Key Insights

The Asia-Pacific (APAC) e-cigarette market is poised for substantial growth, driven by increasing adoption of smoking cessation alternatives and a growing young adult demographic. The market is projected to expand significantly, with key contributors including China, Japan, South Korea, and Southeast Asian nations. Market performance will vary by country due to diverse regulatory frameworks, consumer preferences, and brand strategies. Online channels dominate sales, though offline retail remains vital in less digitized markets. Product innovation, including advanced device designs and varied e-liquid flavors, is a key trend. However, regulatory challenges such as taxation and advertising restrictions, alongside public health concerns regarding long-term effects and nicotine addiction, present considerable headwinds.

APAC E-Cigarette Industry Market Size (In Billion)

The global e-cigarette market anticipates a Compound Annual Growth Rate (CAGR) of 1.8%. The APAC region, with its large and diverse population and higher adoption rates in certain areas, is expected to experience a slightly accelerated CAGR, estimated between 2.5% and 3.0%. Market expansion will be shaped by targeted marketing, competitive strategies from international and regional players, and technological advancements. Divergent regulatory landscapes will continue to influence individual country growth, while a focus on harm reduction and innovative, lower-risk products will drive future market dynamics.

APAC E-Cigarette Industry Company Market Share

APAC E-Cigarette Market Analysis: Size, Growth, and Forecast (2025-2033)

This comprehensive report offers deep insights into the APAC e-cigarette industry from 2025 to 2033, with the base year being 2025. It details market trends, competitive landscapes, and future growth prospects. Leveraging extensive data analysis, the report forecasts market size and growth across key segments, providing critical information for strategic decision-making. The current market size is estimated at 423.7 billion.

APAC E-Cigarette Industry Market Structure & Competitive Dynamics

This section analyzes the APAC e-cigarette market's structure and competitive landscape. We delve into market concentration, revealing the dominance of key players like RELX International Enterprise HK Limited, British American Tobacco p l c, and Philip Morris International. We assess the innovation ecosystems, highlighting the continuous development of new e-cigarette devices and e-liquids. The regulatory framework, characterized by varying levels of stringency across different APAC countries, is also examined, along with its impact on market growth. The report also investigates the presence of substitute products, like traditional cigarettes and other nicotine delivery systems, and evaluates their influence on market share. End-user trends, including evolving consumer preferences and consumption patterns, are analyzed, providing insights into future market demand. Finally, we explore the mergers and acquisitions (M&A) landscape, including deal values and their impact on market consolidation. The estimated market size in 2025 is xx Million, with a projected xx% market share for RELX International. Significant M&A activity has been observed in the period 2019-2024, with total deal values estimated at xx Million. This activity is primarily driven by larger players seeking to expand their market presence and product portfolios.

APAC E-Cigarette Industry Industry Trends & Insights

This section delves into the key trends shaping the APAC e-cigarette industry. We analyze the market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) and project the CAGR for the forecast period (2025-2033), considering factors like increasing consumer awareness, changing smoking habits, and technological advancements. The report explores technological disruptions, such as the introduction of innovative e-cigarette devices and e-liquid flavors, and their impact on market dynamics. Consumer preferences, including shifts towards specific product types and distribution channels, are also carefully examined. Market penetration rates are analyzed across different countries and segments, highlighting areas of high growth potential. The competitive dynamics, focusing on pricing strategies, branding, and marketing efforts, are also studied, shedding light on the strategies employed by leading players. We find that the increasing popularity of disposable e-cigarettes and the growing demand for innovative product features are key factors driving market growth. The market penetration rate in key markets is projected to reach xx% by 2033.

Dominant Markets & Segments in APAC E-Cigarette Industry

This section identifies the leading markets and segments within the APAC e-cigarette industry. We analyze regional variations in market size and growth rates, pinpointing the most dominant countries. This is followed by a deep dive into dominant segments based on product type (e-cigarette devices and e-liquids) and distribution channel (offline and online retail stores).

Leading Regions: [Insert dominant region, e.g., Southeast Asia]. Key drivers include rapidly growing economies, high smoking prevalence, and increasing disposable incomes. Specific country analyses will detail factors such as regulatory environments, consumer preferences, and infrastructural development.

Dominant Product Type: [Insert dominant product type, e.g., Disposable e-cigarettes]. The reasons for dominance will be explained in detail, highlighting factors such as convenience, affordability, and diverse flavor options.

Dominant Distribution Channel: [Insert dominant distribution channel, e.g., Offline Retail Stores]. Analysis will cover the extensive network of physical retailers and their reach into diverse consumer segments, complemented by the rising influence of online channels.

APAP E-Cigarette Industry Product Innovations

The APAC e-cigarette industry is characterized by continuous product innovation. Recent years have witnessed the introduction of advanced vaping devices with improved battery life, enhanced flavor delivery systems, and sophisticated temperature control mechanisms. Disposable e-cigarettes, particularly those with replaceable pods, have gained significant traction due to their convenience and affordability. These innovations are directly responding to evolving consumer preferences and market demands, resulting in a dynamic landscape where companies continuously strive to differentiate their products and capture market share. Technological trends such as AI-powered personalization and smart features are likely to further reshape the industry's offerings.

Report Segmentation & Scope

This report segments the APAC e-cigarette market based on product type (e-cigarette devices and e-liquids) and distribution channel (offline and online retail stores).

E-cigarette Devices: This segment includes various device types, such as disposable, refillable, and pod-based systems. Growth projections will vary based on product type, reflecting varying levels of consumer demand and technological advancements. Market size projections for 2025 and beyond will be included, as well as an analysis of competitive dynamics within the segment.

E-liquids: This segment includes various flavor profiles and nicotine strengths. Growth projections for this segment are linked to the overall growth of the e-cigarette market, with considerations for regulatory changes and consumer preferences for specific flavor profiles. Analysis will include market size estimations and an assessment of competitive dynamics based on flavor innovation and brand positioning.

Offline Retail Stores: This segment encompasses traditional retail outlets, including vape shops, convenience stores, and tobacco retailers. Growth projections reflect the expansion of retail networks, accessibility, and brand availability.

Online Retail Stores: This segment includes e-commerce platforms and online retailers. Growth projections consider the increasing popularity of online shopping, the convenience of home delivery, and the potential for wider market reach.

Key Drivers of APAC E-Cigarette Industry Growth

Several factors contribute to the APAC e-cigarette industry's growth. Increasing awareness of e-cigarettes as a harm-reduction alternative to traditional cigarettes is a significant driver. Furthermore, technological advancements leading to improved product designs and functionalities, along with a broader range of flavors and nicotine strengths, are boosting market appeal. The growing availability of e-cigarettes through diverse distribution channels, including both offline and online platforms, enhances market accessibility. Finally, favorable economic conditions in several APAC countries, coupled with rising disposable incomes, contribute to increased consumer spending on e-cigarettes.

Challenges in the APAC E-Cigarette Industry Sector

The APAC e-cigarette industry faces several challenges. Stringent regulations and evolving government policies concerning e-cigarette sales and marketing impose significant hurdles for market growth. Supply chain disruptions, particularly concerning the sourcing of key raw materials and components, can impact production efficiency and cost. Intense competition among numerous players, including both established tobacco companies and emerging e-cigarette brands, necessitates continuous innovation and strategic differentiation. The perception of potential health risks associated with e-cigarettes also presents an ongoing challenge that influences consumer adoption and regulatory scrutiny. Estimates indicate that regulatory hurdles could reduce market growth by xx% in the next 5 years.

Leading Players in the APAC E-Cigarette Industry Market

- RELX International Enterprise HK Limited

- British American Tobacco p l c

- MOTI Planet

- Philip Morris International

- Vape Company

- Smoore International Holdings Ltd

- JUUL Labs Inc

- Imperial Brands

- Japan Tobacco International

- Vaping Gadget Limited

Key Developments in APAC E-Cigarette Industry Sector

November 2022: Moti Planet expanded its business operation in the Malaysian market by launching its flagship product MOTI K Pro and showcasing other products (MOTI X Mini, MOTI X Play, MOTI BOTO 6000, MOTI Box R7000, MOTI One 4000) at the International Electronic Cigarettes Exhibitions in Malaysia. This expansion significantly increased Moti Planet's market presence in a key APAC region.

August 2021: Philip Morris International Inc. launched IQOS ILUMA, a new heated tobacco device, strengthening its position in the smoke-free products market.

August 2021: Japan Tobacco Inc. launched Ploom X, a next-generation heated tobacco device, expanding its product portfolio and distribution channels in Japan.

Strategic APAC E-Cigarette Industry Market Outlook

The APAC e-cigarette industry presents a promising outlook for future growth, driven by continuous innovation, increasing consumer adoption, and expansion into new markets. The industry's strategic landscape is dynamic, characterized by intense competition and strategic partnerships. The growing demand for harm reduction products, coupled with advancements in e-cigarette technology, will fuel market expansion. Companies that successfully navigate regulatory challenges and adapt to evolving consumer preferences are poised to capture significant market share in the years to come. This growth is projected to exceed xx Million by 2033.

APAC E-Cigarette Industry Segmentation

-

1. Product Type

- 1.1. E-cigarette Devices

- 1.2. E-liquid

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

-

3. Geography

- 3.1. New Zealand

- 3.2. Bangladesh

- 3.3. Indonesia

- 3.4. Rest of Asia-Pacific

APAC E-Cigarette Industry Segmentation By Geography

- 1. New Zealand

- 2. Bangladesh

- 3. Indonesia

- 4. Rest of Asia Pacific

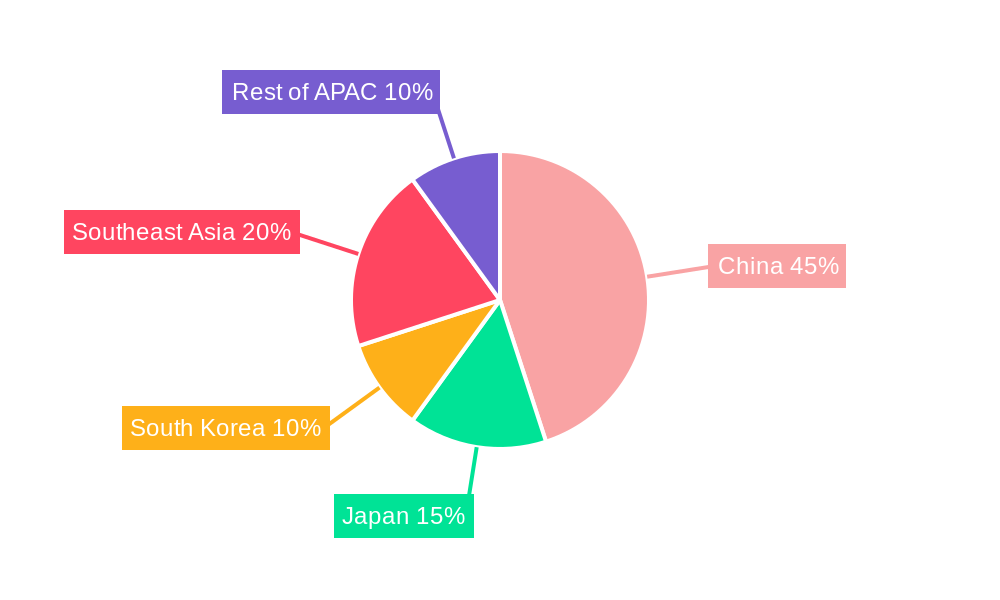

APAC E-Cigarette Industry Regional Market Share

Geographic Coverage of APAC E-Cigarette Industry

APAC E-Cigarette Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Demand for Nicotine-free Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. E-cigarette Devices

- 5.1.2. E-liquid

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. New Zealand

- 5.3.2. Bangladesh

- 5.3.3. Indonesia

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.4.2. Bangladesh

- 5.4.3. Indonesia

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. New Zealand APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. E-cigarette Devices

- 6.1.2. E-liquid

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. New Zealand

- 6.3.2. Bangladesh

- 6.3.3. Indonesia

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Bangladesh APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. E-cigarette Devices

- 7.1.2. E-liquid

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. New Zealand

- 7.3.2. Bangladesh

- 7.3.3. Indonesia

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Indonesia APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. E-cigarette Devices

- 8.1.2. E-liquid

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. New Zealand

- 8.3.2. Bangladesh

- 8.3.3. Indonesia

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. E-cigarette Devices

- 9.1.2. E-liquid

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. New Zealand

- 9.3.2. Bangladesh

- 9.3.3. Indonesia

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 RELX International Enterprise HK Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 British American Tobacco p l c

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MOTI Planet*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Philip Morris International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vape Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Smoore International Holdings Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JUUL Labs Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Imperial Brands

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Japan Tobacco International

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Vaping Gadget Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 RELX International Enterprise HK Limited

List of Figures

- Figure 1: Global APAC E-Cigarette Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: New Zealand APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: New Zealand APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: New Zealand APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: New Zealand APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Indonesia APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Indonesia APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Indonesia APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC E-Cigarette Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC E-Cigarette Industry?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the APAC E-Cigarette Industry?

Key companies in the market include RELX International Enterprise HK Limited, British American Tobacco p l c, MOTI Planet*List Not Exhaustive, Philip Morris International, Vape Company, Smoore International Holdings Ltd, JUUL Labs Inc, Imperial Brands, Japan Tobacco International, Vaping Gadget Limited.

3. What are the main segments of the APAC E-Cigarette Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 423.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Demand for Nicotine-free Products.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: Moti Planet expanded its business operation in the Malaysian market by launching its flagship product MOTI K Pro. At International Electronic Cigarettes Exhibitions in Malaysia, the company has also presented other products such as MIOTI X Mini, and MOTI X Play, as well as disposable new products MOTI BOTO 6000, MOTI Box R7000, and the industry's first replaceable disposable electronic cigarettes were also presented in exhibitions i.e., MOTI One 4000.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC E-Cigarette Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC E-Cigarette Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC E-Cigarette Industry?

To stay informed about further developments, trends, and reports in the APAC E-Cigarette Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence