Key Insights

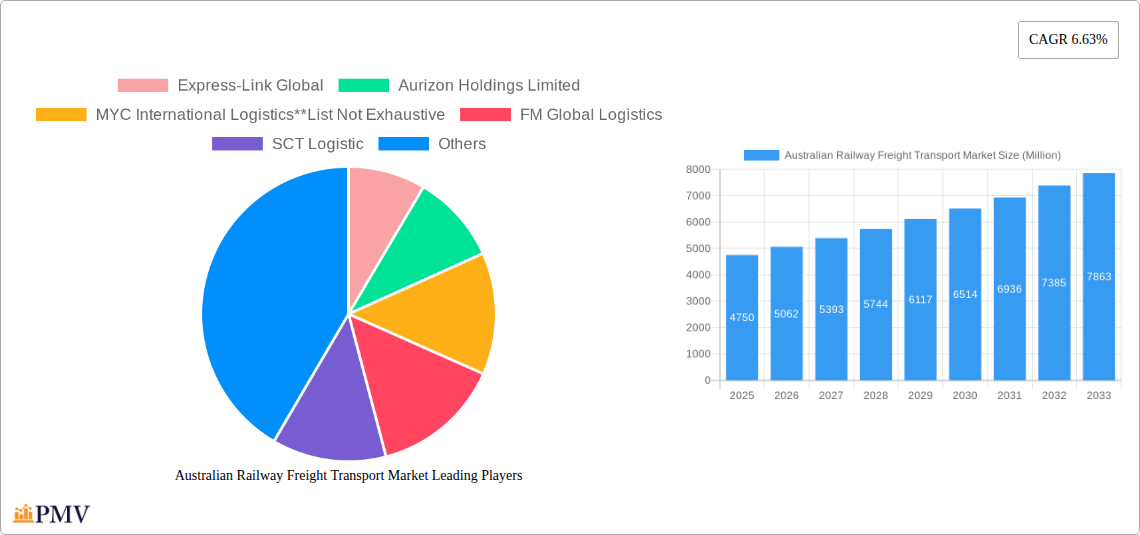

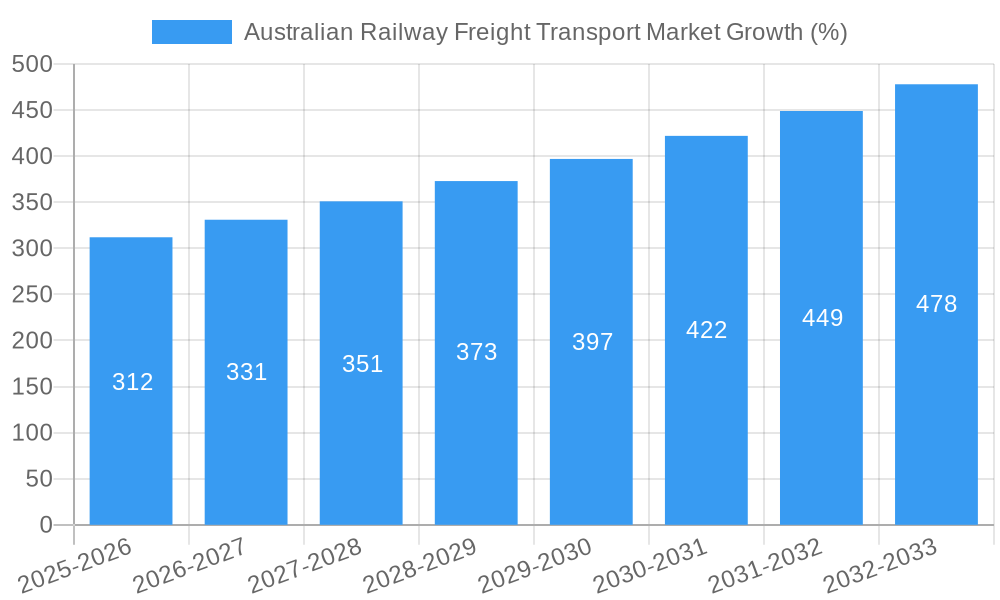

The Australian railway freight transport market, valued at $4.75 billion in 2025, is projected to experience robust growth, driven by increasing demand for efficient and sustainable logistics solutions. A Compound Annual Growth Rate (CAGR) of 6.63% from 2025 to 2033 indicates a significant expansion, reaching an estimated value exceeding $8 billion by 2033. This growth is fueled by several key factors. Firstly, Australia's vast distances and reliance on resource exports make rail a crucial component of the national transportation infrastructure. Secondly, the ongoing investment in infrastructure upgrades and modernization of railway networks will enhance capacity and efficiency, further stimulating market growth. Thirdly, a growing focus on environmental sustainability is pushing businesses to adopt more eco-friendly transportation methods, favoring rail over road transport for long-haul freight. However, challenges remain, including the high initial capital investment required for rail infrastructure development and potential competition from other modes of transport, such as road and maritime. The market is segmented by service type (transportation, maintenance, switching, and storage), cargo type (containerized, non-containerized, liquid bulk), and destination (domestic, international), offering diverse opportunities for various stakeholders. The competitive landscape includes both large established players like Aurizon Holdings Limited and Pacific National Holdings Pty Ltd, alongside smaller specialized operators, suggesting a dynamic market structure. The projected growth signifies significant opportunities for investment and expansion in the Australian railway freight sector, particularly within intermodal transport and the transportation of bulk commodities.

The segmentation of the market reveals key opportunities for targeted growth strategies. The containerized cargo segment is likely to experience significant growth driven by the increasing adoption of intermodal transport solutions. This segment's expansion will be influenced by the efficiency gains offered by rail in connecting various modes of transportation for seamless cargo delivery. Simultaneously, the liquid bulk segment offers promising prospects, given the significant volume of resources (such as minerals and agricultural products) transported across Australia. The domestic freight segment is expected to be a major contributor to overall market growth, propelled by the expansion of the internal Australian economy and the increasing demand for intrastate transportation of goods. Companies focusing on innovative solutions, such as improved track maintenance and the development of more efficient rail cars, are expected to gain a competitive advantage in this evolving market.

Australian Railway Freight Transport Market: 2019-2033 Forecast & Analysis

This comprehensive report provides an in-depth analysis of the Australian railway freight transport market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with a base year of 2025 and a forecast period extending to 2033. The report leverages robust data analysis to project market growth, identify key trends, and assess the competitive landscape. Key segments analyzed include transportation services, allied transportation services (maintenance, switching, and storage), cargo types (containerized, non-containerized, and liquid bulk), and destinations (domestic and international). Leading players like Aurizon Holdings Limited, Pacific National Holdings Pty Ltd, and Express-Link Global are profiled, providing crucial competitive intelligence.

Australian Railway Freight Transport Market Market Structure & Competitive Dynamics

The Australian railway freight transport market exhibits a moderately concentrated structure, with a few major players holding significant market share. Aurizon Holdings Limited, for example, commands a substantial portion of the market, estimated at xx% in 2025. This concentration is driven by significant capital investments required for infrastructure and rolling stock. The market's innovative ecosystem is evolving, with increased adoption of digital technologies such as IoT and AI for improved efficiency and track monitoring. However, regulatory frameworks, including safety regulations and access agreements, significantly influence market dynamics. Product substitutes, such as road transport, exert competitive pressure, particularly for shorter distances. End-user trends towards just-in-time delivery and supply chain optimization are shaping demand. M&A activity has been relatively moderate in recent years, with deal values averaging around xx Million annually during the 2019-2024 historical period. Notable transactions include [Insert specific M&A examples if available, otherwise use "limited publicly reported transactions"].

Australian Railway Freight Transport Market Industry Trends & Insights

The Australian railway freight transport market is poised for significant growth, driven by several factors. Government initiatives aimed at infrastructure development and improvements to the national rail network are boosting capacity and efficiency. The increasing volume of freight, particularly bulk commodities like coal and iron ore, fuels demand. Technological advancements, including automation, predictive maintenance, and improved signaling systems, are enhancing operational efficiency and reducing costs. Consumer preferences are shifting towards reliable and sustainable transportation solutions, giving railways a competitive edge over road transport in terms of environmental impact. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033). Market penetration of digital technologies within the sector is gradually increasing, with xx% adoption in 2025, projected to reach xx% by 2033. However, competitive pressures from road transport and the cyclical nature of commodity markets pose challenges.

Dominant Markets & Segments in Australian Railway Freight Transport Market

- Leading Region/State: New South Wales and Queensland dominate due to their significant mining and industrial activity and well-established rail infrastructure.

- Cargo Type: Bulk commodities (coal, iron ore) continue to be the dominant cargo type, accounting for xx% of the market share in 2025. Containerized freight is growing steadily, driven by intermodal transportation.

- Service Type: Transportation services account for the largest segment, followed by allied services such as maintenance and switching. This dominance is primarily due to the higher demand for freight movement. The growth of allied services is slightly lower due to reliance on transportation services' demand.

- Destination: Domestic freight constitutes the major portion of the market, driven by the vast distances within Australia and the need for efficient long-haul transportation. However, international freight transportation (import and export via ports) is witnessing significant growth fueled by global trade.

The dominance of these segments stems from several key drivers: favorable government policies supporting infrastructure investment, the concentration of industrial and mining activities in specific regions, and the economic advantages offered by rail transport for bulk commodities and long distances. Further, the increasing focus on environmentally friendly transport contributes to the rail's growth.

Australian Railway Freight Transport Market Product Innovations

Recent innovations in the Australian railway freight transport market include the adoption of advanced train control systems, improved rolling stock with greater capacity and efficiency, and the integration of digital technologies for real-time tracking and predictive maintenance. These innovations enhance operational efficiency, reduce downtime, and improve safety. The market is witnessing a growing adoption of data analytics to optimize routes and schedules, leading to improved cost management and better service delivery. These innovations are well-suited to address the market's need for increased efficiency and sustainability.

Report Segmentation & Scope

The report segments the Australian railway freight transport market across several key dimensions:

- Service: Transportation services encompass the core freight movement by rail, while allied services include maintenance, track repairs, cargo switching, and storage facilities. The transportation segment is projected to exhibit higher growth due to its direct link to freight volume.

- Cargo Type: Containerized (including intermodal), non-containerized, and liquid bulk cargo are analyzed separately, reflecting the differing needs and operational requirements for each type. Growth varies significantly across segments, with bulk commodities experiencing higher volatility.

- Destination: The market is segmented by domestic and international freight, reflecting distinct market dynamics and regulatory frameworks. International freight is expected to grow at a faster rate.

Each segment's growth projection, market size (in Million), and competitive landscape are thoroughly detailed within the report.

Key Drivers of Australian Railway Freight Transport Market Growth

Key drivers include significant government investment in rail infrastructure upgrades, increasing demand for efficient and cost-effective freight transport, and the growing adoption of advanced technologies to improve operational efficiency and safety. Furthermore, the rising focus on reducing carbon emissions is driving the shift towards rail as a more sustainable transportation mode compared to road freight. The long-term contracts with mining companies and other large industries also contribute to the market's stability.

Challenges in the Australian Railway Freight Transport Market Sector

Challenges include the high capital expenditure required for infrastructure development and maintenance, the competition from road transport, particularly for shorter distances, and potential regulatory hurdles related to access to rail networks and safety standards. Fluctuations in commodity prices also impact the demand for rail freight services and overall profitability. These factors limit the market's growth potential.

Leading Players in the Australian Railway Freight Transport Market Market

- Aurizon Holdings Limited

- Pacific National Holdings Pty Ltd

- Express-Link Global

- MYC International Logistics

- FM Global Logistics

- SCT Logistic

- Southern Shorthaul Railroad

- Wakefield Transport

- KTI Transport

- Innovation Transport Services

Key Developments in Australian Railway Freight Transport Market Sector

- 2022 Q4: Aurizon Holdings Limited announced a significant investment in upgrading its rolling stock.

- 2023 Q1: The Australian government approved funding for a major rail infrastructure project in [State/Region].

- 2023 Q2: Pacific National Holdings Pty Ltd launched a new intermodal service connecting [Location A] and [Location B].

- [Add further developments with year/month and impact on market dynamics]

Strategic Australian Railway Freight Transport Market Market Outlook

The Australian railway freight transport market presents significant growth potential over the next decade. Continued investment in infrastructure, technological advancements, and government support for sustainable transportation will be key growth accelerators. Opportunities lie in expanding intermodal transportation, improving supply chain efficiency through digitalization, and developing specialized services catering to emerging industries. Strategic partnerships between rail operators and logistics providers will play a crucial role in shaping the future of the market.

Australian Railway Freight Transport Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Services

-

2. Cargo Type

- 2.1. Containerized (Includes Intermodal)

- 2.2. Non-containerized

- 2.3. Liquid Bulk

-

3. Destination

- 3.1. Domestic

- 3.2. International

Australian Railway Freight Transport Market Segmentation By Geography

- 1. Australia

Australian Railway Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle

- 3.3. Market Restrains

- 3.3.1. Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits

- 3.4. Market Trends

- 3.4.1. Increasing rail investment infrastructure has given positive outlook to rail freight transport market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australian Railway Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Containerized (Includes Intermodal)

- 5.2.2. Non-containerized

- 5.2.3. Liquid Bulk

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Express-Link Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aurizon Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MYC International Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FM Global Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SCT Logistic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Southern Shorthaul Railroad

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Wakefield Transport

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KTI Transport

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Innovation Transport Services

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pacific National Holdings Pty Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Express-Link Global

List of Figures

- Figure 1: Australian Railway Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australian Railway Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Australian Railway Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australian Railway Freight Transport Market Revenue Million Forecast, by Service 2019 & 2032

- Table 3: Australian Railway Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 4: Australian Railway Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 5: Australian Railway Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Australian Railway Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Australian Railway Freight Transport Market Revenue Million Forecast, by Service 2019 & 2032

- Table 8: Australian Railway Freight Transport Market Revenue Million Forecast, by Cargo Type 2019 & 2032

- Table 9: Australian Railway Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 10: Australian Railway Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australian Railway Freight Transport Market?

The projected CAGR is approximately 6.63%.

2. Which companies are prominent players in the Australian Railway Freight Transport Market?

Key companies in the market include Express-Link Global, Aurizon Holdings Limited, MYC International Logistics**List Not Exhaustive, FM Global Logistics, SCT Logistic, Southern Shorthaul Railroad, Wakefield Transport, KTI Transport, Innovation Transport Services, Pacific National Holdings Pty Ltd.

3. What are the main segments of the Australian Railway Freight Transport Market?

The market segments include Service, Cargo Type, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumption of canned and frozen food; Growth urbanization and increased adoption of healthy lifestyle.

6. What are the notable trends driving market growth?

Increasing rail investment infrastructure has given positive outlook to rail freight transport market.

7. Are there any restraints impacting market growth?

Limited self-life of frozen food; Growing awareness regarding the consumption of fresh vegetables and fruits.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australian Railway Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australian Railway Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australian Railway Freight Transport Market?

To stay informed about further developments, trends, and reports in the Australian Railway Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence