Key Insights

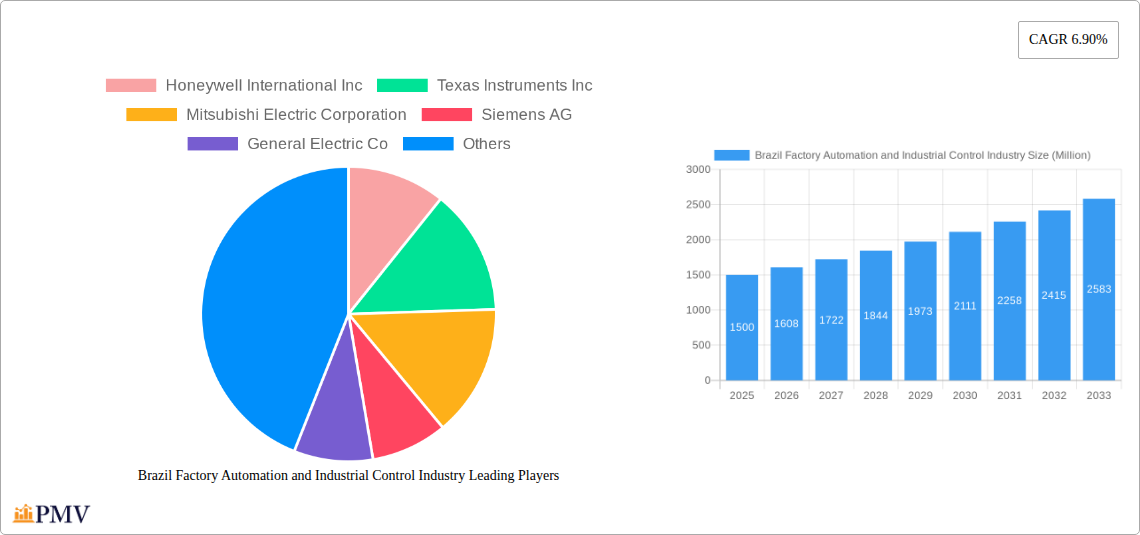

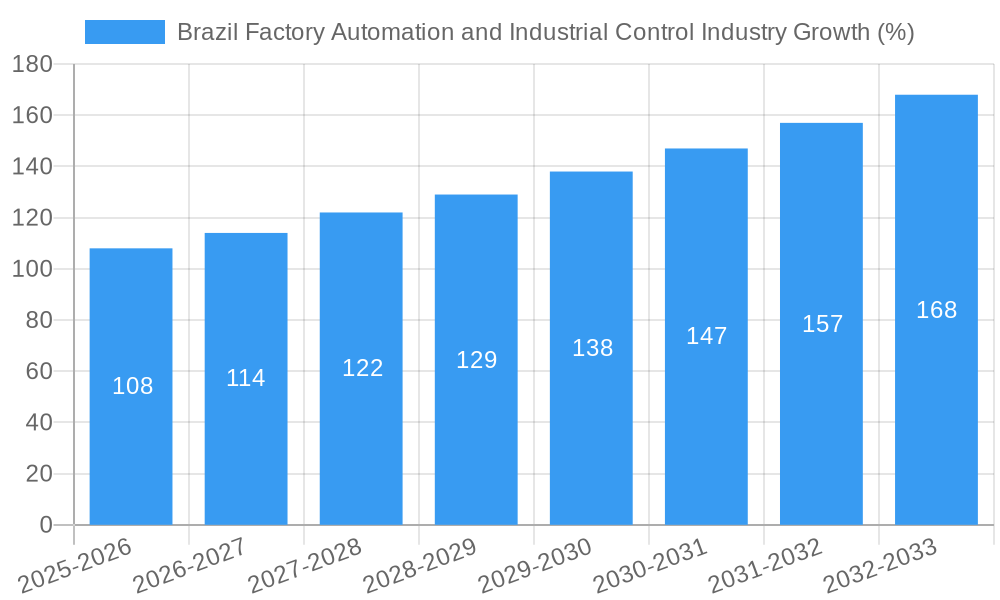

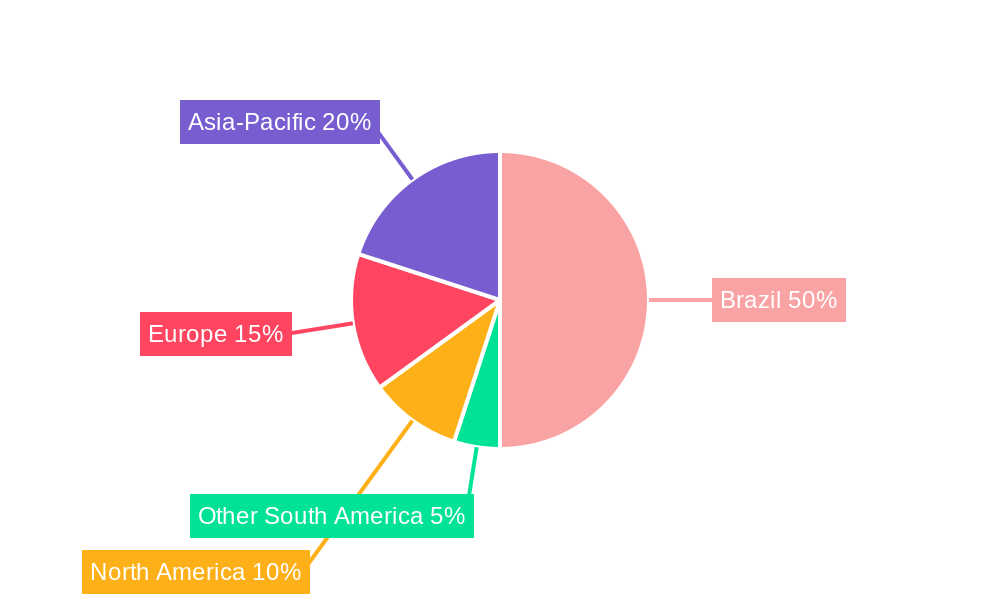

The Brazilian factory automation and industrial control market is experiencing robust growth, driven by increasing government initiatives promoting industrial modernization, a burgeoning need for enhanced operational efficiency across various sectors, and the rising adoption of Industry 4.0 technologies. The market, estimated at $XX million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033, reaching an estimated value of $YY million by 2033 (Note: YY is calculated based on the provided CAGR and 2025 market size. The exact figure requires the missing 2025 market size). Key growth drivers include the expanding automotive, chemical, and petrochemical industries, alongside the growing need for automation in the power and utilities, pharmaceutical, food and beverage, and oil and gas sectors. The segment encompassing field devices, particularly industrial control systems, is expected to dominate the market due to increasing demand for advanced process control and monitoring capabilities. While challenges such as initial high investment costs and a potential shortage of skilled labor may act as restraints, the long-term benefits of improved productivity, reduced operational costs, and enhanced product quality are expected to outweigh these challenges, ensuring continued market expansion.

The competitive landscape is characterized by a mix of global giants like Honeywell, Siemens, and ABB, alongside regional players. These companies are actively investing in research and development to offer innovative solutions tailored to the specific needs of Brazilian industries. Furthermore, strategic partnerships and mergers and acquisitions are anticipated to play a significant role in shaping the market's competitive dynamics in the coming years. The increasing focus on digitalization and the integration of advanced technologies like AI and machine learning into factory automation systems will further accelerate market growth. Brazil's strategic location and its growing role in the global supply chain will solidify its position as a key market for factory automation and industrial control solutions in the years ahead. The focus will likely remain on solutions that improve sustainability and energy efficiency to align with broader global trends.

Brazil Factory Automation and Industrial Control Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Brazil factory automation and industrial control industry, offering invaluable insights for businesses operating within or considering entry into this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report incorporates data from the historical period of 2019-2024 and projects market trends based on thorough research and analysis. The Brazilian market, with its burgeoning industrial sector and government initiatives, presents significant growth opportunities for automation and control solutions providers. This report values the market in Millions USD.

Brazil Factory Automation and Industrial Control Industry Market Structure & Competitive Dynamics

The Brazilian factory automation and industrial control market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players like Honeywell International Inc, Texas Instruments Inc, Mitsubishi Electric Corporation, Siemens AG, General Electric Co, Schneider Electric SE, Autodesk Inc, Robert Bosch GmbH, Rockwell Automation Inc, Yokogawa Electric Corporation, Dassault Systemes SE, ABB Limited, Aspen Technology Inc, Emerson Electric Company, and NOVA SMAR SA (this list is not exhaustive) compete fiercely, driving innovation and price competitiveness.

Market share data indicates that the top five players collectively hold approximately xx% of the market, while the remaining players share the rest. The average market share for the top five players is estimated to be around xx%. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging approximately xx Million USD annually in the historical period. Recent M&A activity reflects a focus on expanding product portfolios and geographical reach. The regulatory framework in Brazil is evolving to support industrial automation, fostering a positive environment for innovation. However, import tariffs and bureaucratic procedures may pose some challenges. Strong end-user demand from sectors like automotive and food and beverage, coupled with increasing government investment in infrastructure and technology, positively influences market growth.

- Market Concentration: Moderately concentrated, with top five players holding xx% market share.

- M&A Activity: Average deal value: xx Million USD annually.

- Regulatory Framework: Evolving to support industrial automation but with some import-related challenges.

- End-User Trends: Strong demand from automotive, food & beverage, and other sectors.

Brazil Factory Automation and Industrial Control Industry Industry Trends & Insights

The Brazilian factory automation and industrial control market is experiencing robust growth, driven by several key factors. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%, exceeding the global average. Increased government investments in infrastructure modernization, particularly in energy and transportation, are fueling demand for automation solutions. This is further boosted by the growing adoption of Industry 4.0 technologies, including the Internet of Things (IoT), cloud computing, and artificial intelligence (AI), enhancing operational efficiency and productivity. The automotive sector, propelled by the expansion of electric vehicle manufacturing, is a significant driver of market growth.

The chemical and petrochemical industries, demanding advanced process control systems, also contribute substantially. However, challenges such as economic volatility, supply chain disruptions, and skills gaps within the workforce could potentially hinder growth. Market penetration of advanced automation technologies remains relatively low compared to developed nations, offering considerable untapped potential for market expansion. Consumer preferences are shifting toward higher levels of automation, driven by the need for cost optimization, improved product quality, and increased safety standards. The competitive landscape is evolving with increased participation from both domestic and international players, leading to enhanced product offerings and service capabilities.

Dominant Markets & Segments in Brazil Factory Automation and Industrial Control Industry

The automotive sector dominates the end-user industry segment in Brazil's factory automation and industrial control market, accounting for approximately xx% of the total market value. This is primarily due to rising domestic and international automotive production, alongside strong government support for local manufacturing. The Southeast region of Brazil represents the largest geographical market, benefiting from concentrated industrial activity and robust infrastructure. The Chemical and Petrochemical sector also commands a significant share due to the extensive presence of petrochemical plants and refineries in the region.

- Key Drivers for Automotive Dominance:

- Strong government incentives for domestic automotive manufacturing.

- Increasing demand for electric vehicles.

- Investments in advanced manufacturing technologies.

- Key Drivers for Southeast Region Dominance:

- High concentration of industrial activity.

- Well-developed infrastructure (transportation, energy).

- Skilled labor pool.

- Other Significant Segments:

- Field Devices: Industrial sensors, actuators, and other equipment account for a significant portion of market revenue.

- Industrial Control Systems: Programmable logic controllers (PLCs), SCADA systems, and other control technologies are witnessing considerable growth.

- Power and Utilities: Demand for automation in power generation, transmission, and distribution is growing steadily.

- Food and Beverage: Automation is crucial for ensuring food safety and optimizing production processes.

Brazil Factory Automation and Industrial Control Industry Product Innovations

Recent product innovations focus on enhancing connectivity, intelligence, and energy efficiency. The integration of IoT sensors, cloud-based analytics, and AI-powered predictive maintenance is transforming industrial processes. New generation PLCs offering improved performance and enhanced cybersecurity features are gaining popularity. The market is witnessing a strong push towards modular and flexible automation systems, enabling faster adaptation to changing production demands. These innovations cater to the growing need for increased productivity, reduced operational costs, and enhanced safety standards across various end-user industries.

Report Segmentation & Scope

This report segments the Brazilian factory automation and industrial control market by product (Field Devices and Industrial Control Systems) and by end-user industry (Automotive, Chemical and Petrochemical, Power and Utilities, Pharmaceutical, Food and Beverage, Oil and Gas, and Other End-user Industries). Growth projections for each segment are provided, incorporating market size estimations and competitive analyses. The Field Devices segment is expected to experience strong growth due to the rising adoption of smart sensors and advanced instrumentation. The Industrial Control Systems segment will benefit from the increasing demand for sophisticated control solutions for complex industrial processes. Each end-user segment's specific growth trajectory is influenced by factors like technological advancements, regulatory changes, and economic conditions unique to that sector.

Key Drivers of Brazil Factory Automation and Industrial Control Industry Growth

Several key factors are driving growth in Brazil's factory automation and industrial control market. Government initiatives promoting industrial modernization and technological advancement are playing a crucial role, as are rising investments in infrastructure and increasing adoption of Industry 4.0 technologies. The automotive industry's expansion, particularly in electric vehicle manufacturing, is significantly boosting demand for advanced automation solutions. Furthermore, the growing need for enhanced operational efficiency, improved product quality, and increased safety standards among Brazilian industries is driving the adoption of automation technologies.

Challenges in the Brazil Factory Automation and Industrial Control Industry Sector

Despite the significant growth potential, the Brazilian factory automation and industrial control market faces several challenges. Economic fluctuations can impact investment decisions and overall market growth. Supply chain disruptions, often linked to global events, can lead to delays in project implementation and increase costs. Furthermore, a shortage of skilled labor and a need for ongoing training and development can hinder the successful adoption and implementation of advanced automation systems. These factors can negatively affect the industry's overall performance and progress. The total cost of these challenges is estimated to impact annual market growth by an approximate xx Million USD.

Leading Players in the Brazil Factory Automation and Industrial Control Industry Market

- Honeywell International Inc

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Siemens AG

- General Electric Co

- Schneider Electric SE

- NOVA SMAR SA

- Autodesk Inc

- Robert Bosch GmbH

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Dassault Systemes SE

- ABB Limited

- Aspen Technology Inc

- Emerson Electric Company

Key Developments in Brazil Factory Automation and Industrial Control Industry Sector

- June 2022: Rockwell Automation partnered with Bravo Motor Company to provide advanced solutions for EV and battery manufacturing in Brazil. This partnership significantly boosts the adoption of automation in the burgeoning electric vehicle sector, enhancing the market's growth prospects.

Strategic Brazil Factory Automation and Industrial Control Industry Market Outlook

The Brazilian factory automation and industrial control market presents substantial opportunities for future growth. Continued government support for industrial modernization, the expansion of key end-user sectors like automotive and renewable energy, and the increasing adoption of Industry 4.0 technologies will propel market expansion. Strategic partnerships between international and domestic players will be vital in driving innovation and market penetration. Focus on addressing skill gaps and improving supply chain resilience will further enhance the industry's growth potential. The long-term outlook remains highly positive, with significant scope for sustainable market growth and technological advancements.

Brazil Factory Automation and Industrial Control Industry Segmentation

-

1. Product

-

1.1. Field Devices

- 1.1.1. Machine Vision

- 1.1.2. Robotics

- 1.1.3. Sensors

- 1.1.4. Mortor and Drivers

- 1.1.5. Relays and Switches

- 1.1.6. Other Field Devices

-

1.2. Industrial Control Systems

- 1.2.1. SCADA

- 1.2.2. DCS

- 1.2.3. PLC

- 1.2.4. MES

- 1.2.5. PLM

- 1.2.6. ERP

- 1.2.7. HMI

- 1.2.8. Other Industrial Control Systems

-

1.1. Field Devices

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Pharmaceutical

- 2.5. Food and Beverage

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Brazil Factory Automation and Industrial Control Industry Segmentation By Geography

- 1. Brazil

Brazil Factory Automation and Industrial Control Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Focus Toward Cost-cutting and Business Process Improvement; Increasing Adoption of Internet of Things (IoT) and Machine- to-Machine Technologies

- 3.3. Market Restrains

- 3.3.1. High Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation

- 3.4. Market Trends

- 3.4.1. Automotive is One of the Major Segment Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Factory Automation and Industrial Control Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Field Devices

- 5.1.1.1. Machine Vision

- 5.1.1.2. Robotics

- 5.1.1.3. Sensors

- 5.1.1.4. Mortor and Drivers

- 5.1.1.5. Relays and Switches

- 5.1.1.6. Other Field Devices

- 5.1.2. Industrial Control Systems

- 5.1.2.1. SCADA

- 5.1.2.2. DCS

- 5.1.2.3. PLC

- 5.1.2.4. MES

- 5.1.2.5. PLM

- 5.1.2.6. ERP

- 5.1.2.7. HMI

- 5.1.2.8. Other Industrial Control Systems

- 5.1.1. Field Devices

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Pharmaceutical

- 5.2.5. Food and Beverage

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mitsubishi Electric Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NOVA SMAR SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autodesk Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rockwell Automation Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yokogawa Electric Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Dassault Systemes SE

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 ABB Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Aspen Technology Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Emerson Electric Company

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Brazil Factory Automation and Industrial Control Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Factory Automation and Industrial Control Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Brazil Factory Automation and Industrial Control Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Factory Automation and Industrial Control Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Brazil Factory Automation and Industrial Control Industry?

Key companies in the market include Honeywell International Inc, Texas Instruments Inc, Mitsubishi Electric Corporation, Siemens AG, General Electric Co, Schneider Electric SE, NOVA SMAR SA*List Not Exhaustive, Autodesk Inc, Robert Bosch GmbH, Rockwell Automation Inc, Yokogawa Electric Corporation, Dassault Systemes SE, ABB Limited, Aspen Technology Inc, Emerson Electric Company.

3. What are the main segments of the Brazil Factory Automation and Industrial Control Industry?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Focus Toward Cost-cutting and Business Process Improvement; Increasing Adoption of Internet of Things (IoT) and Machine- to-Machine Technologies.

6. What are the notable trends driving market growth?

Automotive is One of the Major Segment Driving the Market.

7. Are there any restraints impacting market growth?

High Installation Costs and Lack of Skilled Workforce Preventing Enterprises from Full-scale Adoption of Factory Automation.

8. Can you provide examples of recent developments in the market?

June 2022 - Rockwell Automation partnered with Bravo Motor Company, a California-based company that provides applied innovation in the field of decarbonization, with a focus on the production of batteries, vehicles, and energy storage systems. Through the new alliance, Rockwell Automation will contribute to the provision of advanced solutions for the manufacture of electric vehicles (EVs) and batteries in the Brazilian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Factory Automation and Industrial Control Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Factory Automation and Industrial Control Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Factory Automation and Industrial Control Industry?

To stay informed about further developments, trends, and reports in the Brazil Factory Automation and Industrial Control Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence