Key Insights

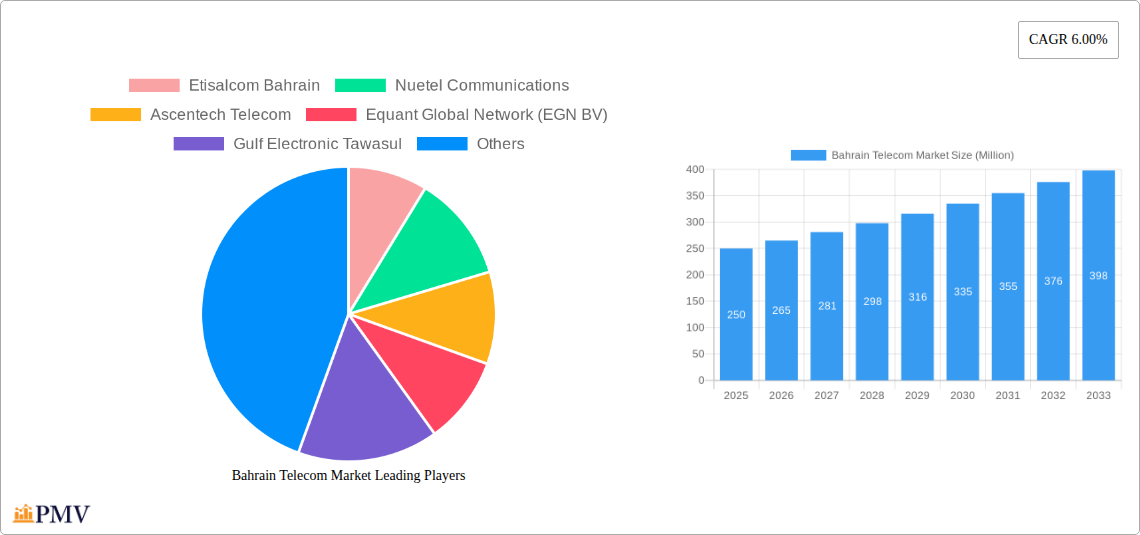

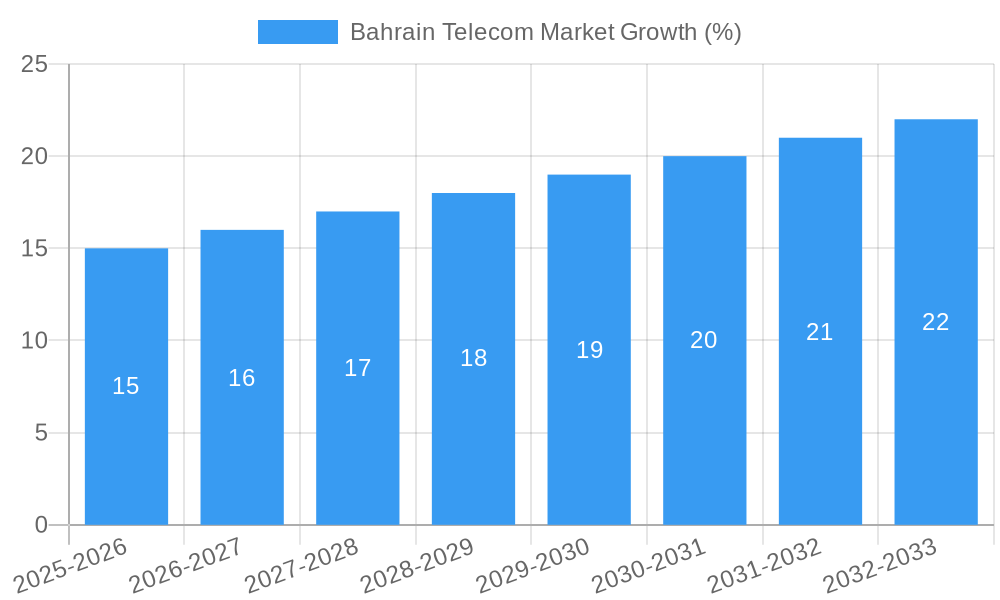

The Bahrain telecom market, valued at approximately $XXX million in 2025 (estimated based on provided CAGR and market trends), is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This growth is fueled by several key drivers. Increasing smartphone penetration and data consumption are significantly boosting demand for mobile and broadband services. The government's ongoing investments in digital infrastructure, including the expansion of 5G networks, are further accelerating market expansion. Furthermore, the rising adoption of cloud computing and IoT applications creates new opportunities for telecom providers to offer advanced services to both businesses and consumers. However, the market faces certain challenges, including price competition among numerous players like Batelco, Zain Bahrain, and STC Bahrain, and the need for continuous investment in network infrastructure to meet the demands of evolving technologies. The market is segmented into Mobile, Fixed-line, and Broadband services, with mobile likely holding the largest market share given current global trends. The competitive landscape includes both established players and newer entrants, leading to innovative service offerings and pricing strategies.

The forecast period (2025-2033) will see continued growth driven by the aforementioned factors. However, the rate of growth may fluctuate depending on economic conditions, government policies related to the telecom sector, and technological advancements. Maintaining a competitive edge will require telecom operators to focus on customer experience, efficient network management, and strategic partnerships to leverage new technologies effectively. The increasing demand for high-speed internet and advanced communication services presents a significant opportunity for both established and emerging players to capitalize on the expanding market in Bahrain. The market's future trajectory depends on successfully navigating challenges related to competition, infrastructure investment, and keeping pace with rapid technological innovation.

Bahrain Telecom Market: 2019-2033 Comprehensive Report

This detailed report provides a comprehensive analysis of the Bahrain Telecom Market from 2019 to 2033, offering invaluable insights for industry stakeholders, investors, and strategists. The report covers market structure, competitive dynamics, industry trends, leading players, and future growth prospects, incorporating detailed segmentation by Mobile, Fixed-line, and Broadband services. With a base year of 2025 and a forecast period extending to 2033, this report provides crucial data for informed decision-making. The study period encompasses historical data (2019-2024) and projections (2025-2033), enabling a thorough understanding of market evolution. The estimated market size in 2025 is xx Million.

Bahrain Telecom Market Market Structure & Competitive Dynamics

The Bahrain Telecom market exhibits a moderately concentrated structure, with Batelco holding a significant market share, followed by Zain Bahrain and other players like STC Bahrain and Vodafone Enterprise Bahrain WLL. The competitive landscape is shaped by regulatory frameworks, technological advancements, and evolving consumer preferences. Innovation ecosystems are developing, driven by investments in 5G infrastructure and digital services. Significant M&A activity has been observed in the historical period, although the exact deal values for many transactions remain undisclosed (xx Million).

- Market Concentration: High, with Batelco dominating the market.

- Innovation Ecosystems: Growing, focused on 5G and digital services.

- Regulatory Frameworks: Influential, shaping competition and investment.

- Product Substitutes: Limited, with most services being essential.

- End-User Trends: Increasing demand for high-speed internet and mobile data.

- M&A Activities: Occasional significant mergers and acquisitions, totaling approximately xx Million in value during the historical period. Further consolidation is anticipated during the forecast period.

Bahrain Telecom Market Industry Trends & Insights

The Bahrain Telecom market is experiencing robust growth, driven by rising smartphone penetration, increased broadband adoption, and government initiatives promoting digital transformation. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%, propelled by factors such as the rising demand for high-speed internet and advanced mobile services. Market penetration for broadband services is projected to reach xx% by 2033. Technological disruptions, including the rollout of 5G networks and the proliferation of IoT devices, are further stimulating market expansion. Consumer preferences are shifting towards bundled services and affordable data plans, creating competitive pressures for service providers to innovate and offer value-added propositions. The competitive dynamics are characterized by aggressive pricing strategies, service differentiation, and a focus on improving customer experience.

Dominant Markets & Segments in Bahrain Telecom Market

The Mobile segment is the most dominant in the Bahrain Telecom market, driven by high smartphone penetration and increasing mobile data consumption. The fixed-line segment continues to experience slower growth, while the Broadband segment is showing significant expansion due to rising demand for high-speed internet connectivity.

- Mobile Segment Key Drivers:

- High smartphone penetration.

- Increasing mobile data consumption.

- Affordable data plans and bundled services.

- Fixed-Line Segment:

- Slower growth due to mobile services substitution.

- Continued importance in business communication.

- Broadband Segment:

- Rapid expansion due to rising demand for high-speed internet.

- Government initiatives to improve internet infrastructure.

Bahrain Telecom Market Product Innovations

Recent product innovations include the introduction of advanced 5G services, enhanced broadband packages, and value-added services like cloud-based solutions and IoT connectivity. These advancements cater to evolving consumer demands for seamless connectivity and enhanced digital experiences. Competition amongst providers focuses on delivering faster speeds, wider coverage, and improved network reliability, with a significant emphasis on providing cost-effective solutions to diverse customer segments.

Report Segmentation & Scope

The report segments the Bahrain Telecom market based on service type:

Mobile: This segment encompasses various mobile services, including voice, SMS, and data. Significant growth is predicted driven by rising smartphone adoption and data consumption. Competitive dynamics are shaped by aggressive pricing and service differentiation.

Fixed-line: This segment includes traditional landline telephony services. Growth is projected to be moderate, as consumers increasingly shift to mobile alternatives. The competitive landscape remains relatively stable.

Broadband: This segment includes fixed-broadband access through various technologies like DSL, fiber optics, and cable. High growth is anticipated, fueled by the escalating demand for high-speed internet access for residential and commercial use. Competition is intense, focusing on speed, reliability, and value for money.

Key Drivers of Bahrain Telecom Market Growth

Key drivers of Bahrain Telecom market growth include:

- Technological advancements: 5G rollout and increased broadband infrastructure investment.

- Government initiatives: Policies promoting digital transformation and investment in infrastructure.

- Economic growth: Rising disposable incomes and increasing demand for digital services.

Challenges in the Bahrain Telecom Market Sector

Challenges include:

- Regulatory hurdles: Obtaining licenses and permits for network expansion can be complex and time-consuming.

- Competitive pressures: Intense competition among telecom operators, impacting pricing strategies and profitability.

- Infrastructure limitations: Uneven broadband access in certain areas requires further investment. The exact cost of expanding infrastructure to meet demand is estimated to be xx Million.

Leading Players in the Bahrain Telecom Market Market

- Batelco (Bahrain Telecommunication Company BSC)

- Zain Bahrain

- STC Bahrain

- Etisalcom Bahrain

- Nuetel Communications

- Ascentech Telecom

- Equant Global Network (EGN BV)

- Gulf Electronic Tawasul

- Infonas WLL

- Kalaam Telecom Bahrain

- Rapid Telecom

- BT Solutions Ltd

- Viacloud Telecom

- Vodafone Enterprise Bahrain WLL

Key Developments in Bahrain Telecom Market Sector

- 2022 Q4: Batelco launched its enhanced 5G network, expanding coverage across the country.

- 2023 Q1: Zain Bahrain announced a new partnership to expand its fiber optic network infrastructure.

- 2023 Q2: STC Bahrain introduced a range of new bundled services.

- (Add further specific developments as available.)

Strategic Bahrain Telecom Market Market Outlook

The Bahrain Telecom market is poised for continued expansion driven by the ongoing digital transformation within the country and sustained investments in next-generation technologies. Strategic opportunities exist for companies focused on providing innovative solutions, expanding 5G infrastructure, and delivering value-added services to meet the evolving needs of consumers and businesses. The market's future potential is particularly strong in the areas of broadband and mobile data, with further consolidation expected amongst the major players.

Bahrain Telecom Market Segmentation

-

1. Type

- 1.1. Mobile

- 1.2. Fixed-line

- 1.3. Broadband

Bahrain Telecom Market Segmentation By Geography

- 1. Bahrain

Bahrain Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Digital Transformation Trends within the Telecom Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile

- 5.1.2. Fixed-line

- 5.1.3. Broadband

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Etisalcom Bahrain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nuetel Communications

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ascentech Telecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equant Global Network (EGN BV)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Electronic Tawasul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Infonas WLL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Batelco (Bahrain Telecommunication Company BSC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zain Bahrain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kalaam Telecom Bahrain

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rapid Telecom

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 STC Bahrain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BT Solutions Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Viacloud Telecom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Vodafone Enterprise Bahrain WLL

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Etisalcom Bahrain

List of Figures

- Figure 1: Bahrain Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Telecom Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Bahrain Telecom Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Bahrain Telecom Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Bahrain Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Bahrain Telecom Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Bahrain Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Bahrain Telecom Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Bahrain Telecom Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Bahrain Telecom Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 11: Bahrain Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Bahrain Telecom Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Telecom Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Bahrain Telecom Market?

Key companies in the market include Etisalcom Bahrain, Nuetel Communications, Ascentech Telecom, Equant Global Network (EGN BV), Gulf Electronic Tawasul, Infonas WLL, Batelco (Bahrain Telecommunication Company BSC), Zain Bahrain, Kalaam Telecom Bahrain, Rapid Telecom, STC Bahrain, BT Solutions Ltd, Viacloud Telecom, Vodafone Enterprise Bahrain WLL.

3. What are the main segments of the Bahrain Telecom Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

Digital Transformation Trends within the Telecom Sector.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Telecom Market?

To stay informed about further developments, trends, and reports in the Bahrain Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence