Key Insights

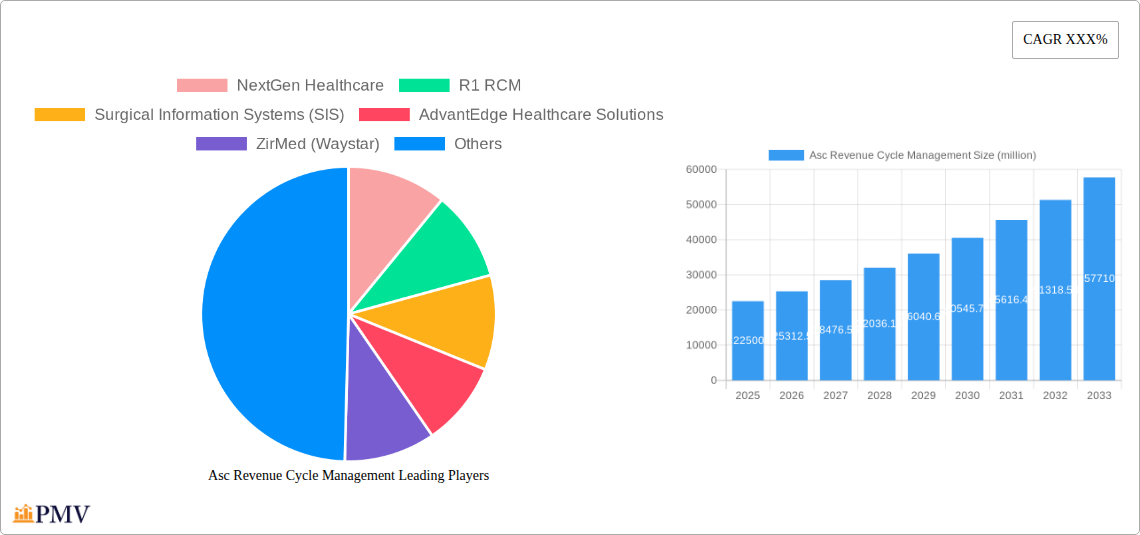

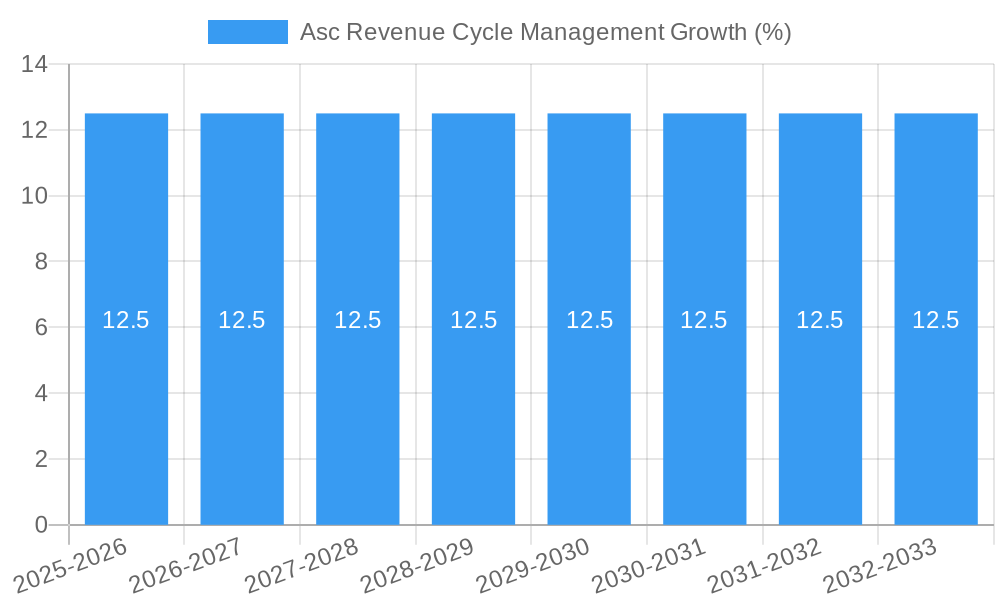

The Asc Revenue Cycle Management market is poised for robust expansion, projected to reach an estimated $22,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 12.5% projected through 2033. This significant growth is primarily fueled by the escalating complexities within healthcare billing and reimbursement processes, coupled with an increasing demand for efficient financial management solutions in healthcare organizations. Hospitals and Ambulatory Surgical Centers (ASCs) represent the dominant application segments, driven by their high volume of patient encounters and the critical need to optimize claim submissions, reduce denials, and accelerate payment cycles. The widespread adoption of cloud-based RCM solutions is a key trend, offering scalability, accessibility, and advanced analytics that empower providers to gain better financial visibility and control. This shift towards digital RCM platforms is further incentivized by evolving regulatory landscapes and the persistent pressure on healthcare providers to enhance operational efficiency and patient satisfaction.

Despite the promising outlook, the market faces certain restraints, including the high initial investment costs associated with implementing advanced RCM systems and the ongoing challenge of integrating these solutions with disparate existing healthcare IT infrastructures. Furthermore, a shortage of skilled RCM professionals can hinder effective adoption and utilization. However, these challenges are being progressively addressed through technological advancements, such as artificial intelligence and machine learning for automated claim processing and predictive denial management, alongside the growing availability of specialized RCM service providers. As healthcare systems worldwide continue to grapple with the imperative of financial sustainability and operational excellence, the demand for sophisticated Asc Revenue Cycle Management solutions is expected to remain strong, driving innovation and market penetration across all key regions.

Here is an SEO-optimized, detailed report description for Asc Revenue Cycle Management, incorporating all your specified requirements and keywords.

Report Title: Asc Revenue Cycle Management Market: Growth, Trends, Innovations & Competitive Landscape (2019–2033)

Report Description:

This comprehensive Asc Revenue Cycle Management market research report provides an in-depth analysis of the global Asc Revenue Cycle Management industry. Spanning the historical period from 2019 to 2024, with a base year of 2025 and a robust forecast period extending to 2033, this study offers critical insights into market dynamics, key players, emerging trends, and future growth opportunities. Our analysis covers market size projections, competitive intelligence, and strategic outlooks essential for stakeholders navigating the complex Asc Revenue Cycle Management landscape. With a focus on Asc Revenue Cycle Management solutions for Hospitals, Ambulatory Surgical Centers, and other healthcare providers, alongside an examination of Cloud-Based and On-Premises deployment types, this report is an indispensable resource for understanding the evolving Asc Revenue Cycle Management market.

Asc Revenue Cycle Management Market Structure & Competitive Dynamics

The Asc Revenue Cycle Management market is characterized by a moderate to high level of concentration, with several major players vying for market share. Key companies such as NextGen Healthcare, R1 RCM, Surgical Information Systems (SIS), AdvantEdge Healthcare Solutions, ZirMed (Waystar), McKesson, and Allscripts hold significant positions, driving innovation and shaping competitive strategies. The innovation ecosystem is vibrant, fueled by the continuous need to optimize billing, coding, and claims management in the healthcare sector. Regulatory frameworks, particularly around patient data privacy (HIPAA) and reimbursement policies, play a crucial role in dictating market entry and operational strategies. Product substitutes, while present in the form of fragmented solutions or in-house management systems, are increasingly being outpaced by integrated Asc Revenue Cycle Management platforms. End-user trends are heavily influenced by the push for value-based care, increased patient engagement, and the demand for enhanced operational efficiency, driving the adoption of advanced Asc Revenue Cycle Management solutions. Mergers and acquisitions (M&A) activities remain a key feature, with recent deal values estimated to be in the hundreds of millions, consolidating market power and expanding service portfolios. For instance, M&A activity has seen valuations ranging from $50 million to over $500 million, impacting market share dynamics and leading to a more streamlined, albeit concentrated, vendor landscape.

Asc Revenue Cycle Management Industry Trends & Insights

The Asc Revenue Cycle Management industry is experiencing robust growth, driven by several compelling factors. The primary growth drivers include the increasing complexity of healthcare reimbursement models, the persistent need for cost containment within healthcare organizations, and the growing adoption of digital health technologies. As healthcare providers face escalating operational costs and shrinking profit margins, efficient revenue cycle management has become paramount. Asc Revenue Cycle Management solutions are instrumental in streamlining workflows, reducing claim denials, and accelerating payment cycles, thereby directly impacting financial health. Technological disruptions are also reshaping the landscape, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive analytics, automated coding, and fraud detection becoming increasingly prevalent. These advanced technologies promise to enhance accuracy, reduce manual intervention, and provide deeper insights into revenue performance. Consumer preferences are shifting towards greater transparency and convenience in billing and payment processes, compelling Asc Revenue Cycle Management vendors to offer patient-friendly portals and flexible payment options. The competitive dynamics are intensifying, with established players investing heavily in R&D to incorporate AI, cloud capabilities, and data analytics into their offerings. Emerging market penetration is significant, with the global Asc Revenue Cycle Management market expected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period. The market size is projected to grow from an estimated $XX billion in the base year to over $XX billion by 2033. This sustained growth is fueled by the ongoing digital transformation in healthcare and the imperative to maximize revenue capture in an increasingly regulated environment. Furthermore, the rising volume of patient data and the need for robust data management and analytics capabilities are propelling the demand for sophisticated Asc Revenue Cycle Management platforms that can offer actionable intelligence.

Dominant Markets & Segments in Asc Revenue Cycle Management

The Asc Revenue Cycle Management market is dominated by Hospitals as the leading application segment. This dominance stems from the sheer volume of patient encounters, the complexity of their billing processes, and the significant financial implications of inefficient revenue cycle management. Hospitals, with their extensive service lines and diverse patient demographics, require comprehensive Asc Revenue Cycle Management solutions to manage intricate insurance claims, payer negotiations, and patient collections effectively. The economic policies within healthcare, emphasizing value-based care and stricter reimbursement rules, further necessitate sophisticated Asc Revenue Cycle Management for hospitals to maintain financial viability. Infrastructure development, particularly in terms of interoperability between Electronic Health Records (EHRs) and Asc Revenue Cycle Management systems, also plays a crucial role in hospital adoption.

Within the Type segmentation, Cloud-Based Asc Revenue Cycle Management solutions are rapidly gaining traction and are poised to become the dominant deployment model. Key drivers for this shift include the inherent scalability, flexibility, and cost-effectiveness of cloud platforms. Cloud-based solutions offer easier integration, reduced IT overhead, and continuous updates, making them highly attractive to healthcare organizations of all sizes. The ability to access data and manage workflows from anywhere, coupled with enhanced security features, further solidifies their leading position.

The Ambulatory Surgical Centers (ASCs) segment is also a significant and growing market for Asc Revenue Cycle Management, driven by the increasing volume of outpatient procedures and the need for specialized billing expertise. ASCs often have simpler billing structures compared to large hospitals but still require efficient systems to manage claims and patient payments, especially with the shift towards bundled payments.

The dominance of these segments is further reinforced by the strategic importance of Asc Revenue Cycle Management in optimizing financial performance, reducing administrative burden, and improving overall operational efficiency in the healthcare ecosystem. The market size for Hospitals within the Asc Revenue Cycle Management sector is projected to reach $XX billion by 2033, while the Cloud-Based segment is expected to capture over XX% of the total market share by the same year.

Asc Revenue Cycle Management Product Innovations

Asc Revenue Cycle Management product innovations are increasingly focused on leveraging artificial intelligence (AI) and machine learning (ML) to automate complex tasks, improve accuracy, and provide predictive insights. Developments include AI-powered medical coding assistants that enhance precision and speed, intelligent denial management systems that identify root causes and prevent future rejections, and predictive analytics tools for optimizing claim submission timing and patient collections. These innovations offer significant competitive advantages by reducing manual labor, minimizing errors, and accelerating cash flow. The market fit for these advanced solutions is strong, as healthcare providers continually seek to optimize their financial operations in a challenging reimbursement environment.

Report Segmentation & Scope

This report meticulously segments the Asc Revenue Cycle Management market across key dimensions to provide a granular understanding of its dynamics. The Application segmentation includes Hospitals, Ambulatory Surgical Centers (ASCs), and Others, encompassing physician practices, clinics, and diagnostic centers. Each segment is analyzed for its specific needs, market size, and growth projections, with the Hospitals segment estimated to hold the largest market share, projected at $XX billion by 2033. The Type segmentation distinguishes between Cloud-Based and On-Premises solutions. The Cloud-Based segment is forecast to exhibit a higher CAGR, driven by its inherent advantages, and is projected to account for over XX% of the market by 2033. Conversely, the On-Premises segment, while still relevant for some organizations, is expected to see slower growth. The competitive dynamics within each segment are explored, highlighting the unique challenges and opportunities presented.

Key Drivers of Asc Revenue Cycle Management Growth

Several pivotal factors are accelerating the growth of the Asc Revenue Cycle Management market. Technologically, the relentless advancement in AI, ML, and automation is transforming revenue cycle operations by enhancing efficiency, accuracy, and predictive capabilities. Economically, the increasing pressure on healthcare providers to control costs, improve revenue capture, and adapt to value-based reimbursement models is a significant driver. Regulatory factors, such as evolving compliance mandates and the continuous need for accurate coding and billing to avoid penalties, also push for robust Asc Revenue Cycle Management solutions. For instance, the shift towards value-based care necessitates better tracking of patient outcomes and associated financial performance, directly benefiting advanced Asc Revenue Cycle Management platforms.

Challenges in the Asc Revenue Cycle Management Sector

Despite its growth, the Asc Revenue Cycle Management sector faces notable challenges. Regulatory hurdles, including frequent updates to reimbursement policies and stringent compliance requirements (e.g., HIPAA), demand constant adaptation and can increase operational complexity and costs. Supply chain issues, particularly concerning the integration of disparate healthcare IT systems and the availability of skilled personnel for implementing and managing these complex solutions, can hinder adoption and effectiveness. Competitive pressures from both established vendors and new entrants offering specialized solutions also present a barrier. Quantifiable impacts include an estimated 5-10% increase in denial rates due to coding errors and an average increase in accounts receivable days by 5-15 days for organizations with suboptimal Asc Revenue Cycle Management.

Leading Players in the Asc Revenue Cycle Management Market

- NextGen Healthcare

- R1 RCM

- Surgical Information Systems (SIS)

- AdvantEdge Healthcare Solutions

- ZirMed (Waystar)

- McKesson

- Allscripts

Key Developments in Asc Revenue Cycle Management Sector

- 2023, Q4: R1 RCM completes the acquisition of HealthPayers in a move to expand its patient engagement capabilities.

- 2024, Q1: McKesson launches an enhanced AI-powered analytics suite for its Asc Revenue Cycle Management platform.

- 2024, Q2: Surgical Information Systems (SIS) announces strategic partnerships to improve interoperability with leading EHR vendors.

- 2024, Q3: Waystar (formerly ZirMed) unveils new automation features for claims denial management.

- 2024, Q4: Allscripts announces a new cloud-native Asc Revenue Cycle Management solution for mid-sized hospitals.

- 2025, Q1: AdvantEdge Healthcare Solutions introduces enhanced patient payment solutions leveraging modern digital payment gateways.

Strategic Asc Revenue Cycle Management Market Outlook

The strategic outlook for the Asc Revenue Cycle Management market is exceptionally positive, fueled by ongoing digital transformation in healthcare and the persistent need for financial optimization. Future market potential lies in the deeper integration of AI and predictive analytics, enabling proactive rather than reactive revenue cycle management. Strategic opportunities include the expansion of services into new healthcare verticals, the development of more comprehensive patient financial engagement tools, and the continuous enhancement of cloud-based offerings for greater scalability and accessibility. As healthcare systems increasingly focus on efficiency and value, the demand for sophisticated Asc Revenue Cycle Management solutions is set to grow, presenting lucrative avenues for innovation and market leadership.

Asc Revenue Cycle Management Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Ambulatory Surgical Centers

- 1.3. Others

-

2. Type

- 2.1. Cloud-Based

- 2.2. On-Premises

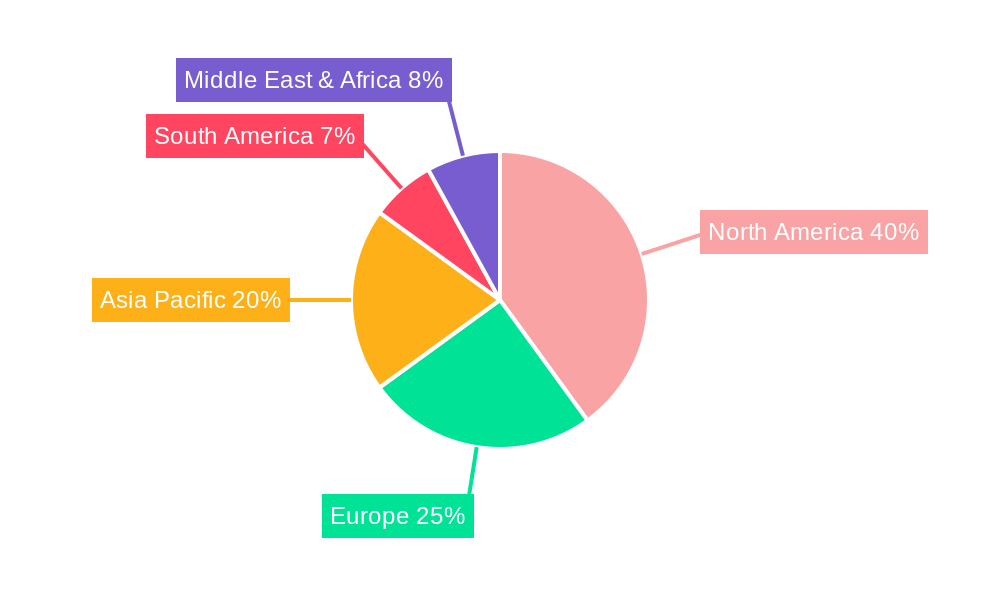

Asc Revenue Cycle Management Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Asc Revenue Cycle Management REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asc Revenue Cycle Management Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Ambulatory Surgical Centers

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cloud-Based

- 5.2.2. On-Premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Asc Revenue Cycle Management Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Ambulatory Surgical Centers

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cloud-Based

- 6.2.2. On-Premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Asc Revenue Cycle Management Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Ambulatory Surgical Centers

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cloud-Based

- 7.2.2. On-Premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Asc Revenue Cycle Management Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Ambulatory Surgical Centers

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cloud-Based

- 8.2.2. On-Premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Asc Revenue Cycle Management Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Ambulatory Surgical Centers

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cloud-Based

- 9.2.2. On-Premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Asc Revenue Cycle Management Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Ambulatory Surgical Centers

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cloud-Based

- 10.2.2. On-Premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NextGen Healthcare

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 R1 RCM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Surgical Information Systems (SIS)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AdvantEdge Healthcare Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ZirMed (Waystar)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 McKesson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Allscripts

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 NextGen Healthcare

List of Figures

- Figure 1: Global Asc Revenue Cycle Management Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Asc Revenue Cycle Management Revenue (million), by Application 2024 & 2032

- Figure 3: North America Asc Revenue Cycle Management Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Asc Revenue Cycle Management Revenue (million), by Type 2024 & 2032

- Figure 5: North America Asc Revenue Cycle Management Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Asc Revenue Cycle Management Revenue (million), by Country 2024 & 2032

- Figure 7: North America Asc Revenue Cycle Management Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Asc Revenue Cycle Management Revenue (million), by Application 2024 & 2032

- Figure 9: South America Asc Revenue Cycle Management Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Asc Revenue Cycle Management Revenue (million), by Type 2024 & 2032

- Figure 11: South America Asc Revenue Cycle Management Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Asc Revenue Cycle Management Revenue (million), by Country 2024 & 2032

- Figure 13: South America Asc Revenue Cycle Management Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Asc Revenue Cycle Management Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Asc Revenue Cycle Management Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Asc Revenue Cycle Management Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Asc Revenue Cycle Management Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Asc Revenue Cycle Management Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Asc Revenue Cycle Management Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Asc Revenue Cycle Management Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Asc Revenue Cycle Management Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Asc Revenue Cycle Management Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Asc Revenue Cycle Management Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Asc Revenue Cycle Management Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Asc Revenue Cycle Management Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Asc Revenue Cycle Management Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Asc Revenue Cycle Management Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Asc Revenue Cycle Management Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Asc Revenue Cycle Management Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Asc Revenue Cycle Management Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Asc Revenue Cycle Management Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Asc Revenue Cycle Management Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Asc Revenue Cycle Management Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Asc Revenue Cycle Management Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Asc Revenue Cycle Management Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Asc Revenue Cycle Management Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Asc Revenue Cycle Management Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Asc Revenue Cycle Management Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Asc Revenue Cycle Management Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Asc Revenue Cycle Management Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Asc Revenue Cycle Management Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Asc Revenue Cycle Management Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Asc Revenue Cycle Management Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Asc Revenue Cycle Management Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Asc Revenue Cycle Management Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Asc Revenue Cycle Management Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Asc Revenue Cycle Management Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Asc Revenue Cycle Management Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Asc Revenue Cycle Management Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Asc Revenue Cycle Management Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Asc Revenue Cycle Management Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asc Revenue Cycle Management?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Asc Revenue Cycle Management?

Key companies in the market include NextGen Healthcare, R1 RCM, Surgical Information Systems (SIS), AdvantEdge Healthcare Solutions, ZirMed (Waystar), McKesson, Allscripts.

3. What are the main segments of the Asc Revenue Cycle Management?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asc Revenue Cycle Management," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asc Revenue Cycle Management report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asc Revenue Cycle Management?

To stay informed about further developments, trends, and reports in the Asc Revenue Cycle Management, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence