Key Insights

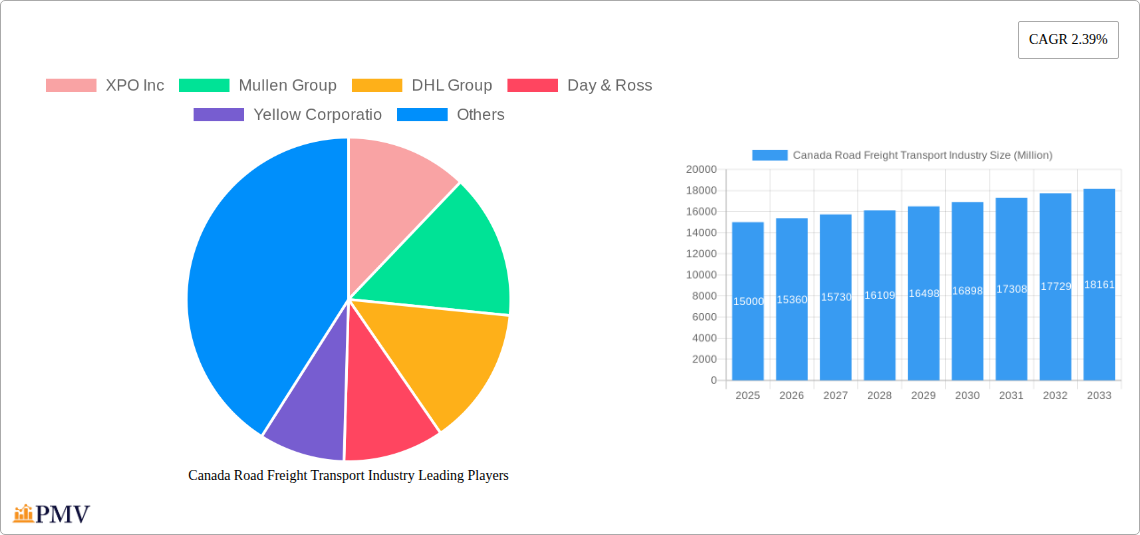

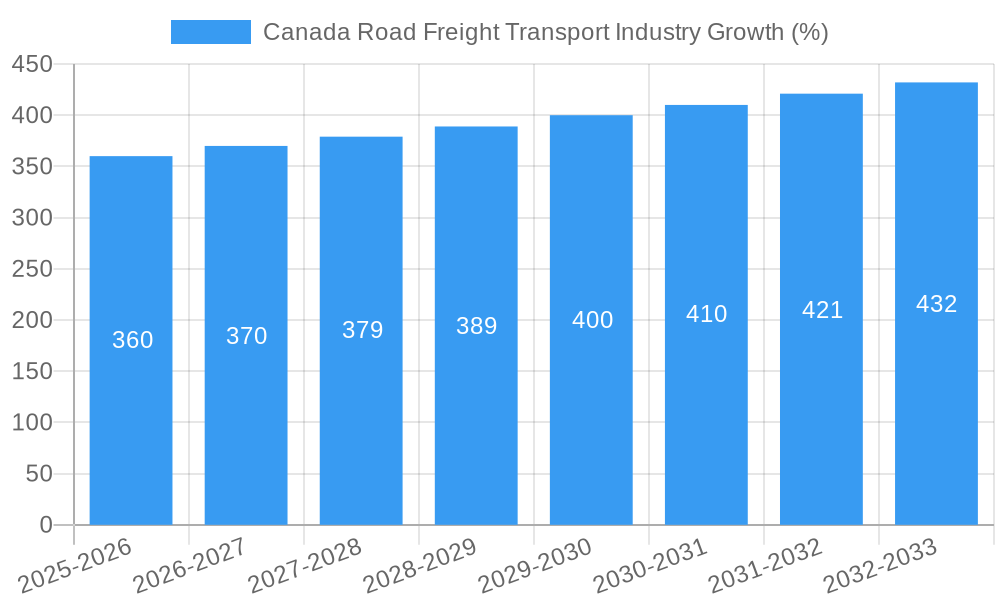

The Canadian road freight transport industry, a crucial component of the nation's logistics network, is experiencing steady growth. While the provided CAGR of 2.39% suggests a moderate expansion, deeper analysis reveals a more nuanced picture influenced by several key factors. The market, estimated at a significant value (precise figure requiring further data, but likely in the billions of Canadian dollars based on industry averages and the size of the Canadian economy), is segmented by goods (fluid vs. solid), temperature control needs, end-user industries (with construction, manufacturing, and oil & gas being particularly important), transport type (FTL, LTL), containerization, distance (long vs. short haul), and domestic vs. international destinations. The presence of major players like XPO Inc, DHL Group, and FedEx indicates a competitive landscape with established players dominating the market. Regional variations exist, with potential for higher growth in regions experiencing significant infrastructural development or economic expansion. The industry's future trajectory is linked to factors such as economic growth, government infrastructure investments, technological advancements in fleet management and logistics optimization, and evolving regulatory environments concerning emissions and driver safety.

Growth is further shaped by trends such as the increasing adoption of e-commerce, which fuels demand for last-mile delivery services, and the growing focus on sustainable logistics, prompting the adoption of fuel-efficient vehicles and cleaner transportation methods. However, constraints include fluctuating fuel prices, driver shortages, and increasing operational costs, particularly in regions with challenging terrains or limited infrastructure. The segment analysis allows for tailored strategies by focusing on specific needs within the industry; for example, investments in temperature-controlled transportation would target the food and pharmaceutical sectors. The data covering the period from 2019-2033 provides a robust historical and future outlook, allowing for informed decision-making and effective long-term planning within the Canadian road freight transport sector.

Canada Road Freight Transport Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada road freight transport industry, covering market structure, competitive dynamics, key trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base year and forecast period from 2025 to 2033. The report analyzes various segments including goods configuration (fluid and solid goods), temperature control (temperature-controlled and non-temperature-controlled), end-user industries (agriculture, fishing & forestry, construction, manufacturing, oil & gas, mining & quarrying, wholesale & retail trade, and others), destination (domestic and international), truckload specification (FTL and LTL), containerization (containerized and non-containerized), and distance (long haul and short haul). Key players like XPO Inc, Mullen Group, DHL Group, Day & Ross, Yellow Corporation, FedEx, UPS, C.H. Robinson, J.B. Hunt Transport Inc, and Ryder System Inc are thoroughly analyzed.

Canada Road Freight Transport Industry Market Structure & Competitive Dynamics

The Canadian road freight transport market exhibits a moderately concentrated structure, with several large players dominating the landscape. Market share is dynamically shifting due to mergers & acquisitions (M&A) activity and the ongoing technological advancements in logistics and supply chain management. The regulatory framework, while generally supportive of industry growth, presents complexities relating to driver regulations, environmental standards, and cross-border transport. Product substitutes, such as rail and air freight, exert competitive pressure, although road transport remains dominant for shorter distances and time-sensitive deliveries. End-user trends are shaped by evolving supply chains, e-commerce growth, and the increasing demand for efficient and reliable delivery services. Recent M&A activity demonstrates a strong push towards consolidation and diversification.

- Key Players Market Share (Estimated 2025): XPO Inc (xx%), Mullen Group (xx%), DHL Group (xx%), FedEx (xx%), UPS (xx%), Others (xx%)

- Significant M&A Activity (2019-2024): The total value of M&A deals in the period is estimated at xx Million USD, with deals like Ryder System’s acquisition of Impact Fulfillment Services significantly influencing market dynamics.

Canada Road Freight Transport Industry Industry Trends & Insights

The Canadian road freight transport industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Growth is primarily driven by robust e-commerce expansion, leading to a surge in last-mile delivery demands. Technological disruptions, including the adoption of telematics, route optimization software, and autonomous driving technologies, are reshaping operational efficiency and cost structures. Consumer preferences increasingly lean towards faster and more reliable deliveries, pushing companies to invest in advanced logistics solutions. The competitive landscape is marked by increased pricing pressures, the pursuit of operational excellence, and strategic partnerships to expand service offerings and reach. Market penetration of advanced technologies like AI-powered route optimization is gradually increasing, reaching an estimated xx% market penetration by 2033.

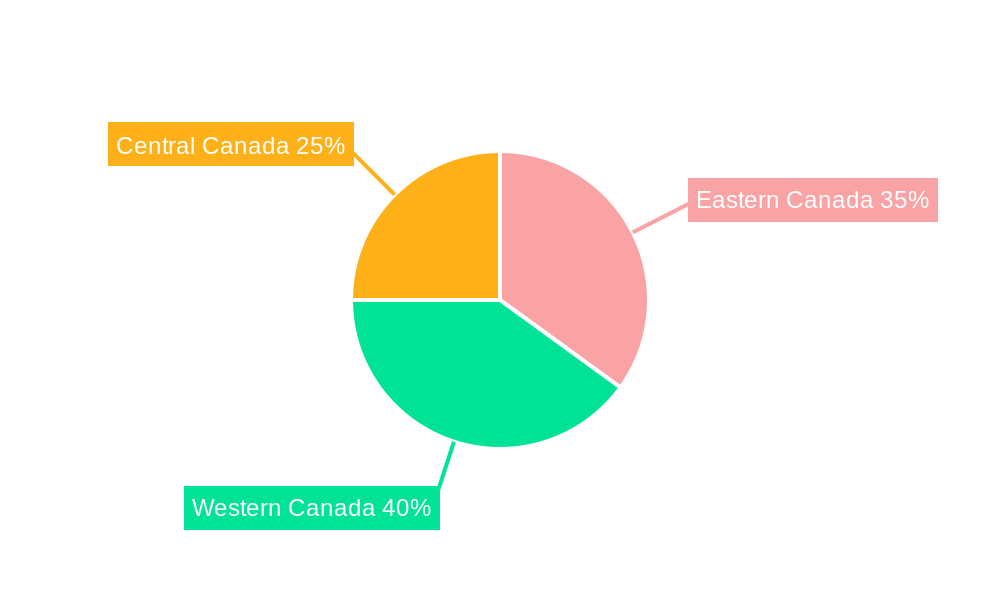

Dominant Markets & Segments in Canada Road Freight Transport Industry

The domestic market segment commands the largest share of the Canadian road freight transport market, driven by the strong and diverse economy. The Solid Goods segment holds the biggest share in the Goods Configuration category due to high demand across diverse end user industries. Within the end-user industry, Wholesale and Retail Trade remain the dominant segment, reflecting Canada's robust consumer market. The Full-Truckload (FTL) segment dominates in Truckload Specification. The Non-Temperature Controlled segment in Temperature Control has the biggest market share. The Short Haul segment in Distance is dominant.

- Key Drivers:

- Robust economic growth across several sectors.

- Well-developed road infrastructure, although with ongoing maintenance and expansion needs.

- Government support for infrastructure development.

- Expanding e-commerce sector driving last-mile delivery demand.

Canada Road Freight Transport Industry Product Innovations

Recent innovations emphasize efficiency and sustainability. C.H. Robinson's new AI-powered appointment scheduling technology significantly streamlines delivery processes. The industry is witnessing a gradual integration of telematics, GPS tracking, and route optimization software, enhancing delivery predictability and reducing fuel consumption. There is also a growing focus on developing environmentally friendly solutions, such as electric and hybrid trucks. These advancements improve operational efficiency and reduce environmental impact, increasing market fit.

Report Segmentation & Scope

This report segments the Canadian road freight transport market across several key parameters: Goods Configuration (Fluid Goods, Solid Goods); Temperature Control (Non-Temperature Controlled, Temperature Controlled); End User Industry (Agriculture, Fishing & Forestry, Construction, Manufacturing, Oil & Gas, Mining & Quarrying, Wholesale & Retail Trade, Others); Destination (Domestic, International); Truckload Specification (Full-Truck-Load (FTL), Less than Truckload (LTL)); Containerization (Containerized, Non-Containerized); and Distance (Long Haul, Short Haul). Each segment's market size, growth projections, and competitive dynamics are analyzed individually. The report presents a detailed market outlook for each segment, outlining its projected growth trajectory and influencing factors.

Key Drivers of Canada Road Freight Transport Industry Growth

The Canadian road freight transport industry's growth is fueled by several factors. E-commerce expansion fuels demand for efficient last-mile deliveries. Technological advancements, such as AI-powered route optimization and telematics, increase efficiency and reduce operational costs. Government initiatives supporting infrastructure development bolster the industry’s capacity and capability. Continued growth in various end-user sectors—like manufacturing and retail—drives freight transportation volumes.

Challenges in the Canada Road Freight Transport Industry Sector

The industry faces challenges including driver shortages, leading to increased labor costs and operational constraints. Fluctuations in fuel prices significantly impact profitability. Stringent environmental regulations necessitate investments in greener technologies. Increasing competition from other modes of transportation, such as rail, puts pressure on pricing and margins. These factors, coupled with potential economic downturns, could constrain industry growth.

Leading Players in the Canada Road Freight Transport Industry Market

- XPO Inc

- Mullen Group

- DHL Group

- Day & Ross

- Yellow Corporation

- FedEx

- United Parcel Service of America Inc (UPS)

- C.H. Robinson

- J.B. Hunt Transport Inc

- Ryder System Inc

Key Developments in Canada Road Freight Transport Industry Sector

- February 2024: C.H. Robinson launches AI-powered appointment scheduling technology, boosting efficiency.

- January 2024: Mullen Group Ltd. agrees to acquire ContainerWorld Forwarding Services Inc., expanding its logistics and warehousing segment by approximately USD 150 Million in annualized revenue.

- October 2023: Ryder System acquires Impact Fulfillment Services, expanding its supply chain services with 15 new operations across nine states.

Strategic Canada Road Freight Transport Industry Market Outlook

The Canadian road freight transport industry holds significant future potential. Continued e-commerce growth and investments in technological advancements will drive market expansion. Strategic partnerships and acquisitions will shape the competitive landscape. Companies focusing on sustainability and operational efficiency will gain a competitive edge. The industry's future trajectory hinges on adapting to evolving technologies and consumer demands while navigating regulatory challenges.

Canada Road Freight Transport Industry Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Canada Road Freight Transport Industry Segmentation By Geography

- 1. Canada

Canada Road Freight Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses

- 3.3. Market Restrains

- 3.3.1. 4.; Stringent Rules and Regulations4.; Higher Costs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Eastern Canada Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Road Freight Transport Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 XPO Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Mullen Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DHL Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Day & Ross

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Yellow Corporatio

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 FedEx

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 United Parcel Service of America Inc (UPS)

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 C H Robinson

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 J B Hunt Transport Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ryder System Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 XPO Inc

List of Figures

- Figure 1: Canada Road Freight Transport Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Road Freight Transport Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Canada Road Freight Transport Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Canada Road Freight Transport Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Canada Road Freight Transport Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Canada Road Freight Transport Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Canada Road Freight Transport Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Canada Road Freight Transport Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Canada Road Freight Transport Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Canada Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Eastern Canada Canada Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Western Canada Canada Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Central Canada Canada Road Freight Transport Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Road Freight Transport Industry Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 15: Canada Road Freight Transport Industry Revenue Million Forecast, by Destination 2019 & 2032

- Table 16: Canada Road Freight Transport Industry Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 17: Canada Road Freight Transport Industry Revenue Million Forecast, by Containerization 2019 & 2032

- Table 18: Canada Road Freight Transport Industry Revenue Million Forecast, by Distance 2019 & 2032

- Table 19: Canada Road Freight Transport Industry Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 20: Canada Road Freight Transport Industry Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 21: Canada Road Freight Transport Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Road Freight Transport Industry?

The projected CAGR is approximately 2.39%.

2. Which companies are prominent players in the Canada Road Freight Transport Industry?

Key companies in the market include XPO Inc, Mullen Group, DHL Group, Day & Ross, Yellow Corporatio, FedEx, United Parcel Service of America Inc (UPS), C H Robinson, J B Hunt Transport Inc, Ryder System Inc.

3. What are the main segments of the Canada Road Freight Transport Industry?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing production of chemical and allied products driving the market4.; Rising demand for green warehouses.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Stringent Rules and Regulations4.; Higher Costs.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.January 2024: Mullen Group Ltd has entered into a letter of intent (LOI) to acquire Richmond, British Columbia-based ContainerWorld Forwarding Services Inc. and its operating subsidiaries. The transaction will close in the second quarter of 2024, subject to regulatory approval and final closing conditions. ContainerWorld will operate within Mullen Group's Logistics & Warehousing segment ("L&W segment") and it is expected to generate annualized revenue of approximately USD 150 million.October 2023: Ryder System has entered into a definitive agreement to acquire IFS Holdings, known as Impact Fulfillment Services. The 3PL provides a range of services, including contract packaging and manufacturing, warehousing and more. The deal aims to expand Ryder’s supply chain services by adding 15 operations across nine states, involving California, Florida, Georgia, Illinois, North Carolina, Ohio, Pennsylvania, Texas and Utah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Road Freight Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Road Freight Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Road Freight Transport Industry?

To stay informed about further developments, trends, and reports in the Canada Road Freight Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence