Key Insights

The Canada Customs Clearance Market is poised for significant growth, propelled by robust cross-border trade and expanding e-commerce operations. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 0.1, with an estimated market size of 16.9 billion by 2025. Key growth drivers include the increasing complexity of import/export regulations, the imperative for optimized supply chains, and the demand for specialized customs expertise. The market is segmented by transportation mode (sea, air, land) and region (Eastern, Western, Central Canada), each presenting distinct growth dynamics. Leading service providers are investing in advanced technologies and strategic alliances to meet evolving business needs. Emphasis on regulatory compliance and risk mitigation highlights the value of experienced customs brokers.

Canada Customs Clearance Market Market Size (In Billion)

The forecast period (2025-2033) indicates sustained expansion, supported by projected e-commerce growth, new bilateral trade agreements, and the overall growth of the Canadian economy. Market dynamics may be influenced by currency fluctuations and global supply chain disruptions. Consolidation among larger entities is anticipated, alongside the integration of innovative technologies like automation and AI to enhance efficiency and reduce processing times. Government initiatives to simplify customs procedures and industry adaptability to new technologies will be crucial for future development. This dynamic market offers considerable opportunities for both established and emerging businesses that can deliver value-added services and adapt to evolving international trade landscapes.

Canada Customs Clearance Market Company Market Share

Canada Customs Clearance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Canada Customs Clearance Market, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, equipping stakeholders with the knowledge to make informed strategic decisions. With a base year of 2025 and an estimated year of 2025, this report projects market trends through 2033, using data from the historical period of 2019-2024. The market size is projected to reach xx Million by 2033.

Canada Customs Clearance Market Market Structure & Competitive Dynamics

The Canadian customs clearance market is characterized by a moderately concentrated structure, with several large multinational players and a number of smaller, specialized firms. Market share is largely held by established logistics providers, leveraging extensive networks and technological capabilities. The market exhibits a dynamic innovation ecosystem, driven by advancements in technology, including AI-powered customs brokerage solutions and automation of processes. The regulatory framework, governed primarily by the Canada Border Services Agency (CBSA), significantly impacts market operations. While the market experiences some degree of substitution, with businesses exploring alternative solutions for smaller shipments, the core customs clearance services remain essential. End-user trends reflect a growing demand for efficient, transparent, and technologically advanced customs brokerage solutions. M&A activity has been moderate, with consolidation primarily driven by larger players seeking to expand their market share and service offerings. The total value of M&A deals in the past five years is estimated at xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation: Strong focus on digitalization, AI, and automation.

- Regulatory Framework: Primarily governed by CBSA regulations and compliance requirements.

- Product Substitutes: Limited substitutes for core customs clearance services.

- M&A Activity: Moderate consolidation, with deal values averaging xx Million per transaction.

Canada Customs Clearance Market Industry Trends & Insights

The Canada Customs Clearance Market is experiencing significant growth driven by increasing cross-border trade, rising e-commerce activity, and advancements in supply chain technologies. The market’s CAGR from 2025 to 2033 is projected at xx%. This robust growth is fueled by several factors. The expansion of e-commerce necessitates efficient and reliable customs clearance solutions, leading to increased demand. Moreover, technological advancements, particularly in automation and data analytics, are streamlining processes and improving efficiency. However, competitive dynamics, fluctuating economic conditions, and regulatory changes pose challenges to consistent market growth. Market penetration of advanced customs brokerage solutions is increasing, with adoption rates projected to reach xx% by 2033. Consumer preferences shift towards faster, more transparent, and technologically driven solutions.

Dominant Markets & Segments in Canada Customs Clearance Market

The airfreight segment currently dominates the Canadian customs clearance market, driven by the high volume of air cargo passing through major airports like Toronto Pearson and Vancouver International. This dominance is fueled by the crucial role air transport plays in time-sensitive shipments and the growing e-commerce sector, where speed and efficiency are critical. Cross-border land transport and sea freight segments also contribute substantially, however, air cargo holds a clear lead.

Key Drivers of Airfreight Segment Dominance:

- High volume of air cargo through major Canadian airports.

- Increased e-commerce driving demand for fast delivery solutions.

- Time-sensitive nature of many air shipments.

- Robust airport infrastructure and efficient logistics networks.

Sea and Cross-Border Land Transport: These segments hold a significant portion of the market, largely influenced by bulk cargo and the vast trade relationships with the US. However, these segments face challenges related to infrastructure development and potential logistical complexities.

Canada Customs Clearance Market Product Innovations

Recent product innovations include the integration of artificial intelligence (AI) and machine learning (ML) into customs brokerage software, enhancing accuracy, efficiency, and compliance. This technology facilitates automated document processing, risk assessment, and tariff classification, improving operational speed and reducing errors. Blockchain technology is also being explored to increase transparency and security in supply chains, further streamlining customs clearance processes. These innovations cater to the growing demand for fast, accurate, and secure customs clearance services.

Report Segmentation & Scope

The Canada Customs Clearance Market is segmented by mode of transport:

Sea Freight: This segment includes customs clearance for goods transported by sea. Growth is projected to be moderate, driven by international trade, but faces challenges regarding port congestion and shipping delays. Market size is expected to reach xx Million by 2033.

Air Freight: This high-growth segment, as discussed earlier, is fueled by e-commerce and the need for rapid delivery. Market size is projected to reach xx Million by 2033, with significant competitive pressure among major players.

Cross-Border Land Transport: This segment comprises customs clearance for goods transported by road or rail between Canada and the US. Market size is estimated at xx Million in 2025, experiencing steady growth driven by robust trade relationships.

Key Drivers of Canada Customs Clearance Market Growth

Key drivers include the ongoing expansion of e-commerce, driving demand for expedited customs clearance; increased globalization and cross-border trade; the implementation of advanced technologies such as AI and automation to streamline processes; and supportive government policies fostering international trade. These factors collectively contribute to the market's robust growth trajectory.

Challenges in the Canada Customs Clearance Market Sector

The market faces challenges such as fluctuating global economic conditions impacting trade volumes; complex and ever-evolving customs regulations that require constant adaptation; potential supply chain disruptions causing delays and increased costs; and intense competition among numerous players, demanding continuous innovation and operational efficiency. These factors can influence profitability and overall market stability. For instance, supply chain disruptions in 2022-2023 resulted in an estimated xx% increase in processing times for some types of goods.

Leading Players in the Canada Customs Clearance Market Market

- DB Schenker

- United Parcel Services (UPS)

- Kuehne + Nagel

- FedEx Corporation

- Livingston International

- Argo Customs

- Universal Logistics

- DHL Group Logistics

- World Wide Customs Brokers Limited

- A. N. Deringer

Key Developments in Canada Customs Clearance Market Sector

March 2023: Air Menzies International (AMI) opened a new branch near Toronto Pearson International Airport, expanding its airfreight services, including customs clearance. This expansion signifies increased investment in the sector and caters to growing demand.

March 2022: The Department of Finance Canada imposed a 35% tariff on goods from Russia and Belarus, significantly impacting import volumes and creating new challenges for customs brokers in handling the increased compliance needs.

Strategic Canada Customs Clearance Market Market Outlook

The Canada Customs Clearance Market presents considerable growth potential driven by ongoing e-commerce growth and increased cross-border trade. Strategic opportunities exist for companies that invest in innovative technologies, such as AI and blockchain, to improve efficiency and transparency. Expanding into niche market segments and strengthening partnerships within the supply chain will also be crucial for success. The market's future trajectory depends significantly on sustained economic growth, efficient infrastructure development, and effective adaptation to evolving regulatory landscapes.

Canada Customs Clearance Market Segmentation

-

1. Mode Of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-Border Land Transport

Canada Customs Clearance Market Segmentation By Geography

- 1. Canada

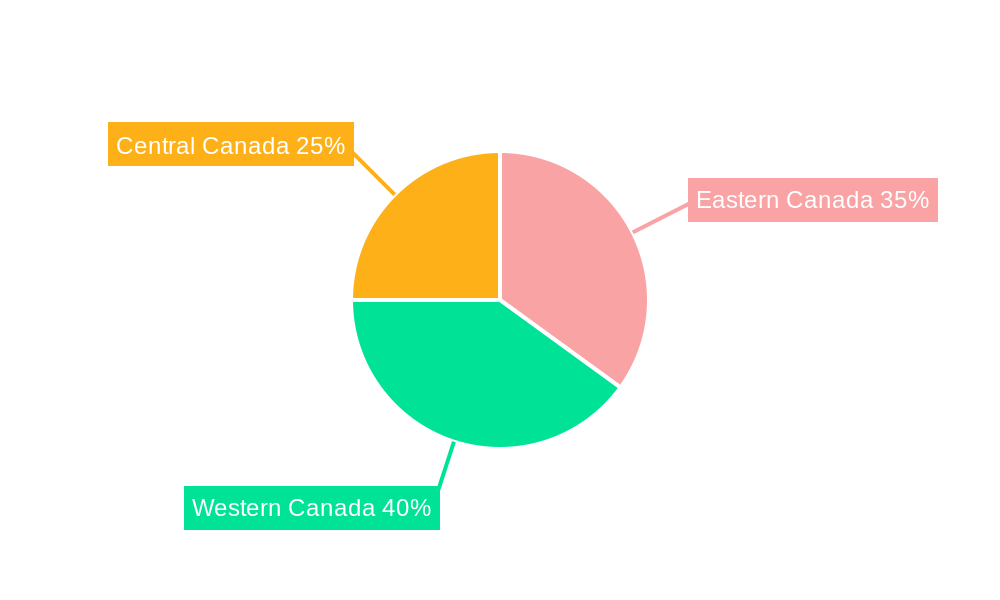

Canada Customs Clearance Market Regional Market Share

Geographic Coverage of Canada Customs Clearance Market

Canada Customs Clearance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing international trade; Complex custom regulations

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Geopolitical Uncertainity

- 3.4. Market Trends

- 3.4.1. Increasing International Trade Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Customs Clearance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-Border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne and Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Livingston

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Argo Customs

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Universal Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Group Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 World Wide Customs Brokers Limited**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 A N Deringer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Canada Customs Clearance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Customs Clearance Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Customs Clearance Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: Canada Customs Clearance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Customs Clearance Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 4: Canada Customs Clearance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Customs Clearance Market?

The projected CAGR is approximately 0.1%.

2. Which companies are prominent players in the Canada Customs Clearance Market?

Key companies in the market include DB Schenker, United Parcel Services, Kuehne and Nagel, FedEx Corporation, Livingston, Argo Customs, Universal Logistics, DHL Group Logistics, World Wide Customs Brokers Limited**List Not Exhaustive, A N Deringer.

3. What are the main segments of the Canada Customs Clearance Market?

The market segments include Mode Of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing international trade; Complex custom regulations.

6. What are the notable trends driving market growth?

Increasing International Trade Driving the Market.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Geopolitical Uncertainity.

8. Can you provide examples of recent developments in the market?

March 2023: Air Menzies International (AMI), a Canadian airfreight reseller, has built a new branch near Toronto Pearson International Airport. The new branch is AMI's second in Canada, and it will provide a wide range of wholesale airfreight services, including door-to-door services on global import and export shipments; exports with consolidation and 'Back2Back'; 'Quick2Ship,' AMI's express shipment platform; X-ray screening and warehousing services; and customs clearance and documentation support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Customs Clearance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Customs Clearance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Customs Clearance Market?

To stay informed about further developments, trends, and reports in the Canada Customs Clearance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence