Key Insights

The Asia-Pacific B2B e-commerce market is experiencing robust growth, driven by the increasing digitalization of businesses across the region and the expanding adoption of e-procurement solutions. A compound annual growth rate (CAGR) of 15.20% from 2019 to 2024 suggests a significant expansion. Key drivers include improved internet infrastructure, rising smartphone penetration, and a growing preference for online procurement among SMEs and large enterprises alike. China, India, Japan, and South Korea are major contributors to this growth, fueled by their large and increasingly digitally-savvy business populations. The market segmentation reveals a dynamic interplay between direct sales and marketplace sales channels, with marketplaces like Alibaba and Amazon playing crucial roles in connecting buyers and sellers. The prevalence of these platforms significantly lowers entry barriers for smaller businesses, fostering competition and driving innovation within the industry.

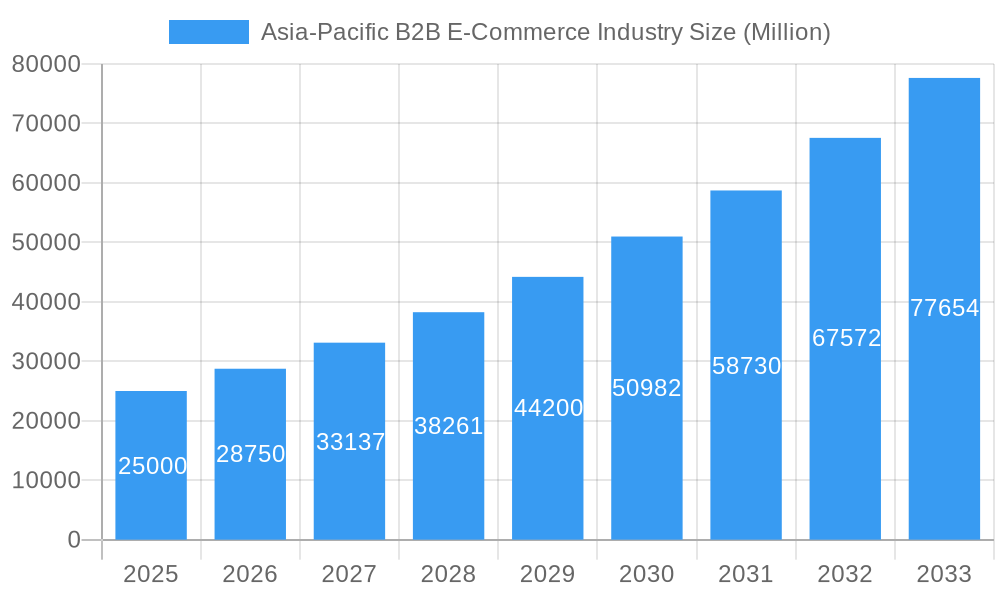

Asia-Pacific B2B E-Commerce Industry Market Size (In Billion)

Looking ahead, the forecast period (2025-2033) promises continued expansion, fueled by further technological advancements such as AI-powered supply chain management and enhanced cybersecurity measures. However, challenges remain, including the need for robust digital literacy programs to support broader adoption, particularly in less developed areas. Furthermore, concerns surrounding data security and cross-border regulations might act as potential restraints on market growth. Nevertheless, the overall outlook for the Asia-Pacific B2B e-commerce market remains optimistic, with substantial opportunities for established players and new entrants alike, particularly those focusing on niche industries and offering tailored solutions to meet the unique needs of businesses within the diverse regional landscape. The continued penetration of mobile commerce and the evolution of integrated B2B platforms will be key factors shaping future market dynamics.

Asia-Pacific B2B E-Commerce Industry Company Market Share

This in-depth report provides a comprehensive analysis of the Asia-Pacific B2B e-commerce industry, covering market structure, competitive dynamics, growth trends, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for businesses operating or planning to enter this dynamic market. The report leverages extensive data analysis to provide actionable intelligence and strategic recommendations. Expected market size is valued at xx Million by 2025, experiencing a CAGR of xx% during the forecast period.

Asia-Pacific B2B E-Commerce Industry Market Structure & Competitive Dynamics

This section analyzes the market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the Asia-Pacific B2B e-commerce landscape. The market is characterized by a mix of large multinational players and smaller, regionally focused businesses. Market share is highly dynamic, with intense competition driving innovation and consolidation.

- Market Concentration: The Asia-Pacific B2B e-commerce market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. However, a large number of smaller players also contribute significantly to the overall market volume. Alibaba Group Holding Ltd and Amazon.com Inc are major players, each possessing a substantial share. IndiaMart InterMesh Ltd holds a significant position in the Indian market.

- Innovation Ecosystems: Strong innovation ecosystems are driving growth, fueled by technological advancements in areas like AI, big data analytics, and blockchain technology. These technologies are transforming supply chain management, enhancing customer experiences, and fostering new business models.

- Regulatory Frameworks: Varying regulatory frameworks across different countries within the Asia-Pacific region present both opportunities and challenges. Understanding these regulations is critical for successful market entry and operation. Recent regulatory changes related to data privacy and e-commerce regulations are closely analyzed.

- Product Substitutes: The threat of substitution is moderate, with traditional B2B sales channels continuing to exist. However, the efficiency and convenience offered by B2B e-commerce platforms are gradually shifting market preference.

- End-User Trends: The increasing adoption of digital technologies by businesses, coupled with a growing preference for online purchasing, is driving market growth. Businesses are increasingly realizing the benefits of streamlined procurement processes, improved efficiency, and expanded market reach.

- M&A Activities: The industry has witnessed significant M&A activity in recent years, with larger players acquiring smaller companies to expand their market presence and enhance their product offerings. The total value of M&A deals within the past five years is estimated at xx Million.

Asia-Pacific B2B E-Commerce Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Asia-Pacific B2B e-commerce market. Market growth is driven by a confluence of factors including increasing internet and smartphone penetration, rising digital literacy among businesses, and the growing adoption of e-procurement systems. Technological advancements, particularly in areas like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), are further accelerating market growth. Changing consumer preferences toward online convenience are also noteworthy factors. The competitive landscape is marked by intense rivalry, with both established players and new entrants vying for market share. The market is expected to experience robust growth, driven by factors like increasing internet and smartphone penetration, expanding digital literacy, and the rising adoption of e-procurement systems across various industries.

Dominant Markets & Segments in Asia-Pacific B2B E-Commerce Industry

This section identifies the leading regions, countries, and segments within the Asia-Pacific B2B e-commerce market. China and India emerge as dominant markets due to their large and rapidly expanding economies, substantial business populations, and significant investments in digital infrastructure.

- By Channel:

- Marketplace Sales: This segment holds a larger market share compared to direct sales due to the wide reach, ease of access, and cost-effectiveness offered by marketplaces. Key drivers include the expanding availability of diverse products and the convenience of integrated payment and logistics solutions. China's massive online marketplaces significantly contribute to this segment's dominance.

- Direct Sales: This segment is experiencing steady growth, driven by the ability of businesses to establish direct relationships with their customers and build brand loyalty. However, it requires significant investment in technology, logistics, and marketing.

Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting digitalization and e-commerce are significantly bolstering market growth.

- Infrastructure: Extensive and continually improving digital infrastructure, including high-speed internet access and robust logistics networks, fuels market expansion.

Asia-Pacific B2B E-Commerce Industry Product Innovations

Recent product innovations are focused on enhancing user experience, improving supply chain efficiency, and expanding the range of available products and services. The integration of AI-powered tools for personalized recommendations, predictive analytics for inventory management, and secure payment gateways are notable advancements. These innovations are improving overall customer satisfaction and operational efficiency for businesses.

Report Segmentation & Scope

This report segments the Asia-Pacific B2B e-commerce market primarily by channel: Direct Sales and Marketplace Sales.

- Direct Sales: This segment comprises businesses that sell their products or services directly to customers through their own online platforms. The growth projection for this segment is xx% CAGR, with a market size expected to reach xx Million by 2033. Competitive dynamics are characterized by strong brand building and efficient logistics management.

- Marketplace Sales: This segment includes businesses that sell their products or services through third-party e-commerce platforms. This segment is projected to have a xx% CAGR, with a market size of xx Million by 2033. The competitive landscape is highly dynamic, requiring significant attention to customer reviews, search engine optimization, and competitive pricing.

Key Drivers of Asia-Pacific B2B E-Commerce Industry Growth

Several factors fuel the growth of the Asia-Pacific B2B e-commerce industry. Technological advancements, such as improved e-commerce platforms, mobile commerce, and sophisticated data analytics tools, significantly contribute. Strong economic growth in many countries within the region creates increased business activity and demand for online solutions. Supportive government policies further accelerate the adoption of e-commerce technologies.

Challenges in the Asia-Pacific B2B E-Commerce Industry Sector

Despite significant growth potential, several challenges hinder the industry's progress. Varying regulatory frameworks across the region create compliance complexities. Supply chain disruptions and logistical challenges, particularly in less developed regions, impact efficiency and increase costs. Intense competition, both from established players and new entrants, puts pressure on profit margins. Cybersecurity threats and data privacy concerns are also significant barriers. These factors collectively result in an estimated xx Million loss annually.

Leading Players in the Asia-Pacific B2B E-Commerce Industry Market

- IndiaMart InterMesh Ltd

- Flipkart Online Services Pvt Ltd

- Alibaba Group Holding Ltd

- DIYTrade com

- B2W Companhia Digital

- KOMPASS

- ChinaAseanTrade com

- Amazon com Inc

- EWORLDTRADE Inc

- eBay Inc

Key Developments in Asia-Pacific B2B E-Commerce Industry Sector

- June 2022: Vertiv launched its official store on Tokopedia, expanding its reach in Southeast Asia's e-commerce market.

- June 2022: Ramagya Mart added home appliance categories to its B2B platform, attracting 900 new manufacturers.

Strategic Asia-Pacific B2B E-commerce Industry Market Outlook

The Asia-Pacific B2B e-commerce market holds immense future potential, driven by continued technological innovation, economic growth, and supportive government policies. Strategic opportunities exist for businesses that can adapt to changing market dynamics, leverage technology effectively, and navigate the complexities of the regional regulatory landscape. Focus on strengthening supply chain resilience, enhancing cybersecurity measures, and providing superior customer service will be crucial for long-term success.

Asia-Pacific B2B E-Commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Regional Market Share

Geographic Coverage of Asia-Pacific B2B E-Commerce Industry

Asia-Pacific B2B E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Advancement in Technologies Plays a Significant Role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. South Korea

- 5.2.5. Rest of APAC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Rest of APAC

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. South Korea

- 6.2.5. Rest of APAC

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. South Korea

- 7.2.5. Rest of APAC

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 8.1.1. Direct Sales

- 8.1.2. Marketplace Sales

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Rest of APAC

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 9. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 9.1.1. Direct Sales

- 9.1.2. Marketplace Sales

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. South Korea

- 9.2.5. Rest of APAC

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 10. Rest of APAC Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 10.1.1. Direct Sales

- 10.1.2. Marketplace Sales

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. South Korea

- 10.2.5. Rest of APAC

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IndiaMart InterMesh Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flipkart Online Services Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Alibaba Group Holding Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DIYTrade com

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 B2W Companhia Digital

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 KOMPASS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ChinaAseanTrade com

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amazon com Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EWORLDTRADE Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 eBay Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IndiaMart InterMesh Ltd

List of Figures

- Figure 1: Asia-Pacific B2B E-Commerce Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific B2B E-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 2: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 5: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 8: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 11: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 14: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Channel 2020 & 2033

- Table 17: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific B2B E-Commerce Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific B2B E-Commerce Industry?

The projected CAGR is approximately 15.2%.

2. Which companies are prominent players in the Asia-Pacific B2B E-Commerce Industry?

Key companies in the market include IndiaMart InterMesh Ltd, Flipkart Online Services Pvt Ltd, Alibaba Group Holding Ltd, DIYTrade com, B2W Companhia Digital, KOMPASS, ChinaAseanTrade com, Amazon com Inc, EWORLDTRADE Inc, eBay Inc.

3. What are the main segments of the Asia-Pacific B2B E-Commerce Industry?

The market segments include Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support.

6. What are the notable trends driving market growth?

Advancement in Technologies Plays a Significant Role in Market Growth.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

June 2022 - Vertiv, a provider of critical digital infrastructure and continuity solutions, announced opening its official store in Tokopedia, Indonesia's e-commerce platform. This is part of Vertiv's continuous expansion into the e-commerce space in Southeast Asia, reaching more customers looking to buy small to medium-sized uninterruptible power supply (UPS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific B2B E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific B2B E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific B2B E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific B2B E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence