Key Insights

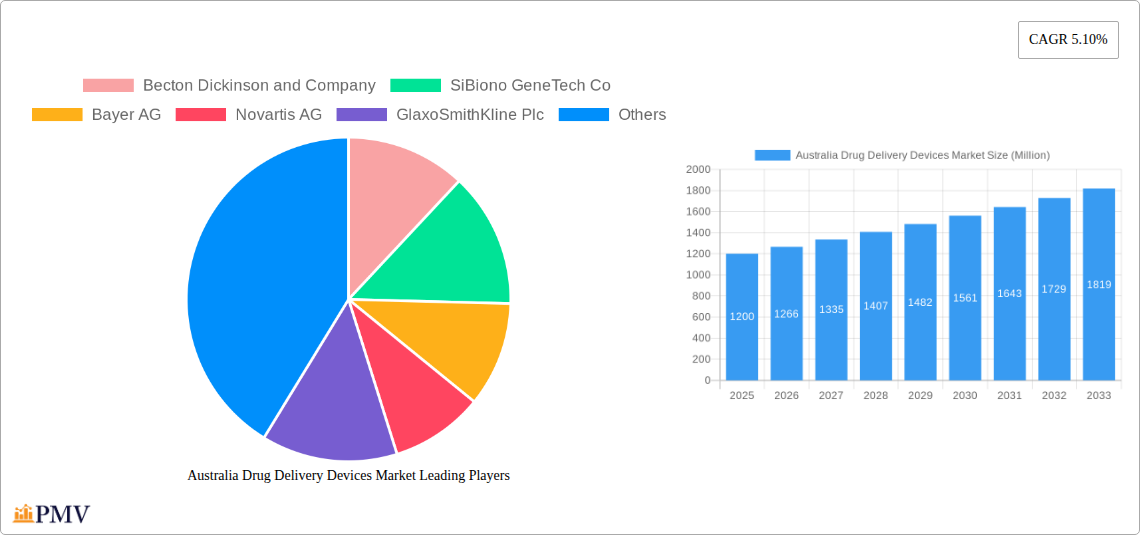

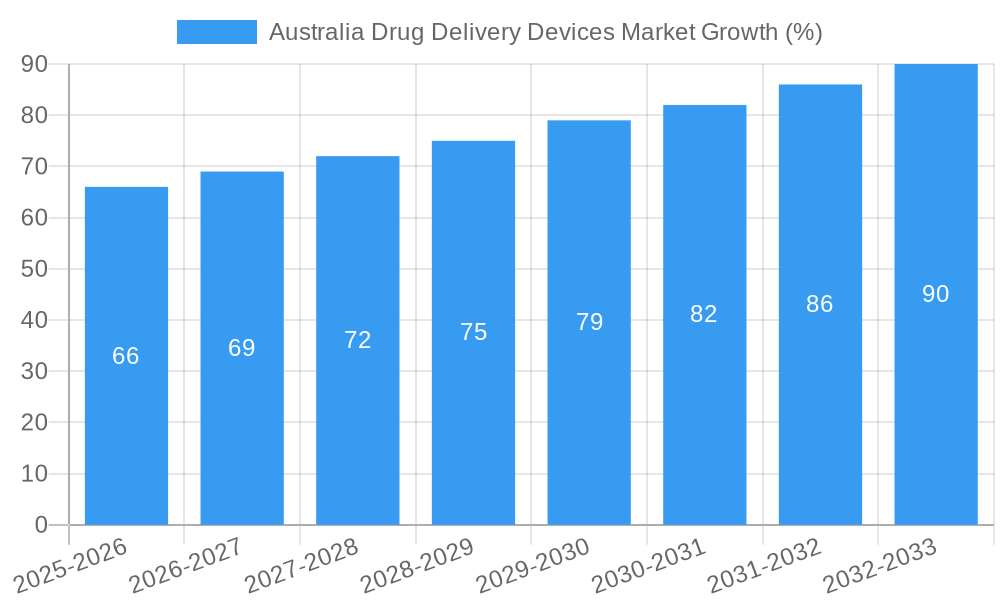

The Australian drug delivery devices market, valued at approximately $1.2 billion AUD in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This expansion is fueled by several key drivers. An aging population necessitating increased medication adherence and a rise in chronic diseases like diabetes and cardiovascular conditions are significantly increasing demand for efficient and convenient drug delivery systems. Furthermore, technological advancements leading to the development of innovative devices like smart inhalers, wearable drug pumps, and microneedle patches are contributing to market growth. The increasing preference for minimally invasive procedures in hospitals and ambulatory surgical centers further boosts the adoption of these devices. While the market faces challenges like stringent regulatory approvals and high development costs, the overall outlook remains positive. The market segmentation reveals strong growth across various applications, including cancer treatment, cardiovascular therapies, and diabetes management, with injectable and topical routes of administration dominating the market share.

The market is highly competitive, with key players such as Becton Dickinson, SiBiono GeneTech, Bayer AG, Novartis, GlaxoSmithKline, Teva Pharmaceuticals, AbbVie, Novo Nordisk, Johnson & Johnson, Sanofi, Viatris, and Pfizer vying for market share. These companies are investing heavily in research and development to introduce advanced drug delivery solutions. Growth within specific segments is expected to vary; for example, the demand for advanced injectable devices in hospitals is projected to outpace growth in other segments. The Australian government's focus on improving healthcare infrastructure and promoting technological advancements within the healthcare sector is further expected to positively impact market growth in the forecast period. Geographical variations within Australia may also be observed, with larger metropolitan areas experiencing higher adoption rates compared to rural areas.

Australia Drug Delivery Devices Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia drug delivery devices market, offering valuable insights for stakeholders across the pharmaceutical and medical device industries. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by end-user (hospitals, ambulatory surgical centers, other end users), route of administration (injectable, topical, ocular, other), and application (cancer, cardiovascular, diabetes, infectious diseases, other). Key players analyzed include Becton Dickinson and Company, SiBiono GeneTech Co, Bayer AG, Novartis AG, GlaxoSmithKline Plc, Teva Pharmaceutical Industries Ltd, AbbVie Inc, Novo Nordisk, Johnson & Johnson, Sanofi AG, Viatris Inc (Mylan N V), and Pfizer Inc. The market is projected to reach xx Million by 2033.

Australia Drug Delivery Devices Market Market Structure & Competitive Dynamics

The Australian drug delivery devices market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. The market is characterized by a dynamic innovation ecosystem, driven by ongoing R&D investments in advanced drug delivery technologies. Stringent regulatory frameworks, overseen by the Therapeutic Goods Administration (TGA), ensure product safety and efficacy. The market witnesses continuous technological advancements, with substitutes emerging for traditional delivery methods. End-user trends, particularly the growing preference for convenient and patient-friendly devices, are shaping market demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million in recent years.

- Market Concentration: The top 5 players hold approximately xx% of the market share.

- Innovation Ecosystem: Significant investments in nanotechnology, biopharmaceuticals, and personalized medicine are driving innovation.

- Regulatory Framework: TGA regulations heavily influence product development and market entry.

- Product Substitutes: The emergence of novel drug delivery systems, such as microneedle patches and inhalers, is impacting traditional methods.

- M&A Activity: Consolidation is expected to continue, driven by the need for scale and technological expertise.

Australia Drug Delivery Devices Market Industry Trends & Insights

The Australian drug delivery devices market is experiencing robust growth, driven by several key factors. The increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases fuels demand for effective drug delivery solutions. Technological advancements, particularly in pre-filled syringes (PFS) and other advanced delivery systems, are enhancing efficacy and patient compliance. Consumer preference for convenient and user-friendly devices is shaping market trends. The market is witnessing increased competition, with both established players and emerging companies vying for market share. The CAGR for the forecast period (2025-2033) is estimated to be xx%, with market penetration expected to increase by xx% by 2033. This growth is further fueled by government initiatives supporting healthcare infrastructure and investment in research and development.

Dominant Markets & Segments in Australia Drug Delivery Devices Market

The injectable route of administration dominates the Australian drug delivery devices market, driven by its widespread use in various therapeutic areas, including cancer treatment and diabetes management. Hospitals represent the largest end-user segment, reflecting high volumes of drug administration within hospital settings. The cancer therapeutic area displays strong growth, fueled by rising cancer incidence rates and the demand for effective targeted therapies.

- By End User:

- Hospitals: High volume of drug administration procedures drives segment dominance.

- Ambulatory Surgical Centers: Growing popularity of outpatient procedures is fueling growth.

- Other End Users: This segment includes clinics, pharmacies and home healthcare providers.

- By Route of Administration:

- Injectable: Largest segment due to prevalent use across numerous applications.

- Topical: Steady growth driven by increasing demand for convenient and non-invasive treatments.

- Ocular: Significant growth is attributed to a rising number of ophthalmic disorders and advancements in drug delivery systems.

- Other Route of Administration: This segment includes oral, transdermal, and inhalation routes.

- By Application:

- Cancer: High incidence rates and demand for targeted therapies drive robust growth.

- Cardiovascular: Treatment of cardiovascular disorders necessitates high demand for drug delivery devices.

- Diabetes: Chronic nature of diabetes contributes to sustained growth.

- Infectious diseases: Outbreaks and increasing antibiotic resistance are impacting the market.

- Other Applications: This includes neurological disorders, respiratory diseases, and other therapeutic areas.

Australia Drug Delivery Devices Market Product Innovations

Recent innovations in drug delivery devices focus on enhancing patient convenience, improving drug efficacy, and minimizing side effects. Advancements in pre-filled syringes, such as BD's next-generation glass PFS, offer enhanced processability, cosmetics, and integrity. The introduction of pre-fillable polymer syringes for low-dose applications, like Terumo's PLAJEX syringe, caters to the growing need for specialized delivery systems for ophthalmic and other high-value drugs. These innovations align with the market's growing demand for sophisticated and user-friendly devices.

Report Segmentation & Scope

This report offers granular segmentation of the Australian drug delivery devices market, covering various aspects:

By End User: Hospitals, Ambulatory Surgical Centers, and Other End Users; growth projections vary significantly, with Hospitals maintaining the largest share.

By Route of Administration: Injectable, Topical, Ocular, and Other Route of Administration; the Injectable segment is projected to hold the largest market share throughout the forecast period.

By Application: Cancer, Cardiovascular, Diabetes, Infectious diseases, and Other Applications; the Cancer segment is expected to witness the most robust growth. Competitive dynamics vary significantly across segments, reflecting diverse technological and clinical needs.

Key Drivers of Australia Drug Delivery Devices Market Growth

Several factors fuel the growth of the Australian drug delivery devices market. The rising prevalence of chronic diseases necessitates advanced drug delivery systems for improved patient outcomes. Government initiatives promoting healthcare infrastructure and R&D investment stimulate market expansion. Technological advancements, such as the development of smart inhalers and microneedle patches, offer superior drug delivery capabilities. Moreover, increasing healthcare expenditure and rising disposable incomes further contribute to market growth.

Challenges in the Australia Drug Delivery Devices Market Sector

Despite strong growth prospects, the Australian drug delivery devices market faces several challenges. Stringent regulatory approvals increase the time and cost associated with product launches. Supply chain disruptions can impact the availability of raw materials and finished products, affecting market stability. Furthermore, intense competition from established players and new entrants necessitates continuous innovation and cost optimization to maintain market share. The impact of these factors is estimated to reduce the overall market growth rate by approximately xx% during the forecast period.

Leading Players in the Australia Drug Delivery Devices Market Market

- Becton Dickinson and Company

- SiBiono GeneTech Co

- Bayer AG

- Novartis AG

- GlaxoSmithKline Plc

- Teva Pharmaceutical Industries Ltd

- AbbVie Inc

- Novo Nordisk

- Johnson & Johnson

- Sanofi AG

- Viatris Inc (Mylan N V)

- Pfizer Inc

Key Developments in Australia Drug Delivery Devices Market Sector

September 2022: BD launched a next-generation glass refillable syringe (PFS) setting a new standard for vaccine PFS, enhancing processability, cosmetics, contamination control, and integrity. This innovation strengthens BD's position in the market.

May 2022: Terumo Pharmaceutical Solutions introduced a pre-fillable polymer syringe for low-dose applications, expanding options for ophthalmic drug delivery and enhancing patient treatment. This launch caters to a niche market with high growth potential.

Strategic Australia Drug Delivery Devices Market Market Outlook

The Australian drug delivery devices market exhibits promising growth potential, driven by sustained demand for advanced therapies and technological advancements. Strategic opportunities lie in developing innovative drug delivery systems tailored to specific therapeutic areas and patient needs. Companies focusing on personalized medicine and digital health integration are well-positioned to capitalize on market growth. Furthermore, strategic partnerships and collaborations can facilitate faster market entry and enhance product development capabilities. This dynamic market offers significant opportunities for players willing to invest in innovation and address the evolving healthcare landscape.

Australia Drug Delivery Devices Market Segmentation

-

1. Route of Administration

- 1.1. Injectable

- 1.2. Topical

- 1.3. Ocular

- 1.4. Other Route of Administration

-

2. Application

- 2.1. Cancer

- 2.2. Cardiovascular

- 2.3. Diabetes

- 2.4. Infectious diseases

- 2.5. Other Applications

-

3. End User

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers

- 3.3. Other End Users

Australia Drug Delivery Devices Market Segmentation By Geography

- 1. Australia

Australia Drug Delivery Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Risk of Needlestick Injuries

- 3.4. Market Trends

- 3.4.1. Cancer Segment is Estimated to Witness a Significant Growth Over The Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Drug Delivery Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Injectable

- 5.1.2. Topical

- 5.1.3. Ocular

- 5.1.4. Other Route of Administration

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cancer

- 5.2.2. Cardiovascular

- 5.2.3. Diabetes

- 5.2.4. Infectious diseases

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SiBiono GeneTech Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novartis AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GlaxoSmithKline Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teva Pharmaceutical Industries Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AbbVie Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novo Nordisk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson & Johnson

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Viatris Inc (Mylan N V )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Pfizer Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Australia Drug Delivery Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Drug Delivery Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Drug Delivery Devices Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 5: Australia Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Australia Drug Delivery Devices Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Australia Drug Delivery Devices Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: Australia Drug Delivery Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Australia Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Australia Drug Delivery Devices Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 14: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Route of Administration 2019 & 2032

- Table 15: Australia Drug Delivery Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: Australia Drug Delivery Devices Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Australia Drug Delivery Devices Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 19: Australia Drug Delivery Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Australia Drug Delivery Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Drug Delivery Devices Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Australia Drug Delivery Devices Market?

Key companies in the market include Becton Dickinson and Company, SiBiono GeneTech Co , Bayer AG, Novartis AG, GlaxoSmithKline Plc, Teva Pharmaceutical Industries Ltd, AbbVie Inc, Novo Nordisk, Johnson & Johnson, Sanofi AG, Viatris Inc (Mylan N V ), Pfizer Inc.

3. What are the main segments of the Australia Drug Delivery Devices Market?

The market segments include Route of Administration, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases; Technological Advancements.

6. What are the notable trends driving market growth?

Cancer Segment is Estimated to Witness a Significant Growth Over The Forecast Period..

7. Are there any restraints impacting market growth?

Risk of Needlestick Injuries.

8. Can you provide examples of recent developments in the market?

September 2022: BD introduced a next-generation glass refillable syringe (PFS) that sets a new standard in performance for vaccine PFS with new and tightened specifications for processability, cosmetics, contamination, and integrity. The device is available in Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Drug Delivery Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Drug Delivery Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Drug Delivery Devices Market?

To stay informed about further developments, trends, and reports in the Australia Drug Delivery Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence