Key Insights

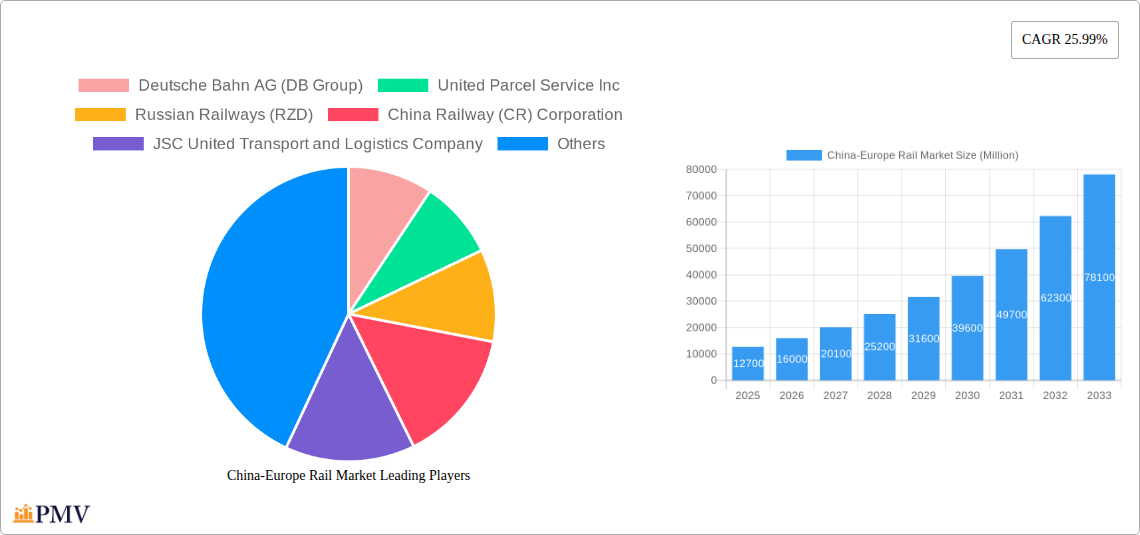

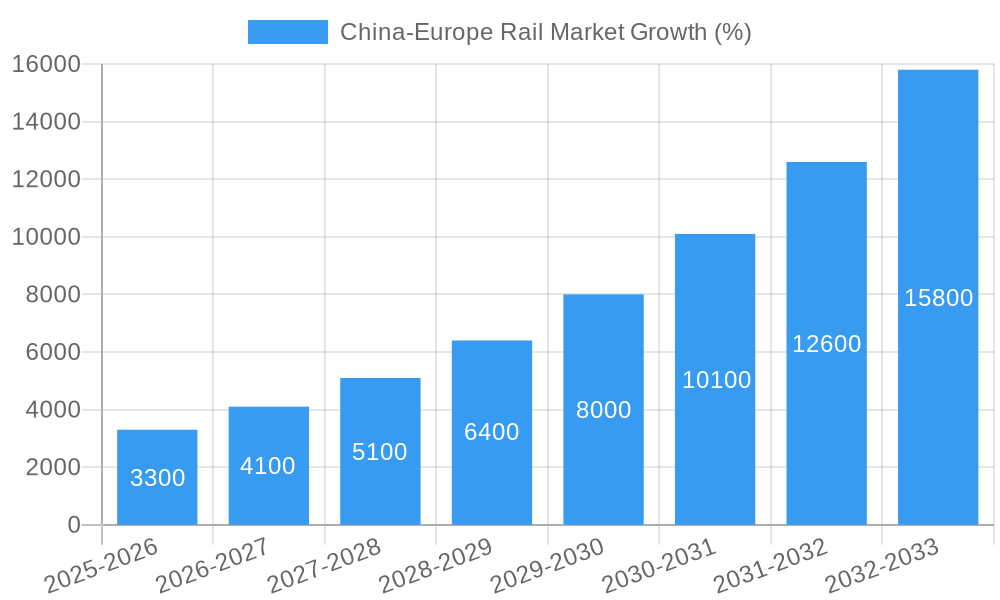

The China-Europe rail freight market, valued at $12.70 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 25.99% from 2025 to 2033. This rapid expansion is driven by several key factors. Firstly, increasing demand for efficient and cost-effective transportation solutions between Asia and Europe fuels the sector's growth. The rising volume of e-commerce shipments and the need for faster delivery times compared to sea freight are significant contributors. Secondly, government initiatives promoting the development of rail infrastructure and streamlining customs procedures in both China and Europe are fostering a more favorable business environment. Finally, the inherent advantages of rail transport, including lower carbon emissions compared to air freight and greater reliability than sea freight, are attracting businesses seeking sustainable and dependable logistics solutions. The market’s competitive landscape is shaped by a mix of state-owned enterprises, such as Deutsche Bahn AG, Russian Railways, and China Railway, and private logistics providers like DHL and Kerry Logistics. These players are constantly innovating to improve efficiency and service offerings, further driving market growth.

This dynamic market exhibits several notable trends. The integration of technology, such as real-time tracking and improved scheduling systems, enhances transparency and efficiency. Furthermore, the development of specialized rail infrastructure catering to specific cargo types, such as refrigerated containers for perishable goods, contributes to market expansion. However, challenges such as geopolitical uncertainties, fluctuating fuel prices, and occasional bottlenecks along the extensive rail routes may act as potential restraints on market growth. Despite these challenges, the overall outlook for the China-Europe rail freight market remains positive, projecting significant expansion over the forecast period due to the increasing demand for reliable and cost-effective intercontinental trade. The market segmentation will likely be driven by cargo type (e.g., consumer goods, automotive parts, machinery), route specifics, and the types of service providers.

China-Europe Rail Market: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the China-Europe rail market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends and opportunities. The report covers market size, segmentation, competitive dynamics, key players, and future growth prospects, enabling informed strategic planning and investment decisions. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

China-Europe Rail Market Market Structure & Competitive Dynamics

The China-Europe rail market demonstrates a moderately consolidated structure, with a few major players commanding significant market share. Key players include Deutsche Bahn AG (DB Group), United Parcel Service Inc, Russian Railways (RZD), China Railway (CR) Corporation, JSC United Transport and Logistics Company, Deutsche Post DHL Group, Kerry Logistics, Far East Land Bridge Ltd, KORAIL, InterRail Group, Nunner Logistics, Kazakhstan Temir Zholy (KTZ), Beijing Changjiu Logistics, Hellmann Worldwide Logistics, HLT International Logistics, DSV, and Wuhan Han'ou International Logistics Co. Market share varies significantly based on geographical reach, service offerings, and strategic partnerships.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025.

- Innovation Ecosystems: Collaboration between technology providers and logistics companies drives innovation in areas like tracking, automation, and sustainable solutions.

- Regulatory Frameworks: Varying regulations across countries impact operational efficiency and cost. Harmonization efforts are crucial for market growth.

- Product Substitutes: Air freight and maritime shipping pose competition, particularly for time-sensitive goods. However, the cost-effectiveness and environmental benefits of rail are significant competitive advantages.

- End-User Trends: Increasing demand for efficient and cost-effective cross-border transportation fuels market growth. E-commerce expansion is a significant driver.

- M&A Activities: Several M&A deals, valued at approximately xx Million in the past five years, have reshaped the market landscape, leading to increased consolidation and enhanced service offerings. These deals focused on expanding geographical reach and service capabilities.

China-Europe Rail Market Industry Trends & Insights

The China-Europe rail market exhibits robust growth, driven by several factors. The increasing volume of cross-border trade between China and Europe significantly impacts market expansion. Technological advancements, such as improved tracking systems and optimized logistics, enhance efficiency and reliability. Furthermore, government initiatives promoting rail freight and sustainable transportation contribute to market expansion. The rising demand for efficient and reliable transportation solutions from e-commerce and manufacturing sectors significantly impacts market growth. The growing awareness of environmental concerns among businesses and consumers is fueling the demand for greener transportation alternatives.

The market is experiencing technological disruptions, including the adoption of blockchain technology for enhanced security and transparency, and the integration of IoT devices for real-time cargo tracking and monitoring. Consumer preferences increasingly favor reliable, environmentally friendly, and cost-effective logistics solutions. Competitive dynamics are shaped by strategic partnerships, technological innovations, and expansion into new markets. The market is projected to experience a CAGR of xx% during the forecast period, with market penetration increasing from xx% in 2025 to xx% in 2033.

Dominant Markets & Segments in China-Europe Rail Market

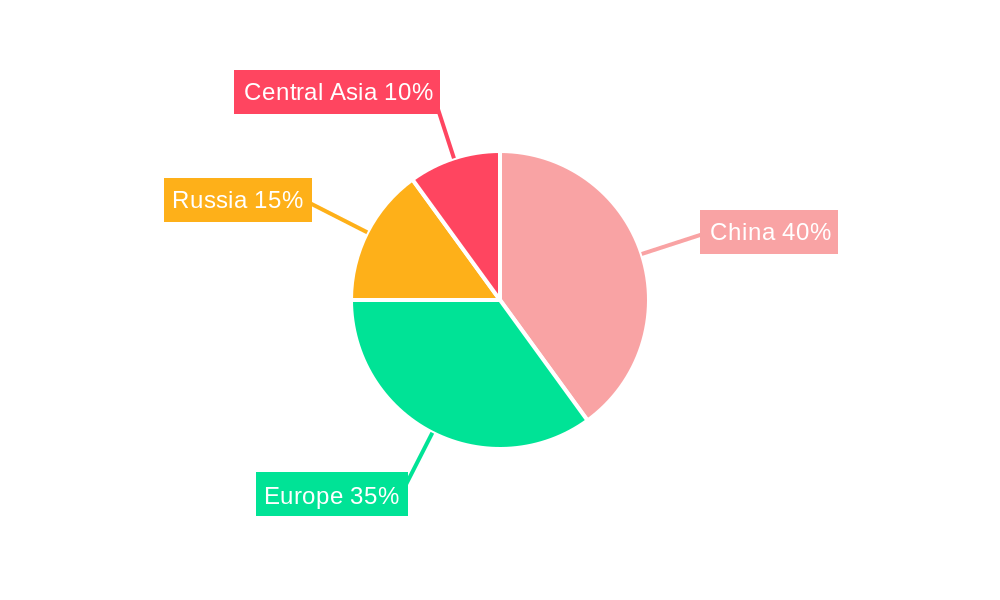

The China-Europe rail market is geographically diversified, with significant growth across multiple regions. However, specific regions exhibit stronger dominance.

- Key Drivers for Dominant Markets:

- Economic Policies: Government initiatives supporting rail infrastructure development and cross-border trade are key drivers.

- Infrastructure: Well-developed rail networks and improved customs procedures in certain regions contribute to dominance.

- Geographical Proximity: Regions with closer proximity to major transportation hubs benefit from reduced transit times and costs.

The detailed analysis reveals that Western Europe (particularly Germany and Poland) currently leads in terms of rail freight volume, due to its advanced infrastructure and strong manufacturing base. Eastern European countries are emerging as important hubs, attracting significant investment in infrastructure upgrades. China's eastern coastal regions are pivotal for origin and destination points within China. The dominance of these regions is expected to continue throughout the forecast period, though other regions are expected to witness substantial growth.

China-Europe Rail Market Product Innovations

Recent innovations focus on enhancing efficiency, reliability, and sustainability. Developments include advanced tracking systems employing IoT and blockchain technology for real-time monitoring and improved security. The integration of AI and machine learning optimizes route planning and resource allocation. The adoption of cleaner fuels and technologies is promoting a greener approach, aligning with environmental sustainability goals. These innovations provide competitive advantages by improving service quality, reducing costs, and meeting evolving customer demands. Market fit is ensured by focusing on addressing critical industry challenges, enhancing efficiency, and providing value-added services.

Report Segmentation & Scope

This report segments the China-Europe rail market based on several criteria to provide a granular understanding of market dynamics.

By Cargo Type: This includes a detailed analysis of various goods transported (e.g., consumer goods, raw materials, manufactured products). Growth projections and market size for each category are included. Competitive dynamics are also analyzed.

By Transportation Mode: This explores differences between different rail routes and their impact on market share. The analysis accounts for the varying costs, transit times and levels of reliability.

By Geography: The report provides a regional breakdown of the market, analyzing market dynamics in key regions and countries along the rail routes.

Key Drivers of China-Europe Rail Market Growth

Several factors fuel the growth of the China-Europe rail market. The rising volume of cross-border trade between China and Europe, particularly in consumer goods and manufacturing, is a significant driver. Furthermore, government initiatives promoting rail freight and infrastructure development, including investments in logistics and transportation networks, play a critical role. Technological advancements, such as the adoption of blockchain technology for enhanced security and transparency, and the implementation of improved tracking systems, contribute to increased efficiency and reliability. The cost-effectiveness of rail freight, compared to air and sea freight, particularly for large-volume shipments, is also a key factor.

Challenges in the China-Europe Rail Market Sector

The China-Europe rail market faces several challenges. Regulatory hurdles and inconsistent customs procedures across different countries impact operational efficiency and increase costs. Supply chain disruptions, influenced by geopolitical factors and natural disasters, cause significant delays. The inherent complexities of coordinating logistics across multiple countries and jurisdictions pose ongoing challenges. Competition from other modes of transportation, such as air and sea freight, requires a continuous focus on competitive pricing and service quality. These challenges represent significant obstacles to sustained market growth, impacting profitability and creating operational uncertainties.

Leading Players in the China-Europe Rail Market Market

- Deutsche Bahn AG (DB Group)

- United Parcel Service Inc

- Russian Railways (RZD)

- China Railway (CR) Corporation

- JSC United Transport and Logistics Company

- Deutsche Post DHL Group

- Kerry Logistics

- Far East Land Bridge Ltd

- KORAIL

- InterRail Group

- Nunner Logistics

- Kazakhstan Temir Zholy (KTZ)

- Beijing Changjiu Logistics

- Hellmann Worldwide Logistics

- HLT International Logistics

- DSV

- Wuhan Han'ou International Logistics Co

Key Developments in China-Europe Rail Market Sector

June 2022: Shanghai Way-easy Supply Chain and Nurminen Logistics Plc announce a business alliance to improve logistics and rail freight services between China and Europe. This collaboration expands service reach and leverages complementary strengths, particularly emphasizing the new Southern Trans-Caspian route.

April 2022: Alstom and ENGIE partner to supply clean hydrogen for a fuel cell system in European rail freight. This initiative promotes sustainable transportation and expands the capabilities of electric locomotives into non-electrified areas, enhancing operational flexibility and reducing environmental impact.

Strategic China-Europe Rail Market Market Outlook

The China-Europe rail market exhibits significant growth potential. Continued investments in infrastructure, technological advancements, and supportive government policies will drive expansion. Strategic partnerships and collaborations between logistics providers and technology companies will play a key role in enhancing efficiency and service quality. The rising demand for sustainable transportation solutions presents considerable opportunities for innovative players. Focus on overcoming challenges, such as regulatory hurdles and supply chain disruptions, is crucial for realizing the market's full potential and ensuring sustained growth.

China-Europe Rail Market Segmentation

-

1. Cargo Type

- 1.1. Containerized (Intermodal)

- 1.2. Non-containerized

- 1.3. Liquid Bulk

-

2. Service Type

- 2.1. Transportation

- 2.2. Services Allied to Transportation

China-Europe Rail Market Segmentation By Geography

- 1. China

China-Europe Rail Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing freight volume driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China-Europe Rail Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 5.1.1. Containerized (Intermodal)

- 5.1.2. Non-containerized

- 5.1.3. Liquid Bulk

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Transportation

- 5.2.2. Services Allied to Transportation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Cargo Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Deutsche Bahn AG (DB Group)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Russian Railways (RZD)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Railway (CR) Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JSC United Transport and Logistics Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Deutsche Post DHL Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Far East Land Bridge Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KORAIL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 InterRail Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nunner Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kazakhstan Temir Zholy (KTZ)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Beijing Changjiu Logistics

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hellmann Worldwide Logistics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 HLT International Logistics

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 DSV

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Wuhan Han'ou International Logistics Co

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Deutsche Bahn AG (DB Group)

List of Figures

- Figure 1: China-Europe Rail Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China-Europe Rail Market Share (%) by Company 2024

List of Tables

- Table 1: China-Europe Rail Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China-Europe Rail Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China-Europe Rail Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 4: China-Europe Rail Market Volume Billion Forecast, by Cargo Type 2019 & 2032

- Table 5: China-Europe Rail Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: China-Europe Rail Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 7: China-Europe Rail Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China-Europe Rail Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: China-Europe Rail Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 10: China-Europe Rail Market Volume Billion Forecast, by Cargo Type 2019 & 2032

- Table 11: China-Europe Rail Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 12: China-Europe Rail Market Volume Billion Forecast, by Service Type 2019 & 2032

- Table 13: China-Europe Rail Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China-Europe Rail Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China-Europe Rail Market?

The projected CAGR is approximately 25.99%.

2. Which companies are prominent players in the China-Europe Rail Market?

Key companies in the market include Deutsche Bahn AG (DB Group), United Parcel Service Inc, Russian Railways (RZD), China Railway (CR) Corporation, JSC United Transport and Logistics Company, Deutsche Post DHL Group, Kerry Logistics, Far East Land Bridge Ltd, KORAIL, InterRail Group, Nunner Logistics, Kazakhstan Temir Zholy (KTZ), Beijing Changjiu Logistics, Hellmann Worldwide Logistics, HLT International Logistics, DSV, Wuhan Han'ou International Logistics Co.

3. What are the main segments of the China-Europe Rail Market?

The market segments include Cargo Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.70 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing freight volume driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Shanghai Way-easy Supply Chain and Nurminen Logistics Plc announce a business alliance to improve logistics and rail freight services in China and Europe. As part of the business cooperation. Regarding rail connections to Europe, The Way-easy has a sizable customer base. In an environment where collaboration grows on the advantages of complementarity, the new Southern Trans-Caspian route is crucial and has future potential.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China-Europe Rail Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China-Europe Rail Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China-Europe Rail Market?

To stay informed about further developments, trends, and reports in the China-Europe Rail Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence