Key Insights

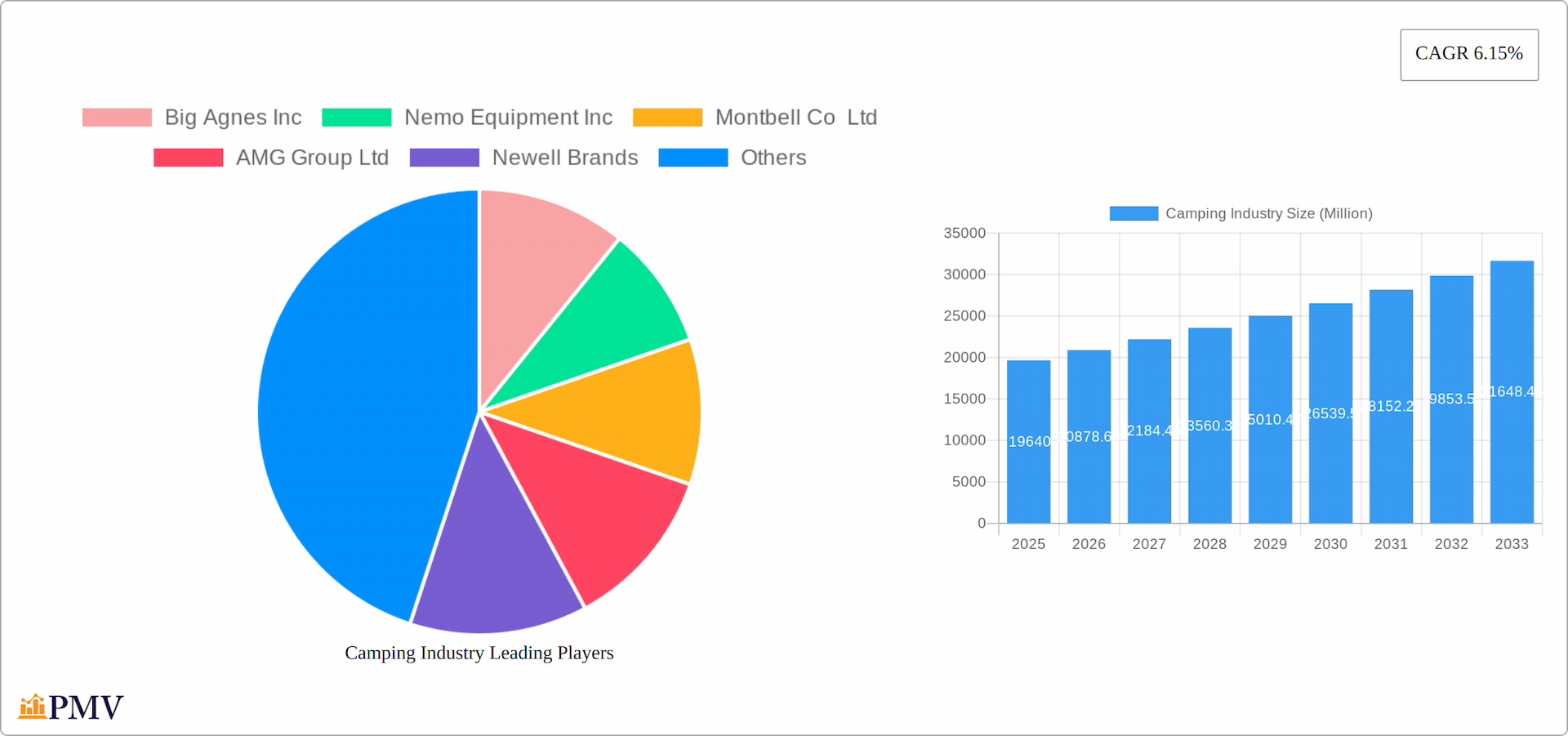

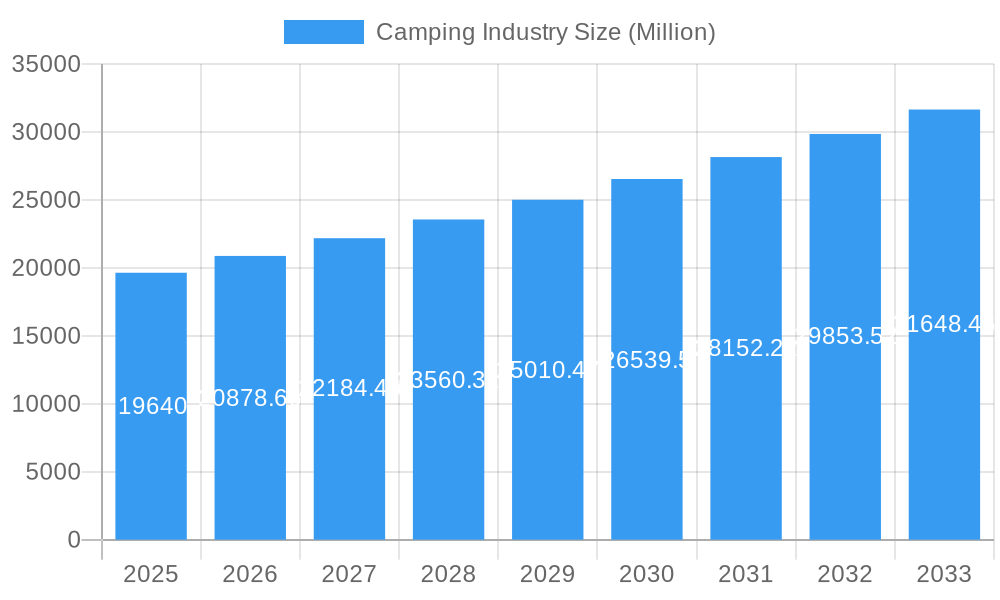

The global camping industry, valued at $19.64 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.15% from 2025 to 2033. This expansion is driven by several key factors. The rising popularity of outdoor recreation and adventure tourism fuels demand for camping equipment, with millennials and Gen Z leading this trend. Increased disposable incomes, particularly in developing economies, are further contributing to market growth. Moreover, technological advancements in camping gear, such as lighter and more durable tents, advanced cooking systems, and innovative backpacking designs, are enhancing the overall camping experience and attracting a wider consumer base. E-commerce platforms are also playing a pivotal role, offering convenient access to a wider range of products and facilitating market expansion. However, factors such as unpredictable weather conditions and the increasing cost of travel can pose challenges.

Camping Industry Market Size (In Billion)

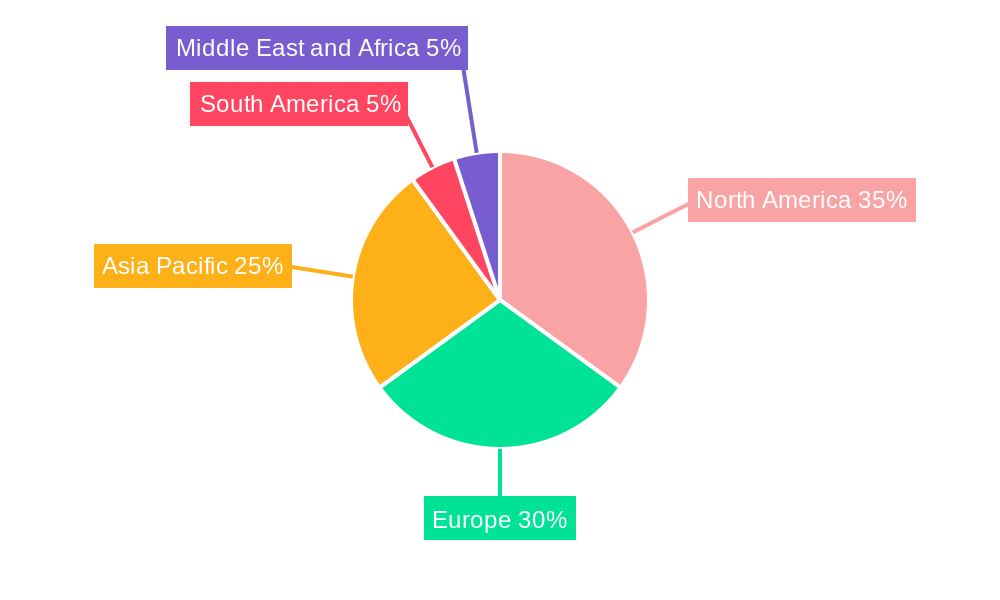

Despite potential restraints, the market segmentation reveals promising opportunities. The product categories of camping tents, backpacks, and cooking systems are expected to dominate the market share, reflecting the core needs of campers. The online retail channel is witnessing significant growth, surpassing traditional offline channels in terms of market reach and customer convenience. Geographically, North America and Europe currently hold significant market shares, driven by established outdoor recreation cultures and high consumer spending. However, the Asia-Pacific region is poised for substantial growth due to increasing disposable incomes and a rising interest in outdoor activities. This presents significant opportunities for established players and new entrants alike to capitalize on the expanding global camping market. Strategic partnerships, product diversification, and targeted marketing campaigns will play a crucial role in achieving success within this dynamic industry landscape.

Camping Industry Company Market Share

Camping Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global camping industry, encompassing market size, trends, competitive landscape, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The report offers actionable insights for industry stakeholders, including manufacturers like Big Agnes Inc, Nemo Equipment Inc, Montbell Co Ltd, AMG Group Ltd, Newell Brands, Zempire Camping Equipment, Exxel Outdoors LLC, Johnson Outdoor Inc, Oase Outdoors ApS, and Nordisk Company AS (list not exhaustive), and investors seeking opportunities within this dynamic market. The global camping industry is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report is your essential guide to navigating the complexities and opportunities within this booming sector.

Camping Industry Market Structure & Competitive Dynamics

The global camping industry is characterized by a moderately concentrated market structure, with a few major players holding significant market share. However, a substantial number of smaller, specialized companies also contribute significantly to innovation and product diversification. The industry is subject to various regulatory frameworks governing product safety and environmental impact, which vary across different regions. Several product substitutes exist, such as glamping (glamorous camping) experiences and alternative vacation options, exerting competitive pressure on traditional camping gear. End-user trends increasingly favor lightweight, durable, and technologically advanced camping equipment, while sustainability concerns are gaining traction.

Mergers and acquisitions (M&A) activity within the camping industry has been relatively moderate over the past few years, with deal values averaging approximately xx Million per transaction. Some notable M&A activities involved strategic partnerships aimed at expanding distribution channels or integrating complementary product lines. The following are examples of key market dynamics:

- Market Concentration: The top five players account for approximately xx% of the global market share in 2025.

- Innovation Ecosystems: Collaborative partnerships between established companies and startups are driving innovation in materials, design, and technology.

- Regulatory Frameworks: Regulations related to product safety and environmental sustainability impact manufacturing and distribution costs.

- Product Substitutes: The rise of glamping and alternative travel styles presents competitive challenges to traditional camping.

- End-User Trends: Demand for lightweight, durable, and technologically advanced camping equipment is rising.

- M&A Activities: Consolidation and strategic partnerships are reshaping the competitive landscape.

Camping Industry Industry Trends & Insights

The camping industry is experiencing robust growth fueled by several key factors. A rising global interest in outdoor recreation and adventure tourism, coupled with increased disposable incomes in many regions, is significantly boosting demand for camping equipment and experiences. This trend is further amplified by technological advancements. Smart features integrated into camping gear, innovative materials enhancing product performance and durability, and streamlined online purchasing experiences are transforming the user experience and driving sales. Sustainability is also a major factor, with consumers increasingly seeking eco-friendly and ethically sourced products. This shift is creating new opportunities for manufacturers committed to sustainable practices. The influence of social media and online influencer marketing is undeniable, particularly in shaping perceptions and driving purchases of items like camping backpacks and tents. While the market enjoys this growth, increased competition among established brands and new market entrants is fostering innovation and price competitiveness. Analysts project a CAGR of [Insert Projected CAGR]% for the camping industry during the forecast period, with market penetration expected to reach [Insert Projected Market Penetration]% by 2033. This growth is not uniform across all segments, with certain niche areas like glamping and luxury camping experiencing particularly rapid expansion.

Dominant Markets & Segments in Camping Industry

Leading Regions/Countries: North America and Europe currently dominate the global camping market, driven by high disposable incomes, well-established outdoor recreational infrastructure, and strong environmental consciousness. However, the Asia-Pacific region is anticipated to experience the fastest growth rate during the forecast period, fueled by rapid economic development and rising interest in outdoor activities.

Dominant Product Types:

- Camping Tents: This segment holds the largest market share due to the high demand for tents across various camping styles and user preferences.

- Camping Backpacks: The popularity of backpacking and hiking fuels high demand and continuous innovation in this segment.

- Camping Gear and Accessories: This category is growing rapidly, encompassing a vast range of products that enhance the camping experience, boosting overall market value.

Dominant Distribution Channels:

- Offline Retail Channel: Traditional brick-and-mortar stores, particularly sporting goods retailers and specialized outdoor equipment stores, still command a significant share of the market, offering hands-on product experiences and expert advice.

- Online Retail Channel: The online channel is rapidly gaining ground, offering convenience, wider product selection, and competitive pricing, thus driving significant growth.

Key Drivers: Strong government support for outdoor recreation infrastructure and favorable economic policies in various countries contribute to the dominance of these segments.

Camping Industry Product Innovations

Innovation is a driving force in the camping industry's continued growth. Smart technology integration is prevalent, with features such as GPS tracking in backpacks, advanced ventilation systems in tents offering improved comfort and safety, and integrated cooking systems in camp stoves enhancing convenience. Lightweight yet incredibly durable materials, such as advanced polymers and carbon fiber, are revolutionizing product design, enabling the creation of gear that is both robust and easy to transport. This directly responds to consumer demand for efficient and comfortable camping experiences, regardless of the terrain or climate. Furthermore, products that seamlessly blend functionality with sustainability are gaining significant traction, reflecting the growing consumer preference for eco-conscious choices. This includes the use of recycled materials, reduced packaging, and durable designs to minimize waste and environmental impact.

Report Segmentation & Scope

This report segments the camping industry based on product type (Camping Furniture, Camping Backpacks, Tents, Cooking Systems and Cookware, Camping Gear and Accessories) and distribution channel (Online Retail Channel, Offline Retail Channel). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail, providing a granular view of the market's structure and future trajectory. The Online Retail Channel is predicted to achieve a higher CAGR compared to the Offline Retail Channel due to increased internet penetration and e-commerce adoption. Each product type's market size is assessed separately, revealing market leaders and growth opportunities within each category.

Key Drivers of Camping Industry Growth

Several factors drive the growth of the camping industry. The increasing popularity of outdoor recreation and adventure tourism is a significant catalyst, coupled with rising disposable incomes in various regions. Technological advancements, improving product design, and eco-friendly manufacturing processes are also boosting market demand. Favorable government policies promoting outdoor activities and investments in recreational infrastructure further fuel growth. The rise of social media marketing and influencer campaigns also plays a key role in shaping consumer perception and driving sales.

Challenges in the Camping Industry Sector

Despite its robust growth, the camping industry faces several key challenges. Fluctuations in raw material prices, global supply chain disruptions, and increased manufacturing costs pose significant threats to profitability. Intense competition, both from established players and new entrants, creates pressure on profit margins. Meeting stringent safety and environmental regulations adds complexity and cost to the manufacturing process. Furthermore, economic downturns and resulting shifts in consumer spending habits can significantly impact demand for discretionary items such as camping equipment. The industry must adapt to these fluctuating economic conditions and find ways to remain competitive while maintaining sustainable practices.

Leading Players in the Camping Industry Market

- Big Agnes Inc

- Nemo Equipment Inc

- Montbell Co Ltd

- AMG Group Ltd

- Newell Brands

- Zempire Camping Equipment

- Exxel Outdoors LLC

- Johnson Outdoor Inc

- Oase Outdoors ApS

- Nordisk Company AS

Key Developments in Camping Industry Sector

- January 2021: Big Agnes partnered with Bluebird Backcountry, expanding its brand reach and enhancing its reputation within the outdoor recreation community.

- March 2022: Big Agnes launched its innovative 3N1 sleeping bag series, introducing a versatile and adaptable product line that catered to a wider range of customer needs.

- June 2022: Newell Brands' Contigo expanded its product portfolio with the launch of reusable beverage containers, capitalizing on the growing consumer demand for sustainable and eco-friendly alternatives.

- [Add other recent key developments with dates and brief descriptions]

Strategic Camping Industry Market Outlook

The camping industry holds significant growth potential, driven by the projected increase in outdoor recreation participation and continued innovation within product design and technology. Opportunities exist for manufacturers to capitalize on the growing demand for sustainable and eco-friendly camping equipment. Strategic alliances and partnerships can be instrumental in expanding market reach and improving supply chain efficiency. A focus on digital marketing and e-commerce strategies will be crucial for capturing a larger market share. The long-term outlook for the camping industry remains positive, indicating a robust and dynamic market with ample opportunities for growth and innovation.

Camping Industry Segmentation

-

1. Product Type

- 1.1. Camping Furniture

- 1.2. Camping Backpacks

- 1.3. Tents

- 1.4. Cooking Systems and Cookware

- 1.5. Camping Gear and Accessories

-

2. Distribution Channel

- 2.1. Online Retail Channel

- 2.2. Offline Retail Channel

Camping Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Camping Industry Regional Market Share

Geographic Coverage of Camping Industry

Camping Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Online Retailers Offering Seamless Shopping Experience; Growing Consumer Inclination Towards Latest Sustainable Fashion

- 3.3. Market Restrains

- 3.3.1. Limited Sensory Experience

- 3.4. Market Trends

- 3.4.1. Rising Participation in Outdoor Recreational Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Camping Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Camping Furniture

- 5.1.2. Camping Backpacks

- 5.1.3. Tents

- 5.1.4. Cooking Systems and Cookware

- 5.1.5. Camping Gear and Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail Channel

- 5.2.2. Offline Retail Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Camping Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Camping Furniture

- 6.1.2. Camping Backpacks

- 6.1.3. Tents

- 6.1.4. Cooking Systems and Cookware

- 6.1.5. Camping Gear and Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail Channel

- 6.2.2. Offline Retail Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Camping Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Camping Furniture

- 7.1.2. Camping Backpacks

- 7.1.3. Tents

- 7.1.4. Cooking Systems and Cookware

- 7.1.5. Camping Gear and Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail Channel

- 7.2.2. Offline Retail Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Camping Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Camping Furniture

- 8.1.2. Camping Backpacks

- 8.1.3. Tents

- 8.1.4. Cooking Systems and Cookware

- 8.1.5. Camping Gear and Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail Channel

- 8.2.2. Offline Retail Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Camping Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Camping Furniture

- 9.1.2. Camping Backpacks

- 9.1.3. Tents

- 9.1.4. Cooking Systems and Cookware

- 9.1.5. Camping Gear and Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail Channel

- 9.2.2. Offline Retail Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Camping Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Camping Furniture

- 10.1.2. Camping Backpacks

- 10.1.3. Tents

- 10.1.4. Cooking Systems and Cookware

- 10.1.5. Camping Gear and Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail Channel

- 10.2.2. Offline Retail Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Big Agnes Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nemo Equipment Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Montbell Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AMG Group Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Newell Brands

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zempire Camping Equipment*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Exxel Outdoors LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson Outdoor Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oase Outdoors ApS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nordisk Company AS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Big Agnes Inc

List of Figures

- Figure 1: Global Camping Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Camping Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Camping Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Camping Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Camping Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Camping Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Camping Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Camping Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Camping Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Camping Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Camping Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Camping Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Camping Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Camping Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Camping Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Camping Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Camping Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Camping Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Camping Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Camping Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Camping Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Camping Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Camping Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Camping Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Camping Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Camping Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Camping Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Camping Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Camping Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Camping Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Camping Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Camping Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Camping Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Camping Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Camping Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Camping Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Camping Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Camping Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Camping Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Camping Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Camping Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Camping Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Camping Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Camping Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Camping Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Camping Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Camping Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Camping Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Camping Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Camping Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Camping Industry?

The projected CAGR is approximately 6.15%.

2. Which companies are prominent players in the Camping Industry?

Key companies in the market include Big Agnes Inc, Nemo Equipment Inc, Montbell Co Ltd, AMG Group Ltd, Newell Brands, Zempire Camping Equipment*List Not Exhaustive, Exxel Outdoors LLC, Johnson Outdoor Inc, Oase Outdoors ApS, Nordisk Company AS.

3. What are the main segments of the Camping Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Online Retailers Offering Seamless Shopping Experience; Growing Consumer Inclination Towards Latest Sustainable Fashion.

6. What are the notable trends driving market growth?

Rising Participation in Outdoor Recreational Activities.

7. Are there any restraints impacting market growth?

Limited Sensory Experience.

8. Can you provide examples of recent developments in the market?

June 2022: Newell Brands' Contigo launched Reusable Beverage Containers, Contigo Uptown Dual-Sip Thumbler, River North 2-in-1 stainless steel can cooler and tumbler, and River North stainless steel wine tumbler with a splash-proof lid. These products are reusable on-the-go beverage containers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Camping Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Camping Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Camping Industry?

To stay informed about further developments, trends, and reports in the Camping Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence