Key Insights

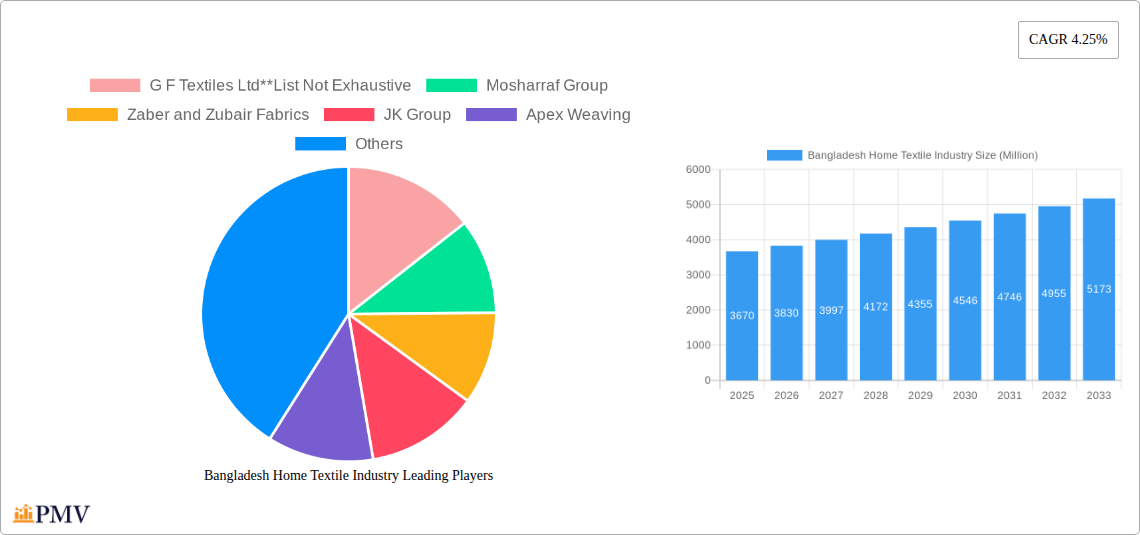

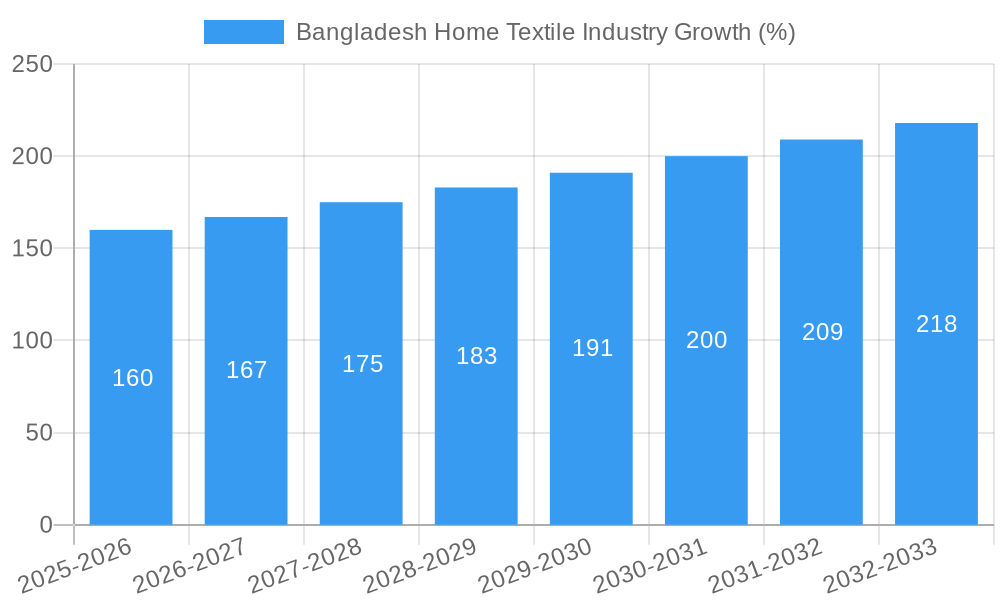

The Bangladesh home textile industry, valued at $3.67 billion in 2025, is projected to experience robust growth, driven by increasing disposable incomes, a rising middle class, and a growing preference for comfortable and aesthetically pleasing home furnishings. The 4.25% CAGR projected from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Key growth drivers include the rising popularity of online retail channels, expanding export opportunities, and the increasing adoption of sustainable and eco-friendly textile manufacturing practices. The industry's segmentation reveals a diverse market, with bed linen, bath linen, and kitchen linen representing significant portions of the product category. Supermarkets and hypermarkets remain dominant distribution channels, although specialty stores and online platforms are gaining traction, catering to the evolving consumer preferences and creating new opportunities for growth. Leading players like G F Textiles Ltd, Mosharraf Group, and Zaber and Zubair Fabrics are shaping the industry landscape through innovation in product design, quality, and distribution strategies. The industry faces challenges such as fluctuating raw material prices and intense competition from regional and global players. Despite these challenges, the long-term outlook remains positive, fueled by the country’s growing economy and increasing consumer demand.

The competitive landscape features a blend of established players and emerging businesses. Successful companies are adapting to consumer preferences by focusing on product innovation, sustainable manufacturing, and effective e-commerce strategies. Further growth will be influenced by government policies supporting the textile sector, improvements in infrastructure, and the industry's ability to adopt advanced technologies to enhance efficiency and quality. The concentration of the industry primarily within Bangladesh provides a clear geographic focus for market analysis. Future growth will depend on strategic investments in research and development, branding, and efficient supply chain management. The ability of domestic players to adapt to global trends and increasing competition will be crucial for sustained growth in the Bangladesh home textile market.

Bangladesh Home Textile Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Bangladesh home textile industry, covering market size, growth drivers, competitive landscape, and future outlook from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report delves into key segments, including bed linen, bath linen, kitchen linen, upholstery covering, and floor covering, examining distribution channels such as supermarkets & hypermarkets, specialty stores, and online platforms. Valuations are expressed in Millions of USD.

Bangladesh Home Textile Industry Market Structure & Competitive Dynamics

The Bangladesh home textile industry is characterized by a moderately concentrated market structure. While a few large-scale manufacturers hold a substantial portion of the market share, a vibrant ecosystem of numerous Small and Medium Enterprises (SMEs) contributes significantly to the nation's overall output. Leading players such as G F Textiles Ltd, Mosharraf Group, Zaber and Zubair Fabrics, JK Group, Apex Weaving, Classical HomeTex, Alltex Industries Limited, Saad Musa Group, ACS Textile, and DBL Group engage in intense competition. Their competitive strategies are multifaceted, focusing on distinct product differentiation, astute pricing tactics, and optimizing supply chain efficiency. Innovation within the sector is progressing steadily, primarily driven by investments in refining manufacturing techniques and enhancing design aesthetics, rather than by radical technological disruptions. The regulatory landscape provides a relatively stable environment for businesses, though evolving trade policies and labor regulations necessitate continuous adaptation. The industry also contends with the competitive pressure exerted by product substitutes, including synthetic materials and a wide array of imported home textiles. Consumer preferences, significantly shaped by global fashion trends and increasing disposable incomes, are a pivotal factor in dictating market demand.

Mergers and Acquisitions (M&A) have been relatively infrequent within the industry in recent years, with average annual deal values estimated at approximately [Insert Average Deal Value Here] Million USD over the historical period. Nevertheless, the potential for consolidation remains, particularly among SMEs looking to achieve greater economies of scale and bolster their competitive standing. Projections for 2025 suggest that the top five dominant players will collectively command an estimated [Insert Market Share Percentage Here]% of the market. The industry's competitive intensity is notably high, with a strong emphasis on both price and product quality, compelling manufacturers to relentlessly pursue operational enhancements and cost-effectiveness.

Bangladesh Home Textile Industry Industry Trends & Insights

The Bangladesh home textile industry is experiencing robust growth, driven by several key factors. The industry's CAGR from 2019 to 2024 was approximately xx%, and forecasts suggest continued expansion with a projected CAGR of xx% from 2025 to 2033. This growth is fueled by increasing domestic consumption, propelled by a growing middle class with rising disposable incomes and a preference for higher-quality home textiles. Export demand remains a significant contributor to overall market size, with major export markets including xx and xx. Market penetration of online sales is steadily increasing, with projections indicating a xx% market share by 2033.

Technological advancements, while not disruptive in a radical sense, are steadily improving manufacturing efficiency and product quality. The adoption of advanced weaving and dyeing techniques is enhancing production capacity and reducing costs. Consumer preferences are shifting towards eco-friendly, sustainable products, creating opportunities for manufacturers who can meet these evolving demands. This trend is significantly influencing product design and material sourcing, with increased use of organic cotton and recycled materials. Competitive dynamics are primarily shaped by pricing, quality, and timely delivery, with companies actively seeking ways to differentiate themselves through design innovation and efficient supply chain management.

Dominant Markets & Segments in Bangladesh Home Textile Industry

-

By Product: Bed linen remains the dominant segment, commanding the largest market share. This is followed by bath linen and kitchen linen. The persistent consumer demand for comfortable, aesthetically pleasing, and high-quality bedding is a key driver for the bed linen segment's growth. The kitchen linen segment is witnessing steady expansion, fueled by an increased interest in home cooking and a desire for visually appealing kitchen textiles. Upholstery coverings and floor coverings, while representing smaller but growing segments, are also gaining traction.

-

By Distribution: Supermarkets and hypermarkets serve as the primary distribution channels, offering unparalleled convenience and accessibility to a broad consumer base. Specialty stores cater to a more discerning clientele seeking premium quality products and bespoke design options. Online sales channels are experiencing exponential growth, propelled by increasing internet penetration across the country and the inherent convenience of e-commerce platforms.

Key growth drivers propelling this industry forward include:

- Robust Economic Growth: The expanding middle-class demographic in Bangladesh is a significant contributor to the escalating demand for home textiles.

- Advancements in Infrastructure: Continuous development of infrastructure is crucial for enhancing the efficiency of transportation and logistics, thereby facilitating broader market access.

- Supportive Government Initiatives: Favorable government policies and incentives are instrumental in fostering industry growth and bolstering export capabilities.

- Expanding Export Potential: The Bangladesh home textile industry possesses substantial untapped export potential across diverse global markets.

Bangladesh Home Textile Industry Product Innovations

Recent product innovations are strategically focused on elevating comfort, enhancing durability, and refining aesthetic appeal. The integration of sophisticated manufacturing technologies is enabling the creation of more intricate designs and superior product quality. The adoption of advanced materials, such as antimicrobial and hypoallergenic fabrics, is a growing trend, addressing specific consumer needs and health concerns. Furthermore, there is a pronounced shift towards eco-friendly and sustainable product offerings, directly responding to the evolving preferences of environmentally conscious consumers. This commitment to sustainability not only enhances market relevance but also provides a significant competitive advantage for innovative products.

Report Segmentation & Scope

The report segments the Bangladesh home textile market by product type (bed linen, bath linen, kitchen linen, upholstery covering, floor covering) and distribution channel (supermarkets & hypermarkets, specialty stores, online). Each segment’s growth projections, market sizes, and competitive dynamics are thoroughly analyzed. For instance, the bed linen segment is expected to maintain the highest growth rate, while online distribution is predicted to show the fastest expansion in terms of market share. Competitive dynamics vary across segments, with varying levels of concentration and competition intensity depending on the specific product and distribution channel.

Key Drivers of Bangladesh Home Textile Industry Growth

Several factors are driving the growth of the Bangladesh home textile industry. Firstly, the country's expanding middle class fuels increased domestic demand for higher-quality home textiles. Secondly, government initiatives aimed at supporting the textile sector, such as tax incentives and export promotion programs, contribute to the industry's growth. Finally, continuous improvements in manufacturing technology and productivity enhance efficiency and competitiveness in the global market.

Challenges in the Bangladesh Home Textile Industry Sector

The Bangladesh home textile industry navigates a landscape marked by several persistent challenges. Volatility in raw material prices, coupled with global economic uncertainties, can significantly impact profitability margins. Intense competition from other major textile-producing nations presents a constant threat to market share. Crucially, ensuring unwavering compliance with international labor and environmental standards is paramount for maintaining market access, upholding brand reputation, and fostering sustainable business practices.

Leading Players in the Bangladesh Home Textile Industry Market

- G F Textiles Ltd

- Mosharraf Group

- Zaber and Zubair Fabrics

- JK Group

- Apex Weaving

- Classical HomeTex

- Alltex Industries Limited

- Saad Musa Group

- ACS Textile

- DBL Group

Key Developments in Bangladesh Home Textile Industry Sector

- April 2022: Youngone Corporation plans to invest up to USD 500 Million in Bangladesh's textile and IT sectors. This significant investment signals confidence in Bangladesh's textile industry and is expected to boost capacity and technology adoption.

- April 2022: DBL Group's investment in Vietnam to manufacture Eco-Thread reflects the growing global demand for sustainable products and the company's strategic expansion into new markets.

Strategic Bangladesh Home Textile Industry Market Outlook

The Bangladesh home textile industry is strategically positioned for sustained growth. This positive outlook is underpinned by favorable demographic trends, the continuous expansion of export markets, and ongoing advancements in manufacturing technologies. Companies that adeptly embrace innovation, prioritize sustainability, and implement highly efficient supply chain management practices will be exceptionally well-positioned for future success. Significant strategic opportunities lie in the expansion of e-commerce channels, the targeted pursuit of niche market segments, and the proactive capitalization on the escalating demand for sustainably and ethically sourced products. Ultimately, the industry's long-term prosperity will be contingent upon its ability to effectively address the challenges posed by raw material price fluctuations, maintain global competitiveness, and consistently adhere to rigorous international standards.

Bangladesh Home Textile Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Bangladesh Home Textile Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Home Textile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Residential and Commercial Construction Activities

- 3.3. Market Restrains

- 3.3.1 Alternative Water Heating Technologies

- 3.3.2 Such as Solar Water Heaters and Heat Pump Systems

- 3.4. Market Trends

- 3.4.1. Increasing Exports of Home Textiles from Bangladesh is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Home Textile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 G F Textiles Ltd**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mosharraf Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zaber and Zubair Fabrics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JK Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apex Weaving

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Classical HomeTex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alltex Industries Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Saad Musa Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ACS Textile

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DBL Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 G F Textiles Ltd**List Not Exhaustive

List of Figures

- Figure 1: Bangladesh Home Textile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Home Textile Industry Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Home Textile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Home Textile Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Bangladesh Home Textile Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Bangladesh Home Textile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Bangladesh Home Textile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Bangladesh Home Textile Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Bangladesh Home Textile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Bangladesh Home Textile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Bangladesh Home Textile Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Bangladesh Home Textile Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Bangladesh Home Textile Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Bangladesh Home Textile Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Bangladesh Home Textile Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Bangladesh Home Textile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Home Textile Industry?

The projected CAGR is approximately 4.25%.

2. Which companies are prominent players in the Bangladesh Home Textile Industry?

Key companies in the market include G F Textiles Ltd**List Not Exhaustive, Mosharraf Group, Zaber and Zubair Fabrics, JK Group, Apex Weaving, Classical HomeTex, Alltex Industries Limited, Saad Musa Group, ACS Textile, DBL Group.

3. What are the main segments of the Bangladesh Home Textile Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Residential and Commercial Construction Activities.

6. What are the notable trends driving market growth?

Increasing Exports of Home Textiles from Bangladesh is Driving the Market.

7. Are there any restraints impacting market growth?

Alternative Water Heating Technologies. Such as Solar Water Heaters and Heat Pump Systems.

8. Can you provide examples of recent developments in the market?

April 2022: South Korean clothing, textiles, and footwear manufacturer Youngone Corporation is planning to invest up to USD 500 million at the Korean Export Processing Zone (KEPZ) in the textiles and information technology sectors in Bangladesh in the next few years, according to its chairman Kihak Sung.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Home Textile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Home Textile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Home Textile Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Home Textile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence