Key Insights

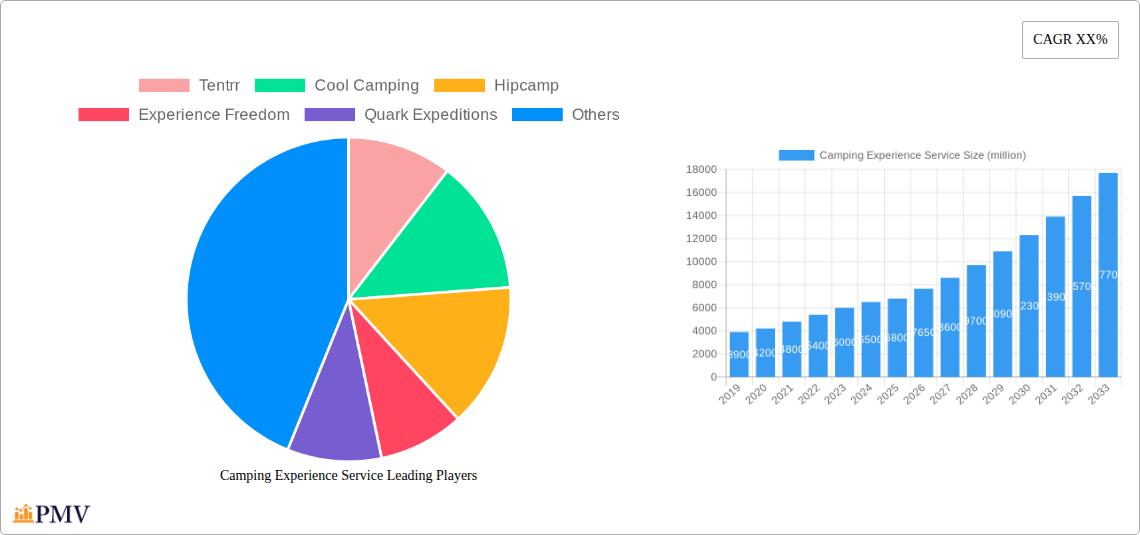

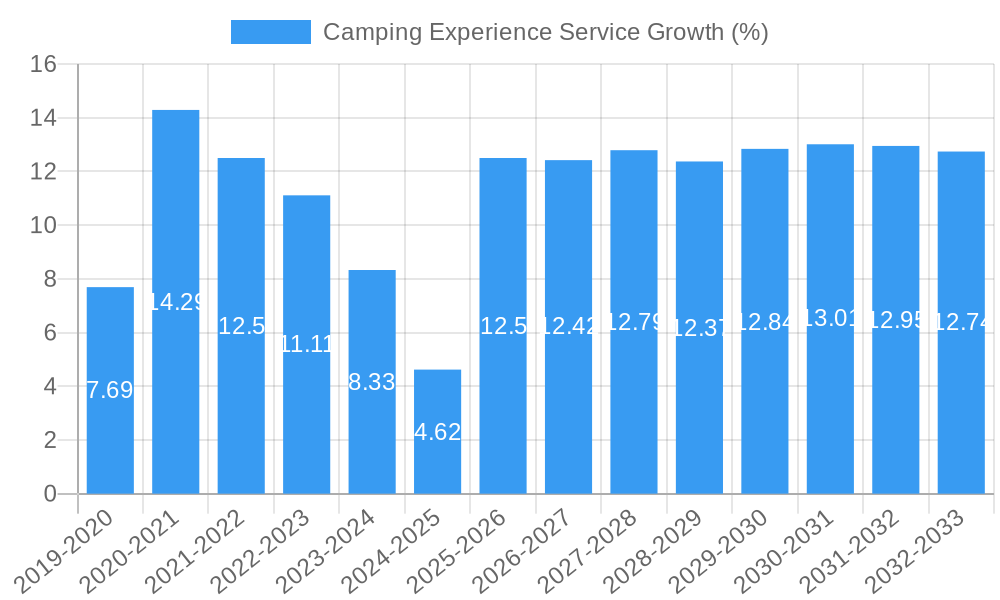

The global Camping Experience Service market is poised for significant expansion, projected to reach an estimated market size of $6,800 million by 2025, with a Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This robust growth is primarily fueled by an increasing consumer desire for authentic outdoor experiences and a renewed appreciation for nature. The pandemic significantly boosted interest in outdoor recreation, and this trend shows no signs of abating. Key market drivers include the growing popularity of glamping and unique accommodation options that blend comfort with nature, appealing to a broader demographic, including adults seeking a break from urban life. Furthermore, advancements in camping gear and the accessibility of booking platforms are lowering barriers to entry for new campers. The market is segmented by application, with "Adults" representing the dominant segment due to the increasing adoption of camping as a leisure activity for stress relief and personal rejuvenation, followed by "Children" who benefit from early exposure to outdoor learning and adventure.

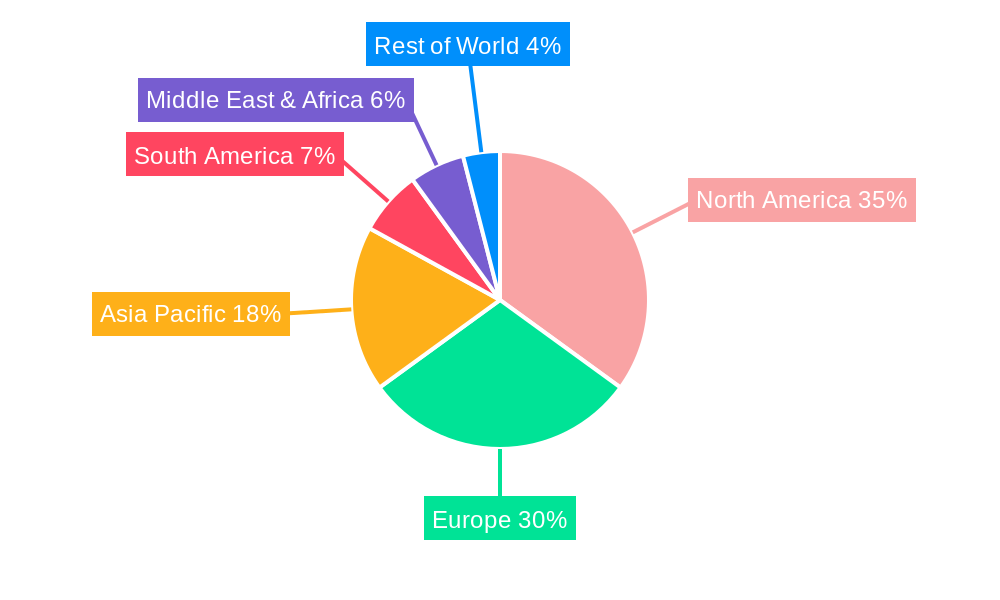

The market is further categorized by camping type, with "Tent Camping" and "Car Camping" holding substantial shares, offering accessible and traditional outdoor experiences. However, "Hiking Camping" is expected to witness accelerated growth as adventure tourism gains traction. Geographically, North America currently leads the market, driven by established camping infrastructure and a strong outdoor culture, particularly in the United States. Europe is also a significant contributor, with countries like the UK, Germany, and France showcasing a high demand for camping services. Emerging economies in the Asia Pacific region, particularly China and India, are anticipated to present considerable growth opportunities as disposable incomes rise and an interest in experiential travel expands. While the market exhibits strong upward momentum, potential restraints include the perceived lack of amenities and safety concerns among some potential consumers, alongside unpredictable weather conditions that can impact the camping experience. However, service providers are actively addressing these by offering improved facilities and robust safety protocols.

Camping Experience Service Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth market report provides a thorough examination of the global Camping Experience Service market, encompassing historical performance, current trends, and future projections. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate competitive landscapes. We analyze key companies like Tentrr, Cool Camping, Hipcamp, Experience Freedom, Quark Expeditions, REI Adventures, Abercrombie & Kent Group, and Butterfield & Robinson, along with critical segments such as Children and Adult applications, and Types including Tent Camping, Car Camping, Hiking Camping, and Others.

Camping Experience Service Market Structure & Competitive Dynamics

The Camping Experience Service market exhibits a moderately concentrated structure, driven by a blend of established players and emerging niche providers. Innovation ecosystems are flourishing, with companies actively investing in technology to enhance user experience and operational efficiency. Regulatory frameworks, while generally supportive of outdoor recreation, can vary regionally, impacting market entry and operations for glamping and adventure travel providers. Product substitutes, including traditional hotel stays and other leisure activities, are present but the growing demand for authentic, nature-based experiences continues to favor specialized camping services. End-user trends reveal a significant surge in demand from millennials and Gen Z seeking unique, eco-friendly travel options. Mergers and acquisitions (M&A) activities are a notable feature, with recent deals valued in the hundreds of millions of dollars as larger entities seek to consolidate their market position. Key companies like Hipcamp have seen substantial valuation increases, reflecting the market's robust growth potential. Over the historical period (2019-2024), average M&A deal values have trended upwards, indicating increasing investor confidence.

Camping Experience Service Industry Trends & Insights

The Camping Experience Service industry is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This expansion is fueled by a confluence of factors, including a growing appreciation for outdoor activities post-pandemic, the rise of sustainable tourism, and increased disposable incomes. Technological disruptions are playing a pivotal role, with the adoption of AI-powered booking platforms, virtual reality (VR) pre-trip experiences, and IoT-enabled campsite management solutions enhancing accessibility and convenience. Consumer preferences are shifting towards personalized and curated camping experiences, with a strong emphasis on eco-friendly practices and community engagement. This is evident in the rising popularity of eco-camping and boutique camping options. Competitive dynamics are intensifying, with companies like Tentrr and Cool Camping differentiating themselves through unique site offerings and curated experiences. Market penetration for organized camping services is expected to reach 35% by 2030, up from approximately 20% in 2023. The demand for family camping and couples camping experiences is particularly strong, indicating a broad appeal across demographics. Furthermore, the integration of digital marketing strategies and influencer collaborations is proving crucial for customer acquisition and brand building. The outdoor recreation market as a whole is benefiting from this surge, making camping services a highly attractive segment for investment and innovation.

Dominant Markets & Segments in Camping Experience Service

North America currently dominates the Camping Experience Service market, driven by a strong culture of outdoor recreation and significant investments in national park infrastructure. Within North America, the United States leads in market share, accounting for over 60% of the regional revenue. The Adult segment is the largest application segment, representing nearly 70% of the total market share, driven by demand for adventure travel, digital detox experiences, and weekend getaways.

Key drivers for Adult segment dominance include:

- Increasing popularity of adventure tourism and wellness retreats.

- Growing interest in experiential travel over traditional vacations.

- Availability of diverse camping options, from basic tent camping to luxury glamping.

The Tent Camping type segment holds the largest share within the types of camping experiences offered, accounting for approximately 45% of the market. This is due to its accessibility, affordability, and traditional appeal.

Key drivers for Tent Camping dominance include:

- Lower cost of entry compared to other accommodation types.

- Ease of setup and portability for various outdoor activities like hiking camping.

- Strong appeal to budget-conscious travelers and families.

Car Camping also represents a significant segment, particularly for those seeking convenience and easier access to amenities, contributing over 30% to the market. The Hiking Camping segment, while smaller, is experiencing rapid growth as more individuals engage in long-distance trails and backcountry adventures.

Camping Experience Service Product Innovations

Product innovations in the Camping Experience Service market are primarily focused on enhancing user convenience, sustainability, and the overall immersive experience. Companies are developing advanced booking platforms with personalized recommendations, integrated weather forecasting, and gear rental options. The rise of eco-friendly camping gear and biodegradable amenities is a key trend, aligning with consumer demand for sustainable travel. Furthermore, portable solar chargers, smart tents with climate control, and advanced navigation apps are improving the practical aspects of camping. These innovations aim to broaden the appeal of camping to a wider audience, including those who may have previously found it intimidating.

Report Segmentation & Scope

This report meticulously segments the Camping Experience Service market across various applications and types. The Children segment of the application is projected to grow at a CAGR of 8.2% over the forecast period, driven by increased parental interest in outdoor education and family bonding experiences. The Adult segment, as previously noted, is the largest, with a projected market size of over $15 billion by 2030.

In terms of types, Tent Camping is expected to maintain its leading position, with a projected market value exceeding $20 billion by 2030. Car Camping is a close second, driven by accessibility and convenience, while Hiking Camping is anticipated to see the fastest growth among the types, with a CAGR of 9.1%, as more individuals seek physically demanding and immersive outdoor adventures. The Others category, encompassing unique experiences like van camping and RV camping, is also showing promising growth, reflecting the diversification of outdoor accommodation preferences.

Key Drivers of Camping Experience Service Growth

The Camping Experience Service sector is propelled by several key drivers. Technologically, the proliferation of user-friendly booking apps and the integration of digital tools for campsite management are significantly boosting accessibility and convenience. Economically, rising disposable incomes and a growing preference for experiential travel over material possessions are driving consumer spending towards outdoor recreation. Regulatory factors, such as government initiatives promoting outdoor tourism and investments in public lands and camping infrastructure, also play a crucial role. Furthermore, the increasing awareness of the health and wellness benefits associated with spending time in nature is a powerful societal driver. The trend towards digital detox and reconnecting with nature is a significant propellant for this market.

Challenges in the Camping Experience Service Sector

Despite its robust growth, the Camping Experience Service sector faces several challenges. Regulatory hurdles can arise from varying land-use policies and permit requirements across different regions. Supply chain issues, particularly for specialized camping equipment and sustainable materials, can impact operational costs and availability. Competitive pressures from both direct camping providers and alternative accommodation options like hotels and rental properties are significant. Furthermore, ensuring consistent quality of service across diverse locations and managing environmental impacts, such as waste management and land preservation, are ongoing challenges. Weather dependency also poses a risk to business continuity and customer satisfaction.

Leading Players in the Camping Experience Service Market

- Tentrr

- Cool Camping

- Hipcamp

- Experience Freedom

- Quark Expeditions

- REI Adventures

- Abercrombie & Kent Group

- Butterfield & Robinson

Key Developments in Camping Experience Service Sector

- 2023: Hipcamp secures significant Series B funding, valuing the company in the hundreds of millions, signaling strong investor confidence in the outdoor accommodation market.

- 2024: Tentrr expands its partnership network, offering enhanced booking and insurance solutions for private landowners offering camping sites.

- 2024: REI Adventures launches new guided multi-day hiking trips in Patagonia, catering to the growing demand for international adventure travel.

- 2025: Cool Camping introduces an AI-powered recommendation engine to personalize glamping and boutique camping experiences for users.

- 2025: Abercrombie & Kent Group announces strategic acquisition of a leading luxury camping operator to expand its portfolio in high-end adventure tourism.

Strategic Camping Experience Service Market Outlook

The strategic outlook for the Camping Experience Service market remains highly positive, driven by sustained consumer interest in outdoor recreation and experiential travel. Future growth will be accelerated by continued technological integration, with an emphasis on seamless booking platforms and personalized digital experiences. The expansion of sustainable tourism practices and the development of eco-certified camping facilities will cater to an increasingly environmentally conscious consumer base. Opportunities also lie in expanding services to underserved regions and developing niche offerings for specific demographics, such as solo female travelers and accessible camping for individuals with disabilities. Strategic collaborations between booking platforms, gear manufacturers, and tourism boards will further enhance market reach and customer engagement, solidifying the camping experience service as a dominant force in the global leisure and travel industry.

Camping Experience Service Segmentation

-

1. Application

- 1.1. Children

- 1.2. Aldult

-

2. Types

- 2.1. Tent Camping

- 2.2. Car Camping

- 2.3. Hiking Camping

- 2.4. Others

Camping Experience Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Camping Experience Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Camping Experience Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Children

- 5.1.2. Aldult

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tent Camping

- 5.2.2. Car Camping

- 5.2.3. Hiking Camping

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Camping Experience Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Children

- 6.1.2. Aldult

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tent Camping

- 6.2.2. Car Camping

- 6.2.3. Hiking Camping

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Camping Experience Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Children

- 7.1.2. Aldult

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tent Camping

- 7.2.2. Car Camping

- 7.2.3. Hiking Camping

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Camping Experience Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Children

- 8.1.2. Aldult

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tent Camping

- 8.2.2. Car Camping

- 8.2.3. Hiking Camping

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Camping Experience Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Children

- 9.1.2. Aldult

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tent Camping

- 9.2.2. Car Camping

- 9.2.3. Hiking Camping

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Camping Experience Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Children

- 10.1.2. Aldult

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tent Camping

- 10.2.2. Car Camping

- 10.2.3. Hiking Camping

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tentrr

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cool Camping

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hipcamp

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Experience Freedom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Quark Expeditions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 REI Adventures

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abercrombie & Kent Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Butterfield & Robinson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Tentrr

List of Figures

- Figure 1: Global Camping Experience Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Camping Experience Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Camping Experience Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Camping Experience Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Camping Experience Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Camping Experience Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Camping Experience Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Camping Experience Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Camping Experience Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Camping Experience Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Camping Experience Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Camping Experience Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Camping Experience Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Camping Experience Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Camping Experience Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Camping Experience Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Camping Experience Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Camping Experience Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Camping Experience Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Camping Experience Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Camping Experience Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Camping Experience Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Camping Experience Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Camping Experience Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Camping Experience Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Camping Experience Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Camping Experience Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Camping Experience Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Camping Experience Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Camping Experience Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Camping Experience Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Camping Experience Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Camping Experience Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Camping Experience Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Camping Experience Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Camping Experience Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Camping Experience Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Camping Experience Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Camping Experience Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Camping Experience Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Camping Experience Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Camping Experience Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Camping Experience Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Camping Experience Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Camping Experience Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Camping Experience Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Camping Experience Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Camping Experience Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Camping Experience Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Camping Experience Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Camping Experience Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Camping Experience Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Camping Experience Service?

Key companies in the market include Tentrr, Cool Camping, Hipcamp, Experience Freedom, Quark Expeditions, REI Adventures, Abercrombie & Kent Group, Butterfield & Robinson.

3. What are the main segments of the Camping Experience Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Camping Experience Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Camping Experience Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Camping Experience Service?

To stay informed about further developments, trends, and reports in the Camping Experience Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence