Key Insights

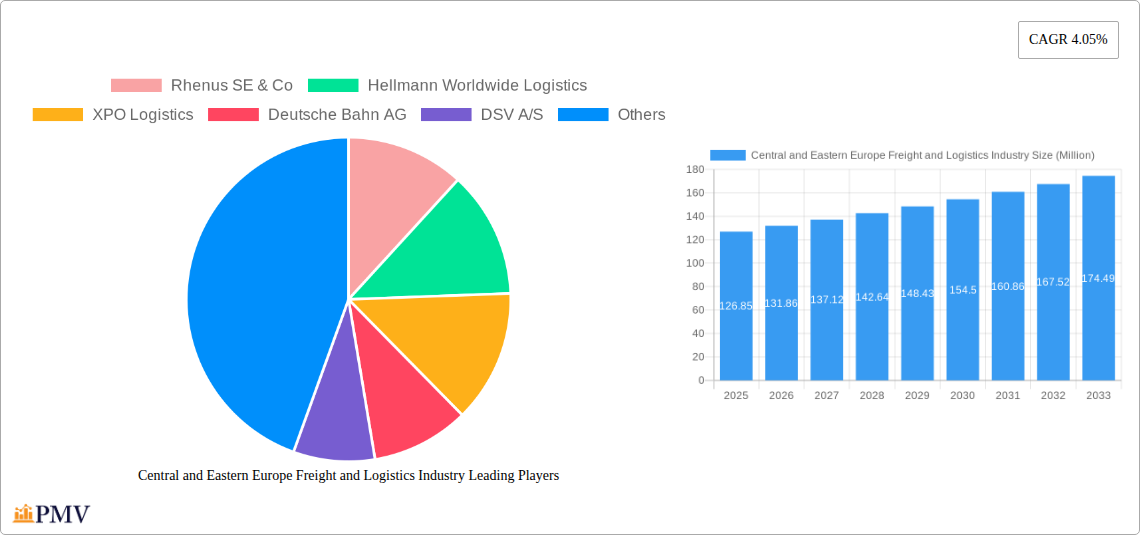

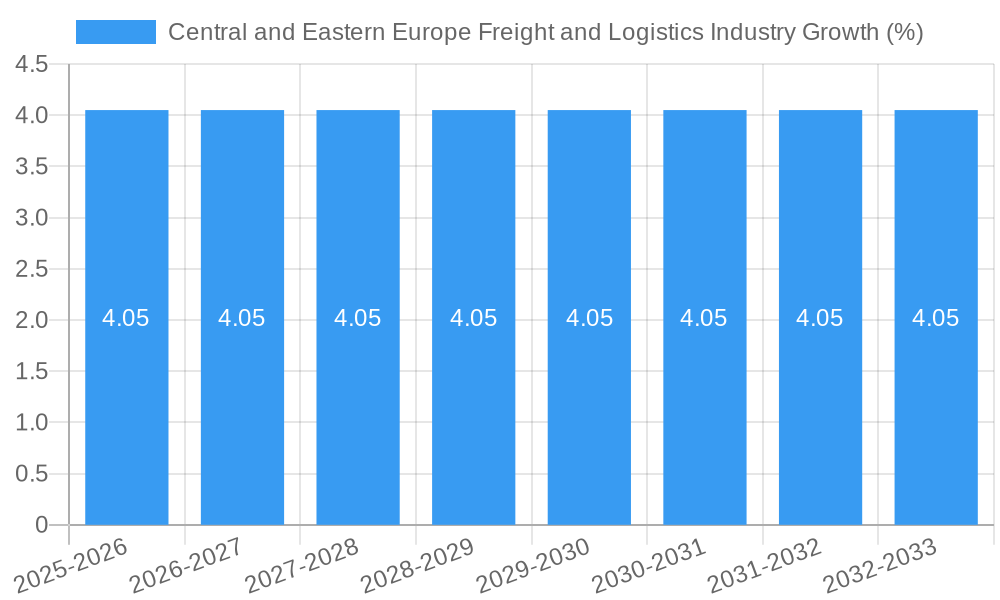

The Central and Eastern European freight and logistics market, valued at €126.85 million in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.05% from 2025 to 2033. This growth is fueled by several key drivers. The increasing e-commerce penetration across the region is significantly boosting demand for efficient delivery services. Furthermore, expanding industrial production, particularly in manufacturing and automotive sectors within countries like Germany, Poland, and the Czech Republic, necessitates robust logistics networks for raw material sourcing and finished goods distribution. Infrastructure development initiatives across the region, including improvements to road and rail networks, are further facilitating smoother and faster freight movements. Finally, the ongoing trend of supply chain diversification, driven partly by geopolitical factors, is directing increased logistics activity towards Central and Eastern Europe. The market segmentation reveals the construction, oil and gas, and manufacturing sectors as significant end-users, contributing considerably to the overall market value.

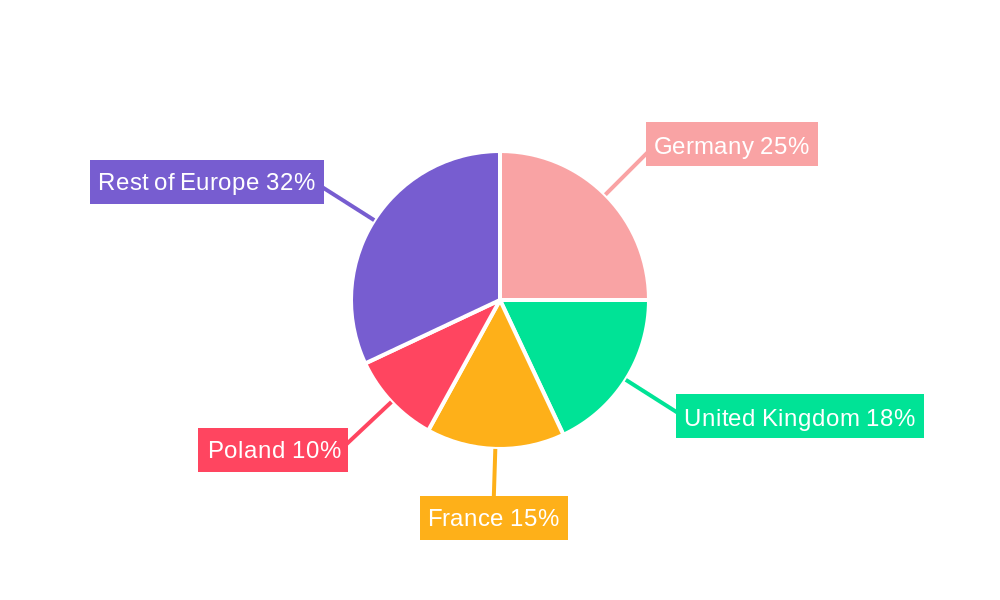

However, the market faces certain challenges. Fluctuations in fuel prices pose a significant operational cost for logistics providers. Moreover, the ongoing skills shortage in the logistics workforce, particularly for specialized roles like freight forwarding and warehousing management, can hinder efficient operations and expansion. Geopolitical uncertainties and potential trade disruptions also present risks. Nevertheless, the strong underlying growth drivers, coupled with ongoing investments in infrastructure and technological advancements in areas like automation and data analytics, are poised to mitigate these challenges and maintain the market's upward trajectory. Specific countries like Germany, the UK, and France will continue to dominate the market due to their established infrastructure and higher economic activity, while countries like Poland and others will experience accelerated growth based on developing infrastructure and expanding manufacturing sectors. The rise of value-added services, such as specialized handling and efficient warehousing solutions, is also driving market expansion and attracting significant investment.

Central and Eastern Europe Freight & Logistics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Central and Eastern European freight and logistics industry, offering invaluable insights for businesses operating within or seeking to enter this dynamic market. Covering the period 2019-2033, with a base year of 2025, this report leverages historical data (2019-2024) and forecasts (2025-2033) to deliver actionable intelligence. The analysis encompasses key segments, dominant players, and emerging trends, equipping stakeholders with the knowledge to make informed strategic decisions. The market size is projected to reach xx Million by 2033.

Central and Eastern Europe Freight and Logistics Industry Market Structure & Competitive Dynamics

The Central and Eastern European freight and logistics market exhibits a moderately concentrated structure, with a handful of multinational giants alongside numerous regional players. Market share is predominantly held by companies like Deutsche Post DHL, Kuehne + Nagel International AG, DSV A/S, and DB Schenker, each commanding significant portions of the overall volume. However, a fragmented landscape exists particularly in niche segments like specialized transportation or last-mile delivery. Innovation is driven by a mix of large corporations investing in technological advancements, and agile startups focused on disruptive solutions in areas like autonomous vehicles and drone delivery.

Regulatory frameworks across the region vary, creating challenges for standardization and operational efficiency. The ongoing evolution of EU regulations on transport and environmental standards significantly impacts industry players, particularly concerning emission reduction targets and driver regulations. Product substitutes, such as improved rail infrastructure and the growing adoption of digital platforms for logistics management, are constantly reshaping competitive dynamics. Mergers and acquisitions (M&A) remain a prominent feature, with significant deals exceeding xx Million recorded in the past five years, often driven by consolidation efforts and expansion strategies into new markets. For instance, the acquisition of [Company A] by [Company B] in 2022 for xx Million significantly altered market share distribution in the [Specific Segment] sector.

- Market Concentration: Moderately concentrated, with major players holding significant shares.

- Innovation Ecosystems: A blend of large corporations and agile startups driving innovation.

- Regulatory Frameworks: Varied across the region, impacting operational efficiency.

- M&A Activity: Significant deals recorded, primarily for consolidation and expansion.

- End-User Trends: Shifting towards digitalization and sustainability.

Central and Eastern Europe Freight and Logistics Industry Industry Trends & Insights

The Central and Eastern European freight and logistics market is experiencing robust growth, driven by several key factors. The expanding e-commerce sector fuels demand for efficient last-mile delivery solutions, while rising industrial production and cross-border trade necessitate robust transportation networks. Technological advancements, such as the implementation of blockchain technology for enhanced supply chain transparency and the adoption of Internet of Things (IoT) devices for real-time tracking, are revolutionizing logistics operations. This contributes to improved efficiency, reduced costs, and enhanced customer satisfaction. However, challenges remain, including infrastructure limitations in certain regions, fluctuating fuel prices, and a shortage of skilled labor. The industry's CAGR is estimated at xx% during the forecast period (2025-2033), with market penetration of new technologies showing a steady increase of xx% annually.

Dominant Markets & Segments in Central and Eastern Europe Freight and Logistics Industry

Germany remains the dominant market within Central and Eastern Europe, driven by its strong manufacturing base, extensive infrastructure, and strategic location as a trade hub. Poland experiences significant growth due to its burgeoning manufacturing sector and increasing foreign direct investment. The Manufacturing and Automotive segment represents the largest end-user group, accounting for xx Million of total revenue, followed by Distributive Trade. Within functions, Freight Transport dominates, closely followed by Freight Forwarding and Warehousing.

Key Drivers for Germany: Strong manufacturing base, extensive infrastructure, strategic location.

Key Drivers for Poland: Growing manufacturing, increasing FDI, strategic geographical position.

Dominant End-User Segment: Manufacturing and Automotive (xx Million in revenue).

Dominant Function: Freight Transport.

Other significant countries: United Kingdom, France, Italy, Spain, Netherlands, Russia

Other significant segments: Oil & Gas and Quarrying, Construction, Agriculture, Fishing & Forestry, Pharmaceutical and Healthcare.

Central and Eastern Europe Freight and Logistics Industry Product Innovations

Recent product innovations include the adoption of autonomous vehicles for trucking and warehousing, the implementation of advanced route optimization software leveraging AI and machine learning, and the growing use of drones for last-mile delivery in specific contexts. These innovations aim to enhance efficiency, reduce operational costs, and improve delivery times, creating competitive advantages for early adopters. The market's inclination towards sustainable practices is also driving innovation in areas like electric vehicle fleets and eco-friendly packaging solutions.

Report Segmentation & Scope

This report segments the Central and Eastern European freight and logistics market by:

End User: Construction, Oil and Gas & Quarrying, Agriculture, Fishing & Forestry, Manufacturing & Automotive, Distributive Trade, Other End Users (Pharmaceutical & Healthcare). Each segment’s growth projection varies; for instance, the Manufacturing and Automotive sector is predicted to expand at xx% CAGR during the forecast period, while the Pharmaceutical & Healthcare sector is expected to show a growth of xx%.

Country: Germany, United Kingdom, France, Italy, Spain, Russia, Netherlands, Poland, Rest of Europe. Germany and Poland are expected to maintain their leading positions, with Germany experiencing steady growth and Poland showcasing strong expansion potential.

Function: Freight Transport, Air Freight Forwarding, Warehousing, Value-added Services, Other Functions. Freight Transport is anticipated to continue its dominant position.

Key Drivers of Central and Eastern Europe Freight and Logistics Industry Growth

Key growth drivers include the increasing volume of cross-border trade within the EU and beyond, the rise of e-commerce boosting demand for efficient delivery services, continuous technological advancements streamlining logistics operations, and government initiatives aimed at improving infrastructure and fostering a business-friendly environment. Specifically, investments in railway modernization and road infrastructure development in several countries are positively impacting the sector's capacity and efficiency.

Challenges in the Central and Eastern Europe Freight and Logistics Industry Sector

Challenges include infrastructure limitations in certain regions, resulting in increased transportation costs and delays. Fluctuating fuel prices present a significant cost uncertainty. Additionally, a shortage of skilled labor, particularly drivers, and growing regulatory complexity surrounding environmental standards and cross-border transportation present ongoing hurdles for industry growth. The cumulative impact of these factors can reduce profitability by an estimated xx% annually for some players.

Leading Players in the Central and Eastern Europe Freight and Logistics Industry Market

- Rhenus SE & Co

- Hellmann Worldwide Logistics

- XPO Logistics

- Deutsche Bahn AG

- DSV A/S

- Kuehne + Nagel International AG

- Freja Logistics

- UPS Europe NV

- Dachser SE

- Arvato

- FEIGE Logistik

- Bollore Holding SA

- BLG Logistics Group

- Deutsche Post DHL

Key Developments in Central and Eastern Europe Freight and Logistics Industry Sector

August 2022: DB Schenker launched its first charter flight between Europe and South America, significantly expanding its reach into South American markets.

September 2022: IKEA Industry, Volvo Trucks, and Raben Group partnered on zero-emission heavy goods transport in Poland, highlighting the growing adoption of sustainable solutions.

Strategic Central and Eastern Europe Freight and Logistics Industry Market Outlook

The Central and Eastern European freight and logistics market presents substantial growth potential driven by ongoing economic expansion, technological innovation, and increased cross-border trade. Strategic opportunities exist for businesses focusing on sustainable solutions, advanced technologies, and niche market segments. Companies capable of adapting to evolving regulations and leveraging digitalization will be best positioned to capitalize on this expanding market.

Central and Eastern Europe Freight and Logistics Industry Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Rail

- 1.1.3. Sea and Inland

- 1.1.4. Air

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End Users (Pharmaceutical and Healthcare)

Central and Eastern Europe Freight and Logistics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Central and Eastern Europe Freight and Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Perishable Products; Growth of Pharmaceutical Products

- 3.3. Market Restrains

- 3.3.1. High Initial Investment Costs; Labor Shortages and Skills Gap

- 3.4. Market Trends

- 3.4.1. Growing E-commerce Propels Demand for the Logistics Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Rail

- 5.1.1.3. Sea and Inland

- 5.1.1.4. Air

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End Users (Pharmaceutical and Healthcare)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. North America Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Function

- 6.1.1. Freight Transport

- 6.1.1.1. Road

- 6.1.1.2. Rail

- 6.1.1.3. Sea and Inland

- 6.1.1.4. Air

- 6.1.2. Freight Forwarding

- 6.1.3. Warehousing

- 6.1.4. Value-added Services and Other Functions

- 6.1.1. Freight Transport

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Construction

- 6.2.2. Oil and Gas and Quarrying

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Manufacturing and Automotive

- 6.2.5. Distributive Trade

- 6.2.6. Other End Users (Pharmaceutical and Healthcare)

- 6.1. Market Analysis, Insights and Forecast - by Function

- 7. South America Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Function

- 7.1.1. Freight Transport

- 7.1.1.1. Road

- 7.1.1.2. Rail

- 7.1.1.3. Sea and Inland

- 7.1.1.4. Air

- 7.1.2. Freight Forwarding

- 7.1.3. Warehousing

- 7.1.4. Value-added Services and Other Functions

- 7.1.1. Freight Transport

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Construction

- 7.2.2. Oil and Gas and Quarrying

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Manufacturing and Automotive

- 7.2.5. Distributive Trade

- 7.2.6. Other End Users (Pharmaceutical and Healthcare)

- 7.1. Market Analysis, Insights and Forecast - by Function

- 8. Europe Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Function

- 8.1.1. Freight Transport

- 8.1.1.1. Road

- 8.1.1.2. Rail

- 8.1.1.3. Sea and Inland

- 8.1.1.4. Air

- 8.1.2. Freight Forwarding

- 8.1.3. Warehousing

- 8.1.4. Value-added Services and Other Functions

- 8.1.1. Freight Transport

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Construction

- 8.2.2. Oil and Gas and Quarrying

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Manufacturing and Automotive

- 8.2.5. Distributive Trade

- 8.2.6. Other End Users (Pharmaceutical and Healthcare)

- 8.1. Market Analysis, Insights and Forecast - by Function

- 9. Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Function

- 9.1.1. Freight Transport

- 9.1.1.1. Road

- 9.1.1.2. Rail

- 9.1.1.3. Sea and Inland

- 9.1.1.4. Air

- 9.1.2. Freight Forwarding

- 9.1.3. Warehousing

- 9.1.4. Value-added Services and Other Functions

- 9.1.1. Freight Transport

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Construction

- 9.2.2. Oil and Gas and Quarrying

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Manufacturing and Automotive

- 9.2.5. Distributive Trade

- 9.2.6. Other End Users (Pharmaceutical and Healthcare)

- 9.1. Market Analysis, Insights and Forecast - by Function

- 10. Asia Pacific Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Function

- 10.1.1. Freight Transport

- 10.1.1.1. Road

- 10.1.1.2. Rail

- 10.1.1.3. Sea and Inland

- 10.1.1.4. Air

- 10.1.2. Freight Forwarding

- 10.1.3. Warehousing

- 10.1.4. Value-added Services and Other Functions

- 10.1.1. Freight Transport

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Construction

- 10.2.2. Oil and Gas and Quarrying

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Manufacturing and Automotive

- 10.2.5. Distributive Trade

- 10.2.6. Other End Users (Pharmaceutical and Healthcare)

- 10.1. Market Analysis, Insights and Forecast - by Function

- 11. Germany Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 12. France Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Italy Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Central and Eastern Europe Freight and Logistics Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Rhenus SE & Co

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Hellmann Worldwide Logistics

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 XPO Logistics

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Deutsche Bahn AG

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 DSV A/S

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Kuehne + Nagel International AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Freja Logistics

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 UPS Europe NV

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Dachser SE

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Arvato**List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 FEIGE Logistik

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Bollore Holding SA

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 BLG Logistics Group

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Deutsche Post DHL

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 Rhenus SE & Co

List of Figures

- Figure 1: Global Central and Eastern Europe Freight and Logistics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Europe Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Europe Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 5: North America Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 6: North America Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by End User 2024 & 2032

- Figure 7: North America Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by End User 2024 & 2032

- Figure 8: North America Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 11: South America Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 12: South America Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by End User 2024 & 2032

- Figure 13: South America Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by End User 2024 & 2032

- Figure 14: South America Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 17: Europe Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 18: Europe Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by End User 2024 & 2032

- Figure 19: Europe Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by End User 2024 & 2032

- Figure 20: Europe Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 23: Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 24: Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by End User 2024 & 2032

- Figure 25: Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by End User 2024 & 2032

- Figure 26: Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Function 2024 & 2032

- Figure 29: Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Function 2024 & 2032

- Figure 30: Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 3: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 14: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 20: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 26: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Russia Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Benelux Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Nordics Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of Europe Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 38: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 39: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Turkey Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Israel Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: GCC Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: North Africa Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East & Africa Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 47: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 48: Global Central and Eastern Europe Freight and Logistics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: China Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: ASEAN Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Oceania Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Central and Eastern Europe Freight and Logistics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe Freight and Logistics Industry?

The projected CAGR is approximately 4.05%.

2. Which companies are prominent players in the Central and Eastern Europe Freight and Logistics Industry?

Key companies in the market include Rhenus SE & Co, Hellmann Worldwide Logistics, XPO Logistics, Deutsche Bahn AG, DSV A/S, Kuehne + Nagel International AG, Freja Logistics, UPS Europe NV, Dachser SE, Arvato**List Not Exhaustive, FEIGE Logistik, Bollore Holding SA, BLG Logistics Group, Deutsche Post DHL.

3. What are the main segments of the Central and Eastern Europe Freight and Logistics Industry?

The market segments include Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Perishable Products; Growth of Pharmaceutical Products.

6. What are the notable trends driving market growth?

Growing E-commerce Propels Demand for the Logistics Industry.

7. Are there any restraints impacting market growth?

High Initial Investment Costs; Labor Shortages and Skills Gap.

8. Can you provide examples of recent developments in the market?

August 2022: DB Schenker operated its first charter flight between Europe and South America. The new route would start in the Netherlands and arrive in Brazil with two stopovers in the United States. In South America, direct flights are available to Argentina and Chile.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe Freight and Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe Freight and Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe Freight and Logistics Industry?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe Freight and Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence