Key Insights

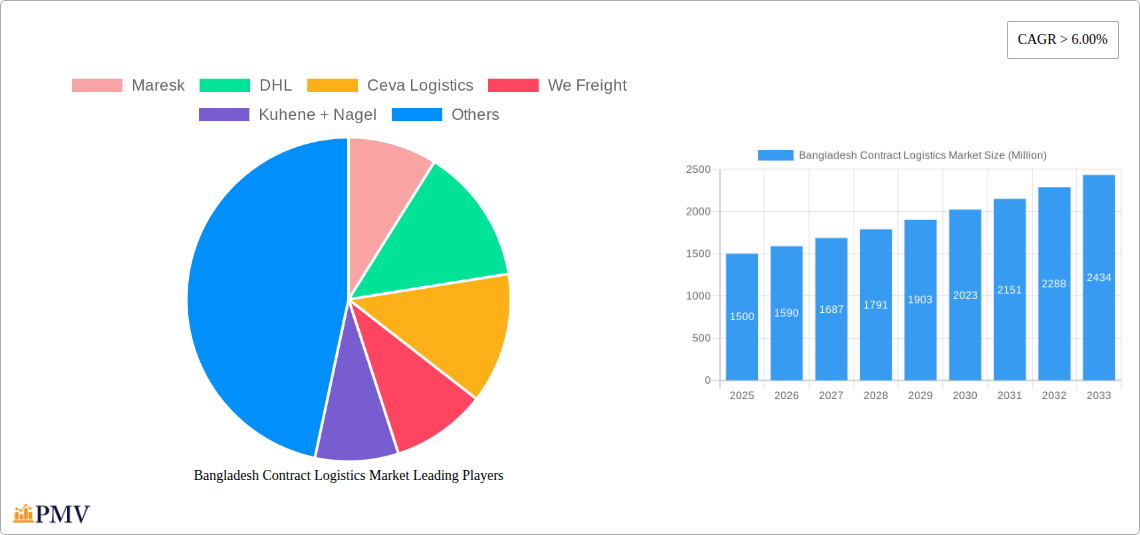

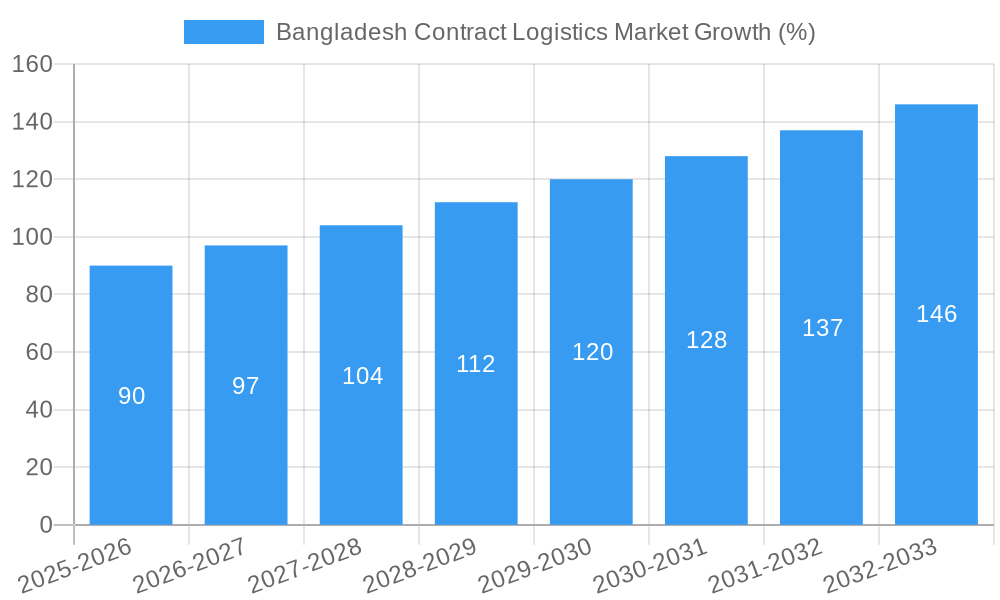

The Bangladesh contract logistics market exhibits robust growth potential, driven by the country's burgeoning manufacturing and export sectors, particularly in ready-made garments (RMG). A CAGR exceeding 6% from 2019-2033 indicates a significant expansion, fueled by increasing foreign direct investment (FDI) and the government's focus on infrastructure development. The market is segmented by type (insourced vs. outsourced) and end-user industry (manufacturing, automotive, consumer goods, high-tech, healthcare, and others). Outsourcing is expected to dominate due to cost optimization and access to specialized expertise. The manufacturing and automotive sectors are key drivers, reflecting Bangladesh's growing industrial base. However, challenges remain, including infrastructure limitations in certain areas and a need for further technological advancements within the logistics sector to ensure efficient and timely delivery. The growth trajectory is projected to remain positive, influenced by the rising e-commerce sector and expanding global trade relations. Key players like Maersk, DHL, and others are strategically positioning themselves to capitalize on this market's expansion.

The forecast for the Bangladesh contract logistics market suggests a steady climb throughout the 2025-2033 period. While precise figures aren't available, extrapolating from the provided 6%+ CAGR and considering the market's growth drivers, we can anticipate substantial growth. The increasing demand for efficient supply chains, especially within the rapidly expanding RMG sector, will continue to boost market size. Competition among established players and emerging local logistics providers will intensify, leading to innovations in technology and service offerings. Focus on improving infrastructure, particularly transportation networks and warehousing capabilities, will be crucial for sustained growth. Furthermore, regulatory changes and government initiatives aimed at streamlining logistics processes will directly influence the market's development trajectory. Successfully navigating these factors will be key for companies aiming to thrive in this dynamic and growing market.

Bangladesh Contract Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bangladesh contract logistics market, covering market size, segmentation, key players, competitive dynamics, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is an essential resource for businesses operating in or considering entry into the dynamic Bangladeshi logistics sector.

Bangladesh Contract Logistics Market Market Structure & Competitive Dynamics

The Bangladesh contract logistics market exhibits a moderately consolidated structure, with a mix of multinational giants and domestic players vying for market share. Market concentration is influenced by factors such as the presence of global logistics providers like Maersk, DHL, and Kuehne + Nagel, alongside local companies like Navana Logistics and SARVAM Logistics. The market’s innovation ecosystem is relatively nascent, with technological adoption driven primarily by larger players. Regulatory frameworks, while evolving, often pose challenges, impacting operational efficiency. Product substitutes are limited, largely confined to alternative transportation modes. End-user trends, particularly within the booming RMG sector, significantly influence market demand.

- Market Share: Maersk and DHL hold a significant share, estimated at xx% and xx% respectively in 2025. Other major players each hold smaller but influential shares. Precise figures are confidential.

- M&A Activities: The market has seen limited significant M&A activity in recent years, with deal values primarily in the xx Million range. Further consolidation is anticipated as larger players seek to expand their market footprint.

- Regulatory Framework: The government is actively working on improving infrastructure and streamlining regulations to support growth; however, bureaucratic hurdles remain.

Bangladesh Contract Logistics Market Industry Trends & Insights

The Bangladesh contract logistics market is experiencing robust growth, driven by the country's expanding economy and burgeoning export-oriented industries, particularly the ready-made garments (RMG) sector. The market’s CAGR for the forecast period (2025-2033) is projected to be xx%, fueled by increasing e-commerce penetration, foreign direct investment (FDI), and government initiatives aimed at improving infrastructure. Technological disruptions, such as the adoption of advanced warehousing technologies and digital logistics platforms, are enhancing efficiency and transparency across the supply chain. Consumer preferences for faster and more reliable delivery are shaping logistics service offerings. Intense competition among both local and international players is further driving innovation and efficiency improvements. Market penetration of advanced logistics solutions remains relatively low, suggesting significant untapped potential.

Dominant Markets & Segments in Bangladesh Contract Logistics Market

The Chattogram region dominates the Bangladesh contract logistics market due to its proximity to the Chattogram Port, the nation's largest seaport. The RMG sector is the leading end-user segment, followed by consumer goods and retail.

By Type: Outsourced contract logistics is the dominant segment, driven by the outsourcing preferences of many businesses.

By End User:

- Manufacturing and Automotive: High growth driven by export-oriented industries, including the RMG sector and the increasing presence of automotive manufacturing.

- Consumer Goods and Retail: Growing rapidly due to the expansion of e-commerce and rising consumer spending.

- High-tech: Growth is relatively moderate.

- Healthcare and Pharmaceuticals: A niche but growing segment driven by increasing healthcare spending.

- Other End Users: This encompasses various sectors with varying growth rates.

Key Drivers:

- Economic Growth: Bangladesh's steady economic growth is a major driver, creating demand for efficient logistics services.

- Infrastructure Development: Government investments in port infrastructure and road networks are crucial.

- Export-Oriented Industries: The RMG sector's continued expansion fuels the need for effective logistics solutions.

- E-commerce Boom: The rise of e-commerce is driving demand for last-mile delivery services.

Bangladesh Contract Logistics Market Product Innovations

Recent innovations include the adoption of advanced warehouse management systems (WMS), transportation management systems (TMS), and the increasing use of data analytics to optimize supply chains. These technologies enhance efficiency, transparency, and cost-effectiveness. The market is witnessing a shift toward integrated logistics solutions, offering comprehensive services rather than individual components. These integrated offerings provide significant competitive advantages by streamlining operations and enhancing customer service.

Report Segmentation & Scope

The report segments the Bangladesh contract logistics market by type (insourced and outsourced) and end-user (Manufacturing and Automotive, Consumer Goods and Retail, High-tech, Healthcare and Pharmaceuticals, Other End Users). Each segment's growth projection, market size, and competitive dynamics are analyzed. Growth is expected to be strongest in the outsourced segment and within the Manufacturing and Automotive and Consumer Goods and Retail end-user categories.

Key Drivers of Bangladesh Contract Logistics Market Growth

The key drivers include: robust economic growth, the expansion of export-oriented industries (primarily RMG), increasing FDI, government investments in infrastructure development (ports, roads, etc.), rising e-commerce penetration, and the adoption of advanced technologies like WMS and TMS. These factors collectively fuel the demand for efficient and reliable contract logistics services.

Challenges in the Bangladesh Contract Logistics Market Sector

Significant challenges include inadequate infrastructure in certain regions, bureaucratic complexities and regulatory hurdles, port congestion, and the shortage of skilled labor. These factors can lead to delays, increased costs, and operational inefficiencies. Furthermore, intense competition and the need to adapt to evolving customer needs pose considerable challenges to market players.

Leading Players in the Bangladesh Contract Logistics Market Market

- Maersk

- DHL

- Ceva Logistics

- We Freight

- Kuehne + Nagel

- Bolloré Logistics

- GEODIS

- XPO Logistics

- Agility Logistics Pvt Ltd

- Navana Logistics

- SARVAM Logistics

- 3i Logistics

- DB Schenker

- DSV

Key Developments in Bangladesh Contract Logistics Market Sector

- May 2023: DHL invests over 2 Million Euros to expand its CFS capacity to support the RMG sector.

- November 2022: Maersk opens a new 100,000-square-foot warehouse facility in Chattogram.

- July 2022: [Add details of July 2022 development if available; otherwise, replace with "Further industry developments are under review." ]

Strategic Bangladesh Contract Logistics Market Market Outlook

The Bangladesh contract logistics market presents significant growth opportunities driven by continued economic expansion, infrastructure improvements, and rising e-commerce activity. Strategic investments in technology, talent development, and the expansion of service offerings will be crucial for companies to capitalize on this potential. Focus on sustainable practices and supply chain resilience will enhance long-term competitiveness within this dynamic market.

Bangladesh Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

Bangladesh Contract Logistics Market Segmentation By Geography

- 1. Bangladesh

Bangladesh Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 SAG'S Increased Focus Toward Transportation Infrastructure

- 3.2.2 Including Railways

- 3.2.3 Airports

- 3.2.4 And Seaports; Establishment Of Special Economic Zones

- 3.3. Market Restrains

- 3.3.1. Limited Visible of Shipments; Increasing Transportation

- 3.4. Market Trends

- 3.4.1. Pharmaceutical and healthcare spending is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Maresk

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 We Freight

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuhene + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolloré Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GEODIS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 XPO Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agility Logistics Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Navana Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SARVAM Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3i Logistics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 DB Schenkar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DSV

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Maresk

List of Figures

- Figure 1: Bangladesh Contract Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Contract Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Contract Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Bangladesh Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Bangladesh Contract Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bangladesh Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bangladesh Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Bangladesh Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Bangladesh Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Contract Logistics Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Bangladesh Contract Logistics Market?

Key companies in the market include Maresk, DHL, Ceva Logistics, We Freight, Kuhene + Nagel, Bolloré Logistics, GEODIS, XPO Logistics, Agility Logistics Pvt Ltd, Navana Logistics, SARVAM Logistics, 3i Logistics, DB Schenkar, DSV.

3. What are the main segments of the Bangladesh Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

SAG'S Increased Focus Toward Transportation Infrastructure. Including Railways. Airports. And Seaports; Establishment Of Special Economic Zones.

6. What are the notable trends driving market growth?

Pharmaceutical and healthcare spending is driving the market.

7. Are there any restraints impacting market growth?

Limited Visible of Shipments; Increasing Transportation.

8. Can you provide examples of recent developments in the market?

May 2023: To serve Bangladesh's ever-expanding readymade garments (RMG) industry, DHL Global Forwarding, the freight-specializing division of Deutsche Post DHL Group, recently committed more than 2 million euros to extend its specialized Container Freight Station (CFS) capacity. Less than 20 CFSs are present in the entire nation of Bangladesh, making CFSs rare. These facilities assist in gathering products from various sources, combining them into a single container, and then transporting the container to the desired location.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Bangladesh Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence