Key Insights

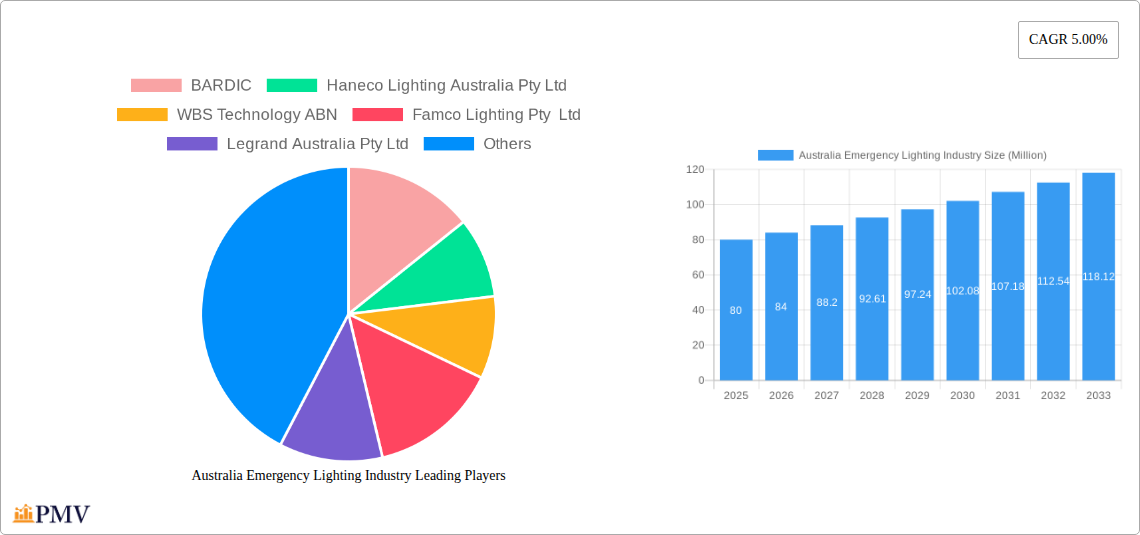

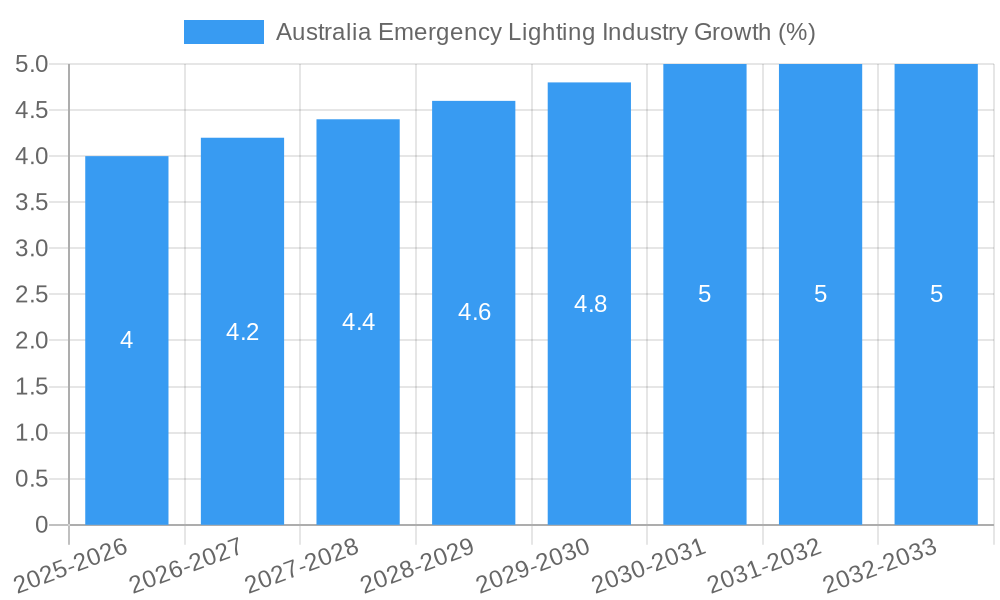

The Australian emergency lighting market, valued at approximately $80 million AUD in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 5% from 2025 to 2033. This expansion is driven by several key factors. Stringent building codes and regulations mandating emergency lighting systems across residential, commercial, and industrial sectors are a primary catalyst. Increasing awareness of workplace safety and the need for reliable emergency illumination in the event of power outages are further bolstering market demand. The adoption of technologically advanced emergency lighting solutions, such as LED-based systems offering enhanced energy efficiency and longer lifespans, is also significantly contributing to market growth. Furthermore, government initiatives promoting energy conservation and sustainable building practices are indirectly fueling the market's expansion.

However, the market's growth trajectory is not without challenges. High initial investment costs associated with installing and maintaining sophisticated emergency lighting systems can act as a restraint, particularly for smaller businesses. The market is also influenced by economic fluctuations, with periods of economic downturn potentially impacting investment decisions. Competition among established players like ABB Australia, Legrand Australia, and emerging companies is intense, leading to price pressures. Despite these challenges, the ongoing need for reliable safety infrastructure and advancements in energy-efficient technologies are expected to outweigh these constraints, ensuring sustained growth in the Australian emergency lighting market throughout the forecast period. The market segmentation reveals a significant share held by the commercial sector due to stringent regulations and a large number of high-rise buildings, followed by industrial and residential segments. Self-contained power systems are likely to dominate over central power systems due to ease of installation and maintenance in diverse locations.

Australia Emergency Lighting Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Australian emergency lighting industry, covering market structure, competitive dynamics, growth drivers, challenges, and future outlook. The report analyzes the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Australia Emergency Lighting Industry Market Structure & Competitive Dynamics

The Australian emergency lighting market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by a dynamic interplay of established players like Legrand Australia Pty Ltd and ABB Australia (ABB Ltd), and innovative entrants such as Clevertronics Pty Ltd. Market share amongst the top five players is estimated at xx%, with Legrand and ABB holding the largest shares. Innovation is a key competitive differentiator, driven by the adoption of smart technologies and IoT solutions. Regulatory frameworks, such as Australian Standards, significantly influence product design and safety compliance. Product substitutes, such as alternative safety signaling systems, present a limited competitive threat due to the mandatory nature of emergency lighting in various sectors. M&A activity has been relatively modest in recent years, with estimated deal values totaling xx Million over the past five years. End-user trends favour the adoption of energy-efficient, intelligent systems, driving product development.

- Market Concentration: Moderately Concentrated

- Top 5 Market Share: xx%

- M&A Deal Value (2019-2024): xx Million

Australia Emergency Lighting Industry Industry Trends & Insights

The Australian emergency lighting market is experiencing robust growth, driven by several key factors. Stringent building codes and safety regulations mandate the installation of emergency lighting across various sectors, creating consistent demand. The increasing adoption of smart technologies, such as IoT-enabled systems, is transforming the industry, offering enhanced functionalities, remote monitoring capabilities, and reduced maintenance costs. Consumer preferences are shifting towards energy-efficient LED solutions, further fueling market expansion. The growth is also fuelled by infrastructure development projects across residential, commercial, and industrial sectors. The market penetration of smart emergency lighting solutions is currently estimated at xx% and is projected to increase to xx% by 2033. The strong focus on safety, particularly in industrial and commercial settings, is another primary growth driver. This has translated to a strong CAGR of xx% during the historical period (2019-2024) and is projected to continue at a xx% CAGR during the forecast period (2025-2033). Competitive dynamics are largely shaped by technological innovation, pricing strategies, and brand reputation.

Dominant Markets & Segments in Australia Emergency Lighting Industry

The commercial sector currently dominates the Australian emergency lighting market, driven by the high density of commercial buildings and stringent safety requirements. The industrial sector shows significant potential for growth due to increasing industrial activity and focus on worker safety. Within power systems, self-contained systems hold the largest market share due to their ease of installation and maintenance, although central power systems are witnessing increased adoption in large-scale projects.

- Dominant End-User Vertical: Commercial

- Dominant Power System: Self-Contained Power System

Key Drivers for Commercial Sector Dominance:

- Stringent safety regulations for commercial buildings.

- High density of commercial buildings across major cities.

- Growing demand for energy-efficient and technologically advanced systems.

Key Drivers for Industrial Sector Growth:

- Increased industrial activity and infrastructure development.

- Focus on worker safety and compliance with stringent regulations in industrial settings.

Australia Emergency Lighting Industry Product Innovations

Recent product innovations in the Australian emergency lighting market center around smart, IoT-enabled systems that offer remote monitoring, predictive maintenance, and enhanced safety features. LED technology dominates, driven by energy efficiency and longevity. Manufacturers are focusing on developing interoperable systems that seamlessly integrate with building management systems (BMS) and other safety technologies. This focus on enhanced interoperability and integration with other building systems represents a major competitive advantage.

Report Segmentation & Scope

This report segments the Australian emergency lighting market based on power system (self-contained and central) and end-user vertical (residential, commercial, and industrial). Each segment is analyzed based on market size, growth projections, and competitive dynamics. The self-contained power system segment is projected to maintain a significant market share due to its ease of installation and cost-effectiveness. Centralized systems are expected to see growth driven by large-scale projects and building management system integration. The commercial segment will continue to dominate due to stringent safety regulations and high building density. The residential segment is expected to show moderate growth driven by rising building construction and homeowner awareness of safety measures.

Key Drivers of Australia Emergency Lighting Industry Growth

The Australian emergency lighting market growth is driven by a combination of factors including: increasingly stringent safety regulations, rising construction activity, a growing awareness of energy efficiency, and the adoption of advanced technologies. The government's investment in infrastructure projects further boosts market growth. Stringent safety regulations across all sectors are a major driver, pushing for compliance and upgrades. The shift towards energy-efficient LED systems also adds to market expansion.

Challenges in the Australia Emergency Lighting Industry Sector

The Australian emergency lighting sector faces challenges including supply chain disruptions impacting component availability and potentially increasing costs. The competitive landscape with both established players and new entrants necessitates continuous innovation and competitive pricing. Strict compliance standards require significant investments in R&D and certifications.

Leading Players in the Australia Emergency Lighting Industry Market

- BARDIC

- Haneco Lighting Australia Pty Ltd

- WBS Technology ABN

- Famco Lighting Pty Ltd

- Legrand Australia Pty Ltd

- EnLighten Australia

- ABB Australia (ABB Ltd)

- E&E Lighting Australia

- Clevertronics Pty Ltd

Key Developments in Australia Emergency Lighting Industry Sector

- October 2021: Clevertronics partnered with Wirepas, significantly enhancing its smart emergency lighting solutions. This partnership has resulted in the deployment of solutions across 630 sites in Australia, New Zealand, and the UK.

- September 2022: MineGlow launched em-Control, a technologically advanced emergency lighting system for underground mines, significantly improving safety standards within this niche sector.

Strategic Australia Emergency Lighting Industry Market Outlook

The Australian emergency lighting market is poised for continued growth, driven by technological advancements and increasing emphasis on safety and energy efficiency. Strategic opportunities lie in developing smart, integrated systems, focusing on niche markets such as mining and infrastructure, and exploring innovative financing models to drive adoption of advanced technologies. The market presents promising avenues for both established players and new entrants who can leverage technological innovation to cater to evolving market needs and strengthen their competitive positioning.

Australia Emergency Lighting Industry Segmentation

-

1. Power System

- 1.1. Self-contained Power System

- 1.2. Central Power System

-

2. End-user Vertical

- 2.1. Residential

- 2.2. Industrial

- 2.3. Commercial

Australia Emergency Lighting Industry Segmentation By Geography

- 1. Australia

Australia Emergency Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supporting Government Regulations (Building Code of Australia (BCA))

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Amongst Non-data Center Applications

- 3.4. Market Trends

- 3.4.1. Commercial Segment in Australia is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Emergency Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power System

- 5.1.1. Self-contained Power System

- 5.1.2. Central Power System

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Residential

- 5.2.2. Industrial

- 5.2.3. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Power System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BARDIC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haneco Lighting Australia Pty Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 WBS Technology ABN

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Famco Lighting Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Legrand Australia Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EnLighten Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABB Australia (ABB Ltd)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 E&E Lighting Australia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clevertronics Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 BARDIC

List of Figures

- Figure 1: Australia Emergency Lighting Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Emergency Lighting Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Emergency Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Emergency Lighting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Emergency Lighting Industry Revenue Million Forecast, by Power System 2019 & 2032

- Table 4: Australia Emergency Lighting Industry Volume K Unit Forecast, by Power System 2019 & 2032

- Table 5: Australia Emergency Lighting Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Australia Emergency Lighting Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 7: Australia Emergency Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Emergency Lighting Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Emergency Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Emergency Lighting Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Emergency Lighting Industry Revenue Million Forecast, by Power System 2019 & 2032

- Table 12: Australia Emergency Lighting Industry Volume K Unit Forecast, by Power System 2019 & 2032

- Table 13: Australia Emergency Lighting Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 14: Australia Emergency Lighting Industry Volume K Unit Forecast, by End-user Vertical 2019 & 2032

- Table 15: Australia Emergency Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Emergency Lighting Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Emergency Lighting Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Australia Emergency Lighting Industry?

Key companies in the market include BARDIC, Haneco Lighting Australia Pty Ltd, WBS Technology ABN, Famco Lighting Pty Ltd, Legrand Australia Pty Ltd, EnLighten Australia, ABB Australia (ABB Ltd), E&E Lighting Australia, Clevertronics Pty Ltd.

3. What are the main segments of the Australia Emergency Lighting Industry?

The market segments include Power System, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Supporting Government Regulations (Building Code of Australia (BCA)).

6. What are the notable trends driving market growth?

Commercial Segment in Australia is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness Amongst Non-data Center Applications.

8. Can you provide examples of recent developments in the market?

September 2022: MineGlow has launched em-Control, a new technologically advanced, interoperable emergency lighting system designed to improve the safety of underground mines. The em-Control is an intelligent, network-based solution that warns and directs an underground workforce to safety with multi-directional light pulses and colors. The complete system comprises em-Lighting, the LED light strip, em-View, a web interface, and em-Controller, a network-based controller that integrates with third-party systems via an open application programming interface (API).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Emergency Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Emergency Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Emergency Lighting Industry?

To stay informed about further developments, trends, and reports in the Australia Emergency Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence