Key Insights

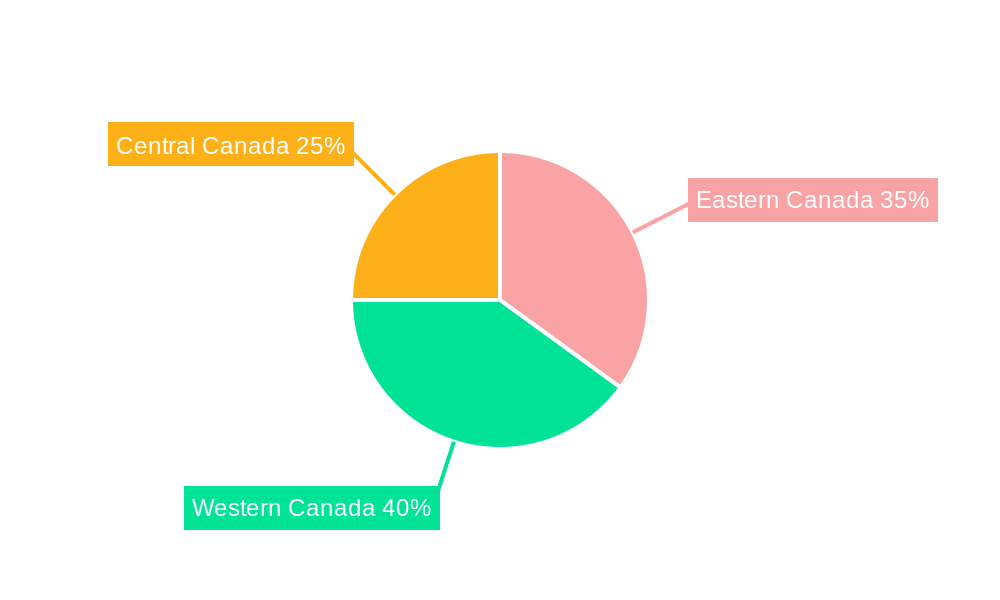

The Canada Location-Based Services (LBS) market is experiencing robust growth, driven by increasing smartphone penetration, the proliferation of IoT devices, and the rising adoption of location intelligence across various sectors. The market, valued at an estimated $1.5 billion CAD in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 12.05% from 2025 to 2033, reaching a significant market size by the end of the forecast period. This expansion is fueled by several key drivers. The burgeoning transportation and logistics sector is leveraging LBS for optimized route planning, fleet management, and delivery tracking, significantly enhancing efficiency and reducing operational costs. Similarly, the IT and telecom sectors are integrating LBS into their offerings, enabling location-aware applications and services. The healthcare sector is employing LBS for patient monitoring, emergency response, and asset tracking. Government agencies are also increasingly adopting LBS for infrastructure management, public safety, and urban planning initiatives. Furthermore, the growing popularity of location-based advertising and social networking applications is contributing to market expansion. Specific regional variations exist within Canada; the Western and Eastern Canadian regions are likely to exhibit stronger growth due to higher tech adoption rates and stronger investments in digital infrastructure compared to Central Canada.

However, certain restraints are also present. Data privacy concerns and security breaches related to location data are major challenges impacting market growth. The high cost of implementing and maintaining LBS infrastructure can also hinder adoption, particularly for smaller businesses. Competition among various providers, both domestic and international, remains intense. To maintain a competitive edge, market players are focusing on innovation, developing advanced LBS solutions, forming strategic partnerships, and expanding their service portfolios. This dynamic interplay of drivers and restraints will shape the trajectory of the Canada LBS market in the coming years, presenting opportunities for both established players and new entrants. Further segmentation analysis into indoor and outdoor applications reveals a strong emphasis on outdoor LBS solutions due to the prevalence of mobile devices and navigation applications, but the growth potential of indoor LBS, particularly in smart buildings and facilities management, presents a significant opportunity for future expansion.

Canada Location-Based Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada location-based services market, offering valuable insights for businesses, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market dynamics, competitive landscapes, and future growth potential. The report incorporates detailed segmentation analysis, key player profiles, and recent industry developments, providing actionable intelligence to navigate this rapidly evolving market.

Canada Location-Based Services Market Market Structure & Competitive Dynamics

The Canadian location-based services market exhibits a moderately concentrated structure, with a few dominant players and a growing number of niche players. Innovation is driven by advancements in 5G technology, AI, and improved mapping capabilities. The regulatory framework, while generally supportive of technological advancements, faces challenges in data privacy and security. Product substitutes include traditional navigation methods, but location-based services increasingly integrate to offer superior functionality. End-user trends indicate a rising preference for personalized and context-aware location services, driving the market's expansion. Mergers and acquisitions (M&A) activity is moderate, with larger companies strategically acquiring smaller firms to expand their product portfolios and geographical reach. Estimated M&A deal value in 2024 reached approximately xx Million. Market share for the top 5 players is estimated at xx%.

- Market Concentration: Moderate, with a few major players holding significant market share.

- Innovation Ecosystem: Strong, driven by advancements in 5G, AI, and mapping technology.

- Regulatory Framework: Supportive but with ongoing challenges in data privacy and security.

- Product Substitutes: Traditional navigation, but LBGs offer superior functionality and integration.

- End-User Trends: Growing demand for personalized and context-aware location services.

- M&A Activity: Moderate, with strategic acquisitions driving market consolidation.

Canada Location-Based Services Market Industry Trends & Insights

The Canadian location-based services market is experiencing robust growth, driven by increasing smartphone penetration, rising adoption of IoT devices, and the expanding use of location data across various sectors. Technological disruptions, such as the rollout of 5G networks and advancements in AI and machine learning, are enhancing the accuracy and capabilities of location-based services. Consumer preferences shift towards seamless, personalized experiences, and this is driving demand for innovative location-aware applications. Competitive dynamics are marked by continuous product innovation, strategic partnerships, and acquisitions. The market's CAGR during the forecast period (2025-2033) is projected at xx%, with market penetration exceeding xx% by 2033.

Dominant Markets & Segments in Canada Location-Based Services Market

The Transportation and Logistics sector currently represents the dominant end-user segment, driven by the need for efficient fleet management, real-time tracking, and improved navigation systems. Within the component segment, software dominates due to the increasing demand for location-based analytics and data-driven decision-making. The Outdoor location segment holds a larger market share than Indoor due to the extensive application across various sectors like transportation, utilities, and resource management. Mapping and Navigation remains the leading application segment, followed by Business Intelligence and Analytics.

- Key Drivers for Transportation and Logistics: Stringent regulations for safety and efficiency, optimizing delivery routes, real-time tracking of goods.

- Key Drivers for Software: Increasing demand for data analytics and insights, cost-effectiveness compared to hardware.

- Key Drivers for Outdoor Location: Large-scale applications in agriculture, resource management, and environmental monitoring.

- Key Drivers for Mapping and Navigation: Rise in smartphone usage, demand for precise and reliable navigation solutions.

Canada Location-Based Services Market Product Innovations

Recent innovations focus on integrating AI and machine learning into location-based services to enhance accuracy, personalization, and context awareness. New applications leverage 5G capabilities for real-time tracking and data transmission. The competitive landscape is characterized by continuous improvements in location accuracy, data security, and the integration of location data with other data sources for richer insights. This trend improves the overall user experience and market fit.

Report Segmentation & Scope

This report segments the Canada location-based services market across several key parameters:

- By Component: Hardware (e.g., GPS receivers, sensors), Software (e.g., mapping software, analytics platforms), Services (e.g., data analytics, integration services). Software is projected for significant growth.

- By Location: Indoor (e.g., indoor navigation, asset tracking), Outdoor (e.g., fleet management, geographic information systems). Outdoor applications currently dominate.

- By Application: Mapping and Navigation, Business Intelligence and Analytics, Location-based Advertising, Social Networking and Entertainment, Other Applications. Mapping and Navigation is currently the largest application area.

- By End-User: Transportation and Logistics, IT and Telecom, Healthcare, Government, BFSI, Hospitality, Manufacturing, Other End-Users. Transportation and Logistics is the largest end-user segment. Growth projections vary significantly across segments, with high growth expected in Healthcare and BFSI.

Key Drivers of Canada Location-Based Services Market Growth

The Canadian location-based services market is propelled by several key factors: growing smartphone and IoT adoption, advancements in 5G and related technologies, increasing demand for real-time data and analytics, and government initiatives promoting digital transformation. Investment in infrastructure, such as improved mapping data and high-speed networks, further fuels market expansion. Stringent regulations encouraging data security and privacy also create market opportunities for secure LBG solutions.

Challenges in the Canada Location-Based Services Market Sector

Challenges include concerns about data privacy and security, the high cost of implementation and maintenance of location-based infrastructure, and competition from existing players and new entrants. The dependence on reliable network connectivity and potential regulatory hurdles related to data usage create significant hurdles for market penetration. These factors limit market growth but also offer opportunities for innovative solutions.

Leading Players in the Canada Location-Based Services Market Market

- HPE Aruba Inc

- IBM Corporation

- Google LLC

- Zebra Technologies Corporation

- Esri Technologies Ltd

- DigitalGlobe Inc (Maxar Technologies)

- Cisco Systems Inc

- Ericsson Inc

- ALE International (Nokia Corporation)

- Teldio Corporation

Key Developments in Canada Location-Based Services Market Sector

- December 2022: Comtech secured a contract to establish a 5G virtual mobile location center (vMLC) production facility, significantly advancing precise geolocation services.

- March 2023: The release of Minerva Intelligence's climate85 wildfire risk map provides crucial data for risk management and infrastructure planning, impacting the insurance and emergency response sectors.

Strategic Canada Location-Based Services Market Market Outlook

The Canadian location-based services market is poised for significant growth, driven by continued technological advancements and increasing demand across various sectors. Strategic opportunities lie in developing innovative solutions that address data privacy concerns, leverage 5G capabilities, and integrate location data with other data sources for richer insights. The market offers promising prospects for companies that can deliver secure, reliable, and personalized location-based services.

Canada Location-Based Services Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

Canada Location-Based Services Market Segmentation By Geography

- 1. Canada

Canada Location-Based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing adoption of Smart Phones

- 3.2.2 Social Media

- 3.2.3 and Easy Availability of GPS Technology is Expected to Drive the Market Growth; Technological Advancements Aided by Emergence of BLE and UWB for Indoor Services

- 3.3. Market Restrains

- 3.3.1. Trade-offs between privacy/security and regulatory constraints; Consumer speculation over the exposure of their data and anxiety about being followed & tracked are among the factors challenging the growth of the Canadian location-based services market.

- 3.4. Market Trends

- 3.4.1. Indoor Location Segment is Expected to Hold Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Location-Based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Eastern Canada Canada Location-Based Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Location-Based Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Location-Based Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 HPE Aruba Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 IBM Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Google LLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Zebra Technologies Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Esri Technologies Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 DigitalGlobe Inc (Maxar Technologies )

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cisco Systems Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Ericsson Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 ALE International ( Nokia Corporation)

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Teldio Corporation

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 HPE Aruba Inc

List of Figures

- Figure 1: Canada Location-Based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Location-Based Services Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Location-Based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Location-Based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Canada Location-Based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: Canada Location-Based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Canada Location-Based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Canada Location-Based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Canada Location-Based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Eastern Canada Canada Location-Based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Canada Canada Location-Based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Canada Canada Location-Based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada Location-Based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 12: Canada Location-Based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 13: Canada Location-Based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Canada Location-Based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 15: Canada Location-Based Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Location-Based Services Market?

The projected CAGR is approximately 12.05%.

2. Which companies are prominent players in the Canada Location-Based Services Market?

Key companies in the market include HPE Aruba Inc, IBM Corporation, Google LLC, Zebra Technologies Corporation, Esri Technologies Ltd, DigitalGlobe Inc (Maxar Technologies ), Cisco Systems Inc, Ericsson Inc, ALE International ( Nokia Corporation), Teldio Corporation.

3. What are the main segments of the Canada Location-Based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing adoption of Smart Phones. Social Media. and Easy Availability of GPS Technology is Expected to Drive the Market Growth; Technological Advancements Aided by Emergence of BLE and UWB for Indoor Services.

6. What are the notable trends driving market growth?

Indoor Location Segment is Expected to Hold Significant Share of the Market.

7. Are there any restraints impacting market growth?

Trade-offs between privacy/security and regulatory constraints; Consumer speculation over the exposure of their data and anxiety about being followed & tracked are among the factors challenging the growth of the Canadian location-based services market..

8. Can you provide examples of recent developments in the market?

December 2022: Comtech secured a contract to establish a 5G virtual mobile location center (vMLC) production facility. This contract was awarded by a prominent tier-1 mobile network operator (MNO) operating in Canada. This development marked another stride in Comtech's ongoing mission to become the world's leading provider of precise, network-based geolocation services. Comtech's vMLC system plays a pivotal role in accurately determining the locations of mobile devices connected to 5G networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Location-Based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Location-Based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Location-Based Services Market?

To stay informed about further developments, trends, and reports in the Canada Location-Based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence