freight Transport Market Segmentation By Geography

- 1. China

China Sea Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. Positive Trend of Chinese Imports and Exports.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Water Transport Services

- 5.2. Market Analysis, Insights and Forecast - by Vessel Leasing and Rental Services

- 5.3. Market Analysis, Insights and Forecast - by Cargo Ha

- 5.4. Market Analysis, Insights and Forecast - by Supporti

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Water Transport Services

- 6. China China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. India China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific China Sea Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 CTS China Hong Kong International Logistics Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 SINOTRANS Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fujian Xiamen Shipping Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 SITC International Holdings Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hosco Group (Hebei Shipping)

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Jincheng International Shipping Agency**List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 COSCO Shipping Lines

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 China Merchants Group

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 C&K Ocean Shipping Company

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nanjing Ocean Shipping Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 CTS China Hong Kong International Logistics Co Ltd

List of Figures

- Figure 1: China Sea Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Sea Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: China Sea Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Sea Freight Transport Market Revenue Million Forecast, by Water Transport Services 2019 & 2032

- Table 3: China Sea Freight Transport Market Revenue Million Forecast, by Vessel Leasing and Rental Services 2019 & 2032

- Table 4: China Sea Freight Transport Market Revenue Million Forecast, by Cargo Ha 2019 & 2032

- Table 5: China Sea Freight Transport Market Revenue Million Forecast, by Supporti 2019 & 2032

- Table 6: China Sea Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: China Sea Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific China Sea Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: China Sea Freight Transport Market Revenue Million Forecast, by Water Transport Services 2019 & 2032

- Table 16: China Sea Freight Transport Market Revenue Million Forecast, by Vessel Leasing and Rental Services 2019 & 2032

- Table 17: China Sea Freight Transport Market Revenue Million Forecast, by Cargo Ha 2019 & 2032

- Table 18: China Sea Freight Transport Market Revenue Million Forecast, by Supporti 2019 & 2032

- Table 19: China Sea Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sea Freight Transport Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the China Sea Freight Transport Market?

Key companies in the market include CTS China Hong Kong International Logistics Co Ltd, SINOTRANS Limited, Fujian Xiamen Shipping Co Ltd, SITC International Holdings Company Limited, Hosco Group (Hebei Shipping), Jincheng International Shipping Agency**List Not Exhaustive, COSCO Shipping Lines, China Merchants Group, C&K Ocean Shipping Company, Nanjing Ocean Shipping Co Ltd.

3. What are the main segments of the China Sea Freight Transport Market?

The market segments include Water Transport Services, Vessel Leasing and Rental Services, Cargo Ha, Supporti.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

Positive Trend of Chinese Imports and Exports..

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sea Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sea Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sea Freight Transport Market?

To stay informed about further developments, trends, and reports in the China Sea Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence